Approaches Used

Kraft Foods Group has realized that the environment in Britain is quite different from its home environment. This is worsened by the fact that the local society did not approve of the acquisition. As a result of this, Kraft Foods was starting on a very challenging note. The firm had to find a way of dealing with this challenge (2006, p. 132). The management of this firm had to break down the problems in order to come up with the solution. The firm realized that the problem was not just with the external environment. There was a problem internally. When Kraft Foods acquired Cadbury, the employees of Cadbury were retained. All the systems of Cadbury remained, except the senior management unit. The overall management of Cadbury was changed to reflect that of Kraft Foods. The management of Kraft Foods realized that this was one of the challenges it was facing with its management.

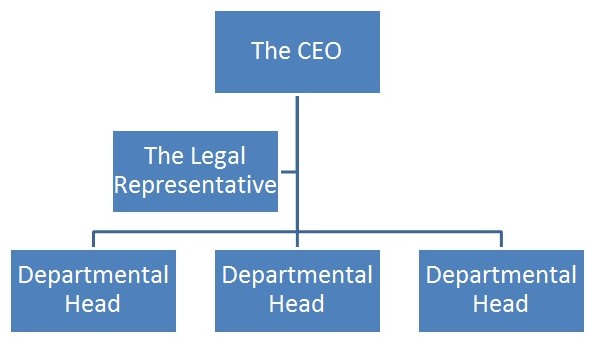

The organization therefore categorized the issues into two. The first was the internal problem that was emanating from the change of the management strategy. Kraft Foods realized that it had to come up with a different approach of management that would be acceptable locally. The management realized that the top managers, some of whom were from the parent firm, were not used to democratic management strategy (McLaughlin & Aaker 2010, p. 75). They preferred fixed management strategy where the top management issued instruction which flowed in the hierarchical order. The following diagram is a representation of the management strategy that this category of the employees preferred to use.

As shown in the diagram, the management structure does not support a situation where the top manager communicates directly to junior employees. The management will use the departmental heads to reach out for the employees (Merna & Al-Thani 2006, p. 87). Alternatively, the chief executive can also use a legal representative to communicate to the departmental heads. The communication is always given in the form of instruction.

This kind of management was very unique to the employees who were initially working for the Cadbury. They realized that the freedom they enjoyed was not in application any more. The diagram below is a representation of the kind of management strategy that the employees were used to.

As can be seen from the above diagram, the top management could easily reach out for the employee without following any hierarchy. This way, it was easy to consult them over various issues relating to the organization (McLaughlin & Kaluzny 2006, p. 48). Employees were also able to reach out to the management and share their thought about the strategies that the management was using. This was no longer possible. They had to follow a fixed management strategy, which entailed communicating to their immediate bosses. The problem with this strategy was that a communication from junior employees would reach the top management only if the mid management unit considers it worthwhile. In most of the occasions, it would be highly distorted by the time it reaches the desired destination. To help curb this problem, this firm decided to have a blend of both strategies (Misra 2008, p.118).

The employees would be allowed to communicate with the top management if they had issues they considered classified, or very important to the organization. The top management could also communicate with the employees directly, especially if it was urgent enough to warrant the same. In the normal operations, the management would issue instructions in a hierarchical manner. They would pass their message to the employees through the middle managers. The employees would also be allowed to communicate to the middle management as was necessary (Liew 2009, p. 121). This mixed strategy was important as it would accommodate both the employees who were former employees of Cadbury, and top management who were transferred from the main office to this facility in The United Kingdom.

The second problem was with the external environment. The external environment was very critical of the decision of acquiring the firm. This move was opposed even by the government. The best way that this could be approached would be to make the society feel that Cadbury was still in existence in the local market. This would involve retaining the name Cadbury. By retaining this name, the local society would be made to believe that the original Cadbury was still in existence (Kotter & Rathgeber 2006, p. 89). The management would achieve this by ensuring that the brand Cadbury is made a sub-brand of the main brand. The management would try to avoid a scenario where the local community rebels against its products. Instead of promoting the main brand, the firm would promote most of its products through the brand Cadbury. To help popularize Kraft Foods, the management has considered active involvement in various corporate social responsibilities within this country. One of the leading activities that this firm has actively participated on is environmental conservation. This has given this firm a positive image in the society. The firm hopes that this strategy will make the brand Kraft Foods acceptable locally.

