Problem Statement

Due to the high rate of inflation worldwide, more and more banks need and search for more customers and most importantly, keeping those they already have. This has redirected banking operations, making them more increasingly customer-dictated. Hence customer satisfaction is given an utmost importance in the banking industry. Customer satisfaction is not just aimed at merely getting profit or sales, rather it focuses on gaining the loyalty of the customer. It is therefore imperative to understand the following:

- What the customers want;

- Whether they are satisfied or not;

- How to meet the customer’s approval.

Since it is obvious that no business can survive without customers, working closely with customers is very essential. It is therefore very critical to keep a good and close working relationship with your clients, making customer satisfaction very important.

Research Objectives

This research is aimed at proffering solutions to the following questions:

- What customer satisfaction tracking programs should be focused on?

- Why it is important to develop customer retention programs?

The main objectives of the paper will be focused on the investigation of existing and functioning retention programs for the customers and their importance in banking system. It is necessary to concentrate on the analysis of satisfaction tracking programs relating their introduction to the promotion of business ethics in relation to the customers.

The paper will analyze in more detail the basic customers’ expectations making the part of customers’ programs. Basically, there are at least three levels of customer expectations about quality. The three levels will be briefly discussed:

Level 1

These are expectations that are very simple and come in form of must-haves, assumptions, or take it for granted. An example is to expect a bank I use to be able to post my money into account as soon as it is deposited and to keep a correct tally for me

Level 2

This type of expectation is quite higher than that of level one. They usually come in form of satisfaction by meeting requirements and specifications. A typical example is that I went into the bank expecting the bank teller to be informative, friendly, and helpful with all my transactions.

Level 3

The expectations here are much higher than those of level 1 and level 2 because they require some sort of delightfulness or a service that is just too good to be true, one that attracts a customer to it. A typical example is seeing the bank officer representing the bank holding my mortgage, he did not only treat me kindly, respectfully, answered patiently all question I had about my mortgage, but before we shook hands to close the deal, gave me a nice housewarming gift.

The chosen strategy in customer service satisfaction is also very important because it sets the stage for appropriate behavior, training, and delivery of the specific service. Before choosing a strategy, it is paramount that the following issues are critically addressed:

Customer service attributes

Delivery of a good/service must be accurate, timely, with concern, and also with courtesy. These elements are very vital due to the fact that all services are intangible and they are largely a function of the customer’s perception. This is due to the fact that they depend on the interpretation of the customer. If the service is left unattended, it can rub on the reputation of the organization since service by definition is perishable if left unattended. The word comfort helps to underscore the importance of service as it relates to customer satisfaction. Comfort entails being tactful, friendly, observant, caring, mindful, responsible, and obliging. Without these characteristics, a customer service cannot function effectively. Hence, there is great dependence on communication, knowledge, sensitivity, empowerment, and interpersonal skills.

Being interested in what a customer wants to say show that you are caring, it could involve spending more time with the customer to ascertain his/her real needs, wants, and expectations. In some cases, it might be candid to inform a customer you are not able to assist or meet his/her needs appropriately. You could even help by suggesting the services of some other company or someone else.

Observing the customer’s need when dealing with service-related items can help to satisfy a customer better than through direct communication. Cognizance should be given to the body language, ensure to listen carefully, read between the lines and check for mannerisms. Try to have a good understanding of the needs of the customer clearly by listening attentively, maintaining good eye contact with the customer, and endeavor to be a step ahead.

Be mindful. The main responsibility of you and your organization is to adequately satisfy the customer needs to the extent possible. Without such needs, the company and its employees will be of no use. The customer has various decisions to make, hence it is imperative that the organization needs to meet up with the customer’s expectations, else, they will not successfully satisfy the customer.

Be friendly. In an attempt to be friendly, do not become a busybody in your customer’s private affairs, rather, be ready to offer necessary assistance, be friendly enough to provide timely feedback, speak the truth, and offer practical guidance.

Be obliging. You need to be patient as some customers do not know what they really want. Many times, you serve as a guinea pig for their decision-making process. Do not be unduly concerned about this, but help to make difference between a satisfied and an unsatisfied customer while you do not fail to educate the customer.

Be responsible. This is very important because the customer expects you to provide him/her with the appropriate information in a way that is clear, brief, and simple to grasp. You need to be careful never to force the customer to accept a sale, rather, develop a relationship where your expertise in the field of endeavor comes into play.

Be tactful. This is essential by communicating to the customer in a manner that would not make the customer feel that he is being threatened. Many times though, conflicts often arise as humans, be ready to present facts or information in a way that would not intimidate your customer. On the part of an employee/employer, it would require listening patiently when the customer speaks, thinking before commenting, and never interrupting the customer.

Approach for service quality improvement

The service quality improvement is an essential ingredient in customer satisfaction. For this to be achieved, attention should be given to the following:

- Costs

- Time to implement the program

- The customer service impact

Caution must be employed so that both customers and the company derive optimum satisfaction, there is need for balance.

