Introduction

Any company should retain a solid grasp on the market that it occupies, perfecting various strategies and tactics to remain relevant and profitable. The case of the General Electric (GE) Company continues to be a demonstrative example of the possible drawbacks of misaligned strategic development. Therefore, developing a plan based on the current state of events becomes plausible after a coherent strategic analysis is conducted; reviewing GE’s place in the market and ongoing business tactics.

Strategic Analysis

It may be difficult to understand the condition of a chosen company without the conduction of extensive strategic analysis. Recognizing the overall course of a company, such as GE, permits foreseeing its possible future as a business, preventing certain emergencies (Ansoff et al. 2019). Through an analysis of the strategies and goals of GE over the previous years, it may be possible to come to an understanding of the causes of the company’s business shortcomings.

Profile of the Industry, Sector, Competitors, Consumers, and Company

GE is a large multinational conglomerate with a presence in multiple markets, achieving profits from a wide variety of sources. The business segments are “aviation, healthcare, GE capital, home and business, power and water, oil and gas, energy management, and transportation,” with capital and industrial manufacturing being the most important products (Agarwal & Brem 2015, p. 203; General Electric CO GE 2019; Thompson 2017). Thus, due to its presence in a variety of sectors, GE also has several contenders for market-space, such as Siemens, 3M, and Hitachi, which are the company’s top three competitors (Bhasin 2019).

It is necessary to examine each industry that GE operates in to identify the market share size of this company. In aviation, which is one of the primary industries for GE, the company controlled about 32% of the market, while in the energy segment the estimation is 64,29% and in healthcare, GE accounts for 55,5% of the market (GE Sales vs. its Competitors Q4 2018 2018). In recent years, the company experienced issues with growth, which was below the predicted at 5,97% while most competitors showcased 13,92% on average (General Electric Co (GE.N) 2019).

In terms of market share history, GE experienced problems with growth and development that affect its revenue. The trends are emphasizing the innovative approaches and ecologically friendly products, which shape the current markets. Colvin (2018) argues that due to the adverse changes in demand, which began in 2001 within the airplane industry and continued within oil and gas fields, GE has been experiencing issues in retaining its market share. Thus, in terms of size, the demand has decreased while its shape changed due to new consumer preferences.

Organizational Purpose

The mission of this company is to be the leader of industrial development, which is reflected in the vision as well because GE states that it wants to be a leader in its primary market sectors. Thus, the major focus of GE is on developing new solutions and bringing innovation to its industries. Based on the amount of investment that GE makes in its research and development unit it can be concluded that the company adheres to its directional statements.

The ethical values of this organization are reflected in its commitment to value each person an idea. Besides, GE has a corporate social responsibility (CR) statement in which it describes its sustainability strategy, corporate citizenship programs, and community development projects. Ecological impact, which is an essential component of aviation and electronic industries is a concern for GE. ROCE of Siemens is 16.84%, which is significant growth from the 2010 ratio of 10,7% (Siemens n.d.). Current PBIT is 8,6%, while in 2010 it was estimated at 3,39%. Hitachi’s PBIT is 1,5%, ROCE, with 9,9% ROE in 2016, both rations have been increasing since 2013. Overall, the balance sheets of competitors are strong because they display a continuous growth over the past several years.

External and Internal Environment

The political component of the external environment that is significant to GE is a governmental support shift towards projects that develop renewable energy sources. The opportunity here is in the possibility to receive financial investment for new developments. The economic factors include the growth of the developing markets, which is an opportunity to establish GE in new countries and differentiate its revenue streams.

However, Colvin (2018) argues that within the developing economy, many rival companies emerge that can manufacture products similar to those of GE. Important social factors that present both a threat and an opportunity for GE is a trend towards green lifestyles.

Technological components include the popularisation of digital technology as an opportunity for GE to introduce its products to new consumers. However, a threat connected to a shifting consumer demand exists due to the need for adjusting operations towards the incorporation of mobile services (Kissinger 2017). Environmental factors are essential for GE because the company has developed a corporate social responsibility policy that targets these issues, which is an opportunity for focusing on renewable and recycled materials.

Legal factors include intellectual property laws that enable GE to protect its developments, which is an opportunity for ensuring that innovative approaches of GE cannot be copied. Besides, while the online market continues to grow, which is an opportunity, many governments begin to regulate online operations, which can be a threat.

The internal environment’s strengths include a long history of GE’s operations. The primary competitive advantage in the research and development that provides GE with an opportunity to introduce innovative products to its clients. The weaknesses include a declining revenue and profit margin that indicate issues within the company. Moreover, the company can exploit its intellectual property, as well as its well-established name as the primary intangible resource that can be considered valuable, rare, inimitable, and unsustainable (VRIN).

The threat of new entrants is low because GE is a large conglomerate that operates in diverse industries. The bargaining power of suppliers is also low because GE is capable of purchasing large volumes of supply for its manufacturing facilities. The bargaining power of buyers is medium because the company develops and manufactures products of high quality for appropriate prices (Colvin 2018). The threat of substitute products is high due to the trends in the industry that emphasize innovation and green lifestyle approaches.

Industry rivalry and competition is medium because GE competes with three companies that operate in similar fields and has a substantiate market share in most segments. Based on this analysis it can be concluded that the industry is highly concentrated and the competition is intense. However, the expansion is constrained by the need to adjust to the new demands of the market and financial difficulties that GE, thus, finance and production are the main issues.

