Introduction

The cases deal with the Apple’s successes majorly within the last two decades. The success of the firm is mainly attributed to the strong leadership of the firm’s founder and former CEO, Steve Jobs (Isaacson, 2011). During his tenure as CEO, Jobs initiated and coordinated a series of operational strategies that led to the developments of various innovative products ranging from the iPod to iPad (Nabi, Holden & Walmsley, 2010). In 2001, the firm concentrated in the development of Mac, which later became the center of digital hub for cardinal photos, videos and music (DeMartino, Barbato & Jacques, 2006). The strategy that contributed to the development of Mac led to the development of iPod, iTouch, iPhone and iPad.

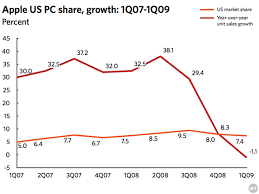

The innovative products led to the increases in the sales growth of the firm from $5 billion to about $108 billion in 2011 (Cameron, 2011). The growth in the profits is estimated to have grown by over 28% during the period from a loss in sales growth of about $350, 000 to returns of over $3 billion (Apple, 2011).

Table 1: Apple’s Net Sales from 2001 financial year to 2013 financial year

In terms of the product category, by 2010, the firm had sold over 300 million ipods while over 100 million iphones had already been sold. The newly launched iPad made a remarkable feat during that year. The firm sold over 25,000 iPads in 2010. The firm’s great success is attributed to its leadership capabilities, both financial and managerial strengths as well as the capabilities of creating a strong demand for most of its products (Cassar, 2007).

The extent to which changes in the competitive environment have changed to provide Apple with a more robust competitive battleground.

The technology is one of the highly dynamic industries with newly emerging firms and technologies evolving continuously. The market structure and composition also changes with the new transformations (Jubak, 2012). In fact, the new transformations in the market reflect the rapid changes in the product forms and features (Heywood & Kenley, 2008). With new firms entering into the market and changes taking place in the industry, old firms such as Apple Inc. are currently facing increased competition. The changes that have occurred in the market affected almost all Apple’s products. The competing firms have come up with new innovations resulting in the production of almost similar products, which in effect offer stiff competition (Christensen, 1997).

Apple’s diversified portfolio has exposed most of its products to intense competition. Currently, the firm is not enjoying most of the competitive advantages in the premium technology market (Culpan, 2011). The entry of other firms such as IBM into the technology services offering a wide array of products to the market changed the competitive landscape in which Apple used to operate (Avery & Bergsteiner, 2011). Besides, the firm is facing stiff competition from new entries into the industry including Amazon and Google (Kafka, 2010). The entry of Google into the smartphones market as well as offering competitive software poses a great threat to Apple (Plunkett, 2011). Besides, the Amazon iPad challenged the original iPad developed by Apple (Kafka, 2010).

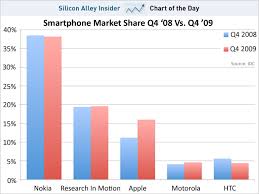

Moreover, in the android phones market for instance, the firm’s smartphones are facing intense competition from large and small firms manufacturing almost the same products (Dalrymple, Michaels & Jonathan, 2009). The emergence of large number of smartphones venders in the market has also resulted in the price reductions. Such a reduction in the prices would automatically put a lot of pressure on the Apple’s smartphones driving their prices down below the required minimum. In the smartphones market, several trends exist together within the global market (McCray, Gonzalez & Darling, 2011). However, the steady declines in the market prices of android smartphones have contributed hugely to the growth of the smartphones’ market. The android technology has enabled the manufacture of new phones and the mergence of new firms, which have contributed to the decline of the selling prices of the smartphones (Eimer-DeWitt, 2008).

