Statement of the problem/ Performance Objectives

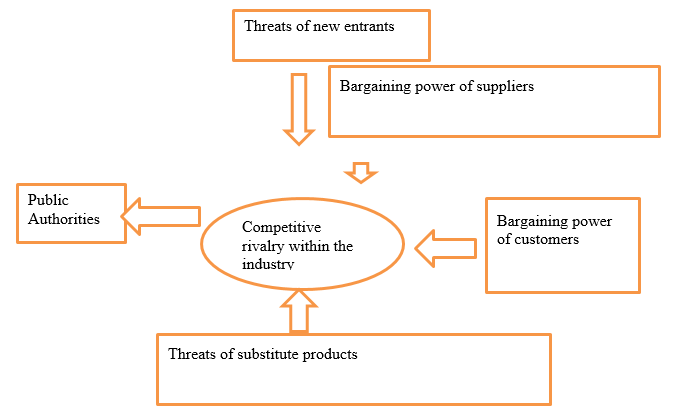

Quaker Oats’s Oatmeal Division had not been very successful by the year 1998 as was planned according to the annual review (Kotler 231). The reviving of the company had been put on the shoulders of the chief executive since the product life cycle was at a decline as it had been in the market for over 125 years (Kotler 231). Analyzing the market forces, Porter’s five forces of market analysis give a firm its competitive environment (Kotler 231). It ensures competitiveness the profitability of the product in the long term. The competitiveness of any company’s product in a given industry depends on the following forces.

Threats of new entrants, competitive rivalry within the company, Threats of substitute,-Bargaining power of customers, Bargaining power of suppliers

The competitive rivalry within the industry

The industry is very lucrative because of a few firms, which are involved in producing breakfast products (Kotler 234). There are several companies who are struggling to maintain their market share, and so far Quaker has managed to control 60% of the total market share. Other competitors include Kraft food with two prominent kinds of cereal in the market, Small Manufacturers and Private Label Manufacturers The major one is Malt-O-Meal Company, which controls about 10% of the total market share.

The threat of new entrants

Quaker bought most of the competitors in order to control the market but failed, (Nordhielm 7). Currently, there are no legal barriers to entering the industry the only way is through pricing strategy and quality of the products which so far they have managed to do so since consumers find it hard to switch their loyalty to other brands.

The threat of substitute products

There are several substitutes for the oats meal, which poses a threat to the Company. However, due to the high quality of its product and its characteristics, which are ready to eat, easy to prepare and remove, it is the number one customer choice. Some of the substitutes include bread products, meat products and other cereals.

The bargaining power of suppliers

Supplier plays a very crucial role in determining the market forces in terms of supply and demand.

The bargaining power of customers

The high bargaining power of the consumers dictates the prices and influences the company’s profitability (Kotler 234). It is possible through consumer federations and other organizations, which do not exist in the Quaker Division. The customer’s loyalty to the company product is high, and this is reflected in the purchase of the high price oats meal and satisfies a high percentage of market share.

The following is a SWOT analysis for Quaker Oats’s Oatmeal Division

Strengths

- According to the consumer survey, Quaker is one of the major top brands in terms of healthy and most nutritious food brands. From the survey result, in terms of healthiness, the oatmeal has 50% nationally. This makes it the number one consumer choice. Quaker has a wide business investment since it has diversified in other industries like chemical companies, toy manufacturing, etc. This makes Quaker one of the best companies in terms of risk diversification.

- Quaker commands 60% of the total market share.

- A larger capital base compared to other market competitors has enabled the company to acquire a larger market share compared to other market competitors. Product contains low-fat content and is thus preferred by elderly people and for health reasons.

- It commands consumer loyalty due to the quality of its product and continues to maintain market share lead. The company has a strategic consumer segment based on both age and lifestyle, unlike other competitors who have one line of consumer segment (Nordhielm 8). Quaker Oats has the largest market share

Weaknesses

- The company had a mature product that showed no signs of growth causing a decline in its product lifecycle; this particularly affected the company’s profit (Nordhielm 6).

- The company was inconsistent with its acquisition plan since the acquisitions were not strategically done making the company lose focus on its core business (Exhibit 4)

- The company had high prices compared to other competitors and most of the customers used to stock more during the promotion and offers and this negatively affected the demerits of the company $(3.48-2.24)= $1.24 in percentage it is (1.24/3.48) % = 35.63% high

- There is a low product improvement since it takes close to 30 years before the change happens. With changes in technology, consumer needs, wants and lifestyles, the company needs to keep pace with these changes in order to meet consumer wants through product development and innovation in 125 years period

- Decrease in sales $(430-465) = $35 decrease in sales between 1997-1998

- The company only segmented the market in terms of age and lifestyle. There is a need for the company to improve the market segment through income segmentation. The company lacked enough and qualified manpower to manage its entire business portfolio, which made the Quaker profits start declining with time

Opportunities

- With the number of resources, the company is able to hire more qualified personnel to manage its business portfolio since the business brand and name are able to attract qualified personnel. Working capital (1115-1009.1) =$105.9(millions) which can be used for other projects

- Quaker Company has its major market in the United States, yet the company can open other branches and stores in European countries. Most competitors of oatmeal target mainly high and middle class with high prices, hence the company is capable of increasing their market share by targeting low-income earners through pricing strategy. From the market segment calculation

- High-profit margin for re-investments

Gross profit margin = 2468.1/4842.5 = 0.50967, Net profit margin = Profit/sales

= 248.5/4842.5 =0.0513 showing opportunity for further investment

The market potential is still high with only $2374.4 goods sold from the total population of over 100 million customers showing that they have only served 40% of the total population.

The Product development from the industry trends shows that most companies have similar product widths and they are not creative enough to come up or develop new products. Quaker Company can capitalize on product development to come up with new products such as ready to eat oats meal, liquid Oats meal to cater to continuous changing consumer needs

Threats

Stiff competition in the industry is a major threat. Major competitors include Kellogg Company, General Mills, and Kraft Foods Company. Firms are well established and also command a substantial market share. Continuous consumer change in tastes and preferences is another major threat as the initial product is becoming obsolete. Rapid development and growth of product lifecycle is also a drawback as the company profits start declining due to a drop in sales (Nordhielm 10).

They control close to 40% of the total market. Price = higher 35% of disposable income in the market compared with other players, higher price elasticity of demand price elasticity is given by (Change in price/ change in demand) (7.5-8)/(3.48-2.24) = 0.403 showing low elasticity since customers take long before they can change to price changes.

Conclusion

The company is not performing well as per sales and market coverage of its products hence it has not achieved the company objective.

Works Cited

Nordhielm, Christie L. Marketing Management: The Big Picture. Australia: John Wiley & Sons Australia, Limited, 2006. Print.

Kotler, Philip. Marketing Management (14th Edition). Upper Saddle River: Pearson Education, 2009. Print.