CSR approaches and phases

Introduction

“Corporate social responsibility (CSR) is a form of corporate self-regulation integrated into a business model” (Wood, 1991). As Banerjee (2007) further explains, “CSR policy functions as a built-in, self-regulating mechanism whereby business monitors and ensures its active compliance with the spirit of the law, ethical standards, and international norms”. It has been in existence since the 1960s but became popular in the 1970s as more international corporations came into being.

CSR benefits include building a company’s reputation, improving a company’s human resource team by involving employees in CSR activities, and stakeholder engagement by allowing them to air out their views and opinion before a business embarks on any activities in their communities. In the construction industry, CSR allows businesses to establish safety measures, achieve brand differentiation, and have access to funds by operating responsibly.

In Jordan, CSR is ensured through laws and regulations obligating businesses to work in a socially responsible manner. This is through set standards such as ISO, enacted laws, and monitoring business’ level of responsibility towards employees, customers, communities near them, and other stakeholders. This literature review covers CSR and its role in the construction industry, using Jordan as a case study.

Approaches

CSR in different industries is aimed at promoting responsibility and encouraging positive impact through their business activities. CSR activities include those on consumers, communities, the environment, and stakeholders, among others. As Booth (2009) explains, “the discussion about CSR has been very heterogeneous”. This is so as many experts continue to argue the difference between different approaches to CSR.

“The most common and acceptable approach for CSR is the community-based development approach” (Ararat, 2006). This approach involves companies working with local communities to implement projects and initiatives that make communities better. A good example is corporations that have set up learning centers to educate the community on different issues, as well as improving the literacy levels of children in that community. Other community development programs include building trade networks between the corporations and the communities (Ararat, 2006).

Another common approach taken by corporations today is philanthropy. Corporations use donations and aid to communities around them and local organizations involved in development programs. This approach has been criticized for discouraging skill development. They further argue that it does not support sustainable development.

“Another significant approach CSR is garnering increasing corporate responsibility interest, also known as creating shared value or CSV” (Crane et al., 2008). This approach is based on the argument that social welfare and corporate success are dependent on each other. For businesses to compete effectively, they need a sustainable workforce and healthy resources. On the other hand, societies need profitable and sustainable developments. These two present the relationship between corporations and communities.

Phases

The three phases of CSR can be demonstrated as follows;

Fig.1: Phases of CSR.

Source: Developed from Asian Productivity Organization, 2006. Top management forum: Corporate social responsibility. Asian Productivity Organization: Hirakawacho, Japan.

The criteria for corporate sustainability and the triple bottom sustainable development can be represented as follows:

Sustainable development and the triple bottom line

Historical development of CSR as a strategy in business

Corporate social responsibility became popular in the late 1960s due to the formation of many multinational corporations (Asongu, 2007). This trend continued to the early 1970s as more corporations came into being. Freeman’s book on strategic management in 1984, which has been published again in 2010, influenced the common use of the word stakeholder and defined as “those on whom an organization’s activities have an impact” (Freeman, 2010).

CSR has developed over time to become one of the most significant programs in any organization. Its advantages and disadvantages have also been the source of vibrant debates among stakeholders and experts. Proponents of CSR argue that doing business with a perspective helps corporations increase their long-term profits. Critics argue that it is a distraction as businesses work towards performing the economic roles. They also argue that CSR is merely used to emphasize the role of governments in watching and regulating big local and multinational organizations.

CSR paradigms

“CSR principles have long been part of enlightened business practice, but the concept has witnessed an astounding ascendancy and resurgence in recent years” (Jamali, Yusuf, and Khalil, 2008). Even with such developments, the concept is yet to be fully embraced as the topic continues to attract many diverging views. Proponents argue that CSR is an opportunity for businesses to look beyond the financial and profitability element of a business and consider other concerns of its stakeholders. To critics, CSR dilutes a business main focus which is to make wealth (Barthorpe, 2009).

CSR has been long classified based on classical and modern paradigms. The classical perspective of CSR suggests that a business’ main focus is to provide goods and services to its clients and maximize profits, as long as a business is within the set legal frameworks of the country where it operates. The focus of this perspective is the legal and economic elements of a business. A business’ responsibility should, therefore, be to meet the expectations of the law in the area of operation, as well as those of the clients it is serving (Coen, 2010). These expectations can be further categorized into environmental, quality, and development responsibilities.

The modern perspective of CSR is based on the argument that “corporations should serve a wide array of stakeholders needs” (Jamali, Yusuf, and Khalil, 2008). It is also based on the argument that in modern times, the state is not able to address all the social needs and issues resulting from an increasingly complex environment. Corporations are obligated to partner with the state to help them manage the dynamics of modern societies (Drucker, 2000).

Benefits of CSR

Depending on the nature of a business or industry, the nature and scale of CSR may vary (Visser, Dirk, Manfred and Nick, 2010). There a large body of literature and arguments urging businesses to adopt measures that allow them to move away from financial corporate social responsibilities and activities. Orlitzky, Schmidt, and Rynes (2003) in their work “found a correlation between social/environmental performance and financial performance and explain that businesses may not be looking at short-run financial returns when developing their CSR strategy”. Different theories attempt to explain the benefits of CSRS in different ways.

Stakeholder-agency theory argues that the implicit and explicit negotiation and contracting processes entailed by reciprocal, bilateral stakeholder-management relationships serve as monitoring and enforcement mechanisms that prevent managers from diverting attention from broad organizational financial goals (Orlitzky, Schmidt, and Rynes, 2003).

This theory relates CSR with an organization’s performance by arguing that “addressing and balancing the claims of multiple stakeholders, managers can increase the efficiency of their organization’s adaptation to external demands” (Orlitzky, Schmidt, and Rynes, 2003). Another theory explaining the benefits of CSR is the instrumental stakeholder theory by suggesting a positive relationship between corporate social practices (CSP) and corporate financial performance (CFP). The theory argues that “the satisfaction of various stakeholder groups is instrumental for organizational financial performance” (Orlitzky, Schmidt, and Rynes, 2003).

According to Crowther and Lez (2004), “CSR within an organization can vary from the strict “stakeholders impacts” and many be based within the human resources, business development or public relations departments of an organization, or maybe given a separate unit reporting to the CEO”. In some organizations, CSR may include volunteering and charitable efforts, while in some, it may include partnerships with development organizations in communities. CSR benefits in an industry may be materialized in human resources, risk management, brand differentiation and license to operate, among others.

