‘People and their managers are working hard

in order to make things be done in the right way,

forgetting about doing the things right’

(Covey, S.)

Introduction

The Balanced Scorecard method is considered to be the performance management system and strategic approach translating the company’s vision into implementation. An organization’s financial performance is central to its success. The approach of the balanced scorecard, which relates the marketing, developmental and operational inputs to the financial outcomes, enables managements as well as the stakeholders to have a comprehensive outlook of a business in order for an organization to act in their best interests. The concept of the Balanced Scorecard is also seen in the days when firms were encouraged to include factors that affected the financial outcomes, such as long-term skills development and learning, process performance, market share and penetration alongside the financial outputs.

The paper will investigate the concept of the Balanced Scorecard on the objectives and operations of Hong Kong Company, Good Mark Industrial. The analysis of financial and qualitative measures of the corporation under analysis will be demonstrated through the company’s strategic activities on the basis of the Balanced Scorecard Method.

Good Mark Industrial Background

Good Mark Industrial is considered to be a foreign enterprise operating on the international market for over 20 years; its profound experience and high production quality provided the company with a stable and firm position in all its financial and manufacturing operations. The enterprise is concentrated on the production of plastic mold as well as electronics components assembly, plastic injection and mold standard components.

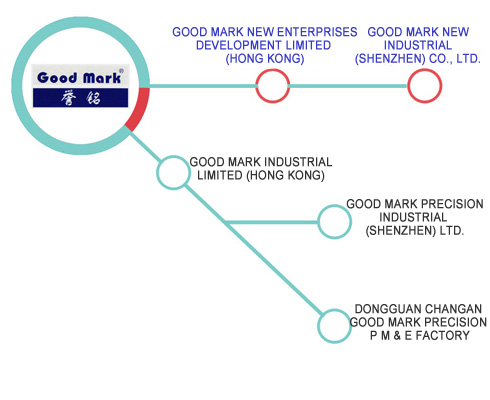

The company has three basic plants located in Dong Guan City and Shenzen City; the trading branches of the Good Mark are widely promoted in Hong Kong and Shanghai. It is important to underline the fact that its brand gained recognition not only among local customers but also among clients abroad. (Good Mark Industrial. 2009).

The Balanced Scorecard Method and its basic Principles

The method is based on marketing, financial and operational inputs for the purpose of comprehensive business view and acting in accordance with the company interests. A number of organizations strive to perform beneficial business operations with minimum efforts. The system of Balanced Scorecard gives an opportunity to view the following organizational performance dimensions: capacity, results and operations. Traditionally, the method of Balanced Scorecard views a company in four perspectives, such as:

- financial perspective,

- customer perspective,

- business process perspective,

- learning and growth perspective.

The method is considered to cover the basic steps leading to company’s success in business strategic operations; they were developed by Balanced Scorecard Institute highlighting the following aspects: Assessment, Objectives, Strategy (strategic themes and results, customer value), Strategy Map, Initiatives, Performance Measures, Cascade, Evaluation, Automation, and Initiatives. The steps preserve the link between the company’s strategic planning and components of management, providing a logical connection between programs and projects identified within the organization’s objectives. The following of the highlighted issues is one of the principal missions of any company management. (Arveson 1998)

Good mark industrial limited

In order to understand the basic objectives and strategies of the Good Mark Industrial, it is necessary to analyze the method of Balanced Scorecard in the company management and planning activities.

Goals and Objectives of the Company’s Balanced Scorecard Method Promotion

Good Mark Industrial manufacturing is aimed at the usage of the Balanced Scorecard Method as the way of mixing the non-financial and financial measures in the accounting sphere. It is necessary to underline the fact that the company sticks to a balanced scorecard through the product differentiation strategy; it means that the company designs the method in order to evaluate the operating income of every particular product manufactured. (Good Mark New. 2009) The method is an effective one for the manufacturing business of Good Mark Industrial for a number of reasons:

- the method demonstrates cause and sequence relationships, describing specific objectives and perspectives in the growth of the company, which allow it to become a low-cost producer;

- The scorecard managers can be effectively informed as to operational strategy and targets to make employees achieve the strategy in a proper way;

- The method is concentrated on financial measures and objectives, allowing providing improvements in the sector;

- The scorecard is aimed at highlighting some trade-offs, in case of managers fail to take into account the complexity of financial and operational measures.

