Introduction

In spite of differences in the impact on economic sectors, the global financial crisis of 2007-2008 influenced all the world economies. The crisis first attacked the economy of the United States, and the U.S. partners, including the world advanced economies, became most vulnerable in relation to the further crisis development and implications (Baharumshah and Thanoon 295).

The Asian economies were also influenced by the world economic downturn significantly, but the impact of the crisis on the economies of such countries as, for instance, India, China, Singapore, and Malaysia was different because of the state of these economies during the crisis progress and because of the different nature of relations with the United States (Freedman 232).

From this point, it is important to analyze how the world crisis influenced the Malaysian economy in the context of its dependence on the U.S. economy. The following research question will be answered in the paper: How has the world economic downturn influenced the economy of Malaysia and what was the Malaysian response to the crisis?

The research in this field is important because it allows comparing different Asian economies in the context of their dependence on the economic relations with the United States and analyzing the overall dependence of the Malaysian economy on the negative economic changes at the global arena.

It is possible to state that the global crisis affected the Malaysian economy significantly because of the economy’s dependence on the export rates and foreign direct investment, but the Malaysian response to the downturn was effective enough to overcome the crisis’s implications with the focus on the strong banking system. This research paper presents the discussion of the global crisis’s aspects, its impact on the Malaysian economy with the focus on different areas, and the analysis of the Malaysian response to the economic challenge.

Features of the World Economic Downturn

The financial crisis began to develop in 2007, when the housing bubble associated with the U.S. housing market burst. The first stage was the mortgage boom observed in the United States, and the next stage of the crisis was the banking crisis that affected investment procedures and policies. As a result, the crisis affected not only the U.S. financial sectors but also the world economies (Sivalingam 185).

Those Asian economies that were discussed as emerging ones were not influenced by the crisis significantly because they followed aggressive economic strategies developed to foster the progress. In contrast, the developed economies followed the more conservative paths in developing the financial practices. The other Asian economies that were affected by the crisis were the export-dependent economies, such as the economy of Malaysia (Baharumshah and Thanoon 296).

The main features of the world economic crisis were the fall of asset prices, the collapse of national financial institutions, the decline in the global trade, and the significant decrease in exports. In this situation, Malaysia suffered from the great contraction because of being dependent on the exports as the necessary condition for the economic growth.

Effects of the Crisis on the Malaysian Economy

While comparing the effects of the global downturn on the economy of Malaysia with the effects of the crisis on the other Asian economies, it is important to state that the Malaysian economy was affected significantly because of its vulnerability and dependence on the exports’ rates, foreign direct investment, and commodity prices.

Focusing on the changes in the GDP caused by the global crisis, Doraisami states that the forecast GDP growth rate of “5.4 per cent for 2009 was quickly revised downwards and, after contracting by 6.2 per cent in the first quarter of 2009 and 3.9 per cent in the second quarter, an overall contraction of 1.7 per cent of GDP” was recorded (Doraisami 41). These numbers support the idea that the Malaysian economy was attacked by the crisis that brought the period of instability in relation to the question of the exports.

The problem of the contraction in relation to the international trade as the inability to keep previous high rates of exports to the United States became the main outcome of the global economic and financial crisis in Malaysia. The export demand decreased significantly, causing the collapse of the Malaysian industry and market (Freedman 234). The manufacturing industry in Malaysia was affected significantly because the annual average growth fell by 3% in comparison with the previous years.

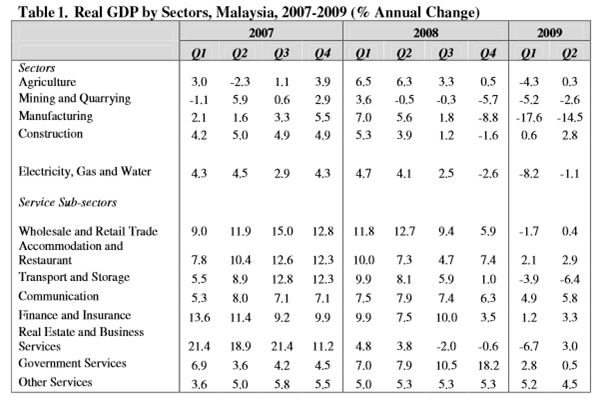

In addition, as a result of the global crisis and contraction, “manufacturing value-added also contracted from 7% in the first quarter of 2008 to -8.8% in the fourth quarter, then to -17.6% and -14.5% in the first and second quarters of 2009 respectively” (“The Global Financial Crisis” 11). The negative results of the contraction were also observed in such industries as mining and the transport sector (Table 1).

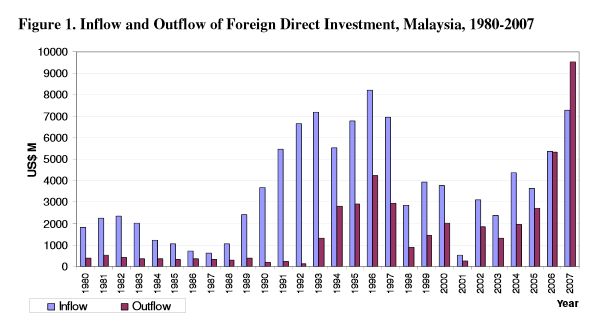

Investment flows in Malaysia were also significantly affected by the implications of the crisis. The problem was indicated with references to examining the changes in inward and outward investments before and during the economic downturn of 2007.

In spite of the fact that the “inward foreign investment had risen steadily over the period 2003-2007” and “outward investment from Malaysia has risen faster than investment inflows since 2003”, Malaysia faced “a negative net foreign investment over the period 2006-2007” (“The Global Financial Crisis” 14).

