Introduction

As soft drinks continually lose popularity for health-related concerns, manufacturers are forced to venture into other markets to boost profitability and distribute risk. Being one of the biggest manufacturers of soft drinks, Pepsi finds itself urgently requiring new products and new sources of income. A recent study by Thompson (2009) reveals that soft drinks manufacturers are switching to natural sweeteners as more people become health conscious. As more healthy products such as ice tea and bottled water gain market shares, the soft drinks industry continues to suffer and becomes less profitable. It is for this reason that Pepsi needs to diversify its markets by introducing its energy drinks in more markets such as Australia.

In the Australian market, Pepsi already has a few varieties of healthy drinks such as Max, Decaff, and Max. Although it has more products in other markets, an energy drink would be new in the Australian market. To introduce a new product to a market, the business would need to define the target market, in this case, the young and active people aged between 18-25 years old, an age that also makes the majority of the consumers in the industry. Avenues available for Pepsi include physical stores, online stores, and sales by email. All these avenues have unique advantages that the business can reap if they are well implemented.

Background

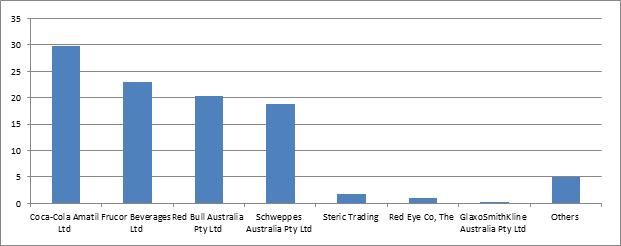

Australian soft drinks market is mainly dominated by carbonated non-alcoholic soft drinks (Council of Australian Food Technology Association, 2010). The region’s climatic conditions favor the consumption of cold drinks since there are hot summers and not-so-cold winters. Pepsi distributes most of its drinks in Australia under the license of Schweppes Australia. The company has a well-established market in the region manufacturing eight of the biggest non-alcoholic brands. The energy drink market is still unexplored but is widely dominated by V, a brand manufactured and distributed by Frucor Beverages Ltd. It controls a 53% market share in the region, posing as the biggest competitor so far if Pepsi was to fully launch in the market. Other significant competitors are Coca-Cola and Redbull.

Hypothesis

After a recession period in the global soft drinks market, a new report by Euromonitor (2011) revealed that consumer returns are high and Australia presents a good opportunity for a business to initiate a new product. The soft drinks industry continues to suffer a decline in sales as more people become more health-conscious. The results are declined sales and profitability. It is for this reason that Pepsi would need to invest in expanding its range of products. The new range of products must deal with consumers’ concerns over artificial sweeteners and include healthier choices.

Studies indicate that consumers are more inclined towards drinks such as ice tea, bottled water, and energy drinks with natural sweeteners. It is for this reason that I propose the launch of a more modern, healthy, and targeted energy drink for Pepsi in the Australian market. In Australia, Pepsi has few varieties such as Max, Diet, Decaff, among others. Although the company has its energy drinks varieties in other countries, the line will be new in Australia. It is expected that the company will gain access to the market by targeting the active and energetic group of people aged between 18-25 years old. The brand will enable the business add a product to its collection and grow its revenues.

From a SWOT analysis (see Table 1), and the five forces analysis (See Table 2), it is clear that its structures and market situation will favor its operations in the Australian energy drink market. Pepsi’s strengths such as a strong brand name allow it to convince consumers more easily, while its opportunities allow it to establish a healthy market share in the region. The porters five forces analysis reveal that Pepsi is in a position that allows it compete effectively with its competitors and manage new entrants. My hypothesis is that launching the product now is a good idea and this proposal is aimed at proving that.

