Introduction

The intense rate of globalization has had an immense influence on the business environment across the globe. Technology in the areas of communication and transportation develops rapidly, which creates new opportunities. Naturally, companies which prosper in their home country begin to consider new locations worldwide. In the case of Sainsbury’s Supermarket plc, the management envisions its development in New Zealand.

Nevertheless, international expansion is related to an array of certain risks, which may impede the process and damage the organization’s performance. In addition to considerable expenditures, Sainsbury’s may fall victim to an unstable political environment, unfamiliar legal frameworks, and cultural differences. To ensure that the new investment is to be worthwhile, the management of Sainsbury’s should have a clear understanding of all negative and positive aspects surrounding the process of business development in New Zealand. This report reveals that New Zealand, indeed, presents a favorable business environment for Sainsbury’s operations, and the company’s management should consider further expansion.

Sainsbury’s Supermarket Plc

The company profile of Sainsbury’s Supermarket is impressive, as it has achieved success in the United Kingdom. It remains one of the UK’s largest supermarket chains represented across the country (Sainsbury’s company profile, 2020). According to public data, the company now operates over 600 supermarkets and over 800 convenience stores in the UK while introducing electronic commerce opportunities (Sainsbury’s company profile, 2020).

In addition to groceries, Sainsbury’s offers apparel, cookware, and homeware, which makes its range of products appealing to the general public. In 2020, the company reported over $37 billion in revenues, with a gross profit of about $2.6 billion (Sainsbury’s company profile, 2020). Judging by Sainsbury’s financial statements, the chain appears to be in a steady position. The current coronavirus pandemic has had a negative influence on an array of business segments, but the retail market has remained active amid the restrictions, and the utilization of e-commerce has contributed to its development. The position of Sainsbury’s appears stable enough to consider an expansion to other markets once the pandemic ends and the remaining restrictions are lifted.

New Zealand as a Nation

New Zealand is an unusual country, which often does not receive proper media coverage due to its remote location and limited participation in global events. From a geographical point of view, New Zealand is an island nation in the southern part of the Pacific Ocean (New Zealand, n.d.) Its territory of 268,000 square kilometers comprises two main masses of land, which are the North and the South Islands. The archipelago remains a remote region, as its closest neighbor is Australia, located 1,600 kilometers to the northwest (New Zealand, n.d.) In 1931, New Zealand joined the Commonwealth of Nations under the statute of Westminster and has remained a part of it until today, as reflected in its flag (Figure 1).

The population of New Zealand is rather small in global comparison, and the estimated numbers for the year 2020 were 4.9 million people (New Zealand – Aotearoa, n.d.) The majority of the population is concentrated in the country’s largest cities, including Wellington, its capital, and Auckland (Figure 2). Overall, New Zealand is a unique, remote location, but the shared cultural heritage instigates UK-based companies’ interest in it.

Risks for Businesses in New Zealand

Political Risks

Political instability in a particular region may undermine a foreign company’s expansion efforts. Hostile or totalitarian regimes tend to increase the pressure on the business, whereas a general indeterminacy of changeable political landscapes also contributes to the formation of a negative environment. However, New Zealand is usually considered to be one of the world’s leading democracies. According to its government, the country serves as “a reassuringly sturdy beacon of economic, political and social stability” in today’s turbulent world (Stability & security, 2020).

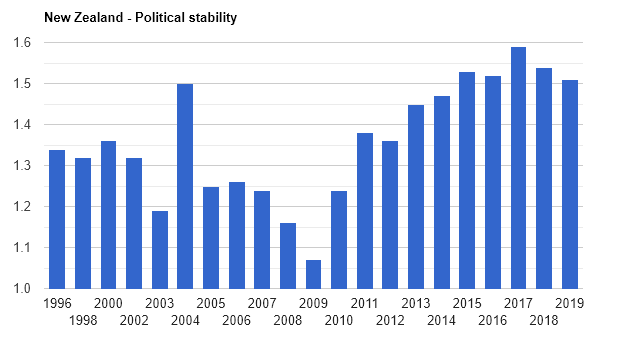

The governing coalition led by Prime Minister Jacinda Ardern appears to be in a secure position, which allows New Zealand to avoid unnecessary perturbations (The political framework of New Zealand, n.d.). According to the global Political Stability Index of the World Bank, the country has been showing steadily positive results over the past twenty years (Figure 3). In 2019, the Index was 1.59 as compared to the world’s average figure of -0.05 (New Zealand: Political stability, 2020). Generally, New Zealand’s political system resembles the UK in many ways, making the political risks for Sainsbury’s insignificant.

