Introduction

Ernest and Young is a combination of merged predecessor company that had founded in 1849 initially by Harding and Pullein in England. Today, the company occupies varies legal frameworks in UK and U.S.A as Limited liability Partnership (LLC). The company’s principle headquarter is located in London while it offers various professional services among which most notables are audit service, tax, financial and business advisory. It is an international company having numerous members in above 140 nations with a global reputation of being one of the major ones among the mega four auditors of PwC, KPMG, and Deloitte. At present, it has selected as ninth mega private organization in U.S.A with 144000 workforces around the world as well as $24.523 billion revenue in 2008. The company is running a trustworthy and customized functioning in terms of unique operational structure with the establishment of international standards and foreign policies with uniformity of servicing.

Business strategy- motives for expansion in international arena

Hill & Jones argued that business strategy means the actions of a firm or business entity to get some competitive advantage on the marketplace 420. Three main areas are important in case of Ernst and Young’s business strategy selection. These are:

Target market means the probable consumers in the targeted area who will have the motive and ability to buy service (Hill & Jones 420-436). In the case of E&Y, it is going to provide some differentiated services to some differentiated location. In this sense, E&Y is segmenting its markets in KSA based on location. Thus, its target market is the consumers who are living in Riyadh, Jeddah and Al Khobar and seeking for assistance in financial services. In Riyadh, it is delivering the service of auditing, advisory business service, tax and business risk services. In Jeddah, it is offering assurance and advisory business service, risk advisory services, business advisory solutions and tax. In AL Khobar, the services are mainly the auditing, tax, risk management, feasibility study, due diligence, valuation and other business related consultancy services.

Value creation is the main target of the consumers in case of buying a service. For this, a service provider must pay close attention to the value creation process of the service delivery. There are two types of activities related with the creation of the value chain.

These are the primary activities and the secondary or supporting activities. In case of E&Y, research and development, production, marketing and sales and customer services are the primary value creating activities. The information system, firm’s structure, logistics, and human resources the supporting activities for the firm. All of these altogether added value not only for the consumers but also for the firm.

Implementation is generally termed as the strategic positioning. For E&Y, the differentiation and the value creation must be tied up with some strategies. For example, a low cost provider, E&Y can get more customers. Besides, as the business level customers are not extreme level price sensitive, becoming a low cost provider can lead to the degradation of the brand image of E&Y. Thus positioning of the strategies is concerning two aspects the costs and the value generated from the cost. The costs may have different forms like search cost, psychological cost and time cost. The implementation of strategies must be cost effective for not only the firm but also the consumers. The service, which will provide more than the cost incurred by the consumer, will satisfy the consumer more.

There can be four motives for expansions in international business. These are:

- Leveraging products and competencies.

- Location economies.

- Effects of experience.

- Leveraging subsidiary skills.

Through expansion, E&Y can be able to expand its marketplace outside its home country to the other countries by offering its generic services. It will increase the growth rate of the firm as will be able to earn some extra money as profit from other countries. Most of the multinationals have this motive to be a multinational. The success of a multinational expanding its business in an international market is not only depends on the service it provides rather the core competencies it has over the competitors in the local markets. In case of E&Y, all these core competencies are underlying with the design and development of the services, shaping it as the customer expectation and market the service to the selected target customers.

E&Y has some core competencies, which the local competitors cannot imitate such as the international information database, skilled personnel, sophisticated technology, and massive investment capacity. With these core competencies, E&Y have a competitive advantage in KSA. For these, E&Y can reduce many of its costs. For example, as it has global experience the personnel can easily match with a problem solved by the firm previously with a local one and thus give simultaneous feedback, which will diminish the search cost of alternatives. These competencies create a strong perceived value in the consumer mind as a symbol of confidence to the firm.

Besides, in case of pricing, the firm can be able to get the perfect probable pricing, which the consumers are thinking as appropriate. In these ways, E&Y can leverage its service offerings and core competencies. In addition, leveraging services and competencies in one country will give the firm the advantage to get same competitive advantage in another country. Transferring core competencies form one country to another may have some costs but the outcome must be overweight the cost.

