Introduction

Vodafone is one of the largest telecommunication companies in the United Kingdom (UK). Headquartered in London, the company has expanded its global presence to more than a dozen countries. Currently, its market outreach spreads throughout Asia, Africa, Europe, and Oceania (Vodafone 2017). Established in 1982, Vodafone provides different products and services to its customers, including mobile money transfer services, m-health services, and corporate social responsibility initiatives (Vodafone Group PLC 2018).

The company’s mission is designed to make the organization a communications leader in an interconnected world (Vodafone Group PLC 2014). This mission is intertwined with its corporate vision, which is “to lead the industry in responding to public concerns regarding mobile phones, masts, and health by demonstrating leading-edge practices and encouraging others to follow” (Vodafone Group PLC 2018, p. 5).

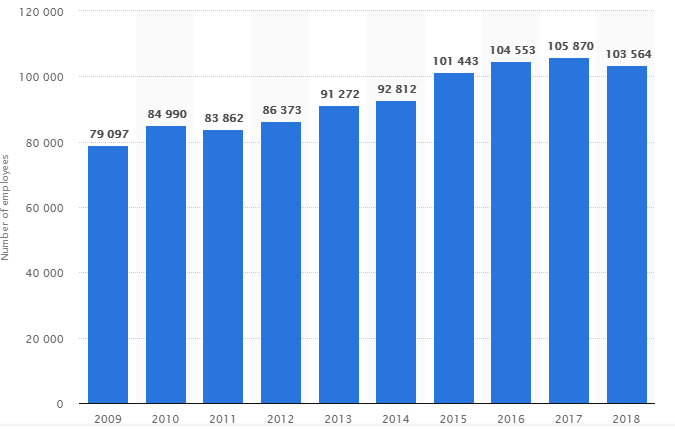

Vodafone has reported tremendous success in the UK telecommunications market. In fact, over the years, it has grown in size to generate about 47.6 billion Euros in annual revenue (Statista 2018). The company’s success has also seen it enlisted in the London Stock Exchange (LSE). Its growth has also helped to provide employment opportunities to thousands of people around the world. For example, according to figure 1 below, the company’s employee population has increased from a low of 79,097 people in 2009 to 103,564 in 2018 (Statista 2019a).

Vodafone’s key corporate and business levels strategies have been hinged on the creation of value through cost reduction and improvement of operational performance (Vodafone Group PLC 2014). They are also aimed at improving the quality of communication services, as can be seen through the company’s investments in the expansion of mobile data services and the maximization of shareholder value (CYBAEA 2018). Its globalization strategy is also a key part of its overall corporate strategy (Vodafone Group PLC 2014).

It explains why the company has a global presence in more than 30 countries (Statista 2018). Comparatively, the company’s corporate strategy is pegged on capital discipline. In other words, it generates between 5 and 6 billion pounds in revenue, yearly to support its growth.

Vodafone’s operations span across different service areas. However, three main departments are instrumental to its operations – marketing department, research, and development (R&D), and licensing (Vodafone 2019). Licensing is at the core of its corporate strategy because the firm obtains operating licenses in all the countries it operates (Vodafone Group PLC 2014). R&D is also another key aspect of the company’s operations because it underscores its innovation plan (Vodafone 2019).

This strategy is operationalized at a group level and allows Vodafone to periodically undertake a technical evaluation of its operations (Vodafone Group PLC 2014). The vision is to align its business and corporate strategies with its business decisions (Vodafone 2019). Lastly, the company’s marketing strategy places the customer at the center of all plans. In other words, Vodafone always strives to pursue business plans that promote customer needs (Vodafone 2019). This paper contains a review of these strategies relative to the challenges that exist in the company’s internal and external environments.

Challenge

As highlighted in this study, Vodafone is a multinational corporation, which has a market presence in multiple countries. Having a strong global market presence means that the company has to consider the effects of varying economic, political, and social factors in its decision-making processes. In the UK, “Brexit” is one of the most poignant issues affecting the company’s operations because it has created political and economic uncertainty.

