Executive summary

Being a global service provider, Abu Dhabi Ship Building (ADSB) Company has been in the minds of many financial analysts and investors due to its ability to provide world class service and thereby sustain growth over long periods despite the continuous financial turbulence that has forced many companies to either shut their operations or cut the employment. With the principal business product services of credit payments as well as charge, the company has forged it operations to sustainable levels thereby giving back sufficient dividends to its investors.

The focus of this paper will be to establish the operational excellence within the company and the supporting financial capability behind the success of Abu Dhabi Ship Building (ADSB) Company. In this regard, the paper will employ the use of ratio analysis; liquidity ratios, leverage ratios, profitability ratios and efficiency ratios analysis of the company’s stock to provide an affirmative indication of the prevailing financial stability within Abu Dhabi Ship Building (ADSB) Company. Besides, excel workings have also been provided for easy understanding of the calculations.

Company background

Abu Dhabi Ship Building Company (ADSB) was established in 1996. The establishment of this company was in accordance with Sheikh Mohammed Bin Zayed’s vision of the need to start one of the best internationally recognized facility, especially in Abu Dhabi. Such facility would help in promoting the UAE Navy’s back up.

Initially, this company concentrated most of its works on refits as well as naval repairs. Later on, the company diversified its operations to include ship building. For example, Abu Dhabi Ship Building is famous for its ‘Baynunah 70m Corvette’ (“Abu Dhabi Ship Building: Adsb_Naval Ship Construction” par. 1). This was a very complex and technologically advanced warship. The company operates in various counties as evidenced in the following quotations:

“ADSB has also built a global network of strategic partners from different countries, each offering a unique set of professional and technical expertise that complement ADSB’s specialised maritime capabilities. ADSB’s strategic partners have been carefully selected for their expertise, specialist knowledge and reputation in the design and build of Naval, Military and Commercial Ships” (“Abu Dhabi Ship Building: Adsb_Naval Ship Construction” par. 4).

Abu Dhabi Ship Building Company has specialized in not only the repair of Naval, but also in its construction. The company refits the Naval as well. This business venture has earned the ADSB Company some significant turnovers, which have boosted the firm’s portfolio to a record high of AED 3 billion. In addition, this company has undertaken heavy projects in both aluminum and steel alloy. For instance, it has successfully operated business on high-tech composite materials. This has been carried out in line with the established international standards ((“Abu Dhabi Ship Building: Adsb_Naval Ship Construction” par. 2).

Introduction

Company based financial analysis has been a predominant topic in the contemporary financial markets. Every investor is quick to evaluate and thereby clearly understand the fair and true standing of any company in which he/she intends to invest. The financial markets as well as the global and technological developments have made it easier for individual investors to access financial information of any entity in the market. Therefore, every company is increasingly becoming articulate in providing financial information to all its stakeholders to remain relevant and of financial standing in the face of its clients as well as other outside stakeholders.

As much as the management of any company requires financial information to forge their decision-making, the other stakeholders have increasingly become wary of the significance role of the financial information in ensuring the safety of their investments. In this regard, the paper seeks to compute and evaluate the financial position of Abu Dhabi Ship Building Company. As such, the paper will utilize appropriate ratios, industry wide analysis and the analysis of the performance of the company. Moreover, the paper will indicate the whether the company is operationally capable of sustaining the reported financial profits as well as the company’s liquidity.

Financial Analysis

Abu Dhabi Ship Building Company’s liquidity

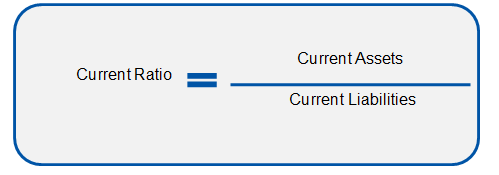

The current ratio of Abu Dhabi Ship Building (ADSB) Company was 1.14:1 and 1.00:1 for the years 2011 and 2010 respectively. The significant movement of the company’s current ratio in the year 2011 from the high of 1.00:1 in the previous year to a higher of 1.14:1 indicates the sufficiency in terms of liquidity in the company.

