Industry Overview

Apple Company is a renowned corporation that was initiated in 1976. It operates in the electronic industry that has shown remarkable growth. The growth is attributable to the increased demand for electronic products. This is due to their effectiveness in driving commercial and social activities. As noted by researchers, electronic gadgets or items play a significant role in transforming an individual’s way of life. The items enhance communication at various levels of operation in institutions. They also help in the execution of complex tasks that require technological support. It is imperative to note that, Apple Company started its operations to meet the needs of consumers in the electronic industry.

Its initiation was with an aim of mitigating the evident imbalance between demand and supply of electronic products. Since its inception, the company has come up with quality, effective and efficient PCs and phones that are acceptable to consumers. The products have enabled users to advance their commercial and social activities with limited complications. The company designs and produces a wide range of products that include iPod, Max laptops, desktop computers, and iPhones. It also produces OSX operating system that is used in various electronic gadgets such as computers. The design of the products conforms to consumer needs and quality ideals (O’Grady 1).

In the industry, the company has been able to advance its competitiveness through the adoption of conventional operating strategies. The strategies that guide its marketing, production and management activities have been essential in enhancing its competitiveness. For instance, the company operates under a lean management technique that ensures the optimization of resources. This has enabled it to produce products of high quality without wastage of resources. This is because the concept provides requisite incentives that enable managers to maximize resources, reduce wastage and streamline the value chain.

Indeed, the company operates in a volatile industry where competition is stiff. Its key rivals in the industry are Dell, Samsung, Nokia and Microsoft corporations. The corporations also produce various electronic products such as phones, computers and operating software. They operate under strict guidelines and systematic production flow with an aim of gaining market control. However, Apple Corporation has remained in business due to the quality of its products that hold global recognition.

Apples background/history

Apple Company was founded in 1976 with a core mission of serving the consumers directly by providing them with quality electronic products that meet their needs. The company’s formal incorporation was in the year 1977 and was later listed in the US security market (O’Grady 1). The idea of the company’s initiation is credited to two renowned entrepreneurs who are Steven Wozniak and Steven Jobs. They had a strong passion for producing quality and effective computers. The two were friends from their childhood. Their friendship became stronger when they were in high school where they developed an immense interest in electronics. Due to their passion, they dropped out of school and secured employment in a local electronic company. The design of what was to become a powerful computer was realized while Steven was working in the company.

In the same year, Steven Jobs insisted that they try selling the product to establish how receptive it could be in the market. Indeed, the product that was named “Apple I” became extremely competitive. This saw the birth of Apple Company in 1976. The company took off a year letter after its initiation. They started proper work during the year 1977 when Steve Jobs and his colleague produced the first personal computer. The computer that was effective and efficient was made using local materials such as plastic cases and color graphics. It was attractive, easy to operate and effective. Since the advent of its first PC, the company has been steadfast in attaining its key objectives. It has been employing conventional and innovative production techniques that have resulted in the expansion of its product portfolio (O’Grady 5). From 1992 to date, the company produces a wide range of electronic items that include modern PCs and phones. The products offer instant solutions to consumers globally.

As noted, Apple Company remains a high-rank corporation that focuses its synergy on promoting the manufacturing of quality electronic products. The company strives to achieve its key objective which is to be the leading producer of quality electronic items globally. Apart from its best-known hardware items, the company specializes in offering solutions such as servers, networking and storage products among others. These products enable consumers to execute their activities pertaining to commercial or social issues with much ease (Lüsted 1). They are instrumental in ensuring absolute technological transformation in diverse facets of operation. The company’s latest products that hold innovative designs are Macintosh PCs, iPods, web browsers and OSX software. The equipment holds conventional electronic features that aim at satisfying consumer needs. They are portable, effective, facilitate multitasking and are efficient.

