Industry Information and Rationale

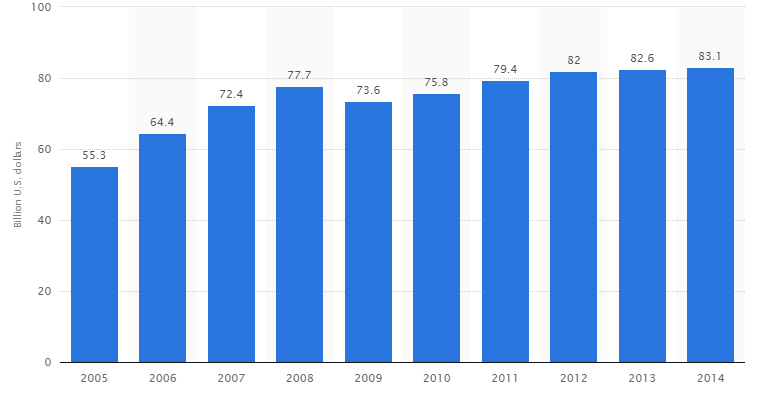

Locating an area to invest in presupposes making a very tough choice between rather promising options. Moreover, with the recent series of technological breakthroughs, which created a variety of opportunities for a range of industries to advance impressively, identifying the most promising area for investment has become especially hard. The industries such as the household and personal products sector, in their turn, have experienced a significant drop in popularity rates (See Fig. 1). Nevertheless, the specified industry is still worth taking into consideration, as it conceals a variety of implicit opportunities, which can be explored with the help of a slight update in technology.

Herein the rationale of the choice is; by putting a stake on a strong and influential organization, which will be able to reinvent the very concept of household and personal products by introducing a specific innovation into the market, one will retrieve impressive revenues. When it comes to identifying the company, which is most likely to change the landscape of the specified industry, corporate giants like Procter & Gamble, PLC, Colgate Palmolive, Avon, Coty, Mary Kay, etc. deserve to be mentioned first. Seeing that the former has been showing a consistently good net income over the past few years (see Fig. 2) and apparently tends to increase its revenues, it should be viewed as one of the first options to consider.

Indeed, the company under analysis deserves to be invested in as one of the organizations that literally define the direction, in which the industry is going to evolve. Although the company has several weaknesses, the fact that the organization’s actions and revenues are defined by the decisions of Wal-Mart should be brought up. Apart from the aforementioned issue, the company has also made a range of recalls recently, which has clearly affected its reputation in the target market. However, despite the above-mentioned dents in its performance, Procter & Gamble has not yielded to the pressure of other organizations competing in the industry so far. Most importantly, the company has been managing to find innovative and inspiring ways of attracting new customers. In the light of the above-mentioned evidence, investing in Procter & Gamble seems quite a legitimate step for an organization willing to enter the global market.

It is obvious, therefore, that P&G has spent an impressive amount of time and money on rebranding, as well as the reconsideration of its marketing strategy and the effects that it has on the organization’s global performance. More importantly, the company has been delivering a consistently good result as far as its sales are concerned, which makes the firm a perfect choice for investment.

Profile

Procter & Gamble was founded by William Procter and James Gamble (see Fig. 4) in 1837. The venture started out as a small company with rather humble goals and objectives, yet soon evolved into a competent and prosperous organization with a variety of products and services. The firm offers products such as personal care related items, as well as family care, hair care, fabric and home care, and personal grooming goods (Leadership brands, n. d.) as well as several services, including project investment: “Companies such as Procter & Gamble, Intel and LEGO have put an enormous amount of investment into building their own external networks, and they are beginning to see a return, but you shouldn’t underestimate the time and effort involved” (Hart, 2015, p. 6). The mission of the organization can be defined as attempting to become leaders in the target industry and satisfy the needs of all stakeholders involved by promoting innovation in the company, excelling in the household and personal products industry, and making connections between individual interests and those of the organization (Proctor & Gamble’s (PG) mission statement, 2015), whereas its vision concerns primarily being “recognized as the best consumer products and services company in the world” (Our purpose, values and principles, 2003, p. 6). While one may assume that the specified concepts are quite shallow for an organization of global size, the principles in question have been working for P&G quite well over a long time period. It is desirable, though, that the company could incorporate the principles of sustainability and corporate social responsibility (CSR) into its framework as well, as the above-mentioned concepts will help Procter & Gamble address the needs of all stakeholders involved, reduce the risks that the latter may be subjected to, and improve the quality of the staff’s performance significantly as the so-called multidimensional shareholder value: “Such multi-dimensional shareholder value is also driven by different global drivers of sustainability, such as cost and risk reduction via pollution prevention, innovation via the development of green technology, growth through actively seeking out to serve under-served markets” (Carbo & Dao, 2015, p. 70).

