This innovation case study explores Apple Company’s managerial decisions that have been made over time. The paper also investigates how the company has responded to changes in competitive markets.

Background Information

The business sector has increasingly become competitive. This situation has forced businesses to make radical decisions to meet the ever-rising consumer needs and fluctuating market demands. As a result, managerial decision-making has become a crucial part of business processes to enable them run objectively. Accomplishment of organizational goals and objectives requires the managers to make sound decisions that are economically practicable as solutions for encounters that deter the progress of a business. However, effective decisions demand managers to have sufficient knowledge about the basic structures that they should use to draw feasible conclusions. This essay explores Apple Company’s managerial decisions that have been made over time. The paper also investigates how the company has responded to changes in competitive markets.

Apple’s History

Apple Inc. is a mass designer, producer, and distributor of personal computers, mobile phones, internet servers, and consumer electronics. In addition, the company designs computer and mobile phone software alongside other functions such as distribution of media content. Steve Jobs and Steve Wozniak conceived the idea of Apple Computer in 1976 before the multinational corporation kicked off its operations a year later. However, the introduction of Apple I computer in 1977 failed to satisfy consumer demands. Nevertheless, Jobs and Wozniak launched Apple II in 1980, which was a successful step towards accomplishment of the firm’s initial goals.

Despite of being one of the leading producers and distributor of personal computers, the company began facing stiff competition from other companies who offer similar products such as HP, IBM, and Dell. This situation compelled the two founders to initiate significant management shifts to counter the market competition. By 1994, Apple has designed a powerful PowerMac PowerPC processor that enabled the company to compete with Intel PC processors. In 1995, the company had an order backlog of one billion dollars. With the advancement of Microsoft’s windows operating system, the financial status of the company worsened in the consecutive years. As a result, Apple Company made numerous acquisitions in 2002 to speed its production and development of the iPod technology and/or intensify its iTunes music store services in countries such as the United Kingdom, Germany, and France.

In the next two years, Apple will incorporate iPod and iTunes technology in the audio systems of various motor vehicle companies such as Ford, General Motors, Mazda, and Chrysler and several airline companies such as Air France, Emirates, and the United Airlines among other automotive and aircraft industries. In 2007, the founders changed the name Apple Computer to Apple Inc. since the company had differentiated its products and services. At the same time, Apple Inc. launched iPhone Smartphone. The product meant a revolutionary phase for the business.

Apple’s Financial Performance

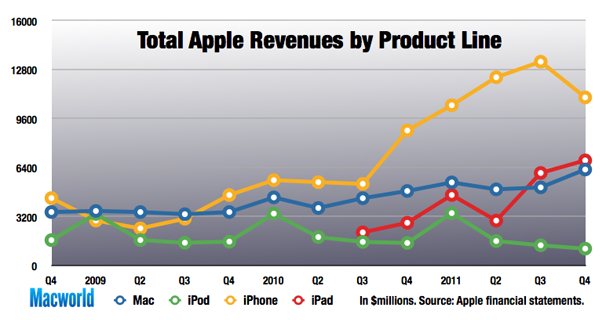

The financial performance varies amongst Apple’s individual products as represented in the graph below.

Apple’s Operational Risk

Apple Inc. has had various risks and uncertainties in its operations that have significantly slowed its growth. Tan (2013) reveals that the company has undergone sporadic management changes and inconsistent opinions that have lessened the company’s competitive advantage in PC and mobile technology over the years. Despite its diversification of products, the company has majored in intensification of its iPod music technology and development of the iTunes software. This business trend has posed a great risk for the industry as it has constricted its market for products. For instance, Apple’s market share has condensed to lower than 6-percent due to lessened input on development of other Apple products and software. There is also reduced motivation in software development for other Apple products since the market size has significantly reduced for such merchandise (Waykole, 2013). Furthermore, the fact that the world production techniques and distribution channels are disrupted by various economic, social, and political factors poses uncertain markets for the company’s products. Apple’s financial reports indicate possible risks and uncertainties that have affected the operations of the business. The software industry has reached a competitive edge with the availability of robust operating systems. The stiff competitive gap has put Apple Inc. at a risk of losing clients on account that the company has failed to match the existing operating systems.