Economic Risks

In the context of ambitious business endeavors, economic risks hold special significance in terms of potential barrier analysis. New Zealand appears to be a viable destination in this regard, as the country’s economy is seen as particularly strong in today’s complicated environment. The national government actively promotes the principles of a free market economy across all segments, reducing its influence on economic relations virtually to zero (The New Zealand economy, 2020). The Treasury of New Zealand focuses on fiscal stability and productivity growth, which are considered key components of sustainable development (The New Zealand economy, 2020).

In addition, New Zealand supports the health of its economy through effective anti-bribery policies, due to which the country reached the first position on Transparency International’s Corruption Perception Index (Stability & security, 2020). However, New Zealand remains a remote island nation, which limits its economic capacity and increases the value of quality workforce, making the country rely on foreign labor (New Zealand Economic Studies, n.d.). The primary economic risk for Sainsbury’s lies in the area of logistics, as the company will need to ensure a stable supply of resources to its new location.

Legal Risks

As discussed earlier, New Zealand and the United Kingdom share the common historical legacy of the British Empire. Today, both countries form parts of the Commonwealth of Nations, which further strengthens their relations (New Zealand, n.d.) Therefore, it appears possible to assume that the similarities between the two nations are profound enough to encompass the legal systems, as well. In other words, the legislative and judiciary frameworks of the UK and New Zealand are based on similar principles stemming from the days of the British Empire. Accordingly, Sainsbury’s Supermarket will not have considerable challenges in this regard.

In addition, the government of New Zealand recognizes the crucial role of private property rights, which is why the related legislation is quite developed. Simultaneously, the country pursues person-centric policies based on modern values and ideals. This tendency reflects in the customer-based retail framework, meaning that Sainsbury’s will have to ensure that the client service is guaranteed. Any infringements in this respect may result in considerable issues for the company.

Cultural and Ethical Risks

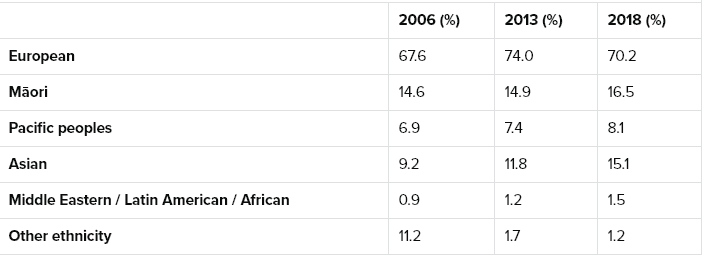

New Zealand demonstrates a particular cultural environment, which may cause additional challenges for companies entering their markets. The ethnic core of New Zealand’s population consists of two major groups. First of all, white descendants of European colonists amount for the majority of the country’s citizens. At the same time, the indigenous people of the Pacific, namely Maori tribes, have been receiving increased recognition over recent years, being represented by a separate party in the leading coalition (New Zealand (Britannica), n.d.).

In addition to this cultural mix, New Zealand demonstrates a strong demand for foreign labor. The country offers an array of international programs for professional immigrants, which leads to further complexity of New Zealand’s cultural and ethnic landscape (Figure 4). Statistics suggest that the number of immigrants has been on a steady increase. Simultaneously, the government of New Zealand promotes human values, equality, and tolerance of all views, being one of the world’s most progressive countries (McDonald, 2020). Accordingly, Sainsbury’s will have to maintain an exclusively positive public image to meet the advanced requirements of local communities in terms of equal, open-minded practices.

When it comes to comparing two nation’s cultural environments, Geert Hofstede’s framework is usually a viable instrument of comparison. It presents relevant information regarding how two societies function and perceive the world in a convenient. Such data will be highly useful for the management of Sainsbury’s Supermarket. As presented in Figure 5, both countries demonstrate similar patterns in all of six relevant aspects. New Zealand appears to be less individualistic, which means that word-of-mouth will play a more important role in this market, thus increasing the importance of a good reputation.