Supported by various turnkey processing solutions, most of the smartphone venders are focusing on low-cost devices in order to build the brand awareness. The decrease in the smartphones prices is expected into the future (Frommer, 2010). Such are the market dynamics that is likely to drive the prices of Apple products down (Välikangas & Romme, 2012). However, the firm’s pricing strategy that goes with quality product will enable it to survive amidst the competition. Essentially, the firm’s strong brand and ability to maintain the loyal clients will be its strongest competitive advantage. In other words, the innovative leadership abilities, the strong global brand and increased market share are some of the capabilities that will enable the firm survive amidst challenges facing the firm (Kim & Mauborgne, 2005.

The post Jobs organizational environment

The transfer and smooth transition of leadership at Apple has also enabled the firm to remain strong in the highly competitive market (Wolverson, 2013). Majority felt that without the founder, Apple will tumble and fall (Popper, N 2013). However, the survival of the firm as the industry leader after the death of Jobs could only be explained by the smooth continuity of the Jobs strategies (Cohan, 2013). The ability to sustain its growth and competitiveness could be seen by the rise in the firm’s stock prices after a sudden fall following the death of the former CEO (Burrows, 2011) The new leadership under Cook maintained and continued with the strategies that formed the foundation of the product development, operational and marketing structures (Ren, Xie & Krabbendam, 2009). The strong leadership capabilities of the new CEO and compassionate professional team provide the capability that will enable the firm to remain competitive (Myuhi, 2013). The management capabilities will increase the firms competitiveness for a long period of time despite the changes observed in the market (George, 2009).

Sustaining competitive advantage

Apple premium pricing strategy and product differentiation

Apple unique products still place it at exceptional competitive position over the rivals. One way through which the firm can sustain its competitiveness is through continuous offering of unique and quality products. Apple is known for its quality and uniqueness in product form and usability. In fact, the firm’s products are designed to be a head of other in terms of market demand (Gitsham, 2012). The changing trends in the competitive landscape require firms to develop distinctive capabilities that will differentiate its products from the competitors. Apple Inc. has managed to create a demand for its products through innovative approach, which has provided the firm with increased power over pricing.

The continuous innovative product development that ensures the attainment of the differentiation strategy combined with inventive advertising would enable the firm to maintain its brands loyalty among the consumers and hypes concerning the launch of new products (Knight & Hormby, 2007). In fact, the firm’s focus on high-end market still auger well with its products, which is an advantage. The emphasis on quality products is a critical action through which clients at the high-end markets could be maintained. The firm believes that the customers are willing to pay more for quality products. The strategy is in line with the long-term goals of the firm that focused on the high-end market. The belief is that the high-end market can still sustain the future profits and product developments (Judge & Douglas, 2009). In fact, through focusing on the high-end market where clients are willing to pay premium prices per unit volume, the firm raises the artificial entry barrier for the competitors.

Efficient distribution channels and the pricing strategy

Apple is one of the firms that have the most efficient distribution channels. Apple distribution channel is structured in such a way that it contributes to the pricing, marketing and product development. The firm is involved in selling and reselling its products as well as third party products directly to the consumers through various channels including the online stores as well as the direct sales forces (Linden, Kraemer & Dedrick, 2008). In addition, the firm utilizes a short indirect distribution channels ranging from third-party cellular network carriers to value added re-sellers. The direct dealing with the clients enables the firm to quickly study the changing needs of the clients and develop its products with the qualities desired by the clients. Besides, Apple’s minimum pricing strategy enables it to maintain the premium prices over its products. The minimum advertising price is a strategy where resellers are not allowed to advertise the Apple products below a certain price. The firm also provides its retailers with the minimum best buy discounts (Li et al., 2011).

The minimum best buy discounts allow the firm to maintain its competitive premium prices by inhibiting the retailers from offering large discounts on its products. However, the retailers are given flexibilities to offer discounts that would allow them attract more customers. The scenario where the retailers could sacrifice the small discount margin to offer discounts in order to attract clients is prevented through offering monetary incentives to the retailers (Verganti, 2008). The monetary incentives would make the retailers to sell the firms products and the minimum advertising prices set by the firm.