Effect of Government Regulations

Different countries around the world have varying regulations that govern international business operations. Waykole (2013) posits that both local and global government regulations have influenced Apple’s decisions and operational capabilities, especially in foreign markets. Waykole (2013) confirms that Apple Inc. adopts a proactive strategy to practice sustainable business activities. This approach has led to additional costs that are not proportional to the productivity and profitability of the business. However, abstinence from environmentally friendly production might lead to censorship and probably termination of Apple’s operations by policy regulators in some countries. As an alternative, the company has chosen to comply with government regulations in both local and global business localities to curtail risks and future uncertainties.

Production Function Inputs

Just like any other company, Apple’s operations are capital and labor intensive. Additionally, land and associated natural resources also form crucial inputs for the overall performance of the giant computer and telecommunication multinational. The company subcontracts other mobile technology companies, especially in China, to assemble and package some of its product components to reduce the overall operational expenditures on labor and space. However, passing on production roles to overseas companies lessens Apple’s responsibility in terms of the value of the finished products. However, it can sometimes result in unpredicted imperfections, which might reduce the overall product quality. In addition, closure or termination of an overseas subcontractor can lead to delayed delivery of the final product. Furthermore, natural calamities such as earthquakes in Japan and China can cause unpredicted closure of firms or damage of components. For example, Waykole (2013) reveals that Apple’s operations on Mitsubishi and Toshiba were forcibly brought to a halt when an earthquake hit Japan in the first quarter of 2011.

Introduction of New Products

According to Tan (2013), Apple Inc. has introduced new products to the existing markets since the establishment of the firm. The company has strived to gain a competitive advantage by establishing aggressive pricing approaches and introduction of alternative brands owing to the shifting consumer demands and changes in technology. The shift has led to a continuous advancement of products. To meet the industry ideals and promote its economic recovery, Apple has resorted to new product introduction and/or establishment of surplus retail outlets in various parts of the globe (Wayloke, 2013). For instance, Wayloke (2013) reveals that Apple introduced the iPhone Smartphone in 2007 to diversify its production by venturing into mobile phone technology. The introduction the Smartphone into Apple’s existing markets led to subsequent introduction of other products such as the iBook software. The introduction of new merchandise and establishment of new store outlets have gradually raised the financial status of the company.

Price Stability

The prices of Apple products change or remain stable depending on demand, product generation, and its relevance to clients. For instance, a recent survey conducted by Wayloke (2013) determined that the price for the Mac PC has remained stable for the last five years. However, prices for other products such as the iPad and the iPhone have gradually fallen as Apple manufactured new generations of the same products that fetch comparatively higher prices. Further, the iPad ASP generation has declined in price since 2012 whilst the iPhone’s ASP price has dropped by nearly 7-percent in the same duration. Tan (2013) claims that the strength of Apple’s products has made the company introduce premium services. According to Tan (2013), consumers will continue paying for premium services whilst purchasing Apple products such as the iPad and iPhone regardless of the high prices. This trend indicates that Apple’s prices are quite inelastic. Hence, the company seems rigid in terms of its price decisions.

Profitability

A profitability analysis of Apple Inc. indicates that its profit margins have gradually deteriorated over the years with rare improvements in some business periods. A research conducted by Tan (2013) to analyze the profitability of the company indicated that its gross profit margin improved slightly in the 2011-2012 financial year. However, this profit margin declined dramatically in the 2012-2013 financial year. Generally, changes in product and component costs have adverse implications on Apple products. Douglas (1987) posits that a company’s profitability varies in accordance with the nature and pricing of merchandise and marketing strategies. For instance, Apple software generates comparatively higher profit margins than the rest of its merchandise. Nevertheless, the PC and mobile telecommunication industry has had a great influence on the cost, operations, and profitability of the company. Apple operates in a significantly dynamic market owing to dramatic shifts in computer and mobile technology. This situation has profoundly influenced the company’s managerial decision-making in an attempt to attain the anticipated targets.

