Executive Summary

The Kroger Co. has long been the leading corporation in the retail/grocery industry until just recently Wal-Mart has overtaken Kroger in that spot. The Kroger Co. has enjoyed competitive advantage over its competitor because of its private label brands. Kroger currently operates in a wide geographic area across the United States. With over 2,400 stores in addition to other store formats, The Kroger Co. has the biggest market capitalization in the industry.

It manufactures its own products thus it can sell those items at relatively cheaper price compared to other brands. But because of problems and weaknesses in its operations and financial position, it hindered the company in its aggressive expansions.

The existence of labor unions, manual operations in its processes, and outdated information technology in its inventory management and vendor relations are some of the problems that the company is facing right now.

Automating the distribution process in its warehouses will help in reducing costs and increasing efficiency and effectiveness in its operations. It will also give Kroger the opportunity to reduce employees and thus further reduce costs. Reducing costs will enable the company to make their prices more competitive.

However, the company must be careful in implementing these changes because labor unions by its employees pose a risk of strikes.

This paper will discuss the current operation capabilities of Kroger. Also mentioned in this paper are the problems and weaknesses that the company faces together with the possible recommendations to alleviate those problems.

Operations and Business Unit Context

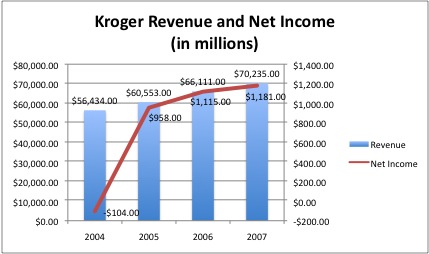

Founded in 1883 by Bernard Henry Kroger, the Kroger Co. is one of the leading supermarkets in the American retail industry. For the fiscal year 2008, the company reported sales of over US$70 billion (Kroger corporate website) or approximately €52.5 billion. The SN Top 75 ranked Kroger as the second-biggest grocery retailer in the United States, with Wal-Mart filling the first spot (Supermarket News, 2007). Operations are managed centrally in its Cincinnati, OH headquarters. Currently, the company operates either directly or via its subsidiaries 2,477 multi-department stores and supermarkets; 418 jewelry stores; 608 fuel centers; and 773 convenience stores. 95% of the total sales volume is accounted for Kroger’s supermarket and departments store chain.

Throughout the entire United States, the company carries out its business via different formats for its stores. The Kroger Co. handles convenience stores, hypermarkets, supermarkets, mall jewelry stores and department stores. States like Arkansas, Illinois, Kansas, Louisiana, Michigan, Missouri, North Carolina, South Carolina, Tennessee, and Virginia are a few of those that has Kroger stores.

Supermarkets are typically a combination of a food and drug store. Customers located within two to two and a half mile radius are the target shoppers of each supermarket in order for them to receive income which is higher than the company’s cost of capital.

Each supermarket offers a wide variety of specialty departments that most customers like. These departments comprises of pharmacies, whole health sections and world class perishables and produce.

Multi-department stores are a very unique shopping center. The store occupies 150,000 s.f. and it offers more than 225 thousand food, general merchandise and apparel products in just one store. This type of store format includes, full-line supermarket, home fashion, apparel, shoes, garden, accessories, home electronics, Nutrition centers and paint and hardware. Multi-department stores have competitive advantage because it put emphasis on national brand products. Furthermore, alternatives with lower prices and competitive quality are also in display. These are basically the private label products of Kroger.

For more budget-conscious customers, price-impact warehouse stores are used to attract that market. This type of store offers high-quality produce. This type of format for stores provides for unique ethnic products that serve well the demographics in the region they are located. Every store, occupies an average of 56,000 s.f. of land.

