Maria Gomez, the founder of PacificCoast Company, is interested in finding an investor to buy it. She intends to find a financially performing organization to do business with PacificCoast to boost its financial success. She hopes to find a suitable buyer to form a merger while still managing the firm. The one buying the business must help in providing capital support that the PacificCoast needs. Disney is interested in promoting its profitability by identifying new innovative strategies as well as creating a good customer experience to attract their loyalty to the business. It would be a good idea for the operation to consider a merger agreement with the PacificCoast. This paper aims to assess the financial health of Disney by looking at the firm’s financial information in determining whether this organization would prove viable for the merger agreement in supporting Maria Gomez’s intention to improve the profitability of her agency. The background and the financial analysis of the Disney are provided on a three-year basis.

Company Background

The Walt Disney listed as DIS on the New York Stock Exchange is an American multinational company operating in the industry of entertainment and mass media. The organization was founded by the two brothers, Walt and Disney in the year 1923 attracting its name as Walt Disney Company. It later became a business leader in the industry of animation before opening its other product lines including film production, television, and theme park programs. The corporation is mainly famous for its products such as Walt Disney pictures and animation studios. Moreover, it is also known for its broadcasting channels that include the ABC and cable networks. The firm, therefore, enjoys a range of products that have contributed to its competitive advantage over other businesses operating in the same industry.

Walt Disney also benefits from its wide pool of resources, such as its 26,000-acre plot that is half utilized. The company has three parks, thirty themed resort hotels, camping resorts as well as several golf club associations. It has introduced one of its major game-changer products developed by launching supermarkets in a number of the organization’s parklands. This strategy is seen to attract a lot of interested parties from both ends of entertainment and purchasing demand-pull. The business is run with its headquarter based in New York while its other subsidiary companies are located in other countries such as Italy, China, and Japan (The Walt Disney Company, 2020). The wide pool of resources has promoted the firm’s success by ensuring that its major operational costs are well funded to steer its goals towards profitability.

Financial Analysis

Financial analysis plays a significant role in determining a company’s economic strengths and weaknesses in any prevailing situation. Detailed scrutiny of a firm’s comprehensive financial data will, therefore, help to focus its future success. The income statements, cash flow statements, and balance sheet statements will form part of the comprehensive financial data that are key in ascertaining the financial position of Walt Disney Company. A summary of other financial ratios will also be useful in establishing the benefits of the merger between Walt Disney and PacificCoast Company.

Income Statement

The income statement reflects on how an organization incurs its expenses attributable to revenues. The net profit of a company represents its surplus from the sale of products after deducting all the expenditures associated with such earnings (Dasuki & Wipartini, 2020). The annual report presented by Walt Disney’s board of directors for the year 2017-2019 shows a gradual increase in the company’s profits for the three years. The reported revenue for the year 2019 was 69, 000 million with a net income of 11, 000 million. The annual report indicates an increase in the gains by 16% from the reported 569, 000 million annual income for the year 2018. The 2018 data recorded a 7% increase in the profit margin from the 2017 financial performance. The company’s profitability can, therefore, be inferred as increasing throughout every financial year.

Balance Sheet

A balance presents a company’s financial aspects of assets and liabilities and how the assets are financed on a year to year basis from the equity funds. The current liabilities for the year 2019 was reported as 20,102 million for the year 2019 appearing to be low as compared to the 21,000 million for the 2018 annual year.

Statement of Cash Flow

The statement of cash flow shows the cash and cash equivalent movements throughout the operations of a firm. The cash flow statements of Disney were reported to increase with a mean percentage of 16 throughout the three financial years (The Walt Disney Company, 2020). This is represented by the 12,000 million cash and cash equivalent amounts that are low as compared to the 2019 cash and cash equivalent amount of 14,000 million.

Analysis of Disney’s Financial Ratios

Financial ratios gauge a company’s situational performance. The ratios report the company’s efficiency, profitability, as well as an organization’s leverage performance. These ratios are identified based on their classification and value of importance.