Location means the courtiers where a multinational organisation is operating. Countries differ based on many dimensions (Hill & Jones 420-436). Economic conditions, political environment, logistics, culture, and people of a country are different from other. For these differences, one country may become more profit generating than the other. For E&Y a country, which has less attractive economic and political environment for financial service than a country with enlightened economic and political environment, is less attractive. In KSA E&Y, have some local benefits though there are some restrictions in doing FDI.

For example, the economic or business entities of KSA have more disposable money than any other Arab countries, which they can use as to buy service from E&Y. Again, the factor costs in KSA are low which will give E&Y some competitive advantage according to the international trade theory. As the business entities and the earning per capita in KSA are higher, the individuals and the business entities have monetary problems more. For these, they need some financial consultancies.

Thus, the motive to expand the business of E&Y in KSA is the local benefit it is going to obtain from KSA, which it cannot get if, expands in a country with low income. In case of the local motive, another additional motive can be available for E&Y, which is creating a global web. Expanding country to country, the firm is now having access to many countries where it can judge the costs of operation in one country and compare it with others. Global web will ensure the addition of value creation activities and outcomes of these activities shared by the every other country branches. E&Y have the intention to have these advantages by expanding in different countries and find which raw materials is less costly in where so that it can use the material in other country also.

Another motive behind international expansion is gathering experience of doing operation, environment, culture and many other things about a country. Experience effect refers to the systematic reductions in production costs that have observed to occur over the life of a product or service. In case of E&Y, the experience effect will be diminish the cost and thus increase the profit if it expand its market in KSA and gather experience.

According to this principle, whatever experiences it has gathered by doing operation in other countries can be useful to start the business in KSA though the cultural, economic, or other dimension may differ. There are mainly three types of advantage E&Y can get, which can be termed as motives. First motive is learning effect, which refers to the savings of cost that come from learning by doing. E&Y can minimise the labour cost by learning effect. As the labour or personnel learned the process of rendering service from other countries, they can do the same work in KSA, which will minimise the training cost.

Besides, E&Y can use minimum numbers of employees as they are well-learned about their job and gaining efficiency. E&Y can reduce the labour cost by this way also. Secondly, it can get the economies of scale. “Economies of scale” means the diminishing the cost by delivering the service in a high volume. As in KSA people has financial problem or need more financial service, E&Y will have customers more than its expectation. As fixed costs will remain same for all the increase in the customer number, the addition of a single consumer will give some additional profit and using this additional profit, it can be able to reduce the cost. Finally, these experiences can help to understand a situation more easily and help to design the appropriate strategy.

Skills have developed in a country of first where the firm started first and after that, it has transferred to other countries by global expansion. Companies like E&Y have subsidiary operations in many countries and is going to introduce it in KSA. Thus if E&Y will expand another business operation in KSA, it will get the advantage of these skills. For example, if the company will enter to banking service after the introduction of its present services, it will have the benefit of skills gathered in the previous financial service offering. Thus, this can be also a motive of E&Y to expand its market.

Whatever motive E&Y have to its global expansion, In case of selecting a business strategy E&Y have to take one of the four major strategies. These strategies are:

- Global standardisation strategy: In this strategy, all the primary activities of the firm will have a standard form, which it applies to all the countries.

- Localisation strategy: According to this strategy, the firm take different strategies to perform its primary activities for different countries.

- Translational strategy: This is the strategy where the firm take strategies based on the location economies, economies of scale and experience effect.

- International strategy: In this strategy, the firm first innovate a service offering in its home country and then expand it to other countries.

In case of expanding its service offering to KSA, E&Y may choose the localisation strategy. The reason behind it is, the culture of KSA is quite different from many countries, and there are some strict government rules and regulation.