At the same time, the primary difference lies in the aspect of Uncertainty Avoidance, the index of which is higher for New Zealanders. Therefore, this culture values accurate, predictable data, and Sainsbury’s management will have to consider this point when designing a marketing strategy for New Zealand. In general, however, the cultural distance between New Zealand and the United Kingdom is not excessively large, making it easier for British companies, and Sainsbury’s, in particular, to adapt to the new environment.

Business Opportunities in New Zealand

GDP Growth Rate

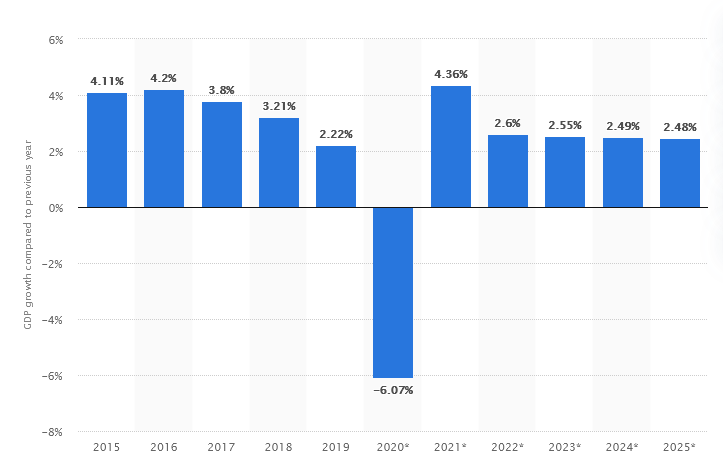

An examination of the most recent indicators of New Zealand’s economy can provide Sainsbury’s with a better understanding of the nation’s overall economic performance. However, it is important to take into account the influence of the current coronavirus pandemic, which has influenced global economic growth on an unprecedented scale. Figure 6 suggests that the economy of New Zealand had seen a stable annual increase until the outbreak of Covid-19. The growing economic activity signified that the business environment in the country was healthy and attractive for companies.

Naturally, the GDP decreased in 2020, following the global tendency caused by the novel coronavirus pandemic. Nevertheless, some reports state that the country has demonstrated quick recovery rates, showing a V-shaped pattern on charts (Withers, 2020). This is a good sign in terms of the economic environment, which confirms that the country has enough potential to resist global challenges. Citizens have enough financial security to engage in active economic relations in the fallout of a global crisis, making them a desirable audience of Sainsbury’s product. Furthermore, as shown in Figure 6, experts suggest that the economy of New Zealand will continue to grow at a quick pace in the upcoming years.

Competition

The aspects described in the previous sections make New Zealand a highly attractive destination for business expansion. Naturally, such markets attract numerous players, thus contributing to the overall level of competition. As mentioned prior, the population of New Zealand is rather small, making the scope of the market narrow, as well. Current reports state the retail market in the country is dominated by local companies. Foodstuffs supermarket chain currently dominates over 55% of the market (New Zealand market: Distribution, 2020 The second position is secured for Progressive Enterprises, and the combination of both organizations forms an actual duopoly (New Zealand market: Distribution, 2020).

Simultaneously, the high-end segment demand grows, and it is represented by Auckland-based chains, such as Nosh, Farro, and Jones the Grocer (New Zealand market: Distribution, 2020). Such data, combined with the increased rate of Uncertainty Avoidance in New Zealand, may suggest that Sainsbury’s will have difficulties fitting in the system. However, the target audience may be ready for new additions to the market and quality foreign products.