In essence, the management used the cognitive theory in addressing this problem. The management realized that the problem was in the mind of the people concerned, and not the structures (Kotter 2007, p. 99). Taking this into consideration, the management decided to get into the minds of the society members and transform it in a way that it would accept the brand. The focus of problem solving therefore, was based on attention, and memory. The society’s attention would be drawn to the positive activities that this firm will be doing. Then the firm would do this repeatedly in order to create a permanent memory of the brand in the minds of the market. This cognitive approach was appropriate because the problem was in the minds of the target group.

Achievements

Success is always measured from many fronts. This firm has had some degree of success in various fronts. Taking the two approaches that was used, it is a fact that this firm has managed to harmonize its internal environment (Hoyle 2009, p. 28). When it started operation, the top management was visible out of control of the employees. There was a serious mismatch between the strategies that the top management had from what the employees preferred. The top management found it strange that a junior employee would walk into his office and express himself, or seek clarification. The junior employees also found it strange that the top management were no longer directly accessible to them. However, the decision to merge the two strategies has been of great success. The management knows that there are cases when the employees would need to have direct communication with them (Mohibullah 2006, p. 68). The employees also believe that there are cases where it is appropriate to follow the well laid communication hierarchy when communicating to their seniors. All the members of this fraternity have come to appreciate that everyone has a role to play within the organization (Hill & Jones 2010, p. 93). The firm currently has a group of dedicated and self-motivated employees who work together in order to achieve a common goal for the firm.

The strategy to promote the sub-brand, Cadbury was very beneficial. The society gladly welcomes the products that had this brand. This ensured that the operation of this firm was sustainable (Hicks 2004, p. 70). Moreover, the brand Cadbury was already known locally and the market did not need a lot of convincing to buy the products. Kraft Food took this goodwill from the market to promote some of the products that were not common in this market. The firm has also managed to counter the challenges posed by the external environment. The firm has gained a niche in environmental conservation effort. It is one of the firms that the community associates with environmental conservation. The move by this firm to engage in various other corporate social responsibilities has created some soft sports for the firm in this community. The society is slowly accepting this firm as part of them. The fact that the brand is concerned of the well-being of the society makes it part of the society itself. Through this, the management knows that the market will accept this product in the market (Heldman & Baca 2007, p. 39). The decision to blend bureaucratic strategy and pluralistic model has had a massive benefit for this firm.

Critical Appraisal of the Approaches Used

The approach used by this firm was appropriate enough to make this firm sustainable in the local environment. In order to have a critical analysis, it would be appropriate to look at two cases where such mergers were complete success or total failure.

Case Study 1: Daimler Chrysler Merger

Daimler is a German car manufacturer known for its prestigious cars like Mercedes Benz. Chrysler on the other hand, is an American car manufacturer which also specialized in prestigious cars, but some of its products were targeted at the middle class customers (Hartman 2002, p. 115). In 1998, the two firms entered into a partnership which they dubbed as the Merger of the Equals. It was believed that the two companies were known for their prestigious cars. Daimler was attracted to this move as it was the easiest way to enter the American markets. Although Daimler was already having a substantial market share in the US, the move to partner with Chrysler was considered very brilliant. Chrysler on the other hand, admired the niche that Daimler had created for its products. This company had created a special niche for its Mercedes Benz where no brand could offer it any serious competition. In the home market, the brand Mercedes Benz was very popular with senior government officials, the wealthy businessmen and other people who considered having prestigious car (Evans & Lindsay 2008, p. 32). A merger will make the two firms share the special niche in the market.

This was the main mistake of this merger. After a short stay in the merger, Daimler acquired Chrysler. It maintained the brand name, Chrysler in the American markets and other regions that it considered were loyal to Chrysler. Problem started in Germany. The local market in Germany refused to accept the fact that Chrysler was as prestigious as Daimler. They considered Daimler as the only part of the entire firm that could offer them the desired quality in a car. The corporate culture clash was another reason why this merger was not very successful. The market therefore boycotted Chrysler products (Dahlgaard & Dahlgaard 2006, p. 72). The value for Chrysler started dropping at an unexpected rate. It was clear to the management that this acquisition was bound to fail. It was clear that Chrysler was having injurious effect on the brand Daimler, instead of the expected benefits. The market developed a notion that Daimler would compromise its products for the sake of developing Chrysler. The management had to act before it was too late. It declared the acquisition a total failure, and subsequently disposed Chrysler at a value less than 10 percent, the value it purchased it at.