- The method usually identifies the critical measures limiting all others. (Bhimani, 2007)

The Financial perspective

The turnover of the company was rapidly increased in 2006 and reached more than 400 million dollars; the company’s success can be observed due to rational analysis of financial perspective. The Balanced Scorecard in Good Mark Industrial recognizes that financial data are as useful as they were earlier in managing organizations. This perspective looks at an organization’s execution and implementation of its strategy to find out if they are contributing to the advancement of the organization. The Financial perspective denotes the lasting strategic goals of a company, and therefore, incorporates tangible results of the strategic plan in conventional financial terms. The executives of Good Mark Industrial are focused on the principle aspects of financial development:

- Fast growth;

- Sustain phase;

- Harvest phase; (Good Mark Industrial. 2009)

The financial measures and objectives for the growth phase arise out of the growth and development of the company, in turn leading to rising volumes of sales, new customers acquisition, revenue growth, and so on. The sustain phase of Good Mark Industrial is illustrated by measures that appraise an organization’s effectiveness to manage its costs and operations as well as by calculating returns on capital, investment, and so on. The harvest phase is rooted in cash flow analysis with measures like revenue volume and payback periods. EVA is one of the example of the most commonly incorporated financial measures into the financial perspective. (Rohm 2008)

The customer perspective

The customers and potential clients of Good Mark Industrial are considered to e the representatives of local and foreign companies, for example, from Malaysia, Japan and Thailand. The interest lies in the development of high production quality. The customer perspective provides the value proposition, used by the company in order to meet customers’ needs and so, create more sales to the customers’ groups that are most profitable. The value propositions being presented to the customer can possibly concern time, quality, performance, service and cost. The outcomes include such aspects as market share and customer satisfaction of the Good Mark Industrial. (Good Mark Industrial. 2009)

Internal process perspective

It is necessary to stress that the internal process perspective involves processes that make as well as deliver the value proposition of the customer. The team of the Good Mark Industrial, which is predominately formed by qualified professionals from Mainland China, Hong Kong and Japan, concentrates the planning of its internal operations around the development of technologies export to other countries.

This perspective emphasis all tasks and crucial procedures needed for an organization to succeed in delivering efficiently and productively the expectations of the customers. In this regard, both long-term and short-term goals are involved as well as creative process development so as to allow the stimulation of advancement. The company Good Mark Industrial is focused on the use of particular clusters so as to help in identifying measures that match with the internal process perspective. The clusters for this perspective include:

- management of operations through asset utilization development, management of the supply chain, and so on,

- management of customers through relations expansion and deepening,

- innovation by new services and products, and

- social and regulatory through making good relations with outside stakeholders. (Barr 2009)

The innovation and learning perspective

The innovation and learning perspective is the basis of all strategic plans. Good Mark specialists strive to contribute to innovation development for the purpose of new companies’ attraction. This perspective, moreover involves human input or capital (jobs), information capital (the systems), and the organization capital (the climate). Indeed, this is based on the long-term because the learning and growth perspective would incur some expenses that could alter negatively the short-term financial outcomes, although it would contribute to the success of the long-term goals of the enterprise.

Theoretical overview of Balanced Scorecard Method

The modern approach to implementing the Balanced Scorecard involves four processes:

- Translation of the vision and strategy into operational objectives;

- Communication and connection of the vision to individual performance;

- Index setting;

- Feedback and learning as well as adjustment of the strategy.

It is substantial to say that the Balanced Scorecard as a framework for strategic management incorporates all abstract and quantitative measures of real significance to a business organization. The balanced scorecard has undergone various transformations since its early application as a simple framework for performance measurement to become a comprehensive system of strategic management and planning. Therefore, the evolved balanced scorecard changes a firm’s strategy from a passive but appealing document to a “marching order” for the firm on the day-to-day activities (Balanced Scorecard Institute, 2009). Furthermore, it is a framework that, besides providing performance measurements, assists planners and managers to identify things that ought to be done as well as measured. The decision-makers are also able to affect their strategies effectively due to this framework. (Kaplan, & Norton 2004)

The advantages of the balanced scorecard (Good Mark Industrial)

There are various benefits associated with the use of a balanced scorecard as a management approach:

- It assists focus the entire organization on the main things that are necessary for a breakthrough performance.

- It is useful in integrating several corporate programs like customer service, re-engineering, and quality.

- It breaks down strategic actions towards the lower levels such that employees, operators, and unit managers can know what is needed at their respective levels and so they can excel in terms of performance.

