Abstract

The report’s purpose is to provide a comprehensive analysis of the Kono company’s strategic issues. The total volume sales are growing by 1% annually with a stable upward trend (Euromonitor International, 2020). It increases competitiveness within the wine market between transnational beverage producers and niche local wineries (Euromonitor International, 2020). The tendency for green-labeled products is also prioritized among customers. Due to the COVID-19 pandemic, most companies have faced changes in consumer behavior and decreased wine tourism, being the principal source of marketing.

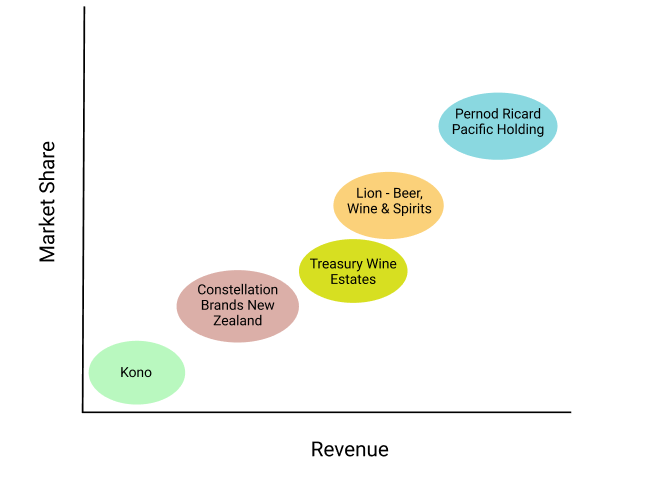

Regarding competitors’ profile of the wine industry, the market is dominated by global companies such as Pernod Ricard Pacific Holding and Lion – Beer, Wine & Spirits. The prominent driving force is the growing interest in organic wine production (Organic Winegrowing, n.d.). Consequently, it impacts the manufacturing process; vineyards located in an ecologically clean area with soil free from chemicals are considered sustainable (Organic Winegrowing, n.d.). Another trend is the potential recovery of wine tourism after the borders open in 2021. It is advantageous as it brings more customers worldwide and increases the total sales volume.

The Kono company represents the niche wine winemakers, which is a small portion of the country’s overall production. It is a Māori iwi-owned beverage business focused on Māori heritage and following traditions (Emen, n.d.). Value chain analysis reveals the company’s activities that can be optimized, such as export and marketing. Competitive advantage analysis has proved that Kono’s core competency is the quality of production contributing to customer loyalty. According to SWOT analysis, the company’s strengths are its own production, sustainability, own vineyards, and favorable territorial location. Weaknesses are the impossibility of implementing family technologies in mass production, small sales volumes, and a narrow range of products.

Opportunities and threats are presented in the New Zealand wine industry in general. These are benefits of developing sustainable production; in this case, the opportunity for Kono is to maintain its reputation as a high-standard winemaker. Key issues are changes in customers’ behavior due to the coronavirus outbreaks and border closure that affected wine tourism.

Introduction

Kono is the food and beverage organization of Wakatū Incorporation. One of the markets the company operates is alcohol drinks. The report’s purpose is to analyze the Kono company within the wine industry in New Zealand. The report consists of several parts; the first is the external review, presenting the industry and competitors profile, competitive analysis, and driving forces. The second part of the report outlines the knowledge gained through the research of the Kono case.

The strategic profile of the company examines its features, mission, values, and business strategy. It is followed by the reviews of the value chain and competitive advantage analysis. Finally, according to all information gained, Kono’s key strengths and weaknesses are summarized, combined with the opportunities and threats. It also includes key issues of the company that might be faced in the future.

Industry Profile

The analyzed market sector is the wine industry in New Zealand. According to Euromonitor International (2020), in 2019, total volume sales increased by 1%, reaching 103 million liters. The industry is marked by intense competition within several multinational companies and local wineries producing premial beverages and focusing on organic production (Euromonitor International, 2020).

The COVID-19 pandemic has adjusted New Zealand consumer behavior; people prefer to purchase beverages and drink them at home due to lockdowns (New Zealand Winegrowers, 2020). The key customers are collectors, tourists, and experts in agricultural and wine-producing. Although COVID-19 resulted in the closure of the borders, the customer profiles have not been changed significantly due to online purchasing and international shipping.

