Article Summary

The article under consideration dwells upon the Microsoft and Yahoo merger. The advantages and disadvantages of such merger are introduced along with the companies’ activities explanation, which is the main support of the arguments for the companies’ merger. Moreover, the information is introduced about how Microsoft and Yahoo merger will influence the Internet sphere and how people’s interests may be met. Moreover, the merger of Microsoft and Yahoo will increase the cost opportunities for these two companies, create the monopolization of sphere, increase supply and demand effectiveness and the economic growth of the companies will be on the higher level.

Introduction

Internet became the essential part of people’s lives. The increase of its widespread gave the rise to the development of the Internet sphere and the appearance of the companies, which managed to become the leaders in the sphere for Internet services implementation. In the time when Internet is crucial in all spheres of people’s lives, the companies begin to think about the development and innovation in the sphere, some of them began to think about merger, which will give the additional opportunities for both companies. The merger of the most influential and the most powerful companies in the Internet sphere, such as Microsoft and Yahoo, may come only for good for people and influence the effectiveness of work of some items for better.

Analysis

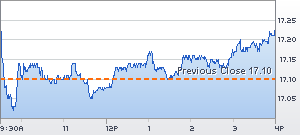

Starting the analysis of the advantages and disadvantages of Microsoft and Yahoo merger, a short summary of the companies’ development should be introduced. Microsoft is the biggest software maker in the world, which development is on the highest level for now (Fig.1).

Yahoo is considered to be a leading Internet Media Company, which services are used by millions of people all over the world (Fig.2).

One of the main competitors for Yahoo is Google, which is considered to be stronger “in the race for online advertising dollars and Internet search market share” (Microsoft/Yahoo Merger par. 3). Google is a very strong company, which may be effectively opposed only by Yahoo, supported fully by Microsoft. Moreover, Microsoft-Yahoo deal is considered to be the largest in the Internet sphere since the other huge purchase on the Internet provided: Time Warner was bought by AOL in 2001 for $182 billions, but this merger is remembered to be the worst deal as the plans, which were created, were never realized.

Advantages of the Microsoft-Yahoo deal

Dwelling upon the advantages of the Microsoft and Yahoo merger, it should be mentioned that the Microsoft-Yahoo deal is completed on the following conditions: Microsoft buys Yahoo for about $44.6 billion in cash (Microsoft/Yahoo Merger par. 2). The advantages for these two companies are visible and may be easily discussed further. The merger of Microsoft and Yahoo is going to be a strong power for competing with Google. Good opportunities will be introduced for consumers, publishers and advertisers, especially in the question about existing problems in the online service market.

Shareholders of Yahoo will only suffer positive outcomes from the merger of Microsoft and Yahoo. Microsoft and Yahoo were the pioneers in the Internet services development and now they may easily see the outcomes, which their merger may have in the field. Furthermore, most specialists in the sphere are sure that there is no other company merger, which could bring the same outcomes. The mutual support of the companies will push them for further development. The Internet sphere does not stand on one place and the increased demands for the sphere development may be met better in the case of companies’ merger (Microsoft/Yahoo Merger par. 9).

Opportunity cost

The merger of Microsoft and Yahoo gives an opportunity to introduce the consumers with the services, introduced by the companies, with the lower prices. This merger may also “provide the potential for savings, as some operating costs may be duplicated (for example, administrative costs, IT costs, marketing costs, research and development costs)” (Atrill 476). Right these cost opportunities will have the Microsoft and Yahoo in the case of merger. There is no need to underline that the reduction of costs for the companies will increase their income and may be the starting point for the improvement and innovation of some services, offered by the companies. This will lead to the increase of the company popularity and to the other advantage – supply and demand increase.

Supply and demand increase

The merger of Microsoft and Yahoo, discussed above cost reduction opportunity will lead to the other advantage for the company, supply and demand increase. The reduction of costs of the company will give the opportunity for more innovative development of the company and the newly appeared company merger will allow offering more qualitative services in the higher volume, so the supply will be increased. At the same time, the increase of higher qualitative services on the Internet market will give consumers more opportunities and the demand for the services of Microsoft-Yahoo merger will also increase.

The supply and demand are highly elastic now, and there is an idea that “a firm cannot exercise unilateral monopoly power by attempting to decrease its supply” (Crandall, Alleman and AEI-Brookings Joint Center for Regulatory Studies 126). This is really so, but we are dwelling upon not one firm, but about the merger of the most powerful and strongest companies in the Internet sphere, the advantages of which merger will influence the supply and demand greatly and will give an opportunity to increase the demand by means of price reduction, services quality increase and the development in the sphere of services supply.

