Cost and Revenue Assumptions

New product launches require that realistic cost and revenue assumptions are made to attract potential investors who will fund the project (Juan, 2011). It is essential, therefore, that all financial projections include predictions on the cost of production, and revenue that will be generated by the new product. Relevant sources describe cost assumptions as the costs that would be incurred while running a business venture over a selected time frame (Reference for Business, 2011). The cost assumptions for the new footwear product will include production and operation costs, sales and marketing costs, and other overhead costs. Production and operation costs include raw materials, machinery, and wages, while sales and marketing costs include advertising and company expansion plans. All this costs fall under two categories, which are fixed costs and variable costs. Fixed costs are all the expenses, which are independent of production, and include rent and maintenance among others (Economics, n.d). On the other hand, variable costs are those costs that change with production, and include utilities, materials and wages (Frongello, n.d). Revenue assumptions refer to the estimations given regarding the potential income generation capability of a business over an identified time frame. In that case, revenue assumptions for the proposed new footwear product will revolve around the size of the target market, market share, cost of product, and total sales over the first three years of operation. Market research provides the platform for making relevant revenue assumptions, which may require detailed analysis of the target market size, value of the product and customer preferences (Juan, 2011).

Marginal Costing Cost Statement

In everyday management of business enterprises, different accounting methods are implemented in order to achieve effective results. In particular, new establishments need appropriate management skills that will score well from their decision making approaches. Marginal costing, for that matter, is an excellent financial accounting method, which effects the decision making process (Drury, 2006). This accounting approach is easier than several other accounting approaches as it differentiates between fixed and variable costs of products; thereby, providing the ultimate platform for a firm’s decision-making process (Globusz, 2001). In this accounting method, the variable costs on products are applied to cost, units, while all the fixed costs are written-off in the profit and loss account. The marginal costs of products comprise of the variable costs incurred in creating the products, and include raw materials, wages and utilities; hence, marginal costs vary with production. Conversely, the marginal costing cost statement is a document, which enables generation of the contribution margins and marginal costs of products from the products (Coulthurst, 2000).

In addition, the marginal cost statement gives the basis for calculation of all relevant costs and revenues for business ventures implementing the marginal cost accounting system. In a start-up venture, the application of this accounting system can be effective because it is easily understood; hence, will be a perfect tool for presenting financial data to a group of potential investors (Coulthurst, 2000; Drury, 2006). Besides that, this accounting system gives a clear reflection of the links between the resultant costs, price and volumes of production. Under this method, however, fixed costs are not charged to the goods, which give an impression that fixed costs do not serve any function in production. In fact, it becomes difficult to distinguish between variable and fixed costs since the assigning of variable costs relies entirely on estimations (Kinney & Raiborn, 2008). With all this information, it is evident that marginal costing provides an excellent platform for decision making as the production costs and stock estimates can be established. Therefore, the marginal costing statement for the proposed new footwear product, ‘Baric’, is presented below.

Table 1: Baric Footwear Limited

As shown in the marginal costing statement, Baric Footwear Limited will realize a contribution margin of £7.20 per unit of the new footwear product. During the first year, the venture is expected to sell 100,000 units; hence, the contribution margin will be £720,000 for the whole year. Consequently, the fixed costs will amount to £396,000, which will generate an annual net profit of £324,000. Therefore, the annual net profits generated from the new product will be 18% of the total sales for the first year of operation.

