Executive Summary

Coca Cola is a major soft drink brand, which is available to consumers in 193 countries, while the Coca Cola Company produces syrup and concentrate used to create this drink, as well as many others. The national economy for this corporation is the United States. However, it sells its soft drinks globally through licensing agreements with bottling companies. The company has a definite competitive advantage, and little competition exists in the market that is comparable in the scale and scope of operations, with the main competition being another soft drink brand from the United States – Pepsi.

The industry overview and prognosis for the timeframe from 2020 until 2025 suggested that Coca Cola will grow and increase its profits since the consumption of soft drinks should increase. However, the recent outbreak of COVID-19 and the safety measures imposed by governments across the world have affected the production capabilities and the consumption within the soft drink industry. This paper examines the external and internal factors that impact Coca Cola’s strategic plans through Porter’s generic strategy, Five Forces, SWOT, PESTLE, Value Chain, Resource-Based View and Balanced Scorecard.

Introduction

Soft drinks are a popular category of beverages that include sugar, syrup, aspartame or another sweetener as the main ingredient. These drinks have been on the market for at least one hundred years, and some companies such as Coca Cola managed to establish themselves as a popular brand of soda. This paper will examine the strategic objectives of Coca Cola, its mission, vision, values, competition, and provide recommendations for further improvement.

Background

Coca Cola today is a corporation operating globally, with a brand name familiar to consumers and a wide choice of drinks under different brands. The Coca Cola Company is a multinational brand, selling its beverages across 193 countries (The Editors of Encyclopaedia Britannica, no date). Although the most popular product of this company is the Coca Cola beverage, its main focus is on manufacturing syrup and concentrate, which are the main ingredient of the soft drink.

The business model that this corporation applies is licensing agreements for bottling companies that can produce one of the 2,800 drinks that Coca Cola offers. Over the years, Coca Cola gained an audience of loyal customers, with its notable advertisements, the contoured glass bottle, the word “Coke” used in advertisements, and the wide array of soft drinks and citrus beverages it offers.

It was established in 1886 by John Pemberton, who created the first Coca Cola drink from cocaine and caffeine-rich extracts (About us – Coca Cola history, no date). Later, in 1903 the formula was revised, and cocaine was removed. At that time, the original trademark for Coca Cola – the flowing script that the company uses to this day was created as well. The unique Coca Cola drink was intended as a tonic for minor illnesses.

Griggs Candler purchased the rights for the drink and the trademark in 1891 and registered the company as a legal corporation, also patenting the trademark in Atlanta, United States (The Editors of Encyclopaedia Britannica, no date). Over the years, the corporation purchased other drink-related businesses and established manufacturing facilities or license agreements outside the United States, making it a global corporation.

Overview of the Industry

Although Coca Cola owns many brands that are popular among the consumers of the soft drinks and beverages industry, it has some competition. The main competitors within the industry are “Groupe Danone; Keurig Dr Pepper, Inc.; Monster Energy Company; Nestle SA; PepsiCo, Inc.; Red Bull GmbH; The Coca-Cola Company”(Global soft drinks industry, 2019, para. 10). All of these corporations maintain operation on the international level, selling their products in many countries. According to the “Global Soft Drinks Industry Report,” the market was expected to grow by $449.6 billion, or £365 billion in 2020 (Global soft drinks industry, 2019).

Moreover, the percentage of growth for the carbonated soft drinks is perceived as the most significant, at 6.3% when compared to an average of 5.8% for other categories. Moreover, the report estimates continuous growth of this industry and predicts it reaching $696 billion or 564 by 2025 (Global soft drinks industry, 2019). In terms of areas of growth, the majority is attributed to the United States, European Union, and China.

Coca Cola

The Coca Cola Company declares its vision as the following:

“to craft the brands and choice of drinks that people love, to refresh them in body and spirit. And done in ways that create a more sustainable business and better-shared future that makes a difference in people’s lives, communities and our planet” (Vision, no date, para. 1).

Notably, in its vision statement, Coca Cola includes elements of CSR strategy, suggesting that it has integrated ethical values in the core of its operations. This is achieved by manufacturing and selling beloved brands sustainable and working for a better future (Vision, no date, para. 1). When outlining key vision elements, the brand representatives mention disciplined portfolio as a key strategy. This implies that Coca Cola has committed to working in a single industry and does not plan to expand its operations beyond soft drinks by entering field it has no experience in. Developing the Coca Cola brand appears to be central in this strategic objective, which is understandable since the Coca Cola brand already has a loyal consumer base and having such leverage is a major competitive advantage.

