Marketing

The advantages and disadvantages of Barr’s Product Mix

Product mix is the combination of products that are produced by a particular company to attain its organizational goals. These products can be sold either in a particular market or in several markets. Diversifaction of the market helps the orgnanization to diversify its brand name. A G Barr has wide range of product mix under one product line of soft drinks. The main brands are; Irn-bru, Tizer, Diet Irn-bru, Simply Citrus, D and B, KA Findlays Springs. Other brands that make the product mix are sold through franchise agrrement include; Oringina and Lipton Ice Tea. In addition, the organization is venturing in Cola products such as Cola, Diet Cola Shandy and cream soda.

Advantages

The wide product mix has provided the following advantages to A G Barr.

- The ability to maintain one product line (soft drinks) has help the firm to consollidates its market share since it reatains customers royalty.

- A G Barrs wide range of products has increased the amount of revenue collected from the sum total of the products.

- A decrease in revenue by one product say Tizer due to fall in demand will be augment by sales in other products like Irn-bru or KA which will be affacted by decrease in demand.

- A G Barr’s wide range of products helps to offer strong competion from world leading brand names like Coca Cola and Pepsi, which come with variety of prodcuts.

- Barr’s product mix helps to meet the needs of various groups such as young children who use Tizer and the elderly who prefer Irn-Bru, special brands like Diet Irn-bru and other flavors.

- Franchised products such as Oringina and Lipton Ice Tea reduce the cost of designing distribution channels as they uses franchisers channels.

- Venturing in Colar products such as, Cola, Diet Cola Shandy helps to attract customer from coca cola.

Disadvantages

A G Barr product mix has some shortcomings, which reduces the amount of profits that the organization makes. The main disadvantage includes;

- Concentrating in soft drinks alone narrows its customer base since it does not appeal to strong drinks customers.

- Barr’s product mix is often overshadowed by the Coca Cola and Pepsi the reowned soft drinks producers.

- Generally, demand for all soft drinks is price elastic and therefore they are uniformly affected by economic slow downwhich reduces their demand.

Effects of price elasticity on how Barr’s markets its products

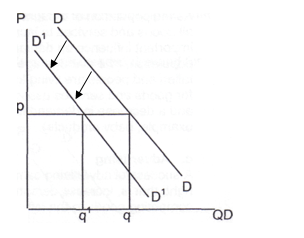

All Barr’s products are price elastistic. This means that a slight change in prices of the products results to a large change in product demanded. Similarly, Barr’s products are income elastic. An Increase in real income causes a shift in the demand curve as more of the products are bought at each price. Conversely, a decline in the real income reduces the demand as less and less of the product is demand at all prices causing the demand curve to shift to the left.

In 20001-2002, the price of pound was relatively higher compared to the prices of Euro. This was due to financial melt down that reduced the real income of the people. As a consequence the demand for Barr products was reduced. This made the demand to decrease, this is Illustrated by the graph above as the shift in demand from demand D to D1. The quantity demand decreased from q to q1 at a steady price p. to increase demand the management was compelled to low prices by up to 30 per cent.

Advantages

- Product which are price elastic helps the organization achieve more profits when the income is high.

- Knowing the elasticity of the products helps the organization in projecting future demand trends and to prepare in advance.

- Demand for products which are income elastic are influenced advertisement and therefore more income can be generated from advertisement (Baker 4).

Disadvanteges

- All Barr’s products are affected in similar way by income changes. A decrease in real income would affect the entire product mix thus reduce the firms profits.

- Any advertisement cost that is incurred by the organization is not repaid off as it happened in Russia when there was a financial crisis.

Price Elasticity

A G Barr’s products are products are price elastic since the firm experience increased sales when prices are low. However, since A G Barr operates in a perfect competitive market a slight reduction in process causes a large shift in demand. Most A G Barr’s products experience both self-price elasticity and cross elasticity. For instance, Irn-Bru brand experienced a cross-elasticity of demand with the coca cola products. Since the two products are complements. When Coca Cola Company experiences increase in production costs the demand for Irn-Bru increases steadily.

Advantages

- Price elasticty helps the organization to counter action of its main competitor. For instance, when Coca Cola products in England were affected high value of pound, Barr was able to project its own demand and by lowering wholesale prices by 30 percent it was able to contain the shift in demand.

- Since the organization is able to reduce it operation cost by installing competrised sustem a little reduction in prices will lead to large shift in demand.

Disadvantages

- Barrs competitors are equally in a position to determine the firm’s strategies and they can counter their action, which would lead the firm to incur massive losses.

- Secondly, since all Barr’s products are price elastic a slight decrease in competiors prices would result to decline in Barr’s revenues.

