Introduction

Demand supply linkages in industries traditionally has been analyzed using chain models where the implicit assumption was that raw materials accumulated on the input side were amalgamated to form the end-product. Production function in economics describes this very relationship between inputs such as labour, capital, and raw material to make the product. Based on this linear ideology and an extended understanding of the industry as comprising of many firms shared technology and resources to produce the particular product, as in case of steel industry. Using this idea, the value chain analysis was developed to show the constant endeavour of firms to reduce cost within the chain (Porter 2001). Another model arose within the chain linkage literature called the global commodity chain (GCC), which represented the backward and forward linkages of the production process along with the numerous distribution and marketing nodes within the chain (Gereffi & Korzeniewicz 1994). This specially aimed at understanding the effect of different taste and preferences around the world on production and marketing activities of a firm.

Main body

One problem identifiable with the chain models is their linear nature, which is limited by the linear chain and industry centred business model. Froud et al. state that the traditional economic activity of an organization is defined through the “… long-established concept of economic activity as an industrial chain leading to a finished product.” (1998, p. 293). In other words, sector matrix shows that the traditional idea of the firm as operating within an industry and solely in an industry is flawed. Rather the sector matrix analysis states that firms operate within not only the industry but also tries to draw advantage through allied sectors (Froud et al. 1998). Though the ultimate aim of the firms remains to be cost reduction, the process is not limited to a linear chain and within a single industry. Thus, sector matrix provides a better understanding of the operations of organizations and understanding the demand supply linkages within the industry.

Porter’s (2001) value chain analysis provides a chained definition of the industry. Porter describes the linkages within the industry through “supply chain” i.e. the linkages between firms in the industry. Porter uses the value chain to describe a series of functions within the supply chain of the industry. Thus, the raw material provided by the suppliers, capital of the firm, infrastructure and labour resources, the actual transformation within the production arena occur. Once the production is completed, the product leaves the manufacturing area and enters the distribution chain. Porter places the supply chain within the value chain and states that the strategic decision making if the organization determines the way the business manages its supply chain. Thus, through this process the firms aim at cost recovery and reducing cost.

The interlinkages between a firm, which essentially connect manufacturers, suppliers, contractors, and distributors within the global industrial framework, and then to the international market forms the GCC framework (Gereffi & Korzeniewicz 1994). The main stress of the framework is on the design, marketing and distribution of the product within the commodity chain and through the creation of core process pressure from competition is transferred to other sectors (Gereffi & Korzeniewicz 1994). Thus, the framework stresses on the production process, which is embedded in the cultural process. Gereffi & Korzeniewicz (1994) presets this idea with the example of the US athletic footwear industry and a case study of Nike. They state: “… the socio organization of advertising, fashion, and consumption shapes the networks and nodes of global commodity chains. The athletic footwear case shows that the organization of culture itself is an innovative process that unevenly shapes patterns of production and consumption in core, semiperipheral, and peripheral areas of the world-economy” (Gereffi & Korzeniewicz 1994, p. 247). Consequently it is evident that both the value chain and commodity chain framework are subject to a few issues:

- linear model of backward-forward integration,

- within-industry analysis,

- applicability limited to “foodstuff and simple, durable throw always”,

- demand of the consumer depends on a “series of reverse relations within the production/distribution chain” and not considering the “social embeddedness of the economic activity” (Froud et al. 1998, p. 301).

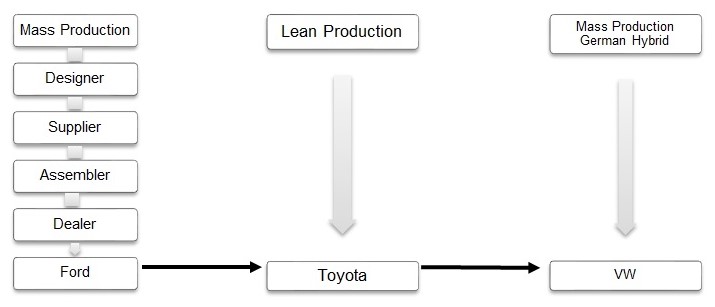

Sector matrix analysis aims to explain the industry linkages for complex products like ethical pharmaceuticals and cars but their applicability is not limited to these products only as many simple products are now bundled with services (Froud et al. 1998). Taking the example of automobile industry, and specifically cars, a chain analysis will show the perspective of the framework is producer centred (see figure 1). Figure 1 demonstrates the mass production process.

The preoccupation of the framework with production driven chain is a drawback for analysing the linkages within the industry. Therefore, in case of lean production, the production process according to the chain analysis becomes a linear horizontal line (Froud et al. 1998). Thus, the chain analysis fails to demonstrate the linkages within the lean manufacturing process. Introducing the matrix system in such a situation, the paper will identify the pros and cons of the sector matrix analysis through an illustrative example of the automobile industry.

In case of simple products like footwear the products are produced, used, and then thrown away. However, their usage does not require a complex infrastructural set-up for or additional services for their usage. For complex products like cars, a complex infrastructure is required to use and additional services are required to support the users. Chain analysis (be it value chain or commodity chain) are limited in its demand side analysis of the completed product and common technology on the supply side used for manufacturing. Chain analysis stress emphasis on the supply side of the production as it illustrates the linkages between suppliers, manufacturers, and distributors. The demand side linkages are defined by competition between the major car producing companies. Thus, based on this, different companies employ a different chain approach to attain competitive advantage (as demonstrated in figure 1 by Ford through mass production, lean production by Toyota and hybrid mass production by Volkswagen).

