Introduction

Canada is one of the richest the second largest countries in the world, situated in the North America. It has a population of 32.5 million. The capital of Canada is Ottawa. It has a dynamic nature of business environment. After the great depression, it has recovered its productivity quickly and emerged as one of the strongest economic power.

Canada has a close historical relationship with USA and UK; as a result, these two countries have greater influence on every section of Canada. The Banking system of Canada is also being influenced by these countries. After establishing a confederation, the Canadian government passed a law where it was said that, any chartered bank could operate within the territory of this dominion.

According to this law, various banks were established with several branches in Canada. Thus, the branch banking system was introduced in Canada. In 2000, there were only 13 domestic banks in Canada. More than 90 percent of all bank assets in Canada has controlled by the six largest banks. The remaining seven domestic banks accounted for about 2 percent of bank assets, and foreign banks accounted for about 7 percent of bank assets.

However, the central banking system was introduced lately in Canada. The central bank of Canada was named as “The Bank of Canada”, which was started its operations in 1935. This essay is concerning the findings of key factors that led to establish Bank of Canada. The essay was started with a brief conceptual presentation of the idea of Central Bank and the central banking system. Then, this paper will represent an overview about the Bank of Canada and the monetary conditions of Canada. Then, the analysis of the situations of money supply of Canada before the establishment of the Bank of Canada is drawn. Lastly, the key reasons for which the bank of Canada was established is listed and described.

Central Bank

Rose S. P., (2009) argued that the Central Bank is a government created and directed institution to design and implement different money and credit policies and thus regulate the actions and performance of the financial institutions. It is an entity, which is responsible for overseeing the monetary system of a country. In almost all independent countries, there have a central bank. The key functions of a central bank are:

- Monopoly on the issue of banknotes and coins in circulation;

- Act as the bank for the government and also for the other banks;

- Manages the country’s foreign exchange;

- Regulating and supervising the banking industry;

- It is essential to setting the official interest rates.

Central Banking system

Central banking system was different from commercial banking system. The principles of central banking system are:

- To protect the financial and economic condition of a country;

- It keeps solvent of the entire banking system of the country;

- It is the reservoir of credit and the lender of the last resort;

- Develop and follow an active policy;

- Issue notes, currencies and securities of different types;

- A central bank should not be a subservient to any parties.

Overview of the Bank of Canada

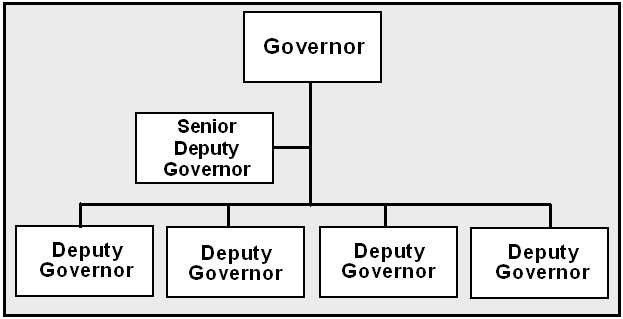

“Bank of Canada” is the central bank of Canada and it was established in March 11, 1935 by the Bank of Canada Act of 1934. It situated on the wellington street, Ottawa, Ontario. The owner of this bank is the ministry of finance. It is primarily responsible for the monetary-policy of Canada. Annual Report (2007) stated that issuance of national debt and management of national debt is the important task this bank has been playing for the last 70 years. It acts as a financial agent for the government of Canada and also performs the tasks of issuing currency. “Governing Council” is the primary policy group of Bank of Canada. This group includes the governor of the bank, the senior deputy governor and four deputy governors. All profits made by Bank of Canada go directly to the Receiver General of Canada.

The commitments of the Bank of Canada

Bank of Canada divides their commitments in three parts based on the ultimate beneficiaries of the operations of the bank. These are:

Commitments to the Canadians

- Drive the monetary policy to improve the value of the money in a confident way.

- Ensure the quality of the bank notes, which results the instant acceptance of the note and give security against counterfeiting.

- Ensure the secure and efficient financial system.

- Provide fund related management services effectively and efficiently.

- Introduce their goals openly and effectively and become liable for their works.

Commitments to excellence

To act as the commitments to the Canadians, it strives for various other commitments to be excellent in their work. These are:

- In all ways of the work, welcome the new ideas;

- Think leadership as a key factor of success;

- Integrity in their business and actions;

- Diversification of the employees and the ideas.