Convenience stores usually occupy 2,900 square feet to 4,900 square feet of one to two acres of land. Each stores, typically include 4 to 8 pumps for gasoline. It is generally roofed with a very large and lighted canopy. The newest credit card reader technology is employed in each gasoline facilities. Convenience stores focus on small to medium-sized towns majority of which have less than 75,000 residents. These are usually located in interstate highways.

In the 1930s, Bernard Kroger, lead the way for the first ever supermarket that is surrounded by parking lots on its all four sides. The Kroger Company acquired Dillon Companies in 1983. Dillon is a grocery chain in Kansas.

Dillon Companies was founded by J.S. Dillon in 1921. It operates more than a hundred stores in different states. In-store pharmacies are located in its supermarkets. Gas stations are also located at the supermarket’s parking lot. Over time, Dillon lose its market share because of discounters like the Wal-Mart Supercenters. Upon its acquisition by Kroger, it brought with it its diverse subsidiaries of Frys, King Soopers, Gerbes, Bakers and Kwik Shop, a convenience store. David B. Dillon, 4th generation descend of J.S. Dillion is the incumbent Chief Operating Officer of The Kroger Co. J.S. Dillion founded the Dillon Companies.

Description of the Current Operations and Operation Capabilities

Aside from selling a wide range of national product brands, The Kroger Co. also has its own manufacturing units for its own private labels. 42 manufacturing plants which are either wholly owned or employed through operating agreements are located in 17 states. These plants produce almost half of The Kroger Co.’s about eight thousand private label produce. The brand names are organized in a three-tiered system so as to attain comprehension and ease for the shoppers. The private labels are packaged and sold to other retailers under the company name: Inter-American Products. Products under Krogers’ private label include dairy products, bakeries and delis, meat plants and grocery items (The Kroger Co. corporate website)

The Kroger Value line was introduced early in 2007. This product line became the successor for the FMV or For Maximum Value product line. The Kroger Value line has been diversified to wide variety of product items like frozen food, ice cream, dog and cat food, and butter.

Shoppers are given the lowest price most acceptable for the products under the For Maximum Value brand. These products under the brand are necessities like canned goods, flour, bread and sugar. Problems existed when the much cheaper but lower-quality products became indistinguishable with its banner brand equivalents. As a result, in the year 2007, the FMV brand was renamed as the Kroger Value brand. Mainly all Kroger Value products carry labels in two languages, English and Spanish.

The banner brands of Kroger, are those the carry with it the name of Kroger or Kroger subsidiaries like King Soopers or Ralph. To attract customers, the company employed a promotional offer where customers who were not satisfied by the Kroger products can simply replace it with a national brand for no cost. The health and beauty products of the Kroger brand are produced by third-party manufacturers.

In competing with more classy products, the company uses the Private Selection brand.

Aside from the main grocery brands, Kroger also manufactures a wide array of general merchandise product under different brand names. These products are especially offered in Fred Meyer stores or Kroger Marketplace stores.

Kroger and The Walt Disney Company partnered in 2006 to create the Disney Magic Selections product line. These items are most of the time used instead of Kroger’s banner brand equivalents. The packaging featured Pixar and Disney characters. The Disney Magic Selections product line is used to aid in encouraging healthy diet for children. These products are very healthy; in fact it contains no grams of trans fat.

Kroger also owns pharmacies. The SupeRx Drug Store chain is the first venture of Kroger in the pharmacy industry. In 1985, Kroger acquired the Indianapolis, IN. based Hook’s Drug Stores chain, since then SupeRx became known as Hook’s-SupeRx. The Kroger Pharmacies has long been an income-producing unit of Kroger. It has now expanded to incorporate pharmacies in Dillons, Fry’s, City Market, Ralphs, QFC, and Kroger Supermarkets.

To expand the operation of the company, Kroger decided to add gas station or fuel centers in the vicinity of the Kroger Supermarkets in 1998.

