Overview

In the 1920s, the conventional model of budgeting was developed. That tie was a positive step towards financial integration. However, with time, the current budgeting standards have been under immense pressure. The current budgeting model is feeling pressure from both, the theoretical as well as practical aspects. On one hand, we find companies complaining about the cost of the budgeting activities. These costs keep on rising whereas the benefits derived from these budgeting activities tend to decline, especially at times of precarious situations. Conversely, few theoretical assumptions about the model have been questioned by the researchers of the field of organization systems and organization behavior (Christopher, 2, 2002). Most of the organizations admit that the budget is the way to recognize their management control system (Murray et al, n.p, 2007). Organizations keep on seeing their budget as the way of controlling and deriving considerable value from its usage (Murray, n.p, n.d).

By the end of 1970, the traditional budgeting was not more than a fixed performance between the company top officials and the subordinates. The budgetary functions were just the analysis of the estimation regarding the future income and underlying expenditures. We can say that at that time budget was working as a key indicator of Managerial performance rather than a purely financial analysis tool (Alexa, 4, 2007).

As a result of these rising arguments, certain alternatives have been proposed. The most famous and acceptable has been the Beyond Budgeting Approach. However, in this study, we would be definitely cover other alternative models as well and then decide how is the beyond budget approach better than the others (Christopher, 2, 2002).

Terminology

We use the term budgeting differently in different contexts. This led to confusion in the past. In this report, we would be taking budgeting in terms of an annual process that sets detailed plan figures for the year ahead. It is usually performed top-down. Budgeting can also be said as a contract which is basically a hierarchical performance. Budgeting also includes analysis of variance. And finally, certain individual financial rewards are definitely attached to the budgeting. Thus we can say that budgeting is not only a financial planning technique. It is a tool that can steer the organization’’ financial performance. It includes the functions of evaluation, motivation, and authorization, and coordination, communication, planning and forecasting (Christopher, 2, 2002).

Problems with traditional budgets

Many major companies have been reported to have abolished the traditional budgeting concepts. They are now focusing on beating the competition rather than the budget (Rutherford, n.p, 2000). We often fail to understand why people hate the traditional budgeting concept. This is because it only adds a little value to the business operation (Pierre, n.p, 2007). Some of them are:

The foremost argument is the duration. It takes too many man-hours to produce a budget. Few corporate giants believe that it takes up 20 percent of the senior management’s time while finalizing the budget. Moreover, it normally takes 5 months to produce a budget (Pierre, n.p, 2007).

People are reluctant in altering the budget during the fiscal year, primarily it is because too time-consuming and complicated. Budgets are considered inflexible and this poses a serious barrier to change. Management does not get enough tie in developing strategies, rather the majority of the time is spent in the operations of data accumulation and reconciliation (Pierre, n.p, 2007).

There lies a constant tussle between cost reduction and value creation. The budget mainly focuses on the cost reduction strategies and ignores the value creation. When the targets appear difficult for the superiors to achieve, sub-optimalisation comes into effect. This ultimately hinders the growth of shareholder’s value (Pierre, n.p, 2007).

Drawbacks of traditional budgeting

The budgeting has been criticized that it was never made to meet the functions of evaluation, motivation, authorization, coordination, communication, planning and forecasting. Budgeting was never designed to match all these tasks. If the budgeting is used in these aspects, the failure is definite. Most of the practical experience severely criticizes budgeting in this regard (Christopher, 2, 2002). The most common criticisms are:

- Budgeting makes a company inflexible.

The decision-making horizon tends to squeeze up for the managers. They are tied to a limited budget and are not allowed to think out of the box. If this is the case, new opportunities cannot be cashed because they are not included in the fiscal year budget

- Budgeting costs too much.

The researches tell us that the companies invest millions and even billions of dollars in the planning and performance of the budgeting activities.

- Budgeting encourages managers to play games with it

The manager will try to negotiate the budget if he is being judged on meeting his budget. This would be easy for him to play.

- Budgeting does not differentiate between forecast and goal

Companies have different goals, which are ultimately influenced by the political situation in the country. And most of the forecasts are the biasness in political efforts.

- Budgeting refers to the past

the budgeting is done on the basis of the historical data and thus lags the financial indicators.

