Abstract

Fierce competition became eminent in the airline industry from the time when this industry became deregulated in the year 1978. In fact, the fierce competition has made each airway to strive towards achieving competitive edge within the global markets. To realize this, most airways including the Kuwait airways, have resorted to use cutting-edge optimization techniques including feasible business models and revenue management strategies. The Kuwait airways together with other airlines see revenue management as a decisive way of maximizing profitability and capacity usage. These airlines accomplish revenue management strategy through proper management of the demand and supply which is ensured via price management.

Therefore, to accomplish the research aims and objectives, this study will be both qualitative and quantitative. Various statistical techniques will be used to analyze the gathered primary and secondary research data. Factors such as clients’ arrival rates, probability that a client will reject or accept the Kuwait airways ticket, the pricing of tickets, the booking periods as well as the itineraries used by the Kuwait airways will be examined to respond to the stipulated research questions.

As a matter of fact, researches relating to revenue management and business models have progressed to include ticket pricing techniques and inventory control. However, given the complexity involved in such techniques and the numerous assumptions made, it has become very difficult to apply them in real life situations. Thus, to investigate the Kuwait airways revenue management strategies, business models and their implementation, a different research model which incorporates relevant pricing techniques, clients’ arrival rate, the probability that clients will accept the tickets and clients behaviours will be examined in this particular research. Finally, both the dynamic and static pricing will be studied.

Introduction

In today’s world of diverse business opportunities and fierce competition in each of them, the customer or the end-user is at the receiving end of the benefits. The price is the major constraint for the majority of customers while buying airline tickets. This is because there are so many options to choose from. It’s not that if a customer can’t get a ticket from a particular airline, he/she cannot travel. There are always other options available. As such, in today’s competitive world, the airline companies have to keep their prices to the bare minimum so as not to lose customers.

Moreover, due to the relaxation in the aviation policies of various governments, there has been an incessant growth in the number of Low Cost Carriers. In order to survive this competitive atmosphere, the airline companies are forced to reduce their prices and at the same time, offer one way tickets as well (especially in the case of international flights). Under such circumstances the profit margin of the airline companies has also gone to the bare minimum. It is obvious that somehow or the other these airline companies are always on the look-out for any chance to increase the overall profit. One of the easiest methods adopted by the airlines is to increase the capacity of the aircraft or in other words buy bigger aircrafts. Even though this is a costly affair but during the long run the airlines are benefitted.

Airline companies worldwide have adopted their own revenue management systems in order to cope up with such circumstances. Various researches have been conducted on the international airways as regards to their revenue management strategies as well as the implementation of the adopted business models. However, the Kuwait airways have received minimal attention if any with respect to these factors. This research intends to investigate the revenue management strategies and business models that Kuwait airways use and how they are implemented. The project is of great essence since literature in the field of revenue management strategies, business model assumed by the airline industry and their implementation have left a gap in this particular case study area.

Evaluation of the available revenue management strategies, business models and their implementation will be the basis for offering recommendations. The evaluation will help in establishing the relationship between the three aspects being observed and the impacts they have in the attainment of the Kuwait airways revenue and business goals, missions and visions. Consequently, the study will examine the Kuwait airways business models and revenue management strategies to establish the essentially needed improvements.

Even though studies that have been carried out in the past primarily focused on revenue management strategies and their importance to various industries, the relationship between these strategies, business models and their implementations have not been appropriately explored. Thus, the importance of this study lies on the fact that any shortcomings that Kuwait airways faces in its revenue management strategies, business models and their implementation needs to be studied and recommendations offered to enhance the company’s global market competitive advantage.

The Kuwait airways management will benefit from this study since important sectors that require specific improvement may be identified through this study. Additionally, strategies and business models that account for changing the Kuwait airways market environment may also be established. The study will identify factors that may facilitate the development of suitable revenue management strategies, business models and their implementation as a way of improving the Kuwait Airways’ organizational performance. A brief write up about Kuwait Airways is as follows:

Kuwait Airways is a renowned airline with its headquarters in Kuwait. The vision of the Kuwait Airways, according to the company website is “Kuwait Airways aims to setting the standard for customer orientation and become an admired airline to fly, to invest in, and to work for” (Kuwait Airways 2009).

As of today, the fleet of Kuwait Airlines consists of Airbus and Boeing aircrafts. A detailed description follows in the table below:

F: First class, J: Business class, Y: Economy class. Source: kuwaitairways.com.

Other features of Kuwait Airways are as under:

- Check in: There are two options for check in at Kuwait Airways. Passengers can either check in from the Kuwait Airways counters at the airports or they can do advance check in through internet. This is a good feature for the customers as it saves their precious time. If the passenger doesn’t have any baggage to check in, he/she can directly go for the security check. But if there is any baggage, then the same has to be checked in.

- Baggage restrictions: For economy class passengers, the maximum number of permissible check in baggage is two. The weight of each baggage should not be more than 20 to 23 Kilograms. The sum of the length, width and the height should not be more than 158 cms (62 Inch). For business class passengers, the permissible limit for check in baggage is again 2 pieces but the weight of each baggage can be up to 30 to 32 kgs. The permissible size remains the same (158 cms). For cabin baggage, the restriction is up to one only. The weight should not exceed 5 kgs. First class passengers can have check in baggage similar to that of the business class passengers.

- Seating options: Kuwait Airways has mainly two seating options namely, the business class and the economy class. But in some of its aircrafts such as the A 300 – 600, A 340 – 313, and B 777 – 269 there is an option of first class seating arrangement as well.

- For its business and first class customers, Kuwait Airways has Oasis Lounge at the Kuwait International Airport.

Objectives

The research study objectives will include;

- To investigate the revenue management strategy for Kuwait airways

- To examine the Kuwait airways business model that ensures effective revenue management

- To examine how business models and revenue management strategies are achieved

- To recommend to the Kuwait airways management new business models and technological advancements that may enhance the level of their market competitiveness

What are the key questions the project attempts to answer?

When this research study is concluded, the obtained outcomes should respond to the following questions;

- What revenue management strategies do the Kuwait airways currently use to maximize on the generated revenues?

- What impacts do the implemented business models have on Kuwait airways revenue maximization strategies?

- How do Kuwait airways implement both the business models and revenue management strategies to ensure that maximum revenue is generated?

- What policy measures and recommendations should the Kuwait airways management develop and implement to ensure they maintain the level of their market competitiveness?

Methodology and assumptions

What Research Methods do you intend to use?

Research Methodology and Study Design

Research Procedure

In order to investigate the Kuwait airways revenue management strategies, business models and their implementations, both qualitative and quantitative research methods will be applied. In qualitative research methodology, much of the conclusions will be drawn from the literature review. On the other hand, the quantitative method will involve a survey. The survey will be conducted online targeting the managers of the major Kuwait airways. More specifically, the survey will target the Kuwait airways management and it will serve as the main source of the research primary data. The researcher proposes to use deductive reasoning. These research methods are successively considered to be the best given that they rarely stand a chance of disqualifying any notable alternative explanations and they infer to the event causations.

Besides, to critically illustrate the revenue management strategies, business models and their implementations on the success of Kuwait airways as they exist when this study is conducted, the suggested descriptive statistics will accrue from the observations made. The researcher also proposes to use the specified research methods by taking into consideration crave to acquire relevant first hand research data and any other related investigated information from the research respondents. It is alleged that this will assist in devising sound and rational study conclusions amid offering feasible recommendations to the research being conducted.

