Executive Summary

Green Life Company will be a new start-up wholesale and distribution of Mosquito killer lamp imported from Taiwan to the United States markets. The business ownership will take a sole proprietorship form; importing the Mosquito lamp directly from Taiwan to United States. The company will be situated at Maryland State and will also have an export market in Taiwan. Maryland State was chosen as a prime place to site Green Life Company as it is among the states that have high preference of mosquito infestation and from market research, it revealed that improved living standards of the potential customers confirmed the needed purchasing power for our product.

Green Life Company’s venture will require a starting cost of $40,800 where the proprietor will finance the business to a tune of $20,800 and $20,000 from financial lenders. Sales are expected to reach 3650 units translating to total sales of $70,000 per annum by the end of the first year (My Own Business Para. 1-4).

Business Objectives

- To achieve high profits from the starting year and the subsequent years.

- Create a business empire in Maryland state and grow to other states.

- Create employment opportunities.

Company Summary

The company’s name will be Green Life Company. Green Life Company name was identified as an appropriate one to name the company as it relate with the product to be sold which is environmental friendly. The company is also registered in United States Maryland State as a limited Liability Company.

Product Description

The product is called mosquito killer lamp. It is a type of lamp which has a fan and a photo catalyst titanium dioxide. This titanium dioxide catalyses when exposed to UV-A radiation from the sun to simulate human’s breath and body temperature conditions to attract the mosquitoes. The fan inside the lamp traps the Mosquitoes then they become dehydrated to death. Tariff Number of the product (Mosquito killer) will be: 8543.70.7000

Start-up Summary

The total start-up cost will be $40,800 with $18,000 as inventory and $9,645 as working capital included in the start-up cost. The owner’s investment ($20,800) will include the purchase of fixed assets and other expenses such as registration fees and the remaining $20,000 needed for the start up of Green Life Company will be financed with a loan from a commercial lender.

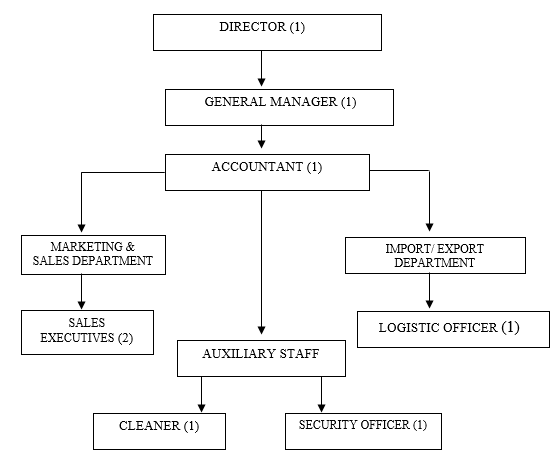

Organisational Structure

This will be a unit with which will deal in synchronization of all production units such as human resource and financial resource and land through planning, organizing and direct utilization of these resources to maximize on profits.

Organizational Chart

Key Personnel Plan

It is expected that; the business owner shall be the Director and shall run the company with the assistance of 7 professional related employees. The employees will be people of high integrity, proficient in English and Taiwanese language to communicate with the Taiwanese as well as other nationals who speak English. As the business expands, more employees will be recruited to conduct sales of our product outside Mary land state.

The tabulation below shows the breakdown remuneration per year.

Based on the business projected performance, the employee’s salaries will be reviewed on an annual basis, and this will be a percentage of the net profit gained during the year of operation. A projected 3% pay increase by the end of 2011 and 4% increase for the year 2011 are expected.

Marketing strategy

The marketing strategy for Green Life Company will be centered upon a refined market analysis that will see a short term market outlook. This will include initial product launch and ensure that the company’s targets are achievable within the first year, followed by a long term outlook and associated goals. Short term Market sales will initially target sales to supermarkets; longer term outlook will focus shift to target both direct and indirect customers.

Market Analysis

Despite the fact that lamp insect killer technology is new one, segments of mosquito kill product market still remains unexploited fully in United States. From the market study, there is an accelerating purchasing power, financial strength of consumers who buys mosquito’s related products which is an indication of customer’s willingness to buy this new product in the market.

In 9 of the 13 consumers who bought mosquito’s related product interviewed during the market study, gave a stronger indication of a need for better means of killing mosquitoes other than the use of insecticide or use of treated mosquito nets are still not customer satisfactory.

Market SWOT Analysis

Strengths

- The Director’s enthusiastic spirit and synergetic will be responsive to dynamics of modern business.

- Low operational costs and cheap rent (outside Maryland city center).

