Introduction

Technological advancement and continued innovation have significantly influenced human social interaction through the conception and growth of several industries in the world. In the face of this claim, in 1976 Steve Jobs and Stephen Wozniak founded Apple with the primary objective of improving human experiences. The first target customer for the primitive computer was the Silicon Valley computer enthusiasts. Apple’s mission to drive and lead technological advancement led to the invention of more user-friendly computers and expansion of its product line. The company’s objective is to enhance and revolutionize technology through innovation and inspiration to offer high-quality products and improve human experiences.

Apple has grown its market share in the United States and the global market despite stiff competition from local and global rival companies. The strategies enhancing its market growth include product differentiation, industry diversification, and leadership in innovation with a customer-centric approach. Despite the milestone achievements, the company still faces several challenges in its business activities, chief among them being stiff market competition and the declining mature PC market.

Strategic Issue

Apple’s strategic plan is to lead in technological innovation and lift user experience through the adoption of broad differentiation strategies in the global market. The steps include industry diversification and discontinuing non-revenue generating investments. The adoption of broad differentiation strategies has enhanced the company’s global market share penetration. The company continues to expand its global market penetration by diversifying its products in the Media player and smartphone industry, expanding distribution outlets in foreign countries, and adopting collaboration strategies.

However, Apple faces global market challenges due to strong brands of rival competitors, new entry by strong global market players in the Smartphone industry, and the presence of low-cost focused market players. The shifting consumer demands to mobile technology, the presence of counterfeit products, and the mature PC market pose an additional challenge to the company’s business activities. The dynamic customer needs in the global market for products with compatible capabilities is an additional problem hindering the expansion of the Apple market. Hence, the strategic issue for Apple is, “What technological alignments and innovations should the company take to enhance its competitive advantage?”

External Environment

The external environment refers to conditions and factors that influence business existence and activities in a given market segment. An analysis of Apple’s external environment provides knowledge on its potential to sustain its business activities both in the local and global markets. The analysis of the external environment involves exploring macro-environment factors, use of Porter’s five forces, identification of key success factors, and defining of industry attractiveness and its profile.

Macro-Environment

The macro-environment factors include social-cultural factors, economic conditions, political factors, legal factors, technological factors, and environmental factors. The shrinking of the world into a small community through technological innovation and improvement positively influences the industry’s socio-cultural environment. Additionally, the advancement in education, business activities, and changes in the individual’s social needs and leisure activities drive the dynamic needs of the global population.

Literature shows that, in the past, “consumers increasingly canceled traditional cable services and began consuming TV and movie content through streaming services” (Gamble & Varlaro, 2016, p. 277). Thus, the changes in social needs due to advancement in the social status and technological innovation promote the attractiveness of the industry.

The global market political conditions significantly influence the economic stability and expansion opportunities of a market segment. The stable economic status of developed countries and growing economies, such as China and South Korea, significantly influence the growth of the information technology industry. “Countries such as China and South Korea and regions such as the Middle East and Africa offered the greatest growth opportunities (Gamble & Varlaro, 2016, p. 276). Therefore, the improved global economic and political conditions enhance the buying potential of the foreign market and open opportunities for industry growth.

Moreover, the expansion of the industry relies on the establishment of regulatory factors and laws. The advancement of technology influences the manufacturing of counterfeit products threatening the growth of the industry’s “intellectual property protection and counterfeit products, including counterfeit Apple stores, and poses significant problems” (Gamble & Varlaro, 2016, p. 267). The protection of intellectual property rights through the facilitation of laws is essential in the global market to enhance the market growth of the industry.

