Introduction

A service is any activity or benefit that one party offers another that is essentially intangible and does not result in ownership of anything (Gilmore 2003, p. 181). It is evident that Barclays bank relies on service provision in their activities and use money as the product during intermediary with its customers. Its banking sector plays a key role in developing the living standards of people by providing solutions to their financial difficulties. It takes advantage of the characteristics of services to maximize profits, maintain price leadership, maximize growth, and ensure its survival in the market. The services differentiate from those of competitors in their quality of delivery (Gilmore 2003, p.181; Barclays PLC Annual Report 2011, p.27).

The aim of the bank is to lend money, accept deposits, and provide other payment services to the government, businesses, and individuals. Barclay’s bank establishment was first in 1690 in London, and its popularity grew fast. By 2010, it was top ten largest in the banking sector. Its headquarters are in London. It is a worldwide banking sector (Ackrill 2001, p.1).

Characteristics of services in the banking sector

Barclays bank provides financial assistance to households and businesses through a system of profitability, technology, customer orientation, and risk management. It acquires funds for its operations from interest gained from deposits and loans. The services conducted are according to corporate governance, management and international standards, and the objectives of the bank. The financial institution has branches to ensure diversity and availability of those services to large numbers of customers to maximize profits.

It has additional facilities and activities such as call centres, mobile banking, relationship management, ATMs, online banking, email communications and deposits, and professional consultation banking to ensure delivery of quality services to its customers and success in their activities (Zopounidis 2002, p.4). Characteristics of services in the banking sector include:

Characteristics of services (Facility operations in exercise and health fitness services 2011, P.1)

Intangibility

The satisfaction derived from the banking service cannot be touched, smelt, heard or tasted. The satisfaction felt is through the quality of the service. The consumers evaluate the bank by accessing the expected value versus the actual value in the product. The decision making of consumers to consider the bank relies mostly on its good reputation. Therefore, perception and motivation play a major role in attracting and maintaining more customers for their services. They influence the attitude of the consumer and the intention to purchase the services (Stevens 2005, p.174; Jenster 2005, p.164).

The bank, however, has rules and regulations to control the risks involved in the transactions. Documents such as a national identification card and bank documents are required during the transaction. Such documents include cheques, accounts, ATMs, banknotes, and bonds. The services accompany online banking, mobile banking, and use of professional consultants in the bank (Zopounidis 2002, p.5). The table shows the satisfaction analysis of customers.

Inseparability

The consumer and the service provider have to be present to carry out the transactions. However, technology has introduced the use of ATM, which only requires only the customer in the purchase of the service. This technique has helped its customers remain loyal due to the high quality and performance of the service. It provides easy and efficient accessibility of the bank accounts by allowing the customer to withdrawal money and checks the bank balances on savings or deposits (Jenster 2005, p.164).

Deposits and consultations are limited to the inseparable characteristics of the services. Nevertheless, some customers may choose to interact with the service provider at all the transactions without limitations. The bank focuses on the key elements of the exchange process, which leads to the satisfaction of the customer, the organization, and the society as well (Bettencourt 2010, p.165).

Perishability

The services provided cannot be stored as every successful transaction counts to the overall profit of the bank. Royal customers will keep on repurchasing the services. Research and continuous analysis of the proceedings of the business maintain high confidentiality and implementation of new strategies for the bank. Due to the high competition in the market, the company aims to improve its quality services to customers to differentiate the company from the others (Ackrill 2001, p.18; Jenster 2005, p.165).

Heterogeneity or Variability

The satisfaction derived from the process depends on the service provider. Banks hire competent and efficient employees to attract customers. The bank has responded to the changes in the banking sector whereby new strategies, techniques and skills constantly develop to ensure coordination between the parties who can influence the overall satisfaction of the ultimate consumer quality of service delivery. High levels of customer service depend heavily on the person interacting with the customers (Bettencourt 2010, p.178; Jenster 2005, p.164).

The role of employees is very critical; therefore, training and staff development and integration schemes are necessary to enhance knowledge and understanding of the overall marketing orientation within the organization. The bank strives to provide better services than those offered by its competitors to attract and maintain more customers. This ensures its survival in the competitive market (Bettencourt 2010, p.180).