A company’s human resource can benefit from CSR through policies that involve employees in community development programs initiated by a corporation (Visser, 2011). Businesses involve employees through payroll contribution, allowing them to design and initiate projects in the communities, and have employees work in CSR programs supported by the company. Another significant benefit of CSR is stakeholder engagement. This is through allowing stakeholders to air out their views and has their opinion considered before policies are implemented. Stakeholder engagement is also through working with communities where suppliers, employees, and clients come from.

CSR in the construction industry

Deringer defines corporate social responsibility as “the voluntary integration of environmental, social and human rights considerations into business operations, over and above legal requirements and contractual obligations” (Deringer, 2006). The author further quotes the former UK’s minister of energy who says that the only successful companies are those that will seek to be as responsible as possible in their operations and business models. CSR is not only concerned with how companies make money but also how they spend and invest their profits (Organization for Economic Co-operation and development, 2001).

In explaining the trend of CSR a few years back, Deringer (2006) explains that “recently, there has been a proliferation of initiatives at national and regional levels as CSR becomes increasingly widespread, creating pressure on companies to not only disclose their CSR record but also to improve it”. As a result, businesses have been forced to include CSR in their annual budgets and invest in research on how they can benefit from CSR. Those that have been able to establish it as it should benefit from reputational, financial and other practical benefits of CSR.

The main concerns for the construction industry are more likely to be centered on sustainable development, climate changes, community progress, among other things that affect the progress and future of the industry. In the UK, figures released in 2002 revealed that housing and construction account for almost 30% of the carbon emissions. Newly housing developments can play a critical role in reducing emissions if companies invest in research and development of environmentally friendly technologies.

CSR in the construction industry is applicable through cost-saving, energy-saving and environmentally friendly measures (Murray and Andrew, 2007). Lighting, heating, cooling, and transportation are areas that consume the most energy and money. CSR in the industry, therefore, tends to focus on them by initiating research and adhering to government recommended and benchmarked procedures. CSR in the industry can have application in the following areas;

Reporting on performance

Transparent reporting is a significant aspect of business ethics. The industry has long been accused of operating under very secretive financial systems (Petrovic-Lazarevic, 2004). Financial information, especially for the small corporations is not easily accessible. Construction companies owe stakeholders a right to access information about the company and its financial operations (The World Bank, nd.). CSR policies are used in companies to accord stakeholders’ rights to access information that directly affects them.

Environmental responsibilities

Environmental concerns continue to rise in every part of the globe. The construction industry is one of the most significant contributors of carbon gases. Production of construction materials and their transportation have negative effects on the environment if not managed well. CSR promotes environmental responsibility by obligating construction companies to fund and support projects that protect the environment, as well as adhering to Standard Assessment Procedures such as calculating carbon index (Schreck, 2009).

Procurement

CSR policies in different countries address the issue of transparent procurement for government and public projects. The law in many regions provides for open tendering processes, fair and equal procurement processes, and equal access to the relevant information for contractors that want to be involved in public projects (Saleh, 2009). It is by involving the communities in a corporation’s activities that they are aware of available opportunities that can benefit them.

Clients and supplier relationships

CSR plays a significant role in building healthy relationships in a corporation. Designing and implementing projects where different stakeholders can work together allows them to identify the roles that each of them plays in the corporation. Clients and suppliers in a construction business influence how well the corporation can meet the expectations of each one of them. CSR policies offer platforms where both the parties can recognize each other, and work towards ensuring the each of their expectations are met (Rawlinson, 2010). These include partnering to develop projects, conducting educational programs for them, and making information available to them, just to mention a few.

CSR in construction companies in Jordan

“The Jordanian real estate market is divided into; residential, raw land, tourism-oriented and commercial segments” (Kokash, George and Salem, 2011). The industry has experienced accelerated growth especially in the tourism and the residential areas. Recent economic reforms introduced in the country have boosted investors’ confidence and brought about increased activity in the markets.

The industry in Jordan ensures companies are socially responsible through measures such as having them publish annual CSR reports. This allows the government to access the level of commitment and responsibility among the companies. Companies in Jordan meet their social responsibilities by working with local employment agencies to provide employment and support to the locals. It is also through providing financial, professional and technical support for community projects.

To protect employees, communities and other stakeholders, CSR in Jordan companies involve ensuring improved health and safety standards in construction companies. This is through standards such as ISO and OSHA, among others. Financial institutions consider a corporations performance in CSR before funding projects, a factor that encourages those that do not take it seriously to do so. Projects that support communities are more likely to be supported by financial institutions and the government.

ISO 26000 (guidance on social responsibility) has received a lot of support in many regions. It was written to ensure businesses and organizations respect business ethics. A

The International Standard ISO 26000:2010, guidance on social responsibility, provides harmonized, globally relevant guidance for private and public sector organizations of all types based on international consensus among expert representatives of the main stakeholder groups, and so encourage the implementation of best practice in social responsibility worldwide (International Organization for Standardization, 2010).

Among the countries, ISO 26000 has been implemented in Jordan (Hanks, 2010). It is applicable in both private and public organizations to assist them to do all their operations in a socially responsible manner. Unlike ISO 9001: 2008 and other ISO standards, it does not contain requirements but rather has voluntary guidelines. ISO 26000 has helped organizations in Jordan to be socially responsible in their organizations by offering advice and practical guidance on:

- Background and relevant trends in CSR.

- Social responsibility practices and principles.

- Critical subjects on CSR.

- Benefits of CSR.

- How to involve stakeholders in implementing CRS initiatives.

According to the International Organization for Standardization, (2010), “ISO 26000 will be a powerful tool to assist organizations to move from good intentions to good actions”

The (International Standard) ISO guidelines provide corporations with guidelines on how to implement CSR policies and strategies. CSR performance can influence many operations in a business including its reputation, its ability to establish business networks with the communities around them. It also influences the relationship between corporations, the media, the communities, as well as the government.

“ISO is not intended to replace, alter or in any way change the obligations of the state” (n.a. 2010). This argument is further supported by Horrigan (2010) who explains how standards such as ISO are used to guide business on what is expected of them. Organizations are encouraged to use ISO standards to be more socially responsible by implementing the set guidelines. ISO allows businesses at different stages of understanding and operations to integrate CSR into their different levels of business.

Table 1: Core subjects and issues of social responsibility (ISO 26000).

Even though ISO certification in highly applauded for encouraging CSR initiatives, many regions are yet to integrate it in their laws regarding CSR. In 2004, a report released by Christini et al, quoted by Petrovic-Lazarec (2004), ranked the ten countries that have embraced ISO in their construction industry, and Jordan was not among them. The comparison of ISO 14001 certifications in BCI by country can be summarized in the graph below:

How can CSR be used to improve the industry in Jordan

CSR can be used to improve business ethics in the construction industry in Jordan. “Business ethics or corporate ethics can be defined as ethical principles and moral challenges in a business environment” (Panagiotakopoulos, 2005). As Maon, Adam, and Valerie (2009) further explain, it applies to all aspects of business conduct and all professions and is equally relevant to individuals just as it is to an organization. Business ethics in the construction industry address a wide range of concerns. One of them is studying and understanding the fundamental purposes of a construction company.