Competitor Profiles

New Zealand’s wine industry is characterized by intense market competition. The leading actors remain multinationals; nevertheless, the portion of local wine producers increases annually but remains relatively small. The renowned company is the global corporation Pernod Ricard Pacific Holding. The other player is also an international company – Lion Beer, Wine & Spirits (NZ), retaining the second rank (Euromonitor International, 2020). As Kono is popular in a specific group of customers, such companies are not considered large-scale production.

Competitive Analysis (P5F)

The impact of new companies on profits in the sector is minimal; hence, the threat of new entrants is medium. Domestic wine producers are growing, not having an established supply chain network (Euromonitor International, 2020). The power of buyers intensifies competition due to increased requirements for the quality of goods and service level (Lee-Jones, 2020). The bargaining power of suppliers is defined by a shortage of supply in wine grapes (New Zealand Winegrowers, 2020). Concerning substitutes, beer and ciders become customers’ favorable choices and the fastest-growing products within the alcohol industry (Alcoholic Drinks in New Zealand, 2020). Thus, competitive rivalry, the New Zealand market is characterized by the power of multinational winemakers and increased local actors with high product quality as a market advantage.

Driving Forces (From PEST+/PESTLE)

The demand for organic wine production is the first driving force. New Zealand is flourishing in organic and biodynamic winemaking and aims to produce all wines produced in this way by 2025 (Organic Winegrowing, n.d.). Such a trend reflects the green initiatives and society’s values on ecological preservation and a healthy lifestyle. Another trend that affects the wine industry significantly is wine tourism (Jamali et al., 2020). Activities include “cellar door visits, restaurants, winery and vineyard tours, and accommodation” (New Zealand Winegrowers, 2020, p. 8). The forecasts claim that wine tourism will be at the same level in the short term in 2022 (Impact of COVID-19, n.d.). Therefore, the trend may be advantageous for all stakeholders and adjust the wine industry, bringing more clients worldwide after opening borders.

Strategic Profile

Kono NZ LP (Kono) is an associated business of Wakatū Incorporation. It is a vertically integrated, family-owned Māori food and beverage company (Our Values, n.d.). One of its products is wine; vineyards are located mainly in the sub-regions of Marlborough (Kono Wines, n.d.). The world consumers acknowledge excellent product quality; the pricing strategy is driven by quality, technology, and the company’s mission (Kono Wines, n.d.). The popularity of New Zealand wine is primarily due to favorable soil and climatic conditions (Kono Wines, n.d.). In the Kono case, the traditional technologies of European winemakers have been improved due to green innovations. The distribution of herbicides is controlled; irrigation is monitored (Luzzani et al., 2020). Kono uses areas that have not been previously designed for vine grove (Kono Wines, n.d.). Hence, the company reflects in its wines respect for the land, nature, and tradition.

