Overview of the market

The packaged cookie market in the United States falls under the Cookie and Cracker manufacturing industry. In the United States alone the packaged cookie market was estimated at over $3.3 billion in 2008 (AIB international). Most if not all of the sales of these cookies were sold to consumers in grocery stores, convenience stores, drug stores, and mass merchandisers, however, the product has also been sold in vending machines. General consumers of packaged cookies are those who don’t need a cookie, but rather need fulfillment through a chocolate chip cookie. In this report, we hope to identify the major firms in this market, their positioning within the market, the overall segmentation of the packaged cookie market, and the strategy of the firms in reaching the different segmentation of the packaged cookie market.

Firms in the Marketplace

The packaged cookie market is fairly saturated. There are 56 manufactures of chocolate chip cookies that are distributed on a national or regional level in multiple distribution points. The product life cycle is at or near maturity and the prospect of new firms entering the market is low. In the packaged cookie industry the firm with the leading market share is Nabisco (Nabisco is owned by Kraft Foods Inc.) with its Chips Ahoy brand. Nabisco had sales of approximately $1,309,852,000 in the U.S. and unit sales of 441,833,000. Following Nabisco in market share is Keebler (Keebler is owned by Kellogg Company) and its Chip’s Deluxe brand cookies. In 2008, Keebler recorded sales of $392,136,100 and unit sales of 139,049,100. The third-largest cookies maker in the market is Pepperidge Farm (part of Campbell Soup Company) and their Soft Baked brand cookies. Pepperidge Farm recorded sales of $233,647,500 and unit sales of 72,670,210 in 2008. The other firms are McKee Food with a sale of $ 225,703,200 and unit sales of 150,168,600. These are the firms we will be examining in this report.

Segmentation of the Market

The cookie industry is an industry that is driven by impulse purchases by consumers. Therefore, companies must choose effective strategies to increase the appeal of their products and encourage purchase. In the packaged cookie market the general consumer is those who don’t need a cookie but rather need fulfillment through a chocolate chip cookie. It is also important to note that 80 percent of all packaged cookie purchases are made by women. However, the end-users of the product, the actual consumers, tend to be children who wield remarkable influence in the decision-making process of which brand of packaged cookie to buy. The market segmentation of the cookie industry follows a first and second-order segmentation wherein the former is based on the price sensitivity of the customer while the latter is based on measurable factors within the segment (Piercy and Morgan 124). In this case, the companies usually use the use/benefit segmentation and the demographic segmentation.

The target customer of the packaged cookie industry mainly consists of children aged 12 and below. Families that buy packaged cookies come from a variety of demographics, personalities, and value beliefs. The segmentation of the packaged cookie market is broad. The main segment or target segment for most packaged cookie manufacturers is children 12 years of age and under. This segment does not buy the cookies itself but rather buys through their parents. The main desires for this segment are having a sweet and tasty cookie that can be put into their lunches or available to them at home. Here the implicit segmentation is based on the taste preference of children and the parents’ wants are portability and the ability to satisfy their child’s wants.

The next segment is young adults aged 16-24. This segment tends not to have children, and to indulge in the product of their choice. For this segment, the price is moderately important, the main desire is to have a sweet snack that is readily available and easy to consume. The young adult, 16-24 segments, develop loyalty towards the product to which they were repeatedly consumed when they were younger. Here the segmentation is based on the price sensitivity of the customers.

The next consumer segment is adults aged 25-55. This segment may or may not have children and also might be buying multiple packaged cookie products, one for themselves and one for their children. The want of this segment differs from the previous two because first, this segment is far more health conscience so the nutrition of the product is important, second, this consumer is looking more at the quality of taste in the product and the products ability to be indulgent not just if the product is sweet and satisfies the want of a filling treat.

The final segment is adults 55 and over, this segment is similar to the adults 25-55 in that they are looking for more quality of taste in the product, but they do not see the product as an indulgence, but rather incorporate it into their meals or snacks as a dessert or pairing it with coffee. Adults 55 and over also are more interested in sharing the product with others and tend to consume the product in more social settings with other people. These segments make up the largest groups of the packaged cookie market and are the main groups the different firms try to cultivate with advertising and other forms of marketing.

