I have chosen the company Billabong International Co, as it is one of the renowned brands in the board sports industry. I found this company interesting because its market value is increasing every year throughout the world. Its core operations include promoting, distributing, wholesaling and retailing its products. It offers a wide variety of products including board sports clothing, eyewear, hard goods, accessories and wetsuits under the name of Billabong. The company is also providing its products to other companies such as Tigerlily, Kustom, Element, Sector 9, Palmers Surf, DaKine and other famous brands (Billabong Corporate 2010). Billabong has always remained focused on the company’s objectives and functional values. Its fundamental objectives incorporate a dedication to brand protection and development, the production of appropriate designs and efficient products, advertising in the basic board sports channels, the proficient improvement of the workforce and enduring customer service and associations (Billabong biz 2010).

I believe that the company has experienced significant growth in its sales over the last decade or so, rising from just $110 million in the year 1999 to a huge $1.67 billion figure in the year 2008-09. Throughout the expansion period, Billabong has sustained its brand reliability and developed its dedication to the international board sports division through sponsorship, event production and advertising the products through industry famous athletes. This devotion to fundamental values has permitted the Company to attain many objectives including brand development and improved product accessibility worldwide.

Company Overview

Billabong was initiated by a surfer named Gordon Merchant. The company was started in 1973 on Australia’s Gold Coast. Mr. Gordon is also a surfboard shaper, and he started his business by making board shorts at home and selling them on a local surf store. The business established a well-known trademark within a few years. The surfers were attracted by the finest quality of the Billabong board shorts. They were long-lasting with superior stitching. The company organized special events and competitions to commence their products to local surfers. It also advertised these famous surfers in its marketing campaigns (Billabong biz 2010).

In the 1980s, Billabong had determinedly ascertained its brand position in Australian surf traditions and was all set for spreading out globally. The preliminary focal point was to target the North American surf market and, once more, the brand got massive success. Currently, 4500 co-workers are working for Billabong International. It is one of the leading brands in the surf industry, and its shares are listed on the Australian Stock Exchange. Billabong International’s products are accepted worldwide giving the company brand recognition in more than 100 countries and its products are sold in more than 10,000 stores globally. Its collection is distributed through the expertise of board sports dealers and also through Billabong’s retail outlets (Billabong biz 2010).

In 2009, Billabong started marketing and selling its products through the online sales channel. The company acquired a US-based board sport online dealer named Swell.com, and also advertised its products on Surfstitch.com. The company is selling its collection in various countries such as all over Europe, South Africa, New Zealand, Australia and Japan, Brazil and North America (Billabong Corporate 2010).

Billabong’s leading competitors are Nike and Quicksilver. The company’s assorted geographic reach minimizes the seasonality of its earnings. Its pre-ordering structure and outlets sales are higher than its competitor’s distribution, which embraces the firm’s-owned outlets and various other department stores. The Company’s trademarks are advertised and promoted globally through alliances with highly famous proficient athletes, junior athletes and sponsorships (Billabong Corporate 2010). In the 1990s the surf industry expanded exceptionally and expert surfing achieved a brand new morality and respectability. Billabong also tracked its vital end-users into other board sports products, including skateboards and snowboards, where it simulated its established business structure. At the beginning of the year 2000, Billabong had been reorganized to capitalize on the rising worldwide openings in the board sports industry (Billabong biz 2010).

Analysis and Findings

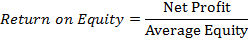

Financial ratios are considered to assist and calculate a financial statement. Managers use ratio analysis to improve the company’s operations (Brigham and Ehrhardt 2001). The appendix attached to this report presents various essential financial ratios that form the foundations for significant evaluation of the company’s financial position based on the financial figures reported in the years 2008 and 2009. The findings are then reviewed in light of various sources of information provided by the company. In the following section of the report, the company’s financial performance is discussed to form an overall opinion regarding the company and set forth recommendations for investment potential in the company’s stocks.