In terms of the corporation’s mission, Coca Cola addresses this element in the form of the following purpose statement – “Refresh the world. Make a difference.” (Purpose and vision, no date). In this statement, the core value of the company – refreshment drinks and the strive of Coca Cola to change the world, mainly in the way soft drink businesses operate is evident. Based on the mission and vision statements, one can assume that the core values of Coca Cola are sustainability and innovation.

When examining values, it is necessary to evaluate the CSR strategies of the business. CSR helps companies such as Coca Cola create a positive brand image, which contributes to customer loyalty and profits the business receives. Moreover, “having ethical business practice helps retain customers trust and enforce their loyalty to the brand” (Bidiwala and Liu, 2019, p. 3). According to Ciafone (2019), Coca Cola encountered its first difficulties relating to social responsibility in 2000 when Indian villagers protested against exploitation of water resources and pollution in the area that was a result of the company’s work.

However, Coca Cola is known to respond to industry trends and create products that correspond to its CSR, for example, in 1992 it was the first beverage manufacturer to use recyclable plastic for its bottles (The Editors of Encyclopaedia Britannica, no date). Currently, the business is focused on creating operations that do not pollute water and the environment around the bottling factories. To achieve sustainability, Coca Cola contrasts business objectives with its environmental impact, including “water usage, carbon ratio, and sugar” (Vision, no date, para. 10). This practice highlights the fact that past controversies urged Coca Cola to view CSR as a core business value and include it in strategic planning.

Corporate objectives are goals that a business sets and the timeframe for achieving them. Corporate objectives of Coca Cola are listed as part of its growth strategy and vision and include disciplined portfolio growth, innovation, revenue increase, and improved execution (Growth strategy, no date).

Additionally, the company focuses on the consumer-centric strategy, which includes brand building, innovation and mergers and acquisitions, revenue growth management and execution as a continuous cycle of operations. One example is the corporate objectives for 2019, which include +6% revenue, +4% transactions, +3% volume, -3% sugar, which the Coca Cola Company successfully achieved (Growth strategy, no date). Therefore, in terms of corporate objectives, this company sets clear targets, and as 2019 benchmarking suggests, it manages to achieve them.

Competition

Porter’s generic strategies outline the sources of competitive advantage for a company that provides long-term sustainability with the main focus on the profits and whether they are below or above the average for an industry. This data helps determine the corporation’s relative position in the industry of soft drinks and the main two approaches are low costs or differentiation with cost leadership, differentiation, and focus being the main strategies (Porter, 1985).

In the case of Coca Cola, Table 1 in the Appendix presents an assessment of the key factors that enable its competitive advantage. Arguably, Coca Cola mainly focuses on cost leadership because Coca Cola focuses on the price of its products to target a narrow market and aims to develop business processes to reduce costs. Coca Cola takes advantage of the economy of scale – which allows it to lower the cost of materials (Liu, 2019).

Because it is a large organisation operating globally in 193 countries, it has a substantial demand for raw materials, allowing it to negotiate with suppliers for lower prices. When compared to smaller beverage manufacturers, Coca Cola is a more important customer for the suppliers due to volume size for each unit, and as a result, smaller soft drink manufacturers cannot access raw materials at the same price. In addition, since it is the largest soft drink provider, it benefits from a large number of companies that are a part of Coca Cola because the corporation has a diverse marketing network and distribution system (Liu, 2019).

Also, it is important to look at franchising and licensing agreements of Coca Cola, which allow the business to save costs associated with establishing manufacturing facilities in different countries. Coca Cola does not manufacture the drinks under its brands, and it produces the syrup and concentrates, which is then distributed to bottling companies that have a license to produce the drinks (Caifone, 2019). Therefore, it does not have to invest in opening factories in each county and establishing a distribution network from scratch because its partners are responsible for these aspects of production.

Next, in regards to differentiation leadership, Coca Cola has been successful and creating a portfolio of beverages for different target audiences. Over the years it purchased brands such as Fanta, Sprite, Dasani, Siel, and many others (Brands & products, no date). In some cases, the corporation purchased the existing businesses, in others, it established a new brand, such as “Diet Coke,” which targets the consumer audience that cannot have sugar or individuals that purposefully limit their sugar intake for health-related reasons. As a result, The Coca Cola Company is one of the industry leaders in terms of differentiation leadership and the company successfully employs this strategy by offering a wide variety of soft drinks. Additionally, it has a unique formula for its original “Coke” drink, which has not been revealed since its creation, which is also a unique competitive advantage (Ciafone, 2019).

