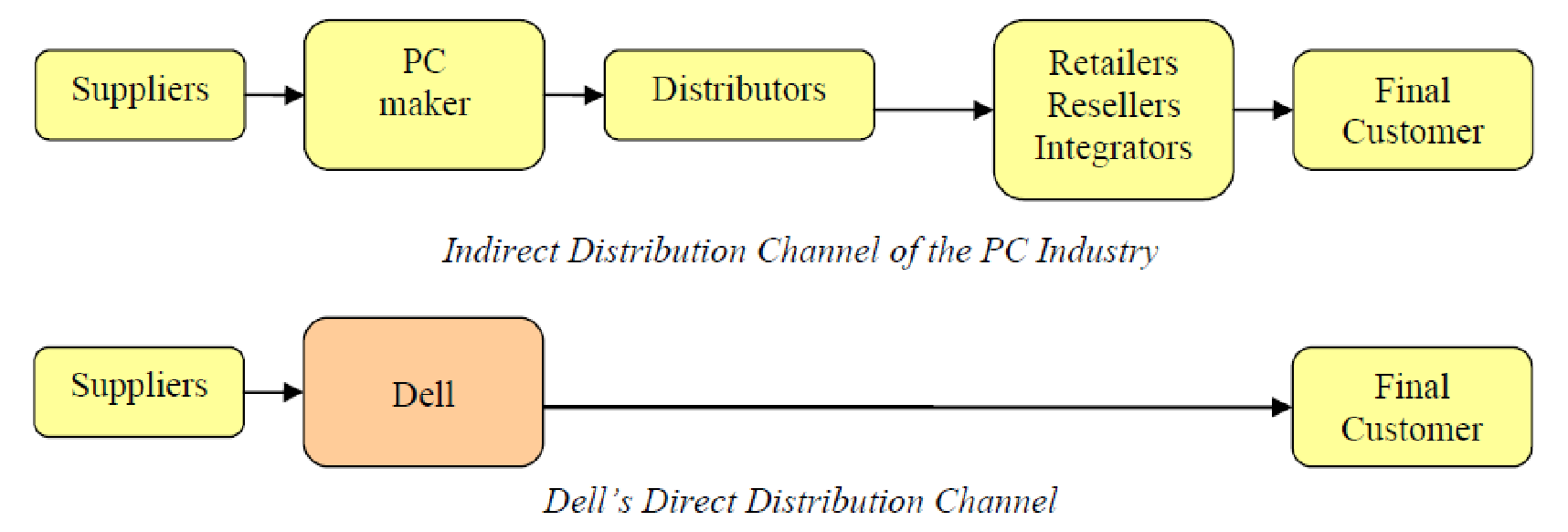

Dell Inc. was founded by Michael Dell in 1984 based on the direct sales and build to order model focusing on providing customized computers to the customers at low prices. The model was an instant hit which had no retailers or wholesalers in the supply chain as Dell sold directly to customers by taking orders on telephone and online. This allowed Dell to better understand the customer requirements. Also, Dell had a very strong relationship with the suppliers. Dell partners with its suppliers on producing high quality components for its computers which it only purchases instead of manufacturing.

Dell keeps almost zero inventory as it has transferred this burden to its suppliers by forcing them to maintain inventories near their plants so that they can be acquired on extremely short notices. This strategy paid rich dividends for Dell until recently. The competitors adopted many of Dell’s strategies to narrow the gap. Dell also had to face a few supply chain and cost related problems following decreasing prices of components leading to diminishing advantage of a direct sales model. In fact, in some cases it led to higher costs. Now, Dell plans to restructure by bringing change to its supply chain structure which has lost its advantage. Dell plans to turn to contract manufacturing and building plants in the developing world to reduce cost. Apart from all this, Dell should spend more on R&D and think about running a hybrid supply chain system where they are able to cater to both standard and customized computer markets.

Introduction

Dell Inc. was established in 1984 by Michael Dell in his dorm room at University of Texas, Austin (Fredman, 1999). He started selling computers with the idea that by selling directly to consumers, he would be better able to understand the needs and requirements of his customers. He was so focused on his idea that he dropped out of school to concentrate on his newly found business with financial support from his family.

The company directly advertised to the customers, offering them lower rates than what the retailers did and offered computers customized to the need of the people. Dell’s company was certainly not the first one to use this model, but it was one of the first to succeed with the idea. The company registered sales of $73 million in its first year (Koehn, 2001). Today, Dell is a multinational corporation selling desktops, laptops, printers and network technology worldwide. The company is still based in Texas but today it employs around 76,500 people worldwide (SEC, 2008).