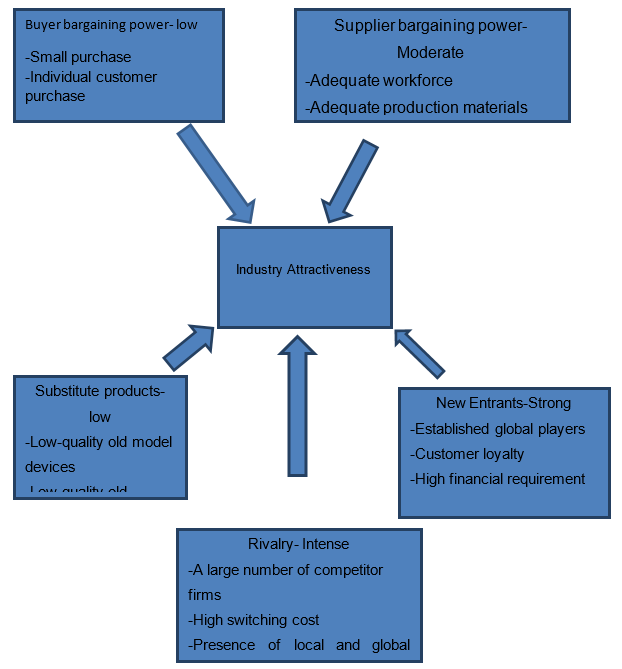

Porter’s Five Forces Analysis

The analysis describes the factors that influence the industry situation and attractiveness (Appendix A). The forces include buyer bargaining power, supplier bargaining power, substitute products, threats of new entrants, and competitive rivalry. The buyer bargaining power in the information technology industry is low. The industry depends on individual customer purchases in driving their sales. The individual customer purchase increases competition from rival firms leading to price cuts. “Lenovo deep price discounts had yielded to a 34 percent increase (Gamble & Varlaro, 2016, p. 274).

The supplier bargaining power is moderate. The workforce and manufacturing materials required in the industry is adequately available, as “driving the increase in the smartphone shipments is due to the decrease in the overall manufacturing cost” (Gamble & Varlaro, 2016, p. 276). Additionally, software developers are sufficient in the market. Thus, supplier bargaining power determines the product price and profitability of the industry.

Competition from substitute products in the industry is low. The old model devices in information technologies do not match the quality of innovation. Thus, companies offering high-quality products do not face pressure from substitute products that would influence product pricing.

The entry barriers are strong due to the presence of financially established firms with large global market share and strong customer loyalty programs such as HP. “HP recorded total net revenues of $111 billion in 2014” (Gamble & Varlaro, 2016, p. 274). Therefore, the high financial requirement for quality product manufacturing and brand promotion limits entry by small firms. Thus, established firms enjoy a market monopoly and high-profit margins.

The pressure of rival firms is the strongest force experienced in the industry due to a large number of competitor firms. Competitor firms include Apple, HP, Samsung and Google, and Netflix “with competitive rivalry continuing in the smartphone and tablet market (Gamble & Varlaro, 2016, p. 278). The diverse needs of customers in the global market for better technology-enabled devices enhance rivalry in the industry.

Key Success Factors

A key success factor refers to fundamental steps for accomplishing company goals. The fundamental steps essential in the information technology industry include technological improvement, constant innovation, and the adoption of flexible market strategies. Technological advancement necessitates the manufacture of high-quality products. Improved technology facilitates the adoption of the best-cost strategy through the invention of low priced devices with powerful capabilities to perform with speed in multiple-use and compatibility. These attributes positively influence a company’s position by enhancing customer satisfaction and competitive advantage leading to high-profit margins and business expansion.

Sustained innovation is an important element necessary for industry expansion. Constant innovation helps meet the diverse consumer needs, growing product line, and improve on product quality. This success factor supports a broad differentiation strategy in facilitating the manufacture of quality devices and continued improvement of product features. Therefore, companies need to adopt this element of key success factors to promote sustained profitability through the manufacture of products that effectively enhance competitive advantage over rival firm’s products in the market by improving consumer satisfaction and meeting the dynamic customer needs.

The adoption of flexible market strategies presents a reliable marketing strategy through collaboration and joint venture initiatives to facilitate brand promotion. Additionally, flexibility in the market is essential in facilitating the co-production of high quality and highly innovative products that strongly stand out over rival products such as the production of multiple devices compatible software and devices.

Industry Profile and Attractiveness

The information technology industry faces distinct challenges affecting its profitability that include relaxed legal laws and an unstable political climate that threatens the growth and profitability of the industry. Despite these challenges, socio-cultural factors, economic growth, and technological advancement positively influence the exploitation of the global market segment. Dynamic consumer needs and the shifting market demands of technologically advanced devices significantly promote industry profile and attractiveness for sustained growth and future expansion. Overall, I would say that the information technology industry is highly attractive to the current players about sales, profits, and competitive intensity.

Company Situation

Apple derived its existence and expansion from the company’s inspiration to improve the human experience through continued innovation. The company continues to enjoy revenue income of $19 million, $70million, and $170 million from Mac, iPad, and iPhone, respectively, as of 2015. The latest development is the 2015 diversification and launch of Apple watch. However, despite these growth achievements, Apple faces intense competition from the established computer, smartphone, and media player industries such as HP and Samsung.

The top management of Apple has benchmarked the competitor companies to identify their success areas in the global market to increase their productivity. For example, “Google entry into the market with its Android operating system had allowed vendors such as LG, Motorola, and Samsung to offer the model” (Gamble & Varlaro, 2016, p. 276), which encouraged Apple to enter joint ventures with other firms, such as HBO, to promote growth and expansion.