In 2008, the company has named the world’s most admired and the largest technology corporation by revenue due to its wide range of products that result in high performance. It was also named the third-largest mobile phone maker after sum sang and Nokia corporations are its key competitors. Additionally, the company has 394 retail stores in fourteen nations. This shows how superior its distribution and supply network is global. This has enabled it to gain a significant competitive advantage over its rivals (Lüsted 2). In 2011, the company was declared the largest publicly traded corporation by market capitalization globally. Currently, its security market value stands at US$626 billion. It also has a strong financial capacity as evident in its financial reports.

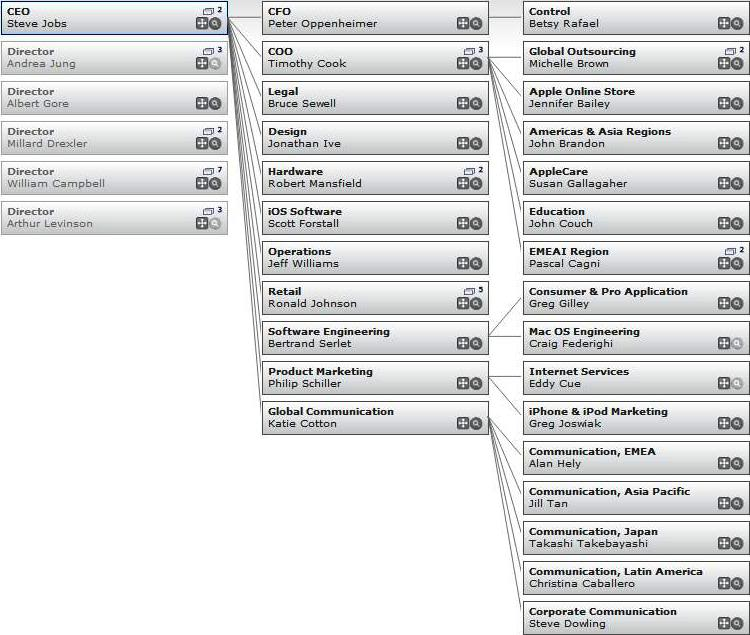

The organizational chart of the company

The company adopts a matrix organizational structure that provides quality functional incentives. The structure allows the combination of functional and divisional departments with an aim of enhancing performance. Its core objective is to enhance efficiency by creating a favorable working environment that eradicates bureaucracy. It ensures that business units in the organization work harmoniously (Daft & Hugh 49). It also enhances communication, team building and innovation which are key elements that drive the execution of activities in the electronic industry.

The structural system has been a central pillar in driving performance in the company. It has enabled the company to combine its functional and corporate departments. This has improved efficiency in service delivery since the staff members are able to coordinate well as team members. The structure has also provided the company with a flexible management framework that facilitates its work plan. The framework enables the management to ensure effective coordination of resources, enhancement of employee specialization and flexibility (Daft, Jonathan & Hugh 49).

Apples structure

Ratio and stock analysis

Ratio and stock indexes are fundamental indicators that accountants and financial professionals evaluate when analyzing performance levels in corporations. They form the key elements that give clear comparative values that are essential in decision-making. Evidently, liquidity ratio, acid test ratio, debt collection ratio and current ratio are the commonly used ratios in evaluating these elements. They hold the capacity of showing the level of performance in terms of growth or reduction in productivity (Linzmayer 2). This explains the significance of the ratios that are computed using the figures that are realized in the financial statements.

Indeed, Apple Company’s performance ratios have been recording remarkable growth since its initiation. The ratios and stock values record an upward trend in the graphical representation as evident in the past years to date. This shows how well the corporation’s management is applying the basic principles of financial administration. In its yearly report, the company has recorded substantive growth in its capital strength and asset base. Secondly, it has advanced its income capacity and market security investment. This depicts the corporation as a vibrant entity with the requisite potential for future development. The company’s asset value stands at US$156,508 billion for the period ending September 2012. This figure is higher than its asset portfolio for the same period in the year 2011 which was valued at US$108,264 billion.