- Budgeting creates an effective floor for costs

the managers become very precautious about the money restriction and therefore spend less money than their budget allows.

- Budgeting over-emphasizes variance analysis

another important drawback of budgeting is that it overstresses variance analysis, even though in highly unstable and unpredictable circumstances the actual outcomes may differ from the year-old data in the budget.

- Budgeting rewards mediocrity and punishes risk-taking

the company focuses on the attainment of budget rather than the absolute success. That is why the mangers mainly focuses on the maximization of meeting the budget at its fullest and ignore the well-being of shareholders’ value.

- Budgeting is bureaucratic and hinders creativity

budget can be worked well in an environment where the situation is predictable and stable. However, if the conditions alter and the budget remains fixed then the traditional budgeting is not at all useful. The budgeting needs to be flexible in nature.

Models of Budgeting

In competitive and uncertain situations, the company needs greater involvement of the employees (Lyne, 2, 2007). Thus, the organization needs to be flexible. This flexibility could only be achieved if the company has a non-hierarchal relationship. The non-hierarchal relationship should be networked. This network must include the strategic business units and the investment center. Moreover, this networking concept is greatly dependent upon the Management Information Systems. Management Information System must include diverse issues such as the executive reward systems that cater to the conformance of shareholder value Management information System should also include such systems that can easily measure the strategic performance and serve as an indicator. Finally, Management Information Systems should also adapt to financial forecasting. The shortcomings in traditional budgeting can be overcome by applying the three types of budgeting modeling in the background of the above-discussed company scenario (Christopher, 4, 2002). After analyzing the weaknesses of the budgeting, the managers need to think critically about the alternatives. The managers had two options. Either they review the whole budgeting process and optimize it. Or else they can create a new management philosophy regarding budgeting (Moeini, 10, 2005).

IT Automation

This approach basically deals with the automation of the Budgeting processes. It highlights the technical scenario of the budgeting processes. This approach does not aim at changing the process of budgeting. However, this approach does look into making the processes of budgeting much faster and less expensive. By introducing automation techniques in the budgeting processes, the company can easily improve the cost-benefit ratio of budget in a broadest sense (Christopher, 4, 2002).

The main principles of this approach say that an organization requires a company-wide integration of databases. The collection of the information in the form of a database helps a company in creating a broad vision. The data from a variety of sources need to be accumulated in one place and then analyzed so that better decisions could be taken. The decisions would require less time and similarly they will be less expensive too. Secondly, the actual data should be covered topically. This can be done by decentralizing it via web interfaces. It can also be automated via sensors. Thirdly, the application of management information system will help in the analysis of large and sophisticated data that will ultimately produce reports. These reports will be customized for various recipients belonging to different departments. Fourthly, the budget processes need to be integrated into process management tools and groupware (Christopher, 4, 2002).

In majority of the cases, the automation also requires business reengineering process. Both the reengineering process and the automation of IT go hand in hand. These simultaneous actions help the budgeting processes to be more and quicker and hassle-free. They are made as smooth as possible. This smoothness can be brought by designing such processes that ate more people-oriented. The computers and information systems should offer a wide array of support to the people who are directly involved in preparing the budget (Christopher, 4, 2002).

The introduction of the latest technologies has changed the way the data is gathered, accumulated, analyzed, and finally concluded. In few cases, the world has witnessed that the application of enterprise-wide systems has played a vital role in increasing the accuracy, precision and speed of the forecasting and budget-making (Jackson et al, 4, 2004).

To conclude this approach, we can say that IT Automation believes that the budget processes lack the required convenience and efficiency. This approach of IT automation odes does not attempt to put an end to the indwelling demerits of the traditional budgeting structure. However, by automating the budgets procedures, these limitations can be overcome (Christopher, 5, 2002).