Developing feedback systems to improve customer service quality

A shaky and ineffective feedback system will in doubt tear down the company/organization. This can be ensured by not mixing marketing and customer satisfaction together.

Literature Review

The purpose of Customer satisfaction research is aimed at helping to measure customer satisfaction for the purpose of determining where the company stands in this regard in the eyes of its customers.

This step gives an opportunity to improve service and product helping to generate a higher satisfaction level. (Giese, and Cote, 2000) For customer satisfaction to be effective and achieve the intended purpose, a bank/organization should avoid the following:

- Sticking to a rigid chain of commands

- Close supervision of employees

- Rewarding customers by basing these on carrot and stick principles

- Upholding of wrong objectives

To succeed in attaining optimum customer service satisfaction, bank employees should be allowed to take personal responsibility for their actions when it comes to communication, customer satisfaction and performance. But what can help us to adequately awaken our employees to these relevant issues?

First, there is need to define who really our customer is. Secondly, a clear understanding of the customer’s level of expectation concerning quality is essential. Thirdly, understanding the best strategy for improving customer service quality, and lastly, understanding how to weigh cycles of customer satisfaction.

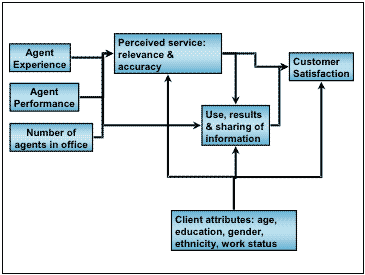

The graph presents example of customer service satisfaction model to be introduced within banking system. (Terry, and Israel, 2004).

A customer is the person or unit that receives the output derived from a process on the system. As the case may be, a customer may be the intermediate, immediate or ultimate customer. (Wargo, R.A.,1994.) Likewise, a customer may be person, a person, or a process or process. Therefore, customer satisfaction can only be achieved when a customer is satisfied with a service/product that meets his or her needs, wants, and ultimately his expectations. To understand customer satisfaction in detail, we must have a deep look at the various levels of customer satisfaction, paying special attention to this aspect as the science introduced in business. (Fornell, 2001)

Research Design

The research paper will be concentrated on the analysis of customer satisfaction tracking programs and the importance of retention programs on the basis of qualitative and quantitative methods.

Data collection for results and findings formulation is the part of comparative analysis of statistical data related to banking operations in the sphere of customers’ service. It is necessary to underline the fact that the conduction of research will become the part of various specialized software and people questionnaire as the basis for research instrumentation.

Basic results and findings of the analysis will be presented in the form of tables and graphs, underlining the peculiarities of customers’ programs promotion and their role in the sphere of banking operations.

A considerable part of the research will be dedicated to the analysis of business ethics in the sphere of customers service. It is necessary to investigate the role and level of ethical issues promotion within banking system and generalize the rate of ethical impact on interaction between the service providers and customers. One should stick to ethical programs developed for the banking staff and stress a list of significant points forming efficient ethical atmosphere.

Ethical analysis of customers’ programs should be concentrated on the following aspects:

- Ethics as the basic component forming business relationships;

- Strategies for ethical atmosphere introduction and its promotion;

- The validity and effectiveness of analyzed ethical methods;

- Identification of principal ethical difficulties faced by customers and employers;

- The analysis of procedures aimed at business ethics supports within banking system.

Nature and Form of Results

Based on provided methodologies and strategic analysis to be used in the research paper, one can totally analyze the point of customers’ service programs. The descriptive method will allow understanding the level of usability of these programs; qualitative and quantitative methods will demonstrate graphic analysis of research findings based on articles, statistical and business reports.

Central management questions investigated in the research paper will meet the standards of business analysis in the sphere of the banking system. It is necessary to concentrate on strategic management comparing the experience of existing companies and providing distinct perspectives for the future.

Conclusion

The major focus of this research work will focus on:

- Customer satisfaction tracking programs that should be focused on?

- Why it is important to develop customer retention programs?

With the use of relevant online documents, books, charts and appropriate data, critical analysis of the Customer experiences when logging complaints either vocally or otherwise coupled with the service they receive in daily operations in banks like checking accounts issues, using ATM, loans, and many others.

More to that, the research will also determine the best satisfaction tracking programs, and why it is important to develop such customer retention programs. It will also help to identify the need for quality service as it helps the Customer to perceive that the bank is clearly and actively concerned about retaining their customers.

References

Fornell, Claes G. The Science of Satisfaction. Harvard Business Review. 79.3 (2001): 120-121.

Giese, J. and Cote, J. Defining Consumer Satisfaction. Washington State University. 2000. Web.

Stamatis, D.H. Total Quality Service, Delray Beach, FL: St. Lucie Press, 1996.

Terry, B. and Israel, G. Agent Performance and Customer Satisfaction. University of Florida. 2004. Web.

Wargo, R.A. “How to Avoid the Traps of Benchmarking Customer Satisfaction.” Continuous Journey 1994. Web.