Introduction

Corporate finance is an area of management that focuses on how corporations get access to funds they need and how they are budgeted to address both long-term and short-term goals. Bodmer (2015) defines corporate finance as “the area of finance dealing with sources of funding and the capital structure of corporations, actions that managers take to increase the value of the firm to shareholders, and tools and analysis used to allocate financial resources,” (p. 41). In most of the cases, it is the responsibility of chief financial officers (CFOs) to ensure that their organizations have access to resources needed to keep it operational. After accessing funds, another major responsibility, as seen in the above definition, is to allocate them to the most important projects. Corporate finance seeks to increase a firm’s value for the benefit of shareholders. It means that every action that is taken should be focused on increasing the value of shareholders. According to Chang (2015), corporate financing is narrowed down to sourcing for funds and gives little emphasis on how funds are managed after they are received. The top management unit of corporations must understand the best sources of funds that would yield the best value for the firm by reducing its burden when it comes to repayment. In this paper, the focus is to discuss the long-term and short-term corporate financing strategies used by successful companies in the country.

Corporate Financing

Corporate financing is one of the most important areas of management that seeks to ensure that a firm has the financial capacity to meet both long-term and short-term goals. According to Kim (2015), the chief financial officer, working closely with the chief executive officer and other top officials within a firm, should be capable of making informed decisions when selecting the most appropriate sources of funds within a given period. A firm may use various strategies to fund its operations based on the current needs and internal financial environment. A company may choose to borrow money from the local or international financial institutions. An organization may decide to issue debt securities to get funds from the capital market (Hirota, 2015).

Another strategy that is also popular with corporations is to sell stocks as a long-term means of getting funds for expansion. The entire process involves a delicate balancing act of ensuring that funds are provided but not at the expense of the value of shareholders. Getting loans from financial institutions may be a quick way to access funds without introducing new shareholders into the ownership of the company. However, Chang (2015) warns that too much debt can be dangerous, especially if there are no clear ways of paying them within the required time. On the other hand, selling of stock is another way of getting funds, but it has to be done in a way that does not devalue shares of owners. It is important to analyze both short-term and long-term financing in corporate entities critically.

Long-Term Financing

According to Hirota (2015), long-term financing primarily focuses on sourcing of funds for capital investments. These are long-term projects that seek to expand operations of a company beyond the current scope. In such cases, the company may need a large amount of capital within a relatively short time. The most proffered method of getting money for expansion is from the company’s profits. If profits are substantial enough to support such projects, then it may be unnecessary and undesirable to involve third parties in such processes. The second-most preferable approach to accessing the money is to receive it from the current shareholders.

It increases their value within the firm as the firm continues to expand. However, it is common to find scenarios where the needed funds are so large that profits and shareholders’ contribution cannot manage it. In such cases, it may be necessary to involve outside parties in getting the money. Chang (2015) argues that one of the most common long-term financing strategies used by companies is getting long-term loans from financial institutions. Commercial banks always offer loans to corporate institutions at negotiated interest rates based on the amount desired and the time within which it has to be paid. When borrowing from financial institutions, Pyles (2014) warns that the management should ensure that it can be paid within the planned duration. Failure to repay such loans may lead to cases of bankruptcy, which is an undesirable eventuality for shareholders.

The stock market is another strategy that has become popular among corporate entities. Instead of relying on commercial banks to get loans, some companies opt to sell stocks in the securities market. The approach introduces new shareholders into the firm but avoids the burden of debts. The current shareholders must be willing to lose a portion of the value of their shares to enable new investors to own a portion of the company. Selling of stock makes it possible to have a large sum of money without facing the fear of having to pay the debt within a specified period. According to Kim (2015), the initial public offering (IPO) of Facebook that was held on May 18, 2018, is a perfect example of how a corporate entity can get long-term finds for major projects. It was the biggest in the history of the technology sector and made available $ 104 billion to the company within a very short time. The ownership of the company changed from a few individuals to numerous people, but the company also increased its value significantly, making it able to expand its operations and improve its services. Many other companies have used the same approach to fund their mega projects not only in the United States but also in other parts of the world. Long-term bonds can also enable a corporation to access the needed funds.