Commitment to one another

In the workplace, the bank of Canada targets several commitments to achieve success in the above two commitments. These are:

- Clear and open communication;

- Knowledge and experience sharing;

- Talent and career oriented development;

- Recognise the persons, who are dependent to these commitments;

- Creating the respect for one another both in and outside the workplace.

Current Canadian Monetary Situation

From the history of Canadian monetary system, it has been seen that, it had exclusive strength and performance ability. However, some events are created monetary troubles in last few months because of continuous harsh depreciation of Canadian dollar in foreign exchange market with debtor and raw material suppliers’ countries in the system.

In 1914, before outbreak of war, the standards of Gold was first accepted by Canada and keeps the tradition sixty years without any gap. Most of this pure gold was worth in America, with a legal tender, some were distributed in British sovereigns in reserves of Government bank.

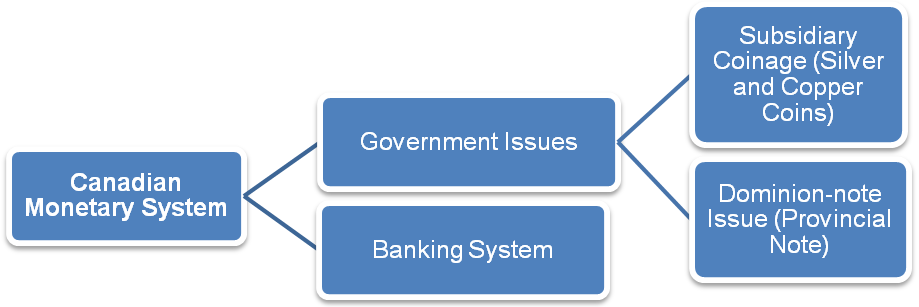

Now, the pre-war structure of Canadian monetary system, which is depended on gold standard, is parted in two divisions:

Curtis, C. A., (2007) argued that the subsidiary coinage system has limited legal tender of Government with silver and copper coins. The Dominion-note is the important part of monetary system of Canada with different provincial note issued with compounded and inflated in Ministry of Finance with legal tender. Currently, the principle amounts of these notes are combined with gold in part and other are by the reserves. It is very close to gold certificates. The purposes of using these notes are:

- For hand to hand currency in everyday transactions with small recovery

- Legal Cash reserves for Commercial banks.

Therefore, larger Dominion notes are suitable to handle than gold in large amounts of cash currency for reserve purposes. Actually, it is used for the automatic exchange of gold for notes in real world with the exchange in demand.

