Introduction

An organization may deem it right to collaborate with another firm to enable it to achieve a certain objective. At initial arrangements, the agreement between such organizations may be just temporal arrangements, ranging from efforts to initiate a formal entity to a loose arrangement with both firms owning separate identities. Such collaborative arrangements may continue to grow over time as each member of the initiative begins to realize the benefits that such arrangements may bring in the future.

One of the key reasons why an organization would want to establish a joint venture is the desire to increase its international markets operations. Any organization that has no critical market intelligence at its disposal to help it manage its international market segments has a greater opportunity to succeed when it decides to collaborate with an established competitor with an overseas experience (Henry 2008, p.235). Studies have shown that at least 50% of all joint ventures or mergers fail in making their synergies work (Hitt & Ireland 2008).

The reason for these big number failures is normally attributed to the difficulty in integrating the management cultural differences. Creating and managing a strong organizational culture is usually the main basis of measuring success in a post-merger situation.

This paper presents a critical analysis of the Sony Ericson Joint Venture that kicked off in 2001. The merger between Sony, a Japanese electronic company, and Ericsson, a Swedish mobile phone company allowed them to exploit their respective core competencies and benefit from one another’s market segment. Joint ventures are used by companies that intend to develop new products and enter new markets. If the firm manages to enter the new market, it is likely to accelerate its activities with the new partner due to the availability of complementary technical skills. However, if a joint venture is not well managed, several failures can be registered (Hewitt 2005). One of the major areas that have presented the biggest challenge is finding the code between the two firms’ corporate culture to enhance strategic management.

Brief profile of Sony Corp. and Ericsson

Sony is a leading Japanese company that specializes in the manufacture of electronic devices in the category of audio and video gadgets. They also manufacture the game and other communications and information technology gadgets that are in use within the electronic market segment around the world. Their wide product range in electronics, games, fiancé in addition to audio and visual game products makes Sony the most recognized brand in the world in terms of its products category.

Sony was founded in 1945 by two Japanese, Masaru and Akio, who joined hands together to set up a shop where they would repair radios (Henry 2008). Set up in one of the war-damaged buildings after the end of WWII, the company was initially called Tokyo Telecommunications Engineering Corporation and later pioneered the manufacturing of tape-recorder in Japan (Henry 2008).

The name Sony was adopted in 1955 when it produced the first Japanese transistor radio. To date, Sony has increased its product range from a mere tape recorder to almost all entertainment gadgets, cameras for pictures, computer game gadgets, and lately online business. Currently, the company has positioned itself to be the leading manufacturer of broadband entertainment gadgets in the world. During the Financial Year ended 31.3.2001, when they began a merger with Ericsson, Sony recorded almost US$ 60 billion (Henry 2008, p.54). This kind of performance was attributed to its strategic market penetration that many companies in the same business had not managed to achieve for many years.

Ericsson is a Swedish mobile and internet broadband manufacturer that has made a mark in its mobile communication technology (Henry 2008). The company is known for its superiority in mobile technology and is billed to become one of the biggest internet broadband market players. Its wide market penetration is reflected in its 140 countries of operation around the globe. With its present initiatives, it is expected to create one of the most competitive communication gadgets around the global markets.

Sony’s corporate venturing activities

Sony/Tektronix Corporate Venture

After its wide establishment in the early 1960s, Sony resorted to diversify into new areas of their business initiatives, where it collaborated with overseas firms to develop new products. Their first-ever operation that faced diversification was its electronic Sony products. Sony’s first joint venture was with Tektronix, Inc., a U.S.-based company that was highly popular for its instruments and measuring types of equipment manufacturing (David 2007).

The two companies joined hands to form Sony/Tektronix Corporation, which had its operations in Japan. This was an equally shared venture with each party accounting for 50% of the capital invested (David 2007).

This was one of its kind as, by this particular time, no one foreign company could own more than 49% of a Japanese company. However, due to Tektronix’s well-known brand worldwide and its 80% of market share in oscilloscopes manufacturing, Sony had seen a possibility of using its partner’s international brand popularity. Sony needed more technological ability to help them further research new upcoming technologies, hence the need for measuring pieces of equipment that would do the measuring precisely. It is even rumored that the “semiconductor tunneling effect” discovered by Esaki was successful due to Tektronix’s oscilloscope technology (David 2007).