The pricing strategy still places the firm at the highest competitive edge in the high-end market compared with the competitors (Woodman, Pasmore & Shani, 2009). The minimum advertising prices prevents the retailers from competing directly with the Apple’s own stores as well as reduces the advantages one retailer can have over another. The main aim of the minimum advertising strategy is to keep its distribution channels clean and to increase its direct sales revenues (Weintraub, 2010). The pricing strategy will still put Apple above the competitors in the industry particularly the high-end market (Sanchez & Heene, 2010).

Premium prices

The main goal of the firm is to create a highly quality and unique product to attract high prices. The firm’s cheap products are normally marketed at the middle range markets. However, they have increased user experience compared with the competitors (Katz & Shapiro, 2008). The feature that increases the user experience is what differentiates the products from the competitors. In fact, the firm ensures that the hardware and the user interface are designed to increase the value for the price charged. Studies indicate that most of the client still considers Apple products to be of extraordinary quality despite the high prices being charged (Sanchez & Heene, 2010). The combination of value and higher prices strategies still provide Apple with a positioning that competitors could not match. Besides, the combination of value and prices keeps the firms profits high compared with the competitors.

Even though the firm has enjoyed the aspirational status, the firm’s products are facing stiff competition from the newly merging cheap android and smartphones. However, the firm’s strategies of developing the products that lead in the technology industry will still enable it to retain its top position in the high-end market (Hiebing & Cooper, 2003). In fact, the firm still enjoy the competitive advantage that would allow it charge the premium prices.

The steady declines in the market prices of some products such as android smartphones will have a negative effect on the Apple premium pricing strategy (Woodman, Pasmore & Shani, 2009). The android technology has enabled the manufacture of new phones and the mergence of new firms, which have contributed to the decline of the selling prices of most of the firm’s smartphones. Supported by various turnkey processing solutions, most of the competing smartphone venders are focusing on low-cost devices in order to build their brand awareness. The decrease in the smartphones prices is expected into the future. Such are the market dynamics that is likely to drive the prices of Apple products down (Harmon & Kravitz, 2007). However, the firm pricing strategy that goes with quality product will enable it to survive amidst the competition.

Three dimensional strategic analyses – Financial Strength, Relative Market Share and Relative market strengt.

Apple is one of the technology firms that have the financial strengths and brand credibility to pull the new products into the market. The firm’s main strategy is to create a product and put it in the market where the competition is still weak. The main goal of the firm is to create a highly quality and unique product to attract high prices. In order, to succeed, the firm has to utilize its most critical strengths that range from the financial capabilities to its distinctive marketing.

The relative financial strength

Apple is currently one of the firms with the highest revenue in the technology industry. As indicated in appendix 1, in 2011, the firm’s sales turnover is approximated to be over $108 billion (Apple, 2011). The growth of over 4% from the last financial period and about 6% compared with 2012 results. The growth in the profits is estimated to have grown by over 28% during the financial period. Besides, the firm is boasting of over $3 billion net returns in the last quarter with the highest market capitalization compared with other firms in the industry (Apple, 2011).The revenue growth has enabled the firm to compete favorably in the market. In fact, the firm’s successful marketing strategies have been attributed to its financial capabilities (Judge & Douglas, 2009). Apple will still utilize its financial strengths to develop and position its products at the top of the industry.

Relative market share and strength

Apple is currently the firm with the highest market share compared with other firms within the industry. Even though in terms of product category, some of its products lag behind other firms products. In fact, studies indicate that most of the client still considers Apple products to be of considerable quality despite the high prices being charged (Gilligan & Wilson, 2005). The combination of value and higher prices strategies still provide Apple with a positioning that competitors could not match. Besides, the combination of value and prices keeps the firms profits high compered with the competitors. The goal of the firm is to maintain the market leadership in terms of appropriate pricing and product quality.

