Introduction

The Apple Company was established approximately four decades ago with a view of designing, innovation, production, and distribution of computers. The company is based in Cupertino, California in the United States of America. Presently, it carries out its operations on an international scale. Various operations of the company include designing, innovation, manufacturing, and selling of consumer electronics, computer hardware and software, and wearable devices among other products and services. The company also offers a variety of online services worldwide. It also develops software products that include computer and mobile phone operating systems, web browsers, online music and book libraries, and productivity suites among others. The company has a strong focus on the provision of superior products and services. This essay provides an evaluation of Apple’s position that enables it to sustain its recent success in the consumer electronics industry.

Product/Process Innovation in Apple Company

The world recognises the Apple Company for its outstanding design and manufacturing techniques that enable delivery of superior and unique products. According to Barker (2003), the company’s overall innovation strategy is a product of the employees who are dedicated to accomplishment of performance goals. They also exhibit a culture of team spirit. Furthermore, Barker (2003) reveals that Apple Inc.’s workforce is driven by the desire to satisfy customers. The company’s innovation process is based on sound business techniques, procedures, models, and products that suit the needs of the end consumers. The functionality of the Apple Company is built on a culture of constant improvement, teamwork, and customer satisfaction unlike its competitors whose businesses are primarily value-driven. This situation has enabled the organisation to make effective use of employee creativity by promoting stimulation of new ideas, streamlining the design processes, and launching successful innovations that are profitable (Finkle & Mallin 2010).

The innovation techniques also ensure that the products that are introduced are easier to use and ergonomically suitable to customers. Partnership is also a factor that the management implements to ensure unremitting innovation of products and/or processes. In this case, factors such as diversity inclusion, ideas, business networks, and partners among others are combined to seize opportunities in markets. This situation culminates into unceasing improvement and expansion of the company despite various hurdles that derail its operations (Carr 2013). Many companies venture in acquisition strategies to expand their operations. However, the Apple Company invests heavily in its supply chains. According to Lawson and Samson (2001), adoption of acquisition strategies by the Apple Company can only add important values to existing products.

Product Development

Various electronic products have been developed since the launch of Apple II, a successful microcomputer that was invented in 1977 (Kawasaki 1990). A series of immense technological improvements has led to continuous introduction of other products such as Macintosh computers that hit the market in 1984 (Kawasaki 1990). Other features that were more advanced were added to the existing products. This situation resulted in invention of newer devices such as the iMac G3 computer, iPod in 2001, mini iPod in 2004, and iPod shuffle in 2005. The company benefitted from the expertise of Steve Jobs who returned to the company. Under his leadership, the Apple Company invented other products such as the iPod nano in 2005 and MacBook in 2006. In 2007, the iPhone and iPod touch hit the market in 2007. Further innovation led to introduction of iPhone 3G in 2008 that was GPS-enabled. This mobile phone was later upgraded to iPhone 3GS by integrating various design and voice features. Other leading products include the MacBook Air that hit the market in 2008 (Lashinsky 2012). The MacBook Air came with invention of a variety of techniques that led to the launch of the iPad tablet in 2010, iPod touch 4G, and iPhone 4 that possessed better features such as voice calling and FaceTime. A series of others products that were delivered to the market include iPhone 4S, iPad 3, iPhone 5, iPad Mini, Mac Pro, iPad Air 5S, and iPhone 5C (Lashinsky 2012). Although the company has not introduced new products in the recent past, capitalisation has been the latest achievement in 2014. Brand makeovers have also been restructuring the products by developing counterfeit devices with simpler features (Lashinsky 2012).

Post Steve Jobs Leadership: Strategic Decision Making

The Apple Inc. is an in cooperation that includes four main diverse companies combined to one. The affiliate companies encompass hardware, software, service, and retail businesses. As a result, effective management of such an organisation demands good leadership that is well structured (Beer 2002). The late Steve Jobs had provided an archetypal leadership since his return to the Apple Company in 1997 (Hansen, Ibarra, & Peyer 2010). The management structure that was implemented assumed a central leadership style. As a result, the CEO, who instructed the junior employees on specific business strategies, centrally made most decisions (Elkind 2008). Steve Jobs ensured that his arbitrary leadership style was effective. Although his style was hectic to the employees, Steve Jobs had strived to incorporate various management methods and leadership roles to bring everybody on-board. As a result, the Apple Inc. became the world’s most valuable company by market capitalisation.