This is because current ratio implies that the company operates over a higher margin of safety as is the conventional expectation. For a company to have a satisfactory current ratio, it must attain a two to one (2:1) current ratio.

In this regard, the Abu Dhabi Ship Building (ADSB) Company with a current ratio of 1.14:1 presents a higher level of current assets to current liabilities and this indicates the sufficiency of the company’s ability to meet its current obligations. There is no likelihood of liquidity problem in the company if the trend in the last two years is something to go by (“Abu Dhabi Ship Building PJSC” 5).

Abu Dhabi Ship Building Company’s quick ratio is 0.21:1 and 0.29: 1 in the years 2011 and 2011 respectively. Given that a quick ratio of 1:1 is what is considered as a satisfactory financial condition, Abu Dhabi Ship Building (ADSB) Company is thus not sufficiently liquid.

The ratio of 0.21:1 shows that even if the company’s inventories are sold, Abu Dhabi Ship Building (ADSB) will still not be able to meet its current liabilities if there is need to pay them immediately. Further, the ratio does not indicate significant improvement from the results of the previous year. Therefore, this fails to show operational excellence within the company in the current year.

The interval measure of the Abu Dhabi Ship Building (ADSB) Company for the year 2011 records does not significant improvement as compared to the previous years. The value 514 days indicates that Abu Dhabi Ship Building (ADSB) Company does not have sufficient liquid assets that can finance its operations for 514 days without receiving any cash from the outside sources.

This lack of improvement in the interval measure could be attributed to the failure of the company to cut its cost bases. The company is currently implementing strategic policies that are cost driven to curb such problems. The company is currently focusing on strategies that will ensure efficiency improvement, and this has to be paid off (“Abu Dhabi Ship Building PJSC” 5).

Abu Dhabi Ship Building Company’s leverage capacity

The debt percentage of total assets ratio of Abu Dhabi Ship Building (ADSB) Companyis 0.90 and 0.79 percent for the years 2011 and 2010 respectively. The trend of the debt percentage of the total asset shows that the company’s shareholders have increasingly improved their stake in financing the operations of the company.

In the year 2010, the shareholder had (100-0.79) % financing portion, however this has since decreased to (100 – 0.90) % in the year 2011. This shows that the lenders have only financed 0.90 percent of the capital employed in Abu Dhabi Ship Building (ADSB) Company in the year 2011.

Interest coverage ratio for the company was established 15.1 and 14.2 in the years 2011 and 2010 respectively. This ratio shows the number of times the charged interest is covered by the ordinarily available cash that could be used for their payment. Thus, the positive 15.1 indicates that the company is charged interest that it is sufficiently capable of paying since it has much of comparable ordinarily available cash.

The ability of the company to cover its interest charges could be associated with the increasing values in the revenues of the company and the resultant increase in the cash and cash equivalent components of Abu Dhabi Ship Building Company. The increase in revenue is further attributed to the improved efficiency and effectively with which the company operates to serve its clients (“Abu Dhabi Ship Building PJSC” 5).

Dhabi Ship Building (ADSB) Company’s profitability

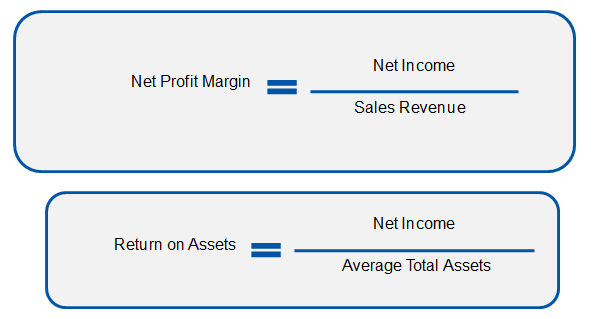

The group profit margin for Abu Dhabi Ship Building (ADSB) Company is established to be 5.15 and 15.68 percent in the years 2011 and 2010 respectively. The relatively decreasing value trend indicates the management’s inefficiency in converting each $ sales into net profit. The margin ratio also indicates the firm’s inability to withstand adverse economic conditions.

