Introduction

Economists use the term “price elasticity of demand” (PED) when talking about how prices respond to the supply and demand of a product. A product is defined as “elastic” when it reacts to price changes, which technically means that there is a relationship between the price of the product and demand for it. If a significant price change does not affect their demand, it can be said that it is inelastic. With price elasticity, it is wise to measure the reaction of prices to changes in demand and supply of Software and services. Arbitrage price theory (APT) is a trading method based on asset returns prediction, using expected returns from a range of macroeconomic variables that capture systematic price and quantity changes (Terrizzi and Meyerhoefer 98). It was developed in 1976 by the economist Stephen Ross. Historical investment returns are generally considered relative to factors used to estimate their beta.

A market for a product that is very elastic would mean that it reacts to price changes in response to a significant shift in demand. Conversely, a market that experiences little or no quantitative difference regarding even significant price changes, is considered to be inelastic (Terrizzi and Meyerhoefer 100). Here, price fluctuations affect the demand side of the equation, bearing in mind that price elasticity can be contrasted with demand and price elasticity of supply.

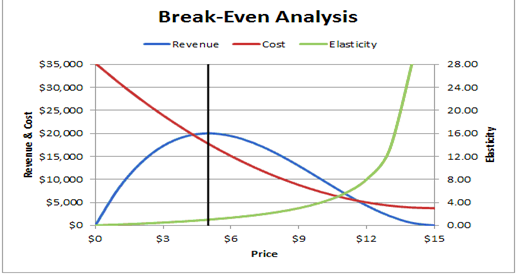

Whether the firm prefers fixed or tiered pricing or is frustrated by freemium, the pricing model discussed here will help the firm to find the optimal way to sell and grow the firm’s software business. Flat-rate prices are probably one of the easiest ways to sell a software solution. It offers all the benefits of a software licensing model that uses the firm’s existing cloud infrastructure, with the bonus that it is usually billed monthly, and is probably the cheapest and most cost-effective. A break-even point must be reached as indicated in the graph below;

For many Software companies, cost calculation (also known as cost-based pricing) serves as a starting point. Cost pricing is the targeted profit margin that increases the firm’s costs (say 20%) and determines the price of the firm’s product. It does not take into account the perceived value or other input factors that should influence pricing. For example, it can be a nudge – a thought process for a price discussion that starts somewhere with often limited information. Developing, marketing, and selling a product requires resources and, of course, money.

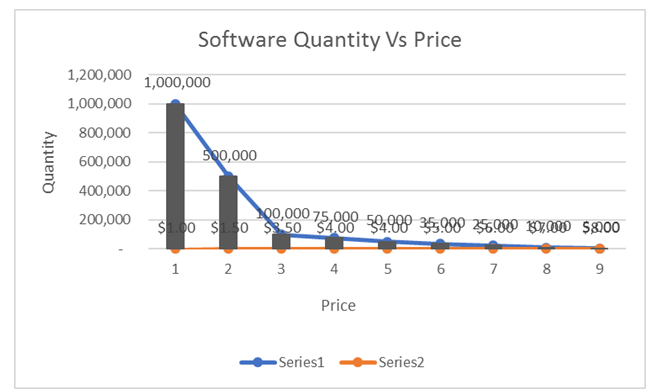

Value-based pricing is the only viable option for Software. Pricing is what people think about when they think about the pricing strategy. The reality is that the firms do not need to base the firm’s pricing on maximum revenue – difficult – firms need the right pricing strategies. Quantity is a measure used in economics to indicate the amount required for a Software or service when its price increases by nothing more than a change in price. Explicitly, it specifies a quantity that is needed in response to a 1% price change. Price elasticity is usually negative, although analysts tend to ignore this sign. Still, this can lead to ambiguity.

When prices rise, the quantity on offer usually increases, but consumers “willingness to buy the Software usually decreases. This is called price elasticity of supply and demand, calculated as a percentage change in the quantity required in response to a 1% increase in the cost of the Software. A product that does not have a readily available replacement is likely to be elastic, which means that it is more responsive to price changes than a product. As a result, if sales of the commodity increase by 20 percent, that the prices for the demand for it are 2.0.