On the other hand, Tektronix wanted a way in which it could reach the global market segments, notably Europe and Japan that were highly promising. The post-war period saw Japan recover from war ravages from the 1950s onwards. The problem Tektronix faced was the fact that Japan’s market was highly protected around this time of the century. The then Tektronix CEO Howard Vollum noticed that the only way to navigate these rich and promising markets was through the formation of joint ventures (David 2007). That is the sort of partner in Sony to gain entry into the Japanese market.

Interestingly, the two companies were founded during the same period, 1946. More importantly, they had developed similar corporate culture as well, which eventually proved very critical in managing the venture. That is, both their number one priority was on engineering and technology expertise to help them come up with new technological innovations. Despite the two companies possessing different core competencies, they found it easy to mutually work together and build their reputation in various areas of operations.

Within 10 years, the oscilloscope was the leader in the industry and sold in numerous countries overseas. Although the initial venture agreement was mainly to focus on production and marketing activities for the products of the joint venture, the two companies found themselves engaged in the additional activity, Research, and development. The joint venture established a wide array of products and ventured into new fields such as graphic material displays, broadcasting, and optical devices and was thus in a position to penetrate a wide market segment both domestically and internationally.

Other Prominent Venture: Michael Jackson and Sony Corp.

In November 1995, the late pop megastar Michael Jackson formed a joint venture with Sony. The venture that was reported to be at the tune of about $600 million involved Jackson’s music catalog being published by Sony Corp.’s music publishing division (Henry 2008). This kind of venture was meant to help Sony establish copyright over Michael Jackson’s music catalog, thus merging it with its catalog increase ownership of varied music, and more importantly aggressively build a publishing portfolio full of popular songs.

Sony Ericsson Corporate Venture

In 2001, Sony announced that they had agreed on a joint venture with Ericsson. The main goal of the venture was for the two to gain entry into each other’s market segments since their products complement each other. Although Sony had made a mark in the electronic sector, their mobile phone business entity was struggling. So their desire to diversify their products and venture more into the mobile phone market was the driving force towards this venture. Ericsson by this time was struggling with their mobile phone products, continuously making losses despite its known brand and wide market coverage.

The two parties, therefore, agreed to make use of Sony’s consumer electronic expertise and Ericsson’s communication technology leadership to make mobile phones together. The agreement put an end to each company manufacturing their mobile phones. Notably, Ericsson’s inability to keep up with competitors in the mobile industry made it difficult for them to make any significant profit. It, therefore, follows that the joint venture allowed the two companies to “establish economy of scale, global customer reach purchasing power or capital investment resource necessary to meet the strength of international competition” (Hewitt 2005, p.7).

However, there has been concern over the venture due to falling profitability in the last 5 years. Sony CEO had in 2008 expressed his concern over the corporate structure and culture of the joint venture. Although at initial stages the company’s performance was good with its branded mobile phones, the increased number of music phones from other competitors has rendered this product less effective in terms of market performance.

Some of the strongest brands are iPhone and other more popular low-end market phones manufactured by other companies, mainly targeting developing markets. In markets like South Korea, the company had its profit fell by over 40% and sales falling by almost 10% in 2008 (Henry 2008). Their market share has also dropped by about 1.5% even though the handset market grew by 10% in that same year (Henry 2008). The situation has seen many including the CEO fearing massive job loss (nearly 2000 jobs at risk)

Analysis

One of the main contributions of a corporate venture is to get rid of business ventures that are declining and changing the corporations into core business (Covin & Miles 2007). From this perspective, it is apparent that Sony Ericsson has stuck to manufacturing mobile phones instead of diverting their attention to the communication business. One company that has excelled in this line is Nokia. They had to change their core business from manufacturing to telecommunication, hence establishing for themselves a market niche in the telecommunication industry and not generic manufacturing.