Corporate social responsibility addresses business ethics, moral rights of a company and its duties towards its stakeholders (Maon, Adam, and Valerie, 2009). It also addresses leadership issues, political involvement of a company, law reforms and use or misuse of different corporate ethical policies. Every area of a construction business has its ethics, which are expressed and illustrated in a company’s CSR. Furthermore, CSR helps a company address ethics of finance, ethics of sales and marketing, ethics of property and property rights, ethics of technology, ethics of human resource, ethics of international business and ethics of production just to mention a few (Nicolau, 2008).

Corporate social responsibility means more than being in line with law and regulations, and impressing stakeholders with generous deeds (Mallin, 2009). Unfortunately, many organizations assume that CSR means not breaking the law, being generous to different stakeholders, avoiding any actions which may result in a lawsuit or ensuring one does not engage in any action which might taint the image of a business. It is also notable that many organizations only involve themselves in CSR activities that offer the most benefits to them (Lindgreen and Valerie, 2010). These are however not the only concerns for corporate social responsibility. CSR activities are concerned with ensuring that negative outcomes are avoided and making sure there is openness and genuineness in the way corporate activities are done (Lindgreen, Valerie and Francois, 2009).

CSR will further help the construction industry improve its relationship with people directly involved in it. These include suppliers, customers, employees, investors, and other stakeholders. An industry’s ability to stay vibrant and progressive is greatly influenced by how it relates to the people, as well as its inability to address immediate needs in a society. Industry will not perform if there are regular misconducts such as abusive behaviors towards employees, lying to customers and the public, withholding important information to employees and other stakeholders, discriminating based on age, race, gender, and other factors, theft, sexual harassment, falsified financial records and corruption, and inappropriate political involvement. CSR policies address such issues by having a provision for activities that allow them to air their views and have them addressed.

Successful CSR policies are based on their ability to address issues in different categories. These categories include conflict of interest, fairness and honesty, communications and business relationships (Lazarevic, 2004). Conflict of interest arises when an individual decides to consider their interests rather than considering the good of the business or when a business chooses to consider their interest without any regard to the interests of employees and other stakeholders. Fairness and honesty which is considered the heart of every industry measures the general values of decision-makers in the business. Communication, on the other hand, is more concerned with how true or misleading advertisements and other sources of information are. Corporate social responsibility policies call for relations that are ethical towards suppliers, customers and other stakeholders (Kotler and Nancy, 2005).

Application of CSR in construction companies in Jordan

Companies that have implemented effective CSR policies have well-established employee policies that ensure that their employees are heard and treated as assets (Mullerat, 2005). Such companies’ employee philosophy is that they are the business’ biggest assets. The companies will many times put a lot of emphasis on attracting, recruiting, retaining and motivating highly talented employees (Hond, Frank and Peter, 2007).

They will go further and provide for its associates a nurturing and caring environment to solicit the best performance from them. CSR policies allow businesses to place a high importance on their nationals and recognize that they are an important element of their workforce. It also allows them to put in place well-planned initiatives and career advancement programs to ensure that their employee’s quest for excellence and growth is taken care of.

Business’ code of ethics regarding employment in CSR conscious businesses ensure that communities are not disconnected from they are not involved in community activities, it will not be done without being provided with a good reason. They also ensure that employees, suppliers, and clients’ rights will be protected equally. Since respect, trust and loyalty are expected from stakeholders, the business has to ensure that it has entailed reciprocal obligations. The company also provides in its rules that stakeholders have a right to be protected from arbitrary power held by the management (Kokash, George and Salem, 2011). It is due to such companies’ employment ethics and high level of professionalism in the way they treat people that such companies will receive numerous awards from different organizations. This goes far in developing their reputation.

CSR policies also provide guidelines on how employees should be treated. Discrimination and harassment are completely prohibited at the workplace and this is done by eliminating the vestiges of discrimination from a business. Hiring and promotion is done strictly based on qualifications and performance. Lending, housing, and other benefits are done based on very professional standards and are not based on personality or other individual factors. In the past, companies in Jordan have been accused of exercising discrimination based on religion and race (n.a., 2009). Religion plays a big role in Jordan business decisions, something which many critics would not agree with. CSR policies will go a long way toward helping these businesses eliminate any actions that could be damaging to their reputation.

Marketing and Disclosure of Information

There has been a major transition in the way construction institutions do their marketing. The new mode of construction is now acceptable in many regions around the world and competition seems to be very high in the construction industry in Jordan. Business ethics in marketing has raised a lot of controversy over how much information sales and marketing people should ethically disclose to customers and stakeholders (Jensen, 2000.).

Selling properties and assets has for a long time been surrounded by secrecy and hidden information. CSR provides guidelines which require that a policy in marketing holds that the buyer is solely responsible for the decisions they make. A business should disclose as much information as possible to the buyers. It also states that stakeholders should only be allowed to modify as little information as possible to avoid the risk of injury (Ghaemi, 2007).

According to CSR policies, fairness should rule in a construction company’s information disclosure policy where the business must ensure its protection when disclosing information and should ensure it protects its customers in the process by ensuring they have enough information required to make decisions. They should observe the mutual benefit rule which requires that there should be enough information to interested parties to make reasonable judgments. This rule also allows salespeople to meet their ethical obligations by providing enough information for customers to make a decision and ensuring that they uphold the companies’ privacy (International Labour Office, 2006).

It is also a company’s responsibility to ensure that it upholds market competency rules by ensuring that its marketing skills are not intentionally supposed to create an unfair environment in the market. Its customers should have the freedom to shop around for other service providers; they know the products the company offers, and have legal rights against the institutions (Gray, Owen, and Maunders, 1987). Companies should not deny their customers the ability to protect their interests and should ensure they are not put at vulnerable levels which might expose them to harm. It is not morally unacceptable for any business to take advantage of the customers’ vulnerability of a lack of information regarding a certain product.

Finance and Accounting

“For a business to take responsibility for its actions, that business must be fully accountable. Social accounting, the communication of social and environmental effects of a company’s economic actions to interest groups, is thus an important element of CSR” (Hawkins, 2006). The construction industry can be considered a very secretive business when it comes to information regarding finances and accounting. Information regarding accounting and finance is only accessible to the partners and shareholders. However, by examining some of the construction companies’ financial books of records, it is clear that the companies’ financial reports are prepared professionally by the generally accepted accounting principles.