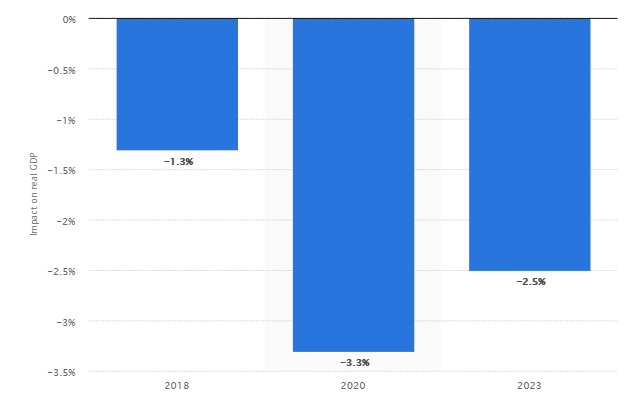

Its effects have not only affected Vodafone’s operations but the larger UK economy as well. Indeed, as reported by Market Inspector (2016), “Brexit” has caused a 1.3% decline in the country’s economy. Economists predict that “Brexit’s” negative effects will affect the economy up to 2023 (Market Inspector 2016). Figure 1 below shows the projected negative effects of “Brexit” on the UK economy.

Based on its negative economic impact, “Brexit” could also affect people’s purchasing power. This trend could affect Vodafone because it would lead to a reduction in customer spending, thereby negatively affecting the company’s sales. Since 11% of Vodafone’s revenues come from the UK, “Brexit” could also affect the company’s general performance (Morris 2018). The firm’s European operations are also likely to be affected by the uncertainty because they could cause changes in taxation policies and human resources practices. Europe accounts for about 55% of Vodafone’s revenues. This market share means that when the UK renegotiates its EU agreements, the company’s operational practices are likely to be disrupted or redesigned (Market Inspector 2016).

Analysis

Vodafone’s operations are often affected by several internal and external factors. The external environment will be assessed using two tools: Porter’s five forces and PESTLE analyses, as described by Johnson et al. (2014). The SWOT analysis will be used for the internal review and will contain information relating to the company’s strengths, weaknesses, opportunities, and threats.

PESTEL Analysis

Political: The government’s effects on laws and regulations governing the UK have a significant impact on Vodafone’s operations. For example, the privatization of the British telecommunications industry is one such force because it redefines the business landscape. Phone licensing procedures and tax policies also have the potential of influencing Vodafone’s operations (Gijrath 2017).

Technological: Technological advancements in the telecommunication industry also have a significant role to play in influencing the operational environment of telecommunications companies, such as Vodafone. At the same time, these advancements may influence the licensing procedures and patents that the company holds concerning products and services offered in the telecommunications industry.

Economic: The economic stability witnessed in the UK after the 2007/2008 economic crisis has played a significant role in influencing the operational procedures of telecommunication companies in the industry. High labor costs in the UK have also affected the operational performance of telecommunication companies because they lead to high operational costs. However, in contrast to overseas markets, telecommunication companies could benefit from lower wages paid to workers in developing nations. This economic factor offers an opportunity for companies to gain a competitive advantage. The high cost of building and maintaining technological infrastructure is also a product of the economic environment because it could negatively affect the bottom-line performance of companies

Environmental: Several researchers, including Delgado and Callén (2017), have documented the negative environmental impact of the telecommunications industry. Therefore, issues relating to waste disposal, recycling, and the use of environmentally friendly raw materials could be poignant to the decision-making processes of Vodafone and other telecommunication companies (Namen et al. 2014). It is also important for telecommunication companies to be one of the primary generators of electronic waste to be socially responsible. They may also be required to participate in environmental conservation programs, depending on the country’s laws.

Social: There is an increased awareness of the health risks of products and services offered by telecommunication companies. This trend may influence customer-purchasing behaviors because many people are hesitant to buy products that have adverse health or environmental impacts (Hackshaw-McGeagh et al. 2018). The growing number of aging people in developed countries is also likely to affect customer purchasing behaviors and consumer preferences by influencing how receptive people would be to new products and services in the market.

