Definitions

Investment can be defined as the acquisition of property or assets that will be used for the generation of wealth. For instance, R&D expenditures of companies can be viewed as a form of investment.

The monetary base is the term used to refer to the total amount of currency possessed by people and financial institutions that have to meet the minimum reserve requirements set by the central bank (Lloyd 338).

The consumer price index is the indicator that reflects the change in the price of goods and services purchased by a consumer. This indicator is usually used to measure the variations in the price of the market basket.

The business cycle is the concept that refers to the variability in economic activity over a long period. During the cycle, an economy goes through periods of expansion and contraction. These fluctuations in performance are normally measured with the help of real gross domestic product (Cashin and Quliaris 8).

Demand deposits are the funds that can be withdrawn at any time without informing the financial institution ahead of time. A checking account is an example of a demand deposit because the holder can withdraw at any time without the necessity to keep the bank informed.

A time deposit is an interest-bearing deposit that can be withdrawn from a financial institution only after giving a notice. A savings account can be regarded as a time deposit that can be taken only at the moment when it reaches maturity.

The asset is the term that is supposed to describe both tangible and intangible resources that can be used by the owner to generate cash flows. For instance, trademarks and patents are viewed as assets.

The policy is a set of actions that are supposed to achieve a certain goal. For instance, one can mention the monetary policy intended to achieve stability in an economy.

The producer price index is a measure of fluctuation in the price of goods and services received by domestic producers (Australian Bureau of Statistics par. 4). This index is usually applied to the wholesale market.

Velocity is the indicator showing how often a unit of currency is used to purchase goods and services. It shows how quickly money is passed from one economic agent to another.

The price deflator is the index describing the changes in the price of goods and services. This index is one of the tools for measuring inflation. It is obtained by applying the formula:

nominal GDP/real GDP×100%.

Bank reserves are currency deposits that cannot be loaned by a financial institution. Commercial banks and other deposit-taking organizations are required to maintain a minimum reserve against particular deposits. The reserve is critical for maintaining the stability of the financial institution.

A coupon interest rate is a payment given to a bondholder whose money is used by a financial organization. The amount of compensation is determined in the agreement signed by the two parties. Nevertheless, one should mention that the amount of compensation can vary provided that the value of a coupon change over time (Brigham and Joel 197).

Treasury securities are debt instruments used by the government to generate money. Among these instruments, one can distinguish bills and bonds. When an individual decides to purchase the security, the government is under the obligation to settle the debt. Such assets are considered to be the most secure ones.

Liabilities are the financial obligations that arise in the course of economic activities. They are included in the balance sheet of an organization. For instance, the liabilities of a financial institution include customer deposits.

Equity is the term that denotes funds supplied by owners and outside parties such as creditors and banks for purposes of acquiring assets and purchasing goods. Additionally, this concept can be interpreted as the principles of fairness in welfare economics.

What is GDP? Provide at least two interpretations of the concept of GDP

GDP or gross domestic product is the indicator measuring the value of goods and services offered in a country during a certain period such as 12 months. It is important to note that subsidies are not included in the GDP. In addition to that, GDP can be interpreted as the total income earned in the country. In this case, it can include wages, corporate profits, or interest. However, this index excludes subsidies.

Explain the relationship between Aggregate Demand and GDP

William McEachern describes aggregate demand (AD) as a downward sloping curve signifying an inverse relationship between price and real GDP (205). Aggregate demand is increased at a particular price level when consumption, investment, government purchases, or net exports are increased (Arnold 192). The increase in AD is represented by a rightward shift in the curve which indicates the rising level of GDP. To demonstrate the relationship between AD and GDP, it is necessary to give an example of an increase in investment. When the investment is increased at a constant price, aggregate expenditures also grow. As a result, the level of the real GDP also rises. In turn, the increased GDP intensifies aggregate demand, and this trend is reflected in the rightward shift of the AD curve.

Develop a mathematical model explaining GDP, and describe the impact of each of its components

Economic transactions affect both buyers and sellers. One of the approaches to obtain GDP is to sum the expenditures of consumers on products and services. Alternatively, GDP is obtained by summing incomes earned by persons employed in production. The former is the expenditure method, which is usually applied in expressing GDP mathematically as shown below:

Y = C+I+G+NX

The main elements of this equation include consumption, exports, government purchases, and investment. According to the equation, an increase in the components leads to the growth of GDP.