Corporate social responsibility calls for well defined and designed roles and responsibilities for the auditors, which need to be included in any company’s codes of ethics regarding its financial data. Businesses are required to ensure that stakeholders have a sufficient understanding of the industries internal control structure. As required by CSR policies, companies should take auditing very seriously to ensure that its shareholders are well informed of all financial activities and decisions in the business (Ihlen, Jennifer and Steve, 2011).

Part of a business measures to observe discipline and responsibility towards its shareholders in this area is auditor’s independence. Auditors of a company are free from pressure and any other factors which may influence the outcome of their findings (Idowu and Walter, 2009). A company should have an established course of action in an event where someone is reasonably suspected of compromising the auditor’s ability to give unbiased results.

The auditors have the responsibility of establishing whether the level of independence in any construction company is acceptable, or if employees are coerced to make unethical financial decisions. Resolving financial conflicts in any construction company should also be in a way that protects stakeholders, employees, and the communities around them. Available guidelines for businesses willing to adopt social accounting, reporting and auditing include the global reporting initiative’s sustainability reporting guidelines, Accountability’s AA1000 standard, and the Standard Ethics Aei guidelines, just to mention a few (HM Government, 2009).

Emerging Technologies

CSR addresses a business’ responsibility towards all the stakeholders when investing and implementing emerging technologies. Businesses are expected to use new technology in a way that does not put a consumer or any stakeholder in a disadvantaged position. Technology should not be used to scale down the amount of information available to customers and should not change the type of information available to either of them (Harrison and Edward, 2007). The scale of exchange of information should only be changed to a level that is acceptable between the business, customers and all stakeholders whose interests would be influenced by the change of technology.

Jordan construction companies justify their information collection activities by arguing that it helps them make better business decisions. By collecting relevant information, the industry can make decisions regarding customer preferences, sponsor’s interests, market trends, and completion among others. However, CSR requires that companies should only collect information that is reason enough to make decisions (Beisinghoff, 2009). It should also be clear from a company’s privacy policy that the business would not under any circumstance use or reveals a customer’s information without the customer’s consent.

Ethical Issues Regarding the Environment

One of the most popular CSR approach in most businesses today is financing and supporting environmentally friendly projects and ideas in the communities where they operate (Hopkins, 2006). CSR requires that businesses are obligated to protect the environment and minimize negative effects to it. Businesses are not supposed to oppress or oppose environmental legislation. Every business has the responsibility of protecting the environment as well as educating its customers about environmentally responsible choices.

Like many other companies in Jordan, the construction industry in the region has been accused of paying little attention to environmental projects and not partnering with any environmental organizations in the region (Jamali, Yusuf, and Khalil, 2009). Through one of their research papers, the authors have accused the banking and construction industry in the region for showing very little interest in projects that benefit the environment and instead focusing and giving too much attention to projects which have potential to improve their profitability such as educating people on real estate which is picking up well in the region.

Potential benefits of CSR in construction

Industries in Jordan

The benefits of CSR in a corporation differ with the nature of the business, the industry and the stakeholders. The scale of benefits is determined by a business’ ability to implement CSR policies in a manner that benefits both the stakeholders and the business. Several arguments arise when the benefits of CSR are discussed. Proponents of CSR argue that it enables investors and developers to do business responsibly. Critics argue that companies easily use CSR to market themselves when it should be intended at helping the society working with a business. Some of the benefits of CSR are in the areas discussed below:

Human resource

CSR programs can be used by construction companies as a recruitment opportunity. In the current competitive labor markets, potential employees will want to know what a company’s CSR policy is like. It can also aid in retention, especially when a business involves its employees in its CSR activities. Employees can be involved through payroll giving, being assigned to community activities, and being able to join and participate in a business’ volunteering programs, among others. Instead of using economic and governmental factors to drive a company’s CSR, a business can use its employees’ values to make them feel as part of the initiatives.

Brand identification

In today’s crowded markets, getting noticed is a significant challenge for businesses. Getting a unique selling proposition is even a bigger challenge, especially in the construction industry where market activity easily fluctuates. Construction industries in Jordan can use CSR activities to build brand loyalty through distinguishing their ethical values and letting the customers know their values. Construction companies in the region can learn a lot from, business that have built strong brand names through ethical values. Examples of businesses that have been able to build customer loyalty globally through ethical values include American Apparel and the Body Shop.

Risk management

In recent years, a lot of attention has been focused on project risk management. Research has revealed that the success of any project is very dependent on the management’s support for risk management processes. “Construction projects are characterized as very complex projects, where uncertainties come from various sources” (Christ, 2011). Since they gather too many stakeholders, it becomes more difficult to study the whole network. Jordan’s housing construction industry has experienced an accelerated growth in the last five years and is expected to remain vibrant, especially now as the global economy continues to stabilize. It is estimated that the industry will have an annual growth rate of about 20% from 2011 to 2013. As a result, risk management is becoming an increasingly important topic of research in the region.

Risk management is a central part and a critical element of any business. The construction industry is faced with major risks, key among them being financial, environmental and safety risks. Such risks and incidents arising from them can destroy a hard built company’s reputation in a very short period. CSR allows businesses to build a reputation of always doing the right thing, thus stakeholder’s confidence. Taking voluntary steps to register with the government for all the requirements further reduces the risks of being penalized in Jordan, or having licenses revoked.

Managing key processes in CSR

“The best avenues for driving a business’ performance gains is managing the implementation of its processes” (Winser and Keah, 2008). Identifying the key processes in any project is the first and most fundamental step for any developers planning to execute their strategy. “Management of key processes is only productive if the results will be aligned with the project’s strategic objectives” (Segerlund, 2010). Key processes are easily identifiable by their level of impact on the success of a project or initiative. They are those processes whose success or failure has serious implications on a project’s goals and revenues. For Jordan to be successful in all the big projects, the implementation and management of CSR has to be given priority and has to be right. They should also be specific to the country’s unique policies, goals, and approach (Wells, 2000)

Key processes should not be too many in a project. “On average, typical projects will have ten to fifteen key processes” (Wells, 2000). Some are external but most of them are internal, meaning the stakeholders have control over how they turn out. The first important step towards managing key processes is identifying the project’s baseline in regards to its current environment. The management must know how well the team plans to execute its key processes before even deciding how they want to go about it. The second step is identifying the most fundamental success factors for the process. These are factors that must be available if the process has to work out and give results. They include things such as technical requirements and availability, tools for measuring performance and how the process will be aligned.