The increased relevance of social media in the contemporary business environment could also affect the company’s marketing and customer relations (Kampf 2018). This trend is likely to be buoyed by increased access to the internet and a rising number of internet users in many communities (Milan 2015). Collectively, these trends are likely to shape the future strategies of companies, which operate in the telecommunications industry.

Legal: The legal environment of the UK dictates the performance of companies in this market. The current legal environment in the telecommunications sector is designed to stimulate competition and fair practice policies among players in the market. Therefore, companies need to operate within these limits. The increased importance of overseas operations to many telecommunication firms in the UK also implies that they have to manage the effects of different laws on their operations.

Porter’s Five-Force Analysis

Porter’s five-force analysis has been used to analyze the level of competition in the market and how well businesses respond to strategies. In line with this view, the five key forces that will be reviewed are consumer bargaining power, supplier bargaining power, threats of substitutes, threats of new entrants, and industry rivalry. These forces are analyzed below.

Consumer Bargaining Power (Strong): The UK telecommunications industry has a high consumer bargaining power. It is partly caused by the low level of differentiation among the main service providers. At the same time, there is a high level of competition among the main players, while the cost of switching from one telecommunications service provider to another is equally low, such that customers are not hesitant to switch service providers (Kaur & Sambyal 2016). Similarly, there is a lack of brand loyalty among customers, which further makes it easier for them to switch from one service provider to another.

Bargaining Power of Suppliers (Medium): There are only a few major suppliers in the telecommunications industry. This is because few companies have the capability of supplying products that telecommunication companies need. At the same time, there is a lack of substitute products in the larger telecommunications industry because the services provided by major firms are difficult to replicate (Badran 2017). Major telecommunication companies also outsource some of their networks from overseas markets, thereby reducing the bargaining power of suppliers. The common platform that exists across the group of companies also further decreases the bargaining power of the suppliers. Collectively, these factors show that there is medium bargaining power of suppliers.

The Threat of Substitute Products (Medium-High): As mentioned in this study, there is a low threat of substitute products in the market. This outcome is partly caused by the decreasing popularity of landline users. The increased use of video conferencing facilities, especially in the corporate sector, is also likely to influence the competitive environment of telecommunication companies by causing a decline in their market shares (Sørensen 2018).

At the same time, e-mail, social networking sites, and VOIP services, such as Skype, Yahoo Messenger, and Google Talk have the potential to offer substitute products that could similarly decrease the market shares of telecommunication firms. The threat of substitute products is further counterbalanced by the fact that few companies in the UK offer 3G and 4G card services. Collectively, these factors show that the threat of substitute products in the UK is medium to high.

The threat of New Entrants (Low): The threat of new entrants to Vodafone is low because of the high cost of setting up similar businesses. For example, there are high license fees required upfront before a new entrant can be allowed to operate in the market. There is also a high initial capital required for new entrants to set up a profitable business (Zhao 2017).

For example, starting a telecommunications company, such as Vodafone, would require huge infrastructure investments, which could discourage new entrants from operating in the market. The complex regulatory issues that new entrants have to overcome also pose additional impediments to their operations (Badran 2017). Lastly, rapidly changing technology may also influence the potential for new entrants to have an impact on the market (de Reuver, Sørensen & Basole 2018).

Industry Rivalry: Industry rivalry could influence the business strategies adopted by companies in the telecommunications sector. Such a force may manifest in attempts by companies to undercut their competitors through aggressive pricing, poaching the best talents, and even reporting malpractices to authorities to shut down rivals. There is a high level of industry rivalry among telecommunication companies in the UK (FRANZCOM 2018).

Vodafone’s main rivals are Virgin Media, O2, and Orange (just to mention a few) (FRANZCOM 2018). The low level of brand loyalty among specific product categories and a minimal level of discrimination among competitors (besides cost and price) further compound the high level of industry rivalry. Lastly, the open market policy pursued by the UK government favors competition and contributes to the high level of industry rivalry.