The promotion of CSR postulates as the foundation for organizational behavior, the processes of decision making and the improvement of the product quality, however, is only one of the steps towards enhancing P&G’s efficacy. Apart from the above-mentioned concept, the principle of global citizenship needs to be incorporated into the organization’s framework. Consequently, the number of customers is bound to increase along with sales and annual revenue. Thus, Procter & Gamble will be able to retain its position as the leading organization in the industry in question on a global scale. In fact, seeing that the company has received several warnings regarding the effects that its production process has on the environment and people’s health, the specified step is crucial in the organization’s evolution as a global corporation: “Procter & Gamble has bowed to pressure from environmentalists and revealed a new, extensive no-deforestation policy in the production of its products, including demanding fully traceable palm oil from suppliers” (Procter & Gamble bows to pressure on palm oil deforestation, 2014).

The company, therefore, should put a stronger emphasis on maintaining a positive and environmentally friendly approach towards waste management, as well as the generally strong production process. Needless to say, another environment-related issue may become a threat to the company’s popularity; thus, it is highly suggested that the principle of sustainability should be introduced into the company’s framework. To the credit of P&G’s managers, the promotion of environmental awareness has already been launched, yet it clearly needs a boost.

Ratio analysis

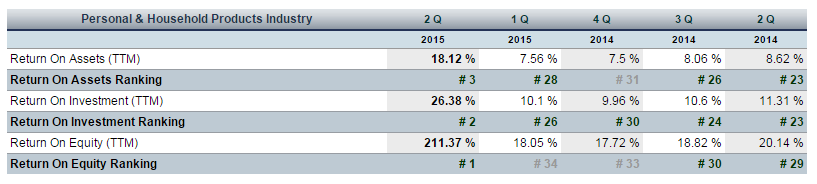

According to the information available, P&G’s current ROE equals 13.34% (Procter & Gamble Co., 2015), which means that the company has significant chances for becoming a leader in the target market, as well as try boost its R&D department so that new brands cold be produced. Though the above-mentioned percentage cannot be deemed as extraordinarily high, it still provides a solid basis for future evolution.

The debt-to-equity ratio, in its turn, shows that the company shows that P&G’s financial leverage can be deemed as quite progressive. The 48.14% ratio, which, according to the latest information on Procter & Gamble, the proportion of P&G’s equity to debt makes (Procter & Gamble Co., 2015), displays the firm’s readiness to carry out a variety of financial transactions and be quite flexible in the allocation of the specified resources. For instance, the current debt-to-equity ratio may mean that P&G can use some of its current capital on enhancing its R&D department and designing a new brand that will meet the demands of the target population.

Evaluating the liquidity of the company, one must mention that the firm has reached a 1.00% current ratio (Procter & Gamble Co., 2015). Consequently, it is reasonable to assume that P&G is fully capable of returning debts to its creditors and complying with the recent obligations. In other words, the current assets of the firm are equal to its current liabilities. Though it is desirable that the ratio under consideration could be increased a few notches, one still has to admit that investing in Procter & Gamble does not presuppose any major risks at present.