Kroger has 44 distribution centers before 1995. Operating this number of distribution is cost and very inefficient. Thus, in 1995 they lessened the distribution centers to only 20. The new operation is composed of three-tiers. The retail stores are being served by the second and three tiers also known as “Peyton’s”. The “Peyton’s” supplies the retail stores with products that are seasonal and promotional. Five “Peyton’s” are operated by Kroger.

Furthermore, a fleet of trailers and trucks are being managed and owned by Kroger. These trucks and trailers are used for distributing the products to the different stores.

Kroger Co. uses the name of its subsidiary, Inter-American Products for its self-manufactured products. Westco Foods, another subsidiary of Kroger, is responsible for the purchase of products other than their private labels.

Just recently in 2007, Kroger Personal Finance was launched. This includes services like loans and mortgages, credit cards, insurance, and identity theft protection.

Bulk of the retail divisions’ supplies used in operations like bags, uniforms and cleaning supplies are purchased by the Kroger’s Corporate Supplies Procurement Group. The headquarters in Cincinnati handles the procurement of services used by the company. This services include laundry, safety and security, stock management, distribution and technology. For the manufacturing plants, another team is in charged for the procurement of the materials used and services needed.

According to The Kroger Co., it generally earns one to two pennies for every one dollar of sales. 40 to 50 thousand product items can be made available in every Kroger store. As a yard stick for the success of a product the total dollar sales is employed.

The Kroger Co. has 17 retail divisions. These divisions are strategically organized in terms of geography. The Kroger’s Merchandising Group is responsible for directing and coordinating the company’s process of retail buying. It brings together the major merchants in each main category of products in order to make strategies.

Although, the Kroger’s Merchandising Group controls the merchandise selections of the Kroger stores, each local retail division has the power to buy and offer to the customers’ local requirements. Every store encounters a unique demographic profile in its local community thus the stores are patterned to serve that need. But of course, quality and price competitiveness should not be compromised.

The Kroger Co. recognized the added value of supplier diversity. Thus Kroger offers a number of opportunities for women-owned and minority-owned businesses. A broad diversity in its choice for suppliers reflects the broad diversity of its customers in the market of the company.

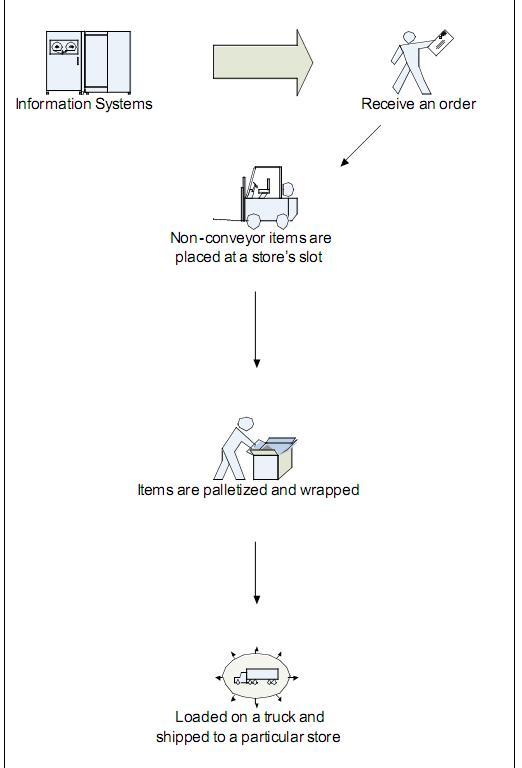

In its distribution and supply chain management, presently, The Kroger Co. is using a pull system of inventory (JIT) which is just appropriate for the retail industry because inventory turnover is high and the level of inventory should be kept on the minimum. Information technology like bar codes and other readers are also used. No conveyor system are used thus warehouse operations are manual. Furthermore, because a manual operation is used, the number of employees for Kroger is significantly higher, thus labor costs and it resulted also to slow operations. In warehouse ownership, Kroger owns its warehouses. In its relationship with vendors, Kroger does not have any project that directly affects the impact of distribution and supply chain management. The distribution process for Kroger can be seen on Exhibit E.