The other important factor in managing key processes is the organization and location of the processes. Key processes are many times in constant interaction with each other and therefore, they need to be located in a way that makes interaction possible (Keong, 2000). Today, project management and business models are constantly changing calling for very flexible locations of key processes. “The need for instant process execution in the current fast-paced business environments calls for consolidation, standardization, and management of cross-functional processes” (Winser and Keah, 2008). Since the country may have many similar processes being implemented at the same time, there is a need for standardization to ensure high-efficiency rate of execution.

A key step in managing major processes in any organization or region is automating them where possible and affordable (Keong, 2000). Automation reduces the chances of human error and will save the country a lot of time. Many project managers will avoid automation due to the high costs involved without realizing that the investment will save them much more in the future. At an age where consistency is critical, automating key processes will allow the country to have consistent quality, develop proper communication channels and keep stakeholders constantly and accurately updated.

Many times key processes in a project may be a new idea that requires high levels of expertise. In this case, Jordan is involved in the construction of big projects, some of which have not been implemented before in the country. Training employees is therefore very critical in ensuring a successful implementation and management of key processes. Employees need to understand what any CSR project’s goals are, what role their functions play in realizing them, and how as an individual an employee impacts the success of failure of a key process in the project.

Involving employees in key processes ensures that every person in the project feels appreciated and puts their all in ensuring success. Every idea, whether small or big, should be respected in a project. After employees have submitted their suggestions, they should go through vetting and then the country develops them, allowing employees to feel part of the process. Such initiatives will many times save Jordan’s construction industry a lot of money on research, as it is amazing how many good ideas employees can come up with when given a chance.

Another important step in key processes management is learning to be flexible and embrace change. Jordan must be able to identify those CSR processes that are not working and easily redesign them. Inefficient processes will cost the country a lot of money and even drag the other processes. Once a CSR project has baselined its processes, it should be able to identify those strategies that are either not working or are taking too long and costing it m much more than it can bear. For the mega-projects, such as developing school community projects, or for processes that require a lot of investments, key processes can be implemented one at time. This way, the country will be able to bear the costs and management becomes easier with fewer processes being handled at one time.

Technology is important for the effective management of key processes. “Technology influences management and workforce in organizations by analyzing production, resource impact, routine to non-routine operations, structure impact, industry impact and work impact as well” (Winser and Keah 34). It allows the managers together with the workforce to match the resources available with technology through different approaches. The management can run operations more easily by changing techniques and processes to better and modern ones.

Finally, the management of key processes would not be complete without putting in place performance measures. These measures should be a continuous process to help Jordan establish what is working and what is not at an early stage. They will help the country identify where to make improvements or put more investment. Performance measurements include scheduling operations and setting targets to ensure the implementation of key processes is done on time.

Barriers and obstacles

Financial

Lack of time and budget allocations can hamper the efficient and successful implementation of CSR policies in a business. CSR can be costly for a business, depending on the approach a business decides to take. If a business uses philanthropy as its main CSR approach, it will many times involve donating a lot of money. When a corporation’s profitability is not healthy enough, then it will not be possible to have CSR programs implemented as effectively as possible.

Behavioral

Implementing CSR requires effective levels of expertise. A corporation that lacks the professional knowledge and skills may not benefit as much from CSR. Lack of professionalism and capabilities pose a significant challenge, especially for small businesses. Furthermore, CSR requires creativity and thoughtfulness, something that a company may lack in its team.

Governmental

Government laws, regulations, and policies play a significant role in a business’ ability to implement CSR. Lack of proper support from the government is a major reason for companies’ inability to maximize returns from CSR programs. This is especially so for those companies in developing and third world countries. Laws and regulations should be flexible and friendly enough to allow corporations to choose CSR activities that fit into their business operations and budgets.

Legal

Lack of clear regulations has been identified as a major reason why corporations have not been able to implement CSR in their businesses. In some countries, the law exposes corporations to legal conflicts as a result of the CSR programs they choose to engage in. Furthermore, corporations have to be cautious enough when they engage in community development projects to ensure they do not bring about any controversy between the state and the people.

Summary

Corporate social responsibility has been in existence for over 50 years now. It became popular in the late 1960s due to the formation of many multinational corporations and this trend continued to the early 1970s as more corporations came into being. It has developed over time to become one of the most significant programs in any organization. It has also been the source of continued debates between its proponents and opponents. Proponents of CSR argue that doing business with a perspective helps corporations increase their long-term profits. Critics argue that it is a distraction as businesses work towards performing the economic roles. They also argue that CSR is merely used to emphasize the role of governments in watching and regulating big local and multinational organizations.

“In CSR implementation, good management is not enough. Strategic CSR demands that the companies must take stock of the real fundamentals-what it is in business to achieve” (Wether and David, 2011). CSR in different industries is aimed at promoting responsibility and encouraging positive impact through their business activities. CSR activities include those on consumers, communities, the environment, and stakeholders, among others.

As Booth (2009) explains, “the discussion about CSR has been very heterogeneous”. This is so as many experts continue to argue the difference between different approaches to CSR. The foundation of CSR is built on encouraging corporations to work with local communities and stakeholders to implement projects and initiatives that leave them better. A good example is corporations that have set up learning centers to educate the community on different issues, as well as improving the literacy levels of children in that community.

The benefits of CSR in a corporation differ with the nature of the business, the industry and the stakeholders. The scale of benefits is determined by a business’ ability to implement CSR policies in a manner that benefits both the stakeholders and the business. Several arguments arise when the benefits of CSR are discussed. Proponents of CSR argue that it enables investors and developers to do business responsibly. Critics argue that companies easily use CSR to market themselves when it should be intended at helping the society working with a business.

The construction industry can benefit a lot from implementing the right CSR initiatives. Construction businesses’ human resource departments can benefit from CSR through policies that involve employees in community development programs initiated by a corporation. Another significant benefit of CSR is stakeholder engagement. This is through allowing stakeholders to air out their views and has their opinion considered before policies are implemented. Stakeholder engagement is also through working with communities where their suppliers, employees, and clients come from. CSR further allows the businesses to build a good reputation and earn the market’s confidence as a company that is concerned about its stakeholder’s welfare.

Methodology

Introduction

The research methodology applied in this paper included the study of books, academic journals, online articles, past projects by different authors, government statistics and non-governmental organizations on CSR in different industries. It also included a study of various works on CSR management in the construction industry, using Jordan as a case study. The study of books and different articles reveals that the construction industry is among those suffering average levels of CSR implementation. To improve on this, many multinational and local organizations in Jordan have realized that CSR not only benefits the stakeholders, it also does improve business performance. As a result, a lot of attention is being focused on corporate social responsibility, and how it can be used to improve financial performance in a business.

