Executive Summary

Saudi Arabian Airline is an Aviation Company that operates internationally; it is the official Saudi Arabian national airline with its headquarters located in the city of Jeddah. It is among the leading Airlines in the region and the largest in the country with flight schedules that include international and domestic flights in more than 70 destinations located all over the world. Its major flight destination is in Middle East where it is ranked as the second largest Airline; its other flight destinations are in Asia, Europe, North America and Africa. Since the inception of the Saudi Arabian Airline in early 1940s when it only had one airplane, the Company has rapidly grown and expanded in size to become the largest Airline in Saudi Arabia with a fleet size of 114 aircrafts as of 2010. This internship report describes the organizational structure, management and the business operations of the Saudi Arabian’s Airlines Company in general and from a perspective of my internship experience at the Airlines finance department where I was attached during the internship duration.

Acknowledgement

I wish to acknowledge the enduring support and guidance of Mr. (insert name) who was my supervisor and mentor during my internship period at Saudi Arabian Airlines. I also acknowledge the effort of my academic instructors whom efforts and training has made me the professional that I am today; without whom this internship would never have been.

Introduction

Saudi Arabian Airline was found and operated as the Country’s public airline; a status that it has been operating under until recently after the signing of privatization deal that led to the Airline being put in the fast track of privatization. Since then the Airline has been restructured to facilitate the privatization process that is expected to chart the Company towards the path of profitability. With daily flights to major destination in Europe, Middle East, America and Asia, the Airline has come a long way since the days when it used to operate domestic flights with a couple of aircrafts only. Over the years Saudi Arabian Airline has gradually expanded to become one of the leading Airlines in the region as well as internationally, this is despite the financial non-performance that has dogged the Airline since it was founded. For now it would seem that it has resolved to rise above its limitations and achieve its full potential if recent events are anything to go by.

Background Information

Saudi Arabian Airline was found in 1945 as the flag courier airline of Saudi Arabia by the then King Abdul Aziz, ever since it has been the country’s official airline and is currently the leading airline in the country (Saudiairlines.com, 2010). It was initially found and operated by the Country’s defence ministry as their subsidiary airline for official purposes and occasionally chartered to private individuals especially during hajj pilgrims. Until 1952, the Airline flight destinations were mostly domestic as it continued to add on it fleet size which by this time were approximately five aircrafts that included 4-engine Douglas DC-4s airplanes (Saudiairlines.com, 2010).

By 1952 during its ten year anniversary the Saudi Arabian Airline was already operating several international flight destinations mostly in Middle East and Africa. Since then the airline has been expanding gradually to become one of the most respected and profitable airlines with daily flights to almost every major destination in the world. At the start of year 2000, pressure started mounting to privatize the Saudi Arabian Airline through a privatization process that was planned to take place in stages. In 2000 Prince Sultan and the Defence Minister gave a green light for privatizing the Country’s airline by jointly signing a privatization contract (Saudiairlines.com, 2010). Towards this end the Saudi Airline was restructured into Strategic Business Units (SBU) in order to facilitate the privatization process by separating non-core business units from the main Saudi Arabian Airline Company (Saudiairlines.com, 2010).

In 2006, the first phase of privatization process was implemented with the Catering subsidiary being the first Strategic Business Unit to be privatized (Saudiairlines.com, 2010). In 2007, the Saudi government approved and fast tracked privatization of the rest of the Airline’s SBU to be finalized over the next few years. Currently Saudi Arabian Airlines has a total of 114 state of the art aircrafts with additional 35 more expected in the near future broken down as follows (Saudiairlines.com, 2010).

Figure 1. Background: Organizational Structure and Activities.

The Saudi Arabian Airline Company is now structured into five subsidiary-like Companies that are referred as SBU’s which include; Air Cargo division, Ground Services, Technical Services, Catering Unit and Prince Sultan Aviation Academy (Saudiairlines.com, 2010). With the privatization of Catering department in 2006 the Airline core business units remained four; the Catering department first became part of the Airline in 1981 when it was established to provide culinary services to the Airline (Saudiacatering.com, 2010). It would later become a world class culinary Company and recently emerged number one in a culinary competition exercise at Stuttgart, Germany where it won a Silver and Gold medals in culinary (Saudicatering.com, 2010).