Market Analysis

“A market analysis is aimed at determining the attractiveness of a market and understanding its evolving threats and opportunities as they relate to those of a business” (White, 2005). Pepsi would need this to help them determine who the customers are in the market and what they want from the product. When doing a market research, areas of interest for Pepsi will include existing marketing strategies and sales forecasts. “The dimensions of a market analysis include the market size, its growth rate, trends, profitability, its cost structure, success factors and distribution channels” (Prechter, 2002).

For Pepsi, the Australian market for energy drinks seems to be dominated by Suntory Holdings Ltd with their product V. Pepsi’s market share in the energy drinks industry seems to be so low, posing a challenge for their new product. The situation could also present an opportunity for the business since it means they have a big market to target and cover. “The best and most commonly used method of forecasting is extrapolation of historical data into the future” (Wood, Cogin and Beckmann, 2009). By studying the adoption rate of a similar product such as V, it will be easy to estimate or predict the shape of the product diffusion curve for their energy drink.

The industry’s cost structures is an important factor when evaluating a market and its viability. According to Novinture (2011), “it is equally important when formulating strategies for Pepsi to develop a competitive advantage”. Cost structures play a big role in a products indirect costs and consequently, profitability. A company may not be able to sell a certain product in a market whose cost structure is too high even though the product may have a very low production cost. The cost is dependent on the market share a business holds and the amount of sells(Sherwood and Robert, 2007). For Pepsi, a small market share in the energy industry at the moment may increase the market’s cost structure for them, putting them in a disadvantaged position.

The following chart reveals different companies’ shares of functional drinks by off-trade value in Australia for 2009

Market trends

A market trend helps identify the direction in which a market will move over time. Market trends can be secondary or secular. “Secondary market trends are short term and give a direction within a primary trend which includes few weeks or months” (Wood, Cogin and Beckmann, 2009). The secular market trend is long term and will cover Pepsi’s presence in the market for the next five to more than twenty five years. Changes taking place in a market are considered very important as they often come with new opportunities for businesses. They also come with threats which may work in favor of a company with better strategies because they can drive some of its competitors out. Relevant market trends are very dependent on different industries but are also dependent on other factors such as price, supply, demand and level of emphasis and support for various products and services.

Demographics

The Australian population is nearly hitting the 100 million mark (Knox, 2010). It makes it a great opportunity for Pepsi to have a target market. The region records high numbers in consumer expenditure making it easier to market a food product. Euromonitor International (2011) estimates that 50% of the food and drinks sold every year is consumed by 30% of the urban population, an element that gives a clear direction on which market Pepsi should target. The income levels in the region are steadily rising, especially as the global economy continues to stabilize. It is therefore a perfect timing for any business with intentions of launching a product into the market. A high income means that people are able to buy high quality and safe products such as those offered by Pepsi.

Implementation

Market entry plan

In order for Pepsi to successfully enter into the Australian energy drinks market, they must be able to chose a mode that is already working in the market. In this case, the strategy will include partnering with a distributor that is already well established. Schweppes, the business through which Pepsi distributes its other drinks, is a strong and well developed distribution channel. It therefore offers Pepsi the much needed avenue to reach the consumers. Schweppes has a distribution presence in the whole of Australia and well experienced personnel to allow Pepsi reach the target market and receive timely feedback from the market.

Distribution channels

Distribution channels are important in helping a business decide on the best methods to distribute their products and ones which will ensure that products are accessible to as many customers as possible. “In any market, there are existing distribution channels, emerging channels, trends and a well defined structure for the channels” (Holtzman, 2011). Existing channels are more direct to the customers as they are more used to them. Emerging ones however offer businesses an opportunity to develop a more competitive advantage as each business has a chance to come in with a new one. The power structures give retailers and other middle men a ground to negotiate with the manufacturers. Launching a new product in any market requires a well established distribution channel and a system that allows easy access of products. Schweppes Australia is a well-established company with a well-able distribution network. It will therefore be easy for Pepsi to reach its targeted consumers through a distribution channel they are already familiar with.