Gobble (2012) reveals that Steve Jobs planned for future leadership by establishing dedicated teams who carried out the management processes based on competence and high performance values and styles among others. Mr. Tim Cook promised to continue with Steve Jobs styles by upholding the same culture of producing innovative products that surpass customers’ expectations (Cheng 2011). He introduced various changes in the Apple Company by reducing some of the affiliate retail shops. In addition, he streamlined various strategies in an attempt to push the company’s sales towards high-end retail outlets whilst maintaining minimum inventory (Friedman 2011).

In terms of leadership, Tim Cook applies a more collaborative approach that incorporates other management staffs in decision-making processes. Both the Apple Company’s software and hardware teams collaborate in their operations. The new approach has enabled the company to be more deliberate in terms of problem reduction. It enables the management to identify and focus on other products that the CEO cannot identify easily unlike Steve Job’s approach that concentrated on one product at a time (Friedman 2011). As a result, departments can make decisions quickly irrespective of the time that is wasted before an agreement is reached (Quinn, Doorley, & Paquette 1990; Phan, Schmidt, & Chen 2010).

Three Dimensional Strategic Analyses of the Apple Company

Current Market Share

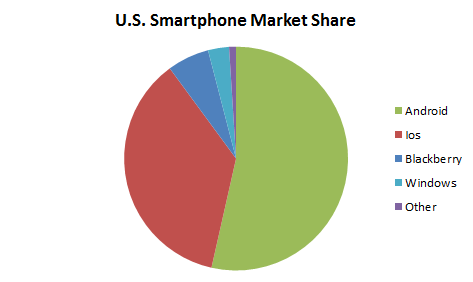

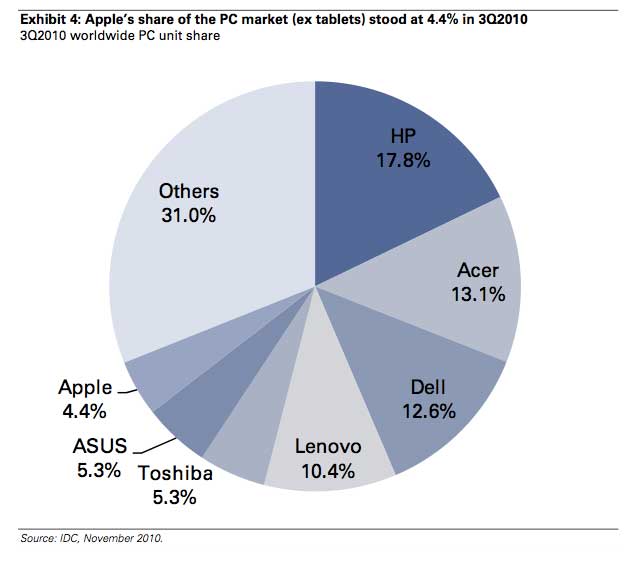

Throughout its development, the Apple Company has been striving by its innovation techniques to seize customers amidst a competitive consumer electronics market that is dominated by giant multinationals such as Samsung and Microsoft among others. Although the company’s market share has been rising slowly, it is still below 50-percent (Lashinsky 2012).

Campbell, Goold, Alexander, and Whitehead (2014) reveal that the company faces a number of hurdles that challenge its position in the global market. At the outset, the company majorly depends on its engineers to close the existing competition gap. Secondly, piracy of its product has been on the rise due to emergence of fake companies. Nonetheless, the Apple Inc. benefits from its dedicated employees who have worked hard to ensure that it does not encounter problems such as hacking and virus infections that are frequently experienced by competitors companies. The company strives to maintain the existing customers who are in love with their innovation and superior production. According to Yang (2014), the company is likely to gain the biggest share in the information technology market in the near future. Although the Apple Company has lost some share in world market, the current market share statistics indicate that it is still the best handset manufacturer internationally (Reder 2009).