SWOT Analysis

Strengths

One of the biggest strengths of Vodafone is its globally recognized brand name. Indeed, over the years, the company has made a name for itself as one of the world’s most reliable telecommunication firms with a global market presence. It has used this strength to leverage its business in new and frontier markets. The sheer scale of the company’s operations in different parts of the world also adds to its strengths because of economies of scale, which are instrumental in creating a strong competitive advantage.

Weaknesses

One of Vodafone’s greatest weaknesses is its market concentration in Europe and Asia (Vodafone 2018). This confined focus means that it may fail to exploit market knowledge to oversee successful operations in other parts of the world. At the same time, the concentration of the company’s operations in Europe and Asia could mean lost opportunities for the company because it does not have a balanced global market presence. Vodafone also has a weak performance in the fixed network area, which is further compounded by the lack of rural network wireless access (Gijrath 2017). These weaknesses mean that some of the company’s customers are not effectively served because of poor service and network reception in some parts of the country.

Opportunities

Vodafone’s opportunities related to the improvement of its infrastructural capacity to accommodate technological advancements that would improve the quality of services offered to customers. For example, there is potential that exists in providing 4G services as opposed to 3G or 2G (Arceneaux 2017). The firm could also expand its operations into emerging markets to increase its operational efficiency, reduce its overall operating costs, and offer better prices to customers.

There is also an untapped potential that lies in diversifying the company’s operations and services. This opportunity aligns with the company’s innovative strategy, which has allowed Vodafone to develop new products and services over the years. In line with this view, the firm could increase its focus on non-mobile related services, which could improve the quality of products and services offered to its consumers. This strategy requires more investments in its research and development strategies.

Threats

The potential of market saturation in Europe and Asia poses a threat to Vodafone’s operations because it makes it difficult for the company to maintain a growth forecast. The uncertainty in the regulatory climate, which has been occasioned by “Brexit” also poses a threat to the company’s operations by making it difficult to develop effective plans under such conditions.

The use of alternative telecommunication platforms, such as Skype, teleconferencing, and Whatsapp also poses a threat to the company’s operations by increasing the risk of proliferation of substitute products. Lastly, increased competition from other players, such as Orange and O2, in the market is also a threat to the company because it changes market dynamics. For example, the partnership between T-Mobile and Orange made Vodafone lose its second position as the most dominant player in the UK telecommunications industry (FRANZCOM 2018).

How the Problem can be addressed

Vodafone’s problems could be addressed using the cost-leadership and new product development strategies.

New Product Development

As part of its corporate strategy, Vodafone has been identifying and targeting new markets in emerging economies to improve its performance and profitability. However, this plan has not been fully exploited because there are still many untapped opportunities in some Asian and African countries. Changing demographic patterns and the improvement of economic conditions among some of these countries adds to the importance of undertaking more comprehensive market research to establish which economies are better tuned to receive the new products and services.

This strategy has been partly supported by the success of some of Vodafone’s subsidiaries in Africa and other emerging countries. For example, the firm is a major shareholder in a leading telecommunications company in Kenya – Safaricom (Tuwei & Tully 2017). The success and popularity of the company’s mobile payment service (M-Pesa) has underpinned its success in the East African nation because M-Pesa is the leading model transfer service in the country (Tuwei & Tully 2017).

Such a record of success highlights the potential that Vodafone could exploit through new product investments in new and emerging markets. The saturation of the Asian telecommunications market is a further indication that Vodafone needs to invest in new product development, especially in markets that are still growing in terms of mobile penetration and internet service provision. In doing so, the company could leverage its strong brand image to outwit its competitors in these markets and possibly establish dominance before new entrants have a significant impact on its operations.

Lastly, to avoid the negative impact of “Brexit” on the company’s new product development strategy, Vodafone should conduct a feasibility study to evaluate how its competitors would be affected by the same uncertainty. This information will allow its managers to adopt strategies that would align with the findings. The importance of employing such a strategy is enshrined in the fact that “Brexit” will affect companies differently.

