Introduction

Poundland is arguably the largest discount retail store in Europe that sells merchandise for £1. Dave Dodd and Stephen Smith founded Poundland in 1990 with the aim of offering common household goods at affordable prices (Wood, 2014). The discount retailer deals with more than 3,000 types of goods that fall into product groups such as food and drink, health and beauty, home and garden, stationery and crafts, leisure and entertainment, party and celebrations, baby and kids, and gifts (Express, 2013). The introduction of price-point retailing in Europe is attributed to Poundland. However, it began in the United States in the 1870s.

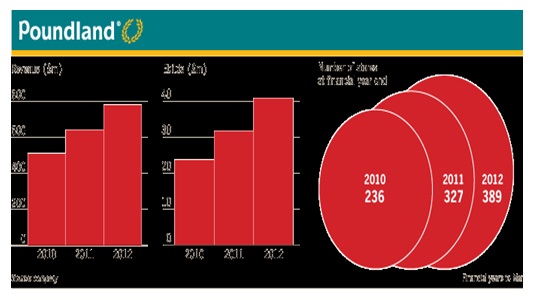

According to executives, the retail store serves more than 2.75 million customers every week (Wood, 2014). Poundland announced a plan to list in the London Stock Exchange in order to raise money for its expansion program. The retailer has experienced steady growth and rise in profits despite the current business environment that is characterized by inflation and high volatility. Its earlier expansion plans were very successful. For instance, in 2006, it increased its number of stores in the U.K. from 80 to 150 (Davey, 2014). In the future, Poundland aims to increase the number of stores in the U.K. from 500 to 1,000.

Evaluation of why Poundland is seeking stock market listing

Conducting an Initial Public Offering (IPO) is imperative for any private company in order to execute expansion plans, reduce costs of loans, and increase organizational value. Companies adhere to certain rules and regulations before listing on the stock exchange. In order to conduct an IPO, an issuer company contracts an investment company that oversees the entire process. The contracted company determines the price of shares and monitors their sale to investors. In February 2014, Poundland agreed to an initial public offering (IPO) of approximately £700m. The company’s rate of growth was very high and therefore, it needed additional capital to execute its expansion plan.

Public listing is beneficial to companies and stakeholders. First, companies conduct IPOs in order to raise money to fund their expansion programs. The main reason for Poundland’s IPO is to raise money to finance its expansion program. In the next ten years, the retailer plans to increase its number of stores in the United Kingdom to 1,000, as well as expand its operations into Spain (Graham, 2013). Without additional funding, Poundland would not be able to grow its business operations. Many companies have conducted IPOs in the past to grow their business operations.

For instance, in 2012, Facebook’s IPO raised $16 billion after selling shares at a price of $38 each (Raice et al., 2012). The money helped Facebook expand its operations by acquiring other technology companies such as Instagram and WhatsApp. The second reason for listing is to increase investment through raising equity capital that is used for various purposes. The Twitter IPO of 2012 enhanced its reputation and provided more publicity that increased its market capitalization.

In that IPO, Twitter sold 80.5 million shares that raised its market capitalization to $31 billion (Demos et. al, 2013). Twitter’s expansion was impossible because of losses that hindered its growth. The third reason for an IPO is as an exit strategy for stakeholders. IPOs’ give shareholders and founders of the company the opportunity to exit after investing for a certain period. An IPO provides an opportunity to liquidate one’s investment. Moreover, it enables investors to cash in quickly and use the money for other investments.

In 1980, Apple Inc conducted an IPO that was used by many investors to exit from the company. Many venture capitalists that had invested in the company used the IPO as an exit strategy (Dilger, 2013). Many cashed out and did not reinvest their money. Investors earned billions of dollars in gains from their capital investments. According to reports, the IPO increased the net worth of many investors significantly because 300 investors became millionaires. Fourth, the IPO is aimed at ensuring a lower cost of funds in order to improve the profile of the company.

Through the IPO, Poundland will get capital at a lower cost compared to the cost incurred by borrowing from banks and other financial institutions that lend money at high-interest rates. Amazon’s 1997 IPO was aimed at lowering the cost of loans. The company had made losses for several consecutive years. The IPO raised $54 million and raised the capital base of the company (Galante & Kawamoto, 1997). Before conducting the IPO, Amazon had announced net revenues of $16 million. However, it had not made any profit. It had reported a loss of $3 million (Galante & Kawamoto, 1997). It is difficult for a company to borrow money from banks and other financial institutions without reporting profits in its financial statements.