Current Financial Strengths

Menzel (2014) reveals that the Apple Company’s financial state has revenue of 170,910 billion dollars. This amount implies an increase of more than 9-percent from 2008 to 2012. Its operating income is over 35 billion dollars. The company’s total asset is valued at approximately 230 billion dollars while the total equity is currently standing at 11 billion dollars. On average, its net income is 39 billion dollars. The Apple Inc. maintains over 420 retail stores globally. Menzel (2014) confirms that the company has over 90-thousand permanent employees who are based in 14 countries.

Relative Market Strength

The Apple Company deals with various business units in diverse markets where its retail stores are located (Montgomery 2008). As a result, there is a need to analyse the various investment strategies that it should adopt to gain a competitive advantage over its competitors (Adegoke 2014). The relative market strength determines the company’s rate of development. The Apple Company undertakes robust operations that boost its competitive ability. When its products are ranked to determine the investment rate, the value is found to be above a unit. This value implies that the Apple Company has a stronger market than that of its competitors (Datamonitor 2006).

Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis

Strengths

Effective advertisement has enabled the Apple Company to gain better returns on investment. Although advertising and marketing budgets have been increasing every year since 2010, their cost has remained significantly lower than the competitors’ budgets. However, a need to conduct advertisements arose due to the launch of iPad products. This strategy led to higher sales than the preceding years (Datamonitor 2006). A close comparison by Friedman (2011) indicates that the Apple Inc. spent below 1-percent of its total sales, which is lower than 2-percent that was spent by the Samsung Company.

However, the cost of advertisement increased by over 45 billion dollars in 2010 alone. This value was higher than that of Samsung Company by approximately 20-percent. This statistics showed that the Apple Company still earned more revenue despite its minimised expenditure on advertisement. In summary, the company spends less money on advertisement as compared to the competitors. According to Friedman (2011), the Apple Company mainly depends on quality of its products and services to seize customers. As a result, more funds are used on other projects rather than advertisement. This situation has improved the company’s profitability enormously. Its strength is also depicted in the loyalty of its customers who enjoy the ever-expanding closed ecosystem. This combination has significantly increased the company’s competitive advantage (Datamonitor 2006).

Weaknesses

The main weakness that is faced by the Apple Company is its relatively high prices that are tagged on it diverse merchandize. This situation forces consumers to prefer alternative products that bear similar quality from rival companies. In addition, the company’s devices are incompatible with different operating system software. There is a big difference between iOS and OS X. The two software products also differ from other from the Microsoft’s OS (Datamonitor 2006). As a result, users have developed a high preference to more versatile devices and software that are developed by companies such as the Microsoft Inc. and Nokia. There is a decreased market share due to weak customer influence. The Apple Inc. is also experiencing legal accusations due infringement of the products of other companies. This state of affairs has largely damaged the reputation of the company (Datamonitor 2006). Furthermore, there has been a change in management due to the death of Steve Jobs in 2012. This situation has negatively affected the company (Valentin 2001). A defect that has been noted in the new products such as the iPods and iPhone series smartphones has resulted in lower sales and destruction of the firm’s reputation. Lastly, a weakness of long-term margin reduction is evident. Indeed the company’s analysts have warned of its inability to sustain the component prices and competition margins of the products effectively (Valentin 2001).

Opportunities

The Apple Company has various opportunities for its growth. For instance, there is an increasing demand for iPad and iPhone products that are likely to increase the market share. This situation will strengthen the company’s competitive advantage (Zenger 2013). The launch of the iTV application that is installed in the Apple TV will significantly boost its sales. Expansion of the company’s market share is further enhanced by distribution of more tablets and smartphones globally (Lashinsky 2014)

Datamonitor (2006) reveals that competitors constantly damage the company’s image through software and hardware counterfeiting. Nonetheless, this situation is perceived as an opportunity to increase savings from the customers that are dissatisfied with substandard products that are offered by the fake companies (Datamonitor 2006). Lastly, there is an increasing demand for cloud-based services that are projected to bring about expansion of the company’s range of iCloud services (Apple Annual Report, 2003).