Ways in which Barr’s interacts with its external environment.

The external environment of an organization consists of factors beyond the organizations control that have a direct impact on the organization’s operations. Typically, the external environment consists of political factors, economical factors, social factors and Technological factors.

The operation of A G Barr Plc has been affected by the political factor to a great extent. In 1995-2001 Barr agreed to join a franchise with Pernod Richard. However, in 1999 the French government vetoed a proposal take-over by Coca-Cola. This shows that the government influences most organizations through its diverse control mechanisms. In international undertakings, A G Barr has to comply with all policies and regulations that are set such as tariff, wage laws and registrations. For instance, it is only after the fall of communism regime in Russia that the company was able to venture there.

The other external factor that influences the operation of Barr Plc is the economical factors. These factors determine the demand of the product and the profits margins. In 2002, the value of pound was higher than that of Euro, and conversely the production cost of products were higher in Britain. At this time, it was cheaper to important from countries using Euro than produce locally. This condition forced Barr to reduce prices of Irn-Bru by 30 per cent. In a franchise collapsed despite the rigorous advertisements, campaigns to make it successful but the economic melt down in the country swept it.

All organization operates with the aim of satisfying the needs of customer in a profitable manner. Therefore, any form should consider the needs of it customer hence considering the social factors. Irn-Bru demand is affected by the purchasing behaviors of its clients. To influence the purchasing trend, the organization carries out extensive campaigns to lure more people to purchase the products. In addition, the organization experiences low demand when consumer real income is low as it was the case in 2002 when Pound was over valued compared to Euro currency. To obtain the needs of the customer A G Barr carries out routine market surveys that lead to introduction of new brand or re-branding. From such surveys, Barr has re-branded Irn-Bru and Tizer to suite customers’ tastes and preferences.

The dynamic nature of technology requires firms and organizations to make drastic measure to improve their production mechanism to gain form economies of scale due to large-scale productions. Secondly, the organization needs to install better system to help management to run smoothly as well as enhancing innovation. On its part, A G Barr Plc has adopted latest production technology that reduces cost while increasing productions. The organization has also uses internet to carry out advertisement, training and it has also installed a management system to administration and coordination of the firms production activities.

The firm has also complied with environmental issues by recycling its products containers. In 2002, the organization has been running a recycling campaign with schools a clear sign that they are keen on being environmentally friendly.

Barr’s Relationship with the external Environment

Barr has endevored to foster a good understanding with the government to enjoy a smooth operation. The organization has done this by adhering to all registration requiremnts as well as to the business policies that governs the business in each country it operates in. The ability of the organization to forge good relationship with governments has enabled it sign many Franchise contracts such as KLP

American firm, API andPepsi Bottling Group (PBG)

Towards environment, Barr’s has ensured that it develops environmental friendly packages such as recycable bottles whiche were used for schools promotion. Other products are packed in glass contains which have less environmental harm.

Barrr’s has consolidates its advantage on the social front. It has endevored to ensure that all its products are appealing and catches the public year. Barrs has sponsored many activitoes such as; 2003, free Irn-Bru samples were given to concert goers, in 2002, they sposored series of events in Scotland, in the same year Irn-Bru sponsors the Xmas and New Year Carnival. All these sposorship has popularized Barr’s Brand name and hence increasing it sales revunues.

Barr has embraced technology a great deal. The main area that technology has been successfully applied is in the management, production process hence reducing production costs as well as upgrading its IT system. Moreover, Barr’s has also done exemplary well in integrating advertisement on the internent. All thse has helped the firm to cement its market position by effectivley competing with its rivals.

A G Financial Situation

Information Likely To be Of Value to Finsbury Growth Trust: A Stakeholder in A G Barr Plc

As a stakeholder in the organization, Finsbury would be interested in the performance management of the organization. Additionally, the stakeholder would be interested in the way the organization is managed. Just like any other shareholders Finsbury is interested in accounting records that portrays the position of the firm in the market.

Finsbury having contributed 4.01 per cent of entire capital of the A G Barr, they have an interest in the affairs of the organization. The stakeholders are intersted in knowing the figures in the profit and loss especially earning per share. The firms have been recording increased dividedn earning from 1999 to 2001 as follows 44.07p, 44.42p, 50.17p then a sharp decrease occurred in 2002 dividends earned 38.47p. in the following year the dividend paied increased to 43.78p. This information helps stake holders to know the amount that their investment is gaining each year. The other information that interests FinsBurry growth trust is the balance in the cash flow statement. In2002, the organization had a negative balance of -3110. This implied that the organnization was facing a tough time in meeting its current liabilities.