Supply chain and logistics

The operational techniques to be used in Pepsi’s logistics management will be aimed at sustaining quality in the company. Using such techniques is intended at attaining better quality and keeping it monitored at all times. Quality assurance will be a big part of Pepsi’s operations, largely because of the market share that the business is expected to command in Australia and the loyalty they enjoy from their customers in other products.

In other regions, logistical management in Pepsi is made possible through the company’s commitment to quality. It is through quality that Pepsi is able to have a competitive edge, especially in such a changing, competitive and wide market. For such a big organization, handling information can be hectic and inaccurate without proper quality and organization. Knowing when products have been released and when they are due for delivery may be challenging without real time information, which can only be made through a logistics management that assures quality.

Continual improvement is a big part of Pepsi’s culture. It is one of the focuses in Pepsi’s modern research projects (Penzkofer, 2010). The company seeks to continually improve its products’ quality while reducing the cost of doing so. Being in such a competitive industry, customer satisfaction will have to be on top of the business’ priorities. It will be made possible by ensuring quality assurance through continuous improvement. Logistics will play a major role in quality assurance by ensuring supplies are available and are handled with proper care during transportation and storage.

Another important factor for Pepsi’s quality assurance will be a factual approach to decision making. Such an approach can only be made possible if there is enough and accurate information for the company’s decision makers. Logistics management will have to be in place to ensure that information collection, storage and recovery is available to the executive organ in the company. It is through market and customers information that the company will be able to sustain a mutually beneficial relationship with its clients, who provide the company with the needed feedback about their products and services.

“In Pepsi, logistics management and distribution will be more than a measure of quantitative throughput or output” (Penzkofer, 2010). It is a mechanism that Pepsi will have to put in place to ensure that the needs of different operations in the business are met. When the mechanism lacks quality, many other operations in the business will be affected. For this reason, quality has to be paramount in Pepsi’s logistics management.

Marketing strategy

In order to achieve the marketing objectives, the business will sell a combination of local and international brands but ensure that Pepsi remains a flagship brand in the Australian market. The business will implement measures that will ensure it gains a broader position in the Australian energy drink market. A top or secondary position in the market will help the business delivers a high target in both marketing, distribution and even production. Moreover, such a position will create the much desired platform from which the business can further increase its energy drinks range of products. The businesses branches in other markets such as North America and Europe are good examples of how much an asset position can be. With a continued focus on other market factors such as price and quality, Pepsi will undoubtedly reach its marketing objectives.

Promotion

“The key success factors in a market include those elements which are important for a firm to achieve its marketing objectives” (Penzkofer, 2010). They include access to essential unique resources such as communication services, a company’s ability to achieve economies of scale, accessibility of distribution channels and technological processes. The company with the best economies of scale is able to do much better than its competitors in any market and so will a company with technological resources which best suit the market.

A proper marketing strategy must ensure that the product is felt in the market, not just when it is new but in the many years that follow. “Ultimately, each product will reach its maturity stage and a decline period but how long that takes is dependent on several factors” (Holtzman, 2011). These factors include ability to fight price pressure from a competing product, ability to maintain brand loyalty, how well it can hold with emergence of new products, how soon the market gets saturated, amongst many other factors. Lack of growth drivers has negative effects on a product’s performance in a market regardless of its quality or how well it can cope with pressure and competition in the market.

After a successful launch of the products into the market, Pepsi will need to encourage consumption. The promotion strategy will be aimed at meeting consumers from different places, especially the urban market which is largely targeted. Promotion will include use of video and print advertisements, audio channels and e-marketing. A big percentage of the target market is aged between 18 -25 years, making it easier to reach them through e-marketing. Strategies to be applied in e-marketing will include use of social groups such as facebook and twitter, email advertising, videos posted on the internet and use of a well informing and attractive website.