Discussing the current trends in long-term corporate financing is important. According to Jacque (2014), companies are currently keen on enhancing confidence and predictability before choosing the right approach to funding their long-term projects. Shareholders may prefer a scenario where the business can expand without having to sell part of their shares to new investors. However, that may sometimes be impossible if they cannot provide the needed funds. However, Chang (2015) notes that the current best practice is to ensure that whether it is borrowing from commercial banks or selling shares, the management must be certain of the outcome. Kimmel (2012) argues that corporations are also embracing a new practice of having a diversified source of financing. Instead of relying wholly on the sale of shares or loans from banks, these institutions consider many other approaches to funding their expansion initiatives. Reinvesting of profits, leasing out properties that are not in active use and the use of company bonds are also emerging as alternatives to the other conventional approaches to corporate financing. Pyles (2014) believes that the approach may help a firm to avoid the pressure of dealing with an all-powerful financier who can dictate undesirable terms for the firm.

The main strength of long-term financing is that it provides instant large amounts of money that can support expansion projects of a firm. Some developmental programs may need more money than what is generated through the normal operational activities. Long-term financing makes such funds available. Another advantage is that the interest rates can be negotiated, especially when borrowing large sums of money. When the rate is lowered, the pressure on the firm will be reduced. However, Kim (2015) observes that some disadvantages exist that may make long-term financing less desirable. The interest on loans may be a major burden on a firm. If such loans are not paid on time, such a company may face lawsuits and fines that may affect its image and earnings. Sometimes it may even be driven into bankruptcy.

Short-Term Financing

It is important to ensure that there is enough liquidity within a firm to meet operational needs. Other than the major expansion projects, a firm has to fund daily, weekly, and monthly activities that facilitate its normal running. Wages and salaries have to be paid in time, short-term suppliers of consumables and other products have to be promptly paid, and other short-term financial needs have to be met. According to Kimmel (2012), short-term financing is concerned with managing the working capital and cash flows. At every moment, an entity must be liquid enough to meet operational costs. Cash or cash equivalents available to the management should be substantial enough to meet all current needs. Chang (2015) emphasizes that the cash equivalents (such as stock) should be turned into cash easily to avoid cases of unpaid short-term debts. According to Jacque (2014), the most desirable short-term financing is the use of a firm’s profits. Earnings that a firm makes from its operations should be sufficient to meet its daily, weekly, and monthly financial obligations. In fact, Pyles (2014) observes that a firm whose operations are sustainable should only use a portion of its profits to fund such needs. However, it is important to note that in some cases, earnings made by a firm may not be enough to fund some emergent needs. In such unique circumstances, borrowing from financial institutions may be unavoidable.

A corporation may be overburdened if a long-term loan has to be paid within a short time because it is due. The motive of making such urgent payment may be to avoid consequences such as fines or increased interest. In such cases, short-term obligations may not be met effectively if finances of the company are strained. I experienced such scenario when I was working at a local restaurant as an assistant to the finance officer. The company had borrowed money from a local financial bank to fund its expansion strategies. The money had to be repaid within a short time to avoid further interests. The experience was stressful, especially to the management. Funds available could barely support the daily operations of the company. When the time came to pay employees, the firm did not have enough money to do so. Luckily, the owner was able to secure additional funds from personal savings to address the scenario. The application of my experience at the restaurant can help in explaining some of the challenges that corporate entities often go through when managing short-term financing. Large companies sometimes go through the same experience. In case shareholders are not able to provide additional funding to address such challenges, the corporate entity may have no option but to go for short-term debts.

Comparing and Contrasting Methods/Techniques

The two methods/technique of corporate finance have some similarities and differences which are worth discussing. According to Jacque (2014), corporate financing (both short and long-term) is focused on ensuring that enough funds are made available for the normal expansion and operations of the firm. In both cases, the best approach of financing would be to reinvest profits or get additional funds from the current owners to avoid the pressure of the external parties. However, when it is necessary, short-term and long-term funds can be accessed through loans. The two methods of corporate financing differ in many areas. One of the main differences is the aim. Short-term funding focuses on providing funds for operational needs. They include money to pay short-term debtors, wages of employees, and other miscellaneous short-term expenses.