However firm managed to overturn poor perforamnces in 2003 and recorded cash flow balance of 7,441. A positive balancing figure in the cash flow statement suggests that the firmis moving in the right direction since it’s able to meet all its obligations. Conversely, a negative figure would surmon shareholders to reconsider their position whether to sell their ownership or to retain it.

Information pertinent to Managers and shareholders

Both Finsbury and Barr’s managment are interested in the organizations cash flow statement. Preparation of the cash flow statement helps the organization to assess its current liquidity performance. The statement reflects the liquidity of the organization both in notes and coins as well as in money that is deposited in banks. Once the current liqudity situation is analysed the management decides which action to take to contain the mess while the stakeholders decides either to dispose their ownership or not. In 2002, a negative 4110 balance prompted the management to cut on expenditure and this help to obtain a positive balance in of 7,441.

To managers cash flow statement serves as an indicator of how much money the organization has to meet its current liabilities such as interests on loans, taxes as well as creditors. The Confederation of British Industry (CBI) conducted a survey that revealed that up to 21 percent of business operating under a conducive environment collapses due to poor cash flows despite having positive profitability ratios. Thus with cash flow statement managers can tell whether the business stands a chance for survival or it is waiting for demise.

On the other hand, stakeholders use the cash flow statement to determine whether the firm is meeting its obligations or not. Unlike the profit and loss account, which shows profit margins even when the firm is struggling to meet its current liabilities. For instance in 2002 the P&L account reflect a profit of 10,487 while the cash flow statement reflects a negative value of 3,110. In case one relies fully on the profit and loss account, he or she will be mistaken and will not be able to tell it liquidity status.

However, cash flow statement gives an elaborate picture of the firm’s performances. In addition, the cash flow statement shows the ability or inability of the organization to fund investments in new fixed assets. With this information, stakeholders will be in a position to decide whether to liquidate the firm or to wait for its eminent collapse.

Advantages and disadvantages of Franchising

Barr has been in a number of franchise contracts before. The company produces certain brands having acquired franchise licenses for the same. For example, it distributes Orangina; having acquired a franchise license from a French company. There was some uncertainty related to franchise license when ownership of the French company was uncertainty. This is indicative of one challenge that franchising agreements come with. Therefore, before penning down any franchise contract, the company has to consider challenges likely to crop up.

A decision to engage in another franchise would present a new window for Barr plc to market its wide product mix. Franchise contracts has help Barr’s to venture in new market such as America, France and Russia through API, Pernod Ricard and KLP respectively. Through all these franchise contracts, Barr has been able to consolidate its revenue outlay as well as diversyfying its geographical coverage. Hence, a new franchise contract would enable the organization to appeal to a new region as well as obtaining an opportunity to expand tit brand name.

Another benefit of forming a new franchise agreement would be to take advantege of the already develop marketing channel. Designing and implementing a new distrubution channel is time consuming and resource consuming. Thus, an opportunity to use the already established channels will save the organization time and resources. Moreover, the organization benefits from using the Franchisers production plants to produce its product brands.

Disadvantages

Conversely, a new franchise is also associated with numerous challenges and disadvantages. Firstly, negotiations for franchises sometimes are so long and time consuming. For instance the franchise with Permod Ricard was about to be toppled by the French government due to political gains. In addition, some franchise might not be successful due to difficult economic condition as it happened in Russia where Barr’s franchise with KLP collapsed despite heavy advertisement campaign. Bearing in mind the uncertainty of economic factors occurrences of similar manner cannot be overruled in the future. Although franchise can bring a host of good and bad results this makes the whole exercise as a big gamble.

Barr’s Organizational Structure

A G Barr Plc uses a traditional management structure that assumes a hierarchical model where the chairman Mr. Robin Barr the overall head that controls and directs the entire organization. The organization structure has been diversified to meet allow operation independence. Managing directors in Finance, operations, sales and marketing, aid the chairperson. Hence, A G Barr plc has a well-structured organization that has three main offices where the operations and information flows.

A G Barr Plc uses a traditional management structure that assumes a hierarchical model where the chairman Mr. Robin Barr the overall head that controls and directs the entire organization. The organization structure has been diversified to meet allow operation independence. The chairperson is aided by managing directors in Finance, operations, sales and marketing. Hence, A G Barr plc has a well-structured organization that has three main offices where the operations and information flows.

The heads of various departments have been distributed to various operation regions with exception of some, which are located at the head quarters in Glasgow. Operational managers are based on other branches such as Atherton, Cumbernauld, Mansfield and East Lothian. IT teams are located in head office, while administrative and clerical officers are located in Atherton. This diversified covers the entire operations of the firm with simplicity and efficiency.