Competitive advantages

Earnest and Young is global company which is operating through a wider and complex functional network with a widespread reputation. Therefore, there are some unique features of the company for which clients would like to consume their services rather than others companies (ET AL ey.com). Some of such integrated benefits are-

- The global reputation of E&Y widely depends on its competitive workforces dispersing different operating areas of the world. For this, in 2007, the well- known Fortune Magazine termed it as 25th “100 Best Companies to Work For” and the top among the mega four. It is also different from other for delivering the most favorable working environment for the women by ensuring teamwork, personal motivation and specialized initiative. In this regard, employees are treated here with greater challenge, reward, training and extended aspirations.

- Talented HR acts as basic catalyst for the company in attracting, retaining, and sustaining clients for long- term attachment.

- The company occupies a high standard in knowledge management servicing for which it has been the industry leader within this criterion. Capability of arranging integrated performance with cultural, infrastructural and processing factors have making in expert in delivering such qualified service.

- Functionality of Japanese Business Services throughout an experiential combination American and Japanese organizational surrounding is being greatly effective to attain vital clients.

- Private Equity Services of the company is also specialized since it has delivered in customized and holistic framework characterized by deep concern about the need of capital, industrial and obligatory restrictions of the clients. Devotion of cordial effort by 8000 M&A experts and long- term experience of the company have helped it to achieve such advantage.

- To manage a complex corporate treasury service, E&Y offers an additional bravery and honesty in their regular service in order to assist the customers in fulfilling demand for clarified auditing, supplying information to their investors and other related parties.

- To improve performance of their clients, E&Y is committed to arrange multidisciplinary groups, utilize international tools and techniques, and stream complete length of its international destination, qualities and experiences.

- Program Management Strategic Direction People and Organizational IT Advisory are two competent products of the company.

- For servicing technology market, it offers IFRS, risk management, revenue gratitude, FM and technology risk etc. options.

- The cost management service of the company has also delivered with long- term leveraging vision accomplished with three stages of evaluation, assessment, and implementation, which is not easy to find out in other ones.

Mode of Entry Strategies

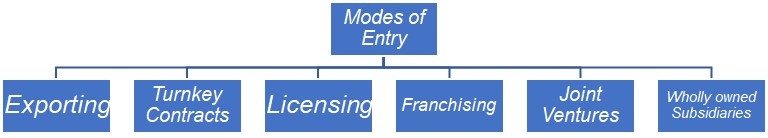

There are six entry strategies available for E&Y in investing in Kingdom of Saudi Arabia. These are:

- Exporting: For serving in a foreign market many successful business entities started with exporting and then do expansion (Hill & Jones 493-500). For E&Y this can be an option to expand their operation in KSA. It means to market the services directly to the KSA without any regional establishment.

- Advantages:

- If E&Y go for exporting, it will not need to incur any substantial costs in establishments. This will decrease the investment cost for the firm and thus E&Y can be able to have some extra money.

- By exporting its services, E&Y can get the experience curve and location economies.

- Disadvantages:

- To provide service with centre in USA, it will not be cost effective for E&Y cause to setup local service-providing centres in KSA is less costly.

- The cost advantage may become abandon for the transportation cost through USA to KSA.

- Advantages:

- Turnkey Projects: In a turnkey project, a local contractor act as a retailer, distributor, or local partner for a foreign company who performs every details and jobs of the project including the training of the personnel.

- Advantages:

- This is less risky than conventional FDI.

- Use of local people who have better know how and technical knowledge

- Disadvantage:

- E&Y will loose any long-term interest in KSA.

- The local contractor of the firm may become the competitors for E&Y.

- E&Y will have to expose its competitive advantages to a local entity.

- Advantages:

- Licensing: E&Y can assign a licensee to provide its service to KSA and using its brand name. This can do through an agreement where E&Y will become a licensor.

- Advantage:

- E&Y doest not have to bear the development costs and thus have no risks.

- As E&Y is a service provider and have actually intangible products, licensing can be an attractive entry mode.