Positioning of the firms within the Market

The positioning of the firms within the packaged cookie market varies. We will only examine the top three performers in the market, starting with Nabisco and the Chips Ahoy brand. Nabisco has positioned itself as the leader in sales and market share in the packaged cookie industry. Nabisco offers its product at nearly all of the possible outlets it can, and is very conscious of its price, trying to make sure it stays competitive with other name brands, especially Keebler and the Chips Deluxe brand. As the target segment is price sensitive, Nabisco follows a price segmentation measure. For middle-class American families who desire packaged cookies, Nabisco has positioned itself as moderately priced with a moderate to above moderate taste. Nabisco wants its products to rank higher in taste than all other moderately priced packaged cookies. Keebler and their Chips Deluxe brand share similar positioning in the packaged cookie market as the main competitor Nabisco. Keebler is also trying to position itself as the premium taste moderately priced packaged cookie option. On average Keebler is less expensive than Nabisco but looking at the market share Nabisco still outsells Keebler. This would position Keebler as less expensive and less desirable than Nabisco on a perceptual map. Pepperidge Farm varies from Nabisco and Keebler in that Pepperidge Farm is attempting to position itself as a premium alternative to the other two brands. Pepperidge Farm sells its cookies at a higher price point and also with a perceived addition in the quality of their product.

The marketing mix of the firms

All three of the firms studied in this report try to reach their customer base similarly. The products of the different firms are similar to each other. The product is prepackaged cookies normally sold in a container or packaging meant for the contents to be eaten at different times. When analyzing the distribution point or place of sale all three can be found easily in grocery stores, convenience stores, drug stores, and mass merchandisers. All three are normally found in the same places in those stores, usually an aisle designed to display snacks including cookies, crackers, nuts, and sweets. The products can also sometimes be found in smaller sizes while waiting in line at the checkout counter. Their placement in the checkout line is a great example of showing how cookies are often an impulse buy.

The price component of the marketing mix is different for all three companies. Price is a factor, which essentially determines the demand for the product (Bronnenberg and Vanhonacker 29). For Nabisco, the company is trying to keep their price above generic brands to reinforce the brand strength and quality of their product while trying to keep the price competitive with another name brand moderately priced cookies. Keebler is similar to Nabisco in its pricing strategy. Keebler is Nabisco’s main direct competition and neither want their price to be substantially higher than the other does. Pepperidge Farm however is trying to use price as a way of differentiating itself away from Nabisco and Keebler. Pepperidge Farm offers its product at a higher price point to distance itself from generic cookies but more importantly to emphasize that it has a higher quality of taste in its cookies. Of the three firms, Pepperidge Farm has the highest price point with Keebler and Nabisco having price points at or near each other.

The promotion of the three firms varies. Advertising is a very critical marketing tool because it promotes awareness for smaller companies and it serves as a means of reinforcement for larger companies. Currently, Chips Ahoy brand cookies are second in terms of the amount of money spent on advertising. Nabisco is spending $18.8 million in media ad spending, while their largest competitor Chips Deluxe spends only $3.3 million in media ad spending. Chips Ahoy spends almost 5.5 times more on advertising than Chips Deluxe. About the market share of the entire cookie industry, Chips Ahoy has a nine percent share and Chips Deluxe has a 3.4% share. Chip Ahoy is spending $2.08 million per market share percentage, while Chips Deluxe is only spending $1.03 million for every market share percent (Thompson).

Market Strategy used by the Firms

Nabisco’s Chips Ahoy mainly targets the children 12 and under segment. The price of Chips Ahoy is moderate making the price difference to other products negligible to the parents buying them. Nabisco is relying on the strong brand name of the Chips Ahoy line and its promotions aimed at children. The advertising Nabisco takes to promote their Chips Ahoy cookies centers on playing up how taste-driven their cookies are. The current Chips Ahoy tag line used in their advertising is “So Irresistibly Delicious, They Go Fast” this continues to play the angle of taste. At the point of sale, Nabisco puts their product in bright glossy packaging and normally has some kind of streaking or explosive action involved in the packaging meant to catch the eye of younger consumers. To help create brand loyalty Nabisco advertises games and videos available free on their website for children to play and make them more amiable to the brand. To make their Chips Ahoy products desirable to the parents of the consumers Nabisco offers their products in many different packaging to meet the needs of portability, and ease of use depending on the transportation needs of the parents. In the other segments mentioned in this report, Chips Ahoy is not actively targeting those segments. Nabisco is again relying on its strong brand name and hoping customer loyalty will aid for continued use in the other segments.