For example, some of them will be strongly impacted by the restriction of labor movements among European countries, while others will be impacted by an increase in operating costs (CBI 2018). It would be prudent for Vodafone to study its competitor’s cost structures and develop strategies that allow it to benchmark its cost structures against them. A resource-based view will also help to evaluate how well the company is prepared to manage the “Brexit” challenge. The resource-based view is also linked to the creation of competitive advantages because resources allow companies to compete favorable, relative to their peers (Grant 2016).

Cost Leadership

To mitigate the effects of “Brexit” on Vodafone’s operations, the company should consider aggressively pursuing a cost leadership strategy. This recommendation comes from current efforts by the company to improve its operational performance through the improvement of its operational efficiency (Vodafone Group PLC 2014). In line with this view, Vodafone should focus more on reducing its operational costs and establishing itself as a leader in the provision of cost-effective services.

The cost-leadership strategy is appropriate for Vodafone because of the firm’s large-scale size and scope of its operations. Therefore, it could leverage its economies of scale and provide customers with goods and services at a lower cost than its competitors do. By exploiting its economies of scale, the company should not compromise on quality, but maximize the cost savings it offers customers. For example, the company could exploit the internal competencies outlined in the SWOT analysis, such as a strong brand image, to produce highly standardized products at a lower cost. It could do so through outsourcing or better contract negotiations with suppliers and partners.

The cost-leadership strategy should also be augmented with an innovation plan. The blend of synergy should make sure that the company constantly updates its technological processes to benefit from improved efficiencies, fewer operational errors, and lower production overheads (Taghizadeh et al. 2017). The innovation strategy should be confined within a larger context of new product development because advancements in R&D processes should facilitate the development of new products and services (Taghizadeh et al. 2017).

Again, this plan should aid in improving the company’s performance through a reduction in operational costs without compromising on quality. The strategy would be useful in helping Vodafone to improve its success in the local and global marketplace because it would better enable the firm to respond better to prevailing market conditions in the target markets (Casey 2018). The strategy would also support the company’s competitive strategy because it would allow it to better leverage its internal competencies for an expanded market share. Companies that have adopted such strategies have reported increased productivity and profitability (Dimson et al. 2019). Other firms in the UK telecommunications industry, such as O2 and Orange, could also learn from the same success.

Summary

The findings of this paper show that Vodafone’s key corporate and business levels strategies have been hinged on the creation of value through cost reduction and improvement of operational performance. The company has also strived to improve the quality of communication services, as can be seen through the company’s investments in the expansion of mobile data services and the maximization of shareholder value.

Its globalization strategy is also a key part of its overall corporate strategy. It explains why the company has a global presence in more than a dozen countries and is a leader in many of its key market segments. Its past success is also attributed to its corporate strategy, which is pegged on capital discipline. However, this record of success is under threat from “Brexit” and the uncertainties that exist in the global economy.

In line with the analysis undertaken in this paper, Vodafone’s managers should not view “Brexit” as a challenge, but rather an opportunity for the firm to solidify its dominance as a formidable telecommunications company in the UK and around the world. Particularly, the organization should exploit its strong brand image both locally and around the world to improve its market dominance.

At the same time, the company should adopt the new product development and cost-leadership strategies to navigate the regulatory and operational challenges caused by “Brexit.” The company has pursued this strategy with relative success in its overseas markets. It is time for it to do the same in the UK and provide more innovative solutions for customer needs in both the telecommunications and health sectors where it has specialized.

Reference List

Arceneaux, N 2017, ‘Monsoon Hungama’ and the 2G scam: public interest and mobile spectrum policy in India, 1999–2012’, Global Media and Communication, vol. 13, no. 1, pp. 3-19.

Badran, A 2017, ‘Revisiting regulatory independence: the relationship between the formal and de-facto independence of the Egyptian telecoms regulator’, Public Policy and Administration, vol. 32, no. 1, pp. 66-84.