- It will generate some additional money without any direct investment.

- Disadvantages:

- E&Y will loose the control over the operations related with the service providing.

- Licensing will diminish the ability of E&Y to get advantages from its coordinated strategy.

- Advantage:

- Franchising: This is a specialised form of Licensing where E&Y can impose some rules and regulations.

- Advantage:

- E&Y will be able to get extra control over the operations.

- Disadvantages:

- E&Y will loose control over the quality of the service.

- Advantage:

- Joint Ventures: E&Y can establish a new service providing entity by merging with a local firm, which is a form of joint venture.

- Advantage:

- E&Y can be able to share the establishment costs and risks with local service providers.

- Disadvantages:

- E&Y will not be able to have total control over the operation

- Advantage:

- Wholly owned subsidiaries: According to this strategy, E&Y will go for the total investment in establishment and getting all risks.

- Advantages:

- Protection of its technologies;

- Chance of global strategic coordination

- Disadvantage:

- High risk and cost

- Advantages:

Key Challenges of E&Y

- Saudi Arabian government generally encourages joint ventures with local entities and discourages wholly owned subsidiaries. Thus, E&Y will have to face the challenge of deciding whether to go for a joint venture that has some unavoidable disadvantages (U.S. Department of Commerce).

- The government is focusing on the infrastructure sector for foreign direct investment and has fewer initiatives to attract the financial service sector.

- Saudi government imposes very high tax rate on the foreign owner’s profit earned in Saudi Arabia. For which the profit earned by E&Y can be few.

- KSA has an ultraconservative cultural environment where the values have influenced completely by the Islamic rules and regulations. To some extent investing in the financial service sector like banks, insurance and asset management, KSA strictly follow the Islamic rules, which can be a challenge to earn profit. For example, to get and earn interest has completely banned in Islam and KSA follows it. Thus, the probable profit from the banks and the insurances are not possible. (U.S. Department of Commerce)

- The investment of E&Y in the oil and gas sector will be a challenge as the government is too strict to give the access to privet sector in this sector as they termed this as a national interest.

- There are three major codes of conducts in KSA to the FDI or capital investment. These are:

- The investment must be on a development project

- Technology must be transferred from the FDI to KSA through the investment

- Minimum of 25% of the ownership equity of the FDI must be to a Saudi partner.

Development projects have defined as an investment in industrial, agriculture, health, contracting and specialised service projects. E&Y has no development projects to initiate in KSA rather it has some assistance service over the financial sector, which will diminish the attractiveness for the proper government attention. Besides the sophisticated technologies like financial software used by E&Y is an asset and competitive advantage for the company, which has the risk to be copied if the second code would obligated by E&Y. Finally, if the third code is obligated by E&Y, it will have to go for a joint venture, which is also a challenge for E&Y.

- The process of going with a joint venture or a wholly owned business, there has some steps according to the rules of KSA. These steps consume more time, which incurs some extra costs.

- In some extent, the attainment of appropriate information regarding any sector is more difficult in KSA. For this E&Y will face problems to collect and utilise the information appropriately. This will result in a high margin loss, as information is a key issue for financial sectors.

- KSA does not have any duty free import zones or free ports. For this, E&Y will have to face some import duties on its operations.

Concerned Issues of E&Y

In case of entering to KSA, E&Y have to re-evaluate its business model. The target of its re-evaluation is to introduce innovation in its stages of service delivery. To do so, E&Y must challenge its existing business strategies continuously and adopt new models to create new business environment. This issue is to make positive changes in profit margin (Ernst & Young 8-23).

E&Y have the goal to optimise its operational flexibility. Flexibility means the use of appropriate resources in an appropriate way. Improvement in responsiveness to the environmental changes, decrease the expenses, develop the efficiency of working and simultaneous adaptation of appropriate strategy with the change occur is the issue here.