Operations’ Problems and Weaknesses

A weakness of Kroger is the existence of labor unions for its employees. These labor unions have stalled the capability of Kroger in competing with other companies in the grocery and retail industry. Because of these labor unions, the company is pushed to pay higher wages and more likeable health benefits for its staff. It has been observed that there has been an increase of 92% since 1999 for the cost of health benefits of employees. The company cannot increase their prices because stiff competition exists between Kroger and Wal-Mart which also offers very competitive prices. Cutting wages is not also a good idea because an employee strike might occur thus resulting to severe losses. Smaller profit margins are the result of this situation. On the other hand, its key competitor, Wal-Mart does not experience this kind of problem. Furthermore, employee retention is also a looming problem for Kroger because of the labor unions.

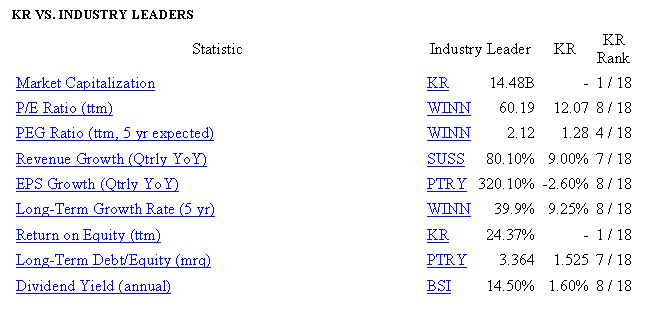

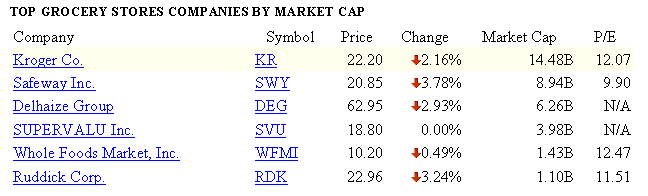

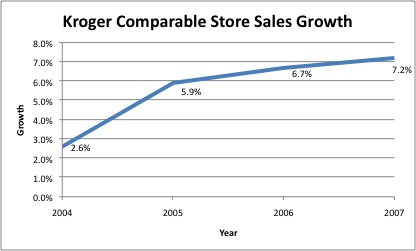

The Kroger Co. is the number one company in the retail industry in terms of market capitalization (see Exhibit B) Kroger Co. is also the industry leader in the return on equity (Yahoo Finance, Feb, 2009)

The quarterly profit of The Kroger Co. rose 3.4% in the third quarter of 2008 despite the slowing economy. Actually, because of the slowing economy, customers are now eating at home more often and trying Kroger’s grocery brands. Cheaper gas and more private label brand items and prepared meals are doing well in terms of sales. 26% of the total grocery sales are accounted for its store-label items (The New York Times, Sept. 17, 2008)

Due to the fact that Kroger Co. has its own private labels and it manufactures them in its more than 40 plants of dairies, beverage and meat plants, and bakeries, it calls for the risk of food contamination. Manufacturing your own food items can hurt the company profits when serious contamination occurs.

The Kroger Co. has grown through acquisition, thus the operational environment of Kroger has been decentralized. The supply chain of Kroger becomes disjointed and decentralized. As a result of this structure, Kroger was not able to gain the benefits of having economies of scale throughout their company.