Break Even Analysis

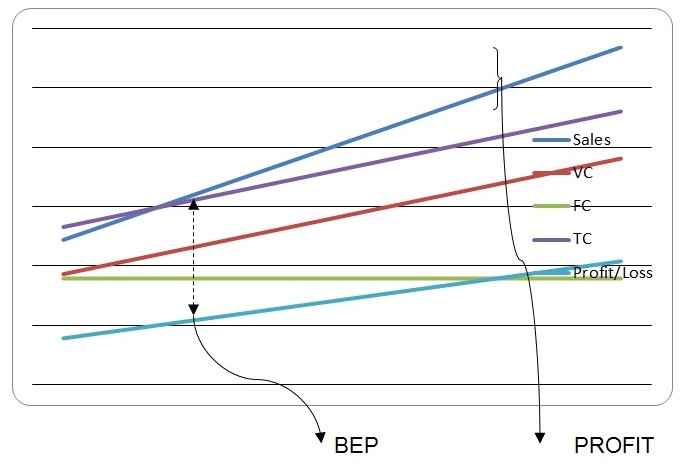

Business managers use various methods in predicting the expected future operations of business ventures, which also creates room for developing appropriative corrective actions. Marginal costing is an example method that has several applications in the day to day management of businesses. From the earlier descriptions, it was established that marginal costing accounting system is easy to understand and can play a valuable role in creating financial documents (Globusz, 2001). In fact, marginal costing gives an excellent working platform for breakeven analysis as will be established within this section (Tutor2u, n.d). On the other hand, breakeven analysis gives business leaders an opportunity of having detailed information on business’ costs especially when there are enormous variations in sales and production volumes (Frongello, n.d). Breakeven analysis is established on the principle that there will be no variation in the variable costs, as well as sales realization of a business (Globusz, 2001). Also, the idea holds that changes in the level of business activity will alter variable costs; however, fixed costs will remain unchanged regardless of the variations in the level of activity (Frongello, n.d). With continuous investment, the business will expand and lead to subsequent increase of the fixed costs.

Break even analysis is mainly designed to establish the breakeven point (BEP), which is defined as the level of activity in which a business venture does not incur any profits or losses (Frongello, n.d). At this point, the business just recovers the cost of its investment, which is measured by the sales volume, production capacity and sales revenue for the established period. In practice, it is essential to determine the cost-volume-profit ratios and product mix calculations because they assist in the formulation of strategic business ideas that will help in redirecting the business towards the right path. During production planning, all the variable costs, or costs that change with the output must be considered in redefining decisions. For calculation purposes, the contribution margin of a single unit a product is defined as revenues per unit minus the variable costs per unit (Frongello, n.d; Waters, 2011). As such, the breakeven point is established by dividing fixed costs by the contribution per unit as shown in the following calculations. All calculations are based on the marginal costing statement formulated in the second task.

Fixed costs = £ 396,000

Contribution per unit = £ 7.20

Breakeven Point = Fixed Expenses/Contribution per unit (Waters, 2011).

= £ 396,000 /£ 7.20

= 55,000 units

From the calculation, the breakeven point of the new venture will be attained after the sale of 55,000 units. At this point, the business venture will have covered all the cost of production without making a loss or profit out of the total sales. The breakeven point allows for the calculation of the breakeven point in sales value of the business venture.

BEP in sales value = BEP Units x Sales price

= 55,000 x 18.00

= £ 990,000.00

BEP in percentage = (BEP Units x 100)/Capacity in Units

= (55,000 x 100)/100,000

= 55%

Break Even Table

Table 2: Baric Footwear Limited

The graphical representation of the data existing in this break even table is as shown in the following chart.

Financial Documents

Financial managers can device various strategies that would meet the requirements of such a business by understanding the business’ profitability and worth (Bose, 2006). As such, various accounting methods will be beneficial in determining the business’ financial position, as well as provide a platform for making effective decisions. In that sense, it is inevitable that business managers use their accounting skills to create financial documents. Financial documents are extremely valuable to business enterprises because they represent the financial strength of such entities; thereby, establishing grounds for appropriate decision making (Brigham & Joel, 2010; Bose, 2006). Severally, new business ventures need financial documents for the initial years of operation in order to present their ventures before potential investors. In such situations, the financial documents must show the most vital information that will convince investors to invest in the ventures, and hope for a rewarding future cooperation. As such, a proposed venture must show the ability to repay both the long-term and short-term loan, and generate enough revenue to sustain the business operations, as well as maintain a significant profit margin. Financial documents can be effectively used to make these basic predictions.

In this section, three financial documents namely the cash flow budget, forecast income statement, and the forecast balance sheet are prepared to reflect the strength of the proposed venture. The proposed venture shall be known as Baric Footwear Limited, and will be registered to facilitate the launch of the new footwear product, ‘Baric Shoe’. The cash flow budget statement will demonstrate the capability of the proposed venture to generate substantial cash from operations, which are valuable for growth and expansion of business (Accounting for Management, 2011). In particular, the cash flow budget will give a clear picture whether the business will produce enough working capital to sustain its operations, as well as initiate substantial growth and expansion (Accounting for Management, 2011). In connection, the forecast income statement will highlight the average profitability of the proposed venture; hence, provide the grounds for effective decision-making process by the concerned members. For example, where the profitability of the firm is below the expected margins, business managers will make appropriate decisions for improvement. Lastly, the forecast balance sheet will highlight the financial position of the proposed venture at the end of the first year of operation (Edwards, 1999). With all these financial documents prepared, the proposed venture will have a clear prediction of its future expected operations, cash generation, profitability and financial worth (Brigham & Joel, 2010). In fact, the documents will play an essential part in convincing potential investors to invest in the business. Therefore, strong and heavily supported financial documents will easily attract investors than weak and poorly supported financial documents (Brigham & Joel, 2010). Baric Footwear Limited is scheduled to start in January 2012; hence, all the necessary financial documents relate to the same period as shown in the following information.