The other subsidiary is the Prince Sultan Aviation Academy (PSAA), which is probably one of the most recently established SBU’s of the Saudi Arabian Airline having been found in 2004 for purposes of supplying much needed professionals in the field of aviation(Saudiairlines.com, 2010). The shortage of well trained and experienced aviation professionals is a challenge that has dogged the Airline since its inception in 1945. As recently as 1990, half of the airline workforce was made up of foreign expatriates since the country could not source the required personnel from within the country. Early on during its inception the majority of the Airline personnel include foreigners from Europe and America. The PSAA academy has a training capacity of more than a 1000 students in all major areas of aviation that are taught through the Academy’s nine departments (Saudiairlines.com, 2010).

In the wake of the historical oil price hikes of the 1973s, the Saudi government invested heavily on the Cargo department of the Country’s official airline being among the largest beneficiaries of the increased oil revenues at the time. It was during this period in 1977 that the Cargo division acquired several Boeing aircrafts among others that led to the rapid expansion of the Airline cargo services. Today, Saudi Cargo is one of the largest divisions of the Saudi Arabian Airlines and a principle subsidiary (Saudiairlines.com, 2010).

The Ground Services of the Saudi Arabia Airline is responsible for range of services that are meant to facilitate the airlines flight operations. It became a fully fledged department in 1988 to cater for the ever expanding needs of the Saudi Airlines and is currently in charge of ground services in major flight destinations with an annual capacity of handling more than 150,000 flights both international and domestically (Saudiairlines.com, 2010). Among the most essential operations of this department include passenger services, cabin services, station management, flight logistics, flight maintenance services and airline management services.

It is on this division in the department of finance that I was based during my internship period with the Saudi Arabian Airline.

SWOT Analysis

A SWOT Analysis is a form of a model that is used to analyze a company’s strengths versus weakness within a given market environment (Griffin and Pustay, 2005). It is the sort of assessment that is most ideal to apply in organizational analysis both from an internal and external perspective in order to locate the strengths and weaknesses of a Company. This can be attained by analyzing the organizational strengths, weaknesses, opportunities, and threats that can be utilized as a basis for short term and long term strategic plan.

SWOT Analysis: Organizational Internal Strength

Saudi Arabian Airline is a member of two reputable international aviations bodies; the Arab Air Carrier Organization (AACO), a regional aviation body which it joined in 1965 and the International Air Transport Association (IATA) which it has been a member since 1967 (Saudiairlines.com, 2010). Since the start of this millennium, the airline has continued exceeding its limitation by achieving important milestones. It was in 2000 that the airline privatization deal was approved by the government that saw the Company restructured in a way that enhanced and improved its business operations. The airlines privatization is a step towards the right direction which can be attributed to the current improved efficiency of the Company and therefore one of its strengths. In the same year, 2000; two of the airlines subsidiary divisions attained ISO 9002:1994 certification boosted by increased passenger freights that reached its highest during that year (Saudiairlines.com, 2010).

During this decade the airlines fleet modernization plan that has been ongoing for more than one decade was finalized in 2001 with the arrival of the last lot of the modern flights, Boeing 777-268 (Saudiairlines.com, 2010). The finalization of this fleet modernization plan has now put Saudi Arabian Airline at par with other international airlines thereby improving it competitive advantage in the aviation industry. Over the recent past the Saudi Arabian Airline has made great progress in improving it customer care services as well it’s online booking system. These improvements have now made it possible for customers to book flights online, cancel tickets, check-in and obtain boarding pass through it innovative e-ticketing project (Saudiairlines.com, 2010).

For many years until recently the airline has been a monopoly Company operating in Saudi Arabia. The fact that the airline is the national courier makes it a heritage for the Saudi Arabian nationals which put it at a favorable position to benefit more from this monopolistic advantage. The recent restructuring of the Airline into SBU’s has been very effective in diversifying the Company areas of business operation which is important in reducing its exposure from single source financial risks. Finally, like all successful organization the Airline recent performance and success can be attributed to its human resource that are well trained and experienced (Saudiairlines.com, 2010).

