Introduction

Tamweel Company has been operation since the year 2004 in the UAE. The company offer financial services to private developers and runs a financial institution. The company has five financial service products. The Company has been a market leader in financial services in UAE since its inception. However, the company has lost this spot to its competitors. Thus, this treatise attempts to draw a marketing plan that will ensure that the Tamweel Company recovers from the current losses to profitability within the year. The treatise targets market location expansion, creating and increasing product awareness, and increasing the units of sales. The key to successful recovery strategy will function on development of e-business, expansion of the business, growth of the domestic market, brand awareness creation, and organizational flexibility in the dynamic UAE market.

Company Profile: Tamweel Company

Nature of Tamweel’s Products

Tamweel Company was introduced in 2004 and has grown to be the largest in Abu Dhabi real estate industry. It is a government owned real estate firm. Currently, the institution has financed property worth over AED 10 billion. The Tamweel offers services especially in the real estate industry. Tamweel Company specializes in financing investment projects following the Islamic Sharia. Among the finance models it adopts include the Ijara. Ijara is a contractual agreement in which Tamweel purchases an asset from the owner for a defined amount as demanded by the client. Later, this property is rented to the same client on a periodic lease agreement.

Murabaha is another finance model practiced by the company. In this model, the company enters into a contract with a client following a mutual agreement based on the promise made by the client to honour the pledge. In addition, the Istisna’a finance model operates on an agreement with the client in which the company erects a premise in line with the particulars defined in the requirement blue print which automatically becomes valuable upon completion as per the set deadline. Besides financing property development, the company deals in brokerage among other activities. The company also participates in staff assistance programs that are aimed at instilling moral suasion in business. It serves as a subsidiary of Dubai Islamic Bank. The company has four branches across the United Arabs Emirate.

Tamweel’s Competitive Advantage

Although Tamweel has been a household name in the financial services industry, the chain has an expanded business portfolio which includes investments in customised services and introduction of new financial service models. The expanded portfolio provides the business with competitive advantage in the sense that it can still maintain profitable performance even in instances where one side of the business experiences poor performance. Through diversification and portfolio balance, the company has been in position to survive turbulence in the harsh UAE economic environment characterized by stiff competition.

Tamweel Business Strategy

Tamweel Company has adopted the cost leadership strategy to improve its efficiency through streamlining operations. As a result, this venture has developed a cumulative experience, optimal performance, quality assurance, and is in full control of their operational chains. In order to cut down cost of service delivery and marketing, the company has embraced the modern technology in its online sales, human resource management and purchasing departments.

The company has entered into a partnership with financial services agents rather than engaging its resources in obtaining and selling to its customers. As a result, the general over head cost of operation has been reduced substantially. In addition, the company has opted for diversification and expansion of stores in order to gain from economies of scale as the overall turnover grows.

As a result, issues of underperformance have been minimized substantially. At present, this company produces the best quality packaging of its customized financial services. In addition, the company has introduced a series of efficiency monitoring systems such as performance valuation, target management, and electronic purchasing which has greatly reduced labour cost. These ventures aim at enabling the company to optimise profits through efficiency in sales, accountability, and use of company resources while maintaining quality.

Swot Analysis of the Tamweel Company

A SWOT/TOWS analysis is carried out to highlight the key strengths, weaknesses, threats and opportunities of a company. This will also reveal any bottlenecks that are likely to affect the smooth flow of the projections of the Tamweel Company.

Strengths

- The company is already established in the financial services market and so it is already into trade. It has previous experience and it offers the best quality of financial services among its competitors in the UAE financial services market.

- The company has good terms with its financial services agents and can deliver high quality marketing services at a reasonable price.

- The company has concentrated in the customized financial services that have been ignored by other marketing players.

- The company has established a cult like customer loyalty for its financial services.

Weaknesses

- The company retails its financial products at higher price than the average market price.

- The company has to contend with more or less similar products by its competitors despite constant growth of interest rates.