Consequently, its capital base stands at US$180,000 billion and 112,000 billion in the year 2012 and 2011 respectively. This explains why current and liquidity ratios are showing appositive performance trends over the years. Particularly, the corporation’s current ratio that shows the balance between assets and liabilities gives an appositive figure that stands at 1.50: 1%. The growth is attributable to the effective administration of resources, control of liabilities and expansion of the asset base (Linzmayer 2). Apple’s present current ratio stands at 1.50:1percentage while its stock turnover rate stands at 67%. Its quick ratio stands at 1.35 and 1.26 for the respective periods under review. The cash conversion cycle stands at 23 days from 28 days in the previous period. This shows an outstanding growth in debt collection and management.

The corporation’s earnings per share (EPS) have also increased enormously. It has recorded appositive growth from 28.05 in the year 2011 to 44.64 for the same period in the year 2012. Further, the company’s divided capacity has increased to 2.65 dollars. This has enabled investors to gain confidence in the company. This is due to its promising future in terms of a high return on investment (ROI) that is attributable to the current performance levels. Clearly, the company’s resource base holds the capacity to drive it to greater heights. This will enable it to expand its product portfolio, enhance the quality and gain a competitive advantage that is paramount for growth.

Discussion on the company’s liquidity, solvency and profitability

Accountants and financial managers execute comprehensive evaluations on liquidity, profitability and solvency ratios to establish the performance level in institutions. These elements are critical since they give a clear picture of the company’s performance that can be positive or negative. Particularly, profitability is the ability of a company to make sound financial returns on its investment (Bull 3). It enables managers to establish the state of affairs of the company through the computation of profitability ratios. It is imperative to note that, Apple’s financial capacity is on the increase. Its profitability index is increasing every financial year (Daft & Dorothy 156). This is evident in its computed profitability ratios that have never shown a decline in value.

The company’s net income for the current period also records 41,733 billion US dollars in comparison to 25,922 billion US dollars for the previous period. The figure shows a significant increase that is only achievable in institutions with clear-cut financial management policies. Consequently, the company’s solvency level does not bring any uncertainty. It has a strong liquidity capacity and debt management system that does not threaten its solvency levels. Daft & Dorothy (156) indicated that solvency is the ability for a company to settle its debts with limited complications. It measures debt collection and repayment ability that requires proper planning. This element has been well administered in Apple Company through an effective debt repayment scheme. The company has no outstanding debt and has effective plans that saw its yearly debts settled promptly.

The company also has stable liquidity strength. It has adequate resources and financial capacity that drives operations in its business units. This is noticeable in its financial statements that report effective cash inflow and outflow management. The company’s cash equivalent stands at US$10,746 billion in comparison to the previous period which was valued at US$9,817 billion. Its income levels as depicted in the income statement also report an increase. These elements explain the corporation’s liquidity value that seeks to eradicate any possible uncertainty among investors.

SWOT analysis of the company based on financial Parameters

Apple’s SWOT analysis evaluates it’s internal including external strengths, weaknesses, opportunities and threats that affect the firm’s operations. SWOT analysis is essential due to its relevance in establishing operating capacity and weaknesses in institutions. This promotes credible decision-making on key issues that affect production and general performance in institutions (Schermerhorn 1). For instance, strength evaluation focuses on establishing what the company practices well. These may include the hiring skilled professionals, making viable investments and acquisition of modern facilities. Weaknesses highlight what the company is not able to execute well, while opportunities are environmental potentials that the company can capitalize on to advance performance. However, threats are the factors that hold the capacity to impede performance at various levels.

Apple Company has immense strengths that aid its exemplary performance. The company has a strong financial capacity, asset base, capital structure and a strong product brand. It also has an effective product distribution network and marketing strategy that aids its performance (O’Grady 4). The opportunities that give it a promising future include the increase in demand for electronic products, an increase in its financial base and the invention of new electronics. These strengths and opportunities are vital for expansion and the company should capitalize on them effectively. Variably, the company’s weaknesses and threats include low penetration to other market segments and competition. Criticism that the company has been facing for flouting labor practice guidelines also poses a threat to its future performance. The management of the company must develop viable modalities to mitigate these weaknesses and threats to ensure that the company maintains its excellent performance capacity.