However, in general, there are many alternatives to the products Coca Cola offers, for instance, Pepsi has a similar soft drink, which is a direct competitor for Coca Cola. Moreover, Coca Cola does not aim to charge a premium for its beverage, which is also an indicator of not pursuing the differentiation leadership strategy (Porter, 1985). As a result, one can assume that differentiation leadership is not as important for Coca Cola at this stage.

Finally, the focus strategy implies selecting a narrow target audience or consumer base and tailoring the soft drinks to their tastes, with an exclusion of other audience segments. This would be a difficult strategy to pursue Coca Cola because of its emphasis on a large scale of operations and focus on minimisation of costs. In the conclusion of Porter’s generic strategies for Coca Cola, it is not advised to follow more than one strategy, and the corporation appears to be successful in leveraging the cost leadership strategy. Considering the fact that its corporate objective is to leverage the disciplined portfolio growth, it is a good strategy since the corporation abandoned the differentiation leadership strategy and did not aim to use focus strategy and now is focused on cost leadership.

Next, an alternative method for analysing competitive advantage is Five Forces, which is displayed as Table 2 in the Appendix. Based on this assessment, Coca Cola has a good position in the market without many potential threats from competitors or suppliers that can disrupt its operations. The risk of new entrants that would be a substantial competitor for Coca Cola is low, as the previous part of this paper show, the company has an extensive manufacturing and distribution network globally, and to establish a rival one would have had a significant investment, which is unlikely.

Similarly, this provides little bargaining power to the suppliers, because losing a client such as Coca Cola, which purchases large volumes of raw materials if undesirable. The primary materials the business supplies are water, aluminium, plastics which are not unique, meaning that Coca Cola can switch suppliers if necessary (Lui, 2018). Next, the bargaining power of buyers is low, since the business sells to a large number of customers globally, the price of Coca Cola’s drinks is comparable with that of competitors, and the market is not particularly sensitive to price.

The main substitute product for the businesses key offer “Coke” is Pepsi’s soft drink for a comparable price, others are less popular or do not have such a large distribution network. Since the two have been competitors for years, it is inevitable that each company has established itself as a brand for different consumer segments. Finally, in terms of rivalry, Pepsi is the main competitor for Coca Cola. However, the latter is a more prominent company and has a well-established brand name (Caifone, 2019). In general, based on the Five Forces analysis, Coca Cola has a good market position.

Environment Analysis

Table 3 in the Appendix contains the SWOT matrix developed for Coca-Cola. Firstly, for the factors that impact Coca Cola from its operational environment, the opportunities and threats are reviewed. As was discussed in the industry overview, COVID-19 is a major disruption for the business, and it is currently unclear how it will affect the profits and operations, is the main threat to the operations, however, since this factor incorporates social, legal, and political elements in will be discussed more in the PESTLE analysis.

The main opportunity for Coca Cola is the overall trend for increased consumption of soft drinks, which was discussed in the industry overview section (Global soft drink industry, no date). Due to the fact that Coca Cola is present in many countries and the high profits, it can leverage consumer trends by introducing new products.

The strengths of Coca Cola were discussed previously because they are largely connected to the competitive advantage of the corporation – it has low production costs because of scale economy, the licensing agreements lower risks and diverse distribution network. However, the main advantage of this corporation is a well-established brand name, both domestically and internationally. As Caifore (2019) suggests, over 94% of the global population recognise the brand’s logo, which makes the power of the Coca Cola brand, the most significant strength of this business.

As for weaknesses, the main issue is the health-related concerns for carbonated drinks made of syrup or even aspartame, a healthier, calorie-free offer from Coca Cola. Agha (2017) suggests that these drinks also may contain pesticides, although no large-scale studies were performed to evaluate the actual impact of the drink on people’s health. However, general knowledge implies that having too many drinks with high levels of sugar is unhealthy and can lead to health impairments such as diabetes, excess weight, and other issues.

Next, for an in-depth examination of Coca-Cola’s external environment, Table 4 in the Appendix presents an assessment of PESTLE. In regards to PESTLE analysis, which mainly focuses on the environmental factors, it is necessary to mention the coronavirus outbreak and the measures taken by the governments globally to combat the pandemic, which affect Coca-Cola’s ability to manufacture its drinks and the sales, because of legal restrictions relating to the number of people that can be in manufacturing facilities or offices and other safety restrictions.