Another key issue is to avail maximum potential capital and deployment of this capital properly. This is a precondition for attaining flexibility in the market. E&Y is continuously termed capital as an important issue and thus in KSA it must seek some sources of capital allocation. Thus it can robust its financial statement.

Another critical issue is to select and reach to the market, which will give the maximum outcome. E&Y has its services spread all over the world but reaching a market niche in a country like KSA is a function of its service offering, quality and cost benefit for the consumers. To this extent, E&Y has to exploit new customer opportunities and get optimum returns along with mitigating the risks.

Becoming accelerated in decision-making and execution of those decisions is also a major issue. The purpose is to increase the swiftness of taking decision and to execute appropriate projects according to those decisions effectively. To utilise the little opportunities of investing in KSA, E&Y must consider this issue. Besides, this flexible decision-making would facilitated by the appropriate evaluation of possible alternatives.

The most important issue is to manage the probable risks associated with the financial service providing. To minimise any types of risks, research and development must be done by E&Y. In KSA, the financial service market is a little bid complex in nature and the environment is more risk generating. Therefore, E&Y has to have a broader strategic decision making process assisted by a strong controlled framework.

The selection of personnel and their training program is a vital issue in investing a country like KSA. Personnel are the only component, which can strengthen the talent, expertise, and skill of the management. Experienced personnel would need to train the novice employees and the training program should run to keep in mind all the possible issues related with the business (Ernst & Young 8-23).

Finally, E&Y must go for such activities, which will increase the confidence level of its stakeholders higher. In this issue, regain and retain of the confidence is important which can be earned by transparency and proper communications of all possible operations of the company.

Prospects of the company

- Value creation and Managing performance: Value creation process means the earning of confidence of the consumer to the service of the company. E&Y have the possibility of create value by effective use of its sophisticated technology, experienced and skilled personnel and strategic and functional plans. It has some successful operations in most of the countries, which can use in KSA also. It has enough facilities to identify the appropriate value creation opportunities. Efficiency and effectiveness, both are the key strength of the firm. Finally, the delivery of the value to the consumer will be the major attraction for E&Y, which has done by effective management of business performance (Ernst & Young 4-10)..

- Identifying the Value Creation Opportunities: As a financial service, providing company, E&Y has huge amount of information in global perspective and the company can use these resources to identifying the value creation opportunities for the company. Though there is some restrictions to access appropriate information in KSA, E&Y can get the benefit of having international channels and sources, which it established as a part of its operation. Furthermore, it can build its own database of information about KSA within the passing of time. If the proper opportunities of value creation can identify simultaneously, the delivery of values to the customer will be smooth (Ernst & Young 4-10).

- Gaining operating efficiency and effectiveness: E&Y will be able to have a balanced support function, which will increase the efficiency and effectiveness of the operations and service delivery process. There might be some conflicting objectives or goals or the principles of doing business may contradict with the customer interest, but E&Y can overcome it through the strategic decision making and developing necessary business models. As it has a global network of financial service demand, fluctuation and outcome, it can be able to make a general framework to solve any case in any service sector. It has the facility to use the globally performance measurement techniques which will increase the efficiency and effectiveness of the firm also.

- Managing business performance: E&Y can be able to get enlightened business performance in four stages and these are strategic planning stage, business-planning stage, financial planning stage, and functional plans and near term initiative stage. All these can achieve by designing appropriate plans, implementing those plans and measuring hose implanted strategies accurately (Ernst & Young 4-10).

Recommendation

However, the company is a market leader in terms of many services and differential advantages, some vulnerable issues can notified and for removing of such issues, some suggestions can be proposed as below-

- E&Y should reinforce more caution to prevent disgraceful wastage of corporate time, money and other assets. Adequate precaution and preventive measures would help it not to reply such scandalous case occurred in 2004 by Equitable Life Assurance Company in terms of £2.6 billion of non- paid duty.

- The company should be serious enough for accounting the hedging agreements of gold and dollar.

- It should also enhance the formal tendency of obeying and respecting international and domestic laws of a foreign country.