SWOT Analysis: Organizational Internal Weakness

For many years since its inception, Saudi Arabian Airline has never been profitable, it’s for this reasons that the Saudi government eventually resolved to privatize the Airline in order to affect a turnaround of the Airline profitability (Saudiairlines.com, 2010).

From the onset, the Airline was unable to source locally the technical expertise required to run the Company, in fact until 1960s the Airline was run and managed by an American firm known as Trans World Airlines (Mann, 2005). These constraints of experienced human resource would continue to be a challenge to the Saudi Arabian Airline for a long time to come. It is probably the lack of this technical expertise that led to the mismanagement and under performance of the Airline during it early years when it had its greatest potential. Lack of technical business expertise to expertly chart the Company during the economical turbulence of the 1990s saw the Airline business operation rapidly decline and eventually halt. Lastly the airline aging fleet would later become a costly liability to the Airline at a time when the aviation industry in the region was very much strained economically.

SWOT Analysis: External Environment Threats

The Aviation industry worldwide is very competitive and a risky business to invest in, if the September 11 and the 1990 gulf war is anything to go by. During the Iraq-Kuwait war of the 1990 and for several years thereafter, the Saudi Arabian Airline was technically not operational including other Airlines in the region (Mann, 2005). Immediately after the war broke out on August of that year the Saudi Arabian Airline was grounded due to the heightened state of security that also led to many Companies suspending their business operations in the region, which comprised the biggest percentage of their clients (Mann, 2005). To worsen the situation, most of the Airlines freight destinations during this period were mostly at regional with very few international flights schedules.

Two years after the war, the Airline has only attained 75% resumption of regional and domestic freights and the effects of the gulf war continued to linger on affecting international flights as well (Mann, 2005). In the wake of September 11th attack in United States, the Airline suffered a drop in it international freight services but which it eventually recovered from. More recently early this year the Airline cancelled a total of 28 flight schedules in Europe and froze all services due to the risk of volcanic ash caused by climatic conditions (Saudiairlines.com, 2010). In terms of accidents, the aviation industry is not an ideal line of business; since its inception the Airline has suffered six major accidents that resulted in loss of life and complete damage to the aircrafts (Saudiairlines.com, 2010).

In addition, since the Airline is owned and managed by the government it is possible that the Airlines mismanagement during the early years was contributed by political factors, indeed the Airlines Director General position has historically been a political appointment (Saudiairlines.com, 2010). The technological limitations of the 1970s in the aviation industry in the area of aircraft manufacture were a limitation in themselves due to the high cost of freight operation and maintenance.

Organizational Marketing Strategy: Porter’s 5 Forces Model

Michael Porter 5 Forces Model is a framework developed to serve as a guideline for market analysis and for development of strategic business objectives for an Organization (VectorStudy.com, 2008). The Porters Five Model concept is especially most applicable to this situation, It is a process of determining the five forces that directly impacts on a firm performance in terms of financial performance and customer service delivery based on a total of ten economic concepts (VectorStudy.com, (2008).

Basically Porters 5 forces is made up of two major groups of forces, those that are categorized as horizontal which include; threat from substitute product, from established rivals and from new entrants (VectorStudy.com, 2008). The other group of forces is collectively referred as vertical force and includes customer bargaining power and supplier bargaining power, together these five forces makes up the 5 Porter model as shown below (VectorStudy.com, 2008).

In the area of threat of substitute products, Saudi Arabian Airline is not experiencing any sort of competition from other modes of transport since air transport offers distinct advantages and convenience that cannot be obtained by substitution with other modes of transports. In the second area of threat of entry by new competitors, Saudi Arabian Airline is experiencing stiff competition from every side; within and without. The privatization process of the Airline for instance ushered in a new era of competition with the end of the Airlines monopoly advantage that it has enjoyed for many years; from a domestic level this is one area that the Airline is facing stiff competition. At the international level the Saudi Arabian Airline has to put up with international world class airlines such as British Airways and Emirates that have business presence in the region.