This organizational structure suits Barr because of its geographical diversification. Regional managers help the organization to deal issues that emerge at regionla level rather leaving everything to the senior manager. Maslow’s theory implies that hierarchical organizational structures help the management to identify human needs as well as offering the procedure through which such issues should to be tackled. In addition, it provides an environment which employees can develop their ego through self-fulfilment.

Barr’s has borrowed heavily from Herzberg motivational theory. According to this theory, the management uses two methods to motivate their employees, the hygiene factors and motivational factors. Bar’s hygiene motivational factors include provision of a better working environment, provision of educational and job security. On the other hand it uses motivational factors such as promotional incentives for hardworking and lon serving employees. The other motivation that is provided is ownership plan through which emplooyee are allowed to own organization share. Similarly, the firm has a scheme to reward long serving who have worked for 25 years. The entire motivation scheme has helped the firm’s employees to work to their capacity.

Advantages

- The organization structure has been effective in meeting challenges that are associated with growth; both geographically and productionwise.

- The hierachical structure promotes responsibility in the part of employee who becomes accountable because they are immediately accountable to their seniors.

- Hierachical structure allows inclusion of senior mangers in the decision-making therefore making it easier for th decision to attained easily.

Disadvantages

- Hierachical organization does not provide interpersonal motivation that is experienced in other structures.

- Employees may lack vision of the firm since the top manager is the sole custodian of firm’s strategic plan. This would limit the firm’s expansion and growth.

- Hierachical dtructure becomes strained as the scope of operation increases and especially when the firm goes regional.

However as the organization diversifies it need to consider changing its operation method to assume an organic structure that allow diversification of all aspects of management to all operation zones. This method suites a dynamic firm that faces changing condition and new challenges constantly.

Factor affecting A G Barrs performance

Factors Affecting Irn-Bru’s performance in the UK

Barr’s in UK are influenced by two factors namely price factors and non-price factors. The price factor that influences demand for Barr’s products are population parameters, real income advetisement, seasonal factors and personal tastes. All these factors influences the way demand for the products behaves. For instance, an increase in population increases the demand for the products. Similarly, an increase in real income increases the demand. Advertisement has also been identified to increase the demand for the products.

On the other hand, Barr’s product is also influenced by price facors such as changes in prices, supplement goods, prices of substitute goods, changes in taxation. Since Barrs operates in a competitive environment. Any change in the prices s of the commodity sold by competitors affects the demand for the goods. The first factor that influences its operation is existence of stiff competition from Coca-Cola and Pepsi brands. Since all these firms produce complementary goods, a decision by one firm to reduce its prices decreases demand for other products. The level of income of the people has also affected operation of A G Barr.

When customer has income that is more dispensable they tend to purchase more than when they have low income. Similarly, the government has also affected the operation of the firm through its taxation policies as well as it monetary policy. In 2002 overvaluation of the Pound lead to decline in demand for Irn-Bru leading to a 30 percent price cut. On the same note, concern for environmental factors has forced the firm to use recyclable containers for its products. Just as Mukherjee (57) shows the level of technology has also contributed to the operation of the firm in UK as the organization has adopted better production methods as well as better management systems.

Factors that influence Barr’s financial situation

Several issues such as the amount of share capital as well as its current market situation influence Barr’s financial situation. The capital base of the organization is mainly from ordinary shares as well as profits re-investments. This has help the firm to reduce liabilities, however the firm issued some shares to acquire some additional capital and it is paying dividends o worth 1,374 in 2002 and 11,645 in 2003. This amount reduces the amount of cash flows available. In addition repayment of loan worth 30 has also reduced the finance situation other factors that have negatively affected financial situation are dividends paid, taxes, interest paid as well as depreciation. On the other hand stable operation has increased profits and other issuing of shares worth 50.

The firm’s financial instution are also influenced by other factors as government policies. For instance, any decision by the UK government to increase production materials reduces the firm’s revenues and therfore reducing the financial situation of the firm. Similarly Barr’s finacial position is also influenced by the trend that is assumed by seasonal factors. Generally, during the festive seasons the firm experiences increased sales which in the process increases the amount of fiancial status of the firm.

Determining effects of advertisement under the above circumstances

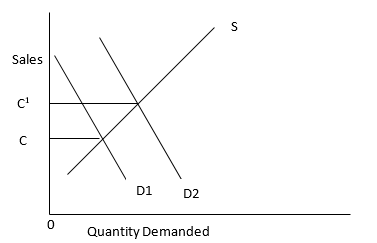

Advertisement is a tool that is generally used to stimulate sales in a competitive market. Since Barr Plc operates in competitive market, promotional stimuli would increase demand, the same will be the case when it comes to revenue.