Financial Analysis

Financial analysis of Apple during the 2010-2014 period shows that it has a moderate financial status for financial ratios have remained fairly constant (Appendix A). Gross profit margin has been relatively constant over the period for it has been 39.4%, 40.5%, 63%, 37.0%, and 38.6% in 2010 through 2014, respectively. Similarly, its profit margin remained constant over the same period for it has been 21.4%, 23.9%, 26.7%, 21.7%, and 21.6% correspondingly.

Return on assets has been 18.6%, 22.3%, 23.7%, 17.9%, and 17.0% in 2010 through 2014, which shows that Apple has been stagnating in growth. However, its return on equity has increased by about 6% over the same period – from 29.3% in 2010 to 35.4% in 2014. Liquidity ratios show that Apple has been facing the challenge of meeting its short-term liabilities. The quick acid ratio has been 1.7, 2.1, 2.1, 1.6, and 1.3 in 2010 through 2014 respectively. In the same period, the working capital ratio has been 2.7, 2.9, 3.0, 2.5, and 1.9 respectively.

However, leverage ratios show that Apple has a low-risk financial status because the debt ratio and debt-to-equity ratio were significantly less than one. In 2010 through 2014, the debt ratio was 0.46, 0.34, 0.33, 0.40, and 0.52 while the debt-to-equity ratio was 0.57, 0.52, 0.49, 0.68, and 1.08 respectively. Equity ratio fluctuated over this time because it was 1.57, 1.52, 1.49, 1.68, and 2.08 in 2010 through 2014 respectively.

Activity ratios show that Apple uses its capital effectively as total asset turnover, cash turnover, and operating efficiency are favorable. Total asset turn over was 0.19, 0.22, 0.24, 0.18, and 0.17, while cash turnover was 0.78, 0.79, 0.72, 0.73, and 0.72 correspondingly. Operating efficiency remained about 30% because the ratio in 2010 through 2014 was 0.40, 0.30, 0.24, 0.31, and 0.34 in that order. Overall, financial analysis depicts Apple as having a moderate financial status because of the unfavorable financial ratios, and thus, requires management to strengthen its financial status for it to compete effectively in the global markets competitive markets.

SWOT Analysis

Strength

Apple continued diversification of the product line is a strength that facilitates customer satisfaction and loyalty. The innovative culture of Apple is a strength that enhances the company’s competitive edge through the provision of software and hardware products. The adoption of improved technology is another strength that facilitates the production of quality products.

Opportunities

The dynamic shift of global consumer needs into mobile technology is an opportunity for growth as identified earlier in industry profile and attractiveness. Additionally, collaboration and the continuing diverse customer demands on device capabilities and features influence innovation, as it provides an opportunity for diversification. These opportunities therefore positively influence the company’s growth in the global market.

Weaknesses

The dynamic needs and shift of customer demand limit the company’s sustenance of product lines. This would lead to a discontinuation of other products in the market. Moreover, Apple’s focus on product differentiation results in high priced products, forcing customers to switch to low priced rival products. These weaknesses lead to low company revenue income.

Threats

The availability of substitute products threatens Apple’s market expansion efforts. Further, the availability of substitutes and intense competitive rivalry offering price cuts on products and matching product capabilities threaten Apple market growth and expansion.

Recommendations

Strategic Issue

The strategic issue entails the company’s strategic plans to enhance market competition. The goal of a strategic plan includes the exploitation of opportunities and enhancement of competitive advantage. Therefore, the company requires a change in its market strategy to improve sales.

Strategic recommendation

For the generic strategy, the company needs to enhance its global penetration by expanding its product distribution outlets and product lines. Apple needs to maintain its focus on a product differentiation strategy to maintain high quality and market appealing products, which constitute a key success factor.

The grand strategy for Apple includes extensively enlarging its flexible market strategy approach through collaboration and development of various device compatible software to promote the penetration to rival products market share and enhance brand recognition. These strategic steps will help improve market penetration and expansion of the company.

Objectives

The company should adopt an assessment of joint ventures and production of compatible software through the evaluation of the coproduced new products in the market and revision of product compatibility. Additionally, the company should continue to focus on its innovative strategies and expanding product lines, such as the Apple watch, to enhance customer satisfaction and brand recognition.

Strategic Justification

The joint venture and compatible software will significantly influence the company’s market penetration. It will provide customers with firsthand experience on the company’s product; this will be essential in influencing customer product perception and switching decisions.

The strategies and objectives will enable the company to provide price-friendly quality products to consumers to enhance its competitive edge. These steps will positively influence the company’s growth by addressing its weaknesses and threats to promote competitive advantage and improve global market share.

Reference

Gamble, J., & Varlaro, J. (2016). Case 3: Apple Inc. in 2016. pp. 236-278.

Appendix A: Porter’s Five Forces