Introduction

Short-term and long-term needs are considered before stating financial goals. Swart discusses that immediate goals may include settling debts (2002, p. 11). Long-term goals put retirement funds into consideration. Short-term goals include investing in stocks or bonds. The client’s personal goals are to payoff debts, increase returns to investment, balance portfolio to reduce risk and taxes, purchase a house, and invest in a pension scheme. Swart (2002, p. 17) discusses that it is necessary to have “periodic revisions in order to provide for changing needs and circumstances”. Portfolio balance may be reviewed annually to cater for changing needs. Shifting portfolio from one form of liquidity to another involves transaction cost or taxation. It should be done less regularly to take reduce costs.

Assets and Liabilities Analysis

Assets and liabilities analysis gives an individual’s net worth. According to Mayo (2011, p. 95), “an analysis of assets and liabilities is actually a balance sheet”. It looks into what is owned against what is owed. From calculations, the client’s net worth is £592,385. The value of the car he owns is unknown so it has not been included in the calculations (see appendix 2).

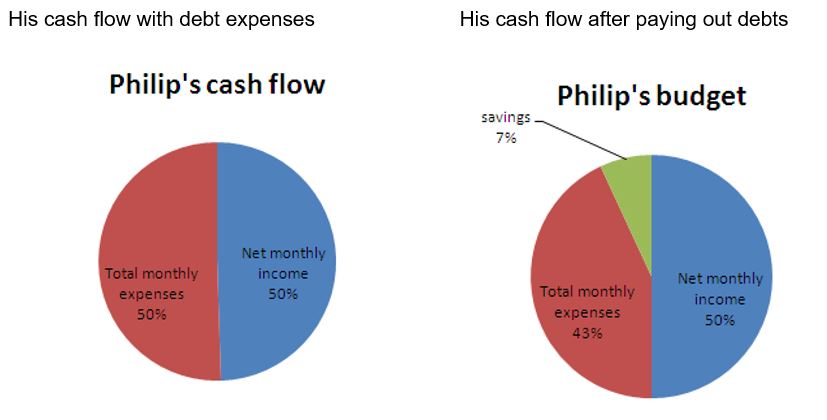

The individual’s cash flow statement includes his income and expenditure. Mayo (2011, p. 95) discusses that “the cash budget enumerates receipts and disbursement and may cover such periods such as a month or a year”. When the receipts exceed expenditure, the individual can allocate funds for future expenses. From calculations, taxable income is 26,495 (see appendix 3). The client’s annual disposable income is £29,389.75. Income from liquidities has been averaged to get monthly values. Expenses exceed receipts by an average £50.35 on a monthly basis. There is a need to reduce expenditure so that there is some amount left to save.

Income and expenditure analysis

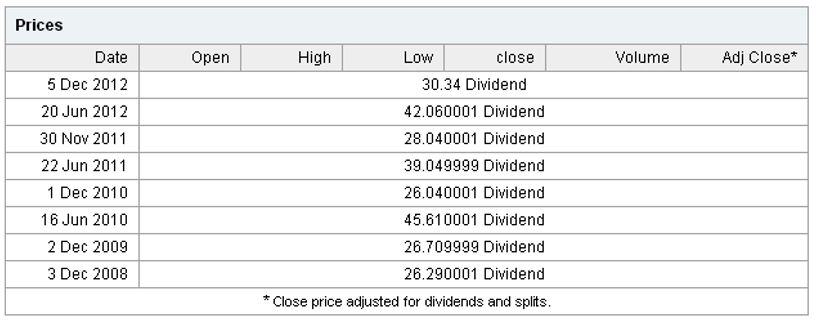

The client can reduce expenditure by paying off liabilities which earn interest. The total liabilities are £9,980 which would make his net worth to remain the same at £592,385. However, his cash flow will be positive. The expenses will be reduced by £320 car loan repayment and £80 interests on loans. The expenses become 2,180.85 and savings will amount £349.65. There is an improvement in his cash flow as illustrated in appendix 4.

Buying a house may not reduce expenses effectively. The benefits may only be generated from the 25% discount that a person whose marital status is single receives. The client can obtain an apartment worth £35,000 using the funds in the building society account. He should choose this amount because it earns the least rates of return.

The client has invested in a building society savings account. Simon discusses that the “best building society savings account earn rates of up to 3.8%” (Simon 2012). Examples of building societies with high interest rates include Derbyshire BS and Melton Mowbray BS. Other big-sized building societies offer rates that are lower than 3%. These rates are lower compared to what he earns in the gilts (6%).

