Abstract

Most mergers are carried out with a view to jointly share market opportunities and strengths that underpin each participating company. The top management needs to see eye-to-eye with stakeholders on many critical issues that may impact upon running of a successful business model in a competitive environment and also positively utilize structural changes that have taken place in business, post merger.

However, the main aspects of the merger are gaining objectives in terms of hiking share prices, allocating business prospects in different countries, improved resource management and enhanced combined business prospects, and all form the core of future business.Seen on a larger canvas, the spin-offs from merger could signal large scale favorable and beneficial changes for the company; workforce of the company and all people who have contributed in small, or large measures to make this a successive and beneficial merger or acquisition for all concerned. It is also necessary that the grey areas in mergers and acquisitions are identified and due diligence needs to be applied to significantly reduce their impacts or even eliminate them completely for the better interests of the company as a whole.

Introduction

Mergers and acquisitions (M&A) are corporate strategies, helping in the expansion of the business entities within and beyond countrywide borders. With the globalization process in full swing, these genres of strategies have gained popularity and credence. Perhaps the main issue would be the stakes involved and the synergistic advantages gained by participating players.

This process proves its enhancement in the growth of the companies in general and the industries in particular. It aids toward the financial growth, attaining market share, helps in the easy entry into a new business, gaining customers. “Mergers and acquisitions (M&A) and corporate restructuring are a big part of the corporate finance world. Every day, Wall Street investment bankers arrange M&A transactions, which bring separate companies together to form larger and more effective ones.

When they are not creating bigger companies from smaller ones, corporate finance deals do the reverse and break up companies through spinoffs, carve-outs or tracking stocks” (McClure 2010).

M&A strategy deals with the firm in a long term dimension till the whole life of the firm. The strategies need be framed and applied carefully for the smooth and successful functioning of any organizations. The strategies are not essentially the same till the continuation of the growth of the organization. It can be and must be changed according to the changes of the business environment in general and environment in which the organization exists in particular. “Approach to future that involves

- examination of the current and anticipated factors associated with customers and competitors (external environment) and the firm itself (internal environment),

- envisioning a new or effective role for the firm in a creative manner,

- aligning policies, practices, and resources to realize that vision” (Corporate strategy, n.d).

Strategy is action planned, there is a saying that thing well planned is half done. Strategy is a long term plan for the organization when it is done in an operational dimension, which is when the planning is performed at the operational level it meant towards the short term plan.

According to Bob De Wit and Ron Meyer in their book strategy synthesis strategy is given as a paradox “(at) the heart of every set of strategic issues, a fundamental tension between apparent opposites can be identified (p 13)” (Kazmi 2008, p.11).

The authors believed that strategy is a bit of a complicated issue. When dealing with strategy, two dimensions need to analyzed carefully and thoroughly. The thoughts with reference to strategy will differ with people who are dealing with the thought process. Well planned strategies and when implemented with perfection will easily pave towards the goal of success to the organization.

The aim of business is profit making and wealth creation which are given greater importance for any business. No business is planned organized and implemented with an aim of charity. Planning is essential in the strategic and the operational dimension. Mergers and Acquisitions will definitely result in a number of causes and consequences in all the activities of the organization and the impact will be with the environment in which the organization and the industry are operating. With the introduction of the concept globalization business started expanding beyond the borders.

Companies started merging and acquisitions with their neighbor countries.like any other process of business this too is associated with the positives and negatives as consequences and causes.

These are needed to be analyzed and will be of much interest to the corporate world, which will constitute the analysis and will be gaining from the results of such analysis. In this analysis the strategic and operational dimensions are concerned.