Keebler and the Chips Deluxe brand have taken a comparable tact in targeting primarily the segment of children age 12 and under. Keebler has chosen to make the price point moderate on their cookies, similar to their main competitor Nabisco but still high enough to main their brand distinction from generic cookies. Keebler is also trying to convey the idea that their cookies are superior in taste to their target segment. Keebler also has shiny brightly packaged products but has developed the marketing icon – Keebler Elf or Elves. Keebler’s marketing almost always uses the Keebler Elf in one way or another and uses the idea that the elves make the cookies better. This coincides with the advertising slogan Keebler uses with its cookies “Uncommonly Made Uncommonly Good”. Keebler also uses the marketing tool of having free online games for kids to play advertised on their packaging. The online website also uses the Elf because to enter the website you go through a door in the tree where the elves live. As a whole, the effect Keebler is trying to obtain is that their cookies are made with something special that other firms do not have.

Pepperidge Farm and their Soft Baked Cookies brand have taken a different tact to price than Nabisco and Keebler. Pepperidge Farm has priced their cookies higher than both the firms, to distinguish themselves as premium cookies makers. Pepperidge Farm is not targeting the largest segment but instead, targets adults within 25-55 years and adults 55 and over years of age. Pepperidge Farm wants their product to be an indulgence that people will eat as a way to reward themselves. In fact, on the Pepperidge Farm website, a quiz is available to find out what kind of cookie is for you and the possibilities for drink pairings with your cookies. This suggests that Pepperidge Farm is targeting a more refined consumer who wants a high-quality cookie and is willing to pay a premium price for it. As long Pepperidge Farm continues to keep its brand strong, it can continue to be a luxury good for those who want the high-end cookie.

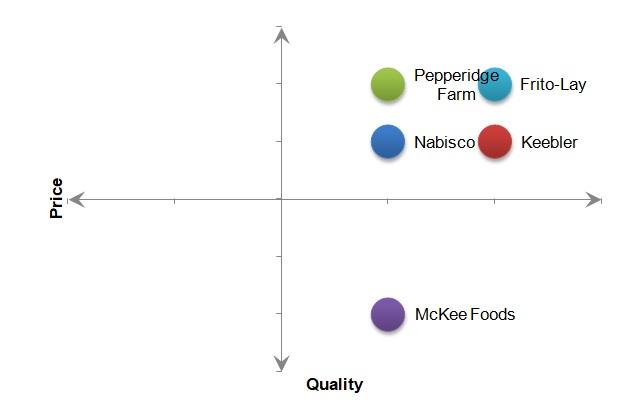

Perceptual Mapping

Perceptual mapping is used to develop a marketing strategy and positioning for a brand. This helps organizations identify a positioning strategy for the product. This is a graphic technique, which provides a visual display of the consumer perception regarding the products by different dimensions. Here the relative position of the brand or company is presented by its competitors. These maps are usually made using two dimensions. In our perceptual map, we use two dimensions – quality and price.

The main questions that will be dealt with in making the perceptual mapping are quality and price. This is because the main criteria of choosing a cookie in the US market are based on the “taste” preference of the cookie and the price of the product. The brands that we will consider are Nabisco’s Chips Ahoy, Keebler’s Chips Deluxe, Pepperidge Farm’s Soft Baked Cookies, McKee Foods’ Little Debbie, and Frito-Lay.

Works Cited

Bronnenberg, B.J. and W.R. Vanhonacker. “Limited choice sets, local price response and implied measures of price competition.” Journal of Marketing Research (1996): 1-36.

Piercy, Nigel F. and Neil A. Morgan. “Strategic and operational market segmentation: a managerial analysis.” Journal of Strategic Marketing 1(2) (1993): 123-140.