The usual merging and acquisition of some of the international Airlines as recently happened with British Airways, serves to only agitate further the competition level in an industry that is already very competitive. This is because merging enables an Airline to fully benefit from the scales of economies which leads to high profit margins that are passed on to the customers in form of discounts. Merging and acquisition of multinational Airlines Companies contributes to shrinking of market share with the large Airlines that are continuously expanding operations obtaining the lions share. Third, the intensity of competition is a real threat that Saudi Arabian Airline must strategize against by developing contingencies. This is because ongoing acquisitions and mergers, or just rapid growth by International Airlines makes them formidable competitors that can afford to significantly lower costs in order to attract customers as well as acquire new market shares.

The fifth force is the bargaining power of customers which has relevance in that clients have now generally become sensitive to slight price changes heightened by the level of competition within the industry. The implication is that Saudi Arabian Airline, like all other airlines has operating costs that are largely dictated by a set of several factors such as; market price, oil price, political factors, economical factors and customer bargaining power. Lastly, the bargaining power of suppliers is a key determinant that influences the Airline financial performance and operations in general; this is because of the high capital required to equip an airline and the associated high costs of fuel. It is perhaps the major force of threat that faces any type of business that relies on oil sector where the cost of production, politics, government policy, currency change and civil wars are always influencing the production and therefore the price of fuels (Gulati, R. (1998).

Combined together these factors are responsible for the marketing and competitive strategy that the organization has adopted in order to remain operational. The marketing strategy for the Airline has recently been focused on customer satisfaction and royalty promotion. Just this year, the Saudi Arabian Airline launched another innovative modernization program that integrates several customer focused services known as Amadeus system (Saudiairlines.com, 2010). The Amadeus system will facilitate several customer automated services that would ease the manual process and avail key services. It is one among series of innovations that the Airline has been implementing over the recent past including upgrading of the Company online portal for public relations services as well as for marketing purposes (Saudiairlines.com, 2010).

Since its inception the Airline marketing strategy has always been focused on acquiring and dominating a market niche of hajj passengers that makes annually pilgrims in the country.

Organization Competitive Strategy

With the advance of technology in every sector, operating an airline has become less expensive; some of the Airbuses for instance have the capacity of more than 600 passengers thereby greatly maximizing on the economies of scale. The innovation of online system and e-ticketing, currently implemented by the Airline also greatly reduces the operating costs by cutting on the number of personnel that the Company requires to maintain in order to operate effectively. Away from technology, the current diversification business strategy of the Airline is through its SBU’s which are structured like subsidiaries and which have already been proven to be cost effective since they have so far led to increased profit margins (Saudiairlines.com, 2010).

The Saudi Arabian Airline Corporate Strategy is clearly seen to have shifted over the recent past due to the Airline privatization initiative. The corporate strategy of the Airline is seen to be responsible for it recent increase of it annual profits which have been realized because of the Airlines improved customer care quality, well trained personnel and aggressive marketing strategies (Saudiairlines.com, 2010). The Airline is also currently in the process of a 2nd phase fleet modernization plan that is scheduled to begin 2010 in order to boost both domestic and international flights services of the Airline. Part of this strategy which is being implemented in three phases is increasing the number of daily flights operating domestically to more than 100 flights from the current 70 flights.

Job history

My internship period with Saudi Arabian Airline lasted for a total of seven weeks at which time I was based in the finance department of the Airline. In general my main duties and responsibilities at the Airline included preparation of financial records and reports as part of a larger team, cash management activities, management of the Airline investment portfolio. In addition I was also involved in undertaking other functions such as auditing, budgeting and accounting.

Conceptual Framework: Financial Projections

One of the major activities that I participated during my internship duration at Saudi Arabian Airline was projections of the Company financial earnings and the cost-benefit analysis of its fleet modernization project and flight expansion plan. A Company financial projection is a financial statement that indicates expected performance of a Company in all major areas of its operation prospectively (McConnell, Brue and Flynn, (2009). It can be both short term and long term financial projection of a Company performance that provides management with an insight of expected performance of the Company as well as the general direction of the Company.