Dell is known to have sold its products based on a direct sales model. The order is received from the customer through the telephone or Dell’s website. Once the order has been received, the order is processed for credit checking and feasibility of technical configuration evaluations. This process takes two to three days after which the order is sent to the assembly plant at Austin, TX. The estimated time to build, test and pack a product is 8 hours. However, dell may alter the schedule subject to availability of parts or special orders.

The order is shipped to the customer within 5 days of order placement. The time to procure parts from the supplier is significantly more than the time allowed to ship an order. To make up for such high lead times, Dell requires its suppliers to keep inventory ‘on hand’ in Austin revolvers (or Supplier Logistic Centres). These are located near Dell’s assembly plants and are shared by several suppliers who pay rent for using it. The inventory is still owned by the suppliers and payment is only made to the suppliers once they have reached the plant for use.

The most impressive thing about the Dell business model is that it is paid by the customers before it has to pay the suppliers for the material (Moltzen, 2008).

As part of the system, Dell uses a pull approach for purchasing and shipping inventory. According to this approach, computers are only manufactured if an order has been placed by a customer, and raw material is only received at the manufacturing or assembling facility when they are needed. This model has been further refined by the efficient use of the internet for receiving orders and contacting suppliers.

Dell’s supply chain is dynamic and there is a constant flow of inventory, material, information and funds between the stages. For example, the customer submits his/her order through Dell’s website. Once the order has been received, only then does the assembly of the customized machine start. Dell purchases most of the parts from its vendors instead of manufacturing them at their facility (Chopra & Meindl, 2009)

According to Sunil Chopra in his book Supply Chain Management, “The primary purpose from the existence of any supply chain is to satisfy customer needs, in the process generating profits for itself. Supply chain activities begin with a customer order and end when a satisfied customer has paid for his or her purchase” (Chopra & Meindl, 2004). This is the sole reason why the downstream supply chain in Dell’s model is so short and direct.

Dell Strategy

Customer Focused

The strategy to focus on direct channels helps Dell in avoiding issues generally faced by competitors who try to use both direct and indirect channels. They only end up driving up the costs, dual structures and confused channel partners (Koehn, 2001).

Adaptability

Dell has adapted well to the changing business environment by taking maximum advantage of the web. using the internet, they have managed to strengthen their working relationships with the suppliers, and provide a more interactive and fast channel for the customers to place orders. Dell receives more than 50% of its orders online. (Bank of America Securities, 2001)

Component Price Advantage

Dell uses a build-to-order strategy based on a JIT system. According to it, Dell only maintains an inventory required for two weeks. The inventory is kept at Dell’s Supplier Logistic Centers which are situated close to the plants. Dell’s contracts with the suppliers do not require them to buy more than this inventory. Furthermore, the price of the inventory is not finalized until they have reached Dell’s loading dock(Kumar & Tewary, 2007).

This strategy allows Dell to take immediate advantage of decreasing prices, incorporate new technology faster than the competitors, minimize risk of obsolescence and also alter the prices of its products immediately; as there is not inventory in the retail channel.

Low R&D costs

The R&D cost is borne by the suppliers. This is because Dell only incorporates industry standard technology in its products and can change suppliers if it does not get the required parts. Its R&D is only 1.5% of the revenues (Bank of America Securities, 2001).

Advantages of Dell’s Supply Chain structure

The advantage of direct relationships is the access to crucial information about the customer. Information that is available to Dell is usually like who are the end users, what exactly did they buy from Dell and what are their preferences when making a purchase. This allows Dell to provide the customers exactly what they are looking for and, hence, improving customer satisfaction (Kraemer& Deddrick, 2001). This direct relationship with the customers leads to an upgrade to virtual integration, in the case of large customers. Dell’s valuable customers work as partners instead of transactional customers. As Michael Dell puts it “Dell is not going to be just their PC vendor anymore, but their IT department for PCs.” (Magretta, 1998).

The two unique tools that bridge the gap between Dell and its customers are Premier pages and Platinum councils. Premier pages are specially customized IT support sites for large clients who manage their purchases themselves (MIT Process Handbook). Platinum councils, on the other hand, are groups comprising of Dell’s largest customers, salespeople and technicians who meet regularly to discuss their experience, needs and future expectations(Dell Community, 2009).

The use of build-to-order and JIT systems also brings many advantages to Dell’s supply chain model. The small inventory level leads to low inventory costs and opportunity to respond faster to changing demands. For example, if a new microprocessor is released in the market, Dell can immediately incorporate it into its computers as it does not have to wait to exhaust its current inventory.

Also, since the customers pay before the order is processed, the suppliers are also not paid until. This leads to a negative cash flow cycle which highly uncommon in the business world. This means that Dell has to face fewer cash management problems. (Kraemer, Deddrick, 2001) Another advantage is that its inventory is not wasted because of not meeting customer requirements. Dell only builds what customers want. Another new concept that Dell has pioneered through its present supply chain structure is of inventory velocity. Dell expects its suppliers to deliver inventory at extremely short notices, in small numbers and right on time (Cutting-Decelle et al, 2006).