In the year 2010, the company had a margin rate of positive 15.68 percent, but this only declined drastically to a low of positive 5.15% in the year 2011, after the disturbing economic meltdown (“Abu Dhabi Ship Building PJSC” 5). This shows the Abu Dhabi Ship Building Company’s ability to withstand the effects of the economic slowdown that began in the year 2008.

Abu Dhabi Ship Building (ADSB) Company also presented a relatively decreasing rate of its returns on assets ratio from the comparative year 2010 to the most currently published financial statements of the year 2011. The values are 7.24% for 2010 and an average low value of 2.66 % in the year 2011. This is indicative of the fact that Abu Dhabi Ship Building (ADSB) Companyis currently not more efficient in generating profits from the assets employed in the firm.

The inefficiency could be attributed to the dynamic structural demands of the service market, and probably how Abu Dhabi Ship Building (ADSB) Company has failed to master the art of servicing its clients using the appropriate and relevant approaches.

The return on equity ratio of the Abu Dhabi Ship Building (ADSB) Company has been on a relatively constant trend in the last two years. The company achieved a return on equity of 0.00% in the year 2010 and 0.00 percent in the year 2011. This implies that despite the economic turbulence in the year 2008, the company’s ratio did not drop to the worrying zone or even to the negative values as witnessed among many companies over the same period.

This was a clear indication that the leverage efforts of the stakeholders during the economic instability of the year 2008-2009 were sufficient enough to sustain the company. This is due to the fact that the company maintained a constant trend since its return on equity never went below 0.00 percent.

Abu Dhabi Ship Building Company’s efficiency

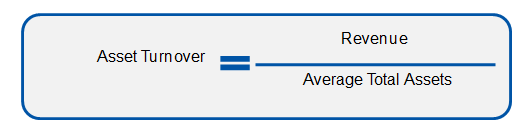

The asset turnover ratio for Abu Dhabi Ship Building (ADSB) Company has not shown a significant change in the last two years. The values are stable between 52 and 46 percent. In the year 2010, the asset turnover averaged at 46%, which improved to 52% in the year 2010. Moreover, the slight increase in the ratio between the year 2010 and the year 2011 could be attributed to the reduced impacts of the economic slowdown that began in the year 2008.

The improvement in the ratio indicates the effectiveness of the Abu Dhabi Ship Building (ADSB) Company’s management in utilizing the assets of the company to earn revenue (“Abu Dhabi Securities Exchange” 1).

Receivables turnover ratio on the other hand indicates how well the receivables are being collected from the credit customers. The rate 4.93 in the year 2011 indicates that the company is capable of converting about 5 times the value of the receivables into cash within one year. This shows that Abu Dhabi Ship Building (ADSB) Company has put into place proper policies to help in the collection of the receivables.

The higher rate of slightly above two implies that the management of Abu Dhabi Ship Building (ADSB) Company is sufficient and vigilant in collecting receivables and this works to corroborates the high amount of outstanding receivables. In the previous year, that is 2010, the receivable turnover stood at 3.54. This presented a positive increment of 1.39 (4.93-3.54). Therefore, the company is focused in its debt collection strategies, which are aimed at the improved efficiency.

However, the Abu Dhabi Ship Building (ADSB) Company has shown relatively lower capability in the management of its inventory. The values 0.93 and 1.24 rates of inventory turnover in the years 2011 and 2010 respectively. This indicates the inefficiencies on the company’s ability to convert its inventory to sales.