- The company market niche is relatively narrow since it has not diversified its financial products branding strategies.

Threats

- Too many competitors are in the market for financial services industry, especially the competitors with more credibility in offering the best prices.

- Unlike other competitors, the company has the option of only customized financial services products. Thus, it cannot franchise to protect its future growth parameters.

Opportunities

- The company has an opportunity for unlimited expansion in the market with more demand for its products across the UAE.

- The company has the opportunity of attracting more clients through referrals since its local network is well established.

- The company has the opportunity of diversifying its products and further re-branding to capture any new market niche.

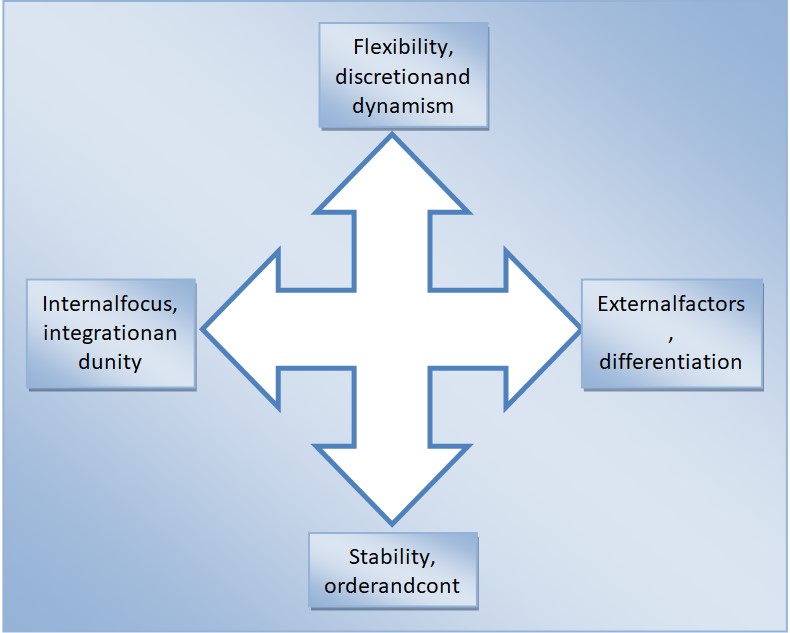

The Marketing Plan for Tamweel’s Financial Services

Fig.1: Summary of the components of the marketing plan

Expansion of the market for the Tamweel’s products

The main objective of this strategy is to attract and increase the market share of the Tamweel financial products. A properly modelled penetration strategy should have minimal disturbances to the market and the company. Therefore, it is important to establish means and ways to reach the potential market that consist of sensitive and relatively rich clients who want private and customised financial services. To achieve this, the company should segment and differentiate its market along consumer-based market segmentation procedures. In line with the marketing principles, this recommends the proper scrutiny of various factors creating a direct or indirect impact on the economic trends and changes of the economies of its target markets.

The physical distribution patterns are with no doubt a critical area of focus, especially for the private borrowers segment that is spread across the UAE. Different distribution channels of the company’s financial products will expand the sales thus increasing the eventual profitability since the company will make more sales to this market segment. In addition, the uses of sale agents will enhance distribution of Tamweel Company products in the macro and micro regions of the culturally integrated market segment that responds instantly to persuasion and have peculiar acceptance behaviour that is influenced by what they see, hear, and experience.

Since the target market is specific, the success variable for the market share expansion strategy will be measured through an increase in sales by an eighth of its current output. Sales records will be reviews bimonthly and revised after every six months. In the first six months, the market share is projected to grow by a quarter of the one-eighth mark. Factoring the current inflation rate and other market dynamics, the same is then projected to follow the normal graph growth as advertisements are expected to sustain the market share expansion.