Drawbacks of cash, gilts, individual shares

The main disadvantage of holding cash is that it is exposed to inflation. The interest rates are lower or in some cases there is no interest altogether (Mukherjee 2002, p. 533). Cash deposits earning interest have limitations on withdrawals. As a result, the advantage of holding cash for personal expenses is eliminated.

Income from financial assets is taxable. Wang (2007, p. 8) discusses that “interest income earned on liquid assets is double taxed both at the corporate and individual level”. Individuals waiting on dividends receive a lesser amount as a result of double taxation. Gilts are advantageous because they are redeemable at a known amount during maturity. Index-linked gilts cover against inflation because it incorporates changes in the price index (Buckle & Thompson 2004, p. 187). The chances of default are very low. The main disadvantage is that they have a low rate of return compared to other financial assets. They are long-term investments and the quoted amount may lose value when maturity reaches.

Professional management refers to the money market specialists who manage mutual funds. Diversification means a pool of funds is invested in various securities. Whitney (2009, p. 14) discusses that some of the advantages of mutual funds include “professional management, diversification, affordability, and liquidity”. Affordability includes the option of initial small amounts that are increased monthly. The JPM New Europe shares may be added monthly at a minimum rate of £100. Liquidity refers to their ability to be traded for cash.

The price of mutual fund shares is calculated once daily. In real time, they are uncertain. The disadvantage of mutual funds is that they deduct “sales charges, annual fees, and other expenses regardless of how the fund performs” (Whitney 2009, p. 15). Individual investors lack control over the influence of portfolio exchanges. The J.P Morgan Asset Management charges 3% initial fee and an additional 1.5% annual fee. The beta value of the managed fund is 1.93 for the 1-year fund, and 2.18 for the 3-year fund. The share prices are volatile to stock market prices and they can change with wide margins.

Capital gains on shares are taxed only through dividends or when sold. On the other hand, capital gains of mutual funds are taxed annually (Whitney 2009, p. 21). The disadvantages of stocks include loss of value when public confidence in an industry is lost. There are gains when a corporation’s market value appreciates. There are annual dividends when it makes profits.

Analysis of his investment portfolio

The gilts are considered safe investments because there is little risk of government defaulting. From a £2,500 investment in gilts, the client earns £150 before taxation. After the 20% taxation, this amount is reduced to £120.

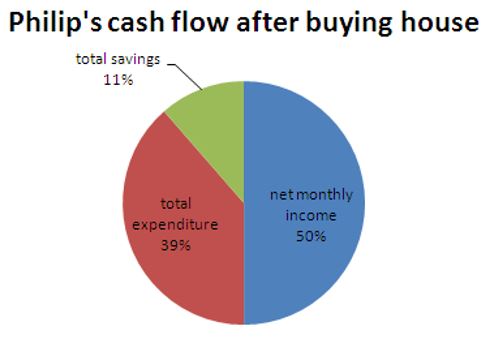

The Drax shares were trading for £747.00 at the end of 15 Sept, 2008. The prices have been fluctuating. The lowest in the recent period was £524.50 in Nov 16, 2012. The closing price on 5 Jan, 2013 was £610.50. This indicates a loss of value of £34,125 (250 * (747.00 – 610.50)). The cumulative dividends from Sept 2008 to Sept 2012 amount to 131.35 per share (see appendix 5). This adds up to £32,837.50 (250 * 131.35). The net value between gains and losses during the four year period is -1,287.50 (32,837.5 – 34,125). The prices of Drax shares are volatile. The client should give the shares some time (1 or 2 years) to appreciate before selling them. The share price is rising gradually.

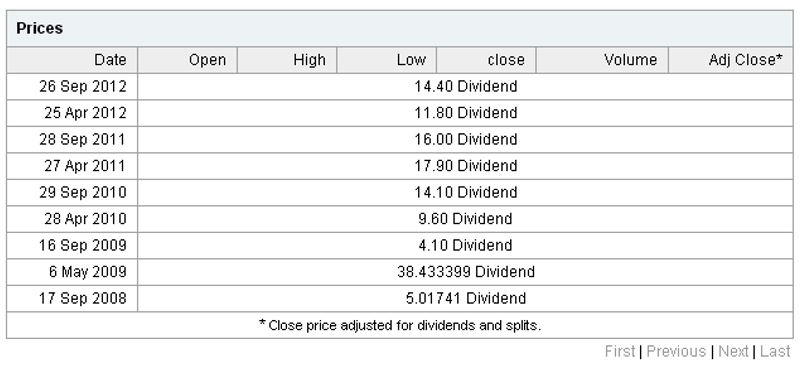

Severn Trent share price on 15 Sept, 2013 closed at 1,323.00. The most recent lowest price was on 14 Jan 2013 closing at 1,550.00 (Severn Trent PLC (SVT.L) Historical Prices). At the end of 5 Feb 2013, the price was £1,620. This stock has done well on the markets through value appreciation. The added value is £44,550 (150 * (1,620 – 1,323)). The cumulative dividends add up to 222.06 (see appendix 6). Considering dividend per share, the total amount gained through shares in the four-year period is £33,309 (150 * 222.06).