At other times financial projections are required during borrowing of loans or capital and are therefore included in business proposal documents. The innovation and advances in the sector of information technology sector has made it possible for production of various financial projections software’s that are usually used for this purposes. However the basic elements of a financial projection analysis remains the same and must include projected balance sheet that indicates the Company’s liabilities, assets, cash flow projection as well as other factors such as the growth of the industry, economy and political factors (McConnel et al, 2009). Fixed and variable costs must also be considered during financial projection analysis; fixed cost are expenses that are not influenced or affected by the scale of services or goods that a company undertakes such as rent, utilities and employee salaries (Gelles and Douglas, 1996).

Variable costs on the other hand are company expenses that vary with change in scale of company operations such as overtime employee allowances and transport costs among others (Gelles and Douglas, 1996).

Determination of cost-benefit of the Airline fleet modernization project and its flight expansion plan required the application of the Minimum Efficient Scale (MES) concept which is most suitable for determining the ideal production level of a company at which production is most cost efficient. In this analysis, economies and diseconomies of scale are used to determine the point at which the maximum effectiveness of the plant is attained (McConnell, Brue and Flynn, 2009).

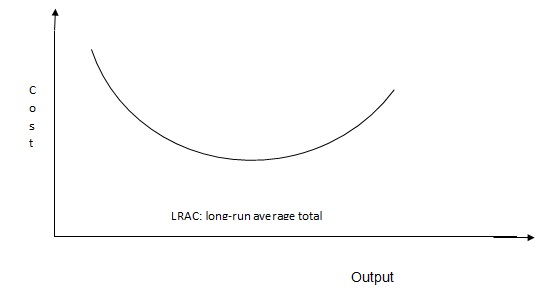

Minimum Efficient Scale (MES) is a concept primarily used in industrial organization to describe a point in production whereby a manufacturing plant produces the least amount of units that are able to minimize the Long Run Average Costs (LRAC) of the plant (MacAuliffe, 2004). It is the point where minimum efficient scale of a plant is attained since the least production of units at the lowest opportunity cost is attained, below this point a plant is not able to produce goods and meet the long run average costs of the plant. It is usually indicated as the first point of the LRAC curve when the variables of production and costs are graphically represented. Since the minimum efficient scale is a specific point in the production curve its value is often expressed quantitatively as an exact figure; nevertheless it can take various ranges as well as values (Frisch, 1980). This is because the long run average cost (LRAC) curve is basically influenced by two major variables: economies of scale and diseconomies of scale (Frisch, 1980). Hence minimum efficient scale is not necessarily a single value of quantity but may also include range of values for which the point of minimum efficient scale can be said to occur.

Technical Part: Determination of Cos-Benefit using Economies and Diseconomies of Scale Principle

Normally in estimation of MES the long run average cost curve is usually L-shaped since manufacturing industries has substantial low-end economies of scale that eventually get exhausted rapidly (Frisch, 1980). The result is that average costs for production remain constant for all firms in the industry. Hence the L-curve design of long run average cost implies that MES is a concept that mainly defines the lower end limits of plant size as well as the high bound limits.

Output

Being a Company that has been in operation for more than half a century, the Saudi Arabian Airline has so far exhausted the low end economies of scale and is now in a stage where the average cost of business operation are relatively equal among all players in the industry. Hence, the only option for the airline is to expand its business operations and pursue the economies of scale returns that would increase it revenues. The only question therefore is to determine at which point the Airline should cap it expansion bid beyond which no further returns can be attributed to it expanded size.

As indicated in the curve above the cost of production for a firm reduces with increasing output of the plant up to a certain level, thereafter further increase of output leads to increased cost in production since it is at this point that diseconomies of scale sets in, this is the point that we needed to determine. Prior to that, the firm is efficient because of various returns on scale such as managerial economies, technical economies, marketing economies and purchasing economies (McConnell et al, 2009). The determination of the actual point at which the returns on economies of scale was highest was actually calculated using a Breakeven Analysis program that indicated it to be in the region of 185 aircrafts operating at maximum output of 200 flights per week. Currently the Airline has 114 aircrafts with approximate 70 domestic and international flight departures which means that it is yet to fully take advantage of the economies of scale concept.

