Introduction

This report aimed to assess the current performance of the car industry and determine the potential likelihood of moving to the motorcycle industry as a related sales industry. The key trends in sales and consumer interests were reviewed, and the outcomes of the assessments were compiled into statistics and visual aids. As a methodology for comparing development prospects, Porter’s Five Forces model was applied. According to the comparison, the conclusion was made that moving into the motorcycle industry could help broaden the sphere of the company’s influence, but potentially high sales in this area were unlikely.

Description of the Problem

A diversification strategy based on attracting new platforms for product distribution is a relevant approach to expanding the sphere of influence and strengthening a market position. An opportunity to supply motors to a new market is a potentially viable solution to bolster the company’s portfolio and increase revenue. The analysis of these perspectives concerns both internal stakeholders, including the sales department and the company management, and external stakeholders, such as component suppliers, investors, and potential customers. As quantitative data to include in the research, the current performance of the US automotive manufacturing industry and its trends will be examined with the same data from the motorcycle industry.

Description of the Current U.S. Automotive Industry

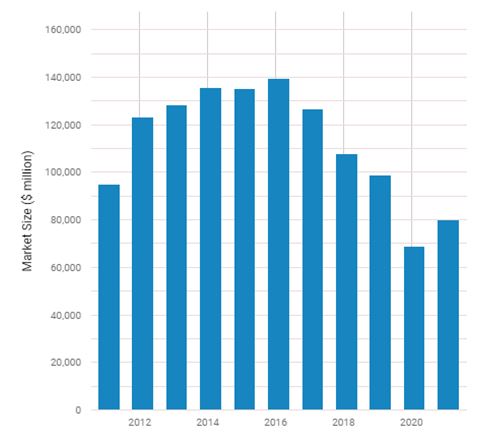

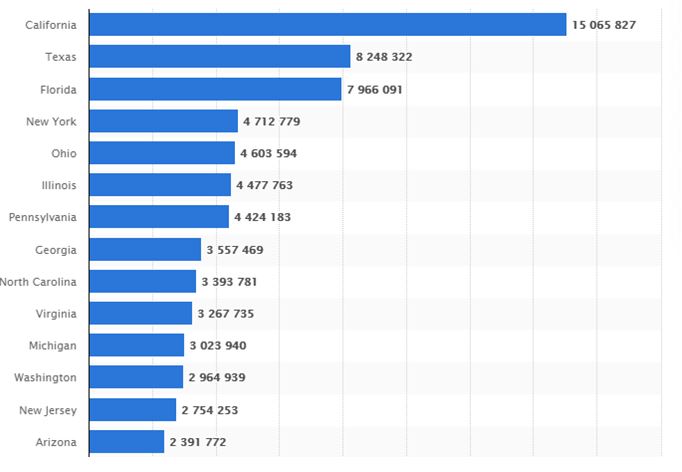

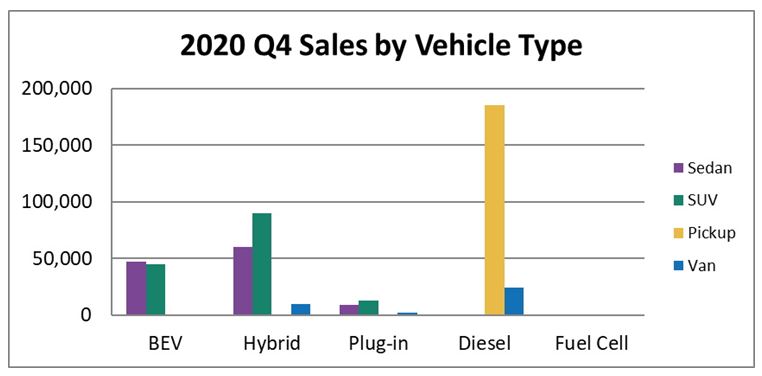

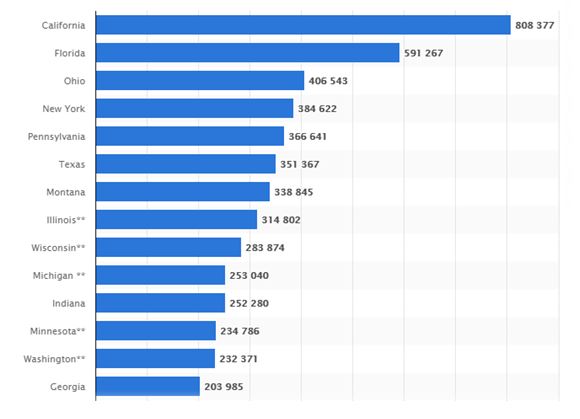

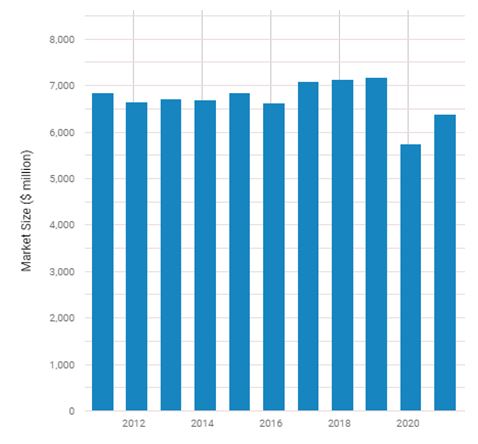