The total capital gain from Severn Trent is £77,859 (33,309 + 44,550). This is an average annual increment of 19,464.75. This is higher than all the other gains from financial assets. This value reflects public confidence and it can be lost over a short period. The client should keep these shares because the annual gains from dividends are high.

The yield on JPM New Europe A Acc is 1.52 which is a percentage of price. The value can be calculated as 1.52% * 216.20 which gives 3.29. The total capital gains are £2,303 (= 700 * 3.29). The volatility for the 1-year and 3-year investments is 18.59% and 24.31%. It shows that investors are capable of gaining values through price appreciation. The Sharpe ratio shows the additional returns that an investor gets by taking risk. Sharpe ratio considers the fact that “an investor could always earn a certain return risk free – for example by investing in T bills” (Schwager 1996, p. 30). The Sharpe ratio for this holding is 0.61 (JPM New Europe).

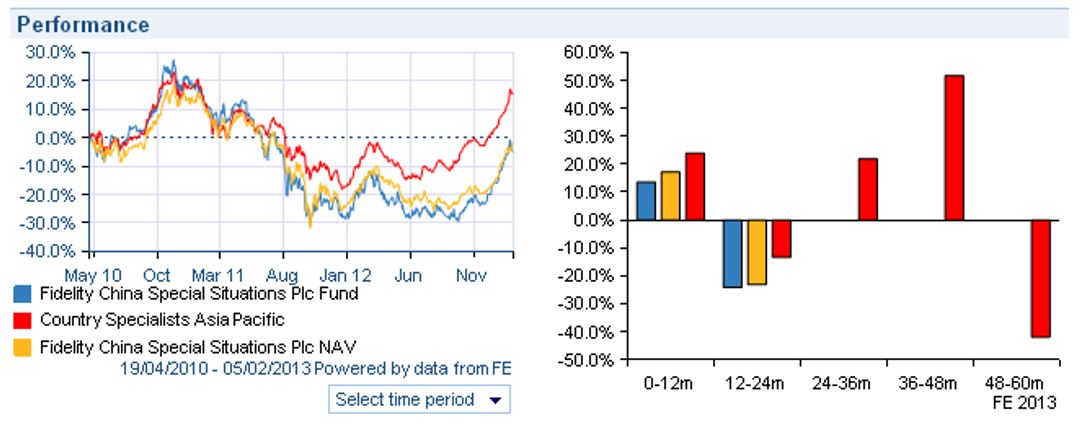

This indicates that it is better to invest in this mutual fund than in treasury bills. The performance of this fund was not good through the last four years but it is improving (see appendix 7). The cumulative dividend for the three-year-period (from Jan 2010) is 1.65. The total amount is 1,155 (= 700 * 1.65). Together with the yields, the capital gains are £3,458. This spread over three years gives an annual amount of £1,152.65. If the same investment was made on gilts at 6%, it would yield £9,038.4 (6% * 150,640) annually. Fidelity China dividend yields are lower at 0.79%. The cumulative dividend for 2012 and 2011 is £1.00. This is lower what JMP yielded in the same period (see appendix 9 for comparison).

A balanced portfolio allows an investor to gain from all kinds of securities. Brennan (2002, p. 58) describes a balanced portfolio as one in which “investment is made across three major asset classes – stocks, bonds, and cash investments”. On the other hand, a diversified investment is similar to Philip’s investment. It involves investing in equities issued by different companies. According to Brennan, the capital gains for a person who invested in all-stock between 1977 and 2001 grew almost 20 times the invested amount (2002, p. 60). The risk involved is also higher because fluctuations on the market can make the same value drop to very low points.

When equity prices and interest rates rise, bond rates will decline and vice versa. Balanced portfolio allows an investor to gain on one side when the other side is losing. This ensures that there are always positive capital gains on investment. For this reason, Philip needs to reduce other shares that are performing poorly such as JMP New Europe and Drax shares to increase investment on gilts. The majority of people consider 60% bond and 40% stocks as a balanced portfolio. It can vary depending on the short-term gains that an individual wants. The tax rate is similar on both securities.