Pepsis’ reputation as a leading producer of soft drinks will serve as an advantage as the business tries to market the product. The high level of quality exhibited by its products has proven the company’s commitment to customer satisfaction. The foundation on which the business and its brands are built is based on putting customers’ needs first and ensuring a good experience with the company’s products. The promotion campaign must therefore be focused on selling these strong points. Acquisitions and partnerships are a good way to build the business’ position in the Australian market and must therefore be put into consideration.

Pricing and profitability strategy

“While profitability of different companies will vary in the same market, its average profit potential is used to give guidelines on how easy or difficult it is to do well in it” (Groucutt, Patrick and Peter, 2004). According to Penzkofer (2010) “a market’s profitability is influenced by several factors among them being supplier power, buyer power, threat of substitute products, entry barriers and rivalry among different firms”. It helps to identify a market’s potential and the benefits a business will enjoy by entering the market. This then allows a company decide on which products to sell in the market, selling and pricing strategies.

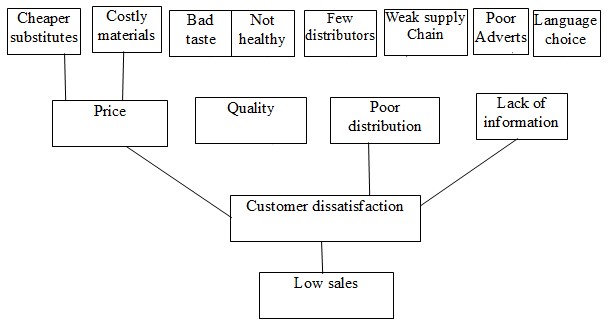

“Any business with intentions of launching a new product to a market must base their pricing on several key trends that continually shape the global marketplace of soft drinks in that market” (Retail World, 2010). Factors that would affect pricing include the cost of production, target market, competitors’ pricing, consumers’ wealth, spending habits, among many others. Pepsi’s pricing strategy must take into consideration how much its other products have performed in the Australian market. “In terms of market segment, premium and specialty brands of Pepsi have a share of volume growth estimated at 5% per year, against the 2-3% overall growth rate” (Penzkofer, 2010). Such a growth level offers an advantage as the business tries to convenience the people to try one more product from them. The business will ensure profitability through high sales volumes. Poor sales volumes could be caused by several factors analyzed on Fig. 1.

Finance and Operation plan

Proper financial strategies will determine how well the other implementation strategies work. Good financial planning standards require comparable financial statements that allow the organization and analysts compare what is going on in their organization with performances by other organizations in the same industry. Several indicators have been set to help compare between different beverage companies in the industries. Comparison will make it possible to point out areas of error in Pepsi.

The business will need to have proper priorities in their expenditure especially during the implementation period. Priority will be placed on promoting the product and doing a comprehensive market analysis to help the business establish where they can make improvements. Research and development will be an important investment to ensure the product meets the consumers expectations and stays ahead of competition.

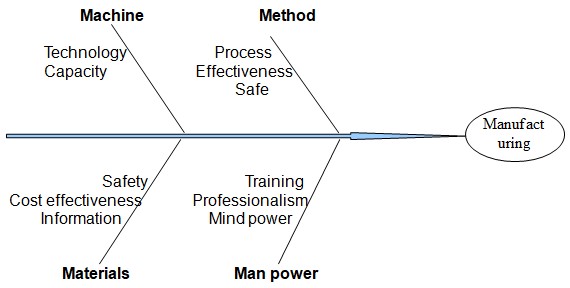

Pepsi will also be required to ensure the development of an integrated financial analysis. To protect investors, financial records and information will be comprehensive and easy to understand. Financial information will also be confidential and only enough information will be released to stakeholders. This will protect the organization from being over-exposed to competitors. Proper financial reporting standards demand that financial strategies should reveal a proper approach to the future which should involve examining the current and anticipated factors. The factors have also to be associated with customers who make the external and internal environment, and the business itself, which makes the internal environment (IEEE Spectrum, 2010). Proper financial planning is supposed to envision new and effective strategies for the department, while exercising its creativity and aligning its practices, resources and policies, to realize its goals. The biggest part of operations will be manufacturing where important factors to consider will include man power, machinery, method and methods. Factors that could hinder an effective manufacturing process are summarized in Fig 2.