Profitability Position

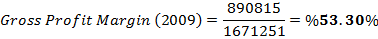

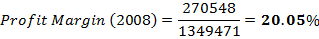

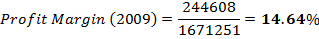

Profitability is the net outcome of a number of procedures and conclusions. These ratios offer an efficiency of the firm’s procedures. Profitability ratios exhibit a collective effect of liquidity, asset management and debt on operating assets (Brigham and Ehrhardt 2001). A company’s profitability is another important area of investigation. The total group sales show flat and down condition in 2009 as compared to the prior year. According to the company, it is mainly due to the negative impact of foreign exchange, as the value Australian dollar has declined. It has been observed that the company’s sales have been on the lower side which are mainly affected by overall poor economic conditions and trends in the consumer market which have forced the retailers to revisit their strategies and hold same or lower levels of prices for their products. Various profitability ratios have been calculated to form an overall opinion regarding the company’s financial position and expectations of the shareholders that they may hold for their investment in the company’s stocks. The results clearly indicate that the company is operating at comparatively lower gross profit margins which have further declined in 2009 to 53.30% from 54.94% in 2008. This is due to Billabong’s higher direct and indirect expenses. The higher expenses are most probably due to the high rate of inflation worldwide.

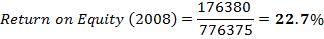

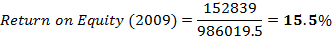

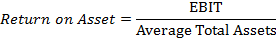

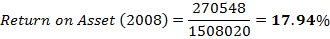

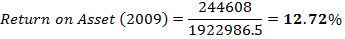

Their capacity to embrace the margin turned down to 1.64% evaluates that Billabong created the strategic decision to reduce discounting with the objective of sustaining brand equity. The return on equity of 2008 is 22.7% on the other hand; in 2009 it has decreased to 15.5% which clearly influences a negative impact upon the company. This specifies that the company’s ability to generate returns for its shareholders has declined in the year 2009. The main cause of this decline is the economic recession mainly in the United States. The company’s ROA is quite weak; however, this is due to the company’s capital-intensive status. This explains that as compared to the year 2008 the company’s basic earning power has declined. The capability of the firm to generate operating income is relatively low.

Asset Efficiency Position

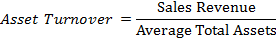

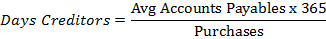

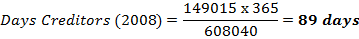

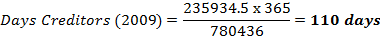

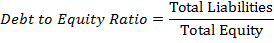

“An Asset management ratios measure a firm’s to manage the assets at its disposal. The most commonly used asset efficiency ratios include account receivable turnover ratio, inventory turnover ratio, accounts payable turnover ratio, fixed assets turnover ratio, and the total assets turnover ratio” (Baker and Powell 2005).

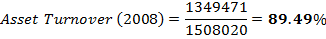

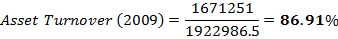

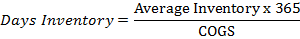

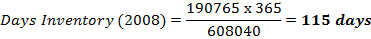

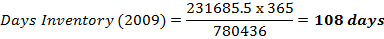

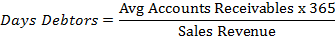

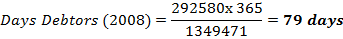

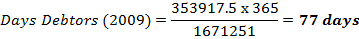

The asset turnover ratio is 2009 is 86.91% whereas in 2008 it was 89.49%. This demonstrates a slight decline in asset turnover because the company is not generating enough sales as compared to high asset generation. Therefore, the company should dispose of some of its assets or increase its sales. The inventory days are also decreasing as in the year 2009 it is 108 days, but in 2008 they are 115 days. This is a negative impact for the company, as it depicts the company as holding a massive amount of inventories. There is a slight difference in days debtor as it is now 77 days and in 2008 it was 79 days. It portrays a plus point, as the company’s days outstanding are decreasing. The day’s creditor also gives a positive impact, as they have increased from 89 days to 110 days. Subsequently, the firm has more time available to pay off our debts to the creditors (Billabong 2010).