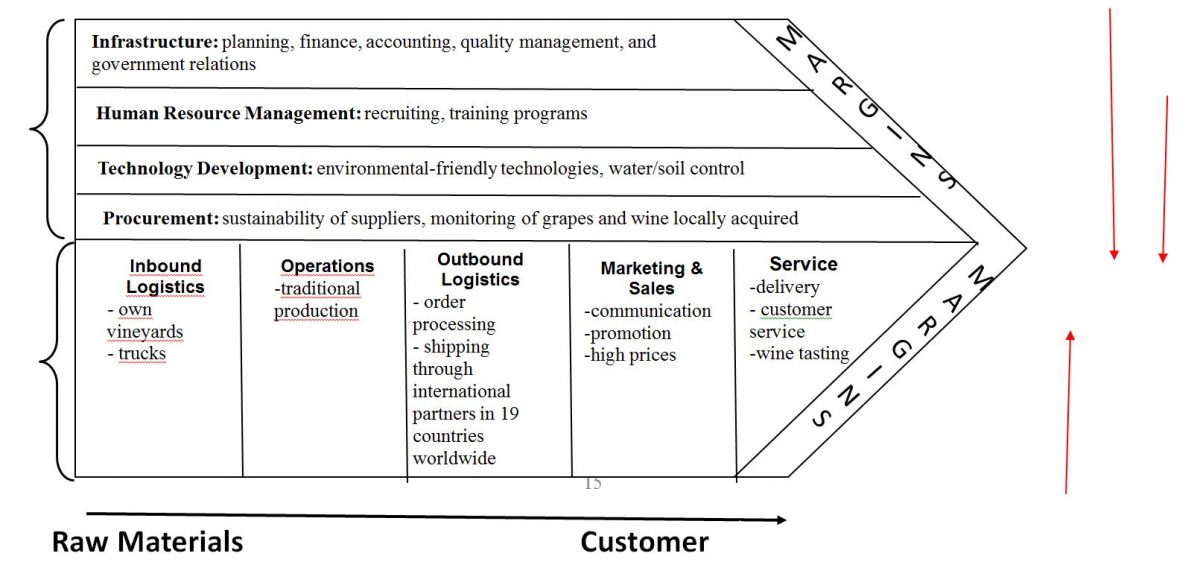

Value Chain

Concerning inbound logistics, the company’s vineyards are the finest quality producers in South Island in New Zealand. The quality value is added through hand-craft wine production, rare mineral-rich soils, and a coastal climate. Its vineyards are certified as Sustainable Winegrowing New Zealand, providing a competitive advantage regarding multinational wine companies (Kono Wines, n.d.). Operations are all activities aimed at converting incoming flows of resources into finished products: manufacturing, packaging, equipment maintenance, check for defects (Hanson et al., 2017).

The operation and inbound logistics are connected as the company uses its own vineyards. Therefore, these areas are interconnected and provide quality and cost-competitive superiority. Outbound logistics is defined by international partners in nineteen countries worldwide and includes cost advantages for export (Partners, n.d.). These organizations are the retail sailors of alcoholic beverages aimed at the import and supply of wine. Due to the COVID-19 crisis, the amount of online orders has increased.

Marketing and sales refer to all activities that inform buyers about the company’s offers and make it possible to purchase. Regarding small wineries, tasting room facilities are an essential part of marketing strategies (Gómez et al., 2019). Kono’s core competence is production quality referring to business-level strategy. Thus, cellar door visits draw consumers’ attention towards the wine, allowing them to taste and appreciate the quality; the process is beneficial for direct sales and provides a cost advantage (Baird et al., 2018).

Overall, Kono invests in superior quality products and wine tourism. Kono aims to maintain customer loyalty by perceiving sustainability, an essential point of competitive quality advantage (Baird et al., 2018). The company offers premium products; therefore, the price is not low and not available for middle-class customers.

Regarding support activities, infrastructure includes general management, planning, finance, accounting, quality management, and government relations. Human resource management involves the selection, training, development, and motivation of all employees of the organization (Woodfield & Husted, 2017). The commitment is a crucial aspect of the winery’s success (Our People, n.d.). However, non-family employees need to be taught the culture, behavior, and approaches, which might be faced with some disagreements or lack of interest. There is a low turnover of workers as senior managers provide a complete understanding of work culture and mission. For wine production, part of the dairy industry’s equipment and technology is used; it includes cost advantage (Luzzani et al., 2020).

Concerning sustainability, low-volume machines are adopted to decrease the volumes of water distributed in vineyards (Luzzani et al., 2020). At the same time, it increases quality advantage as Kono actively advances costly technologies: thinning, tying vines, cultivating hills (Kono Wines, n.d.). This has a positive effect on product quality and adds value in terms of cost and quality. High-quality standards are ensured by Kono’s policy on avoiding outsourcing its procurement and adopting a qualification policy.

Competitive Advantage (VRIO) Analysis

Kono’s core competence is wine production, as it is fundamental for the company to maintain the image of a family business that offers premium products. Therefore, Kono does not chase large volumes but intends to make high-quality wines; it builds customer loyalty and trust. Regarding temporal competitive advantages (TCA), marketing/sales promote wine tourism and after-sales service, mainly customer support. The company intends to reach minimum environmental pollution; exported wines are registered as passed the appropriate ecological certification. This benefits export due to increased demand for the products of the green economy.

However, this trend is inherent in most of the country’s vineyards; consequently, technologies used to decrease environmental pollution, supplier qualification policy that includes sustainability criteria are competitive parity (CP). Inbound logistics and infrastructure are also considered CP as a wine region has similar advantages for all wine producers such as grape processing equipment, storage tanks, cooling systems. The transportation and logistics infrastructure is also common for all market actors.

Strategic Issues: SW+OT

First, Kono uses its own raw materials; the harvest is gathered from the company’s vineyards. This ensures high-quality products and minimal costs for transporting initial products (Kono Wines, n.d.). Second, this is a favorable location at the top of the South Island in Awatere Valley, Marlborough, and Upper Moutere, Nelson (Kono Wines, n.d.). Third, it is an environmentally friendly product adequate to Sustainable Winegrowing New Zealand (SWNZ) (Kaitiakitanga, n.d.). Concerning weaknesses, these are the difficulty of applying family technology to mass production.