While the program can accurately project the actual point at which the Airline should peg its business operation, ideal cost-benefit analysis requires more than numerical numbers since other factors must be considered as well but which were not included as variables by the program. The overall organization structure for instance will influence the determination of cost-benefit analysis; other factors include nature of industry, politics and technological advances among others.

Evaluation

Overall, the internship activity at the Saudi Arabian Airline provided me with an experience in my career that was very valuable.

Besides the technical expertise that I gained from the various sections in the finance department that I worked during this period, I also gained essential managerial and interpersonal skills. As a result I gained experience and skills in implementing financial tasks that required teamwork collaboration and support. My involvement in various projects within the Company provided me with problem solving skills that compliments my knowledge in the area of finance. Throughout my work experience at the Airline I learned to work with personnel from diverse background and manage relationships while building consensus around project implementation. I indicated great acumen of learning and ability to adapt to new work environments within a multicultural, dynamic and challenging organization and I was excited about the challenging job responsibilities.

Summary of findings and recommendations

It is my opinion that Saudi Arabian Airline has great potential of growth and expansion beyond its present business operations. Looking at the Airline history since it was first founded in 1945, it is clear that the Company has missed great opportunities of expansion at various stages of its growth; in fact the Airline has never entered any merger or acquisition deal to date.

With the expansion opportunities presented by the prospect of mergers and acquisition deals it is not hard to see that this is one of the reasons why the Airline is yet to attain its full potential. Besides, the trend in the aviation industry indicates that acquisition and mergers deals are very profitable

Another area that Saudi Arabian Airline needs to focus on is on reduction of operational costs that are most notable in some of the department which has turned out to be very costly and negatively impacts on the profitability of the Airline. It is for this reason that the Airline has always encountered losses; more effort is therefore required to identify and eliminate all costly and unnecessary expenses. Lastly the airline needs to be more aggressive in its marketing strategies as well as to come up with customized services that will ensure its domination of the domestic market share since this is one of the core business areas of the Company. This is because the Airline has recently been losing dominance of this market share to old rivals such as Emirate Airways and new entrants; being their core areas of business operation means that they cannot afford to concede from this end.

Conclusion

Over the next few years when the Airline will have finalized its 2nd phase fleet modernization project, it is expected that the Company will gain the much needed competitive edge that would turn around it financial performance. With the current efforts that are underway to privatize the Airline, there is no doubt that the Airlines will indeed turnaround, nevertheless a good place to start will be to ensure that the Airline is well managed from the top down. This is because without good management even the best laid strategic plans or massive capital infusion would not turn around an ordinary Company beyond its potential.

References

Austvik, G. (1993). The War Over the Price of Oil. International Journal of Global Energy Issues, 12(3): 46-62.

Frisch, R., (1980). Theory of Production. California, CA: Drodrecht Press.

Gulati, R. (1998). Alliances and Networks. Strategic Management Journal, 19(1), 293.

Griffin, W. & Pustay M. (2005). International Business: A Managerial Perspective (4th ed.). New Jersey: Pearson Prentice Hall.

Gelles, G. and Douglas, W., (1996). Returns to Scale and Economies of Scale: Further observations. Journal of Economic Education, 27(5): 259-261.

MacAuliffe, R. (2004). Minimum Efficient Scale. Web.

Mann, Mimi. (2005). Executive Briefing. Middle East Executive Reports, 13(4):4-10.

McConnell, C., Brue, S. & Flynn, S., (2009). Economics: Principles, Problems and Policies. 18th ed. New York, NY: Mcgraw-Hill Irwin.

Saudiacatering.com. (2010). Saudi Arabian Airlines: Catering. Web.

Saudiairlines.com. (2010). Saudi Arabian Airlines. Web.

VectorStudy.com. (2008). Porters Five Forces Analysis. Web.