COVID-19 is a factor that impacts the political, social, and legal environment significantly for Coca Cola, both domestically and internationally. Notably, the majority of reports for the soft drink industry and syrup industry were created prior to the COVID-19 outbreak, and they do not account for this major disruption, which will affect the supply chains and consumption. However, the British Soft Drinks Association released guidelines for food-related businesses, which outline the key practices for manufacturers and distributors for safety (COVID-19, no date). This guide implies that companies will have to invest in ensuring that they can adhere to safety recommendations to avoid contamination of their products.

It is unclear how COVID-19 will affect the consumption of soft drinks. However, the restrictions imposed by governments will definitely have an impact on the financial gain of the businesses. Moreover, in some states, including the United Kingdom, soft drink manufacturers, as well as other businesses are eligible for loans to support their operations during quarantine (COVID-19, no date). Some assumptions regarding the changes to the services that companies such as Coca Cola will have to make include reducing expenditures and reducing the number of people it employs.

Welhering (2020) reports that Carlsberg, a company owned by Coca Cola, announced cost-cutting strategies, and abandoning the financial forecasts for the month of April because they are unreliable considering the conditions. Prior to this, reports estimated that the niche of alcohol drinks sold by Carlsberg would experience a 270% increase in sales in the United States (Welhering, 2020). However, because quarantine measures imply less public events or private outings in the parks or other locations, it is possible that the beverage industry will experience significant profit losses.

Although COVID-19 has an adverse impact on the industry, some reports suggest an increase in consumer interest for specific beverage categories. For instance, in the United States, beer consumption during the lockdown in March has increased by 16% (Morton, 2020a). Although this is a positive trend, the increase is attributed only to certain categories of drinks, with other companies, such as Halewood Wines and Spirit, preparing to cut costs since they expect a decrease in consumption in the United States(Morton, 2020b). As a result, one can assume that in general, the industry will experience a negative trend in the consumption and because of the need to close down some facilities and implement new safety measures to protect the employees and consumers.

Some companies in the industry have used the crisis caused by COVID-19 further to pursue their corporate social responsibility (CSR) objectives. Askew (2020) states that Pepsi Co., a major competitor for Coca Cola, is going to spend $45 million, which is approximately £36.5 million, to provide relief packages to communities suffering from COVID-19 outbreak in the United States and in Europe. Pepsi Co. will spend these funds to provide meals and protection equipment for people. It is possible that other companies in the industry, including Coca Cola, will also allocate funds for crisis relief.

In terms of PESTLE analysis, COVID-19 affects the domains of social, political, and legal environments, since governments have to impose restrictions and lockdowns, affecting the ability to manufacture Coca Cola’s products and the demand for them. The environmental concerns are consistent with those prior to COVIS-19 – Coca Cola pollutes the environment, which was proven in India, due to its approach to water use (Caifone, 2019). The technology of production has to change as well to address new safety regulations. In terms of economic impact, it is possible that this corporation will lose profits because of demand and purchasing ability decrease as many people will lose jobs.

Value and Resources

Main elements of Coca Cola’s value chain is the inbound logistics because the company is dependent on the ability to supply water to its bottling facilities. Caifore (2019) argues that the main issues in terms of the ecological impact that the corporation has are connected to water supply and water waste, because it is a valuable resource for the drinks, as it is the basis of all beverages. Additionally, it requires syrup or aspartame, which is purchased from suppliers within the United States. In terms of outbound logistics, the corporation partners with independent bottling partners and distributors.

