Introduction

The Australian government has concentrated on controlling inflation to ensure economic growth and stability. The government has minimized debts to limit economic fluctuations by controlling demand. When viewed from a macroeconomic perspective; balance in supply and demand may not result in constant economic growth. With such control over demand, macro-economic policies have been practised alongside microeconomic reforms to influence supply.

Government budget and expenditure are balanced through the monetary policy, which dictates the amount of money available, what is to be spent and the credit limits through the Reserve Bank of Australia (RBA). Through the monetary policy, the country’s expenditure has been minimized, and this has seen Australia develop over the past decades (Garnett and Lewis, 2008). This paper discusses the effect of the macro-economic policy in Australia on inflation and the country’s economic growth. It further seeks to illustrate how this policy has successfully contributed towards avoiding recession which is a significant cause of the global financial crisis.

Past and present challenges facing policymakers in Australia

In the past, the government used fiscal policy to achieve balanced economic growth. However, on experiencing steady economic growth through private investors and microeconomic reforms, the government has slowly shifted its attention to monetary policy. This has been reflected through the marginal deficits observed in the budget, which means the expenditure is much lower than in the past. The difference has been close to one billion US dollars which is a positive direction towards maintaining steady economic growth. In 2003, the private sector saw the GDP grow by about 3.25% with its contribution being 1.6%, which is equal to that of the public sector (The Treasury, 2012).

Exports have lagged, which has called for the monetary policy intervention to promote the increase of demand, maintain low inflation, and reduce unemployment. The RBA has played in this process by raising cash to about 5 % to ensure that inflation does not exceed its maximum expected limit. The slow economic growth in the mid-’90s saw the unemployment rate rise to about 8.5 %. With the intervention of the monetary policy, inflation reduced to 5.6% (Nguyen, 2009). The Gross domestic product was reduced from the 1990s until 2009 when this trend changed and started improving. This is attributed to the control of expenditure through the monetary policy. Shifting from manufacturing to concentrate on export has also substantially improved the Australian GDP (Shiller, 2008).

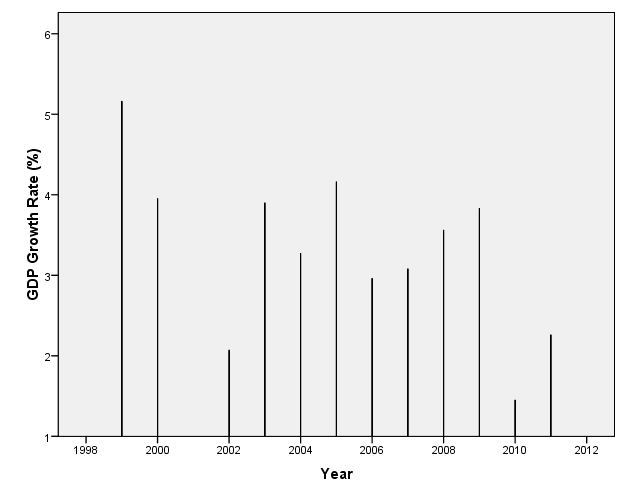

Table: Australian GDP growth in percentage.

Source: The World Bank (2012).

From Table 1 and Figure 1, it is evident that the GDP has been fluctuating. However, the GDP has been declining from 1999 to 2011. In 2009, the country experienced the highest GDP growth rate. In 2000, the country recorded the lowest GDP growth.

From Table 2, the inflation rate was highest in 2008. This shows that the country was affected by the global financial crisis that happened during that financial year. The inflation rate declined in 2011.

Table 2: Inflation rate (consumer prices).

Source: The World Bank (2012).

Introduction of exports and increased government expenditure have also led to a balance of the increased productivity with demand; this saw employment opportunities increase tremendously in 2009 (Singh & International Monetary Fund, 1998). Exports caused the exchange rate to improve significantly. This led to increased revenue, and it is expected that this trend will continue to improve steadily.

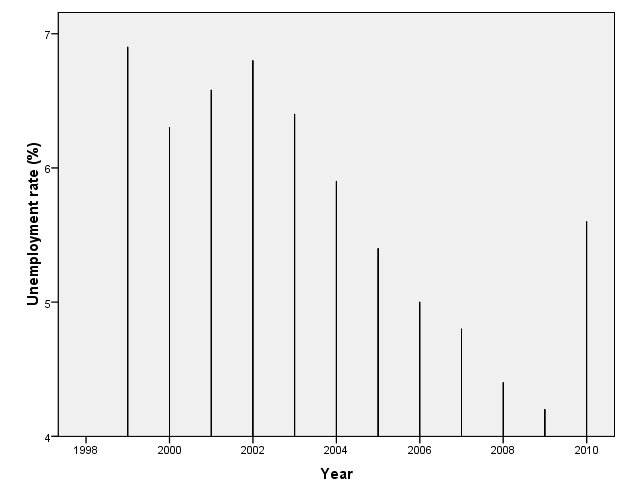

Such expectations are since Australia is a leader in exporting raw materials, steel and oil, which have a very high demand in foreign markets (Ioppolo, 2008). From Table 3, it is evident that unemployment has been low. However, the country has been experiencing high unemployment rates since 2010. Unemployment was highest in 1999, 2000, 2001 and this rate started to decline up to 2009. However, in 2010 the unemployment shot rapidly (Figure 2).