Performance and Risk Management in the Barclays Bank

Improvement of Performance in the Barclays Bank

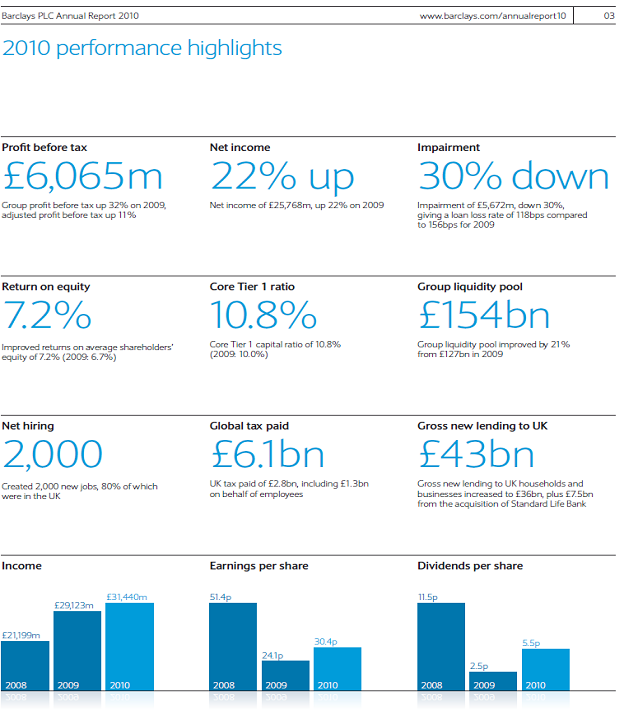

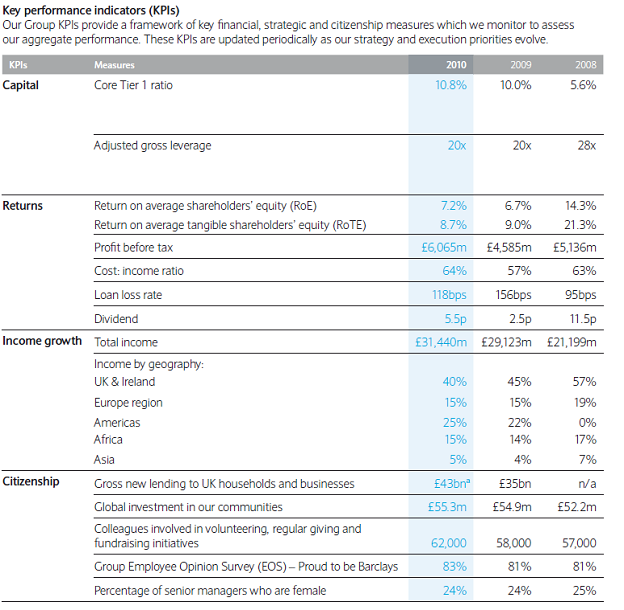

The table and graph below show the performance level and standards of Barclays between 2008 and 2010.

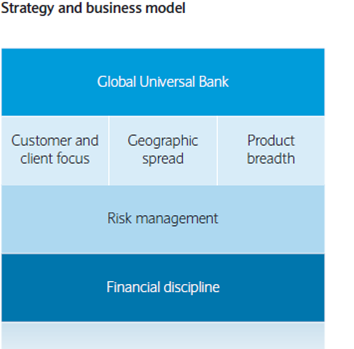

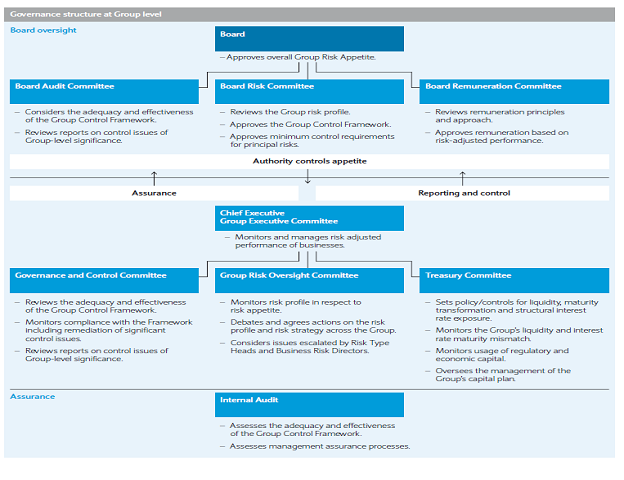

The diagram below shows how the bank manages the delivery of its services to its customers. Their goal is to maximize profits while maintaining the required expense.

The aim of managing the performance of the bank is to ensure high-quality financial systems, high returns on capital, and high levels of technology to meet the standards of the global economy. The diagram and table below show how the bank manages its performance.

The table shows that the bank is capable of balancing capital resources while managing its activities to maximize the satisfaction of its shareholders. The bank adjusts its advantage to ensure its survival in the market. The bank is able to balance its needs and that of its shareholders. It ensures that its expenses are less than the income to ensure successful operations of the business. The bank aims to help the individuals and non-financial institutions improve their financial stability through the offering of loans at affordable and suitable interest rates. The bank engages in successful hiring and recruiting procedures to retain the best and most talented employees. This shows their potential of commitment to improving the performance of its service delivery of its customers (Barclays PLC Annual Report 2011, p. 5).

Challenges

Improving Profits

The bank puts forward strategies aimed at maintaining stability in times of financial crisis in the future by maintaining high-quality services. This strategy helps to maximize profits throughout the service delivery to customers to make it easy to carry out its operations without affecting its customer’s interest and expectations. In case the bank fails to make profits, it collapses. It is a business and profits are the main aim of the business. Failure to make profits means that there is no business (Gilmore, 2003, p.142). The following graph and tables show the financial strength of Barclays.