As it was mentioned in VC, due to hand-craft wine production Kono is a niche wine producer in the New Zealand alcoholic beverages market. Consequently, in a competitive market environment, it is challenging to build a strong brand that will become entrenched in the minds of consumers. The third weakness, concluding from production and marketing, is the narrow range of products; the company produces premium wine in small quantities, which is time-consuming.

Concerning opportunities, it concerns the New Zealand wine industry in general regarding VRIO analysis. First, due to the COVID-19 pandemic outbreak outcomes and subsidies from the government, the chance that in 2021, improved grapevine farming would lead to a greater overall average yield per hectare (Lee-Jones, 2020). Second, it is adherence to sustainable production; the standards cover biodiversity, air, water, soil, energy, plant protection, waste management, and social engagement (Baird et al., 2018). Compliance with criteria will help the wine industry to maintain its reputation.

Threats include the pandemic consequences; for instance, the wine industry in New Zealand intends to export products, while the buyer demand abroad is growing. Hence, the uncertainty in 2020 has affected wine consumption among the country’s residents (Lee-Jones, 2020). Consumer behavior has shifted towards purchasing beverages at supermarkets or online and off-license premises to drink at home. Another threat is the declining wine tourism business in New Zealand due to the COVID-19 pandemic outbreak.

Thus, the critical issue for the company is to maintain its competitive advantages by distributing its products in supermarkets and off-license supply channels (Lee-Jones, 2020). Due to the decline of wine tourism, it may be challenging for marketing to promote wines; therefore, it is suggested to develop advertising campaigns online and shift focus on the international market, as the popularity of New Zealand wine is growing.

Appendices

Competitor Profiles

PEST+ Analysis

Porters 5 Forces Analysis

Value Chain

VRIO Analysis

SWOT

Reference List

Alcoholic Drinks in New Zealand (2020). Passport. Web.

Baird, T., Hall, C. M., & Castka, P. (2018). New Zealand winegrowers attitudes and behaviors towards wine tourism and sustainable winegrowing. Sustainability, 10(3), 797-826. Web.

Constellation Brand. (2020). Annual Report. Web.

Emen, J. (n.d.). New Zealand’s First Māori-Owned and -Operated Winery Has Global Distribution and a 500-Year Plan. VinePair. Web.

Euromonitor International. (2020). Wine in New Zealand: Country report. Web.

Gómez, M., Pratt, M. A., & Molina, A. (2019). Wine tourism research: A systematic review of 20 vintages from 1995 to 2014. Current Issues in Tourism, 22(18), 2211-2249. Web.

Hanson, D., Hitt, M. A., Ireland, R. D., & Hoskisson, R. E. (2017). Strategic Management: Competitiveness and Globalisation (6th ed.). Cengage.

Impact of COVID-19 on Wine Tourism of New Zealand. (n.d.). WineTourism. Web.

Jamali, H. R., Steel, C. C., & Mohammadi, E. (2020). Wine research and its relationship with wine production: A scientometric analysis of global trends. Australian Journal of Grape and Wine Research, 26(2), 130-138. Web.

Kaitiakitanga. (n.d.). Kono Wines. Web.

Kono NZ LP. (2020). Dun & Bradstreet. Web.

Kono Wines. (n.d.). Kono Wines. Web.

Lee-Jones, D. (2020). New Zealand Wine Sector Report 2020. United States Department of Agriculture. Web.

Lion – Beer, Wine & Spirits (n.d.). Dun & Bradstreet. Web.

Luzzani, G., Lamastra, L., Valentino, F., & Capri, E. (2021). Development and implementation of a qualitative framework for the sustainable management of wine companies. Science of The Total Environment, 759(143462), 1-11. Web.

New Zealand Winegrowers. (2020). Annual Report. Web.

Organic Winegrowing (n.d.). New Zealand Wine. Web.

Our People. (n.d.). Kono Wines. Web.

Our Values. (n.d.). Web.

Partners. (n.d.). Web.

Pernod Ricard. (2020). Annual Report. Web.

Treasury Wine Estates. (2020). Annual Report. Web.

Woodfield, P., & Husted, K. (2017). Intergenerational knowledge sharing in family firms: Case-based evidence from the New Zealand wine industry. Journal of Family Business Strategy, 8(1), 57-69. Web.