Better Budgeting

There is no single concept to which we can say that it is the concept of Better Budgeting. However, we find a number of models that help in defining what Better Budgeting is. All these self-contained models have some common assumptions. According to the advocates of Better Budgeting models, the traditional budgeting lacks efficiency and effectiveness. Each model of Better Budgeting targets a specific problem of traditional budgeting (Christopher, 5, 2002). We can term better budgeting as an attempt towards reducing the inherent weaknesses in traditional budgeting (Moeini, 10, 2005). The various methods in Better Budgeting are:

Variable Frequency Budgeting

The organizations following this model say that certain businesses are found to be more dynamic in nature than the others. Their environment is more dynamic than their counterparts. Thus, the followers Variable Frequency Budgeting works on abolishing the common annual or yearly budgeting processes. This is replaced by the budgeting intervals. These budgeting intervals are inconsistent with the time horizon of the better-known individual business units. Whenever the business faces an unstable environment, they can adopt this Variable Frequency Budgeting only as a work-around technique, but not as an alternative to traditional budgeting (Christopher, 5, 2002).

Rolling Forecasts

The method of Rolling Forecast focuses on the production planning. According to this method, the Rolling forecasts take into account the production plans of the next periods. On one hand the coming period’s planning is made in detail. On the other hand, the later periods are either not planned, or if planned so they are quite rough. Moreover, the planning is viewed in short intervals of time. Whenever new information becomes available to the management, the planning is made by it. Whenever uncertain conditions arise, the Rolling forecast model can help a lot in tackling the problem. However, it becomes useless when assessing individual performance (Christopher, 5, 2002).

Benefits of the Rolling Forecast Process

Our next discussion part includes how to analyze the benefits of the rolling forecast process, an alternative to traditional budgeting (Pierre, n.p, 2007). The benefits created by this process are:

We all know about the 80/20 principle. If the managers start spending most of their time analyzing the data rather than gathering the data, the companies would have more time focusing on these key drivers that really shape their business.

The companies can have comparatively much faster response time to emerging threats and opportunities if they focus on reducing the complexity of budget planning processes. The management should be given flexible working environment by freeing them from the restricted strategic boundaries.

The managers become more productive because they are not bound to hit predefined targets but rather they work for beating the market and competition.

The time demands the managers to shift from the spreadsheet applications to Performance Management applications. This would help them automate their budgeting and forecasting systems. This would in turn save many man-hours of manual work.

After the streamlining of the forecasting process, the management should involve the line managers in the decision-making process. These line managers are experts in their fields. Their point of view can help drive the company towards quick, fast and accurate forecastings.

The last thing to ponder is the usage of external data. The external data can be used to provide a broad vision to the organization by analyzing the performance of the organization with that of the competitors’’ performance.

Zero Based Budgeting (ZBB)

The majority of the organizations just modify the figures of the last years to some extent and then construct this year’s budget. The increment in the budget leads to inflated values, which when spent, show a comparatively higher costs pattern. Zero Based Budgeting (ZBB) takes into account all the spending and then analyzes whether or not they justify on the basis of the indirect or direct value received by the client. If a particular spending helps the client in gaining an indirect or direct value, then Zero Based Budgeting (ZBB) will permit the budget to incur that particular spending (Christopher, 5, 2002). This gives managers both ‘operational responsibility and budget responsibility” (Pendlebury, n.p, 1994). An analysis of this technique in a non-profit context is important given that ‘ZBB has mostly been applied in local and government organizations where predominant costs are of a discretionary nature’ (Drury, n.p, 2004).

Activity-Based Budgeting (ABB)

The model of Activity Based Budgeting (ABB) is based on activity-based costing which says that the budget should be made in such a way as to suit the need of the manager. We all know that manager is responsible for the performance of an activity. Hence, the mangers can be termed as the person having full; command over the drivers of the cost. The idea behind the Activity Based Budgeting (ABB) is quite persuasive, but still many companies find it difficult to implement activity-based costing (Christopher, 6, 2002).

One way to effectively determine the level of organizational spending required in the future is through the Activity Based Budgeting (ABB). Activity-Based Budgeting (ABB) is based on the Activity-Based Costing (ABC). The distinctive approach helps the company in providing distinctive edge over the traditional budgeting standards. Activity-Based Budgeting (ABB) opens the door of opportunities for the company to effectively communicate its objectives throughout the company. This in turn provides optimum utilization of resources and still emphasizes the concept of continuous improvement (VanZante, n.p, 2002).