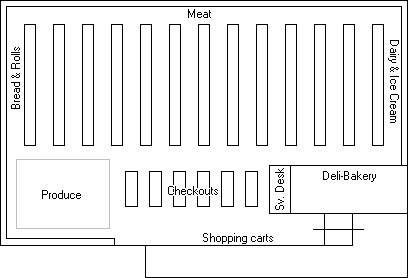

The long-run efficiency of an operation is determined by the layout design of the operation especially for retail stores. A layout strategy should be in place so as to develop a layout that will give the company a competitive advantage. Generally, a good layout must make use of all available space, people and equipment in the most efficient way possible. A good layout must also make for the smooth flow of information, people or materials. Improved employee morale and safe working conditions for employees must also be taken into consideration. Furthermore, the layout should be flexible. In retail layouts, it should be recognized that sales and profit vary directly with the exposure of the products to the customers. (Francism, et al., 1998) For Kroger, the design layout of its stores shows some weakness (see Exhibit A). It is odd to have a solid wall that separates the produce from the whole of the store. It doesn’t allow a smooth circulation of traffic because the wall ends near the rear part of the store and it stops short at the front.

Information overload is one of the weaknesses that Kroger must overcome. This is an effect of the vast amount of data gathered from the regular shopper cards. Because of information overload, the management can not distinguish which are the important and useful information. The end effect of which is that they will just have so many information when making necessary decisions. Wal-Mart, Kroger’s biggest competitor has already used the latest technologies in the efficient and effective use of information in order to create wise decisions. Information overload will have the effect of slowing the responsiveness of the managers in making the appropriate decisions.

For years, the Kroger Co. has been the number one retail and grocery store in the market. Since the entry of Wal-Mart in the industry, it caused trouble to Kroger Co. Wal-Mart has the advantage of mass merchandising thus it can offer grocery items that are 30% cheaper than the average prices in the consumer market. This forced Kroger to decrease the price, sacrificing profit and expansion opportunities. The Kroger Co. significantly lags behind other competitors in the industry in terms of its long-term growth rate and EPS growth rate. Its long term growth rate is only 9.25% compared to the industry leader of 39.9%. Its EPS growth rate is only -2.60% compared to the industry leader of 320.10% (see Exhibit C) (Yahoo Finance, February 2009). This can be attributed in its attempt to prevent a hostile corporate takeover in 1988, Kroger borrowed 5.3 billion dollars. As a consequence of this action, the company became much leveraged. The high principal and interest costs incurred in these loans, a large part of Kroger’s profit must be used in order to settle those debts. As a result, this might be an obstacle for Kroger’s plans for market expansion. Limitations on expansion will make the company less competitive to its key competitor, Wal-Mart. International expansion is also a major down side of those huge debt.

Investors are forewarned by analysts to avoid purchasing shares of stocks of those corporations that are much levered by debt. (Zacks Investment Research, January, 2009)

Another main weakness of Kroger supercenters is that it does not serve a wider range of non-food products compared to Wal-Mart. Men and kids section are not given focus on its superstores thus the company is missing out on some opportunities. According to recent demographic data, 14% of the grocery shoppers are the male members of the households. Sporting equipments, grill, clothing and products which are associated to male grocers can not be found in Kroger stores. Furthermore, toy, kids clothing, and bikes for kids are also overlooked by Kroger unlike Wal-Mart which offers these kinds of products. This missed sale is amplified during the holiday seasons. The growing demographic does not receive so much attention from Kroger thus potential revenues and market share is diminished. Another market that is untouched by Kroger is the growing elderly market. More people in the United States are growing older, but Kroger still does not put much of its resources in tapping this emerging market.

Recommended Changes

In making a good relationship with vendors and also to make the JIT system more effective, the use of Global Data Synchronization will be helpful. This will link the information system of Kroger with the information system of their suppliers. The use of this technology will reduce inventory costs and but still prevent inventory shortages.

There are a lot of opportunities for improvement in the distribution and supply chain management of Kroger. The use of more advanced information technology will be useful in increasing efficiency and effectiveness of monitoring and managing inventory levels. The use of ID tag chips is very promising for Kroger. The use of conveyor belts for certain inventory items will help in automating the entire distribution process. This will speed up operations. Automating the process will also decrease labor costs. Decreasing labor cost will be useful for the company since the company is experiencing problems with its employees’ labor unions.