Liquidity Ratio Position

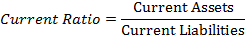

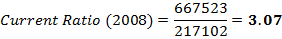

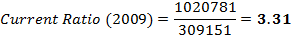

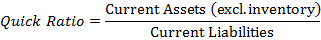

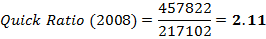

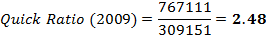

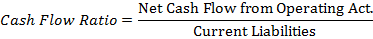

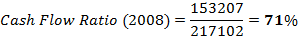

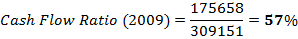

“A liquid asset is one that trades in an active market and hence can be quickly converted to cash at the going market price, and a firm’s liquidity ratio requires the use of cash budgets, but by relating the amount of cash and other current assets to current obligations” (Brigham and Ehrhardt 2001). The company’s short-term liquidity position is assessed on the basis of certain useful KPIs. Firstly, the current ratio which determines the proportion of current assets to current liabilities is presently above one. The high value of the current ratio implies that the company is in a strong position to meet any obligations arising from its current liabilities as it holds a good value of current assets and therefore, the company’s liquidity is quite healthy and no financial problems can be foreseen in the near future. The quick ratio that excludes the value of the company’s inventory from the total current asset as inventory is regarded. The quick ratio is suggesting a positive influence on the analysis, as it was 2.11 in 2008 and has increased to 2.48 in 2009. This specifies that even after decreasing the inventories the company is still capable enough to pay off its current liabilities. The cash flow ratio has decreased to 57%, which suggests that the company’s capabilities of cash inflow from operating activities to pay off its current liabilities are declining.

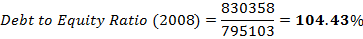

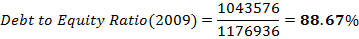

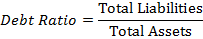

Solvency and Leverage Position

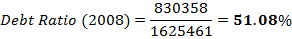

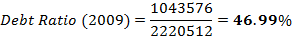

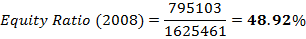

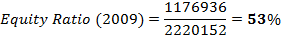

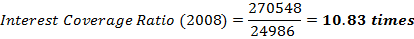

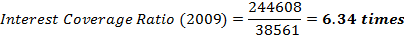

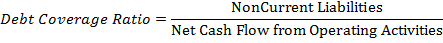

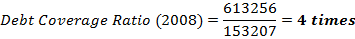

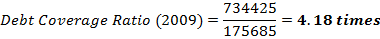

Solvency and Leverage Analysis is also known as Debt Management Analysis. It contains the degree to which an organization employs debt financing or financial leverage. It has three essential propositions. First, by increasing funds through debt, stockholders can retain the power of a firm without risking their investment. Second, the creditors look to the equity to offer a margin of security. Thirdly, the return on capital can be overstated if the company finances its investments by external borrowing and it is able to earn more than the payments of interest (Brigham and Ehrhardt 2001). The company’s debt to equity ratio is declining to 88.67% as compared to the year 2008 i.e. 104.43%. A low debt to equity ratio usually shows that a firm has remained careful in financing its growth with debt. The interest coverage ratio provides an immediate depiction of a company’s capacity to pay the interest charges on its debt. Billabong’s coverage ratio is decreasing from 10.83 times to 6.34 times in the year 2009, which signifies a negative impact. While the company is hardly administrating its interest costs and the company may easily lead towards bankruptcy. There is a 0.18 times difference in the debt coverage ratio. It was 4.0 times in 2008, and in 2009 it is 4.18 times. A debt coverage ratio for both years is more than 1; it points out that there is sufficient cash flow to pay the property’s leasing expenses and the company has less left over to pay mortgage payments (Billabong 2010). Subsequently, the DCR is more than one which is an encouraging implication, and it means the company is generating more cash to pay off the mortgage expense.