Long-term financing, on the other hand, focuses on funding the planned developmental programs. It arises when a firm needs to make a major investment in an expansion project that would increase its production capacity or expand its market share. When it comes to getting short-term loans, a clear mechanism must exist that defines how it would be paid within a short period (Kimmel, 2012). On the other hand, long-term loans are often payable in installments spread through several months or years. According to Graham, Smart, and Megginson (2010), long-term financing in most of the cases and depending on the aim and size of the organization involve substantial amount of money. Their focus is to enable a firm to move to the next step regarding production capacity. Conversely, short-term financing aims at providing finance for operational activities within days, weeks, or a month. The amount needed is relatively smaller compared to what would be needed in funding capital projects.

Roles and Responsibilities in Making Corporate Financing Decisions

Making corporate financing decisions requires a detailed understanding of corporate finance and management. The decisions made by the relevant leaders have serious implications on operations and sustainability of the firm. Pyles (2014) says that the role of financial management is often assigned to specific individuals trusted with the capacity to make sound decisions that can enable a company to achieve the desired goals. The following section discusses officers responsible for corporate financing decision-making processes.

The Board of Directors

The board of directors is the top unit of management in corporate entities. The board is responsible for making strategic decisions that can enable a firm to realize its vision. In corporate finance, their responsibility is to assess blueprints made by the chief financial officers and the finance department and make approvals or suggestions on areas that need improvement. They are always actively involved in the long-term corporate financing. Before a firm can decide to go for large commercial loans or sell shares in the securities market, the board members must approve of the decision. The chief executive officer, who in most cases also acts as the secretary or the chairperson of the board, will provide knowledge that members need to make their decisions. As the top management unit of an organization, the decision of the board is final and binding to all junior officers within a corporate entity.

Chief Financial Officer

The chief financial officer is the senior-most employee in an organization’s financial department. Bodmer (2015) says that the officer has “the primary responsibility of managing a company’s finances, including financial planning, management of financial risks, record-keeping, and financial reporting,” (p. 21). In the corporate financing, the officer’s role is to identify the most appropriate sources of short-term and long-term funds based on needs of the organization. The officer works closely with the chief operations officer and the chief executive officer to ensure that the organizational needs are aligned with the available resource. The holder of this office reports regularly to the chief executive officer and may be summoned to attend various meetings of the board of directors when it is necessary.

Financial Assistants

The chief financial officers work closely with junior financial officers who may hold various positions within the firm. These financial officers are experts in the field of finance who have the responsibility of collecting and analyzing relevant financial data meant to inform decisions of the chief financial officers. In large corporations, the CFO may not have time to collect relevant information regarding the relevant sources of funding based on the emerging trends and best practices. The responsibility is left to financial assistants.

How to Monitor the Performance

Monitoring the performance of the officers identified above is crucial in ensuring that the strategic goals and tactical objectives are realized in a given corporate entity. At each level of financial management, decisions made and actions taken should yield progress in the firm. Pyles (2014) recommends the use of Expectancy Theory of Performance Management. The theory holds that people often behave in a given manner because of the motivation they get from the outcome of such behavior (Chang, 2015). It is important to ensure that the performance of employees is aligned with expectations of a given goal. It means that it is the responsibility of the top management unit to ensure that the outcome of activities of employees is aligned with expectations of the entity. The driving force that makes workers act in a specific pattern should be directly related to the success factors of a company. As shown in figure 1 below, key properties, the application of various strategies, advantages of decisions, and the possible limitations should focus on the expectations of the organization. Therefore, when using this theory, it is necessary for the management to recruit skilled employees, offer them proper training in line with their duties, offer them the relevant motivation that would promote their performance, and closely monitor their output.