Primary and secondary data sources

In order to present significant research findings, appropriate conclusions and credible recommendations, this investigative study on the Kuwait airways revenue management strategies, business models and their implementations will use the two well-known research sources namely the primary data source and secondary data source. However, the primary research information and desired data for this novel study will be obtained through administering self-designed survey questionnaires and conducting in-depth interviews to the study targeted population. In fact, the researcher intends to administer the questionnaires to the study participants in person through choosing each respondent initially incorporated in the study population. Interview schedules that have already been approved to help gather information on Kuwait airways revenue management strategies, business models and their implementations will equally be used to establish the management and employees observations on the extent at which the Kuwait airways have dealt with the implementation of business models and revenue management issues.

On the other hand, the secondary research data and information will accrue from various management, business and financial records in addition to any other authenticated generated revenue documentation that have been filed by the Kuwait airways. A review of the revenue management strategy information, adopted business models and the assumed implementation processes, acceptance and any resistance will be done to obtain secondary information. Such research information will facilitate the ascertainment of whether the organization in question has any primed revenue management strategy and business models which have been implemented and properly managed to help spearhead the Kuwait airways business and operation success.

Basically, the secondary and primary data which will be gathered will relate to Kuwait airways seat inventory, customer arrival rate and the ticket pricing or fare structure. Various revenue maximization strategies data such as the dynamic pricing, network inventory and the static pricing will be used to help answer the research questions. Furthermore, data relating to the clients ticket acceptability or rejection probability will be sought.

Research models

The following three models will assist in ascertaining the Kuwait airways revenue management strategies, business models and their implementations.

Pricing strategy

This model will assist to gauge the prices that the Kuwait airways offer, the maximum period the charged prices might take before fluctuating and the booking periods. Under this strategy, various approaches employed by the Kuwait airways will be investigated including the time remaining approach, hybrid approach and the seats remaining approach.

Acceptance probability

This revenue management strategy will help the researcher to ascertain instances when the Kuwait airways management anticipates whether a client will accept or reject the seat and the offered prices and measures that are undertaken. Three probabilities will be applied in this case including the probability regarding the offered prices, the remaining time as well as the composite probability.

Client arrival rate

The three clients’ arrival rates namely high, medium and low will be looked at under this strategy. The assumed booking processes will also be examined under this model.

Instrumentation and Data Collection

Data Collection Instruments

Data perceived to contain the relevant research information for this study will be acquired from the primary as well as the secondary sources. As a case study survey and a study that involves self-administration of research questionnaires, the relevant primary data will be gathered via self-administration of the study questionnaires, conducting structured in-depth interviews to the selected Kuwait airways revenue management and business plan development employees and through observation. A comprehensive exploration instrument will be developed and satisfactorily tested prior to embarking on the actual Kuwait airways revenue management strategy, business model and implementation research study. That is, after consultation with the supervisor, a questionnaire will be developed and only the selected and amended items that address the study questions and objectives will be included in the questionnaire.

Data Analysis Method

In order to ensure logical completeness as well as response consistency, the acquired revenue management data, business model information and their implementation will be edited by the researcher each day to be able to identify the ensuing data gaps or any mistakes that needs instant rectification. When data editing is completed, the collected research information will be analyzed qualitatively and quantitatively. For example, any data that will have been collected through in-depth interviews and secondary sources such as the generated revenue, customers’ arrival rate, airline networks and business models like the static pricing and dynamic pricing models will be analyzed using content analysis along with the logical analysis techniques (Spector 2006, p.223). Moreover, from the obtained research data, the correlation that exist between study variables namely revenue management strategies, business models and their implementation success or failure will be gauged.

Further quantitative data analysis techniques including percentages, the acceptance or rejection probability and deviations will be used to determine the research respondents’ proportions. The method will be applied for each group of items available in the questionnaire that ideally corresponds to the formulated research question and objectives. Line graphs, tables as well as statistical charts will be used to make sure that quantitative data analysis is simply comprehensible (Spector 2006, p.224). Of great essence will be the development of a research model that constitutes all the study factors such as the client arrival rate, pricing strategies, ticket acceptance probability and the used airline itineraries.

Needed assurances and clearances

Given that this research is essential to the completion of my study, a formal authorization request will be sought from the Kuwait airways management where the survey will be conducted. The researcher will take all the responsibilities encountered during the research process to ensure the integrity, dignity and well-being of the involved study subjects. To make certain the completion of the research tasks within the required time-frame, the researcher will recognize and effectively balance any subjectivity by providing precise research accounts and abiding by the law to develop the indispensable expertise. Considerations and observance will thus be given to a variety of ethical issues as well as guidelines namely the participants informed consents, power and confidentiality (Aguinis & Henle, 2002).

The Kuwait airways employees will be granted a holistic indulgent into the study through seeking for every research participant’s permission to ensure abidance by their respective informed consent. A request for the participants understanding to be involved in the research will also be made clear. For instance, time factor, the significance of the topic researched on, activities to be undertaken, and any risk to be encountered will be revealed to the research respondents or participants. The participants will be free to make independent decisions of whether to take part or not to be involved in the research. This implies that the participants will be informed by the researcher of their indefinite voluntary participation in the study before taking part (Aguinis & Henle, 2002). Further, the researcher will ensure that the participants are aware of the research details and nature and their respective rights to pull out from the study any moment.

Honesty will be observed by the researcher and the participants will not be compelled to take part in this research. To ensure that the participants are not laid up while participating in the research, the Kuwait airways management permission will be sought and the unwilling participants will be exempted from the study. In fact, the participants’ information will not be disclosed to guarantee confidentiality and to preserve their anonymity (Aguinis & Henle, 2002). The information acquired from the study participants will be securely stored and protected whereas study finding reports will not divulge the participants’ identification.

Literature review

Since 1970s the yield or revenue management together with its application in the airline industry has been highly emphasized (Wright et al. 2009, p.6). Littlewoods first depicted the basic problem of airline revenue management in his 1972 article. In that article Littlewoods introduces the so called Littlewoods rule stipulating that each seat should only be fulfilled if its revenue surpasses the future anticipated value. This basic rule forms the current basis in which majority of airline control policies both in practice and theory is anchored (Wright et al. 2009, p.6).

Initially, revenue management was considered to be of interests only to the academicians and the individuals engaged in the airlines operations. But gradually, owing to the increase in revenue, revenue management became a vital factor for all airlines worldwide.

The work of Littlewoods has been expanded by various scholars. For instance, the revenue management problem was examined using the fare-restriction combinations by Belobaba in 1989 (Wright et al. 2009, p.6). Also Glover et al in 1982 explored the passenger-mix problem within the network environment. Moreover, you in 1999 looked at the dynamic pricing model while Van Ryzin in 2004 applied the discrete-choice model of demand (Wright et al. 2009, p.6). More literary work in airline revenue management was contributed by the in depth analysis by McGill and Van Ryzin in 1999. Therefore much of the literary review will surround the works of these scholars.