Liquidity Ratios

The liquidity ratios reflect on the short term position of a company to respond to its obligations. The liquidity ratio performance of the company is therefore summarized below.

Current Ratio

This ratio measures the ability of an organization to meet its short term debts. The consumer service market puts the entertainment industry at a current ratio of 1.20. However, Disney’s current ratio is reported to be 25% below this standard level.

Quick Ratio Report

The ratio reports the ability of a company to pay its current liabilities from its current assets. Disney’s quick ratio is calculated as 28 000/1.000/31 000=0.91 (The Walt Disney Company, 2020). This ratio is reported to have increased by 1% from 2017 and finally by another 2% in the year 2019.

Cash Ratio Analyses

The cash ratio shows a company’s ability to pay its current obligations only from its cash and cash equivalent. The ratio is calculated as cash/current liabilities. Disney Company’s cash ratio is calculated as 5 000/31 000=0.16 for the 2019 financial year. This ratio is reported to have improved by 8.5 % from the previous 2018 financial year.

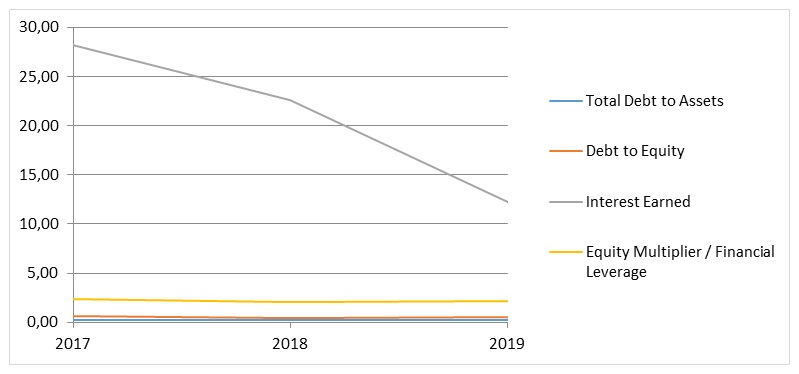

Leverage Ratio Analysis

These ratios measure the ability of an organization to pay its long-term obligation together with the interests associated with such debts. The ratio can be calculated as total debt/total assets. The ratio reflects how the resources of a company can pay up the shareholder’s debts. Disney’s leverage ratio is reported as 23% suggesting that its resources can pay back the shareholders’ money by 23%. This ratio is appropriate for a well-performing company as a higher percentage margin shows that the company is using much of its revenue to pay its shareholders.

Asset Turnover Ratios

These ratios measure the efficiencies with which a company utilizes its assets to generate sales. A high asset turnover would present an efficient use of resources to generate sales. The ratios are summarized as follows:

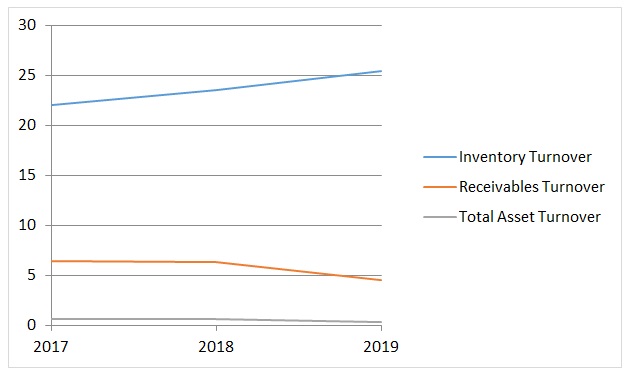

Inventory Turnover Ratio

The ratio measures the rate at which a company sells and replenishes its stocks. The information is useful in ensuring the effective management of inventory. The ratio can be calculated as goods sold/inventory. The annual report of Disney organization pinpoints a gradual increase in the inventory turnover ratio for the three financial years. The 2019finacial year’s inventory turnover ratio of 28 (42/1.5) was reported to be higher than the standard ratio for the entire industry. This however showed that the performance of the company within the entertainment industry was comparatively low.