Case Study 2: Exxon and Mobil Merger

Exxon and Mobil merger is one of the best success merger stories in the corporate world. Exxon and Mobil merged on 30th November, 1999 to form ExxonMobil (Wilson 2008, p. 116). The two giant firms realized that they faced the same opportunities and threats in the market. They also realized that they shared the same vision. The management therefore considered coming up with a firm that would be able to meet the demands of the market in the best way possible. They decided to share their resources in meeting the market demands. The management of the two firms therefore, signed a deal that resulted in the formation of the two firms. The headquarters were moved to Irving, Texas.

This had a positive impact in the operation of the two firms that were now operating as one. The two American firms found out that it was much easier to face problems as a combined force, than when they have to face them as separate entities. The market share increased as the firms combined efforts to capture more markets in Europe and North America. The firm also moved with speed to capture the emerging markets in South America, Asia and Africa. Currently, this firm is rated as the largest oil company in the world, having about 3 percent of the total market share. The firm was ranked as the largest company in the world, by Forbes. The future of this firm is very bright, and as Dahlgaard (2007, p.119) notes, the merger turned out to be exactly what the managements of the two firms had predicted.

Critical Appraisal of the Strategy used by Kraft Foods to Acquire Cadbury

In order to critically appraise the strategy used by Kraft Foods, it would be appropriate to analyze the strategies used in the above two cases, and determine why one was a failure and the other, a success.

The two cases share a number of similarities and differences. They both share the fact that the merger was bringing together large firms that had global outlook. In the two cases, all the firms involved were making attractive profits, and therefore there was need to share the costs associated with production, and eliminate competition in order to achieve a common goal. The merger, in both cases, aimed at capturing more market share for the merging firms (Dahlgaard, Kristensen, & Kanji 2006, p. 62). The two cases also had some differences. While the merger between Daimler and Chrysler brought together firms from two different countries, Exxon and Mobil were both American firms. The management strategy between Daimler and Chrysler deferred, while Exxon and Mobil shared a lot in common in terms of management. The merger between Exxon and Mobil did not face the challenge of a different business environment as the merger between Daimler and Chrysler. These are some of the obvious differences that existed between the two mergers.

Kraft Foods Strategy

It is important to note that Kraft Foods must come out strongly and improve its strategies if this merger is to have the local success that was expected. As was stated in the introduction of this paper, the acquisition faced opposition from a number of bodies within the United Kingdom. The first opposition was from the government which was not comfortable with the acquisition of the Cadbury (Chao 2007, p. 79). The society in general was also in opposition of this decision. The last and worst problem was the mismatch of the employees of Kraft Foods and that of Cadbury. This is the same trend that the merger between Daimler and Chrysler followed. It may be worse in the acquisition between Daimler and Chrysler because the locals feel that their firm has been taken away (Rayment 2001. P. 25). This is an extra challenge that Daimler did not face.

Leadership strategies used by Kraft Foods

The management of this firm has realized that it faces serious challenges that may make it very unproductive in this market. Appreciating the failure of the merger between Daimler and Chrysler, the management has come to appreciate the difference that exists in the working environment of the two firms. The fact that employees of Cadbury realized that the leadership at Kraft Foods was rather strange was enough to make this firm realize that a change of strategy was necessary (Charantimath 2007, p. 49). ExxonMobil was a huge success because the employees from the two firms were comfortable absorbed into the new larger firms without any issues of serious change of strategy. The management’s decision to blend the two strategies was therefore very timely. This was particularly so because the two sets of employees were used to different strategies of operations within the local market. Both sides had to be considered because they had to be brought together under the same leadership.

The management decided to liberalize their management approach. The management unit allowed for a strategy that would make the employees feel honoured, irrespective of their position in the firm.