Table 3: The unemployment rate for Australia.

Source: The World Bank (2012).

The country’s economy has been growing steadily for twenty years. It is expected that this steady growth will at some point be interfered with by inflation. The main challenge is maintaining this sustainable growth and containing inflation at a manageable level. This is a difficult task considering that income generated will lead to much money in circulation in the coming years. Anticipating the solution to this will have factors like the boom expected on resources considered, the steady employment opportunities provided. It poses a risk that the country may not maintain steady growth without experiencing inflation (Henry & Summers 2000).

Instruments in macroeconomic policy for the current policy framework in Australia

The government has applied fiscal measures to regulate the economy. This has been applied by the use of taxes and government expenditure. These tools have been used to regulate recession, inflation, unemployment and other economic problems. Over recent decades, Australia has kept inflation as low as 2 to 3 per cent. This has been associated with the macro-economic policy, which targets expenditure, employment opportunities, and business investment. The objective of inflation control was to achieve expansion in production and employment while maintaining minimum costs on wages and overheads (CIA World Factbook, 2012).

The country experienced a challenge in maintaining stable prices on consumer goods and government expenditure at the minimal; while maintaining the output in the economic activities. For instance, improved productivity automatically leads to raised living standards. This calls for changed consumer behaviour in spending. It also affects government spending because it requires better infrastructure, education and other initiatives, increasing costs (“Organisation for Economic Co-operation and Development”, 2010).

Australia being an industrial country, cost on raw materials and energy is bound to rise. This affects the capacity to maintain prices at a given constant level. When prices go higher, and demand comes down, the policy’s determination to control demand and inflation is diminished. Altering commodity prices is costly, especially if these changes are short term depending on the nature of the economic structures’ changes.

Once prices change, and demand goes down, re-adjusting requires the marketing tools that require expense to restore the expected demand for the products. The inability to know whether the expected changes in prices are short-term or long-term is the main challenge that the policymakers experience. Australia is concentrating on increasing demand through imports because it will lead to higher consumption with low production costs and energy for traded goods. Imports may lead to a fall in domestic supply. This is counteracted by the rise in demand and revenue earned through increased exchange rates acceptable in the trade as long as no inflation is experienced (Ioppolo, 2008).

Housing is also another strategy; with consumers viewing acquiring of houses as wealth. This is bound to increase demand and shift the spending patterns towards long term expenditure which means continuous revenue even in the future. When it comes to expenditure, priority is given to wages to ensure that the cost is directly proportional to the output level obtained from these economic activities.

This ensures that the revenue obtained meets the expected results while providing adequate opportunities to serve the current demand for employment. It has been assumed that Australia has a shortage of skill. However, the introduction of the immigration policy has overcome this while at the same time, providing an opportunity for regional trade (Foster & Australia 1996). This has led to changes in supply. The country can venture in exportation, which translates to increased revenue and the creation of further markets to meet the country’s supply, especially for raw materials. These changes in supply have encouraged trade persons to move from one area of concentration and discover new markets, thus increasing demand while maintaining steady market prices (Shiller, 2008).

To maintain a high demand for its industrial products and raw materials, the country has moved from a rigid supply. It has adopted policies to focus on a liberal market that is flexible to frequent changes in prices. This will lead to increased profitability, which is a positive change because wages will also go up and help solve the unemployment crisis previously experienced (Gordon & Valentine, 2009).

The government has also encouraged the private sector’s growth to ensure that sustainable economic growth is achieved. Through the savings obtained from this sector, the government will reduce its credits. Participation by the private sector also increases demand. For instance, in 2003 the GDP growth was 3.25% to which the private sector contributed about 1.6%. This trend has been encouraged by the government over the years and has contributed to increased business investment. Such investments, coupled with budget surpluses over the years, have promoted growth (Nguyen, 2009).