Measuring success

“The most common method business use to measure success is financial worth” (Novinture, 2011). In the last financial year, the company registered a 4% sales growth in the Australian market. The new product’s success will be measured by a further increase in sells and profitability. It is estimated that Pepsi has potential to grow its revenues by 3% every year in the Australian market (Novinture, 2011) , growth that could be made possible through the introduction of the new product. Another measure of success will be growth in the company’s cash flow. The last year saw the company’s annual income grow to $ 6,338 million, a 13.4% increase from the previous year. A further increase would be expected if the business established a bigger presence in the energy drinks market.

Profitability and customer satisfaction will be the biggest measures of success for the product. Launching a new product will require a significant amount of investment and the period it takes to break even will depend with the company’s marketing strategy. Customer satisfaction will be a significant measure of the products success. Pepsi’s market share in other regions stand at an average 21.4%. In Australia, the business will be looking at improving its market share from the current 15% to the global average, which is at least 21%. Such a development will be proof of the project’s viability.

Schweppes Australia, the company through which Pepsi will launch its new product, employs more than 1500 people, a number that will increase if the business launches another product. Employees’ satisfaction will be significant when measuring the product’s success and quality consistency. Schweppes also registered increased profitability in the last financial year, a trend that puts it a better position for the launch of a new product. A further growth in revenue and profits will be a good indicator of success for a new energy drink in the market.

Challenges and risks

“Australia is ranked the 15th largest economy in the world with a GDP of over $ 1 trillion and is forecast to grow more than 3% in 2011” (IEEE Spectrum, 2010). The government eliminated tariffs offering a good market opportunity for foreign companies such as Pepsi. To help the economy recover from the crisis, the Rudd government invested approximately an amount worth 6% of their GDP to offset the negative effects of the crisis (U.S Commercial Service, 2011.). The stimulus package positively impacted demand for consumer products in the market, putting manufacturers such as Pepsi at a safe position. By launching a new product into the market, Pepsi is exposing itself to a market that has already recovered from the crisis and has so many benefits to offer.

Like every other market, investing in the Australian market posses several challenges for Pepsi. The biggest challenge is high levels of competition, which also poses as a major risk. “Australia’s distance from the rest of the world, large land area and relatively small population has led to market dominance by few large firms in most sectors” (OzBevNet, 2007). The energy drink market is dominated by V with a 53% market share, followed by Red Bull with a 33% market share (Capparell, 2010). Launching a new product for Pepsi will not be an easy task and will need a strong marketing strategy to gain a strong market share.

The other challenge facing Pepsi in their initiative is Australia’s access to low-cost producers such as China. Any producer must therefore demonstrate satisfactory added value to convince consumers. Competing against low-cost producers means that the company has to find ways to overcome most of its expenses and offer their products at competitive prices. This, combined with the fact that doing business in Australia is very expensive, makes it hard to maintain profitability. Pepsi will need to build a strong brand and work on consumer loyalty.

Conclusion

“Pepsi is the second largest food and beverage business in the world and is ranked the largest by net revenue in the North American market” (Schweppes Australia, 2011). The industry is having a hard time retaining customers as more and more people embrace the healthy options. It is for this reason that the business needs to develop new products and expand its markets to increase revenue. Its products have a good reputation, making it easier to convince consumers.

The Australian market size for energy drinks has grown by 19% in the last one year (Waye and Christina, 2009). The growth definitely means that launching an energy drink to the market right now is a good and timely investment. The fact that the energy drink market in Australia is still in its growing stages puts Pepsi in a position where they can grow and develop with the market as they stamp their authority in it. Australian consumers’ spending levels are also high offering a promising situation for Pepsi.