- In foreign investment purpose, the company should pose a major training to its leadership in special risk orientation factors, such as-

- Arranging per year risk assessment for the notification of basic risks coming from internal and external business surroundings would be liable for affecting investment scenario. Early preparation of a separate report would be an effect beginning of such effort.

- The overall risk assessment technique should incorporate financial and regulatory issues in terms of macro environment in foreign business context.

- Arrangement of scenario planning is essential for notification of major risk, which would distort expected regular local responses.

- The leaders should also continuously appraise corporate capability for vital risk control and management in order to ensure that the formal risk management process has a practical integration with real ones.

- Development of a customized monitoring process to assess the projected investment in Saudi context

- The management should have an open mentality to accept and evaluate any kinds of vulnerability generating from local environment.

- Recent recession period has focused on 10 riskiest points of the company for which an immediate response needs to be developed. In this regard, the credit crunch is the most selective issue, which would negatively affect the banking, insurance, credit derivatives etc. sectors. Here, several risk reduction mechanism considering timely anticipation, standard distribution for tailing risk, adoption of capital-intensive corporate plane, achieving more cash than growth, establishment of Program Management Office as an integral area of risk management would be effective. Others are reducing cost; advancing cost management, improving monetary competence and sophisticating loaning intimacy.

- To cope with regulation and compliance, risk prioritization, coping with proactive posture, adequate reaction regarding competitive steps, IT, employee benefits and compensation, improved foreign trade, anticipation of probable future scenario etc. would be better.

- In deepening depression term, geographic diversification, adequate balancing etc. would make a response.

- Radical greening is associated with various problems encompassing non- renewable competition, alternative energy capital, bad bets etc. for which E&Y should adopt “collaborative approach”, pose a major role in that greening and conduct proper evaluation.

- Customised to prevent customer switching, new segment threat assessment and strategic review are three stages that should consider in case of non- traditional entrants.

- For cutting costs, several ideas would be effective. Such as-

- Assessing intellectual assets with licensing contact for raising income;

- Collaborating with a crossing- border contact in Saudi;

- Conducting benchmarking, streamlining, and profitable outsourcing

- Enhancement of managing demand, lowering stock keeping, and sophisticating pricing motto;

- Utilization of IT etc

- While investing, the company should understand intended target, ways of integration and create proper values with the domestic entity.

- It should conduct proper marketing research constituting surveying new offer to understand the chance to become successful. Additionally, realizing domestic competition and political risk and thus ensuring sound control are essential.

- Development of a separate reputation risk technique, constituting important trade decisions regarding public image and setting sound communication module are integral part of minimizing foreign investment risk. Development of protocols for notifying domestic issues, evaluation, and setting of external negotiation modules would also be effective.

- Finally, before investing, the company should consider an effective group of working personnel and upon sourcing, training and motivating in terms of legal and cultural context.

Conclusion

At last, it can be said that foreign investment is a complex issue which requires different situational analysis from both company and country perspective. All these parties form a successful scenario for an effective investment background. Here, from company perspective, E&Y would have some advantages and challenges to invest in Saudi Arabia. On the other hand, the nation also poses several foreign investment policies, procedures, and regulations, which should obeyed by a foreign counterpart.

The overall analysis has shown that, as a global entity, E&Y occupies some unique competitive advantages, which are highly influential for making overseas investment agreed upon with local laws except some extra requirements. Therefore, if the company would adopt some extra curriculum in its regular performance along with some internal modification, it could expect that it would be beneficial enough for investing in Saudi Arabia.

Works Cited

Hill, Charles. & Jones, Gareth. Strategic Management: An Integrated Approach, 8th edition. 2007. print

Ernst & Young. The future of finance. 2009. Web.

Ernst & Young. Lesson from change. 2009. Web.

U.S. Department of Commerce. Saudi Arabia Investment Climate. 2009. Web.

Ernst & Young. About us- Saudi Arabia. 2009. Web.