The problem solving technique was changed from management-cantered approach, to all members approach strategy. Every member of the organization was made part of a wider scheme to solve all the problems of the organization (Naagarazan & Arivalagar 2005, p. 134). The management therefore adopted a decision-making technique that would reflect on the newly adopted problem solving technique. The management decided to incorporate the entire staff and all other relevant stakeholders in the decision making process. The management came up with a procedure where any member of the organization would approach the management with their proposal of how to handle a particular problem. The restriction that was initially put was eliminated and everyone was given opportunity to make this firm a better firm (Belton & Stewart 2002, p. 56). This is one of the strategies that can ensure that this firm succeeds in the market, given the fact that there were resistance from some employees of the management strategy; this strategy would make this firm succeed in the previously volatile market. The workforce will be able to work as a unit, and their focus will be on how to make the firm achieve its goals using the least effort possible (Proctor 2010, p. 17). The management used this combined approach of managing the workforce to convince the internal society that the organization is very keen on satisfying their needs in the best way possible.

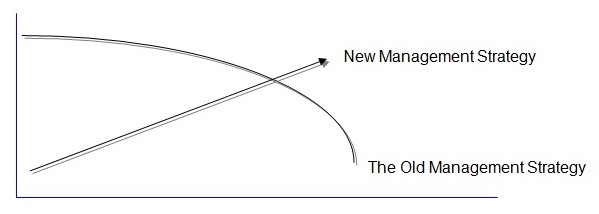

This strategy could be improved to make this firm more successful. The firm should have considered retaining Cadbury structure within the United Kingdom. The local workforce was used to the structure of Cadbury (Beecroft & Duffy 2003, p. 13). The management structure would have been changed gradually after a specified period. This would allow the employees to understand the need to have a change in the management structure. The following diagram shows a model of how the firm should have managed the local workforce.

The Approach in Bringing in New Management Strategies in the New Firm

From the diagram above, it can be seen that the firm should first start by using the strategies that the locals were used to, before the acquisition. The management should then introduce changes gradually within the firm. It will eliminate some of the practices it considers undesirable, and in their places, introduce desirable strategies that has worked for it in other markets. The employees would not find a lot of challenge adapting to these new changes.

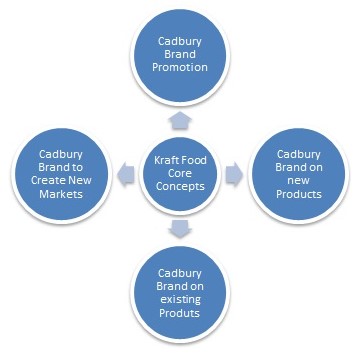

The approach it took in corporate social management was also very appropriate. Trying to engage the public in environmental conservation was not only an appropriate strategy to develop a positive name, but also to make the society feel that it one part of them (Bissoondoyal 2006, p. 34). However, this firm could come up with a strategy that would make the acquisition easier. The market is very comfortable with the brand name Cadbury. This society has come to consider this brand part of them. They feel that they own this brand, and as such, they are willing to defend it from any possible harm. This loyalty is very rare. The management of Kraft food should therefore try to make the most out of this. It should promote most of its products in this country using the brand Cadbury. This is because the market has a serious attachment with this brand, and eliminating it from the market may be a big blow to Kraft foods. Not only will Kraft Foods lose loyal customers of Cadbury, but it may also face rebellion in the market (Adair 2010, p.112). The market can boycott its products as a sign of their displeasure with it. The following diagram shows the strategy that would be appropriate for this firm in this market.

Approach in Managing the Brand Name

As shown in the diagram above, Kraft Foods should consider developing Cadbury brand even further in the local market. The British market cherishes Cadbury, and therefore the management of Kraft Food should take this advantage to introduce new products in the market, or acquire new markets within the local environment.

Implementation

This firm stands to benefit a lot by putting into application the above recommendations. It will have a workforce that is motivated and determined to achieve its objectives. The society will also not realize that Cadbury has been acquired by this firm. In order to ensure that the above recommendations are implemented, the following factors will be taken into consideration.

