About the business

Greencore Group operates in the retail industry. The operations of the company are divided into two divisions. The first one is the Convenience Foods Division. It sells a variety of food products in the US and the UK market. Apart from these two markets, the company also has a presence in other parts of the world such as Europe and Ireland. The main categories of products manufactured in this division are chilled, frozen, and ambient foods. The food division has fifteen production locations in the United Kingdom and seven in the United States. The second division is the Ingredients & Related Division. The division is made up of Trilby Trading and companies that manufactures molasses. The divisions also handle the real estate business. Also, it is made up of experts who work towards improving the value of the firm. The company employes about twelve thousand people (Greencore Group PLC, 2014).

Auditor’s report

The independent external auditors of a company carry out their periodic audit activities with an aim of providing their opinion on whether the financial statements give a true and fair view of the performance of a company. Therefore, they express their view on the fairness of the financial statement. The main aim of auditing is to ascertain if the financial statements are prepared in compliance with the accounting standards. The independent auditors of Greencore Group indicated that the financial statements of the company give a true and fair view. This implies that the auditor’s report is unqualified. The auditors further indicated that the financial statements comply with IFRS as embraced by the EU, Generally Accepted Accounting Principles as used in Ireland, and Companies Acts of 1963 – 2012. Further, the auditors highlighted some areas that were prone to material misstatement (Greencore Group PLC, 2014). Examples of these areas are retirement benefit obligations, taxation, provisions, goodwill, and intangible assets. The main role of an independent audit is to provide credibility to the financial statements prepared by the company. This implies that the statement can be trusted and relied upon by the stakeholders. Therefore, the audited financial statement is a trusted method through which companies communicate the financial results to the users. Auditing gives the stakeholder confidence that the reported financial results give a true and fair representation of performance.

Ratio analysis

The ratios will be calculated using the end year values. Further, end year values will be used in the calculations of ratios.

Yearly percentage change

Discussion of results

Ratios

Profitability

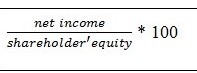

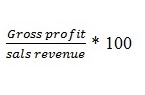

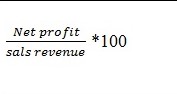

The increase in return on equity from 17.76% in 2012 to 28.46% in 2013 shows that the profitability improved. It means that the amount of profit generated per unit of equity improved. The industry average is 19%. In 2012, the ratio for the company was lower than the industry average, while in 2013 the ratio was higher than the industry average. Return on equity gives information on the efficiency of management in using capital provided by shareholders. The gross profit margin dropped from 30.09% in 2012 to 19.98%. The gross profit margin shows the efficiency of the company in managing units sold and produced, and profits. This can be explained by the high cost of sales. The gross profit margin for the industry was 10%. The performance of the company with respect to gross profit is higher than the industry average. The net profit margin rose from 5.99% in 2012 to 2.98%. It shows that the efficiency of the company in managing the cost of operation improved. It also means that the profitability improved over the period. The net profit margin was higher than the industry average in 2013.

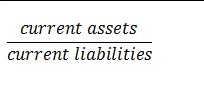

Current ratio

The current ratio dropped from 0.54 in 2012 to 0.45 in 2013. It can be noted that the current ratio is less than one. This shows that the company cannot pay the current obligations. The value of current liabilities exceeds the value of current assets by a large margin. This low value shows that the company is facing liquidity problems. This position can partly be explained by the cost of sales in the industry. The current ratio for the industry is 1.70. Finally, the liquidity of the company is lower than the industry average.

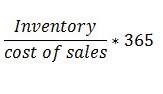

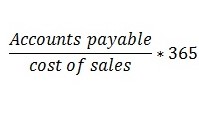

Asset management ratios

The asset management ratios that will be used are inventory turnover period and payables turnover period. The inventory turnover declined from 23.88 days in 2012 to 23.14 in 2013. This implies that the company takes a shorter number of days to replenish stock. The decline is an improvement in inventory management. Further, it can be noted that the ratio was lower than the industry average (50 days). This implies that the efficiency in the management of inventory is higher than the industry average. The payable turnover period rose from 78.24 days in 2012 to 86.26 days in 2013. The decline shows that the company takes a long period of time to pay trade payables. Further, it is an indication of a reduction of efficiency. The company’s level of efficiency in managing payables was lower than the industry average. Thus, a conclusion cannot be made as to whether the overall efficiency has improved or not because the two ratios used gave differing results.

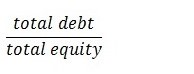

Leverage level

The total debt to equity ratio will be used to ascertain the gearing level of the company. The total debt to equity ratio dropped from 143.95% in 2012 to 98.51% in 2013. The decline shows that the amount of debt in the capital structure reduced. Further, it can be noted that the Greencore Group has a very high level of debt. For instance, in 2012, the amount of debt exceeded the amount of equity. Also, the leverage level of the company exceeded the industry average (4%) by a large margin. A high leverage level discourages investors for putting in their capital in the company because the high cost of capital will reduce the profits attributed to the shareholders.

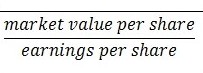

Yearly percentage change

The total sales revenue rose from £1,161,930 thousand in 2012 to £1,1970,099 thousand in 2013. The increase is equivalent to 3.03%. The increase was majorly contributed by the Convenience Food Division. The Ingredients & Related Division does not contribute significantly to the sales revenue of the company. The growth in sales can be attributed to the several acquisitions, disposals and expansions made during the year. The operating profit rose from £46,536 thousand in 2012 to £59,676 thousand in 2013. The increase is equivalent to 28.24%. The increase can be explained by the decline in operating costs. It can be noted that the increase in operating profit is more than the increase in revenue. It could be an indication that the company is efficient in managing the costs of operation. Finally, the share price rose from £0.68 in 2012 to £1.455 in 2013. The total increase was 113.97%. The growth in share prices is significant because it translated to increase in shareholder’s wealth. The trading of the shares of the company is considered to be bullish because the stock prices are currently rising. An investor can either sell the shares and make high profit or hold the shares with an expectation that the share prices will increase further.

DuPont Analysis

DuPont analysis breaks down return on equity into three components. These components are asset turnover, leverage factor and profit margin. It is a quick way of checking strengths and weaknesses of a business. It shows efficiency in the use of inputs to generate profits, use of capital to generate gross revenue and how a business leverages debt capital. Return on assets gives information on net income, sales and total assets. Return on equity gives information on net profit, equity, pretax profit, EBIT, sales, and assets. A summary of the computations of these three components is shown below.

Return on Equity

= Net Profit Margin (Net profit / sales) * Total Asset Turnover (Sales / Assets) * Equity Multiplier (Assets / Equity)

The net profit margin rose from 2.98% in 2012 to 5.99% in 2013. It shows that the overall profitability improved during this period. The total asset turnover increased from 1.14 in 2012 to 1.18 in 2013. This shows that the revenue generated from a unit of total assets rose over the period. However, the equity multiplier dropped from 5.08 in 2012 to 4.01 in 2013. The decline can be attributed to the increase in shareholder’s equity. These changes resulted in an increase in return on equity from 17.26% in 2012 to 28.34% in 2013. The main contributor to the return on equity is equity multiplier. The value was high during the two years. It implies that the company is efficient in using the assets.

Reference

Greencore Group PLC. (2014). Annual reports and accounts. Web.