Receivable Turnover

This ratio measures a company’s effectiveness in collecting its debts. A low receivable turnover rate means that an organization has a low rate of collecting its debts. This ratio is calculated as sales/accounts receivables (Ha et al., 2019). The standard ratio in the entire consumer market was reported as 23 (The Walt Disney Company, 2020). Disney however showed a turnover of 58 for the 2019 financial year higher than the previous 2017 and 2018 financial years. The company, therefore, presented a high rate of debt collection as compared to the standard ratio portrayed by its operating industry.

Total Asset Turnover Ratio

The ratio measures an organization’s revenue generation from its assets. The ratio indicates the level of efficiency in utilizing assets to generate revenue. A company’s good performance, therefore, is indicated by a higher total asset turnover ratio (Kadim et al., 2020). Disney Company reported a gradually increasing total asset ratio for the three financial years. This was an indication of the company’s efficiency in utilizing its assets to generate revenue.

Profitability Ratios

The profitability ratios indicate the level of a firm’s generation of income. The ratios denoting the profitability of a firm are as follows:

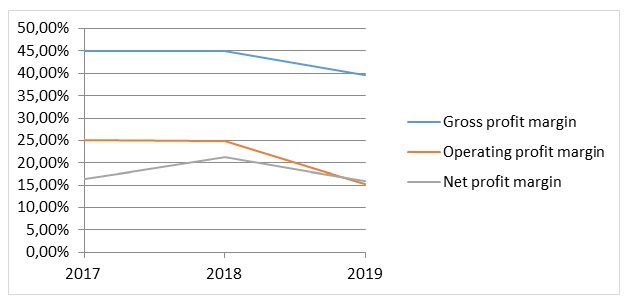

Gross Profit Margin

This ratio measures a company’s realizable profits from its operating expenses. A higher margin is indicative of a profitable performance. The gross profit margin for the company was reported at 101*/27/68=40% this value was below the industry’s gross profit margin of 45%.

Operating Profit Margin

The operating profit margin indicates how a firm generates its profits from the sale of its products. It is calculated as operating earnings/revenue. The Walt Disney Company (2020) reported an operating profit margin calculated as 99*10/69=14% for the 2019 financial year. This ratio was gradually declining over the three financial years denoting its poor profitability from the sale of products.

Net Profit Margin

A company’s net profit is the profit margin after deducting all the operational costs. A higher net profit margin suggests a company’s profitability potential (Keglevic & Basic, 2019). Disney Company reported a net profit margin that gradually increased for the three financial years with the 2019 year recorded the highest margin of 30%. This margin was higher than the industry’s net profit margin of 4%.

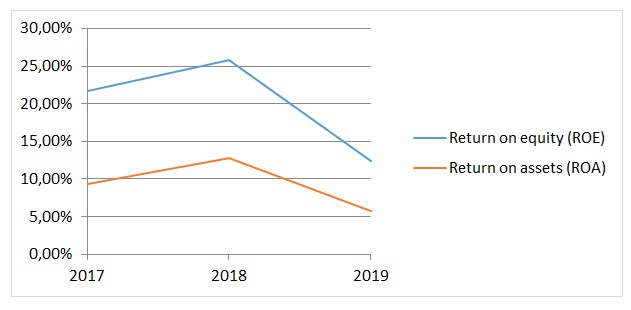

Return on Asset

This ratio measures the net value of assets as an average. It affects a company’s utilization of its entire assets to generate income. The company of Disney reported a higher return on asset ratio for the three financial years. The 2019 return on asset ratio was calculated as 99*11/193=5.1%. The rate of the gradual increase in this ratio for the three years was 30% seemingly a good performance above the market performance.