The management of The Kroger Co. should make a decision of centralizing a number of their operations including transportation. Kroger’s own fleet of trucks moves merchandise and supplies in its stores, warehouses and manufacturing plants for greater than 100 million miles every year. A centralized transportation for its operation would increase productivity of their labor force because centralizing means streamlining and synchronizing businesses processes. Furthermore, centralizing their operations would give them volume advantages in contracting with carriers. Centralizing operations will also enhance inbound visibility with their suppliers. It will also enhance the use of their private fleet efficiency on back-haul lanes.

Transportation management can be centralized by using a third-party provided Retail solution. This kind of solution will automate the scheduling of appointments throughout the organization. Carrier selection, routing and contract management processes can be automated through this kind of business solution. At the same time, instead of using the telephone, carriers can use the internet to schedule appointment of distributions. Through this, dependency on phone and fax communication can be reduced. Furthermore, transportation measurements can be standardized through automated business solutions. Standardization of on-time delivery can be achieved by the use of this technology. Furthermore, the obedience of the suppliers for the deadline of deliveries and the degree of approval and refusal of deliveries can also have standard measures. The supply chain network of Kroger can experience rapid deployment when centralization occurs.

A systematic platform throughout the Kroger’s Retail Transportation and Manufacturing system can improve the visibility of the supply chain. One hundred percent of the important transportation data can be useful in making analysis for long-term strategic planning. Expenditures for annual inbound freight can be reduced across the Transportation Centers regionally and the Manufacturing plants because of the centralized shipment planning and organized and systematic compliance on routing guides. The inefficiencies associated with the use of phone and fax communication can be eliminated. Thus, resources can be used in more strategic and value-added tasks.

In order to solve the problem of information overload, technology must be used in Kroger’s operations. The use of preferred customer cards can be useful. This technology will enhance management’s capability of identifying the needs of the customers. Once the needs of the customers are known, the discount promos can be formulated based on those findings. Furthermore, information system will also help in managing inventory levels and the distribution of products. Communication can also be improved by the use of information systems. The company can determine which sales are happening in which area or geography.

Possible Resistances to the Changes

In implementing the changes mentioned in this paper, resistance that the company might experience should be taken into consideration. First of all, because the company is highly leveraged, it has a limitation on its expansion capabilities. Management is struggling to pay off debts thus in implementing major changes which are costly; the management might be hesitant for those kinds of changes.

Furthermore, automating the distribution process and supply chain management will call for the reduction of employees. This will reduce cost but the employees’ labor unions will certainly resist this move. Employee strikes should be taken into consideration when implementing that option.

APPENDICES

Exhibit A

Exhibit B

Exhibit C

Exhibit D

Exhibit E

Bibliography

“Earnings Rise 3.4% At Kroger. (Business/Financial Desk) (Brief article).” The New York Times 157.54436 (2008): C6(L). Academic OneFile. Gale. University of South Alabama (AVL). Web.

“Kroger introduces Disney Magic Selections in stores nationwide”. The Kroger Co. Web.

“Kroger’s Earnings Surpass Forecasts.(Business/Financial Desk)(Kroger Co.) (Brief article).” The New York Times 157.54352 (2008): C7(L). Academic OneFile. Gale. University of South Alabama (AVL). Web.

2007 Top 75 North American Food Retailers, Supermarket News.

Francism R. L., L. F. McGinnis, and J. A. White. Facility Layout and Location, 3rd ed. Upper Saddle River, NJ: Prentice Hall, 1998.

Heizer, Jay and Barry Render. (2006). Operations management, 8th ed. Pearson Education, Inc., Prentice Hall.

KR 2007 10-K pg. 32. Web.

Kroger Co. Corporate Website. Web.

Stevenson, W. J. (2005). Operations management, 8th ed. New York: McGraw-Hill.

Yahoo Finance. Web.

Zacks Investment Research, (2009) US retail industry: Opportunities and weaknesses. Web.