Consumers will switch to more affordable options if they have a cheaper product that meets the needs of the recently passed Price Increase Act. The duration of price changes and the necessity of an article are some decisive factors that influence the price of elasticity. The general assumption is that customers buy more Software and services when the product is cheaper, and less when it is more expensive. Known as “price elasticity,” this concept is one of the most quantifiable economic equations that accurately illustrates how responsive customer demand is for a product or service. Most customers are price sensitive in most markets. Even if customers and interested parties do not say that the price is essential, it can still be a necessary factor in their decision-making process.

To understand the price elasticity and demand of the product, there is a need to take a closer look at the core concept of demand and help the firm understand it. Demand is fundamentally based on the quantity of a particular Software that consumers are willing and able to buy at any price along a continuum. This is called “price elasticity” (also known as PEDs) or “price elasticity.”The demand curve is a measure of how consumers react to price changes, suggesting that they are more responsive to price changes. This indicates that the fewer consumers react to rate changes, the higher the demand for the product.

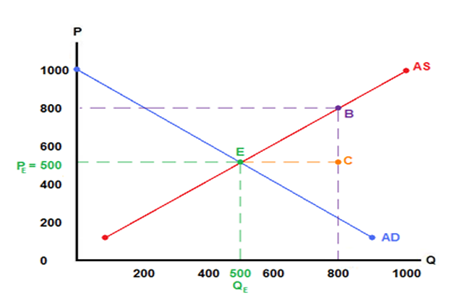

In general, equilibrium is defined as a market situation where prices are such that the quantity demanded by consumers is in the correct balance with the quantities that companies want to supply. The practical application of supply and demand analysis often focuses on the idea that different variables that change the equilibrium price and quantity represent shifts in the respective curves. These comparative static shifts trace the effects of the initial equilibrium to the new equilibrium. A typical and specific example is the graph of supply and demand shown on the right. This graph shows supply and demand as opposing curves, representing the resulting price and the quantity required to achieve the new equilibrium price of that quantity and its corresponding quantity. The intersection of these curves determines the equilibrium prices.

In a price-equilibrium price, the amount delivered does not correspond to the required quantities. If the market price is higher than the equilibrium price, then the quantity delivered is higher than the required amounts, resulting in a surplus. An equilibrium quantity shortens the amount. In a market, equilibrium prices are 60 units and equilibrium quantities 200 units, and the corresponding prices are the “equilibrium price” or market-clearing price.

An equilibrium value is when there is no shortage or surplus of Software on the market. It means that the quantity of Software the consumer wishes to buy is equal to or greater than the quantity supplied by the manufacturer. The market achieves a perfect state of equilibrium when prices stabilize at a level that suits all parties, regardless of the quantity of Software or services available to them. The movement refers to the changes in demand and supply curves that occur when a price change causes quantity changes. If the amount requested rises or decreases, prices must be adjusted to reach the equilibrium price, and vice versa.

The quantity required at a price corresponds to the shift in supply, reflecting the fact that the demand curve does not shift. The equilibrium quantity rises from Q1 to Q2 as consumers move from a higher price (associated with lower demand) to a new lower cost. If price and quantity move in opposite directions, for example, from S 2000 to S 1000, then the equilibrium price also increases, starting with the supply curve S2. However, when the consumer moves from the demand curve to the new low price or shifts the associated small volumes of demand downwards and vice versa, equilibrium volumes decrease, and equilibrium prices rise.

Conclusion

One function of the market is to find an equilibrium price that balances supply and demand for Software and services. The law of demand (also known as the “market-adjusted price”) states that a producer can sell what he wants to produce, and a consumer can buy what he wants. If the manufacturer insists on a higher price, the consumer will buy fewer units. Even if the firm has no competition, the firm is limited by the laws of demand. Market equilibrium is achieved by equating the price of a quantity (corresponding to the quantity requested or delivered) with the demand price or offer price.

Work Cited

Terrizzi, Sabrina, and Chad Meyerhoefer. “Estimates of the price elasticity of switching between branded and generic drugs.” Contemporary Economic Policy 38.1, 2020, pp. 94-108.