Literature review

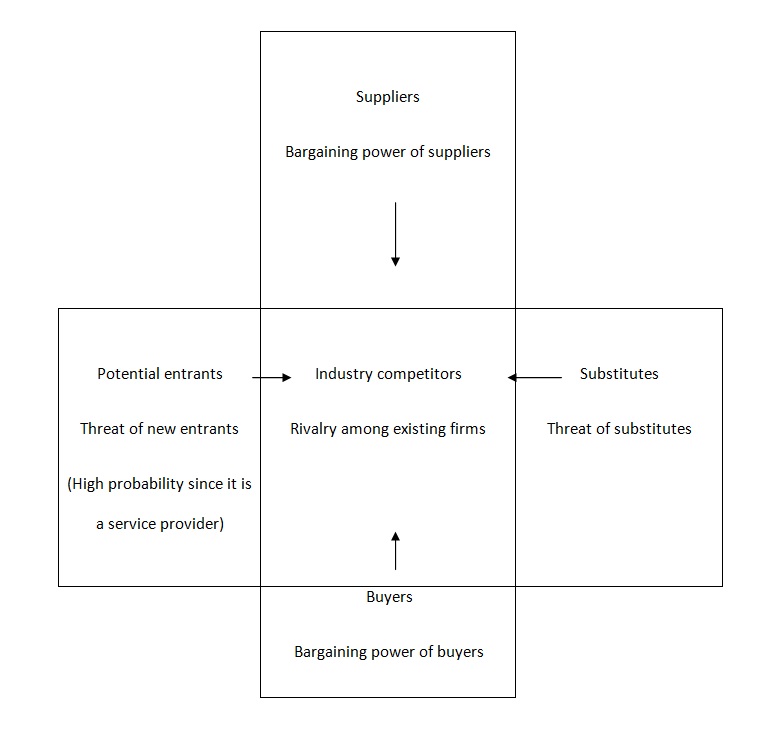

Perhaps the Porters 5 force model clearly and correctly applies M&A system in its present context. The predatory and compelling reason for seeking mergers could be traced to Porter’s argument of suppliers bargaining powers, threat posed by existing and potential rivals, competitive elements in business environment, issues arising out of substitute products and the bargaining powers of buyers.

Porter’s Five Forces

Coming next to the Barney – Citibank merger

The proposed merger between Smith Barney and Morgan Stanley’s Global Wealth Management Group was made public by Morgan Stanley and Citigroup, with the former investing to the tune of $2.7B for a 51% stake in the joint venture. The primary reason was that at that time, both Morgan Stanley and Citigroup were short of funds and as a matter of fact, the Japanese financial major, Mitsubishi Financing had invested in order to stake 21% claim in Morgan Stanley. The Morgan Stanley Smith Barney merger heralds the beginning of new era in global wealth management services, very much of the kind offered by ABN –Amro banking and financial portfolio services. Besides, “

“Corporations may pursue mergers and acquisitions as part of a deliberate strategy of diversification, allowing the company to exploit new markets and spread its risks. AOL’s merger with media giant Time Warner, for example, saved it from being affected quite so disastrously as many of AOL’s Internet competitors by the ‘dot com crash’” (Why do firms carry out mergers and acquisitions, and how can the difficulties involved be overcome? 2003).

According to J. Fred Weston, Samuel C. Weaver, the process of Mergers and acquisition gained acceleration in the 21 st century although it was started in the 19th century.After that the process of merger and acquisition increased in number. The process was gaining popularity till now. A number of industries are benefited with this process. In the process of Merger one unit is formed from two or more units of similar dimension and characteristics which help in the easy expansion of the business some times and some times result in any other related advantages.

This process along with the companies is proved beneficial for the end users, as far as the communication industry is concerned; it is evident that the communication industry witnessed large no. of takeovers and mergers, which resulted for the reduced service cost taken from the end users. The world economy is evident of this fact. Joint ventures, strategic alliances, restructuring activities are also included in this strategy. Today mergers and acquisitions are visible in all industries irrespective of whether it is any manufacturing, pharmaceuticals, telecom, steel etc. (Mergers and Acquisitions by J. Fred Weston, Samuel C. Weaver, Mergers and Acquisitions)

The major cause for many numbers of mergers and acquisitions is occurring because of the fact that the business environment believes in the principle of synergy.

- “The interaction of two or more agents or forces so that their combined effect is greater than the sum of their individual effects.

- Cooperative interaction among groups, especially among the acquired subsidiaries or merged parts of a corporation, that creates an enhanced combined effect” (Arbib 1987).