Other financial priorities

The client needs to save for an emergency fund. Darby (n.d) considers an amount equal to three months’ payment to be the least one can have as an emergency fund. The amount can be saved in a savings account with high interest rates such as the United Bank UK one-year-fixed-rate bond at 2.25% (Compare Savings Account). Philip can save this amount in six months from his salary. He can also consider converting some of his financial assets into cash. If he needs the amount immediately in a savings account, he can consider selling shares.

He can choose a company offering pension plans that charge monthly payment of £100 such as Standard Life (Active Money Personal Pension AMPP). There is a list he can choose from at money.co.uk (Compare Pensions). He should consider regular savings after setting aside emergency fund. It can ranges from £150 to £250 monthly. This is about 6 – 10% of his monthly income. It can be invested in a savings account that offers 1 to 3 year fixed rates. After accumulation, it can be converted into bonds.

Review of goals

He should purchase a house to reduce expenses on rent through the amount held in a savings account. The amount he saves on rent discount is higher than what he earns as interest from the BS savings account. There is a reduction of expenditure through paying out his debts. With a surplus on income, he can save for an emergency fund, pension plan, and other investments. He should balance and diversify his portfolio such that he holds more value on gilts than on stocks.

Appendices

Appendix 2

Appendix 3

Appendix 4

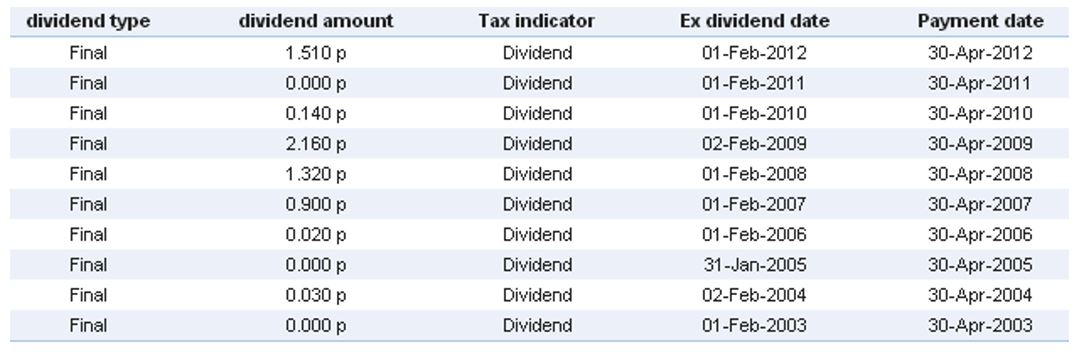

Appendix 5

Historical dividends issued during the four year period. Web.

Appendix 6

Dividends from Severn Trent. Web.

Appendix 7

The graph showing performance. Web.

Appendix 8

The dividends issued to JPM New Europe A Acc. Web.

Appendix 9

Performance graphs for Fidelity China PLC. Web.

References

Active Money Personal Pension AMPP. n.d. Web.

Brennan, J. 2002. Straight Talk on Investing: What You Need to Know, John Wiley & Sons, Hoboken.

Buckle, M & Thompson, J 2004. The UK Financial System: theory and Practice 4th Edition, Manchester University Press, Manchester.

Compare Pensions n.d. Web.

Compare Savings Accounts n.d. Web.

Darby, S n.d., Do I Really Need an Emergency Fund? Web.

Drax Group PLC (DRX.L) 2013. Web.

Drax Group PLC (DRX.L) Historical Prices 2013. Web.

JPM New Europe 2013. Web.

Mayo, B. H. 2011. Investments: An introduction, Cengage Learning, Mason.

Mukherjee, S 2002. Modern Economic Theory, New Age International, New Delhi.

Schwager, J. D 1996. Managed Trading: Myths & Truths, John Wiley & Sons, Hoboken.

Severn Trent PLC (SVT.L). 2013. Web.

Severn Trent PLC (SVT.L) Historical Prices 2013. Web.

Simon, E, The best building society savings accounts, media release, 2012. Web.

Swart, N 2002, Personal Financial Management, Juta & Co. Ltd, Lansdowne.

Wang, F 2007, Three Essays on Corporate Liquidity, Financial Distress and equity Returns, ProQuest Information and Learning Company, Ann Arbor.

Whitney, D. J 2009, Family Financial Guide, GovAmerica.org Bethesda.