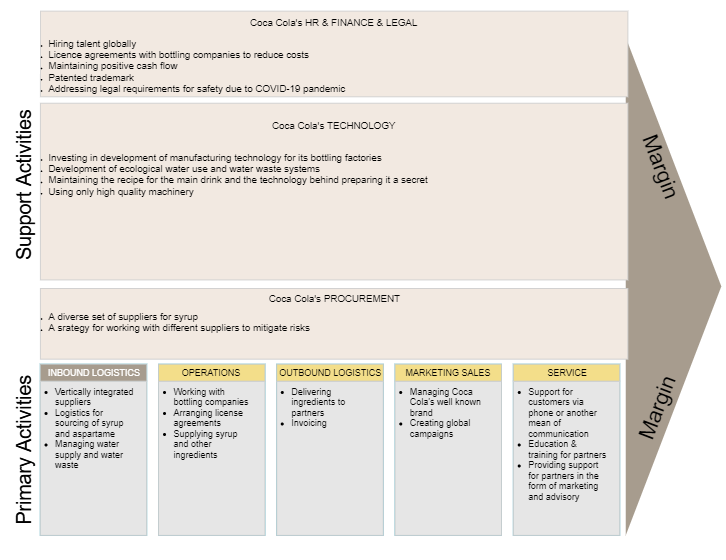

The operations of the business are divided into seven key groups based on the region – Eurasia and Africa, Latin America, North America, Europe, Asia Pacific and separate divisions for bottling and corporate operations (Caifone, 2019). Marketing and sales are one of the strengths of this company since it was able to establish a highly recognisable brand for the global consumer. Finally, the service is mainly connected to customer support activities traditional for the food and beverage industry, which are provided via phone, email, or online chat, in the United States and outside. Figure 1 displays a diagram with Coca-Cola’s Value Chain.

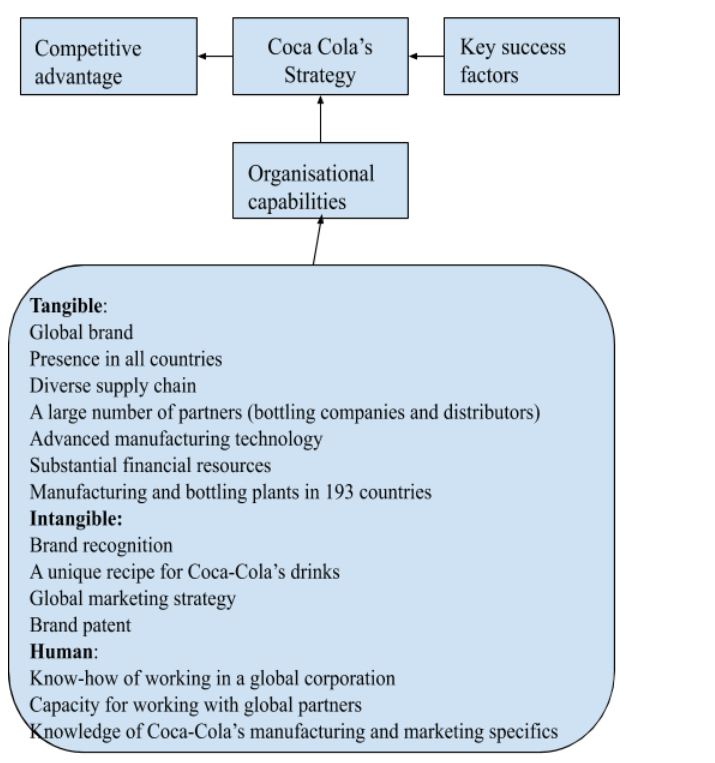

In regard to the Resource-Based View, Coca Cola’s most significant assets are intangible because other companies, such as Pepsi have similar drinks, with the latter having even more significant diversification of products the Coca Cola. However, as was discussed, this brand is recognised by 94% of the global population, which is a significant asset incomparable to tangible resources other businesses can possess (Caifone, 2019).

Additionally, the variety of license partnerships and the bargaining power can be considered an intangible asset as well because it helps the corporation create an effective cost structure. The physical assets it can leverage are the manufacturing facilities and advanced technology that the company uses in its operations. Figure 2 is a diagram representing some of the critical resources Coca Cola possesses as a brand.

The Balanced Scorecard

A balanced scorecard is used to measure the performance of specific indicators within a given timeframe. As Kaplan and Norton (1992, para. 1) state, – “what you measure is what you get,” highlighting the critical importance of balanced scorecard evaluations. Moreover, this tool allows tracking indicators beyond financial performance, allowing to address different dimensions of an organization’s operations. Typically, a balanced scorecard incorporates financial, internal, innovation or learning, and customer objectives (Kaplan and Norton, 1992). Additionally, it includes goals and measures to enable appropriate tracking of performance. The balanced scorecard in the Appendix addresses all four domains, mainly through revenue, customer satisfaction, new water pollution detection system and the number of transactions in a year.

Table 5 in the Appendix displays the Balanced Scorecard for Coca Cola, which is used to measure critical operational activities of the business. This scorecard is based on the 2019 performance of the business reflected in the report for investors and the mission declared by the corporation.

The key areas are revenue, transactions, volume, sugar decrease (Purpose and company vision, no date). These are standard areas of improvement since it is vital to control the revenue and ensure a strategic increase each year, as well as key strategic areas such as volume and transactions. The innovation and learning element of the proposed balanced scorecard is the only item that requires measuring the number of states where a new anti-pollution strategy was implemented, while others focus on the % of improvement. Additionally, the scorecard includes the marketing objectives, since brand recognition is vital for this corporation.