Threats

The Apple Company faces a number of threats. At the outset, unremitting technology shifts have significantly pressured the company to release new products to match consumer demands (Westphal & Wheeler 2014). The paces at which the technology changes can make the company experience a reduced market command. This situation can make the company irrelevant to trendy consumers who prefer up-to-date technology. Recently, the company released the iTV and iPhone 6, which are slight improvements of existing products. Another threat that the company faces is fickle tax increases have had negative effects on its growth (Lashinsky 2014).

The Samsung Company, a competitor that provides application processors demands more finances from the Apple Inc. This situation increases the likelihood of imposing high prices on the company’s products. A possibility of a strong currency due to instability of the US dollar is a threat to the Apple Company since more than half of its revenue is accrued from its retail stores in other countries (Valentin 2001). The depreciation of dollar has a significant effect on other currencies. Sometimes, this situation leads to a reduction of profit. The Apple Inc.’s iOS is currently facing fierce competition from the android OS, especially in the smartphone market. Lastly, other competitors have moved to online music market whilst the Apple Company faces various shortcomings in development of the iTunes music store among others (Valentin 2001).

Change in Competitive Environment in Relation to the Apple Company’s Stability

The competitive environment in which the information technology companies lie has been favourable for the Apple Company. Stability and sustainability are the key factors that have placed the company in a favourable position to compete with its rivals (Ireland & Webb 2007). The shifting technology landscape has significantly affected the operations of the Apple Company. There has been a need to invest in innovations that are more robust meet the ever-changing demands and trends of consumers. This situation has built pressure on the company’s management as they strive to design, innovate, and manufacture new gadgets that suit the prevailing market patterns. Various factors that have been noted in the Apple Company’s environment include organic growth strategy, innovation, and competitiveness.

Organic Growth Strategy

Businesses that thrive in a competitive environment tend to adopt an internal growth strategy. Apple has embraced this business approach through buying, merging, and/or collaborating with other companies such as the Microsoft Corporation, Google Inc. and Cisco System Inc. The Apple Inc. has adopted an effective way of spending on research in an attempt to deliver high-end products and services. Good spending has enabled the company to increase its revenue from 20 billion dollars in 2006 to about 40 billion dollars in 2007 (Ireland & Webb 2007).

Innovation

To survive in a highly competitive environment, the Apple Company established various innovative techniques (Freund & Weinhold 2002). Its employees and managers are focused on development of new products that have a higher quality. The company also diversifies its revenues unlike its competitors who are only focused on innovation of new products and processes (Porter 2008).

Apple Inc.’s Competitive Advantage over its Competitors

The Apple Company has maintained its competitive advantage over its rivals through the introduction of multiple innovative quality products (Setia, Venkatesh, & Joglekar 2013). Its products have a better quality than those of the other companies. Another technique that is used by the Apple Company to gain a competitive advantage is business segmentation that enables it to increase its market demand. The company also makes unique products that are attractive to consumers. This situation has enriched the development of consumer loyalty. Through its focus on customers who are willing to pay more per volume per unit, the company set an obstruction to its competitors (Mathews 2002). The competitors’ brands have overlapping technology that brings about operational complexities. A higher risk of losing a sizeable market is incurred since consumer loyalty is reduced significantly. On the other hand, the Apple Company has a clear brand for its products that is characterised by high compatibility amongst its devices (Ragnetti 2011). This situation improves customer loyalty because of the greater brand experience. Another competitive advantage is the company’s invention potential that results in generation of new and high quality products (Mathews 2002).

Xaomi is a competitor company based in China that innovates, develops, manufactures, and distributes products that are identical to those of the Apple Company. This company is the biggest smartphone producer in China. Although the Apple Inc.’s products still dominate in the China market, the cheaper prices of Xaomi smartphones have posed a major threat to the company. This situation has resulted in both slow and low sales (Shih, Lin, & Luarn 2014).