It is also clear that many businesses are spending a lot of money to ensure satisfaction, safety, and motivation of their stakeholders. Communication has proved crucial in many organizations to have stakeholders air out their dissatisfaction before deciding to shift loyalty. Such information was available from various reports by governmental and non-governmental sources. These reports served very effective and relevant in trying to understand this paper’s background. Recent and past books and research papers by different authors were also helpful in understanding the construction industry, as well as CSR management. Views from fellow students were also collected to get their thoughts on the subject and how it affects them.

As, Vella and Karen (2005) argue, “the best avenue for driving an organization’s performance gains is managing the implementation of its processes”. Identifying the key processes management steps is very fundamental if an organization is expecting to have a successful implementation of its CSR strategies. Key CSR management processes are easily identifiable by their level of impact on an organization’s success. They are those processes whose success or failure has serious implications on an organization’s goals and revenues. For a business to succeed in CSR management, its implementation and management has to be given priority and has to be right. Its objectives should also be specific to an organization’s unique policies, goals, and approach. The study was aimed at establishing the truth in these arguments and establishing areas of improvement.

The research adopted a triangulation method. This means that multiple methods of quantitative and qualitative methods were utilized. This decision is justified by the fact that while the research was interested in measuring the different policies and their effectiveness, it also attempted to qualify their impact on the performance of the companies. Triangulation further allowed this project to get better results and manage any challenges that may arise from one research method. This was possible through balancing the weaknesses of one research method against the strengths of the other. Data collected were categorized into primary and secondary data.

Primary data was collected through a semi-structured face to face interviews with 5 senior management staff in construction companies. Four of these participants were general managers, while the fifth was a director. The surveys aided in exploring the views of the CSR policy promoters in the raison d’etre of formulating these policies and their views on the relationship between the policies and the increased attention placed on CSR by construction. This method of data collection was necessary for the study to be able to collect detailed information about specific questions. “Using semi-structured interviews allows a broad scope of answers and sufficient latitude for further questioning on specific responses” (Singh and Naurang, 1996, p. 1). Questions were closed at the initial stage and opened later to allow more in-depth discussions with the interviewees.

Aim

Research on and discuss corporate social responsibilities in the construction industry in Jordan

Research objectives

- Define CSR in different industries and its role in a business environment.

- Study and analyze CSR in the construction industry.

- To analyze CSR in the construction industry in Jordan.

- Collect primary and secondary data to support arguments in the paper.

- Use collected data to come up with a conclusion and recommendations.

Quantitative and quantitative research

“Quantitative research involves an analysis of numerical data while qualitative research involves analysis of data such as words from interviews, pictures and videos, or objects” (Neil, 2007). The difference between the two can be summarized in the table below:

The qualitative research method of choice used in this paper was interviewing. Qualitative methods include the study of books, reports, online articles, and statistics from government and non-government sources.

Structure of the survey

Participants

Interviews were conducted on 5 senior management staff. Four of these participants were general managers, while the fifth was a director. The participants were drawn from five different construction companies in Jordan. The population was distributed among different age groups, responsibilities at their level, and the number of years the employee had worked in the industry. 3 of the participants had more than 10 years of experience in the construction industry. One of the participants had been working in a construction company for more than 5 years. These participants proved very resourceful in understanding the companies’ CSR strategies and policies.

Recruitment

Recruitment was done by using social networks and online forums to reach out to targeted participants. The snowball technique was used to reach the targeted number of participants required for the study. In this technique, people familiar with the study were used to reach out to more people who were then be directed to the research’s weblink. To narrow down the number, the participants were contacted on the phone by fetching their numbers from the companies’ human resource management departments. All participants were presented with adequate explanations and guidelines for the study. All participants were also required to fill and sign a consent form agreeing to voluntary participation.

Data collection

The research methodology applied in this research project was designed to achieve the set objectives of the paper. It included the study of books, academic journals, online articles, past projects by different authors, government statistics and interviews with people at a managerial level in the construction industry. The interviewees are people who have interacted with CSR policies and activities in the industry. To understand the background of the problem, literature relating CSR management, its policies, procedures, and benefits was reviewed.

Types of data employed

To accomplish the objectives of this study, several types of data were employed. Data collected is classified into exploratory, descriptive and confirmatory. By so doing, it was possible to confirm or falsify the already established hypothesis in the research. Data in this research paper was also classified into primary and secondary data. Secondary data was gathered from past academic materials by different authors. Primary data was collected through interviews. Primary data was used to understand what employees, human resource managers and the executive management in the organizations had to say about CSR. It is also aimed at helping establish how far the multi-national organizations have gone in appreciating the concept of CSR. Secondary data in this paper was very crucial when understanding the scope of the topic and collecting views from different people and professionals.

Case design

The case design was comprehensive and complete enough, to allow the government and construction companies in Jordan to understand and utilize the information in decision-making easily. Beneficiaries of the study include the government of Jordan, construction companies, employees, suppliers, clients, and communities around construction companies, among other stakeholders. Reviewing the case design was critical to ensure its validity and applicability. This was ensured in this research project. Cross-comparing the case design and its outcome, with similar research projects conducted in the past, helped this research to highlight commonalities and identify areas where the results need to be strengthened. Data analysis tools and software were beneficial when sorting out data and identifying patterns.

Data analysis

Jones (2000) defines data analysis as “the process of inspecting, cleansing, transforming, and modeling data to highlight useful information, suggesting conclusions, and supporting decision-making”. Data analysis comprises of diverse techniques depending on the type of data, and expected outcomes. When conducting a CSR study, data mining is an indispensable technique since it involves discovering knowledge, as opposed to describing it.

“In any study focusing on attitudes and perception, the importance of primary data cannot be over-emphasized” (Jones, 2000). In such a project, it is expected interviews will be scheduled early to guarantee enough time for preparation by participants, a factor that was considered and implemented. Secondary data was extremely valuable and was collected to augment the research. Before any data was collected, permission was sought from different authorities such as the relevant ministries. An initial visit to these institutions was important for introductory purpose, familiarization as well as seeking consent for the research project.

Primary data collection was done doing interviews. Secondary data was collected from past research projects, government and non-governmental institutions and other relevant sources. The interviews were divided into different categories, two having three questions and the last category with four questions. The first category of questionnaires was used to establish the importance of CSR in corporations from different industries, the second section was aimed at understanding the role of CSR in the construction industry. The third category was used to establish how construction companies in Jordan can benefit from CSR.

Data analysis was comprised of diverse techniques since the study had different types of data and expected outcomes. When conducting CSR policies study, data mining is an indispensable technique since it involves discovering knowledge, as opposed to describing it. Interviews were scheduled early to guarantee enough time for preparation by participants. Secondary data was extremely valuable in augmenting the research. Before any data was collected, permission was sought from different authorities such as the companies where the participants work. Data analysis tools and software were also beneficial when sorting out data and identifying patterns.