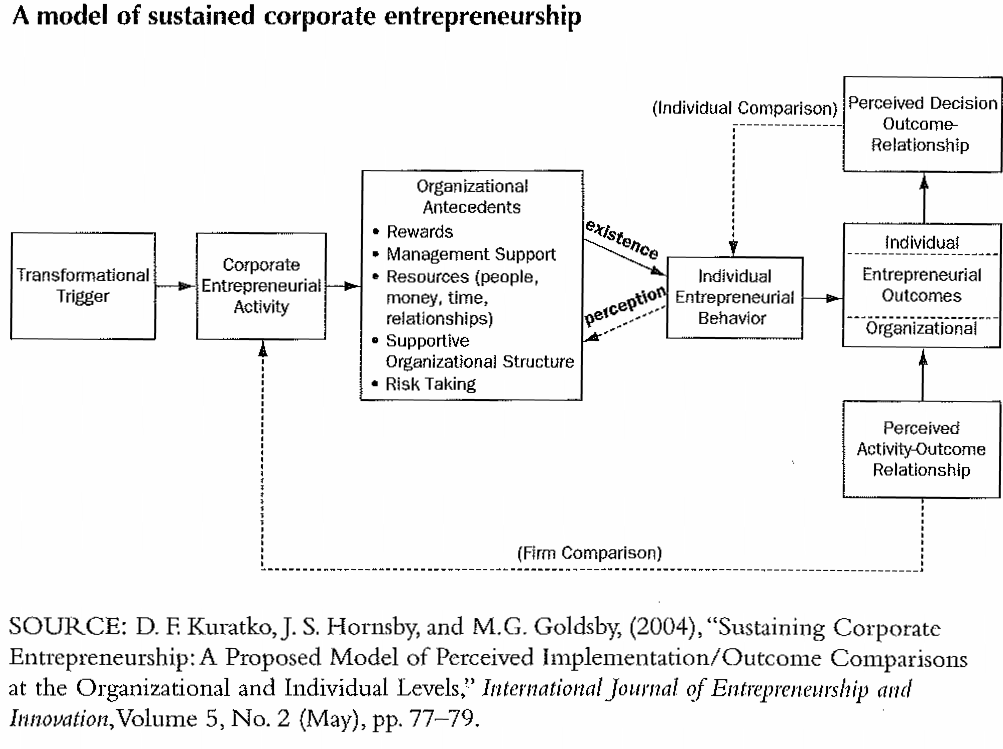

According to a sustaining framework, individual members of the joint venture should be actively involved in pursuing innovative activities (Morris et al., 2008). This model is referred to as a model of sustained corporate entrepreneurship. This kind of framework can only be achieved through strategic management initiatives that generate innovative ideas. Strategic management can be defined as either an art or science of business management strategy that helps to formulates, implement, and evaluate some specific decisions that prove very critical in reaching the organizational objectives (David, 2007).

From this definition, it may be stated that strategic management is a type of management inclined towards integrating management process, marketing, finance, productions, research and development, and technology to reach a corporation’s maximum success potential (David, 2007). That is, that once a strategic plan is put in place, it takes strategic management initiative to carry out the plan and proceed with the process of implementation and evaluation. In other words, strategic management is to exploit as well as create new and different opportunities for tomorrow’s plans. This kind of management is what can drive corporate entrepreneurship to the next level as David (2007) argues.

Strategic Management for Joint Venture: Stages

Strategic Formulation

The strategy formulation stage involves developing a vision and mission, establishing the external opportunities and threats of the firm, establishing internal strength and weaknesses of a joint venture, long term objective establishment, identifying and generating alternative strategies, and finally choosing certain strategies to follow up (Hitt & Ireland, 2008). It is the process of formulation that guides the CEO and his line managers on certain principles of business reorganizations. There seems to be an insufficient leadership model for Sony Ericsson. Unlike Sony/Tektronix that incorporated R&D even though it was not in the initial plan, Sony Ericsson seems to have stuck with their old elements of agreements.

Some of the formulation processes are linked to the ability of the manager to decide on whether to pursue new business opportunities to enter, what business initiatives to drop, how to allocate the available resources to different initiatives, and guides the decision on whether to expand certain operations or just diversify (Johnson & Scholes, 2003; Hitt & Ireland 2008).