Macroeconomic policy in Australia and the economy today

Increased costs on export consequently affected trade terms with people opting to trade their produce in the domestic market. However, this further affected trade because supply exceeded demand considering that only domestic market was available. The local market has seen the market remain stable even without depending on products from foreign markets to increase demand. If exchange rates did not fluctuate rising unexpectedly, the imports would also be viable because this allows for a decrease in production costs. This would also help to keep demand within the country’s domestic output, thereby keeping inflation at the minimum level possible (“Organisation for Economic Co-operation and Development”, 2010).

For the macroeconomic policy to work well with the present economy, it requires that the expenditure is kept at a reasonable level that is proportional to the economic ability to sustain. This introduces the issue of wages and employment; when productivity is high, and income generation rises, it is expected that wages also rise. However, if this trend does not remain constant and adjustments have to be made, then this might lead to reduced earnings.

This can only be expressed by accepting a reduction to obtain income that is free of inflation. The country has given the creation of employment opportunities the first priority through expansion and a steady rise in economic growth that provides more opportunities. To ensure that such opportunities are continuous, the country has engaged in reforms that promote healthy industrial relationships with other developed countries. Secondly, the labour market has been liberated financially, such that no regulations are imposed on trade. Since the country has experienced high incomes and increased revenues from resources, it is advisable to have these saved; in case, these resources are diminished to provide a starting point for other prospective opportunities in future (Shiller, 2008).

Australia being a competitive country globally, it was not left out during the global financial crisis and was forced to strategize to respond to this global drawback. The government, through the RBA, identified spending as a strategy to counteracted the anticipated effects of this crisis which worked to the country’s advantage because it was not hit by this catastrophe at the same magnitude as the rest of the industrialized countries. From this experience, it is clear that the macroeconomic policy is a positive plan to a country’s preparedness for future changes in trade, global markets, production, employment and income growth (Scott, 2009).

Therefore, in the present, Australia is far much better in terms of debts which are not as large as those of other countries following the global financial crisis. When a strategic plan is put in place to anticipate fluctuations in the future, a country becomes flexible, and the turnaround time is minimized. This saves a country the adverse effects of a delayed response, as in the case of Australia (Otto, 2007).

Debts are a threat to future economic growth because when a country is committed to paying debts which are paid back with interest, it is bound to spend more. This may lead to lost opportunities for investment if a country lacks finances. However, it is advisable for a country to borrow during economic crises as long as the money is invested in projects that will generate income in future and may even contribute towards the debt repayment. For Australia borrowing during the global domestic crisis was a strategy for increased future productivity, which has proved advantageous in the long run (Garnett & Lewis, 2010).

Conclusion

Australia is a competitive country internationally with a sustainable economy. These macro-economic policies help the country achieve significant economic growth with indicators like increased opportunities for employment, healthy consumer spending patterns and increased business investment plans. The country also employed the fiscal policy, which helped a terrific deal in integrating the private sector to become one of the main contributors to economic growth.

With the success of this policy, they further applied the monetary policy to control government expenditure and debts. This policy prepared the country for the global financial crisis because the country was able to operate without debts and was not affected by these global crises like the rest of the countries.

References

CIA The World Factbook (2012). Australia. Web.

Foster, W. F., & Australia. (1996). Immigration and the Australian economy. Canberra: Australian Govt. Pub. Service.

Garnett, A. and Lewis, P., (2010). The Economy’, in Aulich, C. and Evans, M.(eds), The Rudd Government, ANU Epress.

Garnett, A. and Lewis, P. (2008). ‘The Economy’, in Aulich, C. and Wettenhall R. (eds), Howard’s Fourth Term, Sydney: New South Wales University Press.

Gordon, C. and Valentine, T. (2009), Economics in Focus: The Global Financial Crisis,NSW: Pearson Education.

Henry, O. T., & Summers, P. M. (2000). Australian economic growth: Non-linearities and international influences. Melbourne, Victoria.

Ioppolo, S. (2008). Import/export: A practical guide for Australian business. Melbourne: Wilkinson Publishing.

Nguyen D. (2009).Macroeconomic Policy in Australia. Web.

Organisation for Economic Co-operation and Development (2010). Australia OECD economic surveys 2010. Paris: OECD

Otto, G. (2007). Central Bank Operating Procedures: How the RBA Achieves Its Target for the Cash Rate.Australian Economic Review,40(2).P 216-224.

Scott, H. S. (2009). The global financial crisis. New York: Foundation Press.

Shiller, R. J. (2008). The subprime solution: How today’s global financial crisis happened, and what to do about it. Princeton, N.J: Princeton University Press.

Singh, A. (1998). Australia: Benefiting from economic reform. Washington, D.C: International Monetary Fund.

Singh, A., & International Monetary Fund. (1998). Australia: Benefiting from economic reform. Washington, D.C: International Monetary Fund.

The Treasury (2012). The Australian Government. Web.

The World Bank (2012). Australia. Web.