Advertisement in a competitive market increases demand from D1 to D2. This is because many customers are lured to purchase more of the product. Assuming Barr advertises Irn-Burr, the sales will increase from point c one to c1. This will therefore lead to an increase in revenues for the firm.

At Ceteris peribus, the demand for products is uniform in a competitive market. However, any attempt by the organization to carry out advertisement campaign influences the demand for the products involved. If Barr decides to advertise Irn-Bru brand, the demand curve of Irn-bru will shift to the right while at the same time it will force the demand curve of competing products to move to the left. Generally, advertisement has been identified to infleunce people purshasing behavior even amid stiff financial conditions.

Considerations for the New Chief Executive of Barr’s

Advantages of the organization

- The newly appointment chairperson will benefit greatly from the milestone that has been achieved by the organization both in production and regional expansion.

- The chairperson will also enjoy operating in sound management system with adequate support from managing directors.

- The existence of a well-established brand name provides enough foundation for future expansion and innovation.

- The several franchise contnracts that have been signed prviously offers a stable basis for future contracts.

- Currently the organization has invested heavily on technical infrastructures as well as production systems that can be used to lower production costs.

- The firm’s hygiene and motivation factors have been used to increase employees’ rayalty and therefore reducing employee turnover.

- The firm’s en joy wide product mix that has distict features from those of its main competitors. This makes it possible to lock in it s customers as it is difficulty for the existing customer to find satisfaction elsewhere.

Disadveantages

- The new manager should devise mechanism to help him deal with the stiff competition from other soft drinks producers.

- The firm has occasionally suffered from franchise collapse, this cast doubts on future success, and therefore the new manager should strive to avoid such in the future.

- Barr’s brand lacks internation outlook which is enjoyed by Pepsi and Coca Cola, hence the manager should strive to elevate the company’s brand name to assume international recognition.

Things that the manager should do to maintain future profits

The new manager should do a couple of things to retain the existing market share while increasing future market. The manager should use a management by objective system of control to run the organization. This method is entails making the objectives of the firm known by all workers (Winkler 27). Once the objectives are internalized, the organization manager has ample time to rely directions. This system allows diverse range of consultation in decision-making. The manager should come up with specific goals to serve as pert of strategic managements (Davis 16).

Secondly, the management should motivate worker by being a real model in terms of operation, innovation and creativity. By extension, his work ethics will be assumed by other subordinate workers. Just Winkler (48) argued involvement of team in promoting the welfare of the firms helps to increase the firms output. He can also increase workers satisfactions by encouraging job specialization and at times job rotation to reduce monotony. In addition to the existing reward schemes, the managers consider giving end of year trips for the employee to visit various historic cites as way of motivating them. Finally, Koontz and Weihrich (289) identify need for power, affiliation and achievement as three areas that satisfy the need for each employ. Should the new manager meet all these needs he will enjoy a wonderful and harmonious working environment.

The new manager should also define the scalar chain to help in streamlining the management of the firm. Scalar chain would entail definition of the level of operation as well as framework of decision formulation.

The manager shoulf also addign each officer in the hierachical structure clearly cut responsibility. This would foster delegation of duties as well as enhncing accountability and responsibility in the part of the employees.

The manager should also adopt organic management system to cater for franchises as well as new venture, which are more vulnerable to changes. The fluid systems enhance speedy decision-making as well as allowing adjustments and continual redifinition of tasks. This method would also form basis for good networking in management, dissemination of information and authority.

On the other hand, the manager may also opt to contogency theory which rewuire the management to changes its operation as per the prevailling environmental circumstances. This theory allows the management to fit itself to the ever-changing environment especially in the technological fronts. Adoption of this theory will help the firm cope with sporadic nature of demand, competition, government poolicy changes and geographic growth of the firm.

Works Cited

Baker, John, M. The Marketing Book. Massachusetts: Butterworth-Heinemann, 2003. Print.

Davis, Bobby. Herzberg’s Theory of Job Satisfaction: a Re-examination. Madison: University of Wisconsin, 1982. Print.

Koontz, Harold & Weihrich, Heinz. Essentials of Management. New Delhi: Tata McGraw-Hill, 2006. Print.

Mukherjee, Sampat. Elementary Economic Theory and National Income Accounting. New Delhi: Macmillan Publishers, 2008. Print.

Winkler, Ingo. Contemporary Leadership and Theories. Berling: Springer Publisher, 2010. Print.