The Activity Based Budgeting (ABB) model is very effective in determining the level of resources that are required to perform a particular operation. The Activity Based Budgeting (ABB) forms a relationship between the activities performed and the resulting output. The managers can further analyze how the changes in the output are affected by the changes in the activities. Activity Based Budgeting (ABB) also helps in the analysis of the three most important questions for the management. They are why activities are performed, what they cost, and how often they need to be performed. Thus we can say that the Activity Based Budgeting (ABB) helps in linking the budgeting processes of the company to its overall organizational strategy (VanZante, n.p, 2002).

To conclude we can say that Activity Based Budgeting (ABB) works better than traditional budgeting. Primarily because it is a predictive model rather than a historical snapshot. Secondly, it takes into account the capacity and highlights the utilization consumption rate of the company. Lastly, because it helps in reflecting the step-fixed, fixed, semi-variable and variable function consumption of resources (VanZante, n.p, 2002).

Balanced Scorecard (BSC)

We can term Balanced Scorecard (BSC) as the most comprehensive tool presented up till now. We say this because the Balanced Scorecard (BSC) takes into account both, the financial measures as well as non-financial measures. Balanced Scorecard (BSC) also analyses the connection of the financial measures with the non-financial measures. Balanced Scorecard (BSC) also reflects the relation of the financial and non-financial measures with the vision and strategy of the organization. A Balanced Scorecard (BSC) also lays great stress on the strategic learning for the employees. Moreover, Balanced Scorecard (BSC) emphasizes the overall feedback response as well (Christopher, 6, 2002).

As we have already discussed that Balanced Scorecard (BSC) is the most comprehensive tool available today. A balanced scorecard (BSC) can be easily adapted by the management for managing its budgeting affairs. Due to its management adaptability, the Balanced Scorecard (BSC) has become one of the most famous tools for budgeting. Balanced Scorecard (BSC) has been successful in the past few years. But the problem lies in its application as a budget tool rather than a management tool. Whenever Balanced Scorecard (BSC) is put into effect as a budgeting tool, the same sort of problems as traditional budgeting faces, are encountered (Christopher, 6, 2002).

To conclude Better Budgeting, we can say that the above mentioned all the models are appropriate to solve the deficiencies of conventional budgeting. But they are acceptable to some extent. They cannot fully rectify the shortcomings of the traditional budgeting. Nevertheless, the above-mentioned models of Variable Frequency Budgeting, Rolling Forecasts, Zero-Based Budgeting (ZBB), Activity Based Budgeting (ABB) and Balanced Scorecard (BSC), all lack coherence in their operational activities (Christopher, 6, 2002).

Beyond Budgeting

Beyond budgeting has a very simple slogan in its head. That is “abolish budget”. This model claims to have abolished the traditional budgets and budgeting techniques. Initially, beyond budgeting seems to be anarchy for the business world. However, if we critically evaluate the approach beyond budgeting, we would come to know that this approach is ambitious in developing a full-scale unitary concept. We can term beyond budgeting as an attempt towards challenging current budgeting processes(Moeini, 10, 2005). This unitary concept of beyond budgeting helps in developing a sound budgeting and management policies in general (Christopher, 6, 2002). According to the Beyond Budgeting’s head of leading research project says that:

“Organizations are best understood by looking at the whole value delivery system rather than its individual parts.”

Before we proceed further we need to look into some important aspects of Beyond Budgeting. Firstly, there is no special model for Beyond Budgeting. Rather superstructures are constructed to the Beyond Budgeting’s model. When the model of Beyond Budgeting requires concrete implementations, then other models such as Balanced Scorecard or Rolling Forecast are brought into action. These borrowed models are not used as the command and control tool for a company; rather they are utilized as supportive tools for the strategic leadership under the Beyond Budgeting concept. Secondly, we studied in the beginning that companies should be networked. The Beyond Budgeting concept supports the companies in networking. Beyond Budgeting is designed in such a manner so as to suit the networked environment (Christopher, 7, 2002). The Beyond budgeting is also known as Coherent model. Its aim is to overcome the drawbacks of traditional budgeting and the creation o an adaptive and flexible budgeting model for the organization (Fraser et al, 3, N.d). to be effective in the global economy, the company needs to apply the right concepts of budgeting. The beyond budgeting will allow the company to create the maximum value for the customers and shareholders (Daum, n.p, 2005).