As a result, it is possible to state that the contraction affected the inward foreign direct investment more significantly than the outward foreign direct investment, “suggesting that net FDI will only get worse over the period 2008-2010” (“The Global Financial Crisis” 14). From this point, the crisis of 2007-2008 demonstrated the degree of the Malaysian economy’s dependence on the flows and volumes of the foreign direct investment (Figure 1).

The effects of the global crisis on the financial sphere of Malaysia should be discussed with references to the analysis of the Malaysian central bank’s activities. The Bank Negara Malaysia is the central bank in Malaysia that controls the financial sector of the country. The crisis led to the decline of the total loans to about 2% in 2008 (Baharumshah and Thanoon 297). Still, it is possible to state that the Malaysian banking system was stronger in comparison with the other Asian economies and their financial systems.

That is why, the Malaysian banking system succeeded in adapting to the financial crisis. It is possible to state that the Malaysian banking system was discussed as preparing to the instability associated with crises because the system was restructured after the Asian financial crisis of 1997 (Doraisami 44). The banking reforms realized during the post-crisis period allowed the Malaysian banking system to improve the banking sector and the current financial system.

The Malaysian Response to the Crisis

The Government responded to the crisis with establishing new policies and approaches to overcome the downturn’s implications. The main focus was on overcoming the exports’ collapse, while stabilizing the economy with references to supporting the public sector, coping with the decline in FDI inflows, and supporting the banking system. The first strategy was associated with introducing rescue or stimulus packages (Freedman 234).

These packages were an effective approach because the Malaysian economy received the support in more than $18 billion, and it could focus on stabilizing the rates and overcoming the reductions in expenditures (Sivalingam 186). These packages were also introduced in order to complete the strategic goal to make the Malaysian economy rapidly developing within the next ten years (Doraisami 48).

The declines in the world trade was the main problem for the Malaysian Government, as a result, the size of rescue packages was increased in comparison with the reaction to the crisis of 1997 (Sivalingam 186). It is important to pay attention to the fact that Malaysia continued to develop in the negative economic environment associated with the global crisis because of the strong financial sector.

As a result, the decline of international markets affected the Malaysian economy directly, but it was adapted to the changes because of the focus on utilizing the available internal resources.

The focus of the Government on overcoming the crisis in the market and industries can be explained by the fact that the banking system was prepared to the negative crisis’s implications. That is why, there was no need to stabilize the exchange rate or to focus on reviewing the monetary policy, as it was previously, during the Asian financial crisis of 1997 (Sivalingam 188).

The Bank Negara Malaysia was proposed to follow the effective strategy, according to which the bank “reduced its Overnight Policy Rate by a total of 150 basis points between November 2008 and February 2009 to 2 per cent” (Doraisami 47).

The proposed approaches were oriented to increasing the “borrowers’ disposable income, which could then feed into higher domestic consumption” (Doraisami 47). From this point, the main focus was on supporting the domestic consumption and borrowers’ income as the first step to stabilizing the situation with loans.

The effective policy implementation can be discussed as the key factor to influence the ability of the Malaysian economy to adapt to the negative changes in the global goods and investment market. Much attention was also paid to diversifying the Malaysian economy to ensure the overall economic growth during the further four years. Recently, the Malaysian economy seemed to develop actively with the focus on high export rates and on supporting strategies leading to developing the high-income state (Freedman 234).

Malaysia continues to develop advantageous economic relations with the United States, focusing on the exchange of not only goods and financial resources but also on the exchange of the human resources. The global financial crisis provided the idea that the exchange of all possible resources is a good strategy for the economic growth in Malaysia which is dependent on the exports rates and foreign direct investment (Sivalingam 186).

Having overcome the economic and financial crisis, Malaysia focuses more on supporting the developed banking system, and it offers paths for investing in the country in order to decrease the dependence on the export rates, while funding technological and innovation sectors in the economy.

Conclusion

The conducted research aimed to provide the answers to the questions about the impact of the world economic downturn on the economy of Malaysia and about the Malaysian response to the crisis. It was found that Malaysia succeeded in avoiding the financial collapse because of the strength of the reformed banking system, but the Malaysian economy was affected by the decline in the export rates and negative changes in the global trade.

The main problem was associated with the fact that the GDP decreased significantly, and the Malaysian economy had to overcome the recession stage after the global crisis of 2007-2008. However, in spite of the negative role of the global economic and financial downturn for the Malaysian economy, the Government of the country responded to the crisis immediately and effectively, while proposing the significant stimulus packages in order to support the economy and change the balance of expenditures.

As a result, the economic contraction was overcome successfully during the next two years, although such sectors as manufacturing were influenced by the global crisis considerably. The stimulus packages can be discussed as the most effective response to the world crisis in the situation when the country’s economy mostly depends on the export rates and trade with the United States. In this case, the Government provided the Malaysian industry with the opportunity to develop the potential within the domestic market.

Works Cited

Baharumshah, Ahmad Zubaidi, and Marwan Abdul-Malik Thanoon. “Malaysia: From Economic Recovery to Sustained Economic Growth”. Journal of Post Keynesian Economics 28.2 (2005): 295-315. Print.

Doraisami, Anita. “Economic Crisis and Policy Response in Malaysia: The Role of the New Economic Policy”. Asian Pacific Economic Literature 26.2 (2012): 41-53. Print.

Freedman, Amy. “Economic Crises and Political Change: Indonesia, South Korea, and Malaysia”. Asian Affairs: An American Review 31.4 (2005): 232-249. Print.

Sivalingam, Gunasekaran. “Malaysia’s Economic Growth Moderates”. Southeast Asian Affairs 1.1 (2012): 185-200. Print.

The Global Financial Crisis and the Malaysian Economy: Impact and Responses. 2009. Web.