Introduction

There are various market structures in the economy, which affect the prices and the nature of goods that are available. Scholars have come up with different market structures and according to the, each of these market structures are based on particular assumptions. According to Arrow (1959) a perfect market structure is one that is based on assumptions while an imperfect market structure has no assumptions and it is based only on facts. Assumptions assist in developing a realistic structure which takes into consideration the different market situations. Market structures are classified according to the extent of being perfect. The perfectly competitive market is one which has perfect assumptions in all aspects and it is generally theoretical. A monopoly, on the other hand, is one which has no perfect aspects. It is the extreme of the perfectly competitive market. The oligopoly market is neither too perfect nor imperfect. It is a moderately perfect market structure.

What is a perfectly competitive market?

According to arrow (1959) and other neo-classical economists, perfect market competition is a situation where there are many buyers and sellers in the same market and no one person has the ability to control the market. In this market both the producers and consumers have perfect knowledge of the market conditions and there is basically no choice for products.

Hence perfectly competitive markets are said to be perfect in respect to the following:

- There are many buyers and sellers, each of whom has perfect knowledge of the prevailing market conditions,

- Both the buyers and the sellers share similar information and therefore there are no individuals who are at a better position than the others,

- Everybody in the market has access to information and people are equally aware of all that is taking place.

- There is rational decision-making and buyers and sellers make decisions reasonably

- There are also no barriers to entry or exit into the market.

- All firms in the perfectly competitive market produce identical/ homogeneous goods and buyers therefore do not have a choice for the goods and services that they buy.

What is an oligopoly?

Oligopoly competition is a situation where there are a few sellers in the market and each of their behaviors is independent (Cournot, 1963). This means that oligopolies are able to make their own decisions without the influence of the other people in the market. The firms in the oligopoly markets are able to control their prices and there are also high barriers to entry or exit in these markets.

Since there are few sellers in the oligopoly market, firms are able to find out the activities of other firms. A firm in the oligopoly market may decide to create monopolistic control over the market by improving the quality and price of its goods and in turn dominating the market. This means that among the few firms present in an oligopoly, some have greater advantage over the others. Hence, this kind of market is said to have the following assumptions (Cournot, 1963):

- There are only a few firms in the market and each firm is independent of the other.

- It is a market structure that acts as an intermediate structure between perfect competition markets and monopolies.

- Firms in the oligopoly market determine their own prices and they co-ordinate with each other to control these prices.

- The firms produce either identical or different goods or services and buyers therefore have a choice over the kind of goods that they purchase.

Differences between an oligopoly and a perfectly competitive market

Prices

One major difference between an oligopoly and a perfectly competitive market is in the setting of prices. Classical economists argue that firms in an oligopoly market are able to control their prices while those in the perfectly competitive market are not. The firms in the oligopoly market may co-ordinate with one another to set prices of commodities. On the other hand, they may form trade restrictions to help them prevent their competitors from setting high prices that become unhealthy for some firms.

According to Mas-Colell (1995) a perfect competition can be defined as an equilibrium price market. This means that firms maximize their profits at all situations because their marginal cost is equal to the marginal price. Firms do not determine the price of commodities and the perfect competition allows that when the firms are making maximum profits, the market price of commodities automatically becomes equal to the cost per production of unit good.

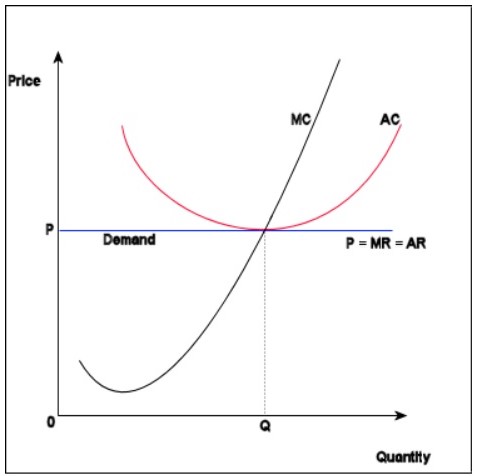

This can be represented in form of a diagram as follows:

A firm producing Q units of a commodity at a level where the marginal cost equals the demand for the commodity means that the firm is making profits. Since buyers do not have a choice for the goods that they buy, their demand will automatically determine the price in the market. The marginal cost is equal to the marginal revenue at P price which is the prevailing price in the market.