The concept of cross docking is very much applicable at Dell. A lot of components of the computer, such as monitors, are ordered from the suppliers and directly shipped to the customers. Dell does not even perform quality testing on the monitors which are shipped to its customers. The reason is that they have outsourced this task to the suppliers. The suppliers are responsible for quality control and making sure that a high quality product is supplied to Dell (Holzner, 2005). According to Steven Holzner, after working hard with its supplier, Dell is so sure of the quality being provided by them that it does not bother about quality of the products purchased from the suppliers (Holzner, 2005).

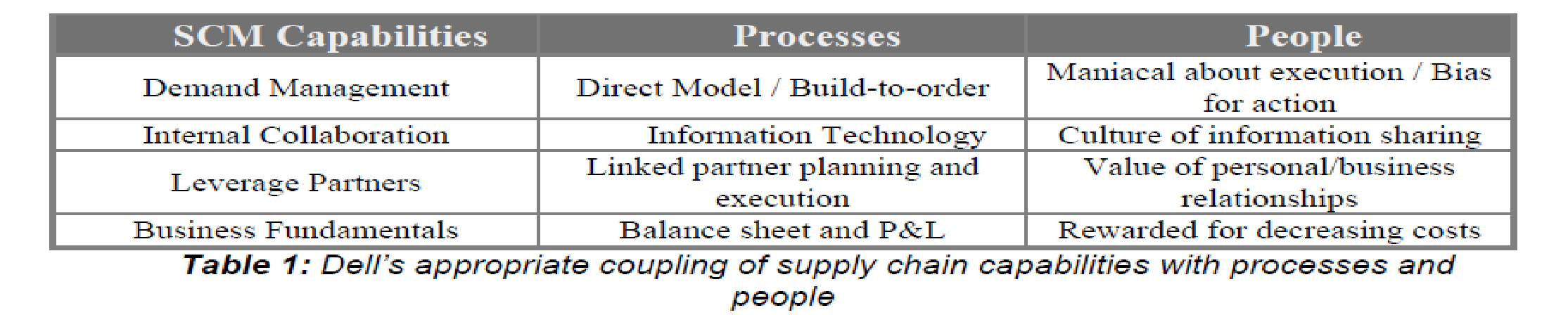

Even though several other companies have tried to imitate Dell’s model, they have failed to do so. Not that they have failed to understand the model, it is the fact that they have failed to execute the supply chain model that Dell has pioneered and mastered over the decade. The question that arises is that why have the others not been able to imitate the model? Fugate et al. answers this question. According to them, the secret behind Dell’s success is the right combination of process and people elements (Fugate & Mentzer, 2004). He refers to the following two statements made by Michael Dell: “Our R&D focuses on process and quality improvements in manufacturing” and that “one of our biggest challenges is finding managers who can share and respond to rapid shifts” (Magretta, 1998)

Dell is a very tough negotiator when it comes to negotiating with suppliers. It keeps putting pressure on the suppliers to improve their business processes, cut down on lead time and especially improve quality. The suppliers know that if they are not up to Dell’s standard, they will be replaced (Holzner, 2005).

Since Dell does not hold inventory worth more than a week and expects its suppliers to supply on extremely short notices, the suppliers are forced to stock up the inventory in order to avoid situations where they run out of stock to supply to Dell, risking to lose their supplier status. As part of improving their own business processes, Dell’s suppliers have also tried to adopt zero inventory model by shifting the responsibility on ‘their own’ suppliers. But many have failed to do so (Holzner, 2005).

Issues

Despite unprecedented successes and praise for its supply chain over the past two decades, Dell has faced several problems with its supply chain over the past few years.

Dell’s problems intensified when they faced forecasting problems following economic changes and overestimated demand for its computers. Financial problems have also not helped matters (SC Digest, 2006). But the main reason is that the gap between Dell and its competitors has significantly narrowed. The competitors such as IBM and HP have managed to build strong supply chains which have challenged the leadership of Dell. Also, the decreasing prices of finished units and individual components have reduced the advantages of the BTO model. Dell’s sales have also been hurt by lack of R&D and hardly any innovation in Dell’s range of product. All has led Del to think about revamping its supply chain system. Dell plans to make use of contract manufacturing for the first time (Gilmore, 2006).

According to Michael Cannon, the Dell Build to Order system worked wonders for them until now. But due to the change in environment, the company will have to accept the fact that the time for change has come. Dell is considering following its competitors supply chain models which were once considered out dated. Another problem is that the idea of offering customized computers with thousands of possible combinations based on a flexible supply chain actually turned out to be a costlier proposition in some cases. For example, the basic components for Dell computers were designed in such a way that they could be upgraded by using add-ons based on customers’ wishes. Therefore, these basic components costed higher. But when the customers ordered basic models without high end addons, Dell actually incurred losses on those models (Gilmore, 2008).