Basis of Competition and Key Success Factors

GE competes in its market by investing in information technology and offering a good ratio of price and quality for its customers, which is the primary operational strategy of the company. Agrawal (2015, p. 200) states that GE aims to “add value on top” as part of its strategic planning. It is the necessary key success factor (KSF) for GE because it needs to offer more value to its customers through additional services and support. Within the industries that GE operates in, when choosing between competitors customers rely on factors such as brand, cost, perceived reliability, and additional services, which are other KSF that GE should consider.

Strategic Development

Currently, the primary business streams are industrial developments and capital. Table 1 and Table 2 present matrixes for both product lines that explain the strategic direction of GE. The current strategy of GE is to provide additional value that would ensure competitive advantage and focus on emerging markets to ensure growth (Kellner 2018). Today, the firm completes this strategy by developing new objectives for its products and services. The strategic goals of GE include expanding the market share in primary industries such as aviation, oil and gas, transportation, and electricity.

Table 1. GE’s Strategic Direction Matrix for industrial manufacturing (created by the author).

Table 2. GE’s Strategic Direction Matrix for capital (created by the author).

On the corporate level, GE decided to change its strategic direction and focus solely on the two business streams that were described. Instead of adding new business lines, GE chose to sell its healthcare companies (Our strategy n.d.). The existing streams complement each other because they allow GE to invest in companies that work on innovative products that can be used by GE in the future.

Generation of Strategic Options

GE can increase its ROCE by either increasing its current operational profit or by reducing the value of the employed capital. The feasible strategic option that is available to GE is to reduce costs associated with manufacturing (Grant 2016; Hill, Jones & Schilling 2015). Additionally, GE must invest in the emerging markets, instead of focusing on the existing market’s share, which can help improve revenue. Within the industries that GE operates in, differentiation is not a valid option because it requires additional financial investments and can be copied by competitors. However, the third strategic option is offering innovative products that would help increase market share for GE.

Evaluation and Ranking of Options

Table 3. BCG matrix (created by the author).

The first option’s costs are estimated at zero because GE would illuminate unnecessary spending, which would help improve the balance sheet’s ratio, while the risk is that GE will be unable to operate efficiently over the next five years. The second option, which is an investment in emerging markets requires substantial financial support; thus, costs will be high and timing for implementation would take several years.

However, by establishing itself in these markets, GE will be able to earn significant profits, which is the main benefit. The downside of this option is that GE will have to maintain operations within these countries for several years before receiving significant profit. The third option involves significant financial investment as well, while benefits will depend on the demand for new products, which is the primary risk.

Table 3 provides an evaluation of the DSG matrix and existing products of GE. On the corporate level, the company already sold its healthcare establishment. Additionally, focusing on market business streams that use renewable sources is necessary by acquiring new manufacturing technology, especially in countries such as China and India, which will help create a range of diversified products with enhanced efficiency. Based on this information, the strategy of investment in developing economies is recommended to GE for the following five years. It is because in this way GE will be able to establish itself as a reliable manufacturer in growing economies, resulting in significant market share and profit.

Implementation

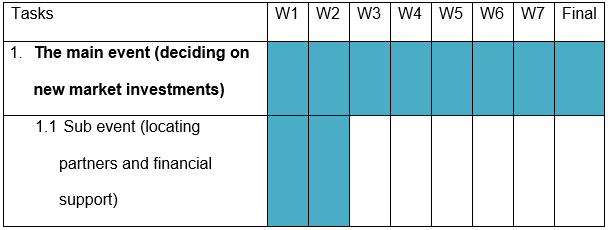

The initial implementation issue with this strategy is locating investments and partners in the developing economies and establishing branches there. Besides, GE should identify whether it should focus on selling or manufacturing its products in these markets. Thus, the key milestones are identifying markets and types of operations, obtaining financials, and establishing new companies. GE should ensure that it has enough investment to enable the work of new organizations for several years, which would help control the primary risks. Table 4 provides an assessment of the timeframe for this strategy.

Conclusion

Overall, GE is a well-established brand that operates in different markets and focuses on industrial manufacturing, capital investments, and healthcare. Over the last several years, the company experiences issues with growth and market share decrease, which continued to decline throughout 2018. GE should focus on innovation and ecological approaches in its new strategies to achieve competitive advantage and on expanding its operations to the emerging markets.

Reference List

Agarwal, N & Brem, A. 2015. ‘Strategic business transformation thought technology convergence: implications from General Electric’s industrial internet initiative’. International Journal of Technology Management, vol. 67, no. 2/3/4, pp. 196-214. Web.

Ansoff, HI, Kipley, D, Lewis, AO, Helm-Stevens, R & Ansoff, R. 2019. Implanting strategic management, 3rd edn, Palgrave Macmillan, Cham, Switzerland.

Bhasin, H 2019. Top 12 GE competitors. Web.

Colvin, G 2018. What the hell happened at GE?. Web.

General Electric CO GE. 2019. Web.

General Electric Co (GE.N). 2019. Web.

GE Sales vs. its Competitors Q4 2018. 2018. Web.

Grant, RM. 2016. Contemporary strategy analysis: text and cases, 9th edn, Wiley, Chichester, United Kingdom.

Hill, CWL, Jones, GR & Schilling, MA. 2015. Strategic management: theory and cases: an integrated approach, Cengage Learning, Stamford, CT.

Kellner, T. 2018. GE, the next chapter: GE CEO lays out plans for the future of the company. Web.

Kissinger, D. 2017. General Electric (GE) PESTEL/PESTLE analysis & recommendations. Web.

Our strategy. n.d. Web.

Siemens. n.d. Web.

Thompson, A. 2017. General electric’s (GE) generic strategy & intensive growth strategies. Web.