Factors and strategies considered

The price of air tickets depends on various factors and the same have been discussed in detail in the ensuing paragraphs. The four main aspects that have an effect on the performance are price of the tickets, time remaining, acceptance probability of the customers, and the arrival rate of the customers.

Pricing strategy

Dynamic pricing models

Considering revenue management as the dynamic pricing model has been largely attributed to the works of Bertsimas (2005, p.307). To maximize the anticipated airline revenues, the scholar set the prices dynamically in a finite horizon model whereby the demand distribution parameters are not known. The scholars suggested promising pricing policy known as the one-step-look-ahead-rule in which the tailor expansion series is applied (Ryzin 2011, p.8). The expansion function of the future reward illustrates the trade-off that is between short-term revenue management as well as future information gains (Bertsimas 2005, p.309).

The optimal dynamic pricing proposes a model that is used in the perishable products having stochastic demand (Wright et al. 2009, p.6). The assumption is on the finite set of allowable prices. In the model the continuous time dynamic programming is applied. The state of the model at each given time is the quantity of items in the inventory and the decision of the retailer is the selling price. In the model demand is assumed to be Poisson with a deceasing rate (IDeas 2005, p.7). What the model is trying to substantiate is the perception that the maximum prices is not increasing within the remaining inventory and non-decreasing in the future (Wright et al. 2009, p.6).

Ticket pricing

Currently those managing the airline consider pricing as an element of revenue management strategies (CAPA 2011, p.1). The reason is that the existence of the airline seat differential pricing is the beginning of the revenue management in the airlines and prices are the most significant determinant of the demand behaviour of the passengers (Bitran & Caldentey 2003, p.207). Also exist is the duality between the seat allocation and price decisions. Therefore prices are viewed as variable that can be manipulated on the continuous basis. Increasing the prices adequately high can cause the shutdown of the booking class (Curry 2001, p.177). Moreover the availability of numerous booking classes when a booking class is shut down can be taken as changing the structure of prices faced by the passengers.

Seats remaining approach

At the initial stage when the booking is about to be started, it is obvious that all the seats are available. At this moment, the fares of any particular flight are the lowest. As the booking starts and bookings start pouring in, the number of seats available starts decreasing and simultaneously, in a fixed proportion, the price starts increasing. To make it simpler, it can be said that the first seat booked is at the lowest price and the last seat booked is at the highest price. The following equation is used for calculating the price of ticket at any given point of time (this includes the number of seats available at that time):

Ticket price = Maximum ticket price – (seats remaining) * K ………….. Equation 1

In this equation, seats remaining mean the number of seats that are still available. ‘K’ is a constant decided by the airline companies and as such is different in different airline companies. When no further seats are available for sale, the ticket price is equal to the maximum ticket price. It is noteworthy that the maximum ticket price and the constant ‘K’ are arrived upon by the airlines and as such are different, case to case. The following representational graph shows the relation between the ticket price and the seats remaining at the time of booking:

Time remaining approach

Likewise the seats remaining approach, the time remaining approach also affects the price of the tickets. At the initial stage of booking, in order to attract more customers, airline companies keep the fare to the base minimum. As the time remaining for the flight decreases, the price of the ticket is increased. This increase in the price of tickets is also in a proportion, depending on the time remaining. The formula used for arriving at the ticket price considering the time remaining, is as follows:

Ticket price = Maximum ticket price – (time remaining) * J ………….. Equation 2

Time remaining is the time left for the flight to take off. ‘J’ is a constant. If the time remaining is zero, the ticket price is equal to the maximum ticket price. As mentioned earlier, the maximum ticket price and the constant ‘J’ are decided by the respective airline companies. The relation between the time remaining and the price of tickets can be represented as follows:

Combined approach

Both the aforementioned approaches have their own significance. But at times there are certain instances where in spite of the time remaining for the flight is less, very few tickets have been sold. In such circumstances the airline companies are in a dilemma because they cannot charge more on tickets because the number of seats available is more and on the other hand, they cannot charge less because the time left for the flight is less. But the tickets need to be sold so the airlines adopt an approach that is a combination of the two approaches. In this approach, the calculation is done as under:

Ticket price = Maximum price – (time remaining) * J – (sales remaining) * K… Equation 3

‘J’ and ‘K’ are constants. These constants are such that if the time remaining is the total booking period and the seats available are negligible, then the ticket price is the maximum.

Acceptance probability

There is always a probability of the customer not accepting a seat. This is called the probability of acceptance or rejection. This acceptance or rejection may be due to various factors that are listed below.

Price

It is obvious that when the price of tickets is lower, there is a greater probability of tickets being sold. So there is a high probability of acceptance from the customers. It may be concluded that when the price of tickets is the lowest, the probability of acceptance is the highest and when the price of tickets is the highest, the probability of acceptance is the lowest. People who mainly benefit from this are either the expatriates who go on annual leave or return back to resume their duties, or those people who plan for holidays in advance. This feature can be depicted by the following formula:

Acceptance probability = 100 – (price of ticket – cheapest fare) * L … Equation 4

‘L’ is a constant and is adjusted in such a manner that when the ticket price is the lowest, the acceptance probability is the highest. The following graph depicts a representation of the relation between the acceptance probability and the ticket price:

The graph shows that lesser the ticket price more will be the acceptance probability and vice versa.

Time

The time remaining is the maximum at the time of opening of the booking of any particular flight. At this time the customers are not in a rush to buy tickets and therefore the acceptance probability is at the minimum. As the time remaining for the flight decreases, the ticket price increases and gradually it reaches to its maximum, when the time remaining is zero. So customers who want to travel instantly have to pay more. This applies mainly to business executives who make plans at the nick of the time. Since business visits are very important, they are ready to take any available flight and at any cost. Such people don’t book in advance because their schedule is not finalized beforehand. The following formula depicts the calculations:

Acceptance probability = 100 – (Remaining time) * M …… Equation 5

‘M’ is a constant and is arrived at in a manner that when the time remaining is less, the probability of acceptance is higher. This feature can be better understood by the following graph:

Price and time combined

It is understood that at the time of opening of the booking of tickets for any particular flight, the time remaining for the flight is the maximum and the fare is the minimum. If we consider the above mentioned two points (a & b), both seem to be contradictory because we have mentioned that if the price is less, the acceptance probability is high and on the other hand, if the time remaining is more, the acceptance probability is less. But we know that both the probabilities are true. Therefore there is a need to establish a combined approach wherein both the price and the time remaining are taken into consideration while measuring the probability of acceptance by the customers. In such a case, the following formula works:

Acceptance probability = 100 – (ticket price – lowest price) * L – (time remaining) * M …. Equation 6

‘L’ and ‘M’ are constants.

Customer arrival rate

The rate at which customers arrive at the service desk during a given period of time is called the customer arrival rate. By this rate, the frequency of customer arrival can be judged. This rate is normally governed by the Poisson distribution system. Suppose on a given day, 10 customers arrive at the service desk during one hour. It may be assumed that every hour 10 customers will come at the service desk. But this is just an assumption. Actually the number may differ during different times. Sometimes the number may increase and sometimes it may decrease. This fluctuation of customers is explained by Poisson distribution.