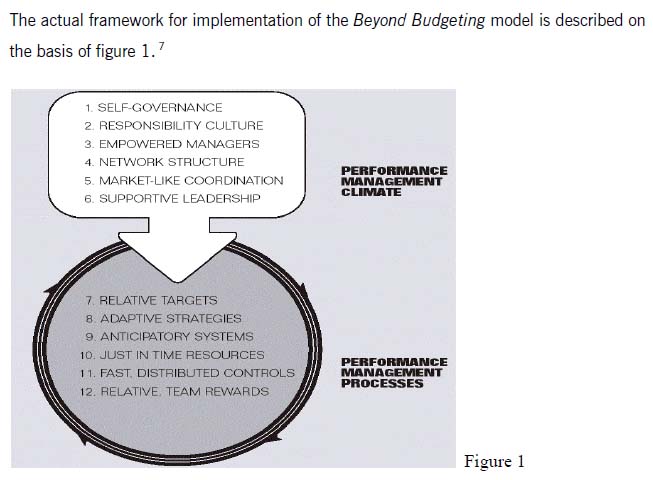

The actual framework of Beyond Budgeting concept

The concepts other than Beyond Budgeting fail to give an effective process plan and clear evidence. Contrary to this, Beyond Budgeting knows the corporate culture and how to make the concept work. Beyond budgeting, it helps in overcoming the hindrances of traditional budgeting. This is reflected in the framework Beyond Budgeting concept. It can be seen in the figure. The figure is divided into two parts. One part discusses the performance management climate and the other performance management processes (Christopher, 7, 2002).

Performance Management Climate

The dimension of performance management climate reflects the corporate culture and the fundamental values of a particular organization. According to this dimension of the Beyond Budgeting framework, the company should meet the following six aspects (Christopher, 8, 2002).

Self-governance

Wide boundaries are brought in by replacing the old prescribed rules and processes. This replacement lets the managers think out of the box. The managers feel the freedom and face the challenges very confidently. They become quick and fast when taking their decisions. They are effective because there is no hindrance, interference or opposition which can disturb the flow of their activities. The managers do not receive any more guidance from the central decision-making authorities. The decision-making becomes decentralized and thus no micro-managing is existent.

Responsibility culture

The managers in the traditional budgeting were accountable for short-term costs. However, under the head of Beyond Budgeting, the managers are responsible for the customer and long-term performance.

Empowered Managers

The managers are empowered with the capability and freedom to make the decisions and move close to the customers as much as possible. The employees get the required training and information they need.

Network Structure

There exists flexible and collaborative communication among the stakeholders. This leads to the integration of the customers and suppliers into the network.

Market-like coordination

In Beyond Budgeting concept, centralized planning is replaced with internal supplier-customer relationships and the market forces. The cost-consciousness is developed due to the outsourcing and the competition of the supporting divisions with the external players.

Supportive leadership

The leadership in Beyond Budgeting concept has visionary tendencies. The traditional command and control are replaced with the coaching and challenging attitude.

Performance Management Processes

The first dimension of the Beyond Budgeting framework dealt with the cultural values that an organization must hold. The second dimension that we would be discussing will tell about the optimal processes that a company pursues in Beyond Budgeting approach (Christopher, 9, 2002).

Target

The targets are based on the competition and the long-term value created by achieving those targets. The basic aim of the Beyond Budgeting is not to beat the budget; rather it is to beat the competition. The managers are free from setting ambiguous goals that were necessary for the conventional budgeting measures and reward systems. The rewards in Beyond Budgeting approach include non-financial rewards apart from the financial rewards.

Strategy

In traditional budgeting, the strategies were annual top-down events. However, in Beyond Budgeting approach the strategies are tending to be more open and continuous process. The strategies in traditional budgeting were plan-driven, but in Beyond Budgeting they are event-driven. The strategy is to deliver highest value to the customer. Moreover, interdepartmental collaboration is promoted.

Anticipatory systems

These systems help managers identify events in advance. For this the most helpful tool is Rolling Forecasting that gives the manager prior notifications regarding the opportunities and threats of the organization.

Resources

Resources are easily available to the managers. Unlike the traditional budgeting, in which the resources had an annual time horizon, the Beyond Budgeting approach allows the managers to acquire the resources at a fair cost and as soon as possible.

Controls

The few financial and non-financial key indicators are used as tools for the purpose of control.