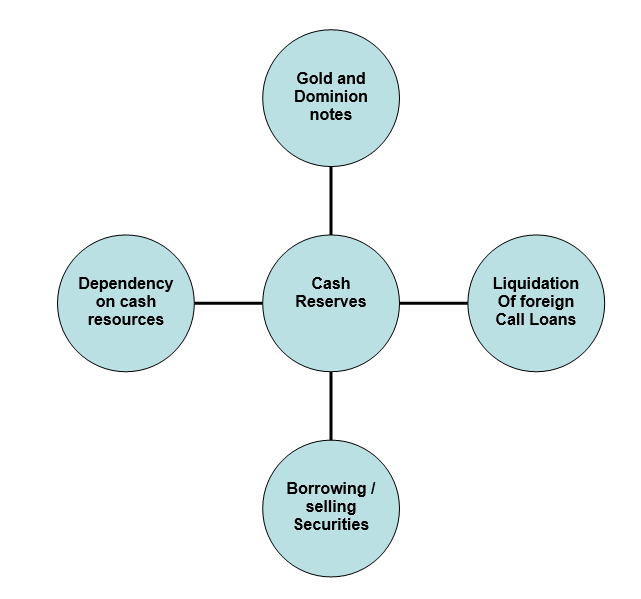

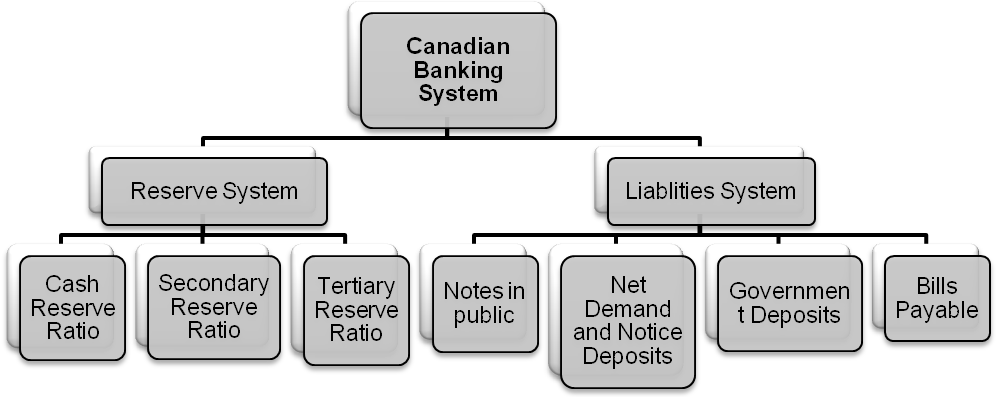

The second parts, Canadian banking system, are consisting of twenty-five banks with branches in all over the country. Without central bank, each bank is an independent and works as decentralized way. The cash reserves of these banks are consisted with:

The cash resources of banks are considered with

- Sufficient liquid to meet demand by public;

- Temporarily increasing Dominion notes.

This liquid or currency is mainly demanded for export business, the refusal of this demand may create extinction of the banks with insolvency. This demand for exports is maintaining by the gold standards. This standard is followed by the Government with automatic and static duties in credit system for solvency of other banks.

The dominion notes are mainly covered by banks’ own securities, and partially by general Government with gold reserve. According to Finance Act, 1914, Government declared authorization of:

- Recovery of Dominion notes in gold with legal rejection;

- Pledged of Dominion notes with adequate security.

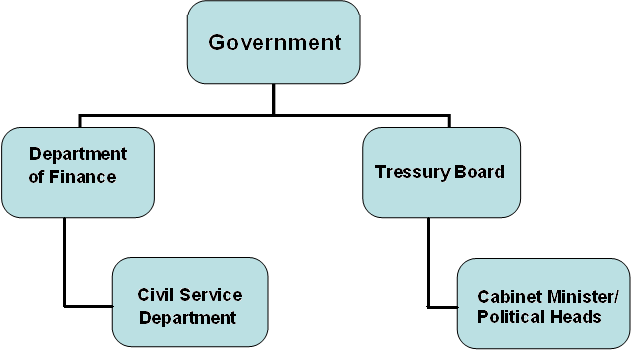

The Treasury Board of Government has full control on the rate of these notes. Promissory tools are another essential tool for pledging as securities for three years maturity and obliged by Minister of Finance.

From recent survey, it is observed that, Canada is maintaining machinery to increase cash reserves overnight, which can add amount in credit wing, where the control is transferred to agency, like Department of Finance.

So, the controls of banks are distributed to many, like:

The gold standard of Canada was established by foreign exchanges. Curtis, C. A., (2007), mentioned that previously, these gold rates are static with normal moves in interest and transportation costs in regulation. When the Department of Finance is stated prohibition in Dominion notes in gold, it is refused to use gold, which are only wanted to be used for cash reserves. After this, Canadian dollar was dropped with the verbal efforts of Government. This is prohibited to export gold as payment system in Canada. After this situation, Dominion notes are exported instead of gold in foreign business. The different price index creates different inflation between countries, which is determined by the treasury board. In recent market, Canada has heavy gold standard with sensitive condition of world developments, which creates pressure on exchange rate, balance of payments and interest payments. Recent banking system is consisting of:

Analysis of Pre-conditions of establishing Bank of Canada

Great depression had an extraordinary influence for the establishment of the Bank of Canada. Courchene, (1969) expressed that the financial and monetary condition of Canada was gold based and the central Gold reserve played the lead role, which was established on 1913. It gave permission of extra issuance of bank notes. The monetary policy of Canada during and immediately preceding the great depression was termed as “Policy of drift” The institutional environment of the then Canada was confined within uncovered prerequisites. In 1929, Canada imposed embargo on export of gold unofficially. However, its policy remained as gold based until 1931.

The emergence of chartered banks was a key influencer. The differences between the chartered banks of those days and modern chartered banks were those banks had the authority of issuing bank notes and the second difference was there were no reserve requirements for the chartered bank legally. In those times, supply of the dominion notes was another important issue. Elliott, (1938) argued that in 1870, the government passed Dominion Notes Act, under which the government specified the issuance of dominion notes which were 25% backed by the gold and remaining part was backed by the government securities. There were several other specified limitations, which were forced to think of a new act.

The finance act was enacted as a temporary observation in 1914. In 1923, it was permanently imposed and it acted a major role of the Canadian financial policies before the introduction of bank of Canada. Under this act, chartered banks enabled to pledge securities, which results equal amount of dominion notes. By this act requirement of gold backing was diminished. For this, the limit of the amount of the dominion notes held by a chartered bank was disappeared. That is there was unlimited supply of the dominion notes.