Developing a model

While developing a model, we have taken into consideration the aforementioned six equations and have arrived at the values of constants. It is obvious that the values of the constants vary depending on the various factors such as the time remaining, seats available and the probability of acceptance. It is up to the airlines to decide the minimum and maximum ticket prices. So the constants differ from airline to airline. Customer arrival rate is also a deciding factor. This rate is governed by the Poisson distribution system. For ease of understanding, the rates have been divided into three segments namely, low, medium and high. Also, it is up to the customers to accept or reject the price of the ticket offered. This is termed as the probability of acceptance. If a customer doesn’t accept the ticket price, he/she will go back. But if the customer accepts the price that has been offered, a seat will be reserved for him/her and a corresponding ticket will be issued to him/her. Simultaneously, one seat will be decreased from the available seats and the price for the next ticket to be sold will be automatically calculated according to the current pricing structure.

In this research we have discussed nine different factors that have an impact on the performance of the airline company. These factors are based on the pricing structure (according to the seats available, time remaining and the combined approach) and the customer acceptance probabilities (based on the ticket price, time available and the combination of both). Apart from these factors, the destinations also have an impact. These destinations may be the home towns of expatriate workers, academic destinations, tourist destinations, business destinations, or a mix of tourist and business destinations. If we combine all these factors, the following result can be achieved (as shown in the under mentioned table):

Revenue management strategy in the Airline industry

Business models and strategies

The airline revenue management has over the years transformed from the simple-leg control systems to the network or origin-destination control system through segment control system. Also, the airline revenue management has been faced with problems which are distinctively divided into two namely the discount or seat allocations and the ticket pricing. These problems define the type of business model and the revenue management strategies being applied by the airlines (Bertsimas 2005, p.304). In revenue management both the single-leg control and network control strategies have continuously been applied till today in the airline industry.

Seat or discount allocation

Discount or Seat Allocation

Also called the seat inventory control strategy the seat or discount allocation is the optimal determination of booking limits for the fare class seats whereby the maximization of total revenue is highly prioritized. Both the single-leg and the network control approaches have been used in this strategy. When applying the single-leg control approach the flight legs are separately optimized. On the other hand, all the flight legs including direct flights connecting pair of cities are simultaneously optimized using the network inventory control strategy. Therefore, to optimize the total revenue for the entire airline network, the network revenue management will have to handle the sale of the airline ticket to the passengers considered local as well as those considered connecting passengers (Al-Watan 2011, p.3).

In almost all major airlines such as Kuwait airways the aircraft seats are categorized into economy and executive classes. The economy classes have comparatively low fares as compared to executive classes which relatively have higher fares. Nevertheless, considering the economy section of the aircraft, all seats will not be priced identically though if looked at physically, they are identical. The result is different fare classes. The major issue is the number of tickets to be sold within each class to dissimilar passengers (CAPA 2011, p.1).

The assumption of the seat inventory strategy is that the prices for each fare classes will be allocated depending on certain predetermined criteria. Moreover, for the airline to maximize its total revenue only the seat allocation needs are determined. The nested reservation system is normally being applied in determining the booking limits for the fare classes (Bertsimas 2005, p.306). In this system the fair class inventory are structured in such a way that high fare request will not be denied so long as there are available seats remaining in the lower fare classes.

However the nested-reservation system is only binding in limited capacity where the lower fare classes are reserved when the higher fare classes are fully booked (Airline Leader 2011, p.9). The booking limit is the highest number of seats for a fare class that can be sold. For instance where the airline considers a nested reservation system for a three-fare class, then the maximum booking for the highest fare-class is going to be the total cabin capacity. The subsequent fare-class will be having maximum booking equivalent to the total cabin capacity less the seats that are reserved for the higher fare-class.

Through the application of the nested reservation system the airline will have to ensure that the demands for higher fare class are for all time accepted so long as there is availability of seats in the cabin. In this system difference that occurs between the compulsory maximum value of seats in the immediate lower class and the required maximum seats of the higher fare class is known as the reservation level of the higher fare classes from the lower fare classes.

Though it will always be attractive for the airline to be able to sell many highest fair class tickets as possible, this would not be beneficial especially by raising the number of seats since a few seats within the highest fare class may remain un-booked or vacant hence raising no revenue (Bertsimas 2005, p.308). Therefore, the major objective of the airline will be to allocate seats for every fare class in such a way that the seat mix sold in the aircraft has maximum revenue generation.

The seat inventory control

As was stated the airline revenue management strategies being discussed is majorly divided into seat inventory control system and the ticket pricing system. According to Anjos et al. (2009, p.538) the seat inventory control system involves apportioning limited seat inventory to the existing demand that occurs overtime before the departure of the scheduled flight. The major objective of this strategy is to get the seats right mix that will maximize the revenue (Belobaba 1987, p.65). The strategy applies either a single leg seat approach or the network inventory control approach.

Single-leg seat inventory control approach is whereby the flight legs are separately optimized (Curry 2001, p.177). For instance, assuming there is a passenger travelling from A to C through B. This passenger offers to pay $1000 for the whole journey. It is assumed that this passenger pays $600 for the first flight from A to B while the second flight costs him $400. Also consider the second passenger travelling only from A to B and offers $800 for the journey. Using the single leg approach the second passenger will be considered for the flight leg from A to B since he offers to pay for higher fare that the first passenger and the airline aims to increase its revenue.

At the same time rejecting the offer of the first passenger will make the airline loose an opportunity of creating revenue for the combination of the two flight legs. In case the second leg flight from B to C is not filled up then it would be profitable to accept the offer of the first passenger. This clearly indicates the disadvantage of the single-leg inventory control system. To sort out this problem of single-leg, two solution methods have been proposed. They include dynamic and static method solutions (Curry 2001, p.177).

Network inventory control

The aim of the network seat inventory control strategy is to optimize the complete network of flight legs that is being offered by the airline simultaneously (Bitran & Caldentey 2003, p.215). In other words the network inventory control strategy considers the whole revenue that the passengers generate from the origin to the final destination. The stochastic approximation approach has been used to solve the problem of revenue management through the application of reinforcement learning algorithm (Berge & Hopperstad 1993, p.157).

Static solution techniques

Basically, in this type of booking, the date for requesting for reservation is regarded as the only interlude. Also the booking limit for each booking class is supposed to be set for each booking period (Coughlan 1999, p.1103). The biggest problem with the static solution method is that it takes into consideration only the bookings that are done at a particular time. However, bookings are normally a continuous process (1999, p.1103). Although this might not be the optimal approach, it has the capacity to handle both huge and compound leg complications.

The first solution method to be used to work out the problem of airline revenue management for the single-flight leg with double fare classes was the Littlewoods rule (Wright et al. 2009, p.6). The idea behind this rule is to equalize the marginal revenue in every fare classes. The whole idea is to close down the low fare class whenever revenues from the other low fare seats exceed the expected revenue when the same seats are sold at higher prices (Wright et al. 2009, p.7).

The Littlewoods rule was further extended to multiple fare classes and the term expected marginal-seat revenue method was introduced (Cote et al. 2003, p.27). The methods integrate nested protection level. That is the number of seats that should be sold in each fare class. The only problem with this method is that it does not yield optimal booking limit in situations where two fare classes are being considered (Cote et al. 2003, p.27).

