Introduction

Below is a financial analysis for Sony Corporation. The evaluation shows Sony Corporation shares to perform slightly below projected values. Here, the picture is a well-established company that is struggling to edge out competitors. Required data for analysis of Sony Corporation, including stock returns, treasury rates, and market returns is available at the Yahoo Finance website. Other relevant data for multiple evaluation computations is available from annual financial reports.

The CAM model-generated values are used for the required rate of return. The equation below represents a general form of the CAPM model (Koller 58).

C= A+ β (B-A)………………………………………………………………………………………………..1

Here, C=Required Rate of Return; A=Risk Free Rate; β= Premium Risk Coefficient. Historical Regression in Microsoft excel yielded a raw value that could proxy β (Koller 58). Computations for calculating historical regression are available in the appended excel datasheet. As suggested by multiple business textbooks, the formula below is useful in adjusting the value of raw β (necessary for accurate computations) (Koller 58).

β(0.67) + 0.33 =Adjusted β

Here, the value for the adjusted β is 1.14204. Afterward, a two-stage dividend evaluation model was useful for calculating theoretical stock returns for Sony Corporation.

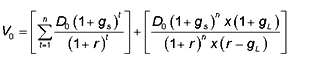

One can get different values for RRR by varying treasury rates. Assuming 4%, as a proxy to the 10-year bond treasury rate, the required rate of return is 0.0514. The two-stage dividend valuation model can then compute stock prices. The equation below represents a general form of the two-stage dividend valuation model (Chan par. 2).

Computations for the Dividend valuation model are in sheet two of the excel worksheet. Here, it is necessary to picture multiple economic scenarios to generate a clearer picture of Sony’s stock. As shown in the table below, different economic situations will generate different economic environments; hence, varying opportunities for the shares of Sony Corporation to grow (Koller 58).

Table 1: Different Economic Environments in the US

The table below shows different values of Sony’s stock under different economic environments. Here, the two-stage DDM model assumes a 2% growth rate during the next five years followed by a 3% indefinite growth. The last dividend paid by Sony Corporation totals $0.316.

Table 2: Theoretical Values for Sony Corporation Shares

The current market value for Sony Corporation shares averages at $9.8. Such a value compares well with values generated by the DDM. Still, it seems that Sony shares are slightly undervalued in the stock market. Historical data (available in excel datasheet) shows a significant plummeting in the value of Sony shares within the past six years. Such a direction could show waning confidence in the strength of Sony’s brand.

SWOT Analysis

One of the main strengths for Sony Corporation includes a strong brand presence in the electronics product market. A traditional niche of customers (who believe in the reliability, quality, and durability of Sony products) can set up a strong foundation for the marketing of different products there (Stewart 121). Besides, Sony Corporation is more experienced in the design, production, and marketing of multiple electronic products. A well-established international network with offices in different parts of the globe can strengthen several departments within Sony Corporation, such as customer care and marketing. Still, Sony must address multiple weaknesses, such as non-competitive marketing and a deficient innovative culture to increase her market share (Koller 58).

Despite a difficult economic environment, Sony Corporation can use several opportunities to grow. Expanding economies in Asia and other developing nations present an emerging market for electronic goods. Here, the mobile phone market is an important segment that can significantly increase the profile of Sony Corporation.

However, competitors in the electronics market, including competitors (like Apple) that design very competitive brands, will continue to offer significant competition to Sony’s Products.

Sony’s management is responding to the above challenges by focusing on policies designed to increase Sony’s market share. Here, the management is striving to create an innovative face in all departments including marketing, manufacturing, and design departments (Chan par. 2). Besides, Sony Corporation is diversifying operations by producing multiple electronic-based products and software (Stewart 121). Despite many challenges, Sony Corporation remains a profitable (despite a low-profit margin: -1.2% in September 2012) company. Currently, the return on equity is -18%. The general picture here is a company with a big brand name that is struggling to increase its profile by trying to make enough profits.

Conclusion

The Performance of Sony corporation shares in the NYSE market is just average. Companies like Samsung and Apple are realizing an increasing market segment mainly because of specialization and innovation; thus, placing traditional producers of electronic products, such as Sony Corporation at a disadvantage. However, Sony remains a big name in the electronics market able to respond to emerging challenges.

References

Chan, Leong. Stock Valuation: Two Stage Dividend Growth Mode. 2012. Web.

Koller, Daphne. Valuation: Measuring and Managing the Value of Companies New Jersey: John Wiley & Sons Inc, 2005 Print

Stewart, Bennet. The Quest of Value New York: Harper Collins, 1991. Print.