Recent Investment and Financial Decisions the company undertook

Apple Company has made performance-oriented investment decisions that promise to boost its financial capacity. The recent investments that the company has initiated to facilitate the realization of its objectives include investment in marketable securities and acquisition of tangible assets. The company has also invested in the manufacturing of new products that hold conventional features. The company’s decision to invest in market securities has yielded immense benefits. The investment has grown and is currently generating a lot of capital that is valued at US$626 billion presently (Schermerhorn 2). This initiative is regarded as the best, and most successful venture that the management of the institution receives credit for.

Indeed, the venture has attracted most investors who make substantial purchasing of the company’s shares in the security market. Its success has enabled them to earn good returns as dividends and earning per share (EPS) incentives. Due to the exemplary performance, the company’s earnings per share now stands at 44.64 in comparison to 28.05 in the previous period. This shows how successful the venture has been over the years. The company’s decision to expand its asset base has also yielded substantive benefits (Bull 1). Its asset base which is valued at US$57,854 billion is contributing effectively in driving operations in its business units. The assets that include infrastructural setups, buildings and assembling machines have been indeed crucial in ensuring timely manufacturing of products.

The company also made a noble decision to expand its product portfolio through the introduction of new items that hold modern features. The products that include Macintosh computers and iPod phones receive well acceptance in the market. They have enhanced the institution’s customer base and market share due to their high demand. This is because they are efficient, effective and portable (Lüsted 23). The new products contribute 20% of the company’s net income as shown in the present statistics. Evidently, the corporation’s administrators made wise investment decisions that have been central in steering its expansion. The investment decisions were economically viable and sustainable. Therefore, the company is still bound to record excellent performance in the years to come.

Financial Review of the company, with recommendations

As indicated, Apple Corporation has a sound financial capacity that is attributable to its effective financial management. The company’s key financial ratios such as current, liquidity and acid test ratios record positive indexes that show how well its strategy is working. It has a strong capital base with high asset value that is significant in facilitating the achievement of its objectives. Its income statement records a net income of 41,733 billion US dollars. The exemplary performance is due to the increase in net sales value that stands at US$156,508bilion with a low cost of sales.

This gives the company a gross margin of US$14.41 for the current period in comparison to the previous period. The company also has a strong balance sheet that reports a sound capital base and increased asset value (Bull 1). This is due to continuous investment in valuables and the acquisition of intangible assets. This has been possible since the management has ensured effective administration of resources by reducing expenditure obligations of the company. The company’s cash flow also depicts appositive performance. Its cash flow reports an increase in net cash and cash equivalent of US$10,746 billion. This represents a 25% increase from the previous year’s cash equivalent figure

Recommendations

- The company should continue with its investment plans to advance its performance and asset base. This will support the effective delivery of services in its business units.

- The company should also invest heavily in innovation, research and new product development to advance its competitiveness in the industry.

- Consequently, the company should adopt proper administration techniques and an effective organizational structure to ensure effective communication and coordination of activities.

References

Bull, Richard. Financial Ratios: How to Use Financial Ratios to Maximise Value and Success for Your Business. Oxford: CIMA, 2008. Print.

Daft, Richard L, Jonathan Murphy & Hugh Willmott. Organization Theory and Design. Andover: South-Western Cengage Learning, 2010. Print.

Daft, Richard L & Dorothy Marcic. Understanding Management. Mason, Ohio: Thomson/South-Western, 2006. Print.

Lüsted, Marcia A. Apple: The Company and Its Visionary Founder, Steve Jobs. Minneapolis, MN: ABDO Pub, 2012. Print.

Linzmayer, Owen W. Apple Confidential 2.0: The Definitive History of the World’s Most Colorful Company. San Francisco, Calif: No Starch Press, 2004. Print.

O’Grady, Jason D. Apple Inc. Westport, Conn: Greenwood Press, 2009. Print

Schermerhorn, John R. Exploring Management. Hoboken, N.J: Wiley, 2010. Print.