Dynamic solution technique

The technique does not begin the reservation control strategy from the inauguration of the reservation date, but it somewhat sets the reservation bound for each and every reservation classes founded on the fixed reservations throughout the uncut reservation course (Bertsimas 2005, p.309). The major constraint to the solution method is that it is computationally rigorous. The discrete time dynamic-programming model has also been considered by some scholars. This is a non-homogenous Poisson process model demand for every fare class (Bertsimas 2005, p.310).

The use of Poisson process result in the Markov model of decision process whereby bookings are considered done at time t except the available capacity. Booking period is sub divided into various decision periods whereby every request constitutes a period (Ryzin 2011, p.7). The rule is that the booking request is accepted only when the fare go beyond the predictable cost at time t (Bertsimas 2005, p.315). Numerous seats booking which is a problem in the airline seat inventory control are also taken into consideration. The Markov decision process model for airline seat allocation on a single-leg flight with multiple fare classes has also been formulated (Bertsimas 2005, p.309). The model has integrated overbooking, absenteeism and cancellations (Bertsimas 2005, p.309).

Also the static and the dynamic single leg-seat inventory control model have been interlinked (Ryzin 2011, p.9). The interlinking process indicates that the Markov decision process brings about the two solution approaches as well as formulating an anthology model that give rise to the dynamic and static models as the special cases (Bitran & Caldentey 2003, p.222).

Overbooking

The airline will not accept only the reservations for the number of seats available rather it will sell more seats beyond the available capacity (Al-Watan 2011, p.3). The reason is that it will risk departing with seats unoccupied because of cancellations or as a result of absenteeism. Therefore the airline will always thrive to book beyond its capacity (Kuwait Airways 2011, p.5). However, there will be a risk of having ticket holding passengers. But such passengers will be rebooked on later flights. Though there will be compensation and loss of good will as well as the bumping cost when there is overbooking, in most cases the fixed percentage will be used as the overbooking factor.

Ticket pricing

In ticket pricing the differential pricing will be used in determining prices of each class tickets in such a way that the revenue is maximized. This will majorly depend on the airline internal structures or the marginal costs and the market reactions. Differential pricing is whereby different seats will be sold at different prices not necessarily according to classes. In other words, even within a class seat price differentiation will be applied. As already been mentioned the ticket profit maximization prices will primarily depend on the market side or demand and the supply side (Bertsimas 2005, p.311). The demand or the market side is the relative perceived value of the seat and the willingness of the passengers as well as his ability to buy the seat.

The sales volume will comprise of the number of seats bought at various seat class levels. When the sales volume is combined with prices the result represents the total revenue that the airline will generate (Kuwait Airways 2011, p.21). The sales volume and price relationship mirrors the ordinary demand curve principles. However the relationship between prices and sales volume can considerably vary within or between the markets. This will make the critical pricing decisions be more difficult (Airline Leader 2011, p.11).

Due to the ever changing airline business environment, the demand for the seats may either increase or decrease. Increases in demand normally result from the internal organizational strategies such as offering promotional fares and good marketing campaigns. However, low demand may be driven by external factors such as low prices being offered by the competing airlines (Kuwait Airways 2011, p.1).

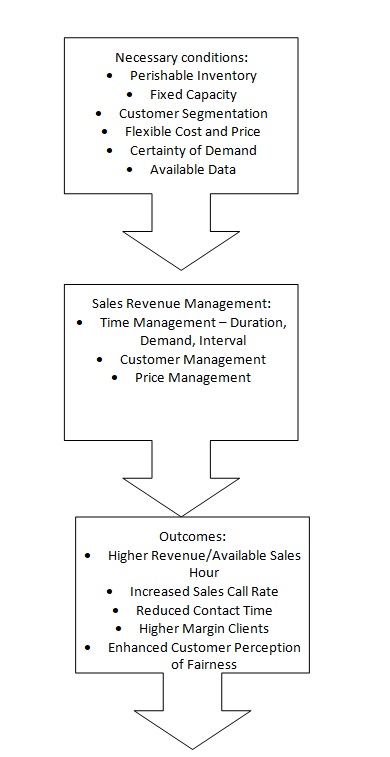

Characteristics of revenue management

“Revenue management is the application of information systems and pricing strategies to allocate the right capacity to the right customer, at the right place and at the right time” (Siguaw, Kimes & Gassenheimer 2003). Following is a framework for revenue management:

“Revenue management has been most effective when applied to operations that have the following characteristics: perishable inventory, relatively fixed capacity, segmented customer markets, flexible cost and pricing structure, certainty of demand, and readily available key data” (Siguaw, Kimes & Gassenheimer 2003).

Perishable inventory: As the word suggests, ‘Perishable inventory’ means such an inventory that can be sold up to a certain time limit. After the time limit there is no point in trying to sell that particular inventory because it perishes. The time limit may be due to certain factors. Like in food items, the factor is the date of expiry, in some products it is the shelf life and in airlines it is the time up to which the tickets of a particular flight may be sold. It is obvious that once the aircraft has taken off, there is no possibility of tickets being sold for that particular flight. It means that the revenue for any particular flight can be generated only until the flight hasn’t taken off.

Relatively fixed capacity: As is understood by the name, this factor relates to the capacity. A hotel has a limited number of rooms, a cruise ship has a limited number of cabins and likewise, an aircraft also has a limited number of seats. This is due to certain restrictions regarding the space available. There is no criterion for the minimum number of passengers that can be accommodated but as far as the maximum number of passengers is concerned, it depends on the size and type of the aircraft. Most of the aircrafts have different classes such as executive class, business class, first class etc. Different space is required for each of these classes and as such, seats are arranged according to that. Once the seats are put in place, they cannot be changed that easily because otherwise the complete interior has to be changed. So the airlines have a restriction of booking tickets according to the seats available in each class.

Segmented customer markets: Segmentation means separating a particular group from another. Airlines adopt the segmented customer markets strategy in order to gain maximum out of the available clientele. The segmentation is done considering various aspects such as the geographic locations, distribution preferences, price preferences, time considerations, demographic considerations, and life style or the standard of living of the customers. It is worth mentioning that factors like the demographic considerations and the life style or the standard of living don’t apply to the airline industry.

- The most common of all these aspects is perhaps the segmentation according to the geographic location. It is a common practice by business houses to market their products in areas for which the products are specifically made or where there is an anticipated good market. In the likewise fashion, hoteliers establish their hotels where there is more probability of tourists. Similarly, airlines also ply more on the routes on which there is more traffic. In following this particular aspect, airline companies are after the quantity rather than the quality. Due to the internationalization of business houses, there is frequent traffic of their workforce. Mainly, this traffic is inbound and outbound from the developing countries. The reason is the maximum number of workforce being from the developing countries. As for example in the case of United Arab Emirates, the airline traffic to and from the developing countries like India is more than that to and from the Western countries.