Demand

The demand for goods in an oligopoly is relatively elastic. This means that a slight change in the price of commodities causes a relatively great change in the demand for products. On the other hand, the demand for goods in a perfect competition is perfectly elastic which means that it is completely affected by a change in the price of commodities. According to neoclassical economists, the difference in the demand from both markets is as a result of the ability to make a choice in the products to buy. Buyers in the oligopoly markets have the choice to buy the product they want and any great change in the price of the goods may cause a significant change in the demand. In the perfectly competitive markets, buyers do not have a choice over different products and hence a change in the price of goods may make all the buyers to shift to another firm.

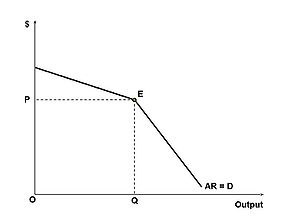

The demand in an oligopoly market structure can be represented in form of a diagram as follows:

According to Friedman (1993) this kind of a demand curve is known as the kinked demand curve. The demand for goods is determined by the price of these goods. When prices are high, say above price P, the demand is highly elastic and a small change in the price will cause a significantly large change in the demand of goods. Price P is the equilibrium level and below the equilibrium price, the elasticity of goods change. Below P, a great change in the price of commodities will cause a significantly small change in the demand for the goods.

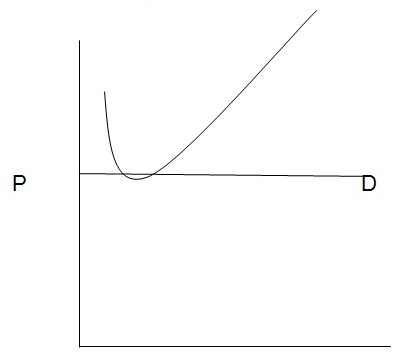

In the perfectly competitive markets, buyers can move from buying their goods in one firm to another different firm whenever there is change in the price. This can be represented as follows:

P is the price of goods and the demand curve D is perfectly elastic, meaning that if P changes by a small margin, buyers will shift to a different product. The firms in this kind of market have therefore no control over the prices and prices are only determined by the prevailing market conditions.

Products

The products in a perfectly competitive market are homogeneous. This means that they are all identical and buyers do not have a choice over the products. The many firms in the perfectly competitive market produce goods which are similar such that buyers can only buy goods from different firms but not different products in the same market structure (Alfred Marshall, classical economist).

In an oligopoly, products may be homogeneous or heterogeneous. Since the few firms in the market determine the market structure, they may decide to produce identical goods or different goods. Where firms in the oligopoly produce identical goods they are said to be getting closer to perfect competition. On the other hand, when they produce different goods, each firm may aim at dominating the market by producing more of its goods at a lower price so as to attract as many customers as possible. Such a firm therefore tends towards a monopoly firm because once many buyers purchase its products and once it produces more than the other firms in the market, it dominates the market and it may be able to control the prices in the market.

Entry and exit to the markets

According to Fudenberg (1986), an oligopoly market structure is one whose entry and exit into the market is restricted. Trade restrictions are established in this market so that new buyers and sellers do not get into the market and the existing sellers and buyers do not leave the market. Since there are few firms in this market, they are able to control the activities of each other and hence they may form cartels or trade restriction policies which will ensure that there is no free entry of exit to the market.

A perfectly competitive market structure has no barriers to entry or exit in the markets. There are many buyers and sellers and each of them has the right to freely enter or leave the market. Unlike in an oligopoly, there is no trade restrictions established and the many buyers and sellers work depending with the prevailing market conditions. The market conditions control the number of buyers and sellers and there is therefore no need for restrictions (Kreps, 1990).