Strategy Implementation

In this stage, the managers are expected to establish annual objectives, identify and implement policies, be the motivational factor to employees, and allocate resources such that the strategies that were formulated can be carried out (Drejer, 2000). While Sony Ericsson claims a global presence, the company has stuck with its one central factory. Such initiatives are not feasible as each regional market has its unique demands hence there is no a universally accepted product to fit all markets. Furthermore, the cultural and economic variance of the regions will dictate the uptake of a newly developed product.

Strategy Evaluation

Sony Ericsson’s strategy has proved unworkable with the changing market environment. The stiff competition from other companies that have designed phones for each niche market has overshadowed their rigid phone products. The primary method to establish whether a particular strategy is not working is through evaluation (Porter, 1980). Evaluation helps the corporation establish whether a particular strategy is successful or not. Since external and internal factors continuously affect strategic management, strategy evaluation would help in the establishment of what areas to change or to emphasize (Drejer 2000).

The basic activities involved in evaluation are: reviewing of external as well as internal factors is combined to form the base for the present strategies, performance measurements, and taking corrective actions (Johnson & Scholes, 2003). Drejer, (2000, p.206) observes that strategy evaluation is necessary because today’s success is not a guarantee of tomorrow’s success; as success will always create unique problems with it, which may be as a result of complacency. This may clearly define Sony Ericsson’s tragedy.

Recommendations

For the success of any corporate venture, there is a need to develop a strategy implementation process. Developing a culture that is supportive of the set strategy will help create an effective structure for the organization, refocusing the marketing efforts, budget preparation and development and usage of information systems, and ensuring that the organization’s performance is connected to the management efforts.

In a corporate venture, it must be noted that the motivating factor is that all the organizations involved have limited resources, hence wants away in which they can share their limited resources to come up with a significant shot in the market. It, therefore, means that managers of each organization would need to acknowledge their strengths and weaknesses. By doing this, they are also able to understand the partner’s strengths and weaknesses as well to concentrate on their core strengths, and at the same time try to mitigate the weaknesses together.

According to Warnaby & Woodruffe (1995), strategies determine long-term competitive advantages over time. Irrespective of the economic situation, strategic decisions have multidimensional consequences and long-term effects on the corporation’s future (Warnaby & Woodruffe, 1995). It is therefore important for Sony Ericsson to review their initial strategic agreement and develop a new marketing strategy for their new mobile phone products.

In other words, strategic management initiatives should be taken into consideration to help develop strategic management rather than manufacturing only. This may be supported by adequate R& D initiatives. To sustain their initial profitability, I recommend a model of sustained corporate entrepreneurship shown in the diagram below.

Conclusions

A Corporate venture needs more than a generic approach to manufacturing. Strategy management, which usually involves marketing initiatives, needs to be the core of corporate ventures. It requires strong interpersonal skills among the team spearheading the venture’s activities. Such questions as; what must be done for successful implementation of part of this plan? How can it be done best? In this regard, the challenge involved is to encourage managers and employees to continuously and consistently work towards the set strategic goal.

Reference List

Covin, J., & Miles, P. (2007) Strategic Use of Corporate Venturing. European Journal of Innovation Management, 1 (3): 30-49.

David, F. (2007) Strategic Management: Concepts and Cases. Oxford. Oxford University Press.

Drejer, A. (2000) Organisational learning and competence development, The Learning Organization. An International Journal of Management, Vol. 7 Issue 4, pp. 206-220.

Henry, A. (2008) Understanding Strategic Management. London, Sage Publishers.

Hewitt, I. (2005) Joint Venture. London, Sweet & Maxwell Publishers.

Hitt, M., & Ireland, D. (2008) Strategic Management: Competitiveness and Globalization, Concepts, and Cases. London. London School of Economics.

Johnson, G., & Scholes, K. (2003) Exploring Corporate Strategy, 6th ed., Prentice Hill: London.

Morris, M. H., Kuratko, D. F.,& Covin, J. G. (2008) Corporate Entrepreneurship and Innovation, 2nd edition. South-Western. CENGAGE Learning.

Porter, M. (1980), “How Competitive Forces Shape Strategy”, The McKinsey Quarterly, pp.34-50.

Warnaby, G. & Woodruffe, H. (1995) “Cost Effective Differentiation: an Application of Strategic Concepts to Retailing”. International Review of Retail, Distribution & Consumer Research, Vol. 5 Issue 3, pp. 253-270.