- It is a well known practice by business houses to market their products under different brand names in different locations. This depends on the social structure or the locality of that particular area. For areas that are inhabited by the affluent, the products are costlier in comparison to those marketed in areas inhabited by the middle-class people. This is done considering the buying power of the people of any particular area. In trains also there are different classes that vary in the comfort provided. Obviously, the prices also differ. If costly products are marketed in areas where the middle-class people reside, then there will be no takers because the people of that area will not be able to afford such costly products. Similarly, airline companies also ply aircrafts according to the sectors. It is understood that there are a variety of aircrafts available with the airline companies. They differ in size and the luxury level. Now to better understand this feature, we take an example of the airlines operating from the Gulf countries to the Asian countries. A majority of the passengers are the working class who work in the Gulf countries in order to earn a handsome living for their families. For such people, luxury is secondary and moreover, is not at all necessary. For them, an aircraft is just a via-media of transportation. They either want to reach their families at the earliest or want to resume their duties. Most of the people employed in the Gulf countries have a contract under which the employing companies provide them with free ticket to and from their home land. It is obvious that the companies would not like to spend more by sending their workforce by luxurious aircrafts. Considering this very aspect, the airlines ply normal aircrafts to and from such countries. On the other hand aircrafts plying to and from the western countries are different, having more of luxury and comfort.

- As mentioned in the previous point, price is the main governing factor for airline companies in plying aircrafts on various sectors. The same factor applies to customers as well. Even a small price variation can amount to thousands of dollars annually. Even though it was not considered a good move by many people, American Airlines came up with a novel idea of reducing the cost and increasing the profits. “First place goes to American Airlines for the brilliant, yet simple cost cutting measure they implemented back in 1987. The airline was able to save $70,000 in 1987 by eliminating just one olive from each salad served in first class” (as cited by Skeptics 2011). Coming to the point, if any business house wants to flourish, it should cater to the needs of all classes of people. Same applies to the airline companies as well. As discussed earlier in this paper, today even an individual earning say about $500 a month (especially in the Gulf countries) has to travel by air in order to reach his/her home place or work place. Then there are individuals who are executives in companies and have to travel the world on business. Owners of business houses that have worldwide offices and franchises travel to various countries to monitor the progress of their business. All these categories or classes of people have different motives of travelling and their perception of travel is different. An ordinary person who earns around $500 per month will not expect any luxury during travelling. An executive will be satisfied with good sitting arrangement and good food. But the owner of a global business house will expect a royal treatment and comfort during his/her journey. So in order to cater to the needs and expectations of its customers, airlines have to be very particular so that they can retain their customers in this competitive world. So airlines have different classes such as the executive class, business class and first class. But providing comfort and luxury involves more expenses. That’s the reason the prices are different for different classes. Some airlines have different aircrafts for different classes.

- Another important factor that has an effect on the price of the tickets is the time. By time we don’t mean the mornings or evenings, but the amount of time left for the flight at the time of ticket purchase. As the duration left for the flight decreases, the price increases. So if two people have purchased their tickets on two different days, they would have shelled out different amounts.

- Peak season is also a criterion for price variation. We generally notice in the market that some products are sold during a particular season only. Like for example fire crackers, candies etc. are sold more often during Christmas. New Year greeting cards are sold during the last month of a year. The prices fluctuate according to the demand and supply theory. If there is more demand, the price will be higher and vice versa. It means that there is a particular time for everything. Similarly, in airline industry also there is a peak time when there is a lot of traffic. This is the time when airline companies increase their ticket prices. Peak time can be due to various reasons. These include school and college holidays, festivals, any special event such as Olympics, world cup football etc.

Revenue management in other industries

In today’s competitive world, revenue management is very crucial for any business in order to survive and flourish. Be it a service industry or a hospitality industry or a manufacturing and marketing industry or an airline industry, having a revenue management strategy is very important. “The origins of RM were in the US airline industry at American Airlines in 1985, where deregulation had occurred. This created a highly competitive environment, with new start up carriers such as People’s Express aggressively undercutting traditional airlines with very low fares” (Airline Revenue Management 2012).

Even though revenue management is applied in all businesses, the characteristics of revenue management are different for each business. Like for example in the garment industry, demographic consideration is a crucial factor, whereas in the airline industry it is not of any major significance. By demographic consideration we mean that in the garment industry, there are separate considerations for men, women and children. There are stores that are meant specifically for men or women. The age factor also counts. There are special stores meant only for children. In the electronic industry there are certain products that are targeted to particular age groups. In the airline industry, there is no such consideration. People of all genders and all ages are allowed in the same flight.

There are certain businesses that are religion specific. Like a company manufacturing Christmas gifts caters mainly to the Christian community. A company manufacturing prayer mats caters mainly to the Muslim community. But in the airline industry religion is not a criterion while selling tickets.

Research organization

The organization of this research has been managed in such a way that all the main points are included in it. Starting with the abstract and a formal introduction, the objectives of the research have been outlined. The methodology of the research has been discussed in detail. In chapter one the researcher has included the literature review and thereafter, has discussed about the various factors and strategies responsible for the performance of any particular airline company. These factors include the pricing strategy, acceptance probability, and customer arrival rate. Also, the revenue management strategy has been discussed in detail with separate paragraphs on seat or discount allocation, overbooking and ticket pricing. Later in the chapter, the characteristics of revenue management have been enlisted and a detailed description has been done. Chapter two includes the experimental design and analysis of the results pertaining to the seats remaining approach, time remaining approach, probability of acceptance and rejection, and the arrival date. Chapter three includes the flight networks and viable recommendations. Then there is the conclusion and then the summary. In the end, the researcher discusses on the scope for further research in the subject.

Experimental design and analysis of the results

In this chapter the researchers has assumed certain figures and has calculated the different constants. The assumed capacity of the flight is 300 passengers. The assumed minimum price of ticket is $200 and the maximum is $500. The booking of tickets for this particular flight is assumed to start 30 days before the date of the flight. This is a single leg model and as such only one way trip has been taken into consideration. The return trip can be modeled in the same manner. The advance time of ticket booking i.e. 30 days has been divided into 6 slots with each slot consisting of 5 days. The arrival rate of the customers is governed by the Poisson distribution system and differs at different intervals of time and as an assumption, three arrival rates are considered. Once all the seats are booked or the time remaining elapses, it will be considered as a terminating point.

Constants

Here we shall calculate the constants ‘J’, ‘K’, ‘L’, and ‘M’.

Seats remaining approach

According to the formula mentioned earlier in this paper,

Ticket price = Maximum price – (seats remaining) * K

Since we are calculating the constant ‘K’ at the time of starting of booking, it is understood that the seats available will be maximum and the price of tickets will be minimum. Hence,

200 = 500 – (300) * K

Therefore, K = 1

Time remaining approach

At the time of starting of the booking, the time remaining is 30 days (assumed) and the ticket price is the lowest. Therefore, according to the earlier mentioned formula,

Ticket price = Maximum price – (time remaining) # J

Therefore,

200 = 500 – (30) * J

Therefore, J = 10

Price and time combined

Ticket price

According to the previously mentioned formula,

Ticket price = Maximum price – (time remaining) * J – (seats remaining) * K

In order to know the constants ‘J’ and ‘K’ in situations where both time and seats are taken into consideration, we have to first know the difference between the maximum and minimum prices of tickets. The maximum ticket price is $500 and the minimum is $200. So the differential is $300.