Consumer Image

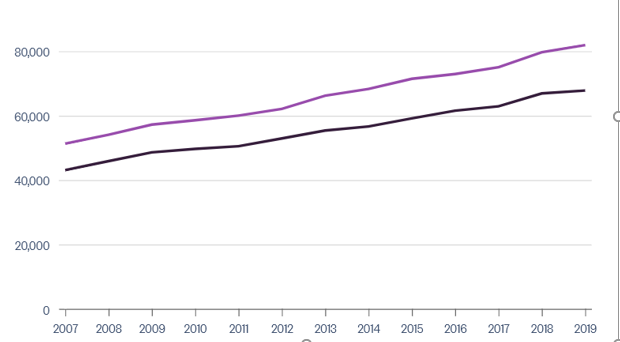

The information presented earlier confirms that New Zealand is a highly progressive, developed country demonstrating economic and social stability. In such an environment, the image of an average customer will inevitably be associated with a high income and considerate approach to purchasing. The disposable income per household in New Zealand has been growing steadily since the 1990s, along with the general economy of the country (Figure 7). Building a loyal relationship with such a capable customer base can provide Sainsbury’s with a stable source of revenues in the long term. However, it is important to understand the particular views of the audience to attain this objective.

Despite being the world’s leaders in progressive thinking, New Zealanders appear to remain cautious about new technology. According to statistics, the development of electronic commerce in the country has not been as rapid as one would expect (New Zealand consumer behavior, 2019). The pandemic and the lockdown may have instigated the development of online stores, but Sainsbury’s should proceed with caution in this regard. Overall, it is better to establish a trusting relationship with the customer base before actively promoting e-commerce opportunities.

Foreign Investment Climate

The favorable investment climate of New Zealand has been attracting multiple international brands. According to Winter (2018), for example, foreign expansion to New Zealand was particularly massive in the year 2017. The list of global players, who have entered this market, comprises such companies as H&M, Zara, and Victoria’s Secret (Winter, 2018). At the same time, customers have been expressing the desire to welcome more international companies in New Zealand, including IKEA. One may observe the tendency, according to which the majority of foreign investors in New Zealand do not specialize in food and beverage retail. Long distances between the country and its neighbors make it difficult to transport perishable items.

Furthermore, New Zealand’s agricultural industry is highly developed, which allows the country to meet the food-related demands of its relatively small population. Therefore, foreign experience suggests that Sainsbury’s should increase the emphasis on its apparel, cookware, and homeware offers. This way, it will avoid additional competition in the already populated grocery market in New Zealand.

Conclusion and Recommendations

In conclusion, New Zealand presents a range of viable business opportunities for foreign companies. The country demonstrates high political stability and outstanding economic performance, which makes it one of the best destinations for foreign investment. Sainsbury’s should consider expansion to New Zealand once the Covid-19 pandemic is over, as the current business environment appears positive for the company. Sainsbury’s is based in the UK, which will make its adaptation to the new market easier. At the same time, the company maintains a stable financial performance, having sufficient funds for foreign expansion.

Nevertheless, Sainsbury’s will have to conduct a comprehensive market evaluation before launching its operations in New Zealand to determine the most promising directions of retail New Zealand is a remote region, which will inevitably entail high logistics expenditures. To optimize the spending, the company should know exactly what and to whom it is going to offer. Considering limited human resources in New Zealand, Sainsbury’s should also focus on creating a positive corporate environment, as it is valued by the country’s residents. Overall, an expansion to New Zealand appears a viable project, which, however, requires further analysis on the level of micromanagement.

References

Compare countries. (n.d.). Web.

Map of New Zealand, Australia/Oceania. (n.d.). Web.

McDonald, E. (2020). Why is New Zealand so progressive?. Web.

Mean and median annual household disposable income in New Zealand. (2020). Web.

Ethnic group summaries reveal New Zealand’s multicultural make-up. (2020). Web.

New Zealand – Aotearoa. (n.d.). Web.

New Zealand consumer behavior & online shopping trends. (2019). Web.

New Zealand economic studies. (n.d.). Web.

New Zealand market: Distribution. (2020). Web.

New Zealand. (n.d.). Web.

New Zealand (Britannica). (n.d.). Web.

New Zealand: Growth rate of the real gross domestic product (GDP) from 2015 to 2025. (2021). Web.

New Zealand: Political stability. (2020). Web.

Sainsbury’s company profile. (2020). Web.

Stability & security. (2020). Web.

The New Zealand economy. (2020). Web.

The political framework of New Zealand. (n.d.). Web.

Withers, T. (2020). New Zealand economy surges out of recession in v-shaped recovery. Web.