The company’s strategy will involve conducting a comprehensive market analysis, a demographic study, designing a pricing strategy and ensuring a well-established distribution channel, which is already available through Schweppes. Risks involved in the market include a highly competitive environment and the region’s access to low-cost producers such as China. To counter these challenges, Pepsi will need to build a strong brand and work on brand loyalty, which will ensure that its customers don’t change preferences when cheaper products come in.

Recommendations

“Since cost is an essential consideration in any business, assessing a company’s costs position against that of its competitors can have more explicitly strategic implications” (Chaston, 2009). If a business understands its competitors costs and strategies, it is able to understand the competitor’s supply curve which they can use to develop a market strategy. Pepsi will need to understand its market’s cost structures and use them as a tool to help it become a cost leader.

The energy drinks market is gaining as much popularity as the soft drinks market all over the world. Pepsi can take advantage of this factor and use Australian numbers to its advantage. The biggest reason for this trend is more health concerns, a situation that presents more opportunities for Pepsi. By using natural sweeteners, the brand will attract the bigger population that has health concerns about artificial sweeteners. Since Pepsi’s brands already enjoy recognition in the beverages industry, the company can use this factor to its advantage.

Strengthening their brand loyalty will of be of a valuable significance in such a competitive market. A healthy brand loyalty will ensure that its customers do not abandon the brand when cheaper products become available in the market. It will also protect the brand from aggressive competitors’ marketing strategies. It is important for the business to invest in cost cutting measures to compete effectively with products from the Chinese and other low cost markets.

Reference list

Capparell, S., 2010. The real Pepsi challenge: The inspirational story of breaking the color barrier in American business. New York: Free Press.

Chaston, I., 2009. New marketing strategies: Evolving flexible processes to fit market circumstances. London: Sage Publications.

Council of Australian Food Technology Association, 2010. Food Australia: Official journal of CFTA. North Sydney, Australia: Council of Australian Food Technology Association.

Euromonitor International, 2011, New Global Report: Soft Drinks New Product Innovations 2010.

Groucutt, J. Patrick, F. and Peter, L., 2004. Marketing: Essentials principles, new realities. London: Kogan Page.

Holtzman, Y., 2011. Strategy research and development: It is more than just getting the next product to market. The Journal of Management Development, 30(1), pp. 126-133.

IEEE Spectrum, 2010. Australian stock markets. Web.

Knox, D.M., 2010. The Australian annuity market. Washington, DC: World Bank Development Research Group.

Novinture, 2011. Pepsi marketing strategy. Web.

OzBevNet, 2007, Australian non-alcoholic drinks market: Australian Convenience Store News.

Penzkofer, A., 2010. The market of Pepsi/PepsiCo. New York: Routledge Publishers.

Prechter, R.R., 2002. Market analysis for the new millennium. Gainesville, Ga.: New Classics Library.

Retail World, 2010, Beverage category heats up during summer. Rozelle, [e-journal] Vol. 63(17), p.34.

Schweppes Australia, 2011. Trade Customers. Web.

Sherwood, P and Robert, S., 2007. Market analysis. New York: The Haworth Press.

Thompson, W.J., 2009. The Australian market. New York: Routledge Publishers.

U.S Commercial Service, 2011. The Australian market. Web.

Waye, V. and Christina, S., 2009. Regulating the Australian water market. Journal of Environmental Law, [e-journal] 22(3): pp. 431-459. Web.

White, P., 2005. Market analysis: Its principles and methods. New York: McGraw-Hill.

Wood, R, Cogin J, Beckmann, J, 2009, Managerial Problem Solving Framework, Tools, Techniques, McGraw-Hill, Australia.

Appendices

Table 1: PEPSI SWOT analysis

Table 2: Porters five force analysis.