Recommendations and Conclusion

Although Coca Cola has introduced some healthier variation of its original sugar drink, “Coca Cola Zero” with aspartame, arguably, the company did not address the trend of healthy nutrition to the full extend. The main recommendation is to diversify the portfolio of drinks further and introduce a new version of “Coke.”

Mainly, this is connected to the threats evaluated in SWOT, since consumers are becoming more aware of the food and drinks they purchase and the brand was accused of producing unhealthy or even dangerous products. Hence, it is essential for Coca Cola to address the concerns regarding the use of syrup and aspartame by introducing a drink that will be low in carbohydrate and low in sugar. One option is bottled natural tea since this is an established niche in the industry and addresses the health and wellness concerns of the population.

The recent market research also suggests that consumers are becoming more attentive to what they purchase and the health benefits of products and drinks they choose. According to Vassalotti (2020), in Coca Cola’s home market, approximately 20% of calorie intake a day is attributed to drinks with sugar. Considering the emerging concerns about obesity and chronic diseases that should be addressed through healthy eating, companies should consider readjusting their offers, since “with the rise in health complications and concerns about obesity, the demand for health drinks is increasing at a considerable rate” (Healthy drinks market by type, 2020, para. 1).

This market report on healthy beverages suggests that the segment is growing, with an urban population contributing to the increasing popularity of healthy drinks. As a result, Coca Cola should address this emerging trend, since although it emerged recently, it has the potential of transforming the market as health and fitness become more and more popular.

To conclude, this report focused on the strategic management of the Coca Cola company. While in general, Coca Cola has a good market position, since it has been on the market for over one hundred and thirty years, some issues are connected to the global pandemic. Previous predictions for the soft drinks globally suggested an increase in consumption, and it is possible that the coronavirus pandemic will affect this trend negatively. Other concerns include the health and safety issues since the corporation mainly produces drinks high in sugar levels and because of allegations regarding pesticides in products. Despite these issues, Coca Cola has a definite competitive advantage with he focus on cost leadership since it has bargaining power over suppliers because of its large purchasing volumes.

Reference List

About us – Coca Cola history (no date). Web.

Agha, Z. (2017) Always Coca-Cola: why environmental exploitation should be included in the legal construction of international crimes. Web.

Askew, K. (2020) ‘PepsiCo pledges funds for COVID-19 response: ‘Bringing food to our neighbours who need it most’, Food Navigator. Web.

Bidiwala, A. and Liu, Z. (2019) Does it matter to have an ethical brand?. Bachelor Thesis, Jonkoping University. Web.

Brands & products (no date). Web.

Ciafone, A. (2019) Counter-Cola: a multinational history of the global corporation. Oakland: University of California Press.

COVID-19 (no date). Web.

The Editors of Encyclopaedia Britannica. (no date) The Coca-Cola company. Web.

Global soft drink industry. (2019). Web.

Health drinks market size, share & trends |analysis forecast by 2025. (2020). Web.

Kaplan, R. S. & Norton, D. P. (1992). ‘Measures that drive performance’. Harvard Business Review, January-February. Web.

Liu, X. (2019) Financial analysis of Coca Cola company. Bachelor Thesis, VSB – Technical University of Ostrava. Web.

Morton, A. (2020a) ‘US beer enjoys coronavirus bounce in off-premise – figures’, Just Drinks. Web.

Morton, A. (2020b) ‘Halewood Wines & Spirits to cut jobs, close US office – just-drinks exclusive’, Just Drinks. Web.

Porter, M. E. (1985) Competitive advantage. New York, The Free Press.

Purpose and company vision (no date). Web.

Vision (no date). Web.

Vassalotti, J. (2020) ‘Healthy drinks’, in Uribarri, J. and Vassalotti, J. A. (eds) Nutrition, fitness, and mindfulness. Switzerland: Springer, pp. 55-63.

Welhering, O. (2020) ‘Coronavirus COVID-19 and the global drinks industry – just-drinks timeline’, Just Drinks. Web.

Appendix A

Table 1. Porter’s generic strategy of the Coca Cola Company (created by the author).

Appendix B

Table 2. Porter’s Five Forces (created by the author).

Appendix C

Table 3. SWOT Analysis for Coca Cola (created by the author).

Appendix D

Table 4. PESTLE for Coca Cola (created by the author).

Appendix E

Appendix F

Appendix G

Table 5. Balanced Scorecard for Coca Cola (created by the author).