Economic growth

Economic growth may be awaited with the merger of Microsoft and Yahoo companies. The effect from this merger may be the same, which was observed in the middle of 1990’s, when economic growth was connected with the Internet boom – new industries and subindustries in the Internet sphere appeared. In fact, the merger of influential corporations, such as Microsoft and Yahoo are, may lead to the increase of the competition in the sphere and the competition, as it is known, a pusher for innovations and development in any sphere. With the increase of Microsoft-Yahoo Company, the economics will be shaken (Deans, Kroeger and Zeisel 136). Most companies will use the opportunity and will desire to appear in the middle of economic relations, especially those, who belong to Internet sphere. So, the competition, which will appear with the merger of Microsoft and Yahoo, may provoke an economic growth.

Monopolization

At the same time, the merger of such huge companies may be the main condition of the monopolization of the sphere. If Microsoft and Yahoo will be able to provide all activities, which are planned, and will be able to become the first and the most powerful and influential corporation in the Internet sphere, so the field will be monopolized and the company will not desire to give any other Internet company to develop to the Microsoft-Yahoo level. The possibility of the Internet sphere monopolization is considered to be one of the main advantages, which may be resulted from Microsoft and Yahoo merger.

Disadvantages of the Microsoft-Yahoo deal

In fact, there are still specialists, who think that the merger of Microsoft and Yahoo will not result with the appearance of the most powerful company and they will never fully outrun Google Company. Moreover, these specialists underline that the merger of Microsoft and Yahoo is not a very good idea. The arguments, which they introduce, are going to be discussed further. First of all, Microsoft and Yahoo are two absolutely different countries with different cultures and spheres of influence, so they will not be able to come to consensus even in such questions as email sending, advertising, news introduction, travel, and finance sites, which are considered differently by these two companies.

Secondly, Tim Smalls, head of U.S. stock trading at brokerage firm Execution in Greenwich, Conn is sure that even the merger of such powerful and influential companies as Microsoft and Yahoo will never impede progress of Google seriously or even reach its heights (Microsoft/Yahoo Merger par. 20).

Furthermore, the purchase of Time Warner is taken as an example, when the biggest deal was analyzed and scholars could not call this purchase effective, moreover, it was called the worst one as the planned desires of the company were not reached and the plans were not realized. So, Time Warner purchase appeared ineffective, and some specialists underline that the same may happen with Microsoft and Yahoo merger, when desired outcomes will never be completed and results of merge will be ruined.

The monopolization of the internet market is a great advantage for Microsoft and Yahoo companies, but this creates huge worries in the European Commission. The fact of Internet sphere monopolization, the usage of other markets for servers and the domination of Microsoft and Yahoo merger in the Internet sphere is not a desired scenario development for European Commission, who will not be able to control the sphere any more in the case of Microsoft-Yahoo merger domination in the future (Delta and Matsuura 4-32). So, for some participants of economic relations the monopolization of Internet sphere is considered as disadvantage, or even undesired reality.

Conclusion

In conclusion, the article under consideration dwells upon the merger of such powerful companies in the Internet sphere as Microsoft and Yahoo. The discussion is concentrated on the advantages and disadvantages, which may appear with the merger, and the outcomes, which should be awaited. The advantages for the Microsoft and Yahoo, after merger, are numerous: the appearance of the more powerful company, the costs reduction, demand and supply increase, the economic growth and some others.

Monopolization of the Internet sphere, in the case of successful merger, is considered as the advantage for Microsoft and Yahoo, but European Commission understands monopolization of Internet sphere as the most undesirable outcome of the Microsoft and Yahoo merger. In fact, coming out of Time Warner purchase experience, the merger of big companies in the Internet sphere does not finish with good results.

Works Cited

Atrill, Peter. Financial Management for Decision Makers. Oxford: Pearson Education, 2008. Print.

Crandall, Robert W., Alleman, James H., and AEI-Brookings Joint Center for Regulatory Studies. Broadband: should we regulate high-speed internet access? Washington: Brookings Institution Press, 2002. Print.

Deans, Graeme K., Kroeger, Fritz and Stefan Zeisel. Winning the merger endgame: a playbook for profiting from industry consolidation. New York: McGraw-Hill Professional, 2003. Print.

Delta, George B. and Jeffrey H. Matsuura. Law of the Internet. New York: Aspen Publishers Online, 2001. Print.

Microsoft/Yahoo Merger Could Shake Up Internet. 2008. Web.