Strategic Objective of the Fund

As a diversified investment fund, XYZ invests in a variety of different organizations; however, it aims to adopt a sustainable investing approach in the decision-making. Thus, the strategic objective of the fund is to direct investment capital to businesses that value corporate social responsibility (CSR) over profit and incorporate CSR into their business model. The comparative analysis of two companies, McLaren Group and John Lewis and Partners allowed for the recommendation of McLaren as a preferred investment option that better fits the fund’s strategic objective.

Comparative Analysis of the Current Strategies of McLaren Group and John Lewis & Partners

Business Model and Value Proposition

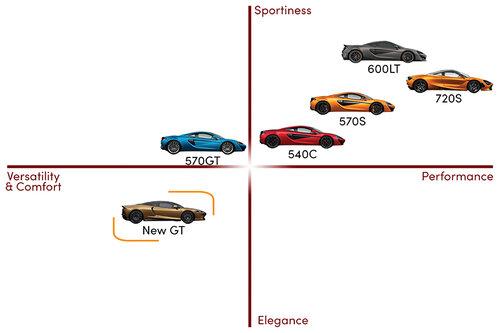

McLaren Group is a UK-based high-technology company with a globally recognized brand that creates luxury sports cars and Formula One race cars. The company’s subsidiaries operate in various fields and include McLaren Automotive, McLaren Racing, and McLaren Applied (McLaren Group Limited, 2019). As shown in Appendix A, McLaren highlights sportiness and performance in its customer value proposition, appealing primarily to high-end clients (Del Bello, 2020). McLaren Group has been hit hard due to the coronavirus pandemic.

The company’s executive chairman admitted its business model’s fragility, which implied the deployment of automotive cash flows into racing and two different return objectives (Noble, 2020, para. 5). The ownership of the race team was thus fragmented from the primary business to prevent the conflict of business objectives and ensure a more fiscally appropriate model. Therefore, the current business model utilizes the strong brand name and market leadership position to adopt a diversification strategy for McLaren’s growth while cultivating pro-innovative culture.

John Lewis and Partners belongs to a British company John Lewis Partnership and offers different products through its retail outlets, including furniture, homeware, electricals, fashion, men’s and women’s wear. It can be considered unique in terms of its distinctive features, continuing success, and popularity among the public (Salaman and Storey, 2016). The business is characterized by a shared commitment and a recognized retail brand (Our values, n.d.). John Lewis and Partners implements a business model which gives part-ownership of the company to each employee. John Lewis adhered to a differentiation strategy by distinguishing the company from the competition as a result of higher-quality value-for-money branding. The coronavirus pandemic affected the business, and the retailer adapted to the changing shopping habits of its customers and presented a number of its in-store services online (John Lewis & Partners, 2020).

The company values its partners’ satisfaction and places it at the center of all the company’s operations (Corporate responsibility report, 2019). Currently, John Lewis and Partners appeal to all social status shoppers, including the middle and upper classes, while presented as an upmarket. Overall, the company’s strategy has contributed to its continued success and longevity.

Distinctive Resources and Capabilities

McLaren Group’s distinctive resources, such as technology and innovation, as well as a high level of brand loyalty, allow it to successfully exploit its business model and deliver value for the customer. Furthermore, the company aims to diversify businesses through efficient resources and capital utilization to contribute to the value of the Group (Del Bello, 2020). Technology partnership constitutes the foundation of the McLaren Group’s strategy (How IT makes McLaren, 2018). Therefore, the VRIO analysis shows that the company’s commitment to innovation allows it to deliver value to the customer.

John Lewis and Partners is characterized by an experimental approach to running a business to benefit partners, customers, and society as a whole. The company has a distinctive management structure and identifies its partners as a competitive advantage, aiming to be an inclusive and diverse organization (Corporate responsibility report, 2019). The VRIO analysis indicates that John Lewis and Partners shows potential as an alternative to the dominant model of organization in the UK and implies the capability to create a value proposition distinctively.