Casey, D 2018. How to deal with Brexit risks. Web.

CBI 2018, How businesses are preparing for Brexit. Web.

CYBAEA 2018. Customer value management for Vodafone Romania. Web.

Delgado, A & Callén, B 2017, ‘Do-it-yourself biology and electronic waste hacking: a politics of demonstration in precarious times’, Public Understanding of Science, vol. 26, no. 2, pp. 179-194.

de Reuver, M, Sørensen, C & Basole, R 2018, ‘The digital platform: a research agenda’, Journal of Information Technology, vol. 33, no. 1, pp. 124-135.

Dimson, J, Hunt, V, Mikkelsen, D, Scanlan, J & Solyom, J 2019. Productivity: the route to Brexit success. Web.

FRANZCOM 2018, Orange and T-Mobile UK merge to crush O2 and Vodafone. Web.

Gijrath, SH 2017, ‘Telecommunications networks: towards smarter regulation and contracts?’, Competition and Regulation in Network Industries, vol. 18, no. 3, pp. 175-197.

Grant, RM 2016, Contemporary strategy analysis: text and cases edition, 9th edn, John Wiley & Sons Ltd, London.

Hackshaw-McGeagh, L, Jamie, K, Beynon, R & O’Neill, R 2018, ‘Health behaviours of young mothers: implications for health promotion and cancer prevention’, Health Education Journal, vol. 77, no. 3, pp. 277–292.

Johnson, G, Whittington, R, Scholes, K, Angwin, D & Regnér, P 2014, Exploring strategy, Pearson Education Limited, London.

Kampf, C 2018, ‘Connecting corporate and consumer social responsibility through social media activism’, Social Media and Society, vol. 4, no. 1, pp. 1-14.

Kaur, G & Sambyal, R 2016, ‘Exploring predictive switching factors for mobile number portability’, Vikalpa, vol. 41, no. 1, pp. 74-95.

Market Inspector 2016, Impact of Brexit on businesses in the UK. Web.

Milan, S 2015, ‘When algorithms shape collective action: social media and the dynamics of cloud protesting’, Social Media and Society, vol. 4, no. 1, pp. 1-10.

Morris, I 2018. BT, Vodafone still fretting over Brexit costs and uncertainty. Web.

Namen, AA, Costa, F, da, Gouveia, A, Abrunhosa, GG, Tarré, RM & José, F 2014, ‘RFID technology for hazardous waste management and tracking’, Waste Management & Research, vol. 32, vol. 9, pp. 59-66.

Sørensen, IE 2018, ‘Content in context: the impact of mobile media on the British TV industry’, Convergence, vol. 24, no. 6, pp. 507-522.

Statista 2018. Vodafone – statistics & facts. Web.

Statista 2019a. Number of Vodafone employees worldwide from 2009 to 2018. Web.

Statista 2019b. Forecasted short-term effects of Brexit on real GDP in the United Kingdom (UK) in 2018-2023. Web.

Taghizadeh, SK, Rahman, SA, Halim, HA & Ahmad, NH 2017, ‘Dwelling into service innovation management practices: a comparison between telecommunication industry in Malaysia and Bangladesh’, Global Business Review, vol. 18, no. 1, pp. 87-98.

Tuwei, D & Tully, M 2017, ‘Producing communities and commodities: safaricom and commercial nationalism in Kenya’, Global Media and Communication, vol. 13, no. 1, pp. 21-39.

Vodafone 2017, Vodafone full annual report. Web.

Vodafone 2018, Linking the Middle East and Asia. Web.

Vodafone 2019, Business overview. Web.

Vodafone Group PLC 2014, Operations. Web.

Vodafone Group PLC 2018, The future is exciting. Ready?. Web.

Zhao, EJ 2017, ‘The bumpy road towards network convergence in China: the case of over-the-top streaming services’, Global Media and China, vol. 2, no. 1, pp. 28-42.