Thus, to avoid the limitations posed by chain analysis, sector matrix analysis was developed (Froud et al. 1998; Haslam, Neale & Johal 2000). The underlying assumption for this framework is to expand the unit of analysis on the demand for new product not by the consumers, but by the households, thus concentrating on household expenditure. The second assumption is on the supply side, instead of adhering to the traditional definition of an industry as a business operating with shared technology and similar product, broaden the definition to “financial consolidation of a range of activities which cut across industry sectors” (Haslam, Neale & Johal 2000, p. 101). At the level of the region or country, the matrix for the automobile industry is determined by the demand side of the automobiles from households and by firms who recover their cost for different supply side activities. As pointed out by Froud et al. (1998) “at bloc or national level, a meso matrix is governed by demand fro households and firms outside the sector which creates the revenue that sustains employment within the sector and allows cost recovery.” (Froud et al. 1998, p. 304).

Figure 2 shows the demand side of automobile sector can be demonstrated using a sector matrix framework. The figure shows that the demand for used cars forms a substitute for new cars, which establishes a relationship of “demand substitution and supply interaction” between new and old cars (Froud et al. 1998, p. 305). This is visible, as many households prefer to buy a second-hand car instead of a new car in order to avoid high depreciation cost of owning one. This causes the demand substitution of the old car for the new car. Car manufacture ring firms have to be in contact with the second hand market due tot heir servicing provided for the car. The second characteristics that is brought forth is while considering the new and old cars as complementary products, they can be simultaneously consumed with additional services like finance, petrol, after sale service, tax, etc. Further, they act as complementary products as cars require payment of loan amount for the period of the loan, purchase of services, fuel, etc. which forms as a complementary product. Figure 2 actually rejects the supply side argument posed by the chain analysis. This analysis shows that there are interlinkages between sectors whose linkages must be understood before ascertaining the linkages within the industry (Froud et al. 1998). Thus, the matrix shows how a more complex system of demand and supply relations intertwines to shape the business strategy. Thus, horizontal as well as vertical relations, which are present in the industries, are demonstrated through the matrix analysis, in contrast to the chain analysis that demonstrates only vertical relations.

Conclusion

The demand side analysis of the sector matrix provides the shift from the traditional chain analysis. The household consolidates the income from the active labour force, and in an economy, the household income is usually unequal which affects the corporate income. Froud et al. (1998) provided an analysis of the household expenditure of the UK and US and showed why households in the US run two automobile a household and one car on average in the UK. Thus, it is stated that it is the pattern of household income that affects the pattern of expenditure. Thus, the household income provides the cost recovery opportunity for firms.

Clearly, a sector matrix is a definitely elaborative than the chain analysis for complex goods. However, in case of simple goods like soaps or footwear, how cans a matrix framework can work? The answer is simple. Different industries have a different characteristic. In case of footwear industries, the sector framework will take a less complex form in comparison to a complex product. Further, a sector matrix understanding of industry presented a broader view for other areas of industrial understanding, i.e. for corporate governance (Bromberg 2004). Therefore, sector matrix has been criticized for neglect of the need to create value and thus neglecting the finacialization of the corporate. Research has shown that sector matrix can be used for analysing the input-output linkages in other forms of industries like timber industry in Malaysia (Othman 1992), convention industry in South Korea (Kim, Chon & Chung 2003 ), etc. Froud et al. (2001) further mentions that with increased stress on generating shareholder value by firms in the US and UK, a sector matrix framework can be beneficial for all industries to follow a model that is followed by motoring and health care industry. Thus, it is important to identify what are the core operations as in case of Ford, it has questioned if assembling is a core function for its business and has experimented with outsourced assemblies in Brazil (Froud et al. 2001). They believe that sector matrix analysis will help the firms attain the financialisation targets for many old fashioned industries (Froud et al. 2001). Reinventing the wheels of horizontal and vertical linkages will help to financialise (i.e. to increase shareholder value for firms) the industry through rapid restructuring of the global industry (Froud et al. 2002). Thus, sector matrix framework can not only be applied to other simple as well as complex products alike, and also help in solving critical issues related to increasing shareholder value and corporate governance, thus, becoming an important strategy development tool.

References

Andersson, T, Haslam, C, Lee, E & Tsitsianis, N 2008, ‘Financialization directing strategy’, Accounting Forum, vol 32, no. 4, pp. 261-275.

Bromberg, T 2004, ‘New Forms of Company Co-operation and Effects on Industrial Relations’, 22nd International Labour Process Conference in , Amsterdam.

Froud, J, Haslam, C, Johal, S & Williams, K 1998, ‘Breaking the Chians? A Sector Matrix for Motoring’, Competition and Change, vol 3, pp. 293-334.

Froud, J, Haslam, C, Johal, S & Williams, K 2001, ‘Financialisation and the coupon pool’, Gestao Producao vol.8 no.3 São Carlos Dec. , vol 8, no. 3, pp. 271-288.

Froud, J, Haslam, C, Johal, S & Williams, K 2002, ‘Cars After Financialisation: A Case Study in Financial Under-Performance, Constrints and Consequences’, Competition adn Change, vol 6, no. 1, pp. 13-41.

Gereffi, G & Korzeniewicz, M 1994, Commodity Chains and Global Capitalism, Praeger, Westport, CT.

Haslam, C, Neale, A & Johal, S 2000, Economics in a business context , Cengage Learning EMEA, London.

Kim, SS, Chon, K & Chung, KY 2003 , ‘Convention industry in South Korea: an economic impact analysis ‘, Tourism Management, vol 24, no. 5, pp. 533-541.

Othman, MSH 1992, ‘Economic Impact of Malaysian Timber Exports ‘, Journal of Tropical Forest Science, vol 5, no. 1, pp. 54-67.

Porter, M 2001, ‘The Value Chain and Competitive Advantage’, in D Barnes (ed.), Understanding business: processes, 1st edn, Routledge, London.