Sustainable Competitive Advantages

As part of the Formula One team, McLaren contributes to the sustainability agenda to create a better future for the next generations while using the available resources. The company positions itself as a company striving to adopt CSR principles in its operations and protect natural resources from long-term depletion and preserve biodiversity and climate (Neale, 2021). Sustainable advantages of the McLaren Group involve the incorporation of the best performance principles, such as “health and safety, quality and environmental concerns”, into the design, manufacturing development, and operations processes (Neale, 2021).

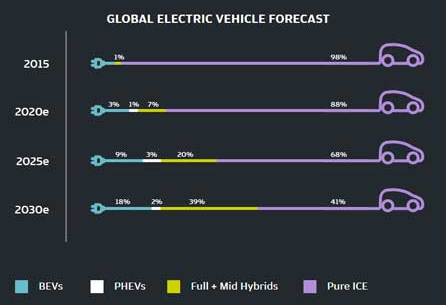

McLaren Racing is considered to be the leader in sustainability principles incorporation in the industry. As shown in Appendix B, hybrid electric vehicles (HIV) will account for “41% of total automotive sales by 2030”, and McLaren shows promising tendencies to contribute to auto-manufacturers sustainability agendas with its pioneering development and outcomes (Neale, 2021, para. 7). Due to McLaren’s innovative solutions, general waste recycling increased from 46 to 97% reducing CO2 emissions significantly each year. (Corporate Social responsibility, n.d., para. 7). McLaren’s sustainable competitive advantages include sharing technology and other resources among the Group’s companies to improve efficiency.

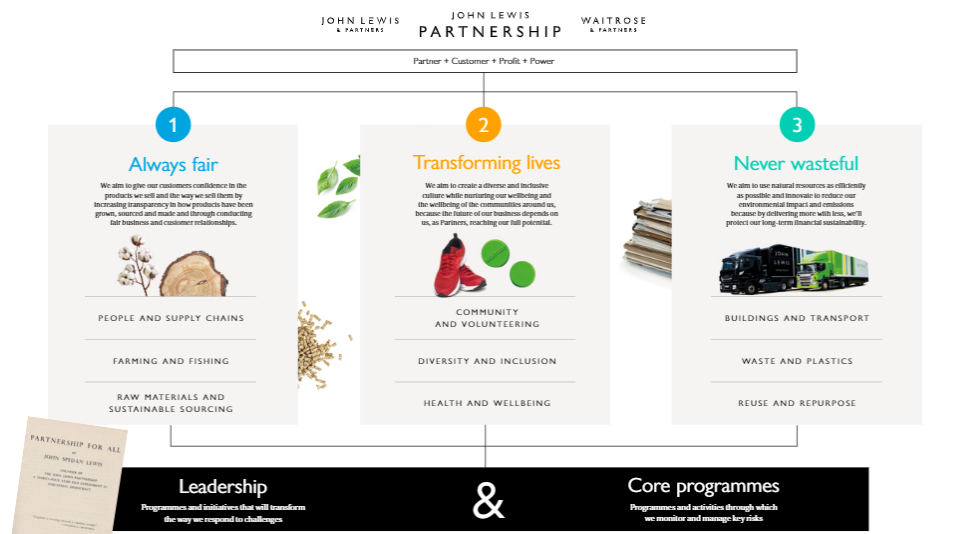

John Lewis and Partners is an employee-owned business that is committed to controlling its social and environmental impacts. As indicated in Appendix C, the company adopts three principles: transparency, transformation, and efficient use of resources (Salaman and Storey, 2016). It promotes wellbeing, diversity, and inclusion, aiming to be more ethical and sustainable while increasing profit to re-invest or share with partners who co-own the business; namely, John Lewis and Partners expects to reach over £200m profit (Fish, 2020, para. 9). To pursue this goal, it expanded the grocery trial with Deliveroo, reaching “3.1 million households across the UK” (Waitrose and Deliveroo, 2020, para. 1). John Lewis and Partners have shown efforts to comply with corporate social responsibility principles (John Lewis Partnership, 2015). However, it is worth noting that Deliveroo’s public offering does not contain any statements regarding Environmental, Social, and Governance (ESG) criteria (Larsen, 2021). Thus, the company implies a lack of social responsibility and such a partnership involves the preference for profitability over sustainable practices.