According to Kamal Ghosh Ray in his book ‘Mergers and Acquisitions’, this sort of corporate strategy is a complicated one, still it is occurring in large numbers across the world and almost in all business. The major reason as pointed out by the author for this is the stiff competition the businesses all over the world is facing this is one among the best way of getting the market share into acquirers’ account or an added advantage for both of the merging companies. This is said so because such a process cause for the easy victory of getting a competitor dissolved along with the advantage of getting the customers hold by them. To survive in the market the process had become essential. Liberalization in the trade policies of different nation boosted to perform the function across the border. The effect of globalization too added on to the benefit of the process. With all this the world becomes too short to acquire and merge with any firm round the globe. (Mergers and Acquisitions by Kamal Ghosh Ray)

Methodology

Mergers and acquisitions (M&A) are the important element of the financial world. These business restructuring brings the different business companies mutually to form big ones. Merging is an economic tool for making the business safe and with huge profit. It will widen the business across the areas. It will take place when the two companies have the joint agreement to go in one hand. Acquisitions are different from the merger. It is related with the takeover of one company by another one. It occurs between the tendering and the intended company. There will be welcoming or aggressive takeovers. The tendering company will buy the shares of the targeted company in acquisition.

Mergers and acquisitions is a prominent strategy for the international companies. There will be major plans to make this merger and acquisitions a success. There will be broad thinking by the company managers to achieve the sensation in the business world.

Research design and data collection methods

This study is analyzing the importance of mergers and acquisitions, with qualitative and quantitative methodologies. There will be different culture and practices in this merger and acquisitions as it will be from the two companies that are different from one another.

The research design would be based on personal interviews with top management and trade union leaders of sample study of 25 jointly merged companies in the recent past. These company directors and top managers would share their experiences, pre, post and during the merger negotiations and the changes that have taken place in their respective industries, post merger implementation plans and programmes. This could also be in terms of gaining first account of merger deliberations and more critically, whether the aims and objectives of the merger from both sides have been delivered.

The justification and rationale behind this is that only responsible authorities of the company at top level would be able to afford answers to critical and case related topics on the subject of merger and its many and varied ramifications across the industry and trade. This is precisely the reason why the research design emphasizes on personal confabulations and deliberations with Group Directors and Managers.

The data collection while resting on the deliberations with Group Directors and whole time managers of twenty five (25) major merged institutions and government enterprises, would also consider using internet search engines to locate facts and figures of the major 30 mergers that have occurred since 2009, not only in the US but in other parts of the world as well. This could give a more macro and detailed account of global mergers- what spurs them and how they are conceived and delivered. Besides, the post merger scenario would also be considered in terms of attaining synergistic goals, widening customer base, increased share value for merger company, and other direct and indirect benefits of an enforce merger scheme.

But the ultimate aims of the both companies were the profit and they will co-ordinate their work disregarding their differences. One of the major mergers in the end of 19th century was between Glaxo Wellcome and SmithKline Beecham and formed GlaxoSmithKline. Some of the other examples include Pfizer Inc and Wyeth, Royal Dutch Petroleum Co. and Shell Transport & Trading Co., etc. The study focuses on the necessary requirements to achieve this successful merger and acquisition, planning a corporate strategy and learning the outcomes from the previous mergers and acquisitions and studying the future plans. For this study separate qualitative and quantitative methodologies can be used. “The benefit of qualitative research is its ability to allow the investigator to gain depth and detail (Patton, 1990), and to address the ‘how and why’ questions (Yin, 2003).

Researchers suggest a qualitative approach may yield important insights into the phenomena of mergers and acquisitions (Pablo, 1994; Cartwright & Cooper, 1990). This methodological design is particularly useful in expanding our understanding and knowledge of mergers and acquisitions in terms of strategic planning and the issues surrounding the due diligence process” (McDonald et al 2005, p.5).

The inspiration for qualitative method is different from the quantitative approach. Qualitative system is planned to help the researchers to comprehend the public and the societal and intellectual circumstance which they exist. The methodology used for the study is questionnaire, which is a quantitative method. The study encourages scrutinizing the effects of merger and acquisition. The data collection involves the interviews. The participants in the study included the higher executives of the company and the session helps in knowing the respondents views on merger and acquisitions and how the company is exaggerated positively or negatively in which the responses interrelate acceptable opinions and interpretation.