Data analysis tools and software were beneficial when sorting out data and identifying patterns. As Punch (2006, p. 13) argues, “data analysis techniques can help virtually any business gain greater insight into organizational, industry and customer trends”. Available data analysis tools today include business intelligence platforms, online analytical processing, excel power, among many others. Answers to closed-ended questions were analyzed in percentages while others were individually analyzed and discussed.

Methodology justification

There are many applicable business research methods for such a project. For primary data, questionnaires, interviews, and surveys were the most applicable. Interviews were the preferred method of data collection because of the ability to get first-hand information from participants. The participants were all employees in senior positions in multinational construction organizations. As Jones (2000) advises, “to ensure satisfactory results, the survey type adopted for any research project must ensure sampling is done from the target population”.

Furthermore, interviews are an excellent way of collecting information about rules, regulations and the working environment of CSR in an organization.

More information and data were collected through;

- Reviewing available literature on CSR and its role in improving the construction industry.

- Critically reviewing international organizations and their CSR policies. This included interviewing 5 managers in major construction industries in Jordan.

- Studying the business models of construction industries in Jordan and where CSR is placed.

- Comparing CSR in the construction in Jordan and other regions such as Europe.

Project implementation

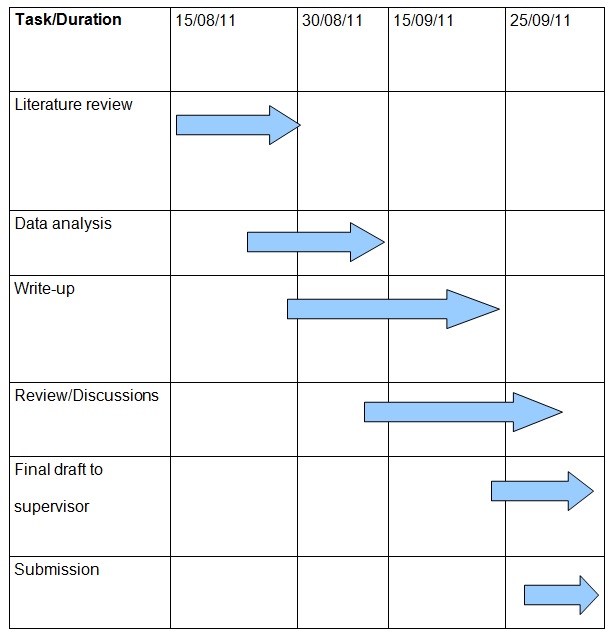

Overall project plan

This research paper is expected to be complete in 2 months

Ethical issues and limitations

Several ethical issues were expected to arise in the course of completing this research project. One of the most fundamental principles that I followed to collect data is voluntarism participation. The principle requires that no participant should be coerced to participate in a research or give false information. A participant must also give consent before their identity is revealed if there is a need to do so, although, for such a project, anonymity was applied.

During a research project, ethics also demand that the process must not subject the respondents to any danger or harm, a factor I took very seriously. A researcher is supposed to apply the principle of anonymity to protect them from the consequences of revealing the information they do. It is also the respondent’s right to be treated with respect and dignity during the study. These ethical issues are expected to be adhered to when any organization or individual is conducting its research.

Limitations faced in the exercise included language barriers since the industry employs a considerable number of foreigners. Lack of cooperation from some respondents also stood as a challenge and there were fears that they may not give accurate answers or they may take too long to respond. Conducting a research project is an expensive activity and finances posed as a challenge. These challenges were addressed by researching the most common language, which was Arabic and using translators. There were also comprehensive explanations about the scope of the research to respondents to ensure they understood the objectives and minimize resistance. I also ensured a proper costing and allocation of funds was done before the task commenced.

Research limitations

- Lack of sufficient time to carry out a comprehensive survey that represents the views of everyone.

- Jordan’s official language is Arabic, a factor that slowed down the speed of data collection due to the need for translation.

- Government and non-government organizations lack sufficient documented information about the industry in Jordan.

- There was limited information about CSR in the construction industry in Jordan.

Summary

Methods used to gather information for the project were designed to achieve the set objectives of the paper. This was done through the study of books, academic journals, online articles, past projects by different authors, government statistics and interviews with people at a managerial level in the construction industry. The interviews were four general managers and a director in construction companies in Jordan. Ethical considerations during the research included applying the anonymity principle, having participants sign consent forms and ensuring they are protected from any consequences that may arise from revealing the information they provided. Limitations included finances, language barriers and having to work with the interviewee’s schedules, some of which delayed the data collection process.

Reference list

Ararat, M., 2006. Corporate social responsibility across Middle East and North Africa. Sabanci University, Faculty of Management.

Asian Productivity Organization, 2006. Top management forum: Corporate social responsibility. Asian Productivity Organization: Hirakawacho, Japan.

Asongu,J.J., 2007. Strategic corporate social responsibility in practice. Greenview Publishing Company.

Banerjee, S.B., 2007. Corporate social responsibility: The good, the bad and the ugly. Cheltenham [u.a]: Elgar.

Barthorpe,S., 2009. Implementing corporate social responsibility in the UK construction industry. Property Management, 23(1): 4-17.

Beisinghoff, N., 2009. Corporations and human rights: An analysis of ATCA litigation against corporations. Frankfurt: P. Lang.

Booth, P., 2009. Editorial corporate social responsibility. Oxford: Blackwell Publishing.

Christ, G.M., 2011. Sustainable management: Coping with the dilemmas of resource-oriented management. Berlin Springer-Verlag.

Crane,A. et al., 2008. The Oxford handbook of corporate social responsibility. Oxford [u.a]: Oxford University Press.

Coen, D., 2010. The oxford handbook of business and government. Oxford: Oxford University Press.

Crowther, D. and Lez, R.B., 2004. Perspective on corporate social responsibility. Aldershot: Ashgate, Cop.

Deringer, F.B., 2005. The development and impact of CSR on the construction industry. Web.

Ditsa, G., 2003. Information management: Support systems & Multimedia technology. Hershey: IRM Press.

Drucker, P., 2000. The practice management. New York Harper.

Freeman, R.E., 2010. Strategic management: A stakeholder approach. Cambridge: Cambridge University Press. Web.

Ghaemi, H., 2007. Building towers: Safety management. Amsterdam: Butterworth Heinemann.

Gray, R., Owen, D. and Maunders, K.T., 1987. Corporate social reporting: Accounting and accounting. Prentice-Hall International.

Hanks, J., 2010. ISO 26000- Social responsibility. Web.