Another element of liquidity assessment, the quick ratio of P&G has reached 0.81 recently (Procter & Gamble Co., 2015). In other words, the organization is quite capable of managing its current liabilities in an appropriate way. The above-mentioned characteristics of the organization shown in a very graphic manner that P&G is not merely competitive in the global market, but also able to put a stronger emphasis on specific elements of its performance in order to attract even more customers, create and promote a new brand product and increase its sales significantly.

Finally, the net profit margin of Procter & Gamble needs to be touched upon. Allowing to evaluate the costs strategy adopted by an organization (Lockwood & Prombutr, 2015), the index in question helps figure out whether a firm is able to make efficient use of the revenues that it retrieves in the course of its operations (Lockwood & Prombutr, 2015). Judging by the results that P&G displays (11.57% according to the 2015 report (Procter & Gamble Co., 2015)), the organization has all chances to continue its development and attract even more customers.

The above-mentioned information allows one to suggest that the company’s financial health is on the uptick. It would be wrong to claim that the organization has recently experienced a breakthrough – quite on the contrary, the organization’s evolution has been rather steady. However, it is the steadiness and stability that should attract investors, who are willing to have impressive returns at the end of the fiscal year. Procter & Gamble’s assets look beyond promising, and dismissing the firm as an investment target would clearly be a mistake.

Stock Price Analysis

According to the information published by Forbes, Procter & Gamble’s sales made $61,680,000,000, in 2014, whereas the profits of the company reached $7,790,000,000 (The Forbes 2000, 2014). The specified rates show in a rather graphic manner that P&G is a trustworthy organization, which should be credited for its accomplishments in the realm of the global economy, where competition is getting increasingly high with every new entry. Seeing that the organization’s marketing assets estimate $136,520,000 (The Forbes 2000, 2014), one may assume that the firm will be able to become even more successful in the target market and remain at the helm of the household products area for another decade. A significant amount of the sum mentioned above can be used for boosting the company’s R&D department and, therefore, work on designing more environmentally friendly approaches to production processes. Moreover, a part of the company’s revenues can be utilized for enhancing communication and feedback analysis; specifically, the issue of communication between the company and the customers as well as between the managers and the staff.