The queries are required to be observed for consistency and strength. Data will be collected and analyzed by using qualitative techniques such as interviews, questionnaire survey, etc. The primary data is to be collected from the respondents, secondary data is to comprise of reference concerning research topic.

The main aim of the research is to conduct a detailed study regarding the mergers and acquisitions. For this purpose, the qualitative as well as quantitative methodologies are employed, as these will helps in reaching the accurate data. Research design comprises primary data as questionnaire, interviews, sampling, surveys, etc. Accurate research plan will guide to a proper study. The thought and the idea of the qualitative study are the employment of statistical and arithmetical form and examination of the data.

Research plan

This is most important part of the methods in making a complete research and occupies in judgment creating further study of all the information and sources collected. This will makes to create the major idea of the research. The research method used for analyzing the mergers and acquisitions and its cross-cultural variations are the observations used in this study.

The idea of the quantitative method is the employment of mathematical and statistical model and analysis of the hypothesis. “While there are ways to streamline data collection and analysis to produce timely qualitative research results (e.g. develop a report template, design interviews and coding schemes with a report format in mind), there is a danger that researchers will simply confirm existing views on the subject” (Frankel & Devers 2000, p.9).

Data collection

It is the method of collecting facts used in replying the research questions. Primary or secondary data, survey design, sampling, survey organization are some matters related with this.

Primary data and secondary data

It is based on the research question and the availability of these data sources. Secondary data consists of information gathered from the related reviews or from the knowledge of other peoples.

Qualitative research

This qualitative approach considers the cause and matters in the decision production approach. In the current situation, the mergers and acquisitions are common in the business world, the research matter is the final outcome and the various cultural and resource differences. The mostly used method is the questionnaire that will give supportive facts from the executives of the company.

Questionnaires

“Questionnaires are a popular means of collecting data, but are difficult to design and often require many rewrites before an acceptable questionnaire is produced” (Primary data collection methods: Questionnaires, n.d).

Quantitative research

“Quantitative research is concerned with testing hypotheses derived from theory and/or being able to estimate the size of a phenomenon of interest. Depending on the research question, participants may be randomly assigned to different treatments. If this is not feasible, the researcher may collect data on participant and situational characteristics in order to statistically control for their influence on the dependent, or outcome, variable” (Data collections methods, n.d).

Analysis, Findings and discussions

While a merger may sound simple on paper and in accounting for such regroupings, the empirical facts reveal otherwise. The valuation of the merger acquisition purchase consideration is a major issue as is the post merger control and management of the firm, post acquisition. Besides, the absorption of existing staff of the absorbed company into the new firm is also a sensitive matter that needs careful consideration and implementation, since they constitute a critical element of the reconstituted enterprise. The fate of erstwhile directors in the respective merging and takeover company are also matter of concern, since it is quite possible that the merged firms would like to induct fresh blood into their rank and file, “When a publicly owned firm that is not owned by its management is merged into another company, the acquired firm’s managers will be worried about their post merger positions.”

(P. 986-7: Chapter 26, Mergers, LBOs, Divestitures, and Holding Companies. Financial Management –Theory and Practice :Eugene F.Brigham and Michael C. Ehrhardt )

The analysis of this research reinforces the fact that there is need for greater emphasis on the cultural aspects of both firms in the case of acquisitions and mergers. For one thing, when there is diverse culture present in the scenario, there arises need for greater assimilation of group values and common cultural aspects. In the event of acquisition, there is also need for the acquiring company to fully understand all aspects of the business and value systems of the acquired company in order for the acquisition to be a successful one.

Again, in the case of mergers, where a common identity needs to be established, since the merger has created loss of existing identification on both sides, it become mission critical for the new management to enforce common goals and objectives for the merged unit. While these aspects may sound simple and enforceable on paper, the truth is that this creates major difficulties for its implementation process and often mergers and acquisitions may not be successful and may even thwart major plans of the business. Besides, where significant management shakeups occur, there are also a section of disgruntled work force who could be a thorn in the path of the most effective and efficient management.

The negative forces in acquisitions and mergers need to be fully and earlier identified, so that planned procedures are undertaken that could either eliminate such occurrences or significantly impair them, so that it does not, in any way, cause harm to the new management in the enforcement of new procedure and also help iron out existing issues within the ambit of joint negotiations that could be beneficial to both parties. “Without the proper oversight and review, one company can fail to live up to its part of the agreement” (Mergers & acquisitions, partnership & alliances, 2010, p.4).