- Integrated marketing, import/export and expansion strategy minimizes pockets of inefficiency/ineffectiveness.

- Receptive penetrations to the house hold market.

Weaknesses

- Though I as the director has the knowledge, lack of the experience in actual enterprise management will be an obstacle to the business.

- Creating a loyal customer base.

- Minimal financial capital and challenge of acquiring adequate loan financing.

Threats

- Global economic meltdown aftershock may push interest rates up.

- Rising tax on imported products to the US markets.

Opportunities

- Minimal direct competition in our operational infancy.

- Availability of credit facilities at competitive interest rates and loan grace period for start-up enterprises.

- Engaging in advertising the product as a unique one.

- Promotion/sponsorship of the lamp though exhibitions to capture new markets.

- Acquiring website to reach wider markets including region and global markets.

As identified in the market SWOT analysis above, there exist some positive and negative factors that will greatly affect the financial success of our product. Using our marketing strategy, we can try to negate the threats and weaknesses whilst maximizing the strengths and opportunities

The biggest drawback to the company will be the small budget that we will have to work with if commercial lenders do not approve our loan application. This is where our competitors will have the greatest advantage over us, as our facilities will be limited to what we can afford.

Product Strategy

Packaging

Green Life Company commits to deliver it’s product in best presentable manner. The lamp will be packaged in carton clearly branded green life Mosquito Kill with a state of the art picture of the lamp. Delivery staff to the supermarkets will be dressed in Clothes bearing the name of our company and the product name.

Promotions

Our business concept is unique and targets diverse markets. We recognize we will need to build a good will from a base of loyal customers. Our entrance strategy will be to partner with supermarkets to sale our products.

Advertising of the product will be done by the use of fryers at supermarket entry points, printing out the company logo and business name on the delivery truck, and advertising on news paper for the arrival of a new product in the market for killing mosquitoes will also be used (Reference for Business Para. 1- 20).

At the same time, the company will create export trade leads by utilizing the State Export Offer Service and Yellow Pages whereas to develop leads for service matchmaking the company will utilize the Import-Export Bulletin Boards offers when the company expands its distribution channels to meet the cost of promotions.

Pricing Strategy

The product is new and a unique one to the existing mosquito kill products in the US market hence I recognize that pricing is critical to the success of the business. I have considered importation cost, the purchasing power of our customers, market demand and competition. By using the cost-plus method of international pricing, basing on the domestic price plus importing costs and subtracting any cost such as domestic marketing cost which is not applicable selling one lamp at a Price of $20 will give good returns ranging between 10% and 13%. Importing cost will include cargo charges, customs duties, and Product advertising costs. This method of pricing allows us to uphold US domestic profit margin percentage, hence setting an appropriate market price.

Distribution Strategy

The company will purchase one truck to distribute the product to various supermarkets. Mechanisms are in place to hire delivery services incase our truck can not be able to deliver the required order it time due to increasing number of orders.

Financing the Business

Desired Financing

Assumptions: Bank loan of $17,800 granted at 10% interest rate per annum for 5 years

Income Statement

Cash Flow Statement

The company is positioning its self with stable cash- flows by the end of 2010 to secures a cash balance of $20,700 and it is expected that the net profit will increase at the rate of 3% and 4% in the year 2011 and 2012

Balance Sheet

Financial Analysis Observations, Assumptions and Contingency plan

- An average net cash inflow of $20,700 within the first year of operation is indicative of healthy status especially with the uncertain macro- economic climate which is likely to have raised interest rates from global economic meltdown aftershock.

- Spanning loan repayment period to 5 years makes it less burdensome on business cash flow.

- The Balance Sheet reports no debtor. In practice, we expect low debt since our product will be generally paid for in cash or using credit card.

- The income statement has provided for interest on loan from January 2010. In practice, banks can allow about 3-month grace period for start-up business. If granted, this business would benefit from further increased cash inflow to undertake aggressive marketing.

Critical assumptions

- Business macro climate (Politics, Economy, Environment, and Socio-cultural) remains stable or improves.

- No annual change on cost of utilities ( electricity, insurance and fuel price).

- No major entrant competitor in the area of business operation.

Contingency Plan

Risk Mitigation provisions:

- Useful life for depreciable equipment is 5 years with zero scrap value. If sold off, value recovered will be an extra income

- No competitor has capability and plan to accomplish a complete imitation of our concept successfully

Conclusion

From financial analysis undertaken with, the operation Of Green Life Company has an opportunity of success. The high demand for our product from our informal market research is expected to break even by the sixth month of operation.

Works Cited

My Own Business. 2003. Web.

Reference for Business. 2010. Web.