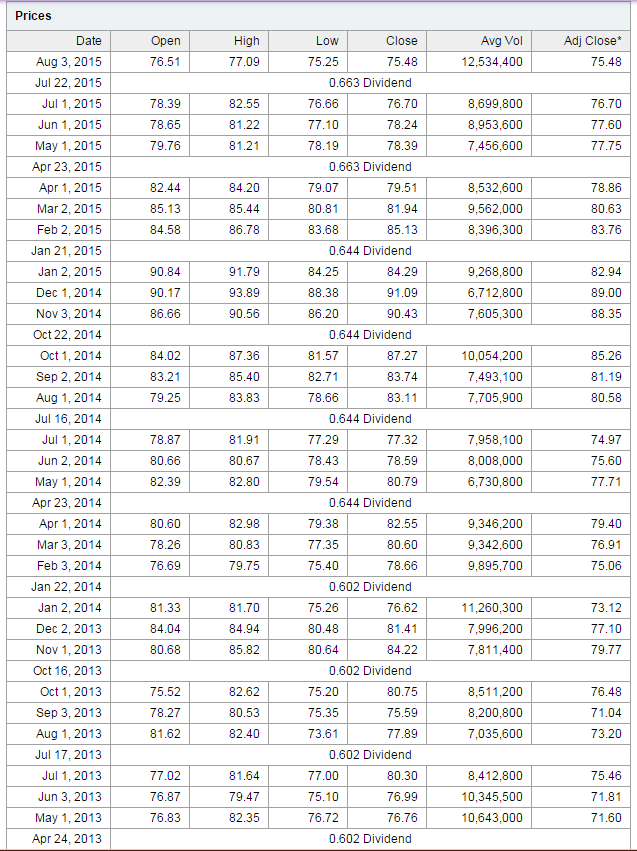

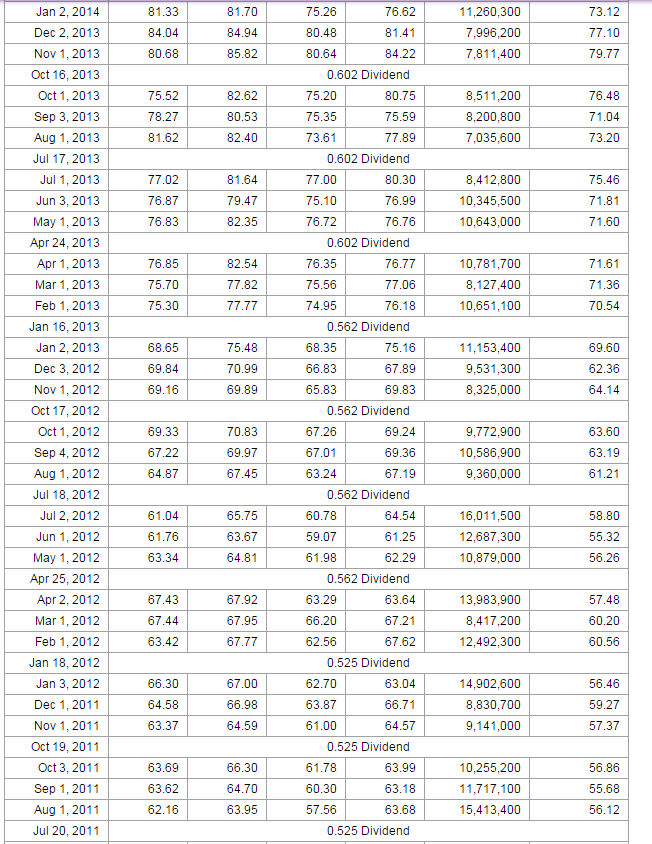

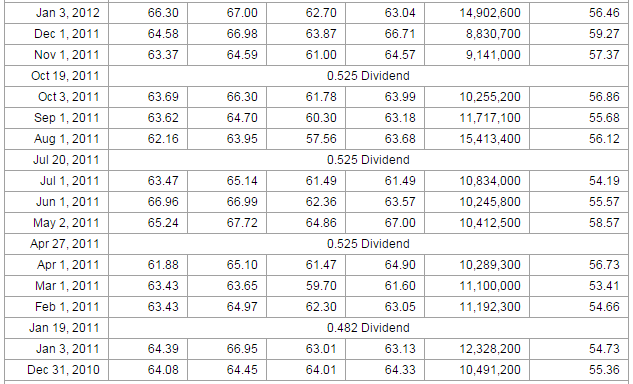

Moreover, a quick look at the change that has been occurring to the stock prices of the organization since 2011 will reveal that Procter and Gamble’s success is truly miraculous in the light of the crises that occurred in the specified time slot. It is quite remarkable that P&G survived even the infamous crisis of 2008, which made the chances of other companies in the global market rather slim and even affected the companies that used to be corporate giants. Indeed, as Appendix A shows, the organization did not see many changes in its monthly income.

One must admit, though, that the dividend rates, which the organization displayed in 2014, were quite low, especially when compared to the current ones. Making 0.482 in December 2010, the above-mentioned number provides a striking contrast to the 2015 rates, which have reached 0.663 so far (The Procter & Gamble Company (PG) – NYSE, 2015).

Apart from the above-mentioned dent in the overall strong performance of the organization, no major issues could be identified. It is worth noting that even the year that was marked as the era of a global financial and economic crisis all over the world, 2008 did not trigger any major disappointments for the organization. Instead, Procter & Gamble delivered its consistently positive outcome and attained an impressive dividend rate (see Appendix A). The phenomenon under analysis can be viewed as the effect of the company’s policy concerning the quality of the staff’s performance and the significance of customer satisfaction. Therefore, corporate ethics coupled with a strong leadership approach and an efficient set of corporate values define P&G’s income. Seeing that the firm has been quite consistent in the identification of the role of its values in the decision-making processes, one can rest assured that the stock prices of the company are only going to get higher.

