Introduction

Sourcing process is one of the most important management activities that a firm has to undertake in an appropriate manner to achieve the desired success. According to Lockstrom, the use of pre-qualification criteria or processes for supplier appraisal in the sourcing process has become very essential for firms as a way of ensuring that the selected company has the capacity to deliver the desired value (45). That is why it is important to collect sources of information on individual suppliers such as the financial reports, credit ratings, or any other relevant information that may help in understanding the financial position of a firm.

The primary objective of the thorough assessment process is to ensure that the firm that will be finally awarded the contract will not disappoint in terms of delivering the needed items in the right quality and quantity, and at the right time. As Coghlan says, firms are currently under pressure to deliver the best value to their customers at the right time and in the right place so as to manage the stiff market competition (356). However, this can only be possible if the suppliers can deliver the desired products at the right time and in the right qualities and quantities. In this section, the researcher will use the financial information provided to evaluate the finances of the organisation, noting its strengths, weaknesses, and ability to deliver the expected results.

Discussion

The company whose financial information has been provided needs to be critically evaluated to determine if it can be considered an appropriate supplier. According to Hugos, for a long time, many firms did not bother to investigate the financials of their suppliers before awarding them tender to deliver various products (81). The pre-qualification criteria at that time were primarily based on the attractiveness of the bids of the supplies and the promise they make about their ability to deliver the items needed by their clients.

However, it became apparent that there was a need to conduct a thorough pre-qualification assessment to determine the actual capacity of the suppliers to deliver the value expected by their clients. Financial assessment became one of the most important assessment tools used in determining the financial capacity of a firm to deliver value to its clients. In this assessment, the researcher will conduct a comprehensive assessment of finances of this firm, focusing on the financial ratios to determine the soundness of its finances in determining the firm’s capacity to deliver the desired value. The table below shows four different types of ratios calculated based on the data provided.

Table 1: Financial Ratios.

Liquidity Rations

According to Lockstrom, liquidity ratios are used to determine a firm’s ability to meet all its short-term financial obligations, especially the short-term debts (121). During the pre-qualification assessment of the potential suppliers, it is very important to determine the liquidity ratios of the suppliers to determine their financial position in the market. The quick ratio of this firm shows that it has the capacity to pay off its short-term debts given that the value is greater than one. That may not be a major issue during this assessment as long as it can recover the finances and deliver products which are needed by the client.

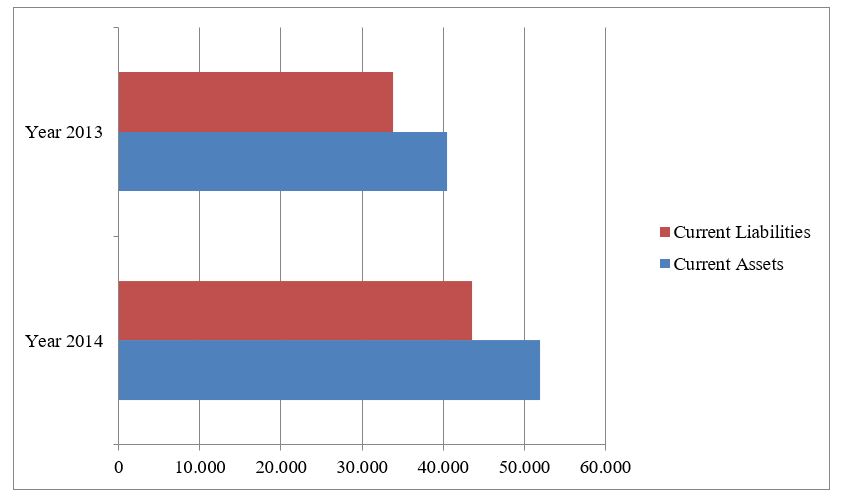

The current ratio, which is the comparison of the firm’s current assets against its current liabilities, is greater than 1, a sign that the firm’s dependence on short term debts is relatively low. However, the figures in the table above shows that in 2014, the firm’s reliance on short-term debts increased compared with 3013. The current ratio for the two years is summarised in the chart below.

Asset turnover ratios

Asset turnover ratio helps in determining the company’s revenues generated relative to its asset value. As Coghlan puts it, the ratio helps in measuring the ability of a company to use the assets to generate revenue (358). During the pre-qualification assessment, this ratio may be used in various respects, including determining the fairness of the firm’s pricing strategy and its ability to continue delivering the needed products to its clients. In the table above, the asset turnover ratio in 2013 was 3.41 while in 2014 it was 3.11. Although the ratio has slightly dropped during the financial year, it is still attractive enough, showing that the firm is still capable of delivering the promised value. This can be presented diagrammatically as shown below.

Financial leverage ratios

Financial leverage ratios, according to Sollish and Semanik, help in determining the financing strategies that a firm uses to fund its business activities (91). When assessing the suppliers, one of the most critical areas of analysis that must be considered is how a firm funds its activities. A firm that heavily relies on borrowing to fund its activities lacks independence because its ability to deliver the needed products will largely depend on whether or not it will have access to credit. Such firms may need to be avoided if possible.