- When both time remaining and seats available are given equal consideration, the calculation is as under:

300*0.5 = 30J

Hence, J = 5

300*0.5 = 300K

Hence, K = 0.5

- In cases where the remaining seats are given more consideration we assume the ratio to be 80:20 where 80% is seats remaining and 20% is time remaining. So the calculation is done in the following manner:

300*0.2 = 30J

Hence, J = 2

300*0.8 = 300K

Hence, K = 0.8

- In cases where the remaining time is given more consideration we assume the ratio to be 80:20 where 80% is the time remaining and 20% is the remaining seats. So the calculation is done in the following manner:

300*0.8 = 30J

Hence, J = 8

300*0.2 = 300K

Hence, K = 0.2

Probability of acceptance and/or rejection

- Probability of acceptance or rejection with respect to the price of tickets

According to the earlier mentioned formula,

Acceptance probability = 100 – (ticket price – lowest price) * L

It is assumed that a high probability is 100% and a low probability is 50%. Also, we have discussed earlier that when the ticket price is highest, the acceptance probability is the lowest. Therefore,

50 = 100 – (500-200) * L

Hence, L = 0.1667

- Probability of acceptance or rejection with respect to the time remaining

According to the earlier mentioned formula,

Acceptance probability = 100 – (time remaining) * M

At the initial stage of the starting of booking, customers are not in a hurry to buy tickets because they still have time to think and finalize their schedule. It has already been assumed that the booking starts 30 days in advance. Therefore,

50 = 100 – (30) * M

Hence, M = 1.6667

- Probability of acceptance or rejection with respect to both the time remaining and the ticket price.

According to the earlier mentioned formula,

Acceptance probability = 100 – (ticket price – lowest price) * L – (time remaining) * M

As mentioned earlier, the lowest acceptance probability has been considered to be 50% and the highest acceptance probability has been considered to be 100%. The difference in the highest and the lowest price is $300 and the 30 days is the time remaining for the flight.

- When both the time remaining and ticket price are given equal consideration, it means that the flow of traffic is balanced. The tourists, business executives, and the expatriate workers are all in need of tickets at this time. The calculation is done as follows:

50 * 0.5 = 300 L

Hence, L = 0.0833

50 * 0.5 = 30 M

Hence, M = 0.8333

- When more consideration is given to the ticket price we assume that the ratio is 80:20 where 80% is the ticket price and 20% is the time remaining. This kind of a situation occurs when there are more tourists and expatriate workers on the flight. The tourists and the expatriate workers will always want a cheaper fare. The calculation is done in the following manner:

50 * 0.8 = 300 L

Hence, L = 0.1333

50 * 0.2 = 30 M

Hence, M = 0.3333

- When more consideration is given to the time remaining we assume that the ratio is 80:20 where 80% is the time remaining and 20% is the ticket price. This situation arises when there are fewer tourists and expatriate workers but more business executives who want the next immediate flight to attend to business chores. The calculation is done in the following manner:

50 * 0.2 = 300L

Hence, L = 0.8333

50 * 0.8 = 30 M

Hence, M = 1.3333

Following is a consolidated table of the various constants and their calculated values:

Arrival rate

The customer arrival rate is governed by the Poisson distribution system. In order to understand this better, the researcher has divided the arrival rate into three categories namely, low, medium and high. The period of 30 days (advance booking starts 30 days in advance) has been divided into 6 slots with each slot consisting of 5 days. It has been assumed that a low customer arrival rate is 0.08, 0.16, 0.25, 0.33, 0.25, and 0.16 per hour which in terms of customers is 2, 4, 6, 8, 6, and 4 customers per day. A medium customer arrival rate has been assumed to be 0.25, 0.33, 0.42, 0.5, 0.42, and 0.33 per hour which in terms of customers is 6, 8, 10, 12, 10, and 8 customers per day. The high customer arrival rate has been assumed to be 0.42, 0.5, 0.58, 0.67, 0.58, and 0.5 per hour which in terms of customers is 10, 12, 14, 16, 14, and 12 customers per day. The customer arrival rate has been calculated by dividing the number of customers per day by 24 (the number of hours in a day). The following table depicts the consolidated customer arrival rates:

Analysis of the results

The values of the constants ‘J’, ‘K’, ‘L’, and ‘M’ are used in the aforementioned nine models and are tested for 30 days.

It is observed that different groups of people prefer different times for booking their tickets. It is a well known fact that workers from the developing countries venture into other countries, mainly in the Gulf region, for search of job. All over the Gulf region, it is a practice adopted by companies to offer annual or once in two years’ leave. Leaves of such expatriates are pre-decided and their tickets are booked in advance, as soon as the bookings are opened. This way, the companies get better deals in the ticket price and save money. Similarly, the tourists going on holidays plan their holidays in advance and book their tickets.

The same applies to students going to foreign countries for higher studies. Their program is also pre-decided and as such they also book their tickets in advance. So the probability of acceptance in these three cases is higher when the ticket prices are low and the time remaining for the flight is more. Such people are very conscious about the price. They want to save money wherever possible. The probability of acceptance also depends on the destinations. Like in the case of expatriates, the probability of acceptance is higher in destinations like the developing countries (from where a lot of people go abroad in search of livelihood). Holiday destinations might include countries like Switzerland, London, Paris, Venice etc. Destinations that are famous for their academic institutions might include Oxford, Cambridge, Yorkshire, etc. It is noticeable that while the destinations of expatriates have higher probability of acceptance throughout the year, the destinations of holiday goers and students have higher probability of acceptance at specific times of the year.

There is another class of people called the business executives. These people have to travel on short notices since meetings, demonstrations etc. are scheduled instantly. Such meetings and promotional demonstration cannot be missed otherwise it may result in losses to their respective companies. To such people the price of the ticket is not a criterion. Their main aim is to get a seat in the immediate next flight to their destination. So the probability of acceptance in such cases is higher even when the ticket price is on the higher side and the time remaining is less. Business is carried out throughout the year and as such the probability of acceptance in such cases is higher throughout the year. Destinations of such business executives are business cities such as New York.

There are certain destinations which are preferred by holiday goers as well as business executives (because they have business at those destinations). Such destinations also have a higher probability of acceptance. But this probability is based on a mix of time remaining and the ticket price. These kinds of destinations are considered to be ideal for airline operators because the acceptance probability is based on the ticket price as well as the time remaining. So the airline companies can benefit on both the accounts.

The results of these three categories have been summarized in the table below:

Flight networks and viable recommendations

Flight Networks

The destinations of Kuwait Airways are listed below:

New York, Paris, Frankfurt, Rome, London, Geneva, Dubai, Abu Dhabi, Istanbul, Beirut, Damascus, Amman, Cairo, Sohag, Dammam, Bahrain, Muscat, Doha, Sana’a, Addis Ababa, Mumbai, Delhi, Kochi, Chennai, Thiruanathapuram, Dhaka, Colombo, Kuala Lumpur, Manila, Bangkok, Islamabad, Kuwait City, Jakarta, Alexandria, and Riyadh.

For our research purpose we have taken three destinations as an example:

- Delhi – 1

- Kuwait City – 2

- London – 3

Making permutation, we arrived at four flight routes, as follows:

- Delhi to Kuwait City (1- 2)

- Delhi to London (1 – 3)

- Kuwait City to London (2 – 3)

- Delhi to Kuwait City to London (1 – 2 – 3)

The flight capacities and the ticket prices (minimum and maximum) have been assumed as shown in the following table:

The pricing of tickets in the case of the single leg flights i.e. 1 – 2 and 2 – 3 will be based on the seats available approach, time remaining approach and the combined approach. This is because the passengers of these flights don’t have any connecting flights to any further destinations. As mentioned earlier in the paper, there can be nine different possibilities but in this case we have assumed only the combination approach because this very approach is more profitable.