Rewards

Company level and unit level performance are the two concepts for measuring the reward under the Beyond Budgeting approach. The rewards promote teamwork and collaboration. This is because the rewards are given on the basis of group perfor4mance rather than the forecasts.

Beyond Budgeting is a unitary and deductive approach. It is inspired by the experiences and sustained by field researches. The Beyond Budgeting approach takes a very good initiative by first developing fundamental values of coherent culture, followed by the pursuit of the profit maximization. Beyond budgeting easily avoids cost responsibility and bureaucracy.

Some instances in support of abolishing budgeting

A research by the Cranfield School of Management concludes that 80 percent of companies are not satisfied by the existing budgeting operations, which includes forecasting and planning processes as well. That is why the financial managers are seen to have been thinking about how to reform and reevaluate their budgeting processes (Pierre, n.p, 2007).

Ex CEO of General Electric, Jack Welch considers the current budgeting system as a bane of corporate America. He views budgeting as an exercise of minimalization. He says that “You’re always getting the lowest out of people, because everyone is negotiating to get the lowest number.” (Pierre, n.p, 2007).

One more example exists of a small bank, Fokus Bank. In 1997, this bank abandoned the budgeting model. It was the worst-performing bank f Norway, but soon after the abandonment of budgeting process, this bank transformed into the best performer with the lowest cost. It also had the highest return-on-capital-employed. In 1999, Fokus bank was acquired by Den Danske Bank, a Danish bank, at the price almost three times its floatation value four years earlier (Pierre, n.p, 2007).

Replacement of traditional budgeting

One of the companies decided to examine how effective is the budget processes for the company. The results were stunning. The budget-making involved a great part of the year along with the several hundred staff and line managers. The managers and senior executives were more concerned about the mechanics of budget. This made them away from the strategic planning for the organization. Lastly, budgets were not considered credible anymore because they failed to reflect the change in the company’s organization and processes. Another study was conducted in which 10 different companies from the industries where energy, transportation and banking were included. The study found that almost 5 percent of the total employees were found to be devoted full time working on the budgeting activities (Jaffrey, n.p, 1992).

The real cost of budgeting

The real cost of budgeting can be better understood by undertaking a hypothetical situation as an example. A company has 3,000 employees, and out of which 160 employees are working full time in budget activities. If we calculate per person cost would be $105,000 per employee for a year. For the whole year the total cost for the company would come out to be approximately $17 Million. This annual cost of budgeting needs to be justified. This cost of $17 Million does not include the cost of supporting services such as software maintenance, administration and computer operations.fi we include the costs of these budget supporting activities then the total would exceed $20 Million per year (Jaffrey, n.p, 1992).

If a company is spending then it must also get the accurate expense forecast. The budget activities should provide effective support for decision-making. Moreover, the budget activities should also help in the employment of effective development and reporting processes (Jaffrey, n.p, 1992).

Multidimensional budgeting (MDB)

The traditional budgeting techniques cannot resolve the issues of growth. The conventional budgeting does not succeed in blocking the growth of uncompetitive cost structures. One way to achieve the effective resource allocation and control is by replacing the traditional budgeting activities with the technique of multidimensional budgeting (MDB).as per this technique, the conventional budgets are converted into those formats that are most appropriate for the management decision amazing and strategy making (Jaffrey, n.p, 1992).

If the Multidimensional budgeting (MDB) is applied properly, the MDB would help the company in providing the insights for the resource use effectiveness. It helps the management to determine how effectively the resources are being used. This enables the management in aligning their resources with their strategic plans and the customer needs. Multidimensional budgeting (MDB) also helps in the improvement of the profitability ratios and the competitive position in the market (Jaffrey, n.p, 1992).

Te conventional budgeting isn’t a full-fledged model. If we incorporate Multidimensional budgeting (MDB) in conventional budgeting, we could have an all-new powerful set of decision support tools and resource allocation. The most attractive feature of Multidimensional budgeting (MDB) is that it does not only focus on “how the budgeted funds have to be spent”. Rather it develops a relationship between the spending pattern and the value created out of that spending (Jaffrey, n.p, 1992).

Analysis

Majority of the organizations are seen following the traditional budgeting. The reason being is that they cover forecasts for a year that does not change during the budget cycle. Other reasons include, they can put down easily. Moreover, all the departments have a well-established simplified coordination of budget assumptions (Harward Manage Mentor, n.p, 2007).