Recommendations

Dell has realized that it requires changes in its downstream supply chain. Dell plans to do away with the BTO model and offer limited options to customers when choosing a computer. What Dell should do is work on a hybrid model involving customized as well as standard computer models. Dell can allocate a share of its supply chain for customized computers at relatively high costs for customers who still prefer to remain loyal to Dell’s BTO model. For the more cost conscious customers, it can move to a standard supply chain which provides limited options of upgrade on standard PCs.

Dell also needs to realign its strategy on opening new factories in the developing markets. So far, Dell has not been able to take much advantage of the factories which it has set up in the developing world as the customization for the US customers seems to create problems. They need to focus on finding markets near the manufacturing plants and understand that these markets may not be as sophisticated to appreciate customization. Standardization will be the way to go for them.

Instead of diversifying to other electronic products, Dell should first focus on building a stronger and more stable supply chain before moving on. Dell’s competitive advantage is its supply chain and it cannot afford to lose that advantage. It also needs to invest more in R&D towards products and improving productivity of the supply chain. For this purpose, Dell should also consider manufacturing components itself when it moves towards standardization. It is important to realize that the changing world of technology requires constant innovation just as Apple has done. Finally Dell also needs to restructure its relationships with the suppliers and customers alike.

Dell has to regain its reputation with the customers which it has lost during the supply chain problems. It also needs to regain lost ground with the suppliers who have been put under a lot of pressure following the rapid business growth that Dell has experienced over the past two decades.

Conclusion

Despite all the problems that Dell has faced in the recent years, it still remains a giant in Supply Chain Management which changed the landscape of the discipline with its direct sales and build to order models. Dell kept surprising the world with its innovations in the business world which kept it one step ahead of its competitors. Now, maybe, Dell has run out of tricks. Its competitors are catching up fast by building upon Dell’s innovative strategies. The external business environment, such as the decrease in demand due to recession, hasn’t helped matters either. Dell has started the process of restructuring by hiring a new supply chain chief (SC Digest, 2007), return of Michael Dell as CEO (Dell, 2007) and the decision to overhaul its direct sales and build to order business models. Knowing Dell’s reputation, we can safely say that it will come back with a bang and, unsurprisingly, surprise us yet again.

Bibliography

- Anonymouse, n.d.

- Banc of America Securities, 2001, Dell Computer Corporation Direct- To the Bottom Line.

- Chopra, S. and Meindl P., 2004, Supply Chain Management. 2 ed. Upper Saddle River, Pearson Prentice Hall.

- Cutting-Decelle, A., Das, B., Young, R., Rahimifard, S., Anumba, C., Bouchlaghem, N., 2006, Building Supply Chain Communication Systems: A Review of Methods and Techniques, Data Science Journal.

- Dell, 2007, Michael Dell Assumes Duties as Chief Executive Officer of Dell Inc. Round Rock, Texas.

- Form 10-K. 2008. Dell Inc., United States Securities and Exchange Commission. Web.

- Fredman C., 1999. Direct from DELL. HarperCollins. pp. 13.

- Fugate, B. S., Mentzer, J. T., 2004, Dell’s Supply Chain DNA, Supply Chain Management Review, p.20-24.

- Gilmore D., 2006, Time for new supply chain icons, Supply Chain. Web.

- Gilmore D., 2008, The New Supply Chain Lessons from Dell, Supply Chain Digest. Web.

- Holzner S., 2005, How Dell Does it, McGraw hill.

- Koehn, Nancy F., 2001, Brand New: How Entrepreneurs Earned Consumers’ Trust from Wedgwood to Dell, Harvard Business Press, pp. 287.

- Kraemer, K., Deddrick, J., 2001. Dell Computer: Using E-commerce to Support the Virtual Company, Center for Research on Information Technology and Organizations, Globalization of I.T.

- Kumar S., Tewary A. K., 2007, Creating Supply Chain Flexibility in the flattening world, SetLab Briefings, Volume 5.

- Lee, H. L., Padmanabhan, V., Whang, S.,1997. The Bullwhip Effect in Supply Chain, Sloan Management Review Pp 93-102.

- Magretta, J., 1998. The power of virtual integration: An interview with Dell Computer’s Michael Dell, Harvard Business Review

- MIT Process Handbook, 2009.

- Moltzen, Ed, 2006, Dell’s cash conversion cycle gets one once over, twice.

- Suply chain digest Editorial, 2007, Supply Chain Digest.

- Supply Chain digest editorial, 2006, Supply Chain.