Apple’s Competitive Environment

Undoubtedly, Apple Inc. operates in a very competitive computer and telecommunication industry due to a number of factors. At the outset, Apple’s business faces international pricing forces that have accompanied increased hardware and software competition. Interminable advanced use of technology has profoundly condensed product life as new-fangled technologies emerge even before the exhaustion of the existing ones. This circumstance has led to product transition challenges and indeterminate inflation of component costs. The overall effect has resulted in competitive pressures in product design, production, distribution channels, and market share. Although Apple has made significant attempts to guarantee product design and quality, many consumers have criticized its competitively high prices. Aggressive exchange rates in the international market have hindered the multinational company from gaining a competitive advantage over its competitors such as Dell, HP, and IBM. Apple’s distribution of market power lies within its ability to deliver innovative products that satisfy consumer taste. The values of the firm’s products serve as determining factors for pricing strategies. The strategic behavior of Apple involves hardware and software changes to remain at par with the most current technology in the computer and mobile telecommunication industry. However, competition remains palpable as competitor companies adopt new technologies at a similar rate (Waykole, 2013). Despite the challenges, Waykole (2013) confirms that Apple has an appeal for strategic business locations such as shopping malls and urban centers.

Market Structure

Apple adopts a 3-point marketing philosophy that has taken the company through falls and ups in the last three and half decades (Tan, 2013). Apple’s marketing approach embraces three core consumer-centered principles that include empathy, focus, and impute. Abiding by these principles, Apple’s marketing strategy exemplifies a limited product line approach that deals with promotion of one product at a time. Using this model, the company has focused on differentiating the computing and mobile technology landscapes with a strong sense of consumer taste. For instance, the generation of iOS7 with contrasting features for the iPad and iPhone leaves the consumer with wide-ranging product choices. In addition, Apple dominates its hardware and software products that make it monopolistic. Nevertheless, this marketing approach has led to anticompetitive aggression that makes its future uncertain. At Apple Inc., the value of a product guides the pricing decisions. As a result, the firm strives to offer highly differentiated products that attract consumers at relatively higher prices than products of competitor firms.

Non-Price Competitive Strategies

Apple is an oligopoly company that extensively uses non-price competitive strategies to gain competitive advantage over its competitors (Douglas, 1987). First, the company guarantees product quality to its consumers. In the modern society, people have become increasingly sensitive to the quality of their electronic gadgets. Consequently, consumers will prefer purchasing a computer or a phone that offers them quality features in terms of both hardware and software. In addition, Apple strives to build strong customer loyalty as a way of penetrating the mobile market with ease. Lastly, Apple spends millions of dollars to advertise its high quality products. This strategy has enabled the company promote Apple products while at the same time strengthening its brand.

Decision Flaws

Perhaps, Apple Inc. manufactures brands that are amongst the world’s best computer and mobile technology gadgets. However, certain decisions in the company focus on short-range profits. According to Tan (2013), the design, development, production, and release of the iPhone in 2007 was a major breakthrough for Apple that made the firm lead other competitor firms in the mobile technology. The edge of mobile technology earned the company dramatic profits that ran into hundreds of billion dollars. However, while the company boasted its technology prowess, other technologies such as Android and Windows Phone software ventured into the Smartphone market, thus posing stiff competition for the iPhone technology. The situation took down Apple’s profits by over 20-percent (Waykole, 2013). In the future, the management should focus on both short-term and long-term profitability and product relevance.

Conclusion

The chip technology industry has become increasingly competitive for many multinational corporations that operate in the industry. There is an emerging need for companies to embrace new managerial decision-making strategies to remain competitive over fluctuating market environments. Future managerial decisions require companies to become more realistic whilst focusing on risk and uncertainties that may arise in future operations. In addition, there is a need to balance pricing of products with profit margins and quality delivery to enjoy a larger market share whilst remaining competitive. For instance, Apple Inc. might have to change the pricing strategy and lower the prices of individual products to capture a sizeable client base in the future lest its sales remain slow for the next few years. Nonetheless, companies should adopt corporate managerial decision-making strategies to foster the formulation of vigorous and holistic decisions that can take them through the shifting market trends.

References

Douglas, J. (1987). Managerial Economic: Analysis and Strategy. London: Prentice Hall.

Tan, J. (2013). A strategic analysis of Apple Computer Inc. & recommendations for the future direction. Management Science and Engineering, 7(2), 94.

Waykole, V. (2013). Role of Managerial Economics in Competitive Edge Dynamic Business Decision-Making Process. Asia Pacific Journal of Marketing & Management Review, 2(1), 136-39.