During start-up, Baric Footwear Limited will need a starting capital of £300,000, which shall be made available by the business founders. However, the starting capital will not be sufficient to cater for all the future operations of the proposed venture and will necessitate for sourcing more funds for running the project. The business will require a total of £720,000; thus, an additional long-term loan of £420,000 from potential investors will be required for successful operation of the business venture. The management at Baric Footwear Limited intends to attract investors who shall be repaid at an interest rate of 10.2 percent, which is slightly higher than the average market rates. According to the ventures financial predictions, the loan will be repaid within the first three years of operation; hence, potential investors should not expect anything contrary to that prediction. Baric Footwear Limited will make an asset investment of £396,000, which will include property, land and equipment to allow for the successful launch of all its operations. The proposed venture will depend on rented structures for the initial years of operations, which will result in rent arrears amounting to £90,000 for the first 12 months. Over the years, rent arrears will gradually reduce as the venture will purchase its own premises due to increased financial stability. A rental advance of £70,000 will be made to the identified premise owner during the launch of the proposed venture. The following document (table 3) shows the cash flow budget statement of Baric Footwear Limited for the year ending 31st December 2012.

Table 3: Forecast Monthly Cash Flow Budget Statement for the Year ending 31st December 2012

Basing on the cash flow budget, the venture will have a cash generation of £271,400 during its first year of operation. After 12 months in operation, the company will have repaid £300,000 of the long-term loan and still remain with the mentioned cash generation. In order for an enterprise to remain in business, there should be substantial capital to sustain its operations, and include raw materials, wages, and advertising among other functions that will enhance the level of productivity. With the aforementioned cash generation, Baric Footwear Limited will have a working capital that will enable it cater for all financial needs necessary for the business to operate.

The following table shows the forecast income statement of the proposed venture with all the necessary elements. From the statement, it is evident that the business will gain an operating profit of £276,400 by the end of the first year, which reflects to 15.36 percent of the total sales for that year. As seen from the document, the operating profit is obtained after deducting the total expenses, but before applying depreciation and interest. The net profit, after applying interest and depreciation charges, of the venture is adjusted to £193,400 that reflects 10.74% of sales for that year. A net profit of £135,380 results, after deducting 30% tax, since it is assumed that there will be no closing stock at the end of the first trading year.

Table 4: Forecast Income Statement of Baric Footwear Limited for the year ending 31st December 2012

The following table shows the forecast balance sheet of the proposed venture, which shows that the venture will have sound current ratio. In that sense, the business will essentially meet its current financial requirements due to availability of substantial capital. As such, the proposed business venture shows appealing results and indicates that the business will be able to sustain its operations, as well as generate substantial working capital for growth and expansion purposes (Bose, 2006).

Table 5: Forecast Balance Sheet of Baric Footwear Limited for the year ending 31st December 2012

Business Plan for the Proposed Venture

Baric Footwear Limited

From_________________________________________________

Baric Footwear Limited____________________________________

To___________________________________________________

XYZ Venture Capital Limited_________________________________

Presentation of a Business Plan for a New Footwear Product

Introduction

In most parts of the world, people are searching for the best footwear products, which are durable, of a high quality, and at the same time, affordable for the common individual. Unfortunately, companies have constantly increased the cost of such products due to several reasons such as brand identity, customer preferences and market capitalization of some large manufacturing companies. As a result, several other companies have taken advantage of this situation and overprice their footwear products regardless of the product quality. This situation leaves many people deprived of their hard-earned cash since some of these products are not worth the high price tag. Fortunately, several people are still searching for the best products that would meet their basic quality requirements, serve the intended purpose, and still be affordable for the common individual (Armstrong & Kotler, 2010). Based on our market research, Baric Footwear Limited is strategically positioned to fill this created gap since the new footwear product will be designed meet all the requirements for quality and functionality, and consequently be affordable to the common person. This proposed venture will focus on quality, functionality and price of the final product; hence, it is expected to compete in the footwear industry favorably well (Armstrong & Kotler, 2010). In this proposal, we hope that we can secure some capital that will make us realize our potential through the launch of the new footwear product. ‘Baric’ is the name of the new product which is a sporting shoe for that can be customized to fit the requirements of all individuals. The shoe will be made from a cheap, but durable material that is also locally available. Hence, the costs of production may be kept favorably low.