What is the Keynesian theory of the macroeconomy? Use the AD/AS model to explain

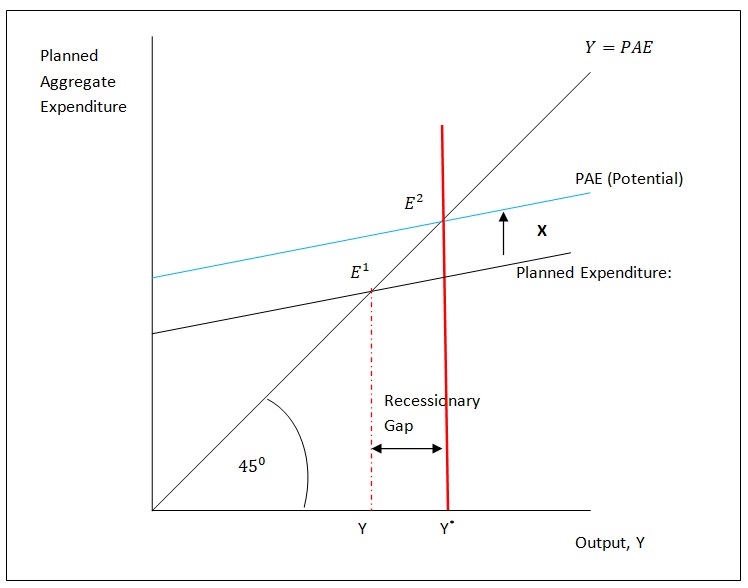

Keynesian theory is supposed to examine the functioning of the entire economy. For instance, one can study total consumption, investment. Income, or expenditure. The applications of this model can be illustrated by using the chart:

According to the figure, the potential output is Y* but the economy is producing at Y which below its potential. This gap is recessionary and it can be rectified by increasing government expenditures. Besides, cutting taxes has the effect of increasing disposable income, which effectively builds aggregate demand in the whole economy.

What is Fiscal policy?

Fiscal policy is an instrument used by the government to influence the development of the. This goal is achieved by changing its expenditures and tax level. The goals of fiscal policy are related to such aspects as employment, economic growth, and the level of prices or wages. Overall, expenditures of the government, tax revenues, and the transfer of payments are the critical tools used for the implementation of a fiscal policy.

Explain how contractionary fiscal policy would be implemented

Contractionary fiscal policy is implemented by reducing government expenditures or increasing the rate of taxes. However, implementation of the policy is accompanied by some difficulties such as the harm caused by poor timing. The adoption of the new legislation is a very time-consuming process, and this situation can be attributed to the complex bureaucratic procedures that should be complied with. As a result, the intended goal of contractionary policy might not be achieved.

How effective do you believe the fiscal policy to be?

Fiscal policy may not be effective due to the crowding-out effect. The increase in government purchases can lead to growing interest rates, and this trend can eventually result in declining consumption, investment, and net exports. This decline in private expenditure followed by an increase in expenditure by the government can eventually stifle the development of the economy.

What is money? What, today, comprises money?

According to Simpson, money is a generally accepted medium of exchange. It can take the form of coins, paper money, and checking accounts (9). A central bank is tasked with the role of supplying paper money. In the modern world, checking deposits can be regarded as the main source of the money supply. Checking deposits are classified as money substitutes since they represent titles to money preserved by the issuing bank.

What is the monetary theory? Explain the Equation of Exchange. What is the role of money in the Macroeconomy?

Monetary theory is a set of assumptions about the implementation and effects of various monetary policies. According to the framework, the monetary policies should be based on the main strengths and weaknesses of the economy; for instance, one can mention its technological and infrastructural economy. The monetary theory incorporates such elements as money supply, price, and interest rates because they are important for understanding the functioning of the economy. The equation of exchange outlines the link between money supply, its velocity, prices, and expenditure index. The equation was largely based on the concept of velocity, which is used to refer to the speed at which money moves from one owner to another. The equation of exchange shows how an increase in money supply affects price levels. Furthermore, the equation can indicate the level of demand for money. In brief, the equation of exchange can be presented in this way:

V = P×Y/ M or MV = PY

In this case, M can be defined as the average amount of money circulating in the economy, V is the velocity of money, P is price level, while Y is the indicator of real expenditures. Overall, in the macroeconomy, money performs the following functions: the facilitation of exchange, the expression of value, and its storage.