The Five Forces analysis identified that McLaren Group could benefit from developing in diversified markets due to the brand loyalty and differentiation strategy. McLaren reported a financial loss from 284 million pounds to 109 million pounds in the first quarter of 2020 following the outbreak of COVID-19 (McLaren losses, 2021, para. 3). Besides, the McLaren Group announced reduced car sales from 953 to 307 in 2020 (He and Harris, 2020, p. 177). The company has achieved a lot of its objectives throughout its history, but the COVID-19 pandemic has significantly impacted its sales.

The Five Forces analysis revealed fierce competition in the retail industry, identifying differentiation as the primary strategy of John Lewis and Partnership. The company generated revenues worth £10,151m at the start of 2020, compared to £10,316m in 2019 and £10,204m in 2018 (Sabanoglu, 2020, para. 2). The Partnership has 83,000 employees working as casuals and permanently employed (Employee Ownership, 2021). The company is dedicated to implementing strategies to save the environment, reduce its carbon footprint and waste, and create an inclusive culture (Duke, 2021). However, it can be seen that John Lewis’ corporate responsibility strategy primarily supports the company’s business plan and places the satisfaction of its partners above everything.

Recommendation

Based on the analysis presented in the previous section, McLaren Group is recommended as the preferred investment option, which aligns with the strategic objective of the fund and shows more effort into incorporating CSR into their business model. While John Lewis and Partnership is committed to social responsibility principles, its employee-owned approach implies that not all partners are aligned with ESG criteria, with Deliveroo being an example. Thus, to not risk the fund’s strategic outcomes, it appears feasible to invest in McLaren Group, which needs financial support to continue operating and shows promising tendencies regarding the sustainability agenda in the automotive industry.

Reference List

Corporate responsibility report 2018/19: A better way of doing business. (2019). Web.

Corporate Social responsibility. (n.d.). Web.

Curle, S. (2019). Does F1 conflict with sustainability agendas? Web.

Del Bello, R. (2020). McLaren and Ferrari: Matching product diversification strategies?. Web.

Duke, S. (2021). Model employer John Lewis is on shaky ground. Web.

Employee ownership. (2021). Web.

Fish, I. (2020). John Lewis reveals a new five-year plan. Web.

He, H. and Harris, L. (2020) ‘The impact of Covid-19 pandemic on corporate social responsibility and marketing philosophy’, Journal of Business Research, 116, pp. 176-182.

How IT makes McLaren go faster. (2018). Web.

John Lewis & Partners shows a willingness to adapt but the bonus was wiped out by COVID-19. (2020). Web.

John Lewis Partnership. (2016). Human rights & modern slavery report 2015/16: Upholding the rights of the people who grow, make, sell and buy our products. Web.

Larsen, P. T. (2021) Breakingviews – Deliveroo’s main sustainability doubt is financial. Web.

McLaren Group Limited. (2019). Annual results: Annual report and consolidated financial statements. Web.

McLaren losses were reduced to £71m for 2019 (2021). Web.

Neale, J. (2021). Environmental policy. Web.

Noble, J. (2020). McLaren’s “fragile” business model risked F1 progress without new investment. Web.

Our values. (n.d.). Web.

Sabanoglu, T. John Lewis Partnership revenue in the United Kingdom (UK) 2009-2020. Web.

Salaman, G. and Storey, J. (2016) ‘A better way of doing business? Lessons from the John Lewis Partnership’, Oxford University Press, pp. 1-24.

Waitrose and Deliveroo expand trial early to meet high demand. (2020). Web.

Appendix A

McLaren correspondent product line Customer Value Proposition chart

Appendix B

Global electric vehicle forecast as an illustration of the automotive industry’s growing contribution to creating sustainable transportation

Appendix C

John Lewis Partnership’s approach to CSR