Re-evaluation of the retail pricing of the Tamweel products

Through fair pricing mechanism, competition factors will positively skew to the advantage of Tamweel when marketing their products to the old and new customers. The main objective of this strategy is to attract and increase the market share of the product among the target market. This costing strategy will achieve the objective of quantity maximization by increasing number of services sold. With the availability of the company’ products, this strategy has the capability of making the company’s operations across the UAE economically feasible and sustainable, while at the same time winning a greater percentage of the market share since more sales will be made in this target segment.

Tamweel should ensure that their prices are relatively fare to boost demand for its products and maintain competitiveness in the market segment that tends to shy away from relatively expensive financial products. To enhance the achievement of the same, the company needs to introduce different price policies which in return will attract various types of clients thus, creating new market segments.

Through re-branding and good, better, best pricing strategies, the new market is projected to increase their purchase of the Tamweel’s financial services. Therefore, applying the costing strategy, the company will reduces the prices to a certain minimum level in order to attract customers from this segment and achieve the aim of the quantity maximization by increasing number of items sold at low prices. At the same, the strategy can help in revenue maximization that results from the large numbers of purchases made.

Product Promotional drives

Advertisements are very manipulative and use tactics that directly and involuntarily appeal to the mind of the target person. Usually, advertisements appeal to memory or emotional response. As a result, it creates an intrinsic motivation response that triggers the mind to activate affiliation, self acceptance, and feign community feeling. In the end, advertisements succeed in appealing to emotions through capitalization on biases and prejudices of people. Therefore, advertisement messages for the Tamweel products should be deeply entrenched in the principle of keeping reliable and professional reputation in convincing customers.

Through timely appeal to emotions and self prejudice, Tamweel Company should increase their advertisement in the social media, newspaper and broadcast media, and billboards. Tamweel will succeed in implementing this aspect of ‘jumping the queue’ ahead of other competitors through visible signs all over the UAE region. Upon noticing the signs, the mind will perceive them to belong to the Tamweel Company, irrespective of the physical geography at the moment. These advertisement erected signs will endeavour to cue the visual mental aspect of the targeted customers into a particular product of the different products of the company.

Since the current distribution channel is already developed, this objective is very realistic since marketing resources (distribution patterns) are fully operational to facilitate a market exercise on target and segmenting position for the Tamweel financial services products. Besides, increasing financial service accessibility is within reach since the projected market share growth can support and sustain expanded market.

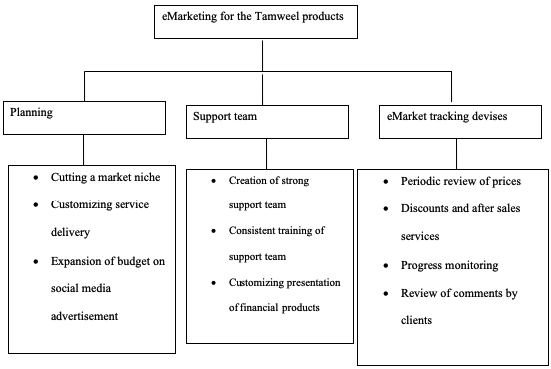

Conclusion

In summary, Tamweel should spread its locations to bustling cities that are characterized with high magnitude market exposure across the UAE. Besides, the company should adopt massive face-to-face sales campaigns that may reverse the current shortfalls the company has experienced in the last two years. The company should actively invest in social media advertisement such as TV commercials and billboards that are easily visible to the target market. Essentially, success of a marketing plan depends on proper alignment of a functional team that is responsible for creation of flexible but quantifiable measurement tracking tools for reviewing results periodically. Reflectively, the product team of Tamweel should have essential knowledge in social media and tools used in marketing.

Besides quality in service delivery and customer satisfaction depend on the support team. Therefore, customer retention is achievable through creation of reliable, informed, and passionate support team. In addition, the plan includes a monitoring matrix that maps out potential competitors and identifies needs and complaints of the clients. Moreover, the reporting criteria should reflect the success of marketing calendar and set target periodically generated. Therefore, marketing plan is pronounced successful when it creates a reliable, informed, and passionate appeal to perception of the target.

Appendices