Return on Equity

This ratio measures the effectiveness by which the management of an organization utilizes the available resources in generating profits. The higher the rate of return on equity the more profitable a company is. The company’s return on equity can be calculated as 99*11000/88000=12% which was above the standard market rate. The company’s profitability was therefore good and was also gradually increasing over the three financial years.

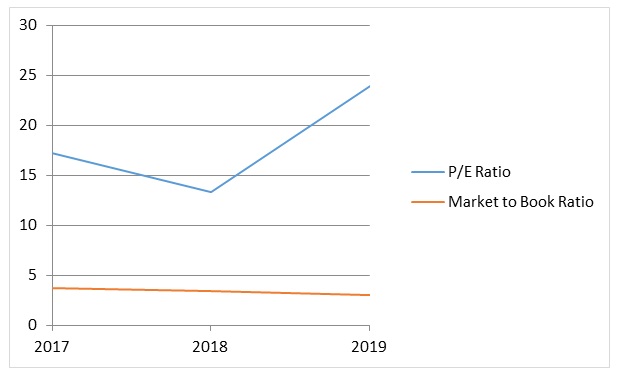

Market Value Return

This ratio provides the financial aspects of market prices per a company’s traded share. It helps assess the economic viability of a company in its tradable shares. For instance, the Price Earnings ratio measures the amount that the investors are willing to pay per dollar of their current earnings (Ogneva et al. 2019). The P/E for the company can be calculated as 146/6=24 for the year 2019. This ratio decreased annually from 2017 to 2019 denoting the company’s unstable performance on the NYSE market.

Trend Analysis

Industry Average Analysis

Walt Disney enjoys being a leading corporate brand within the entertainment, retail, and media industry. Its financial revenue was gradually increasing reaching high amounts of 69 000 million in the year 2019. The company also presents a long-term solvency rate that is strong with a greater chance of paying its debts promptly. The profitability ratios of the company also suggest an overall positive rate suggesting its strong profitability position. With such positive financial ratio valuations, the corporation must be in a position to promote the success of PacificCoast Company. However, the company must check on the P/E ratio in ensuring that its price-earnings ratio gradually increases.

Besides its high financial ratios above the standard recommended market value, Disney Company presents low liquidity ratios showing its inability to pay its current debts from its current assets. The company also presents a poor inventory turnover ratio suggesting its poor management of stocks. Such indicators of poor operations could translate into poor profitability performance.

Recommendations

Despite the financial ratios indicating that Disney Company is a viable business, the company must focus on its price per earnings ratios and also put measures to improve its low liquidity ratio. The company’s presentation of the account receivables and payables information suggests a good track record of its prompt payments. The company however needs to adjust its poor inventory turnover. However, relying on this data does not disqualify the company to enter into a merger contract with PacificCoast Company. A recommendation for Pacific Coast Company to partner and trade with Walt Disney Company is deemed fit. The Organization of Disney has a good track record of financial performance rendering it suitable in responding to the financial needs of PacificCoast Company.

References

Dasuki, R. E., & Wipartini, Y. (2020). Cooperative Business Performance: Quantitative and Qualitative Approaches Related to the Value of Firm. Prosiding ICoISSE, 1(1), 266- 288.

Ha, T. V., Dang, N. H., Tran, M. D., Van Vu, T. T., & Trung, Q. (2019). Determinants influencing financial performance of listed firms: Quantile regression approach. Asian Economic and Financial Review, 9(1), 78-90.

Kadim, A., Sunardi, N., & Husain, T. (2020). The modeling firm’s value based on financial ratios, intellectual capital and dividend policy. Accounting, 6(5), 859-870.

Ogneva, M., Piotroski, J. D., & Zakolyukina, A. A. (2019). Accounting fundamentals and systematic risk: Corporate failure over the business cycle. The Accounting Review, 0000- 0000.

The Walt Disney Company. (2020). Annual Reports. Web.

Appendix A

Appendix B

Appendix C

Appendix D