That is, it can divide the Canadian monetary policy in two stages:

- Stage-1: From 1925 to 1930.

- Stage-2: From 1930 to 1934.

In the first stage (1925-1930), the banking system of Canada was in a desirable position. The outside-money reserve to deposits ratio, including the bank notes were almost 14% and unborrowed reserves to deposit ratio were almost 13%. The increasing reserve of foreign assets and positive current-account balance indicated the healthy banking system. However, Canada was replaced in gold standards on July 1, 1926. From that time to mid 1928, this improvement of Canadian money supply was experienced and improvement increased to a stable position. The effect of these actions led to a decrease in gold reserve.

Bordo M., et al (1999) said that decreased unborrowed high-powered reserves and other declining situation failed to fall the money supply. Banks used the Finance act as a tool to overcome the situation. However, the authorities failed to realize the instability between the gold standards and the Finance act. All the percentage sin advances were declined. As a result, government imposed an embargo on the export of gold informally in 1929. Thus, Canada again lost the gold standards. At that time, the prices of raw materials and foodstuffs declined. But the price of manufactures did not decline. For this, the standard of Canadian Dollar decreased.

The hostile amount of trade of balance, declined prices of exported goods than imported goods and many other issues kept influential effects. Besides the behaviour of the chartered Banks enlightened the damaged parts of the finance act. Bordo M., et al (1999) also said that Banks noticed doubtfully at borrowed reserves, which was the first sign of the upcoming depression. As a whole, the banks started to loose large number of high-powered money but the authorities were idle to these alarming situations. As a result, the government became unable to return to the economy at the end of 1930.

In the second stage (1930-34), gold were flowed out from Canada. Some banks were affected heavily by the deterioration of unborrowed reserves and many of the dominion notes were used to check this adverse effect. Negligence by the government to go on a settlement between the dominion notes act and finance act created dilemma. In November 1932, the government forced the chartered banks to buy treasury bills. This was the first attempt by the Canadian government to take action against the undesirable reserves of the chartered Bank. Besides, the government tried to clear the two major defects of the finance act: the way of borrowing by the banks and the reluctance of expand credit. All these affects the decision of the government to think clearly about the existing acts at the end of the 1934, when the situation was just started to overcome.

Key factors which forced to establish Bank of Canada

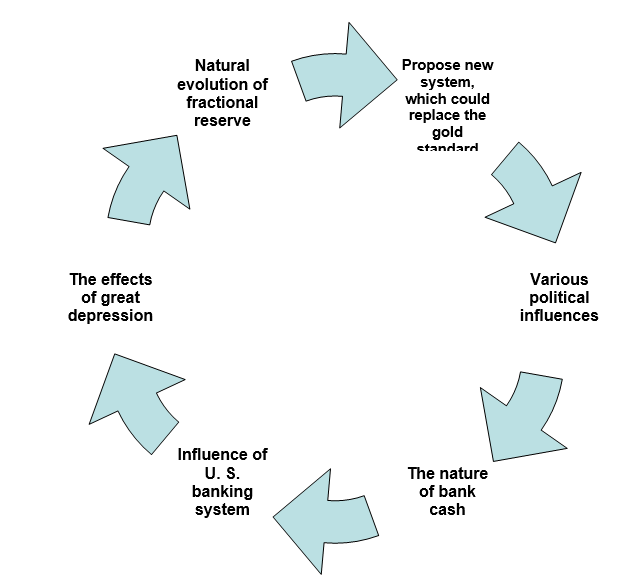

There were several reasons for which a central bank was not seen in Canada before 1935. Before this, the government was not feeling to regulatory reform of banking system. There was an assumption that, central bank was a key feature of revenue-seeking and power loving governments. To protect their image and show their affection to non-profit orientation, the government did not want to establish a central bank. But as because central bank played the role as lender of last resort and helped the banking system by evolving naturally in a fractional reserve. The following figure has demonstrates the major causes of establishing the bank of Canada:

Natural evolution of fractional reserve

The assumption of central bank was the natural evolution of banking system to become a central bank orientation. Public was afraid of the solvency of the banks forced to think of a competitive system where the money of the banks was easily convertible in gold or money. Thus, there were created a liquidity crisis and panic baking paused importance by the people who have not experienced the banking system yet. As because, all the banks were profit oriented, a new banking concept were required to diminish the negative ideas.