Valuation techniques available to Poundland’s advisors

Advisors to Poundland’s IPO include Credit Suisse, Rothschild, Shore Capital, and JP Morgan. They have several evaluation techniques to use including market capitalization, price-earnings multiple valuations, dividend valuation model, net assets model, and discounted cash flow method (DCF). Each of these valuation methods applies different principles and metrics to value companies. In any valuation process, advisors choose the most appropriate valuation method depending on the performance of a company, which is based on its profits, revenue, and losses.

Market capitalization

Market capitalization refers to the market value of a company’s stocks. In this case, it refers to the value of Poundland’s stocks. Market capitalization is limited because it only represents a company’s stock value and disregards other important measures of a company’s performance. An alternative valuation method that gives a more accurate value is the enterprise value. Market capitalization can give a misleading figure of a company’s value. If a company’s number of shares remains constant, its market capitalization will be determined by the fluctuations in the price. The method is disadvantageous because it disregards a company’s debts (Penman, 2006).

To factor debts into the market capitalization value, a variant referred to as enterprise value is used. Enterprise value measures the actual value of a company by adding its market capitalization to its debt and subtracting cash hoarded. Enterprise value (EV) can be represented by the following equation: EV= market capitalization + debt – cash. This value gives a more accurate value because it includes both assets and liabilities.

P/E ratios (price earnings multiple valuation)

The P/E ratios valuation method involves computing P/E multiples by diving a company’s current share price with the earnings of each share. The multiple values are obtained by dividing the market value of a single stock by its earnings. A high P/E ratio implies that the company’s stock is expected to experience high earnings growth (Penman, 2006). On the other hand, a low P/E ratio implies that the company’s stocks are expected to experience low earnings growth (Gup & Thomas, 2010). P/E multiplies show how much an investor would be willing to give for each unit of a company’s earnings.

For instance, if the trading multiple is 10, this implies that every £10 would attract £1 of the net income. The price earnings multiple valuation methods are limited because a company can manipulate its earnings to raise its value (Penman, 2006). Valuation multiples are calculated using a company’s revenue, earnings, EBITDA, total assets, the book value of shareholder’s equity, or EBIT.

Multiples based on earnings, EBIT, and EBITDA are usually calculated using a company’s financial results of the past 12 months (LTM) or the average results of several years. In cases where changes in stock valuations are observed, the main reason for such changes is due to upward or downward adjustments. This aspect is referred to as multiple “revisions.” Adjustments are made to reflect differences between a company undervaluation and a comparable company with regard to factors of comparison such as growth and relative risk for investors.

The dividend valuation model

The dividend valuation model determines the value of a company based on its potential dividend level (Penman, 2006). The constant dividend growth model applies under the assumption that the rate of dividend growth remains constant. In addition, it assumes that the expected rate of return is always higher than the rate of dividend growth. The price of a stock is then calculated using the following formula.

P=D/k-g

In this equation, P represents the price of a stock, D is the ratio of dividend payout, k represents the projected rate of return, and g represents the expected growth rate of dividends (Penman, 2006). It is imperative to practice caution while using this method. Companies that yield high dividends usually experience financial constraints that affect the price of the stock (Henschke, 2009). This valuation method can only be applied when valuing companies that pay dividends. For instance, many technology companies do not pay dividends to investors.

The net asset valuation method

The net asset valuation method is used to value a company by subtracting the value of its liabilities from the value of its assets (Laughton et. al, 2008). The main aim of this method is to estimate how much it would cost to re-establish the business. The net asset valuation method can also give misleading value because the assets to include in a company’s valuation are determined by the people involved (Penman, 2006). On the other hand, the criterion of determining the value of each asset is not fixed.

Assets considered in the valuation process include cash, accounts receivable, incomplete and complete constructions, intangible assets, fixed assets, reserves, financial investments, and VAT recovered from valuables (Gup & Thomas, 2010). On the other hand, liabilities considered during valuation include accounts payable, reserves for deferred payments, liabilities from lending and credits, and debts (Laughton et. al, 2008). The net asset valuation method is not as common as the discounted cash flow method.