The feedback

The balanced scorecard approach incorporates feedbacks around the internal process outcomes of an organization. It provides, in addition, feedback for outputs of business strategic plans. The result is a balanced scorecard process referred to as “double-loop feedback” (Kaplan and Norton, 1992). In the early times of industrial activities, terms such as ‘zero defect’ and ‘quality control’ were very vital. The customer was protected from getting products of poor quality through aggressive efforts emphasizing testing and inspection. However, these approaches had their own weakness; the real fault could not be spotted, and inefficiencies were inevitable because the products suffered rejection. At each and every step of the production process variation is created, and its causes should be identified and fixed. In doing this, it is possible to minimize the faults and enhance the quality of a product indefinitely. Deming (2000) strives to identify a process like this one; each business process is to be compulsorily involved in a system having feedback loops.

Moreover, it is necessary for the managers to examine the feedback data carefully to identify the origin of the variation as well as the processes of existing important problems. In so doing, they could center their attention on restoring that division of the processes. (Arveson 1998).

Output metrics

It is difficult to improve what is not measurable. Developing metrics, therefore, is paramount, and this should be done based on the strategic plan priorities that provide the crucial drivers of business and metrics criteria that managers most desire to see most. Thereafter, processes are created to gather information related to these metrics as well as reduce the information to numerical form for display, analysis, and storage. The decision-makers scrutinize the outputs of different measured strategies and processes and trace the outcomes in order to guide the organization as well as give feedback.

The metrics’ value is defined by their power to give a practical foundation for defining the following:

- Strategic feedback for indicating the existing status of the company in various perspectives for those involved in decision making.

- Diagnostic feedback for several processes so as to direct improvements throughout.

- Trends in the organization’s performance over a period of time.

- Feedback of the measurement approaches themselves. In other words, the kind of measurement to track.

- Quantitative inputs are necessary for forecasting methods as well as for decision support structures. (Balanced Scorecard Institute. 2009)

Kaplan and Norton (1996) provide a clarification of the Balanced Scorecard as follows:

“The balanced scorecard retains traditional financial measures. But financial measures tell the story of past events, an adequate story for industrial age companies for which investments in long-term capabilities and customer relationships were not critical for success. These financial measures are inadequate, however, for guiding and evaluating the journey that information age companies must make to create future value through investment in customers, suppliers, employees, processes, technology, and innovation.” (Kaplan, & Norton, 1996).

Conclusion

The Balanced Scorecard, in addition, does not give a unified view or bottom-line score with recommendations that are clear but presents a listing of metrics (Jensen, 2001). The analysis of the balanced scorecard method on the basis of Good Mark Industrial Limited business operations gave an opportunity to evaluate the basic principles of the company’s strategic and management planning. It is necessary to underline the fact that the paper highlighted the most important aspects of the balanced scorecard systems, underlining its theoretical and practical value.

References

- Arveson, P. 1998. The Deming Cycle. Balanced Scorecard Institute.

- Balanced Scorecard 2009. Balanced Scorecard Basics.

- Barr, S. 2009. Goals for the Performance Measure Practitioner. Balanced Scorecard Institute.

- Balanced Scorecard Institute. 2009. Building and Implementing a Balanced Scorecard: Nine Steps to Success.

- Bhimani, A. 2007. Management and Cost Accounting. 4th Edition, Pearson Education.

- Good Mark Industrial. 2009.

- Good Mark New. 2009. Enterprise Structure.

- Jensen, M. C. 2001.Value maximization, stakeholder theory, and the corporate objective function, Greenleaf Publishing.

- Kaplan, R. S. & Norton, D. P. 1996. Using the balanced scorecard as a strategic management system, Harvard Business Review, pp. 75-85.

- Kaplan, R. S. & Norton, D. P. 1992. The balanced scorecard: measures that drive performance, Harvard Business Review, pp. 71-80.

- Kaplan, R. S. & Norton, D. P. 1993. Putting the Balanced Scorecard to Work, Harvard Business Review, pp 2-16.

- Kaplan, R. S. & Norton, D. P. 1996. Balanced Scorecard: Translating Strategy into Action, Harvard Business School Press, Boston.

- Kaplan, R. S., & Norton, D. P. 2004. Measuring the strategic readiness of intangible assets. Harvard Business Review, vol 82 no. 2, pp 52-63.

- Marc, E. 2006. Advances in Management Accounting. Emerald Group Publishing. Pp. 325.

- Rohm, H. 2008. Performance Measurement in Action: A Balancing Act. PERFORM. Volume 2, Issue 2.