Keeping Pace with the Changes in Technology

The company focuses on improving its technology to enhance the experience and satisfaction of its customers. For example, the company offers replacement credit cards within two to five days and offers mobile banking to all its willing customers. It aims at increasing the distribution of ATMs and bank branches to ensure customers access their services at ease. This action attracts more consumers to its services and maintains the existing ones. It is upon the bank to ensure competence with its competitors to maintain its survival in the market. The bank has to provide what the competitors offer despite the expenses incurred and if possible higher-quality technology than the competitors (Batiz-Lazo 2010, p.48; Wu 2010, p. 63).

Sharpening Skills

The bank faces difficulties in determining the best employees with the capability of committing their full potential to the success of the company. The bank incurs costs for the payment of its employees. It is very important that the bank make enough profits to cover for the expenses (Gilmore 2003, p. 30).

Management of Risks

Risk control avoids losses on investors. The bank analyses the possible risks in the management profile to calculate the outcome of the business, especially due to changes in the economic conditions (Hopkin 2010, p.64).

The graph shows groups risk appetitive, which is responsible for controlling the level of risk the bank, is willing to undertake to fulfil its objectives. It includes balancing the operational, market, and credit risks. The management reduces strain by managing the risk profile (Hopkin 2010, p.63).

The table below analysis the risks caused by currency fluctuations

Providing Better Customer Orientation than the Competitors

The bank has to put more effort to ensure stability in times of financial crisis in the future by maintaining high-quality services to maintain a substantial number of potential customers. The bank has to maximize its profits. Wrong analysis and projection of the bank future operations may lead to a downfall of the company. The bank has to fulfil its promises to its customers to satisfy their expectations and needs. Failure to do so may lead to its customers switching to competitors (Bettencourt 2010, p. 172).

Corporate governance

Maintaining the Level of International Standards

The bank aims at retaining the ability to control the operations of the global investment. Barclays has entered into a framework of global governance and has established the standards required to fit in the global economy. Nevertheless, it faces challenges of the changing economic conditions worldwide, and it difficult for them to balance expenses and profits that maintain its stability (Zopounidis 2002, p.4).

Recovery Procedures

Barclays focuses on managing the performance and compensation of its employees in a way that motivates them to work at their full potential. The bank provides training and development programs to improve the performance of their employees. The bank is established worldwide, giving its employees an opportunity to improve their experience. The bank ensures good working conditions, especially health, safety, and welfare of its employees. These strategies enable the employees to associate well with their customers to maintain and attract customers to the services of the bank. They believe that their employees are the most important assets as they enable maximization of profits and survival in the market. The bank also focuses on community development to create potential customers for their business (Batiz-Lazo 2010, p.49).

The bank ensures it pays taxes to the government in which they operate to safeguard their image and name in the country, globally, and in the governments.

The bank tries its best to safeguard the interest of its customers and shareholders to make it easy for the bank to penetrate the market and to acquire support from society. This enables the bank to reach its goal and objective of profit maximization (Stevens 2005, p.188).

The table below shows the review of the income statement. The bank is able to pay all its taxes and control its expenses. It tries to improve its performance despite the poor economic conditions across the globe.

The table below shows the net worth of the company.

The table below shows the ability of the bank to retain the high performance of its capital in the investment and equities banking.

Conclusion

This analysis is very important in marketing to help the marketer design the best for its customers. The bank is responsible for improving the economic status of people in society by creating jobs and facilitating the growth of businesses by offering loans, investment opportunities, and savings protection. Therefore, the marketer balances the needs of the bank with those of their customers and stakeholders despite the economic conditions. The bank is facing challenges, but it is upon the management to improve the quality of its services to ensure profit maximization for the survival of the bank. The collapse of one bank does not affect the other, so it is upon the society to promote the best banks to benefit them.

List of References

Ackrill, M., 2001. Barclays: The business of banking, 1690-1996, Cambridge University Press, New York.

Barclays PLC Annual Report, 2011. Delivering on our promises, Barclays Bank PLC New York.

Batiz-Lazo, B., 2010. Technological innovation in retail finance: international historical perspectives, Taylor and Francis, New York.

Bettencourt, L., 2010. Service innovation: how to go from customer needs to breakthrough services, McGraw-Hill Professional, New York.

Facility operations in exercise and health fitness services, 2011. Services, National Council for Exercise and Fitness, Web.

Gilmore, A., 2003. Services marketing and management, SAGE, Culver City.

Hopkin, P., 2010. Fundamentals of risk management: understanding, evaluating and implementing effective risk management, Kogan Page Publishers, New York.

Jenster, P., 2005. Managing business marketing & sales: an international perspective, Copenhagen Business Press DK, New York.

Stevens, R., 2005. Marketing planning guide, Routledge, New York.

Wu, Y., 2010. High performance networking, computing, communication systems, and mathematical foundations: international conferences, ICHCC 2009-ICTMF 2009, Sanya, Hainan Island, China, December 13-14, 2009. Proceedings, Springer, London.

Zopounidis, C., 2002. New trends in banking management, Springer, London.