Discounted cash flow method (DCF)

The discounted cash flow method evaluates a company using projections of future earnings (Street of Walls: Valuation Techniques Overview, 2013). The projected future earnings are discounted in order to determine the current value of a company. The value obtained from the DCF analysis is compared with the cost of investment. The word “discounted” implies that a company’s future earnings are less valuable than present earnings.

DCF involves consideration of the effectiveness of business processes and operations, as well as factors such as profit margins, competition, projected future earnings, discount rate, and financial risks. Consideration of these factors helps to understand what would drive the value of a company’s stock after an initial public offering. In addition, it helps advisors value a company reasonably and determine a fair stock price.

DCF has several advantages that render it effective in valuing Poundland. It computes an intrinsic stock value that is realistic compared to other valuation techniques. It does not apply metrics like price-to-sales ratios and price-earnings ratios because they produce biased stock values based on whether the market is overvalued or undervalued (Street of Walls: Valuation Techniques Overview, 2013). It relies on projections of a company’s future earnings and market conditions. However, it ignores the state of the modern business environment that is volatile and unpredictable.

Conclusion/recommendations

Major company valuation methods include market capitalization, price earnings multiple valuations, dividend valuation model, net assets model, and discounted cash flow method (DCF). In my opinion, the advisors would prefer the discounted cash flow method because of the past performance of Poundland, which can be used to predict future earnings. The discounted cash flow method values a company using projections of future earnings. This method would be the most appropriate because the earnings of Poundland in past years would easily predict future earnings. It involves calculating the terminal value (T.V) and using it to calculate the fair value of the company.

T. V = Final Projected Year Cash Flow X (1+Long-Term Cash Flow Growth Rate

Discount Rate – Long-Term Cash Flow Growth Rate

The enterprise value is calculated by dividing the value of cash flows divided by the terminal value. Discounting free cash flow to equity yields the value of equity while discounting free cash flow to the equity yields the value of the company. Poundland has managed to maintain an upward trajectory with regard to the revenue increase in past years. For instance, in 2013, profits soared by 29% and increased its turnover to £880 million (BBC News, 2014). In the future, Poundland expects profits to increase because of two main reasons.

First, executives project that demand for their products will increase due to harsh economic times. Therefore, people will buy their products because they are affordable. In addition, the executives predict that the economy will recover and thus increase consumer spending. Second, Poundland plans to increase profits by increasing its number of stores in the U.K. to 1,000 and expanding its operations to Spain (BBC News, 2014). The expansion plan will increase its earnings and profits. The table below shows Poundland’s earnings between the years 2003 and 2007.

In 2011, turnover rose to £642 million while in 2013, turnover rose to about £880 million (BBC News, 2014). In the future, earnings are projected to increase.

References

BBC News: Poundland in £750m Stock Market Float 2014. Web.

Davey, J 2014, UK’s Poundland Sets Share Offer Price Range at 250-300 Pence, Web.

Demos, T, Dietrich, C, & Koh, Y. 2013. Twitter IPO: Relief, Riches and a $25 Billion Finish. Web.

Dilger, D.E 2013. Apple Inc. Stock Created 300 Millionaires 33 Years Ago today. Web.

Express: Poundland owners May sell Up to £600m. 2013. Web.

Felsted, A. 2012, Higginson Aims to Lead Poundland Growth. Web.

Galante, S, & Kawamoto, D. 1997. Amazon.com IPO Skyrockets. Web.

Graham, R 2013. Poundland Plans £800m float to fund major expansion. Web.

Gup, B & Thomas, R 2010, The Valuation Handbook: Valuation Techniques from Today’s Top Practitioners, John Wiley & Sons, New York.

Henschke, S 2009, Towards a More Accurate Equity Valuation: An Empirical Analysis, Springer DE, New York.

Laughton, D, Guerrero, R, & Lessard, D 2008, Real Asset Valuation: A Back-to-Basics Approach. Journal of Applied Corporate Finance, vol. 20. No. 2, pp. 46-65, Web.

Penman, S 2006, Handling Valuation Methods. Journal of Applied Corporate Finance, vol. 18. no. 2, pp. 48-55, Web.

Poundland: Key Financials, Web.

Raice, S, Das, A, & Letzing, J. 2012. Facebook Prices IPO at Record Value. Web.

Street of Walls: Valuation Techniques Overview. 2013. Web.

Wood, Z. 2014. As Poundland IPO Approaches, Founder Says: I’m Very Proud, It’s My Baby. Web.