The managers are bound to stay within this limit and manage their expenses, try to fit what are the possible expenses, focus on the operational departmental processes, and ignore the future workloads. In the conventional budgeting techniques, the managers have a fixed spending limit and only focus on what amount they are allowed to spend, rather than what resources are needed by the managers (VanZante, n.p, 2002). Zero-based budgeting (ZBB) may be defined as ‘budgeting from the ground up, as though the budget is being prepared for the first time with every proposed expenditure coming under review’. (Horngren et al, n.p, 1996). Under ZBB, during the budgeting process, each activity must be justified in terms of its continued usefulness (Burrows, n.p, 2000).

Thus we can determine certain drawbacks of the traditional budgeting process such as the conventional budgeting techniques appears to have a general lack of ownership and buy-in, does not identify cost drivers, does not support continuous improvement, does not identify the incoming workload and fail to identify waste. Other demerits of the traditional budgeting techniques include the time that it consumes. It is time-consuming for the benefits achieved. It is costly too. The result of the budget is an increment of the arbitrary cost of reductions. Conventional budgeting mainly emphasizes the inputs only and ignores the outputs generated due to those inputs. In essence, we can say that the practices of the conventional budgeting do not stand at par with the overall strategic outlook of the organization (VanZante, n.p, 2002).

Beyond Budgeting is all about realizing the true potential that employees have. The employees use their intellectual abilities in negotiating the budget. This time can be utilized by diverting the attention of these employees from negotiation towards the value creation for customers and shareholders (Hope et al, 4, 2001). The company must evaluate its risk before taking the initiative of beyond budgeting (Leitch, n.p, 2003).

Conclusion

Thus we analyzed the disadvantages that budgeting has on the dynamic economy. To overcome these disadvantages, three alternatives have been proposed. The first two approaches are common. However, the Beyond Budgeting approach is a fresh and new approach on which further studies have to be conducted. We can say that most of the research that is being conducted in the field of Beyond Budgeting has been only by one research group. That is the BBRT group.

No doubt about it that Beyond Budgeting tries encompasses the entire superstructure that is vital for any budgeting process. It tends to include the well-known Rolling forecasting method, network company assumption, etc. but still, it is still in the infancy stage. BBRT must conduct more researchers to remove its limitation.

Recommendations

Beyond Budgeting Approach mainly inherits two basic limitations. Thus our only recommendation would be to look into these limitations and work on improving them. Firstly, the Beyond Budgeting approach is not applicable in public institutions or where the policies for investment are highly symbolic in nature.

Secondly, Beyond Budgeting takes into account certain personality traits in its first part. These fundamental values differ from culture to culture, region to region. Thus the generalization of the Beyond Budgeting approach can be easily questioned. For this, generalized moral standards should be drafted.

Reflective Report

Introduction

This part of the report highlights the experience that I went through while researching and completing this report. This part of the section displays my learning that will ultimately help me excel in the fields of life. This report has definitely added to my personal development along with my professional development. This Reflective section of the report will pass through three phases, the initial assessment; followed by the benefits gained during the report making, and finally discuss the strategies that will be crucial as a researcher in the future.

Initial Assessment

While starting the report, it is very crucial to develop and identify how the learning can be brought and be beneficial for the researcher. At the time of starting the report, I believe my biggest strength was my ability to set up excellent plans. This planning was followed by the successful implementation of tasks. I was highly motivated by the working style of a theorist, and thus, I can say that my learning style was highly dominated by theorists learning style. My learning style was based upon step-by-step learning which was truly logical and objective in its nature. It was a step-by-step progression rather than quickly jumping on to the conclusions. I feel comfortable in analyzing things and then synthesizing them to create strong and firm theories, models, and indispensable principles.

During the whole research, I was highly pleased because it helped me in developing fundamental skills that are very significant in my long-term objectives. The report which is presented is definitely a result of personal hard work, learning and initiatives. Every new phase of report making brought a fresh new experience of learning, skills, abilities, training and development. This report demanded the complete involvement of the researcher in the report making.