Amid the COVID-19 pandemic, vehicle sales have declined, and the total net worth of the industry decreased in the US. At the end of 2020, this market was $69 billion (“Car & automobile manufacturing,” 2020a). In Figure 1, the indicators of recent years are presented, and the downward trend is obvious (“Car & automobile manufacturing,” 2020b). Regarding sales by regions, the highest car purchases are on the west coast. According to the official statistics in Figure 2, California’s share of new car registrations nearly doubles that of Texas, the second-largest state by sales, by the number of new car registrations (“U.S. automobile registrations,” 2019). Concerning sales by fuel type, in Figure 3, the correlation is represented (“U.S. vehicle sales,” 2020b). Diesel cars were most in demand in 2020; in second place, there were hybrid cars were; in third place, there were electric cars were (“U.S. vehicle sales,” 2020b).

Current Automotive Market Trends

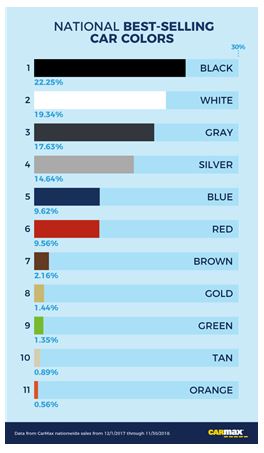

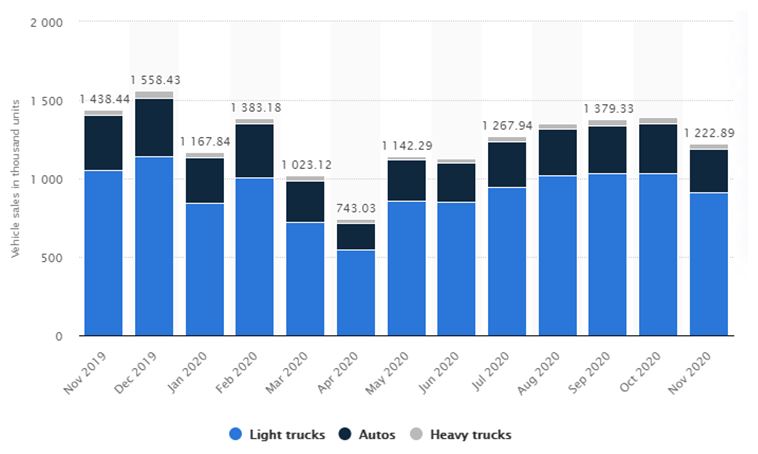

In terms of consumer preferences, the US car industry is characterized by specific trends. In Figure 3 above, the distribution of vehicles by engine type is presented, and hybrid cars are in greater demand than electric cars (“U.S. vehicle sales,” 2020b). The choices of functions and machine styles also shape the current trends. In Figure 4, the most popular models by state of the country are presented, and in Figure 5, the most popular car colors are offered (“Which car color is most popular,” 2019; “The most popular cars,” 2021). The share of sales of SUVs and light trucks decreased by 2.3% in 2020 compared to the previous year, and at the moment, the market size is $173 billion (“SUV & light truck manufacturing,” 2020). According to Voelk (2020), “S.U.V.s made up 47.4 percent of U.S. sales in 2019 with sedans at 22.1 percent” (para. 4). In Figure 6, the sales volume of common autos, light trucks, and heavy trucks are presented (“U.S. vehicle sales,” 2020a).