Market Performance Ratios Position

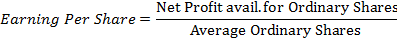

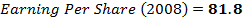

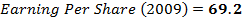

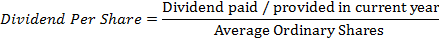

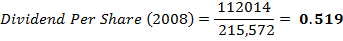

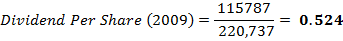

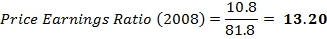

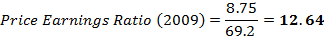

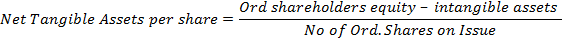

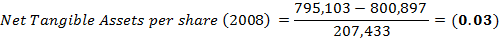

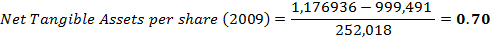

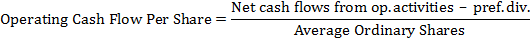

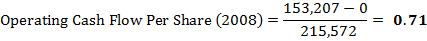

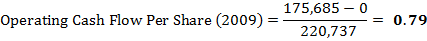

Market value ratios help to understand the firm’s relative value. It is determined by using the market data considering the stock price to gather the essential information. The most prominent market performance ratios include price-earnings ratios, dividend yields, earning per share and dividend payout ratios (Baker and Powell 2005). This analyzes that dividend per share is increasing in 2009. Therefore, stockholders’ gain is increasing as compared to 2008. The price-earnings ratio how much investors are willing to pay per dollar of the given profits, so the decrease signifies that it is riskier for the company. Net tangible assets per share were -0.03 in 2008 but now it has increased to 0.70 in 2009. There is a slight difference of 0.08% in operating cash flow per share which indicates that the earning of shareholders from operating cash flow is almost the same. Earnings per share (EPS) for the year 2009 was down 12.6% from the year prior, which Billabong says is “due to the lower reported NPAT result and increase in the weighted average number of shares on issue following the capital raising conducted by the company in May 2009” (Billabong 2010).

Recommendations

From the above analysis it could be inferred that the company has an overall weak financial position. The company has made significant investments in expanding its operations and product development; however, it must take measures to overcome the recession process that Billabong is facing in North America. Its current markets are somewhat saturated and are adversely affected by the recent economic downturn. Therefore, it is important for the company to undertake serious restructuring of its operations and reevaluate its value chain processes and agreements. This is one way that the company can cut back on its operational expenses and achieve higher profitability. For shareholders investment in the company’s stocks has remained attractive; however, they need to be careful regarding the outcome of the company’s capital expenditures. Although I appreciate one basic factor about Billabong that they are not emphasizing upon buying a distressed brand, as they stress upon cleaning up and building well-established brands. They have acquired the best brands they could find in the industry they were required to be in, and in addition, they knew what the customer wants. They purchased brands with good administration in place and development potential. Since Billabong has defined the categories of brands they wanted and the markets they desired to be a part of. They are no doubt proficient, as they know what brands would help them to gain success.

Appendices

Appendix 1

Sources: Billabong Annual Report 2008-2009

Appendix 2

Financial Ratios Calculations

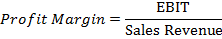

- Profitability Analysis

- Asset Efficiency

- Liquidity Ratios

- Capital Structure Ratios (Solvency & Leverage)

Higher debt (liability) -> higher leverage & lower solvency

- Market Performance Ratios

List of References

Baker, K.H. & Powell, E.G., 2005. Understanding Financial Management. Malden, MA: Blackwell Publishing Ltd.

Billabong biz, 2010. Billabong Company History. Web.

Billabong Corporate, 2010. Billabong International Limited (BBG). Web.

Billabong, 2010. Billabong Financial Fundamentals. Web.

Brigham, F.E. & Ehrhardt, C.M., 2001. Financial Management Tenth Edition. Florida: Cengage Brain inc.