In other countries, central bank was played as a lender of last resort, which also emphasizes to establish a central bank. Besides, central bank is the bank of the government and the characteristics played by the central banks of other countries, for example reservation of gold, bundling of reserves and supply extra cash to the money market. Throughout the nineteenth century, there was a competitive fractional reserve banking system. However, at the beginning of the twentieth century, the key features and conditions of the central bank were emerged. The most important five features were:

- The efficient and stable note issuing system of Canada;

- The countrywide branch office system;

- The establishment of bank of Montreal, which performed the most functions of a central bank;

- New York money market based on-call reserve system;

- The rediscounting power of the chartered bank by the finance act.

Propose new system, which could replace the gold standard

In traditional banking, there was an assumption that the convertibility of assets into gold was the key function of bank. Government used the bank of Montreal as an agent to standardise the discretionary monetary policy. These imposed the lacking of the sense that a central bank is essential. Canadian banks then cooperated with the government and increased the price if the gold. However, in near future, embargo was on the export of the gold. Hence, the necessity of a central bank was realized because of the need of an anchor to the money supply, the price level and the rate of exchange. It was assumed that a central bank could limit the more profit seeking greedy banks.

The banks were expected that, the gold standard would be brought back and they did not think a central bank as a substitute to the gold standard. In 1933, a commission of five men was formed named “Macmillan Commission.” This commission was investigated the opportunity and policy and structure of the central bank. They gave their opinion to establish a central bank. Bordo M., et al (1999) said that the situation of the gold was temporary and this suspension will no longer exist in near future. A managed gold standard was needed and there was stability between the old gold standard and new managed gold structure needed. On that time, the day-to-day discipline of the gold standard was not important. The reason was that, the central bankers would have to gain experiences.

Various political influences

There were some political reasons for establishments of he bank of Canada. The banking system was not the only cause of the deflationary situation; rather the political environment was the key factor. The rise of nationalism and the declined traditional view of beneficial character of the market system effected the assumption of central bank. Because of the stable situation of the Canadian dollar and the deflationary situation slowed the establishment of the central bank. It was an ambiguous question that, whether a central bank can help to replace the gold standard or not. Authorities argued that the depreciation of the dollars would not be occurred. However, in the late 1932, the monetary expansion stressed the banks to borrow.

This type of political influences created an ambiguous situation about the establishment of the central bank. Government expanded the political decision by refusing the inflationary policies and decreasing gold backing bank notes. Bordo M., et al (1999) said that there was a political complains against the government that, deflationary policy of the banks hampered the farmers. Another important complain against the government was the efficacy of the banking and total market system. For all the above reasons, the government took a bill to establish a central bank. The ultimate goal of this bill is to standardize the credit and currency system compared with interests of the people, to maintain the government monetary unit and to moderate the effects of the monetary system on the production, trade, prices and employment.

The nature of bank cash

Between the years of 1914 to 1938, the drastically change in bank cash situation was seen. The principal contrast was on the accessibility of the cash. In 1914, there were almost no differences in the availability of cash for the banks and other business concerns. To access cash, the banks had to dispose their assets. Self-reliant banks and banking system represented that, this unique feature. But in 1938, banks could access the cash by lending and rediscounting authority by the central bank.

Therefore, it can be said that, it was an ultimate outcome of the establishment of the Bank of Canada. In the pre war times of 1900 to 1913, some core economic factors trebled the asset handling and cash collection of the banks. The borrowing of capital from outside the country and investment from the same source was used to expand the national capital equipment. Besides, the problems related to the shift was maintained by the Canadian banking system in being written deposits in its books as national funds while getting back the profits of the capital borrowings as assets collected from abroad accessible for all the purposes inherent in the Canadian balance of international payments.

The increasing number of deposits had to be invested correctly. The divide of the cash, loans, investments and other forms of assets not only ensured the protections for the investors but also fulfilled the requirements of economic development. A banking system’s growth depended on the adequacy of cash not only by accomplishing the clearance of the liabilities but also by legal cash requirements. The heavy importance on cash also brought by the circulation of dominion and other bank notes specific limits.

The ultimate findings were that, the Canadian banking system became dependent on the New York and London money market. It was mandatory that the increase in cash should be equal to the increase in gold. As a whole, in pre war years the Canadian banking system had plentiful access to cash for the help of external credits. In this years the banking laws in Canada was liberal and the quality and the operation was mostly based on the wish of the bank owners.