Even though the firm has enjoyed the aspirational status in terms of market share, most of its products are facing stiff competition from other firms, which puts its market position at a greater disadvantage (Christensen & Overdorf, 2000). However, the firm still enjoys the competitive advantage that would allow it charge the premium prices on its products (Maeda, 2006). The prediction is that the changing trends in the competitive landscape would cause a decline in the market share control (Judge & Douglas, 2009).

Product/process innovation

One of the biggest capabilities of the firm is its ability to develop unique products. Apple unique products still place it at a unique competitive position over the rivals. In fact, offering unique products would still enable the firm to increase the demand for its products globally (Brannback & Carsrud, 2008). As always, the firm’s products are designed to a head of other in terms of market demand. Despite the increasing and changing competitive landscape, the firm has managed to create a demand for its products through innovative approach, providing the firm with increased power over pricing. The innovative product development that ensures the attainment of the differentiation strategy combined with inventive advertising, Apple will still ensure continued brand loyalty among the consumers and hypes concerning the launch of new products.

The firm’s focus on high-end market still auger well with its products. In fact, the firm still produces products with emphasis on the customers willing to pay more for such products. The strategy is in line with the long-term goals of the firm that focused on the high-end market. The belief is that the high-end market can still sustain the future profits and product developments. In fact, through focusing on the high-end market where clients are willing to pay premium prices per unit volume, the firm raises the artificial entry barrier for the competitors.

Understanding the Critical Factors for Success (CFS) in Apple

Apple has the capability of identifying the key success factors of its products and develops the programs for its constant improvement. The Kaizen programs are aimed at constant improvements of the product offerings through enhancing the user experience. The firm’s intonation “thinner, faster, sleeker, lighter, longer, greater, better” forms the foundation of its Kaizen programs. The firm emphasizes the identification of Kaizen in their product offerings and the development teams are advised to use the Kaizen features to push and develop the products along these qualities.

The emphases of the qualities have enabled the firm to come up with products with enhanced qualities which is summarized as having improved user experience. The application of the Kaizen has ensured that almost all Apple products have thinner designs, faster processors, sleek styles, light in weight, longer battery life, have greater storage capacity and enhanced features. The distinct characteristics in the Apple’s products have competitive capabilities over the rival products. The consumers will always be satisfied with the features making the Apple brands superior over its rivals.

Besides the key success factors in the product development, the firm also identifies the success factors in the marketing and supply chain or the distribution channels. The emphasis on the quality products targeting high-end market and establishment of strategies that ensures sustenance of the product line in the high-end market is a critical success factor.

First mover and first mover advantage

Apple was able to exploit the first mover guidelines while developing the groundbreaking products. While developing the iPod, iTune and iTune Store the firm exploited first mover guidelines (Ashcroft, 2012). Some of the products in the market included the MP3 devices, the Sony and Walkman devises, creative and Sonic Blue MP3 players as well as Napster download. While introducing its new products into the market, Apple came up with the second follower interventions, which captured and positioned its products into the market (Carlton, 1997).

Besides, the firm utilized the business models of syndicate suppliers in a bid to market its products as a fast follower while Sonic Blue and Diamond Rio were enjoying the fast mover advantage (Ashcroft, 2012). In fact, by 2001, Sonic Blue was the market leader in the MP3 players market with an estimated 45% market share. However, the firm had a weak financial base. The firm collapsed allowing the other firms such as Apple to take advantage of the vacuum created. In fact, Apple moved fast with new products to capture the market share (Carlton, 1997). Using the first mover strategy, the firm can still have the advantage of developing new products and capture a reasonable market share. One of the major advantages the firm has is its financial capability. The strong financial positioning can enable the firm to remain the market leader for a long time (Ashcroft, 2012). Being a market leader with increased financial positioning is an increased competitive advantage. As such, Apple still has a strong fist mover first mover advantage.