Risk Level

Naturally, investing even in a company that is as relatively safe as Procter & Gamble, one needs to take every possible outcome into account when identifying the appropriate financial strategy. A complete loss of funds invested and zero returns are probably the worst-case scenario when viewing the investment into P&G as an option. However, judging by the above-mentioned assets, which the organization acquired in 2014, as well as the overall progress thereof, one will find out that the company is quite safe in terms of investments, as it has been developing rather steadily and has never faced major shifts in its evolution.

Moreover, the fact that the firm has recently experienced another environmentalism-related conflict shows that there is a slight possibility for media to exploit the aforementioned information as the means to discredit the company and make way for a new and more promising entry. Although the issue seems to have altered the company’s approach towards resource use and even helped promote sustainability, I may still recur, therefore, jeopardizing P&G’s success.

However, based on the performance of the organization, P&G is most likely to be a perfect option for investment. Based on the stock price of the company, as well as fluctuation in the specified index, it can be assumed that the company y has been doing quite well over the past few years. Since the increase in the company’s sales was consistent in 2012–2014, it can be assumed that the company is going to be just as efficient during the next decade. The overall prognosis for investment opportunities as far as the P&G performance is concerned is, therefore, rather favorable. With Procter & Gamble’s experience in mind, one may expect that investing in the company will result in significant returns once the organization releases another successful brand.

Recommendations

As it has been stressed above, the company under analysis seems to lack a strong environmental policy; additionally, on a more general level, the firm might have considered the stakeholder’s satisfaction principle as a possible addition to its current strategy. It is suggested that the investor should redesign the leadership approach, putting a stronger emphasis on its transformative aspect and, therefore, providing the staff with a set of ethical principles and a behavioral model to comply with. As a result, it is assumed that the number of activities leading to environmental contamination can be reduced, and alternative solutions to the current hazardous elements of the production process could be found.

Therefore, when investing in P&G, one should consider the risks related to the possible mismanagement of the organization and, therefore, a sudden drop in the company’s stock price. In order to prevent the specified situation from occurring, one should view the idea of investing into the development of the company’s departments such as R&D and customer relations; moreover, the idea of spending more funds on the promotion of efficient communication tools for the company staff to use could also be considered a necessary step towards the promotion of stakeholders’ satisfaction. Finally, a sufficient amount of funds should be used for updating the company’s equipment and processes so that they could be as environmentally friendly as possible. Thus, the principles of sustainability will be incorporated into Procter & Gamble’s framework.

Investing in an organization presupposes facing numerous risks, the threat of the company losing its revenues being the primary one. However, when choosing the industry that is viewed as comparatively safe in terms of possible financial crises as well as a company that has been in existence for years and earned a solid reputation, one is likely to succeed and retrieve big future benefits. Therefore, with an organization such as Procter & Gamble located in the field that is quite prone to economic crises, the investor will doubtlessly benefit greatly.

Reference List

Barak, E. (2015). 10 amazing facts about well-known brands. Web.

Hart, S. L. (2015). Innovation from the Inside Out. Sloan Management Review, 1(1), 77–86.

Leadership brands. (n. d.). Web.

Lockwood, L. & Prombutr, W. (2015). Sustainable growth and stock returns. Journal of Financial Research, 33(4), 519–538.

Our purpose, values and principles. (2003). Web.

Personal & household products industry. (2015). Web.

Procter & Gamble bows to pressure on palm oil deforestation. (2014). Web.

Procter & Gamble Co. (2015). Web.

Procter & Gamble’s net sales worldwide from 2005 to 2014 (in billion U.S. dollars). (2015). Web.

Procter & Gamble’s new logo, by the numbers [image]. (2013). Web.

Procter & Gamble’s (PG) mission statement. (2015). Web.

The Forbes 2000. (2014). Web.

The Procter & Gamble Company (PG) – NYSE. (2015). Web.

Appendix A: Procter & Gamble’s Dividends (2011–2015)