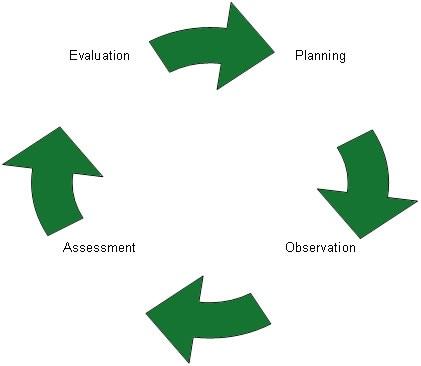

The theory holds that close monitoring of the performance of various officers is critical but not enough to realize strategic goals. The capacity of their team and their motivation to do what is expected of them is equally critical. Kimmel (2012) emphasizes the need to apply motivational strategies in the process of monitoring and managing their performance. The following model (figure 2) can help in monitoring the performance of these officers.

The first step is to develop a plan that will form the basis of performance measurements. When monitoring the performance of different officers, Kimmel (2012) says that one should come up with a plan on how to measure their performance without affecting their productivity. At the planning stage, the parameters that will be used in the assessment of the performance should be developed. The next phase is to observe their performance. In this stage, the focus will be to determine how well the targeted officers are performing based on the set parameters. After the observation, one will be expected to conduct an assessment. In this stage, the observed output of the employees will be compared with the set parameters. The last stage will be the evaluation. The officer will determine if the output is below or above the set parameters. Senior management officers can make the right decisions based on the evaluation recommendations.

How to Alert Leaders of the Organization to Anomalies and Opportunities

When monitoring the performance of various officers and operations of the organization, of interest should always be to make regular reports to the relevant officers. In the report, it is necessary to state any anomalies or identified opportunities that the management should take into consideration. The chief financial officer will be the recipient of such alerts. After every review, all issues that may have negative implications on the success of the finance department and the firm at large should be noted in a formal report. Chang (2015) advises that in such reports, the focus should not only be on anomalies within the system but also opportunities that are yet to be tapped by the firm. In the final report that is delivered to the CFO, it should be clear what the firm needs to do to address issues identified. Jacque (2014) suggests that whistle-blowing mechanism should be put in place to help identify looting or wanton wastage of organizational resources. The top managers should be alerted to such misuse of resources without victimization of whistle-blowers. It is preferable to have a system that enhances the protection of the identity of people who report about the misuse or theft of the resources. When whistle-blowers remain anonymous, it may not be easy for them to be targeted by the implicated officers.

Conclusion

Corporate financing is one of the most important roles of the top management unit in large companies. Financial resources are always needed for developmental projects and daily operational activities. Long-term corporate financing focuses on getting resources to fund capital projects that involve expansion of production or exploring new markets. On the other hand, short-term financing focuses on making available funds needed for operational activities such as salary and wages, and payment of short-term debts. Effective corporate financing helps in ensuring that resources are availed in a way that does not exert excess pressure on the firm, and neither should it reduce shareholder’s value. Internal sourcing of funds for various projects is always the best, but when necessary, a corporate entity can opt to borrow money from financial institutions, sell its shares in the security market, or sell company bond.

References

Bodmer, E. (2015). Corporate and project finance modeling: Theory and practice (2nd ed.). Hoboken, NJ: Wiley.

Chang, P. (2015). The ownership of the firm, corporate finance, and derivatives: Some critical thinking. New York, NY: Springer.

Graham, J., Smart, S., & Megginson, B. (2010). Corporate finance (3rd ed.). Mason, OH: Cengage Learning.

Hirota, S. (2015). Corporate finance and governance in stakeholder society: Beyond shareholder capitalism. New York, NY: Routledge.

Jacque, L. (2014). International corporate finance website: Value creation with currency derivatives in global capital markets. Hoboken, NY: John Wiley and Sons.

Kim, K., & Kim, K. (2015). Global corporate finance: A focused approach (2nd ed.). New York, NY: World Scientific.

Kimmel, P. (2012). Financial accounting: Tools for business decision making (6th ed.). Hoboken, NJ: John Wiley.

Pyles, M. (2014). Applied corporate finance: Questions, problems and making decisions in the real world. New York, NY: Springer.