Conclusion

In the last ten years, the firm’s success is evidence through increased revenues, market leadership and innovative products. Even though the competitive landscape has rapidly changed, the firm still has a greater prospect for growth and success in various fronts. The firm still holds market leadership in a number of areas in the technology sector while its revenues continue to grow despite leadership changes and intense competition from small and large firms. The firm’s distinctive capabilities including the innovative capabilities, the brand positioning, financial capabilities, managerial and technological knowhow will still drive the firm and position it at the top of the industry. Since 2001 the firm has diversified its products most of which still hold the top brand positioning. The firm’s greatest innovation iPod still holds its brand position despite a flood of similar competing products in the market. Apple iPad is still revered by the majority of clients despite similar products being produced by the competing firms.

Such brand positioning combined with appropriate pricing and marketing strategy has increased the firm’s competitive advantage that will still continue into the future. Essentially, Apple is fully aware of the rising competitive threat and has positioned its products appropriately in order to maintain its market share. The firm’s innovative capability will still hold the key to innovative products in the industry. No one knows what is in the store for the future, a secretive characteristic of the firm, the firm is still capable of coming up with a new product that will stun the world, revolutionized the modern business and ordinary thinking and turn the industry benchmarks.

References

Apple 2011, Apple’s library, Web.

Ashcroft, J (2012), Apple from iPod to iPad, a case study on the corporate strategy, Prentice Hall, Famington Hills, NJ.

Avery, GC & Bergsteiner, H 2011, How Apple successfully practices sustainable leadership principles. Strategy & Leadership, vol. 39 no.6, pp. 11-18.

Brannback, M & Carsrud, A 2008, “Do they see what we see? a critical Nordic tale about perceptions of entrepreneurial opportunities, goals and growth,” Journal of Enterprising Culture, vol. 16 no.1, pp. 55-87.

Burrows, D 2011, Apple’s stock dips after death of Steve jobs, Web.

Cameron, A 2011, “A sustainable workplace – we’re all in it together,’ Strategic Direction, vol. 28 no. 1, pp. 3-5.

Carlton, J, 1997, Apple the inside story of intrigue, egomania and business blunders, Times Book, New York.

Cassar, G 2007, “Money, money, money? a longitudinal investigation of entrepreneur career reasons, growth preferences and achieved growth,” Entrepreneurship & Regional Development, vol. 19, pp. 89-107.

Christensen, C & Overdorf, M 2000, Meeting the challenge of disruptive change, Harvard Business Review, vol. 3 no. 4, pp. 66–76.

Christensen, C 1997, The innovator’s dilemma: when new technologies cause great firms to fail, Harvard Business Press, Boston, MA.

Cohan, P 2013, 7 reasons apple is more doomed than you think, Web.

Culpan, T 2011, Apple brand value at $153 billion overtakes Google for top spot, Web.

Dalrymple, J, Michaels, P, & Jonathan, S 2009, Apple reports record profit for first quarter, Web.

DeMartino, R, Barbato, R & Jacques, PH 2006, “Exploring the career/achievement and personal life orientation differences between entrepreneurs and nonentrepreneurs: the impact of sex and dependents,” Journal of Small Business Management, vol. 44 no.3, pp. 350-368.

Eimer-DeWitt, P 2008, How to grow the iPod as the MP3 player market shrinks, Web.

Frommer, D 2010, Apple iPod still obliterating Microsoft Zune. Web.

George, B (2009), I, Steve Jobs, in his own words, Prentice Hall, Famington Hills, NJ

Gilligan, C, & Wilson, RMS 2005, Strategic marketing management: Planning, implementation and control, Butterworth-Heinemann, NY.

Gitsham, M 2012, Experiential learning for leadership and sustainability at Apple, IBM and HSBC. Journal of Management Development, vol. 31 no.3, pp. 298-307.

Harmon, NL & Kravitz, L 2007, “The beat goes on: the effects of music on exercise,” IDEA Fitness Journal, vol. 4 no. 8, pp. 4-8.

Heywood, C & Kenley, R 2008, “The sustainable competitive advantage model for corporate technology estate,” Journal of Corporate Strategy, vol. 10 no. 2, pp. 85–109.