The management should have a strategic plan on how it plans to implement various policies within its system. The strategic plan should include how the employees of Cadbury will be absorbed into the new system. It should reflect on the fact that the employees of Cadbury are not used to the strategy that this firm was using before adopting this strategy. One of the best ways to do this is to include former senior management officers of Cadbury into this new system (Pfeifer 2002, p. 73). By retaining these senior managers, it will be easier for the employees to relate to them as they use to, before the acquisition. Such managers will also be better placed to understand the behaviour of the employees. Such officers will make a very good link between the top management of Kraft Foods back at the head office, and the employees. They would easily communicate with the top management and help them have an understanding of the local workforce.

The corporate strategy of trying to retain the brand name Cadbury in the local market should be implemented. The management must be made to understand that this is the only way of gaining popularity within this country. Already the firm has lost its favour before the government and various other organizations. By eliminating the brand name Cadbury, these organizations will develop further hatred towards the firm. As such, management must come to realize that it has a duty of ensuring that it remains relevant. It must use what is popular in the local market.

References

Adair, J 2010, Decision making and problem solving strategies, Kogan Page Publishers, Washington.

Bissoondoyal, U 2006, Total quality management: a practical approach, New Age International, London.

Beecroft, G.D & Duffy, G 2003, The executive guide to improvement and change, ASQ Quality Press, New York.

Belton, V & Stewart, T 2002, Multiple criteria decision analysis: an integrated approach, Kluwer Academic Publishers, Boston.

Charantimath, C 2007, Total quality management, Pearson Education, India.

Chao, S 2007, Advancing quality improvement research: challenges, opportunities-workshop summary, National Academies Press, Washington.

Dahlgaard, J, Kristensen, K & Kanji, G 2006, Fundamentals of total quality management: a process analysis and improvement, Routledge, London.

Dahlgaard, J 2007, The 4P quality strategy for breakthrough and sustainable development, European Quality, vol. 10, issue, 4, pp. 6-19.

Dahlgaard, J & Dahlgaard, S 2006, Lean production, six sigma quality, TQM and company culture, The TQM Magazine, vol. 18, no. 3, pp. 263- 281.

Evans, J & Lindsay, W 2008, The management and control of quality, Thompson South Western, New York.

Hartman, M 2002, Fundamental concepts of quality improvement, ASQ, New York. Heldman, K & Baca, C 2007, PMP project management professional example study Guide, John Wiley and Sons, New York.

Hicks, M 2004, Problem solving and decision making: Hard, soft and creative approaches, Thomson Learning, London.

Hill, C & Jones, G 2010, Strategic management theory: an integrated approach, Houghton Mifflin, Boston, MA.

Hoyle, D 2009, ISO 9000 quality systems handbook. updated for the ISO 9001:2008

standard: Using the standards as a framework for business improvement, Butterworth-Heinemann, London. Springer, New York.

Kotter, J 2007, Leading change: why transformations effort fail, Harvard Business Press, vol. 3, pp. 96-103.

Kotter, J & Rathgeber, H 2006, Our iceberg is melting: changing and succeeding under any condition, St. Martin Press, Chicago.

Liew, J 2009, Employee training: a study of education and training department in various corporations, General Books, Sydney.

McLaughlin, C & Kaluzny, A 2006, Continuous quality improvement in health care, Jone and Bartlett Learning, Oxford.

McLaughlin, D & Aaker, D 2010, Strategic market management: global perspective, Wiley, Chichester.

Mercer, J 2006, The impact of culture on M&A: doing something about it, Mercer Transatlantic Survey, New York.

Merna, T & Al-Thani, F 2006, Corporate risk management, Wiley, New York.

Misra, K 2008, Handbook of performability engineering, Springer, London.

Mohibullah, N 2006, Impact of culture on mergers and acquisitions: a theoretical framework, John Wiley and Sons, New York.

Naagarazan, R & Arivalagar, A 2005, Total quality management, New Age International, New Delhi.

Oakland, J 2003, Total quality management: text with cases, Butterworth-Heinemann Ltd, London.

Pablo, A & Javidan, M 2004. Mergers and acquisitions: creating integrative knowledge, Wiley-Blackwell, New York.

Pfeifer, T 2002, Quality management, Hanser Verlag, London.

Proctor, T 2010, Creative problem solving for managers: developing skills for decision making and innovation, Routledge, Washington.

Rayment, J 2001, Mind morphing: decision making using logic and magic, Earlybrave Publications, London.

Wilson, A 2008, The main components of quality management, Article Alley, Chicago.