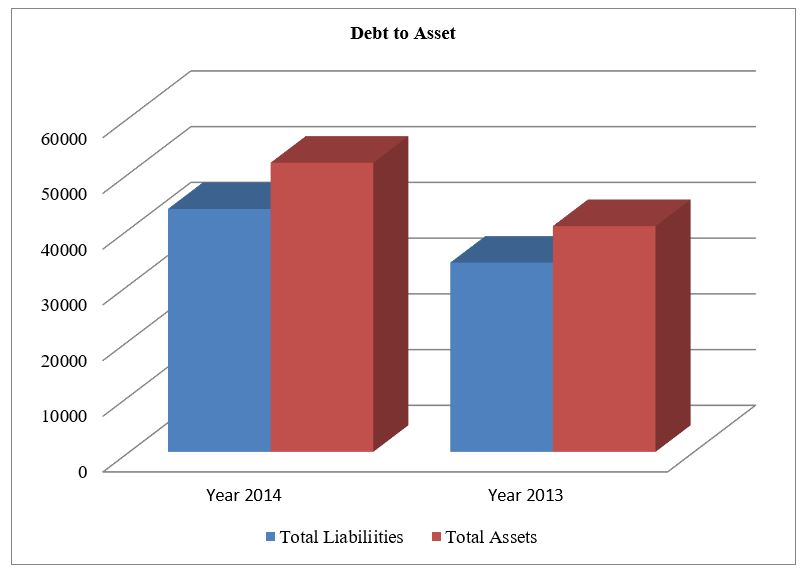

The debt ratio of this firm, as shown in the table above, is less than 1. In 2013, it was 0.838 while in 2014 it was 0.840. Inasmuch as the firm’s borrowing increased in 2014, the management has ensured that the firm does not heavily rely on borrowing to fund its projects. This is another positive sign that the firm can qualify as a preferred supplier. The debt to asset ratio can be presented diagrammatically as shown below.

Profitability ratios

The profitability ratios are also important when analysing the ability of a company to be a good supplier over a given period of time. A company that is profitable is more likely to continue with its operations. The fear of a possible disruption of business relationships with such a firm is relatively low. Coghlan warns that during the pre-qualification assessment process, care should be taken to determine if a firm is making abnormal profits because that can be an indication that its prices are unfairly high (362).

The profitability of the firm increased in 2014 compared with what it had in 2013. In both years, the firm’s profit was fairly good. In 2013, the firm’s return on asset and return on equity was negative because of the net loss the firm made in that year. However, things improved in 2014 because of the net profit that was made in that financial year. The graph below shows the growth of the firm’s gross margin.

Analysing Strengths and Weaknesses of the Company Using SWOT Model

The financial analysis of this firm has revealed a number of fundamental facts about this company that can help in understanding its strengths and weaknesses. One of the main strengths of this firm is that it is not heavily relying on debts to fund its projects. It means that it is a relatively independent firm. It is also making attractive profits, especially in its 2014 financial year. The financial ratios clearly show that it is able to meet its short-term financial obligations. Another major strength is that this company is able to use its assets in an effective way to generate revenues. It is an indication that the firm is poised to prosper in the market if the current statistics keeps on improving.

The financial statements show that there are a number of weaknesses that the management should be addressing to win the confidence of its clients as an appropriate supplier. One of the main weaknesses is inconsistency in the profitability of the company. In 2013, the company made a huge loss of $ 1,352,000. This explains why its return on assets and return on equity for that particular year were negative. In 2014, things changed for the better as the firm made a profit of $ 2,672,000. This inconsistency may cast doubts on the survivability of the firm in the market. It is also apparent that its asset turnover ratio is dropping, something that the management should address.

Conclusion and Recommendations

The evaluation of the finances of this organisation clearly shows that it has the financial capacity to deliver products if it is awarded the tender to do so. Even though the firm made a net loss in the year 2013, all other financial indications show that this company is in sound health and can deliver on its promises without relying on financial assistance from external sources. The following recommendations should be observed:

- The organisation should work on its profitability to ensure that it is consistent in the subsequent financial years.

- The management of this organisation finds ways of further reducing its reliance on debt financing to make it more independent.

- The organisation will need to address the problem of dropping asset turnover ratio.

References

- Anand, Krishnan, and Manu Goyal. “Strategic Information Management under Leakage in a Supply Chain”. Management Science 55.3 (2009): 438–452. Print.

- Benny, Bradley. “Investor Reactions to Substitution-based Outsourcing Agreements”. Journal of Managerial Issues 22.3 (2010): 409–426. Print.

- Coates, Rosemary. 42 Rules for Sourcing and Manufacturing: A Practical Handbook for Doing Business in China, Special Economic Zones, Factory Tours and Manufacturing Quality. Cupertino: Super Star Press, 2013. Print.

- Coghlan, Noel. “The Curse of Inequality”. Studies: An Irish Quarterly Review 102.407 (2013): 355–363. Print.

- Hugos, Michael. Essentials of Supply Chain Management. Hoboken: Wiley, 2011. Print.

- Lockstrom, Martin. Low-cost Country Sourcing: Trends and Implications. Wiesbaden: Deutscher UniversitStäts-Verlag, 2011. Print.

- Mackie, Paula. Modern Materials Management Techniques: A Complete Guide to Help You Plan, Direct and Control the Purchase, Production, Storage and Distribution of Goods in Today’s Competitive Business Environment : Essentials of Supply Chain Management. Toronto: Productive Publications, 2010. Print.

- Sollish, Fred, and John Semanik. Strategic Global Sourcing Best Practices. Hoboken: Wiley, 2011. Print.