Description of the New Industry

As a new area of focus, the motorcycle industry has been chosen. As in the automotive industry, its sales figures fell in 2020 (by 3.5%), but overall, the industry is growing (“Motorcycle, bike & parts manufacturing,” 2020a). The affordability, greater safety, and vehicle versatility of cars are the key constraints to growth. As aspects that have allowed competitors to be successful in this industry, one can mention the constant expansion of motorcycle models, their attractive appearance, and history.

Its potential is promisingly large, although today, its market size is not very big – $6 billion (“Motorcycle, bike & parts manufacturing,” 2020a). As in the automotive industry, motorcycle sales on the west coast are substantially higher, as shown in figure 7 (“U.S. motorcycle registration,” 2020). Today, there is an upward sales trend, and based on the statistics in Figure 8, the share of motorcycles sold will be higher than in 2020 (“Motorcycle, bike & parts manufacturing,” 2020b).

Current Market Trends in the News Industry

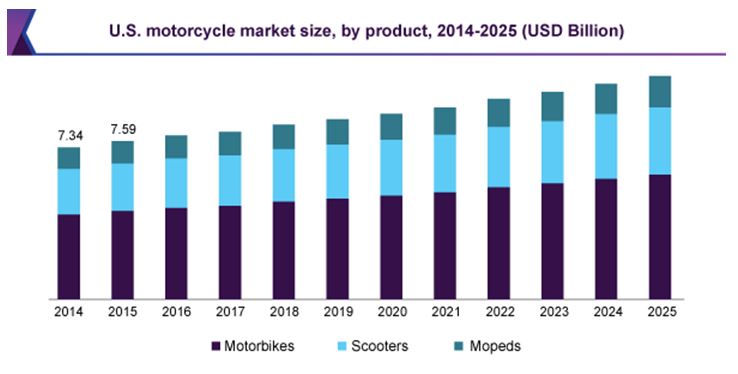

The analysis of the current trends in the motorcycle industry can provide the key insights into consumer preference and demand. In Figure 9, the correlations are shown by market size and type of motorcycle model (“U.S. motorcycle market size,” 2018). Based on these correlations, one can note that there has been steady growth, and approximately the same ratio of motorbikes, scooters, and mopeds has been preserved.

Porter’s Five Forces Analysis

According to the current results of the development of the two industries considered, the prospect of the transition to the new motorcycle are can be made based on Porter’s Five Forces analysis. For the motorcycle industry, the level of rivalry is high since market competition among several brands forms the basis of sales (“Motorcycle, bike & parts manufacturing,” 2020a). The power of buyers is high due to the formation of demand, while the power of suppliers is low since components can be ordered from different manufacturers. The threats of new entrants and substitute products are negligible because a few models are at the top of the line due to their long history of existence and high technical performance.

Conclusion

In general, a transition to the motorcycle industry is acceptable, but large profits are unlikely. Compared to the motorcycle industry, the car industry is more promising due to higher profitable prospects realized in conditions of a wide variety of market products. This may take many efforts to become a leader in the motorcycle sphere. At the same time, in the automotive sector, individual trends affect demand, in particular, the acquisition of hybrid and e-vehicles. Therefore, the transition to the motorcycle industry may allow expanding the sphere of influence, but work in the automotive sphere will be more profitable and active.

References

Car & automobile manufacturing industry in the US – Market research report. (2020a). IBISWorld. Web.

Car & automobile manufacturing in the US – Market size 2005-2026. (2020b). IBISWorld. Web.

The most popular cars by state. (2021). Insurify. Web.

Motorcycle, bike & parts manufacturing industry in the US – Market research report. (2020a). IBISWorld. Web.

Motorcycle, bike & parts manufacturing in the US – Market size 2003-2026. (2020b). IBISWorld. Web.

SUV & light truck manufacturing industry in the US – Market research report. (2020). IBISWorld. Web.

U.S. automobile registrations in 2018, by state. (2019). Statista. Web.

U.S. motorcycle market size, share & trends analysis report by product (motorbike, scooter, mopeds), competitive landscape, and segment forecasts, 2018-2025. (2018). Grand View Research. Web.

U.S. motorcycle registration estimates in 2019, by state (in units)*. (2020). Statista. Web.

U.S. vehicle sales between November 2019 and 2020, by vehicle type. (2020a). Statista. Web.

U.S. vehicle sales dashboard. (2020b). Diesel Technology Forum. Web.

Voelk, T. (2020). Rise of S.U.V.s: Leaving cars in their dust, with no signs of slowing. The New York Times. Web.

Which car color is most popular in your state? (2019). Carmax. Web.