Business Plan

Ideally, the footwear industry is large enough to earn favorable returns for investors, but at the same time, small enough to be fully addressed by the venture’s strategic plans. Since Baric is a sporting shoe, we have established out target market as people within the 12 and 35 age bracket. Apart from the fact that numerous sporting shoes exist in the market, several of these products have high price tags that many young people may not afford. Baric Footwear Limited has considered this gap and hopes to produce sports shoes with matching quality and functionality, but with a lower price tag than other existing brands such as Nike and Puma (Armstrong & Kotler, 2010). We have already completed the design and tested the final product for its functionality, and the results have been astounding as the product is comfortable, durable and effective in use. In fact, several people who participated in testing the new product have shown interest in it, and we are hopeful that the product will take the industry by storm. The market research was conducted in seven cities, and the results have shown enormous potential in the successful market penetration. In connection, the marketing mix for the new footwear product is given in the following paragraphs.

Product

The new footwear product will be known as “Baric”, and will be the company’s key brand. From the test conducted, it was established that Baric sports shoes are fit for both indoor and outdoor gaming environment, and is remarkably comfortable to the user. In fact, several people have shown interest in the new product, which is a clear sign that it will sell remarkably well on its first launch. The young generation will enjoy the product as it will be manufactured from locally accessible material; hence, there will be sufficient supply for the target market. Since the new product will be of a high quality, durable and available in different color and sizes, we expect that its launch will attract several individuals within a short time span (Drypen, 2010; Kotler, 2000).

Price

From the conducted market research, it was established that other footwear products with the same quality, functionality and durability assumed high prices in the market. The new product will be fairly priced at the mid segment, so that young individuals can buy the products without straining their budgets. This will ensure that potential customers try the new product, and in the long run, they will discover its efficiency; hence, become loyal customers with us (Drypen, 2010). In addition, we shall use effective pricing strategies to drive several customers into buying the products. For instance, penetration pricing and psychological marketing will be one of the key pricing strategies for our product. While penetration pricing ensures the selling of the product at the least price possible, psychological pricing tricks the buyer into buying the product; for example, listing a product as £17.99 rather than £18 (Tutor2u, n.d). With such pricing strategies, we expect to sell several units in the first year alone as depicted in the financial documents.

Promotion

Juan (2011), currently pursuing an MBA degree at Depaul University, asserts that “individuals can indeed take the exam without the study notes and may have a chance at doing well, but there is an increase in probability of not doing well.” Effective marketing strategies enable the fast spread of news about a product to various parts of the world (Kotler, 2000; Raj, 2011). As such, it creates awareness in the target market group allowing for voluminous selling of a chosen product (Drypen, 2010). In Baric, the first approach that we shall employ is the use of brochures and commercial advertisement, which capture the essential features of the new product. Additionally, commercial advertisements will include people from all cultural backgrounds using the Baric sports shoes in gaming, and giving its benefits in comparison to other market brands. Since the target market lies within the 12 and 35 age bracket, we expect that these marketing strategies will have a significant impact within a short span of time. In fact, social networking sites will be used in spreading the message by creating “Like” buttons for the new product. Through internet marketing alone, we expect to reach more than 50% of the target market within the first three months of launching the new product.

Place

Business ventures must establish effective supply chains so that the entire target market can be attended to without delays and failure in meeting market demands (Drypen, 2010). For that matter, Baric Footwear will use independent product distributors who will assume all the responsibilities in supplying the various retail stores. This method will ensure that the company deals with production and packaging of the product while the distributors take charge of delivering the products to the target market. This will reduce the overheads and risks that would arise in conducting all the processes by the company. Consequently, it will ensure the smooth operation movement of commodities and finished products between our suppliers, distributors and customers.