What is the Federal Reserve? What are its important functions?

Federal Reserve is the central banking system of a country. This organization has to develop and implement monetary policies to support economic growth. Secondly, the Federal Reserve directs and makes banks and other vital financial institutions to guarantee safety and stability in the national banking and financial system (Bernanke125). This policy is vital for protecting consumers. Thirdly, Federal Reserve has the mandate of countering systemic risk in the financial markets. Finally, the Federal Reserve manages the payment system of a country.

What is monetary policy? Why are banks the means (a mechanism) by which monetary policy must work?

Monetary policy is a mechanism deployed by the Federal Reserve to regulate money in circulation by laying a target for an interest rate or reserve requirements. When the interest rate is changed, the intensity of economic activities and inflation are affected. This policy eventually influences savings, investments, the price of assets, and the exchange rate. Banks can be viewed as the instruments for the operation of monetary policy since they can influence the level of money supply in society. They provide economic agents with access to capital, and the change in the policies can influence economic activities. For instance, the increase in interest rates can make people more reluctant to borrow capital. Similarly, the change in reserve requirements can influence the supply of money.

What are the goals of monetary policy?

The goals of monetary policy are similar to the objectives of the fiscal policies. First, monetary policy is supposed to intensify economic activities in the country and achieve eventual growth. Secondly, the policy is aimed to provide more employment opportunities to people. Finally, it is supposed to ensure that prices are stable.

What are the tools of monetary policy? Explain each

There are various tools included in the monetary policy. One of them is an open market operation during which Federal Reserve changes reserves and monetary base by purchasing and selling securities. The second instrument is the regulation discount on loans to commercial banks, which ultimately affects their interest rates and the monetary base. This tool can also be called a discount window. At a higher discount rate, loans are not attractive and commercial banks tend to reduce loans from Federal Reserve. Conversely, at a low discount rate, commercial banks are attracted to discount loans. Federal Reserve can further require commercial banks to keep a certain level of funds in the central bank. If the reserve ratio is increased, banks have less money at their disposal, and in the long term, the interest rate will increase.

What is the target variable?

The term target variable can be compared to a dependent variable since its value is determined by external factors. In the context of monetary policy, among target variables, one can distinguish interest rates, exchange rates, and the amount of money in circulation that the policy seeks to achieve.

Give an example of expansionary monetary policy, showing the role of the Fed, banks, and any other economic entity

The intention of the central bank to purchase securities from the public is an example of expansionary monetary policy. This step increases the amount of money in circulation, and this trend leads to the reduction of interest rates. Low-interest rate is a message to investors to borrow from banks for investment reasons. When the number of investment rises, output level, as well as employment, will increase. In the long term, this policy enables people to generate more revenues that can be used as their disposable income. As a result, people will have more opportunities for purchasing goods and services.

Works Cited

Arnold, Roger. Economics, Mason, OH: Cengage Learning, 2013. Print.

Australia Bureau of Statistics. Producer Price Indexes, Australia. Cat. no. 6427.0, ABS, Canberra, 2014. Austats. Web.

Bernanke, Ben. The Federal Reserve and the Financial Crisis, Mason, OH: Cengage Learning, 2013. Print.

Brigham, Eugene, and Joel, Houston. Fundamentals of Financial Management, New York: Cengage Learning, 2009. Print.

Cashin, Paul, and Sam Quliaris. Key Features of Australian Business Cycles, New York: International Monetary Fund. Research Department, 2001. Print.

Lloyd, Thomas. Money, Banking and Financial Markets, New York: Cengage Learning, 2005. Print.

McEachern, William. Macroeconomics: A Contemporary Approach, New York: Cengage Learning, 2012. Print.

Simpson, Brian. Money, Banking, and the Business Cycle: Volume I: Integrating Theory and Practice, New York: Palgrave Macmillan, 2014. Print.