Buyers and sellers

A perfectly competitive market has many buyers and sellers, each of whom deals with similar products. This is because there are no restrictions to entry or exit into the market and there is no fear of imperfect competition because the market conditions perfectly controls the market (Adam Smith, neoclassical economist). This means that there is also free availability and mobility of resources into and out of the market.

An oligopoly market on the other hand restricts the number of buyers and sellers getting into and out of the market. There are few firms in the market and since they control their own prices, they are able to restrict the number getting into or out of the market (Kreps, 1990).

Similarities between an oligopoly and a perfectly competitive market

Firms in both markets aim at maximizing profits. In a perfectly competitive market, buyers and sellers are many and the sellers work towards making profits. Market conditions are naturally controlled and since there is free entry and exit, firms will enter the market when there are favorable conditions and they will leave when the market conditions become unfavorable such that profits decrease (Garegnani, 1990).

An oligopoly market is able to control the activities of the different firms in the market so as to maximize its profits. Since firms may produce different goods, they may decide to increase production and lower prices to increase profits. They may also set up trade restrictions which will enhance an effective market structure and hence make firms maximize their profits.

Both of these structures were developed by the neoclassical and the classical economists and they mainly emphasize on the relationship between the demand and price of commodities. In perfect competition, the demand is perfectly inelastic and a small change in price will have a significant change in the demand for products. On the other hand, an oligopoly has a relatively inelastic demand above the equilibrium price and an elastic demand below the equilibrium. This means that the prices for products in both markets determine the demand for these products (Novshek, 1987).

Both of the market structures are based on assumptions. Classical and neoclassical economists have developed different assumptions for the models so that they may come up with models which can be used in real life market situations. It is not possible to incorporate all the market conditions in the models and assumptions have therefore to be made for purposes of learning the market structures in the economy.

Conclusion

In conclusion, it is clear that different market structures have different characteristics, each of which is distinguished by the assumptions made. Whereas a perfectly competitive market may be unrealistic in any economy, the oligopoly market is present in most of the market structures in the economy. It is not realistic to have a perfectly competitive market with free entry and exit of goods and such a market structure is said to be theoretical. An oligopoly market structure, on the other hand, is a realistic market structure which can be placed as an intermediary between a perfect market structure and a monopoly. Most markets operate as oligopolies, where there are few sellers in the market each of whom have control over the activities of the others.

Therefore perfect competition is the extreme side of the market structure and it takes into consideration those factors that are not realistic in the economy. An oligopoly takes into consideration those factors that are present in many economic structures where there are few buyers and sellers and where trade restrictions control the markets.

Works Sited

Arrow K. Toward a theory of price adjustment : The Allocation of Economic Resources, Stanford: Stanford University Press (1959).

Cournot, A. Researches into the Mathematical Principles of the Theory of Wealth. Homewood, IL: Irwin (1963).

Friedman J. Oligopoly Theory. Cambridge, UK: Cambridge University Press (1983).

Fudenberg D. Dynamic Models of Oligopoly. London: Harwood (1986).

Garegnani, P. Classical versus Marginalist Analysis”, in K. Bharadwaj and B. Schefold (eds), Essays on Piero Sraffa, London: (1990).

Kreps, D, A Course in Microeconomic Theory, New York: Harvester Wheatsheaf (1990).

Mas-Colell, A., M.D. Whinston and J.R. Green. Microeconomic Theory, New York and Oxford: Oxford University Press (1995).

McNulty, P. “A note on the history of perfect competition”:Journal of Political Economy (1967).

Novshek, W., and H. Sonnenschein. “General Equilibrium with Free Entry: A Synthetic Approach to the Theory of Perfect Competition”, Journal of Economic Literature (1987).

Petri F. General Equilibrium, Capital and Macroeconomics, Cheltenham: Edward Elgar (2004).

Shapiro, Carl. “Theories of Oligopoly Behavior.” In Handbook of Industrial Organization, Amsterdam: North-Holland (1989).