But during and after the World War 1, the gold-based banking system was abandoned and the cash reserve was pumped off. Though the gold reserves were available, the banks were started to reserve the paper money. The banks decreased their investments on the government securities. That is, the banking system of Canada was succeeding to achieve a high cash reserve ratio and a good discouraged investment portfolio. At the beginning of the 1920, a readjustment was started and the Canadian banking system was strong enough to cope up with this. In that, time the economy of Canada was in a booming condition. In 1926, banks were able to achieve a position of self-reliant. From 1926 to 1929, the amounts of Bank credit were increased.

After the booming situation of 1920, the Canadian banking system got the capacity of entering in the depression with its total and free cash reserves. All these facts keep continuous pressure on the economy and the economy suffered from sudden boom and sudden depressions for long time period. These particular situations led to take decision about to establish a central bank.

Influence of U. S. banking system

As United states is the closest neighbour of Canada and the economy of the US always keep effect in every economy of the world, Canada’s banking system is always influenced by the monetary policies, banking systems and economic conditions of united states. Bordo M., et al (1999) argued that there is a significant difference between the Canadian and US banking system as US faced more instability than Canada. During 1930s, the entire banking system was collapsed in United States. Before the establishment of the Bank of Canada, nationwide branch-banking system was brought the stability. However, the US followed a unit banking system. This paper is comparing the stability and efficiency of the Canadian and US Banking system by their loans to asset ratio and the assets to capital ratio.

Besides interest rates paid was higher in Canada in both real and nominal terms. This was true for the securities also. Canadian banks offered higher net rate of return to equity. The Canadian banks were earned higher and they had the higher ability to invest and higher proportion of portfolios. Canadian banks were capable to decline reserve ratio and improve leverage without any restrictions.

Canadian banks made the differences on lending rates. Thus, these banks enjoyed high price for the stability concern than the US, however, US established “Federal Reserve System (FRS)” in 1913 as the central bank. Therefore, United States followed unit-banking system; Federal Reserve System played a key role in the improvement of the banking system of the US. Bordo M., et al (1999) said that the concept of central banking was old enough in US and Federal Reserve System was not the first central bank of US. The introduction of FRS helped a lot in the time of great depression for US. The role of the central bank of US influenced the Canadian government to think of a central Bank and as a fact; the bank of Canada was emerged.

The effects of great depression

The great depression was a global economic recession spread from 1929 and ended at the late 1930s and in many places in 1940s. It had an important effect on the economies of almost all countries in the world. The horrible two world wars were happened in this time, which increased the devastating effects. Canada also suffered for this depression from 1929 to 1939. It is almost same as the United States in terms of the effects and outputs. The main difference was that, the recovery from the depression was done by US but Canada failed to recover for a long time. The decline in productivity and unemployment were the ultimate results of the depression.

The investments in Canada were felled by 15%. Decline in money supply and price levels were 20%. The decline in nominal interest rates was happened. The federal reserve system of United States took several actions to recover the depression. Thus, the Canadian government influenced by the idea of a central bank. The great depression helped to realize that, government should take a control over the money market and the banking system.

Conclusion

The bank of Canada was established for some key factors. The alarming conditions of great depression and the transformation of the golden standard baking system to cash based banking system was the key influencer for establishing the Bank of Canada. From the beginning, this Bank is playing an important role for the stability and efficiency of the banking system, as well as the entire economy. It is performing the functionalities of Central bank effectively and efficiently.

Bibliography

Bank of Canada, Bank of Canada Annual Report 2007. Web.

Bordo Michael, Redish Angela, & Ronald A. Shearer. Canada’s Monetary System in Historical Perspective: Two Faces of the Exchange Rate Regime. The University Of British Columbia. Web.

Bordo, D Michael, Hugh Rockoff and Angela Redish. The U.S. Banking System From a Northern Exposure: Stability versus Efficiency. The Journal of Economic History, Vol. 54, No. 2, pp. 325-341. Web.

Bordo, D Michael & Angela Redish. Why Did the Bank of Canada Emerge in 1935. Web.

Curtis, C. A., The Canadian Monetary Situation. The Journal of Political Economy, Vol. 40, No. 3, pp. 314-337. Web.

Courchene, Thomas J., An Analysis of the Canadian Money Supply: 1925-1934. The Journal of Political Economy, Vol. 77, No. 3, pp. 363-391. Web.

Elliott, Courtland. Bank Cash. The Canadian Journal of Economics, Vol. 4, No- 3, pp. 432-459, (1938). Web.

Rose S. Peter, Bank management & Financial services, 8th edition, New York: McGraw-Hill Education. Web.