A close examination of the above factors reveals that the Apple Company has an advantage to remain in the market despite of the various obstacles that are brought about by the competitors.

How the Apple Company understands Critical Success Factors (CSFs)

Most companies that have good business platforms outperform their competitors. The platforms are based on the company’s renewal, continuous innovation, and sustainable success (Hong & Kim 2002). Apple’s platform and ecosystem is indicated as sustainable in the economic mean for its growth and development.

The Apple Company’s success has been based on various critical success factors. At the outset, visionary and purpose-oriented leadership has always ensured maintenance robustness within the business ecosystem. The competitive rate of the company is also another success factor that has played a great role to accomplish performance goals. In addition, the company has an extensive business network through establishment of various retail outlets worldwide. Leadership and trust is established through transparency amongst the managers and the staff (Yeoh & Koronios 2010). The company has well defined policies and rules to ensure appropriate products evaluation. Engineers at the Apple Company are highly skilled. As a result, their designs are based on open architecture that has boosted success of the company (Cusumano 2013).

First-Mover Advantage

Cottrell & Sick (2001) define the first-mover advantage as the potential of a business to cover a great market segment. This advantage can emanate from a situation that enables a business to gain a better control of resources and/or market as compared to other players in the same industry. As a result, the business realises high profits margins that makes it assume a monopoly status (Cottrell & Sick 2001). The Apple Company has gained a first-mover advantage in the consumer electronics industry. It has been experiencing a steady stock that ranges from 80 to 160 dollars per share. Other products that have enabled it to gain a first-mover advantage are its iPhone 3GS and MacBook Pro line. The company also operates exclusively in the high end of handset and computer markets. Therefore, high profits are also realised. Finally yet importantly, the CEOs of the Apple Company have created an ecosystem that is difficult to overcome due to its retail stores that have greatly contributed to a first-mover advantage over the rival companies (Cottrell & Sick 2001).

Conclusion

The essay aimed at critical evaluation of the Apple Company’s position to sustain its resent success in the consumer electronics industry. The study enables the company to focus more on factors such as competition, market structure, and financial status among others. In the light of various success factors, the company can maintain and/or deal with counterfeiting rivals such as the China based Xaomi Company. In addition, there is a need to speed up designing, innovation, and production of devices that have fewer restrictions to capture a larger market in the consumer electronics industry.

References

Adegoke, Y 2014, ‘The future of streaming lie: Apple-Beats deal talks were just the starter pistol. Industry execs eye the competition ahead’, Billboard, vol. 126 no. 17, pp. 5.

Barker, G 2003, Apple cult gathers for innovation update, Web.

Beer, M 2002, Building organisational fitness in the 21st century, Harvard Business School, Boston, MA.

Carr, A 2013, ‘What You Don’t Know About Apple’, Fast Company, vol. 1 no. 174, pp. 35-8.

Campbell, A, Goold, M, Alexander, M & Whitehead, J 2014, Strategy for the Corporate Level: Where to Invest, what to Cut Back and how to Grow Organisations with Multiple Divisions, John Wiley & Sons, New Jersey, NJ.

Cheng, J 2011, Tim Cook says, “Apple is not going to change”, Web.

Cottrell, T & Sick, G 2001, ‘First‐Mover (Dis) Advantage and Real Options’, Journal of Applied Corporate Finance, vol. 14 no. 2, pp. 41-51.

Cusumano, M 2013, ‘Technology Strategy and Management: The Apple-Samsung Lawsuits’, Communications of the ACM, vol. 56 no. 1, pp. 28-31.

Datamonitor 2006, Apple Computer, Inc., Web.

Elkind, P 2008, The trouble with Steve Jobs, Web.

Freund, C & Weinhold, D 2002, ‘The Internet and international trade in services’, American Economic Review, vol. 92 no. 2, pp. 236-40.

Friedman, L 2011, Apple turns to Tim Cook to replace Steve Jobs, Web.