This analysis and discussions needs to consider the impact of culture and other changes in business. Mergers are not aimed for a change, but it is all about maintaining the same values and spirit for attaining more heights. It could be said that mergers have both negative and positive aspects. The negative aspects could be in terms of one party assuming proprietary rights over the business to the detriment or loss of the other, or even reinforcing its own dictates over the affairs of business.

These needs to be avoided so that niggles could be ironed out and better business sense could prevail among parties. The second negative aspect could be that difference of opinions among the management teams constituting representatives of both parties could be divided on major issues that could lead to conflict zones. What is to be understood in merger is that both parties have lost their previous identities, and the only identity that remains is that of merged firm with new set of covenants and rules, dissolving the earlier business.

The positive aspects of mergers could be that synergistic benefits could emerge, including sharing of business opportunities, outsourcing of raw materials, work sites and business prospects This analysis and discussion suggest that “Managers negotiating a merger need to be acutely aware of different ‘ways we do things’, to surface those differences and encourage discussion about what might be best for the newly merged organization” (Four steps to a successful merger, n.d).

It is necessary that both sides win in the case of takeovers and mergers. In the case of takeovers it could be the purchase consideration could be much heftier than its true market value. For instance, taking the case of mergers in the mining industry, “Takeover target and nickel miner Allegiance Mining, which is being taken over by Zinifex, says its cornerstone nickel asset will be in good hands if a planned takeover of Zinifex by Oxiana goes ahead” (Allegiance welcomes Zinifex-Oxiana merger, 2008).

Mergers and acquisitions mean different things for different people. “People tend to blame the organization or top management for the changes occurring within the organization. Top management’s actions are usually reactions to some outside force, such as stiffer competition, shifts in the marketplace or new technology.

It is important to realize that change is a key to surviving and growing in today’s global economy” (Managing organizational change, n.d, p.2). It is necessary for the top management to convince the disgruntled employees that the merger or partnership would be beneficial for them in economic terms and would also help in settling long outstanding claims. This analysis seems to underpin the fact that “When working with individuals and teams undergoing change, it is not the actual model used that is important, but that the individuals see it is relevant to them. The best change facilitators use the one which best matches the culture of the organization they are working with at the time” (Managing change in organizational development, 2008).

Thus, the important fact that needs to be underpinned could be in terms of creating and sustaining awareness about the positives of mergers and underplaying its negative sides. “Change management entails thoughtful planning and sensitive implementation, and above all, consultation with, and involvement of, the people affected by the changes. If you force change on people normally problems arise. Change must be realistic, achievable and measurable” (Change management, 2010).

Conclusions

The topic study has its own limitations. It will not be possible to include all the employees and it has reached some of the higher executives and the few employees due to the scarcity of time and the economic problems. The information obtained from the respondents is affecting the research and it is not sure whether all of them are correct or not. There were limitations from the employees as they are not interested in replying for the questions. These all made the study with difference of opinion.

Reference List

Allegiance welcomes Zinifex-Oxiana merger. 2008. Theage. Au: Business Day. Web.

Arbib, M. A., 1987. Synergy. Web.

Change management. 2010. Web.

Corporate strategy. n.d. Web.

Data collections methods. n.d. Web.

Four steps to a successful merger. n.d. Web.

Frankel, R. M. & Devers, K. J., 2000. Study design in qualitative research-1: Developing questions and assessing resource needs. Web.

Kazmi., 2008. Strategic management and business policy. Web.

Managing change in organizational development. 2008. Web.

Managing organizational change. n.d. Web.

McClure, B., 2010. Mergers and acquisitions: Introduction. Web.

McDonald, J., et al. 2005. Planning for a successful merger or acquisition: lessons from an Australian study. Web.

Mergers & acquisitions, partnership & alliances, 2010. Management Centre Europe, p.4. Web.

Primary data collection methods: Questionnaires. n.d. Web.

Why do firms carry out mergers and acquisitions, and how can the difficulties involved be overcome? 2003. Web.