Financials

In order for the launch of the new product to be successful, we need to secure the total amount capital that will enable the proposed venture operate. This will include capital for securing a rented premise, paying wages, buying commodities, and purchasing the essential land, plant and equipment (Collis & Hussey, 2007). From the financial statements, this amount that will be required for start-up amounts to £720,000. The founders of the proposed business will contribute £300,000, while the remaining £420,000 will be sourced from potential investors. According to the financial predictions, the loan will be repaid within the first three years of operation yielding 10.2 percent interest for the investors. The advantage is that the rate 0f 10.2% per year is slightly higher than the current industry rates, and the loan will be cleared by the third year of operation. Baric Footwear Limited will make an asset investment of £396,000, which will include property, land and equipment to allow for a successful launch of all its operations. In the first year, the factory rent will amount to £90,000 and a rental advance of £70,000 will be required since the business will rely on a rented premise.

After 12 months in operation, the company will have repaid £300,000 of the long-term loan and will have a cash generation of £271,400. This reflects to 15.08 percents of the sales figure for that year. Therefore, the profitability margin predicted is workable as the business venture will have enough capital to sustain its operations, as well as allow for growth and expansion (Collis & Hussey, 2007). A net profit of £135,380 will be obtained from the cash generation after deducting 30% tax and other expenses such as depreciation and utilities. These financial highlights show that the proposed venture is viable and will remain profitable after attaining its breakeven point of sales at 55,000 units. Additional information can be traced from the financial documents, which are attached in the appendix section of this paper.

Conclusions

Footwear products must meet essential customer requirements in order to compete favorably in the industry. Our new footwear product is designed in a manner that all the essential elements including quality, functionality, durability and pricing have been considered. As such, the new product will be a perfect match in the market; hence, is expected to sell remarkably well within the footwear industry. In fact, the business venture will penetrate the market and control a sizeable market share within a short time span. Since the pricing is fair, the target market consisting of young individuals will be able to purchase the product without straining their budgets to the limit. On the other hand, the investment has a favorably short payback period, which is evidenced by the generation of substantial cash flows, net profit and operating profit among other indicators. In conclusion, the proposed venture is viable and profitable and any investment made will result in the future success of both parties.

List of References

Accounting for Management (2011) Cash Budget: Cash Budgeting. Web.

Armstrong, G. and Philip, K. (2010) Marketing: An Introduction. 10th ed. New York: Prentice Hall.

Bose, C. (2006) Fundamentals of Financial Management. New Delhi: Prentice Hall of India.

Brigham, E. and Joel, H. (2010) Fundamentals of Financial Management. Southern-Western: Cengage Learning.

Collis, J. and Hussey, R. (2007) Business Accounting: An Introduction to Financial and Management Accounting. Basingstoke: Palgrave Macmillan.

Coulthurst, N. (2000) Absorption and Marginal Costing Systems. [Online]. Tripod. Web.

Drury, C. (2006) Cost and Management Accounting — An Introduction. USA: Cengage Learning.

Drypen (2010) Marketing Mix: Product, Price, Place, Promotion the 4ps of Marketing. Web.

Economics (n.d) Variable Costs and Fixed Costs. [Online]. Economics Fundamental Finance. Web.

Edwards, D. (1999) Cash Budgeting Leads to Better Cash Management. Web.

Frongello, L. (n.d) Break-Even Point Analysis. Web.

Globusz (2001) Chapter 1: Basic Cost Concepts. Web.

Globusz (2001) Chapter 2: Marginal Costing and Absorption Costing. Web.

Globusz (2001) Chapter 3: Breakeven Analysis. [Online]. Globusz Publishing. Web.

Juan, R. (2011) Small Business Marketing: Importance of Market Research. Web.

Kinney, M. and Raiborn, C. (2008) Cost Accounting: Foundations and Evolutions. New York: Cengage Learning.

Kotler, P. (2000) Marketing Management. 10th ed. New York: Prentice Hall.

Raj, G. (2011) Importance of Marketing Mix. [Online]. Ezine Articles. Web.

Reference for Business (2011) Cost-Volume-Profit Analysis. Web.

Tutor2u (n.d) Introduction to Breakeven Analysis. Web.

Tutor2u (n.d) Marketing: Pricing Approaches and Strategies. Web.

Waters, S. (2011) Break-Even Point. Web.

Appendix

Table 3: Forecast Monthly Cash Flow Budget Statement for the Year ending 31st December 2012

Table 4: Forecast Income Statement of Baric Footwear Limited for the year ending 31st December 2012

Table 5: Forecast Balance Sheet of Baric Footwear Limited for the year ending 31st December 2012