Even though the destination in the case of 1 – 3 and 1 – 2 – 3 is the same, there is a difference in the route. The flight leg 1 – 3 is a single and direct flight whereas the flight leg 1 – 2 – 3 is an indirect flight or a connecting flight. So the price calculation foe the flight leg 1 -3 will be in the same fashion as that of flight legs 1 – 2 and 2 – 3.

In the case of the flight leg 1 – 2 – 3 there is a possibility of earning extra revenue from extra seats on routes 1 – 2 and 2 – 3. At the same time, it has to be taken care of that the total revenue earned is not less than that of the direct flight 1 – 3.

Recommendations

- Not much has been considered or written about the overbooking feature that is practiced by the airline companies. The definition is clear but the after effects of overbooking have not been thoroughly studied. It is understood that the revenue generated from overbooking increases the overall revenue of the airline companies but in doing so, the airline companies either don’t consider its negative impacts or are not concerned with such impacts. A customer will never approve of being overbooked. Time is precious to all of us, including the overbooked customers. If a customer is overbooked and he/she is not able to board a particular flight, one can’t imagine the amount of mental harassment he/she has to go through. Apart from this, it is possible that the overbooked customer might have an important meeting to attend at the destination and due to his not being able to board a particular flight he/she could have to incur heavy financial losses. So airlines should consider this aspect and avoid overbooking just for the sake of increasing their revenue. It is understood that the airline companies do this in order to safeguard their interests because they expect that some of the booked passengers might cancel their tickets at the nick of the time and then there will be no passengers to take fresh tickets and the seats will remain empty and that will amount to losses. Instead of doing this, the airline companies impose heavy penalties for cancellations so as to compensate their costs. This way, at least the airline companies will not incur losses if not profit. The customers will also not be able to oppose the penalties because the same will be mentioned in the terms and conditions which all customers are expected to read prior to booking their tickets. Another method of covering the costs can be non-refunding of tickets. Even though there are certain airline companies that have non-refundable tickets, other should follow this concept.

- Another important aspect that the airlines should look into and take some concrete steps in resolving the problem is the issue of connecting flights. In certain cases it is noticed that if a particular airline does not cater up to the required destination, the customers are left stranded at in between airports because there are no connecting flights in the next few hours. For example if a customer is travelling from New Delhi to London, and due to urgency, he has to take the first available flight to Dubai from where he has to board another flight to London. It is quite possible that the customer will have to wait at Dubai airport for a couple of hours before he is able to board a flight to London. Moreover, it is very difficult to get a ticket from Dubai because the flights are already booked. What we mean to suggest is that all the airlines should have reservation links with other airline companies so that the connecting flight is not a nightmare.

- It has been noticed that apart from the less ticket price due to the time remaining in boarding the flight, there is no other discount or concession that is given to the customers. But discounts can actually attract customers to a great extent. Airline companies should evolve some discount policies. There can be a discount for group bookings. This will serve a dual purpose. First of all the tickets will be sold in bulk at a time and secondly in sectors where traffic flow is less, shortage of revenue can be compensated.

- Due to the incessant launch of new airline companies now and then, there has been a lot of competition among the airline companies. As discussed earlier, there are two types of passengers – the product oriented ones and the price oriented ones. The price oriented passengers have patronized the smaller airline companies because they offer better prices. It is not that the smaller airline companies are not making profit. Actually their overhead expenses are less and so they are able to offer lesser price. What we mean to say here is that in order to compete with the smaller airline companies, the bigger ones should curtail their expenses so as to meet the price challenge. This way they will be able to retain their customers even though they may be price oriented.

- It is understood that there are certain baggage rules as far as the weight is concerned. The airlines companies should revise their baggage policies. At present, the maximum baggage weight allowed is about 40 Kg per passenger. This weight is not at all practical for people, especially the expatriates. These people visit their home countries once a year or once in two years. It is obvious that they would like to take back some gifts and presents for their near and dear ones. But due to the stringent baggage weight restrictions, they end up paying hefty amounts as extra charge. In our opinion, this is actually a strategy of airline companies to earn extra revenue. But the airlines should ponder whether this extra amount is worth taking, at least on humanitarian grounds?

Conclusion

In concluding, it has been established that airline revenue management strategy is a vital aspect in any airline company. Airline revenue management strategy helps the airlines to consolidate their revenues in such a manner that it doesn’t hamper the interests of the customers and at the same time proves beneficial for the company. The various strategies adopted by the airline companies such as the time remaining approach strategy, the seats available approach strategy, and the probability of acceptance approach strategy. It’s not that by applying these strategies the airline companies take the benefits alone. They pass on some benefits to their customers as well. Like in the time remaining approach strategy, the customers who book their tickets earlier have the benefit of paying lesser amount for their tickets. In the seats available approach strategy, even though the price of tickets on the higher side, at least business executives, who have to travel on urgent business trips, can get a seat in the desired flight. The probability of acceptance approach strategy is more of a plus point to the airline companies. But customers also benefit out of this approach.

Like in the probability of acceptance based on the tourist destinations, customers benefit due to the fact that they get tickets at lesser price (because they book their tickets in advance). The airline companies benefit due to the fact that their tickets are booked in advance and there is no tension of empty seats. In the probability of acceptance based on the business destinations, the customers benefit due to the fact that they are able to get seats in their desired flights and the airline companies benefit due to the fact that they get better revenue from the sale of tickets. Similarly, the probability of acceptance based on a combination of tourist and business destinations is beneficial for both the customers and the airline companies. The customers in such destinations include tourists as well as business executives. It means that the time available and the seat remaining approaches are applied here. The tourists get better bargain on their tickets and the business executives are able to get seats in their desired flights. On the other hand, the airline companies benefit on both the accounts; the seats are full and they get better revenue from the business executives.

It will not be undermining if we say that without the airline revenue management strategy most of the airline companies would go into losses. American Airlines is considered to be the pioneer in airline revenue management strategy and other airline companies have followed suit.

It is understood that there are two types of customers. The first ones are those who go for the quality or we may say they are product oriented. The second types of people are price oriented and always look for lesser price. The product oriented customers will always book tickets in a specific class only even though there may be seats available in the lower class (with lesser ticket price). The price oriented customers will always book tickets in the lowest class (economy class). Such customers dilute the airline company’s revenues.

The recent years have witnessed a phenomenal increase in the fuel prices and the airport fees. As is understood, aircrafts consume a lot of fuel so the increase in the fuel prices has had a great impact on the impact on the performance of airline companies. This is because due to this increase, the airlines have had to increase their ticket prices. The increase in the ticket prices did not go well with the price oriented customers and they started searching for better bargains. Airport fee is the fee paid by the airline companies to the airport authorities where their aircrafts land and take off. Also, the counters of airlines at different airports have to pay a monthly rent or fee. The increase in the airport fee has also had a great impact on the ticket prices.

The capacity of the airline companies is increasingly incessantly and so is the passenger traffic. But due to the numerous airline companies being launched, the share of each airline company has decreased. Moreover, there has been a great competition ever since more airline companies have been launched. There are some airline companies that cater only to the price oriented customers. Such airline companies have snatched the business from the global airlines.

Summary