However, this ratio could be deceitful, given the business line of the Abu Dhabi Ship Building Company. The company may not need to convert its inventory into sales to improve its profitability. The profitability lies with the capability of the company to transform its operational efficiency legacy (“Abu Dhabi Ship Building PJSC” 6).

Abu Dhabi Ship Building Company’s EBITDA analysis

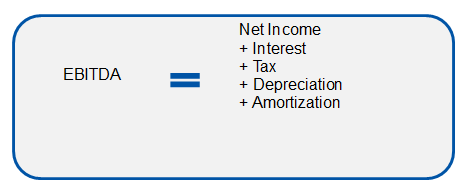

EBITDA

This is an acronym for “Earnings Before Interest, Tax, Depreciation, and Amortization”. The EBITDA for the company is AED 75,142, 000 for 2011 and AED 112, 339,000 for 2012. This show that the company’s earnings have reduced significant in the current year.

Summary of the calculations

Abu Dhabi Ship Building Company Company is performing very well, and any investor would prefer to invest in this viable business venture. This decision is made from both the financial information above and the non-financial information, which have been posted in the company’s website.

The first reason is that Abu Dhabi Ship Building Company is more liquid than most of the companies in the same industry. The current ratio for the two years remained relatively high, while for other firms in the same industry, it has fluctuated upwards. This could imply that other firms in the same industry are still not stable, and Abu Dhabi Ship Building (ADSB) Company has already attained financial stability. It is usually recommended that a company should attain a current ratio of 2, which Abu Dhabi Ship Building (ADSB) Company has already attained.

The acid test ratio is also good since Abu Dhabi Ship Building (ADSB) Company has attained above the recommended ratio of 1. As a result, Abu Dhabi Ship Building is more liquid compared to other firms in the same industry and it can meet its current liabilities from the current assets.

It can as well be argued that the claims of the creditors to the company can easily be met from the current assets of the firm. In addition, the gearing ratio of Abu Dhabi Ship Building (ADSB) Company is also very high. This implies that the company has invested much in long term investments. A creditor’s claim, being a short term liability, would be paid first before other claims are paid by the company (“Abu Dhabi Securities Exchange” 1).

Furthermore, a creditor can prefer to be a stakeholder of Abu Dhabi Ship Building (ADSB) Company due to the fact that it has adopted very good corporate governance principles. This is to ensure that the highest possible standards of corporate accountability and behaviour are attained.

The company’s directors also have adopted and adhered to these principles to ensure that this firm is well managed. With proper and well established governance of a company, the creditors are assured of the firm in meeting their claims. This is because decisions are ethically and responsibly made concerning delivery of the company’s products and services on credit.

Conclusion and recommendation

Considering the value with which prospective investors assesses the financial statements and further importance that they attach to the various significant financial ratios, the report sought to elucidate the underlying financial conditions of Abu Dhabi Ship Building (ADSB) Company. In this regard, the paper sought to evaluate the profitability ratios and the ability of the company to sustain the current profits in the foreseeable future.

As a result, the analysis of the profitability capacity of Abu Dhabi Ship Building (ADSB) Company has indicated that the company is sufficiently profitable and given the other prospects in terms of liquidity, operational efficiency and the leverage capacity, it is imperative to conclude that the company is worth investing in. Moreover, the financial assessment of the Abu Dhabi Ship Building (ADSB) Company profitability together with the competitive environment analysis also indicates positive growth prospects and this is an additional clear indicator of the financial viability of the company.

As a result of this analysis, any prospective investor of Abu Dhabi Ship Building (ADSB) Company will find it easy to evaluate the risks associated with the company as opposed to the other companies in the market. Therefore, this will help in the prospective investor in making highly informed decisions.

Works Cited

Abu Dhabi Securities Exchange 2012. Web.

Abu Dhabi Ship Building: Adsb_Naval Ship Construction 2012. Web.

Abu Dhabi Ship Building PJSC 2012. Web.