Harrison, J.S. and Edward, R.E., 2007. Management: Survival, reputation and success. New Haven: Yale University Press.

Hawkins, D.E., 2006. Corporate social responsibility: Balancing tomorrow’s sustainability and today’s profitability. New York: Palgrave Macmillan.

HM Government, 2009. Strategy for sustainable construction. N.p.

Hond, F.D., Frank, G.A.B. and Peter, N., 2007. Managing corporate social responsibility in action: Talking, doing and measuring. Aldershot: Ashgate.

Hopkins, M., 2006. Corporate social responsibility and international development: Are corporations the solution. Sterling, VA: Earthscan.

Horrigan, B., 2010. Corporate social responsibility in the 21st century: Debates, models and practices across government, law and business. Cheltenham, UK: Edward Elgar.

Idowu, S.O. and Walter, L.F., 2009. Global practices of corporate social responsibility. New York: Springer.

Ihlen, O., Jennifer, B., Steve, M., 2011. The handbook of communication and corporate social responsibility. Chichester: Wiley-Blackwell.

International Labour Office, 2006. ILO decent work country programme; Hashemite Kingdom of Jordan. International Labour Office.

International Organization for Standardization, 2010. ISO 26000- Social responsibility. Web.

Jamali, D., Yusuf, S., Khalil, E., 2009. A three country comparative analysis of managerial CSR perspective: Insights from Lebanon, Syria and Jordan. Journal of Business Ethics, 85(173-192).

Jones, T.M., 2000. An integrating framework for research in business and society: A step toward the elusive paradigm. The Academy of Management Review, 8(4), pp. 559-564. Web.

Jensen, M.C., 2000. Value maximization and strategic management theory. Web.

Keong, l., 2000. Capacity Management Best Practice Handbook. New York:Routledge Publishers.

Kokash, H., George, T. and Salem,A., 2011. Motivations, obligations, and obstacles to corporate social responsibility in Jordanian real estate companies. International Research Journal of Management and Business Studies, 1(4): 107-118.

Kotler, P. and Nancy, L., 2005. Corporate social responsibility: Doing the most good for your company and your cause. Hoboken, N.J.: Wiley, Cop.

Lazarevic, S.P., 2004. Corporate social responsibility in building and construction industry. Monashi University: Business and Economics.

Lindgreen, A. and Valerie, S., 2010. Corporate social responsibility. Oxford: Blackwell Publishing Ltd.

Lindgreen, A., Valerie,S., Francois, M., 2009. Introduction: Corporate social responsibility implementation. Journal of Business Ethics, 85, 251-256.

Mallin, C., 2009. Corporate social responsibility. Cheltnham: Edward Elgar.

Maon, F., Adam, L., Valerie, S., 2009. Designing and implementing corporate social responsibility: An integrative framework grounded in theory and practice. Journal of Business Ethics, 87: 71-89.

Mullerat, R., 2005. Corporate social responsibility: The corporate governance of the 21st century. Boston, MA: Kluwer Law International.

Murray, M. and Andrew,D., 2007. Corporate social responsibility in the construction industry. London: Routledge.

n.a., 2009. Jordanian cultural policy research. Web.

n.a., 2010. ISO/FDIS 2600: Guidance on social responsibility. N.p.

Neil, J., 2007. Qualitative versus quantitative research: Key points in a classic debate. Web.

Nicolau, J.L., 2008. Corporate social responsibility. Annals of Tourism research, 35(4): 990-1006.

Orlitzky, M., Frank, L.S., and Sara, L.R., 2003. Corporate social and financial performance: A meta-analysis. Organization Studies 24(3): 403-441. Web.

Panagiotakopoulos, P.D., 2005. A systems and cybernetics approach to corporate sustainability in construction. Edinburgh: Heriot-Watt University.

Petrovic-Lazarevic, S., 2004. Corporate social responsibility in building and construction industry. Web.

Punch, K., 2006. Developing effective research proposals. London: SAGE.

Rawlinson, F., 2010. UK construction industry site health and safety management: An examination of promotional web material as an indicator of current direction. Site Health and Safety, 10(4): 435-446.

Saleh, M., 2009. Corporate social responsibility disclosure in an emerging market: A longitudinal analysis approach. International Business Research, 2(1): 131-141.

Schreck, P., 2009. Corporate social performance: Understanding and measuring economic impacts of corporate social responsibility. Heidelberg: Springer [distributor].

Segerlund, L., 2010. Making corporate social responsibility a global concern: Norm construction in a globalizing world. Burlington, VT: Ashgate.

Singh, R. and Naurang, S.M., 1996. Elements of survey sampling. Dodrecht: Kluwer Academy Publishers.

The World Bank, nd. Corporate social responsibility and corporate citizenship in the Arab World. N.p.

Werther, W.B. and David, C., 2011. Strategic corporate responsibility: Stakeholders in a global environment. Los Angeles: SAGE.

Wood, D.J., 1991. Corporate social performance revisited. The Academy of Management Review, 16(4): pp: 691-718.

Organization for Economic Co-operation and development, 2001. Corporate social responsibility: Partners for progress. Paris: OECD Publishing.

Vella, A. and Karen, M.Z.M., 2005. Corporate social responsibility in environment planning and the construction industry in Malta. HSBC Corporate Social Responsibility Report.

Visser, W., 2011. The age of responsibility: CSR 2.0 and the new DNA of business. Chichester: John Wiley & Sons.

Visser, W., Dirk, M., Manfred, P., and Nick, T., 2010. The A to Z of corporate social responsibility. New York: Routledge.

Wells, S., 2000. Choosing The Future: The Power of Strategic Thinking. Boston, Mass: Butterworth-Heinemann.

Winser, J. and Keah, T., 2008. Principles of Supply Chain Management: A Balanced Approach. Mason, OH: South-Western Cengage Learning.

Appendices. Interview questions

Corporate social responsibility

- What is CSR and what role does CSR play in different corporations?

- In your own opinion, do CSR programs and initiatives offer any financial benefits to a business?

- How has CSR been embraced in businesses in the modern times?

The role of CSR in the construction industry

- What role does CSR play in the construction industry?

- What is the relationship between a company’s success in CSR and its financial performance?

- What are the challenges and obstacles that construction face in their efforts to implement CSR initiatives?

CSR in Jordanian construction industry

- How is CSR implemented in Jordanian construction industry and what role does it play in the industry?

- Is the government supportive enough to construction corporations in the country in their efforts to partner with communities and stakeholders and promote development?

- What role does the law in Jordan play in promoting successful CSR initiatives in construction companies?

- Can the industry in Jordan benefit from improved CSR policies and programs? If yes, what are the possible benefits?