Finkle, T & Mallin, M 2010, ‘Steve Jobs and Apple, Inc.’, Journal of the International Academy for Case Studies, vol. 16 no. 8, pp. 49

Gobble, M 2012, ‘Resources: Innovate Different: The Legacy of Steve Jobs’, Research-Technology Management, vol. 55 no. 1, pp. 63-7.

Hansen, M, Ibarra, H & Peyer, U 2010, ‘The best performing CEOs in the world’, Harvard Business Review, vol. 88 no. 1, pp. 104-13.

Hong, K & Kim, Y 2002, ‘The critical success factors for ERP implementation: an organisational fit perspective’, Information & Management, vol. 40 no. 1, pp. 25-40.

Ireland, D & Webb, J 2007, ‘Strategic entrepreneurship: Creating competitive advantage through streams of innovation’, Business Horizons, vol. 50 no. 1, pp. 49-59.

Kawasaki, G 1990, The Macintosh way, Pearson, Glenview, United States.

Lashinsky, A 2012, ‘How Tim Cook Is Changing Apple’, Fortune, vol. 165 no. 8, pp. 110.

Lashinsky, A 2014, ‘Apple’s Newest Product: Complexity’, Fortune, vol. 169 no. 8, pp. 73-6.

Lawson, B & Samson, D 2001, ‘Developing innovation capability in organisations: a dynamic capabilities approach’, International journal of innovation management, vol. 5, no. 3, pp. 377-400.

Mathews, J 2002, ‘Competitive advantages of the latecomer firm: A resource-based account of industrial catch-up strategies’, Asia Pacific Journal of Management, vol. 19 no. 4, pp. 467-88.

Menzel, A 2014, How well placed Apple is to sustain its recent success in the Consumer Electronics Industry, GRIN Verlag GmbH, Munich, Germany.

Montgomery, C 2008, ‘Putting leadership back into strategy’, Harvard Business Review, vol. 86 no. 1, pp. 54.

Phan, D, Schmidt, M & Chen, J 2010, ‘Organizational Ecology Success Factors in the Business: A Case Study at Fingerhut Inc.’, Information Systems Management, vol. 27 no. 1, pp. 82-91.

Porter, M 2008, ‘The five competitive forces that shape strategy’, Harvard Business Review, vol. 86 no. 1, pp. 25-40.

Quinn, J, Doorley, T & Paquette, P 1990, ‘Technology in services: rethinking strategic focus’, Sloan Management Review, vol. 31 no. 2, pp. 79.

Ragnetti, A 2011, Apple’s Competitive Advantage, Web.

Reder, M 2009, ‘Case study of Apple, Inc. for business law students: how apple’s business model controls digital content through legal and technological means’, The Journal of Legal Studies Education, vol. 26 no. 1, pp. 185-209.

Setia, P, Venkatesh, V & Joglekar, S 2013, ‘Leveraging Digital Technologies: How Information Quality Leads To Localized Capabilities And Customer Service Performance’, MIS Quarterly, vol. 37 no. 2, pp. 565.

Shih, C, Lin, T & Luarn, P 2014, ‘Fan-centric social media: The Xiaomi phenomenon in China’, Business Horizons, vol. 57 no. 3, pp. 349-58.

Valentin, E 2001, ‘SWOT analysis from a resource-based view’, Journal of Marketing theory and Practice, vol. 9 no. 2, pp. 54-69.

Westphal, C & Wheeler, S 2014, ‘Effects of stakeholder pressures on international business: Apple and Foxconn’, Business Law Review, vol. 47 no. 1, pp. 127-38.

Yang, F 2014, ‘China’s ‘Fake’ Apple Store: Branded Space, Intellectual Property and the Global Culture Industry’, Theory, Culture & Society, vol. 31 no. 4, pp. 71-96.

Yeoh, W & Koronios, A 2010, ‘Critical success factors for business intelligence systems’, Journal of computer information systems, vol. 50 no. 3, pp. 23-32.

Zenger, T 2013, ‘What Is the Theory of Your Firm?’, Harvard Business Review, vol. 91 no. 6, pp. 72-8.