The work done in this report was basically to analyze the rising trends in the field of finance, especially budgeting. The concepts of traditional budgeting are now being challenged. And in my opinion the concerns raised by the people are quite true and realistic.

As a researcher, obviously, it wasn’t easy to discuss such a hot topic. This topic made me hard nuts to crack. This was because I needed immense literature, which was available too. But the problem was how to sum up gigantic Amount of data into this report. To achieve this, I needed to be very selective in conducting research. I had to decide that whether this topic would be beneficial for me to include in the report or not.

However, through this report, I learned the skills of a researcher that have assisted me in selecting the best approach for completing the report. This newly acquired research skill enabled me to demonstrate a very professional kind of data collection and analysis techniques and approaches. Project Management was another factor that helped me a lot. Making this report within a limited time duration demanded me to establish a time schedule first. I did it. Made the schedule and worked accordingly.

While making this report, I came through a number of setbacks. It is not an easy topic. Mostly during the collection of primary data. It is very difficult. However, the secondary sources of data have aided a lot in the completion of the report.

The learning is defined as the process of bringing a permanent change in the behavior of an individual due to past experiences. While making this report, I passed through a series of experiences. This report made me understand the CHANGING and DYNAMIC nature of this world. Nothing is permanent in this world. Change is constant.

Definitely after making this report, I came to certain personal development plans. The plans included that a strong idea generation serves as the foundation stone of a strong report. Once the idea is generated, we have to work on the resource accumulation.

In my view, I really have to work hard on this. This process of collection is accompanied by sorting out relevant and irrelevant data. If I or someone gets skilled in the art of resource accumulation, then he or she may definitely achieve his or her targets easily. He or she would be able to produce results that are in harmony with the idea’s central theme.

Final Assessment

With the completion of this report, I can say that it has changed the way I think and behave. I have learned new methodologies, theories, approaches. It has added to my experiences. I think that now I stand as a better researcher. I believe I would definitely commit myself towards the completion of my formal education in a specific area. This program, and definitely this report have helped me in broadening my skills and knowledge. I see myself in a much better position than I was before making this report.

References

Bock, Christopher. (2002), Recent Developments in Budgeting – an Overview, 2-10. Burrows, G. and Syme, B. (2000), Zero-base Budgeting: Origins and Pioneers, Abacus, Vol. 36, No. 2

Daum, H. Juergen, (2005), Performance Management beyond Budgeting: Why you should consider, how it works, and who should contribute to make it happen, [online]. Web.

Drury, C. (2004), Management and Cost Accounting, 6th Edition, Thomson Learning.

Harward Manage Mentor, (2007), Budgeting: Traditional versus Alternative, Web.

Fraser, Robin. Bunce, Peter. Roosli, Franz. Hope, Jeremy, Beyond Budgeting, page 3.

Hope, Jeremy. Fraser, Robin, (2001), Beyond Budgeting – Questions and answers, page 4.

Horngren, C.T. et al (1996), Cost Accounting in Australia: A Managerial Emphasis, Prentice Hall

Jackson. Chris, Starovic. Danka, (2004), Better Budgeting – A report on the Better Budgeting forum from CIMA and ICAEW, page 4.

Leitch, Matthew, (2003), Risk Management and Beyond Budgeting, [online]. Web.

Lyne, Stephen. (2007), Beyond budgeting or better budgeting, page 2.

Moeini, Hassan, (2005), Beyond Budgeting Scholarly paper, page 10

Michael, Alexa. (2007), Beyond Budgeting – Topic Gateway Series No. 35, page 4

Murray, R. Lindsay, Libby, Theresa, (2007), Beyond Budgeting or better budgeting, [online]. Web.

Murray, R. Lindsay, Beyond Budgeting or better budgeting, [online]. 2010. Web.

Naudé, Pierre. (2007), Re-Evaluating The Traditional Budget, [online]. Web.

Neal R. VanZante, (2002), Beyond Budgeting: A Better Way to Predict Spending. Web.

Pendlebury, M.W. (1994), Management Accounting in Local Government, Financial Accountability and Management, 10 (2)

Rutherford, Brian, (2000), When is a budget not a budget, [online], Web.

Schmidt, A. Jeffrey. (1992), Is It Time to Replace Traditional Budgeting? Journal of Accountancy, Vol. 174, [online]. Web.