Hiebing, R & Cooper, S 2003, The successful marketing plan: A disciplined and comprehensive approach. McGraw-Hill Professional, New York, NY.

Isaacson, W 2011, Steve Jobs, Simon & Schuster, New York.

Isaacson, W 2012, “The real leadership lessons of Steve Jobs, know both the big picture and the details,” Harvard Business Review, vol. 12 no. 3, pp.19-23.

Jubak, J 2012, Can you see apple’s long-term competitive advantage in its new product event? Web.

Judge, W & Douglas, T 2009, “Organizational change capacity: the systematic development of a scale. Journal of Organizational Change Management, vol. 22 no. 6, pp. 635-649.

Kafka, P 2010, Maybe Apple should pay attention to Amazon, after all, Web.

Katz, M, & Shapiro, C 2008, “Systems competition and network effects”, The Journal of Economic Perspectives, vol. 8 no.2, pp. 93–115

Kim, WC, & Mauborgne, R 2005, Blue ocean strategy – How to create uncontested market space and make the competition irrelevant, Harvard Business School Publishing, Boston, MA.

Knight, D & Hormby, 2007, A history of the iPod: 2000 to 2004, Web.

Li, Y, Su, Z, Liu, Y & Li M, 2011, Fast adaptation, strategic flexibility and entrepreneurial roles. Chinese Management Studies, vol. 5 no. 3, pp. 256-271.

Linden, G, Kraemer, K & Dedrick, J 2008, “Who captures value in a global innovation network? The case of Apple’s iPod,” Communications of the ACM, vol. 52 no. 3, pp. 140–144.

Linzmayer, O 1999, Apple confidential 2.0, the real story of Apple Computers, Inc. No Starch Press.

Maeda, J 2006, The laws of simplicity – Simplicity: Design, technology, business, life, The MIT Press, Massachusetts.

McCray, JP, Gonzalez, JJ & Darling, JR 2011, “Crisis management in smart phones: the case of Nokia vs Apple,” European Business Review, vol. 23 no. 3, pp. 240-255.

Myuhi, K 2013, Is Apple seriously doomed? in the tech Next, Web.

Nabi, G, Holden, R & Walmsley, A 2010, “From Student to entrepreneur: towards a model of graduate entrepreneurial career-making,” Journal of Education and Work, vol. 23, pp. 389-415.

Plunkett, J 2011, Google music service to take on Amazon and Apple, Web.

Popper, N 2013, After Apple’s rise, a bruising fall, Web.

Ren, L, Xie, G & Krabbendam, K 2009, “Sustainable competitive advantage and marketing innovation within firms: A pragmatic approach for Chinese firms,” Management Research Review, vol.33 no.1, pp. 79-89.

Sanchez, R & Heene, A 2010, “Enhancing competences for competitive advantage,” Advances in Applied Business Strategy, Vol. 12 no. 4, pp. 121-144.

Välikangas, LA & Romme, GL 2012, “Building resilience capabilities at “Big Brown Box, Inc.,” Strategy & Leadership, vol. 40 no. 4, pp. 43-45.

Verganti, R 2008, “Design, meanings, and radical innovation: a metamodel and a research agenda,” Journal of Product Innovation Management, vol. 25 no. 5, pp. 436–456.

Weintraub, S 2010, Android helps Amazon triple online music market share, Web.

Wolverson, R 2013, The best age for a start-up founder, Web.

Woodman, RW, Pasmore, WA & Shani, A 2009, “A new horizon for organizational change and development scholarship: Connecting planned and emergent change,” Research in Organizational Change and Development, Vol. 17 no. 4, pp. 1-35.

Appendices

Appendix 1: Apple financial performance

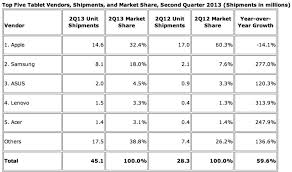

Appendix 2: Apple position in the tablet market 2012 2013 indicating its strength